- Financial market

- Primary market: importance?

- Reform: ECB

- Reform: IDR fungibility

- Reform: FDI vs FII definition

- What is Alternative Investment fund (AIF)?

- Why Fin literacy and RGESS?

- Rajiv Gandhi Equity Savings Scheme (RGESS)

- FSDC

- Misc. Reforms

How does an Indian company arrange for money to start new business / expand existing business? Ans. Via debt or equity.

From Where can Indian company arrange for money? Ans.

| Within India | Outside India |

|

ADR, GDR, External commercial borrowing (ECB), foreign currency convertible bonds (FCCB) etc. |

For the moment, let’s concentrate within India.

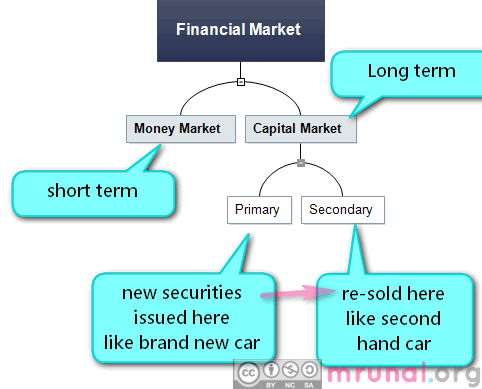

Financial market

Two subtypes

Money market |

Capital market |

| For arranging Short term funds | Long term fund |

Apart from that, financial market also includes: forex market, commodity market, derivative market, insurance market. But let’s pay attention to only capital market for the moment.

Within, Capital market: again two subtypes.

Capital market (long term) |

|

Primary Market |

Secondary Market |

| New securities are issued here. | In common parlance this is known as Share-market.The securities issued in primary market, are sold and repurchased here. |

| This is like a showroom for brand new cars. | This is like a “Mela (fair)” for used cars. |

Both are controlled by SEBI.

Primary market: importance?

- Primary market helps businessmen (and Government) arrange money for their projects.

- It also helps investors earn profit on it via interest / dividend.

- Financial intermediaries come into picture here: they act as middlemen and help investor lend money to borrower (and earn Commission in between).

- If lot of money in invested in primary market (especially for corporate sector), that means economy is booming.

- But as per the Economic Survey, Compared to 2011, companies raised less money from primary market via debt and equity in 2012.

- It means companies are not doing as many new projects / business expansion like they did in 2011. Why? 1) policy paralyses, 2) inflation =less demand of products within India 3) Slowdown in US, EU = less demand of products abroad

Now let’s take a look at the reforms taken.

| From abroad | Within India |

|

|

Reform: ECB

What is ECB?

- External commercial borrowing

- As the name suggest: ECB= when Indian company borrows money from external (non-Indian / foreign) sources.

- Money is borrowed from non-resident lenders.

- Via bank loans, fixed rate bonds, non-convertible shares, optionally convertible or partially convertible preference shares etc.

- For minimum average 3 years.

Who can borrow?

- Hotel, infra, IT, hospital sector. (But company must have registered itself under Companies Act 1956, in India).

- Micro Finance Institutions (MFI) can borrow via ECB

- NGOs, NBFCs, Companies can borrow via ECB, if they’re involved in Microfinance activity.

- SEZ units

ECB money cannot be used for?

- share market or real-estate speculation.

- Acquiring another company

ECB: Pros and Cons

| Pro | Anti |

|

|

Reforms in ECB?

- Government has liberalization in External Commercial Borrowings Policy during 2012-13

- Main Beneficiaries of this liberalization = infra companies, SIDBI and NHB.

Infrastructure companies |

|

SIDBI |

|

National housing bank |

|

This list of ECB reform is not exhaustive but for exam oriented preparation- you’ve to draw a line somewhere hahaha.

Reform: IDR fungibility

Before going into that, let’s look at:

What is ADR?

- American Depository receipt.

- Already explained, just copy pasting from my old article

- Suppose, Indian Co. wants to raise money from America, by issuing shares in American stock exchange.

- But then Indian co. will have to maintain accounts according to American standards.

- To prevent this problem, Indian company gives its shares to American bank.

- American bank gives that Indian company receipts (called ADR) in return of those shares. Then Indian Co. can trade those ADR receipts in American share market, to raise money.

- Sound good? Yes, but then Indian company will have to pay dividends to those investors in Dollar currency.

- Similarly GDR= Global depository receipt

What is IDR?

- ADR= American depository receipt = from America’s point of view, it allows a foreign company (e.g. Indian) to raise money from American financial market.

- Similarly, IDR= Indian depository receipt= from India’s point of view, it allows a foreign company (e.g. American, British) to raise money from Indian financial market.

IDR: Two way fungibility?

- First what is fungibility?= ability for mutual substitution.

- For example, if you borrow Rs.1000 rupee note from someone, you can repay it using two Rs.500 notes or 10 notes of Rs.100. because currency notes are fungible.

- Similarly, One gold bar weighing 100 gms. Vs. 10 gold bars weighing 10 gms. = easily fungible IF all of them are 24-carat gold, because weight and price wise both sides are same.

- But gold bars of 22 carat vs 24 carat = not easily fungible because they’ll have different price.

- ADR is two way fungible. Meaning, (from American investor’s point of view) if you’ve ADR, you can convert it into the underlying shares of that (foreign/Indian) company.

- As part of financial reforms, Now IDR (Indian depository receipts) are also made Two way fungible.

Reform: FDI vs FII definition

Chindu proposed in Budget speech that

- We need to remove the ambiguity on what is FDI and what is FII,

- I propose to follow the international practice:

- if an investor has a stake of 10 per cent or less in a company, it will be treated as FII and,

- if more than 10%= FDI.

- Later Chindu formed a panel under Arvind Mayaram for giving clear definitions to FDI and FII.

FII inflow increased

- FIIs invest in Indian securities markets based on their perception “how much money will I mae?

- Their perception is influenced by

- prevailing macroeconomic environment of India

- The growth potential of the Indian economy

- Performance of corporate sector in competing countries (such as Brazil, South Africa.)

- In 2012, FII inflows were around 30 billion dollar. Much of these FII inflows went into equity segment.

- The increase in FII inflow indicates their confidence in the performance of the Indian economy and Indian market.

- Compared to previous years, the turnover in share market has increased and volatility has decreased.

- The economic and political developments in the Euro zone area and United States had their impact on markets around the world including India.

- ‘fiscal cliff’ in the US had been resolved, and had a positive impact on the market worldwide including in India.

- Further, the reform measures recently initiated by the government have been well received by the markets.

FII reform?

In 2012, FII limit for investment in G-Secs (government securities) and corporate bonds =was increased.

| FII limit (US Billion dollars) | |

| G-Sec | 25 |

| Corporate bonds | 51 |

FDI reform?

- Cabinet has approved increase in FDI for Multibrand retail, pension, insurance, aviation, power and broadcasting.

QFI

To put this in crude terms:

- QFI is a guy who

- Doesn’t live in India

- Is not an FII

- Doesn’t have a sub-account under FII

- Is not a Foreign Venture Capital Investor.

Year |

Reforms taken |

| 2011 |

|

| 2012 |

|

PAN card is mandatory for QFIs.

What is Alternative Investment fund (AIF)?

- An entity that collects money from people, and invests it.

- But unlike the regular mutual funds, they donot usually involve in the conventional debt-equity share market type investment.

- And They’re not covered under SEBI’s regulations for mutual funds and collective investment schemes.

- Such funds / entities are called Alternative Investment fund.

3 types of AIF

SEBI has notified new regulations covering alternate investment funds (AIFs) under three broad categories

| Category | Note |

1 |

|

2 |

|

3 |

|

All the alternative investment funds have to register with SEBI.

Why Fin literacy and RGESS?

- Government wants to make people buy less gold. Because when Indians buy a lot of gold, it increases our current account deficit–> our rupee weakens against dollar –>we’ve to pay more for importing crude oil =petro-diesel price increase= inflation (+bad election publicity for Government).

- Therefore, Government wants to increase financial literacy among (particularly) middle class and lower middle class folks, make them invest in share market, mutual funds etc. and move away from gold-purchase.

- So Government needs to generate awareness that investment in capital market is safe and gives you good returns. => Financial literacy / awareness needed. For this, CBSE already included financial literacy related courses in the syllabus.

- Financial Stability and Development Council (FSDC) also working on forming national policy for financial literacy.

- But just by making people “aware”, won’t make them invest in capital market. Government needs to offer some “carrot” to lure them.

- That’s why Government introduced Rajiv Gandhi Equity Savings scheme- it provides tax benefits and assured returns to FIRST TIME INVESTORS in the equities.

Rajiv Gandhi Equity Savings Scheme (RGESS)

- It is a new tax saving scheme.

- This was announced in Budget 2012.

- Main purpose of this scheme: attract more (middle class and lower middle class) people to invest in securities market. (and divert them from investing money in gold, which increases current account deficit and creates more problems for Indian economy).

| Conditions |

|

| Benefit? |

|

issue/problem in RGESS?

To invest in any type of securities (debt or equity), you first need two things 1) PAN card and 2) DEMAT account. Most of the Indians don’t have either PAN card or DEMAT account.

FSDC

- Government has set up Financial Stability and Development Council (FSDC) in 2010.

Org of FSCD

- FM = chairman

- Heads of financial-sector regulatory authorities (RBI, SEBI etc),

- Finance Secretary and a few other departments

- Chief Economic Adviser

What does FSCD Do?

- Promote financial literacy (their sub Committee has made draft National Strategy on Financial Education).

- Promote financial inclusion (get people in banking, pension, insurance net)

- Increase financial stability

- Increase inter-regulatory coordination (between RBI, SEBI, IRDA etc)

- Promoting financial-sector development

Misc. Reforms

MCX-SX

- SEBI permitted MCX-SX to operate as a full-fledged stock exchange (just like BSE/NSE).

- Now MCX-SX will directly compete with BSE and NSE, and it’ll lead to better services, lesser costs for the investors.

CDS

- Credit default swap (more explained earlier click me)

- Mutual funds and Insurance companies can now participate in CDS as users.

- This will increase liquidity in the corporate bond markets.

IRDA-repo

- Insurance Regulatory and Development Authority (IRDA) has permitted insurance companies to participate in the repo market.

Electronic voting

- A public limited company has shareholders. And the company needs to take votes of the shareholders before merger-acquisition, election of new board of directors etc.

- Earlier this was done through postal ballot.

- But in 2012, SEBI made rule: voting must be done through electronic means. (this reduces any mischief or foul play and brings more transparency).

- At the moment, SEBI has made electronic voting is made Compulsory for the top 500 listed companies and more companies will be included soon.

SCOREs

- SEBI complaints redress system

- It is a web portal, where you can file online-complaints to SEBI.

Mock Questions

- Capital market is madeup of

- Primary and Money market

- Primary and secondary market

- Money, primary and secondary market

- None of above.

- New securities are first issued in

- Primary market

- secondary market

- Either A or B depending on SEBI’s approval.

- None of above

- Correct Statements about ECB?

- Infrastructure companies can borrow money only in dollar currency.

- SIDBI and NHB are allowed to borrow money via ECB route.

- Both A and B

- Neither A or B

- What is the purpose of ADR?

- Help an American company raise money from within USA

- Help an American company raise money from outside of USA

- Help foreign company raise money from American financial market.

- None of Above

- What is the function of IDR?

- Help an Indian company raise money from within Indian financial market

- Help a Foreign company raise money from within Indian financial market

- Help an Indian company raise money from abroad.

- None of Above

- Which of the following Depository receipt has two-way fungibility

- ADR

- IDR

- Neither A or B

- Both A and B

- Arvind Mayaram panel is associated with

- Current Account Deficit

- Double taxation avoidance

- FDI, FII definitions

- PPP project finance

- Correct statement about QFI

- It is a sub-account under FII

- They’re not required to have PAN

- An Investors from Gulf cooperation council cannot register themselves as QFI

- None of above

- Correct statement about Alternative Investment Fund (AIF)

- It is regulated under SEBI’s mutual fund regulations.

- SEBI classifies AIF into four categories.

- Every AIF is required to get itself registered with RBI

- None of Above

- Correct Statement about Rajiv Gandhi Equity savings scheme?

- It offers tax deduction to any investor whose income is below Rs.12 lakh

- Dividend income under RGESS is taxable.

- For investment upto Rs.50,000, it provides 100% income tax deduction.

- None of Above

- Which of the following is a function of Financial Stability and Development Council (FSDC)?

- Controls FDI approvals.

- An organization that aims to increase inter-regulatory coordination and financial literacy.

- Controls external commercial borrowing and current account deficit.

- None of above.

- SCORES an online portal to register complaints with

- IRDA

- PFRDA

- SEBI

- None of Above

Mains

- 2 markers

- SCORES

- AIF

- ECB

- IDR

- 5 markers

- RGESS

- FSDC

- 12 markers

- Write a note on the recent reforms in the Indian capital market

- What do you understand by External Commercial Borrowing? Briefly discuss the recent liberalization in India’s in External Commercial Borrowings Policy.

![[Laws] DESI liquor special edition Kerala, Mizoram & IPS Training, Tribal insurgency](https://mrunal.org/wp-content/uploads/2014/09/Cover_Polity_kerala-liquor-500x383.gif)

![[Economic Survey] Corrections in the previous articles + Parting words before Qatl ki Subha](https://mrunal.org/wp-content/uploads/2014/08/Cover-Economic-Survey-correction-500x383.jpg)

Dear mrunal sir,

i have a lot of confusion with FTA, CEPA and other economic ties area.

would you give a good differentiation btw these.

please !

dear mrunal,

could you please write an article on BRICS n their proposed bank??

I would really appreciate if u could..

regards

puneet

grt sir!!

babcbdcdddbc

Excellent article sir…. Even C.Rangarajan or Raghuram Rajan will not explain economic survey so simply as our Mrunal sir is explaining…Hats off to you sir…

may be a dumb question, but can FII and FDI called as ECB? if not then why?

In my opinion, NO. As there is no mandatory lock-in period for FDI r FII whereas in ECB it was mention min.avg.tenure 3yrs. As per my understanding FII n FDI come in india n invest whenever they find the mkt conducive n leave when expects not so promising. on the other hand in ECBs we go out to different mkt and procure funds into the indian mkt.

1.b

2.a

3.b

4.c

5.b

6.d

7.c

8.d

9.d

10.a

11.b

12.c

how can i download this to studyoffline??

1.b

2.a

3.b

4.c

5.b

6.d

7.c

8.d

9.d

10.d

11.b

12.c

Hi Mrunal,

Could you please explain how does fungibility help in attract foreign companies to be listed as IDR?

1 b

2 a

3 b

4 b

5 b

6 d

7 c

8 d

9 d

10 d

11 b

12 c

4 will be (c)

Answer Keys

B A C C B D C D D A B C

please confirm( by serious Aspirant Only :-P))))

1.B 2.A 3.C 4.C 5.B 6.D 7.C 8.D 9.D 10.A 11.B 12.C

thanks sir

lots of confusion has been cleared now

b,a,c,c,,b,d,c,,d,d,a,b,c,

u said adr,gdr and ecb payments are made in foreign currency only does it account to CAD??

yes.

Sir ….is the ECB comes under fdi or fii or both or different frm both

it is different from both…. in borrowing means we have to pack while FDI and FII are investment…investors will get profit.

sir this is raju

what is the relationship between high demand for gold weakens the indias rupee valu

high demand of gold = more import (comparatively less exports) = Current Account deficit increses = rupees value weakens..

hope this will help… plz correct me if i am wrong

In your ECB …is it non-convertible shares or non-convertible debentures???

thanku

good for every one.

Good

The problem that is mentioned for RGESS is not correct in my view. All the salaried class have to have a PAN card. DEMAT account can be opened at a very nominal price and is easily available through most share brokers. We must take it into cognizance the fact that these schemes are not for the lowest strata

how will convert the rupee into dollar to repay the loan

@Mrunal : Sir you have mentioned that “Banks as such, are not allowed to borrow via ECB route.”

But Raghuram Rajan now have allowed banks to borrow from overseas.

Can you pls guide on this.

Where I can find your discussion on Money Market Topic….?