Prologue

In the previous articles we saw

- Food processing industry: Awesomeness and Obstacles

- Food processing industry: ruckload of Government Schemes and bodies

- Marketing of agricultural produce: issues and constrains, Nuisance of APMC Acts and Commission Agents

Moving on:

| New GS-Mains Syllabus of UPSC | Topic touched in this article |

|

Agriculture export: Anti-dumping, tariff-non tariff barriers, Codex and HACCP standards. |

|

Backward regions grant fund (BRGF) |

|

Warehousing Development and Regulatory Authority. |

|

FDI policy for agriculture, food processing and retail |

|

Budget 2013 for Agriculture and Food industries |

|

The finance/credit problems faced by farmers+ food-entrepreneurs. |

By the way, regarding some earlier comments about what happened to my geography location factor article series? Ans. I got bored writing geography hence shifted to agro/food processing topic for a while, but rest assured [Geography] location factors article series will be finished before Mains 2013.

Agriculture Export

World Trade Organization (WTO) aims to improve international-trade by reducing the tariff and non-tariff barriers. Let’s refresh the concept:

Tariff Barrier

Taxation tools that affect import / export: Examples

- In the Colonization-era, British had imposed heavy taxes on Indian textile coming to London, in order to protect their local industries from competition.

- Before the LPG reforms of 1991, India too had imposed heavy taxes on most of the imported items: be it wristwatches, goggles, cars or radios.

- Aug 2013, Union Government increased the import duty on gold to 8 per cent to reduce the gold consumption (and to provide sustainable livelihood to desi-smugglers who were not given 100 days in work under MNREGA.)

Dumping

- When businessmen export goods at a price that is less than the price charged in the domestic market- it’s called dumping.

- WTO system=> Agreement on Subsidies and Countervailing Measures (SCM)=if a country finds evidence of dumping, it can extra impose duty (known as countervailing duty, CVD) on such dumped products. (=meaning this type of tariff barrier is permitted in WTO)

- USA has imposed a countervailing duty (~6%) on Indian frozen shrimps, because Indian shrimp gets plenty of subsidies from Indian government for shrimp farming and export and hence Indians are able to dump shrimps to USA and hurt USA’s local shrimp businessmen. (or atleast that’s what America claims).

- Anyways, Indian shrimps are not the only items subjected to anti-dumping duty in USA.

| Shrimps from | Why subjected to anti-dumping duty in USA? |

| Thailand | government buys shrimp from farmers and sells it to processors at low price |

| China | government gave finance to build the world’s largest shrimp-processing and export plant |

| Malaysia | government gave finance to build shrimp farms. |

Dumping by India

List not exhaustive (but in recent news)

| Country | Which Indian export was slapped Anti-Dumping duty |

| China | Recently China also started Anti-dumping investigation on Indian exports such as

|

| Thailand | Indian steel |

| Indonesia | Against two leading Indian steel firms: Jindal and Essar. |

Dumping to India (by foreigners)

List not exhaustive (but in recent news)

- We’ve slapped anti-dumping duty on steel wheels imported from China used in commercial vehicles.

- Under probe: US, China, Malaysia and Taiwan: Because They’re exporting solar equipment to India at ridiculously low prices and was bleeding the desi industry. Similar issue with glassmakers and electric cable manufacturers from those countries.

Non-Tariff Barrier

Non-tariff barriers affect import/export, without using taxation tools. For example

| Quantitative restrictions | Under Gold control Acts of 1960s, An Indian Gold Smith was not allowed to possess a stock of more than 300 gms of primary gold at any time. |

| Import prohibitions | On ivory, fur, tiger skin/bones, narcotics, illegal weapons, explosives etc. |

| Import licensing | When Murthy started Infosys, he had to make 50 trips to Delhi for three years just to get a license to import computers. |

| Export Subsidies | We already saw some duty credit schemes for Agri-exports in the second article. click me |

| Labour/Environment standards | e.g. some developed country banning import from third world country saying child labour was used etc. |

| Health Standards | Codex, HACCP- given below. |

CODEX standards

- In the 60s, FAO+WHO setup Codex Alimentarius Commission.

- To develop harmonised international food standards, guidelines and codes.

- In WTO system => Sanitary and Phytosanitary measures (SPS Agreement) – a country can impose ban on imported food products, if they do not meet the Codex standards. (=meaning this type of non-tariff barrier is permitted in WTO).

- and as you can guess, Indian food products get banned/restricted in developed countries for not meeting those quality standards

- This is a two-way street though, India also banned import of American Chicken to ‘prevent Avian influenza’ among Indian poultry. (Although USA has dragged India to WTO saying India has not provided any scientific evidence in line with international standards to justify this ban.)

- Anyways, here are some of the Indian food export, there were banned in US/EU/China/Japan in past.

| Indian food item | banned/restricted abroad thanks to |

|

Aflatoxin |

|

stone weevil, fungus |

|

foot-and-mouth disease |

|

Antibiotic residues |

|

Heavy metals and antibiotics |

|

bird flu/Avian influenza |

Adding insult to the injury, once the ban is imposed and IF we want to get the ban revoked, then

- We’ve to invite their food inspectors/specialists to India, let them check our premises

- We’ve to bear all the cost of their accommodation, travel expenses etc.

=expensive game, small Indian players/companies can’t survive in the international food business.

HACCP

- HACCP (Hazard Analysis Critical Control Point)

- This certification system is adopted by the Codex Alimentarius Commission.

- For preventing microbiological, chemical and physical contamination along the food supply chain.

- So, if you want to safely export food products to US/EU, then first you need to get certificate that your plant meets the HACCP standards. (certificate system similar to ISO standards)

It doesn’t mean we haven’t anything. Here are some of the steps taken:

| EIC | Export Inspection Council of India (EIC)

EIC approved units have to implement following

EIC certificate is recognized in European Commission (EC) for marine products and basmati rice and by the US for black pepper. |

| APEDA |

|

| BIS |

|

| collaboration | We’re collaborating with USA, UK, Netherlands, Switzerland and Germany for Agri-technology transfer, financial and marketing tieup and quality control. |

| MoFPI |

General Area: max 15 lakh assistance NE, difficult area: max. 20 lakh |

Additional Suggestions

| Negotiation | Government needs to expedite the negotiations with US, EU, China and Japan, to lift restrictions on Indian fruit/food/marine exports into these countries. |

| Foreign Offices |

|

| Certification | APEDA already supports the cost of quality certification programs such as HACCP and Eurepgap for grapes and peanuts. More food-items should be included in this scheme. |

| Fssai |

|

| Desi Labs |

|

| Zoning |

|

| Sample Cost |

|

FDI: Agro, Food Processing, Retail

Foreign Direct Investment: Agriculture

100% FDI with automatic approval in following sectors:

| Seeds | Seeds and planting material, their development and productionConditions

|

| Livestock |

|

| Plantation |

|

Note: Besides ^above, FDI is not allowed in any other agricultural sector/activity

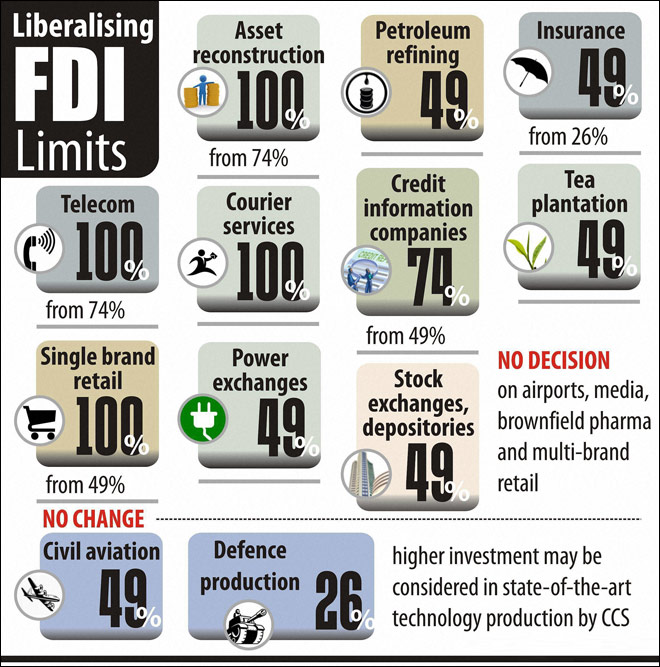

In July 2013, Government changed FDI limits in 12 sectors, here is a fancy graphic courtesy of Indiatoday

FDI: Food processing

- India allows 100% FDI in food processing sector.

- Foreign firms

- don’t need government-approval to start business in India.

- Are eligible for grants, subsidies, benefits offered by various government schemes.

- Our food industry got FDI >Rs.6000 crore in last three years (2009 to 12)

- When talking about FDI in food processing, a doubt comes in mind: if foreign giants are permitted in India, will there be no place for small players, will they be wiped out?

| Fragmented Demand vs Economies of Scale |

|

| Cheapness |

|

| Pace of life |

|

Thus, MNC-food Giant doesn’t get automatic success is every region and every product. Small players have their own opportunities in the food processing sector, while big / international players have theirs.

FDI: Retail

| E-commerce |

|

| Cash and Carry wholesale trading |

|

| Single Brand Retail. |

|

List of Single Brand retail who’ll setup shops in India:

| Single-Brand Retail | What do they sell? |

| IKEA | Furniture |

| Pavers England | British Footwear |

| Brooks Brothers | American Luxury Clothing |

| Damiani | Italian Jewelry |

| Promod | French Fashion |

| Le Creuset | Crockery |

| Decathlon | Sporting Goods |

FDI: Multibrand Retail

Maha-clichéd topic, you probably have read/heard/seen it dozen times already. Hence not going into all details.

| Country | Permitted limit of FDI in Multibrand Retail |

| India |

|

| China, Thailand, Russia, Indonesia, Brazil, Argentina, Singapore |

|

Difference In Single Vs Multibrand Retail?

| Single Brand Retail | Multi-Brand Retail |

|

|

| FDI upto 100% with government approval |

|

| Need to procure of 30% of the goods from Indian MSMEs, village and cottage industries, artisans and craftsmen, in all sectors. |

|

| can be setup in any city, any state. |

|

States/UT that permitted Multibrand Retail

- As per the official FDI circular, State Governments/Union Territories would be free to take their own decisions in regard to implementation of FDI in Multibrand Retail.

- As of June 2013, Following states/UT permitted foreign giants to open multi-brand retail outlets in their area.

|

(As of June 2013) |

But How / Why is Multibrand-FDI relevant/important from food processing/agro point of view?

| less Wastage |

|

| Better Income |

|

| Small Scale |

|

| employment |

|

| Tech-knowledge upgrades |

|

The Diluted Conditions

- No investors came forward, even after Government permitted 51 per cent foreign direct investment in multi-brand retail (henceforth referred as Walmarts to save the typing headache).

- so recently government decided to relax the conditions to attract them (+to bring more dollars to calm down the rupee fall)

| Tight Conditions before | Diluted After July 2013 Reform | |

| CITIES |

|

|

| MSME |

|

|

| BACKEND |

|

|

Finance

To run any type of business: be It farming or food processing= you arrange for finance. What are the Sources of Finance?

| Banks | regional rural banks, cooperative banks, commercial banks |

| NABARD | offers refinance facilities for food processing, agri infrastructure, development |

| SIDBI |

|

| EXIM |

|

| NCDC |

|

| APEDA |

|

| Sharad Pawar |

|

| NHB |

|

| MFPI |

|

| venture funds/angel investors |

|

But both farmers + food processing entrepreneur have trouble getting loans/financing. Why?

Why can’t Farmer get loans easily?

Bank manager hates NPA in their branch. Because it affects his reputation and further career growth/promotions. On the other hand….

| shrewd farmer | I’m not going to repay the loan because I know that government will launch another debt-waiver scheme just before election and my loan will be forgiven! |

| good farmer | Why the hell should I pay the loan diligently while ^others can get away scot-free? |

Hence bank reluctant due to lack of credit-discipline among farmers.

| NPA |

|

| Manpower |

|

| cost of credit |

|

| Stamp duty |

|

| documents |

|

Thus for banks, Agro-loans=risky, high-cost, low-return game.

Regional imbalance

| Loan/Credit distribution among farmers | States |

| High | Southern |

| Medium | Northern and Western |

| Low | Eastern (Bihar, Jharkhand, odisha and West Bengal) and NE |

Nearly three quarters of the farmer households still do not have access to the formal credit or insurance system= have to rely on informal borrowing/credit from evil moneylender @very high interest=always in debt.

Talking of insurance: three main agro-insurance schemes run by Agriculture Insurance Company (AIC):

|

|

|

|

|

|

Negotiable Warehousing Receipts (NWR)

- WE know that prices of potatoes, onions vary significantly between peak harvesting season and lean season. The middlemen @APMC control this storage and supply and make a killing business.

- Then why don’t farmers themselves store their produce for the lean season? Because a farmer cannot afford to wait selling his potatoes for such long time in hope of getting better money. He needs quick cash so he can buy seeds, fertilizer, pesticides for the next round of cropping cycle. (and to settle the loans he took for the previous cycle)

- The negotiable warehousing receipts can help him here. How?

To put this without getting into all technical details:

- Farmer bring his produce to a certified warehouse/cold storage of WDRA.

- He Deposits his produce, gets a piece of paper called “Warehouse receipt”.

- He deposits this “Warehouse receipt” to bank, as a collateral and gets short-term loan for next cropping.

- The farmer can decide to sell his warehouse-produce when prices are favorable (during lean season) and use it to settle the loan.

WDRA

Warehousing Development and Regulatory Authority.

Statutory body under Ministry of Consumer Affairs, Food & Public Distribution (2010). Main functions:

- Regulate, certify, and develop warehouses in the country.

- dispute resolution between warehouses and warehouse receipt holders;

- HRD, training warehouse personnel.

Benefits of NWR receipts

- Bank faces lower risks because collateral for the loan is a liquid asset (agro-produce recipient, backed by a central act).

- Previously, Small/marginal farmers couldn’t easily get loans because they didn’t have conventional loan collateral (land, gold, cattle etc.) But now they can get it easily using Kisan Credit Card +Negotiable warehouse receipt.

- Protects farmers against distress sale of their produce and exploitation by middlemen.

- Minimizes Wastage perishable produce. (Because they’re stored in certified warehouses/cold chains).

- Reduces hoarding and food inflation (because farmers less ‘cartelized’ than APMC Middlemen.)

- Provides alternate employment opportunity for those APMC middlemen- they can form a group, setup warehouse and get certificate from WDRA.

- Warehouse receipts are a proven tool for financing, already successful in Brazil, Indonesia, Singapore and Argentina

Enough of Farmers’ finance, time to move on:

Why can’t food entrepreneurs get loans easily?

From a Bank managers’ point of view: again the fear of NPA

|

|

|

|

|

|

|

|

|

|

Therefore,

- Bank manager will either refuse to give loan OR

- He will give loan but charge higher interest rate for the additional ‘risk’.

- He might give loan for the initial capital for buying plant, machinery, vehicle (for which government provides grants/subsidies) but not for the working capital requirements.

By the way what is working capital requirement?

- Raw Materials, Consumables & Packing Materials

- Electricity, phone, internet, utility bills

- Administrative and Selling Exposes

- Repairs and maintenance

- salaries of workers

- monthly bribes to food inspector

For Small sized food processing unit, the working capital requirement is quite high because high cost of raw material, many middlemen= low profits. Result?

- Poor Economies of scale that we already saw in first article. (click me)

- Can’t do any timely up gradation of technology, can’t improve quality of products / advertisement / marketing.

- Don’t have spare money for backward linkages with farmers. (e.g. contract farming, supplying farmer with seeds/fertilizer to get quality agro produce.)

Permission-raj

As an entrepreneur, even if you manage to get loan/finance, you still need following permissions before setting up a cold storage / food processing unit:

- Approval from district collector for change of land usage and land conversion.

- NOC from Gram Panchayat, if the land falls under Gram Panchayat.

- Approval of building plan

- Fire safety approval, If the building is taller than 15 metres.

- Approval under Factories Act. (has to be renewed periodically)

- NOC from Pollution Control Board. (has to renewed from time to time)

- SSI registration in case of Small Scale enterprises.

- Approval from local Excise Department for getting CENVAT exemption for Cold Storage equipment

- Truckload of forms/formalities if you want to get grants/subsidies under government schemes.

Thus, it takes lot of time (and bribes) to get so many permissions=> food-entrepreneur gets demotivated. Not just Food entrepreneur- any small entrepreneur has to go through same ragging by banks and government departments and as a result: low IIP + low GDP + low export + High CAD + High inflation and so many other problems to Indian economy.

License Raj

- Today, Industrial license is not required for most food processing enterprises, except for alcohol and beer and those food items reserved for small scale sector (=Pickles, chutney, bread, mustard oil, ground nut oil.)

- But for long, food items were reserved for SSI=hampered the growth of this industry.

Taxation

- Agriculture produces have long been subject to numerous taxes, charges: market fees, market cess, commission charges, Octroi entry tax, sales tax, weighing charges, labour charges for handling, loading and unloading, purchase tax, Rural Development cess etc.

- For example, In Punjab, the total market charges on transactions of foodgrains are more than 15% of the final value (2011 data)

| Punjab | tax% |

| market fee | 2% |

| Purchase Tax | 4% |

| VAT | 4% |

| rural development fund (RDF) cess | 3% |

| Punjab infrastructure development fund (PIDF) | 3% |

^These are just the ‘legit’ taxes, the commission by middleman is additional burden on the final consumer.

- Tea/coffee/rubber plantation incomes are subjected to Income tax. Tea plantations also subjected to land tax in Assam.

- Previously plastic packaging, aluminum packaging had been subjected to high excise duty (~16%)= high input cost for food industry.

Budget 2013: Agro and Food processing

Let’s look@how Budget 2013 will directly/indirectly help agriculture/food processing sector

$pending

| Numbers not important, the point is truckload of cash allotted to help farmers (or atleast to pretend) | |

| Agro Ministry | 25000 cr |

| Agro Research | 3000 cr |

| Green Revolution To Eastern India | 1000 cr |

| Crop Diversification Program | 500 cr |

| Ago-Credit Target | 7 lakh crores |

| Rashtriya Krishi Vikas Yojana | 9000 cr |

| Integrated Watershed Program | 5000 cr |

| Small Farmers’Agri Business Corporation | 100 crores for Credit Guarantee Fund |

| Farmer Producer Organization (FPO) | lakhs per FPO |

| Rural Infrastructure Development Fund (RIDF) | 20000 cr. |

| NABARD | 5000 cr. to construct warehouse |

Budget 2013: Schemes/initiatives

That will directly/indirectly help agriculture/food processing sector

| Green Revolution |

|

| Interest Subvention |

|

| Nutri Farms |

|

| Institutes |

|

| Coconut |

|

| National Livestock Mission |

(Don’t you think this overlaps with the national dairy mission that we saw in last article!) |

| Storage |

|

| IDF | Infrastructure Debt Funds (IDF) already discussed earlier. Goto Mrunal.org/economy |

| Skill |

|

| BRGF |

|

Budget 2013: Taxation

That will directly/indirectly help agriculture/food processing sector

| CTT | Agricultural commodities will be exempted from the proposed Commodity Transaction Tax (CTT). |

| TDS | Chindu introduced 1% TDS on transfer of immovable property but exempted agricultural land from this. |

| GST | Work in progress. |

Income tax deduction

If you setup business in following category, you’ll be given tax-deduction (how to calculate income tax and deduction? already explained click me)

| category | income tax deduction |

| cold chain facility | 150% |

| warehousing facility for storage of agricultural produce | 150% |

| warehousing facility for storage of sugar | 100% |

| Bee-keeping and production of honey and beeswax | 100% |

Custom Duty

| reduced the duty on |

|

| Exempted from duty |

|

Excise Duty

| item | excise duty (2013) |

| milk, milk products | 0 |

| nuts-fruits (Fresh and dried) | 0 |

| veggies | 0 |

| Sabudana (Tapioca Sago) | 0 |

| processed fruits and vegetables, Soya Milk, Flavored milk | 2% (classified under merit goods)else 6% |

Service tax: Negative list

Chindu put following services in ‘negative-list’ (meaning they’re exempted from service tax).

| Area | What is exempted from Service tax? |

| Cultivation |

|

| Food Processing |

|

| Supply Chain |

|

| Transport |

|

| R&D/Support |

|

Misc.

Although unrelated to the main title of this article, but let’s get overview of following, since they found mention in the Budget 2013:

Backward Regions Grant Fund (BRGF)

| Who? | Ministry of Panchayati Raj Institutions + Planning commission |

| When? | 2007 |

| Why? | To reduce regional imbalance in development. |

| What? | gives additional Ca$h to backward regions |

Has two components:

|

More than 270 backward districts in 27 statesNote: At least prepare overview of backward districts in your home-state for the profile based Interview questions @UPSC + for State PSC class 1-2 exams. |

|

Gives special funding to

|

How does it work?

| Ca$h Movement |

|

| Transparency |

|

| Planning | Panchayats will prepare plans for

|

| Implementation | Through people’s participation. |

Rashtriya Krishi Vikas Yojana (RKVY)

| When | 2007, under 11th Five year plan (FYP) |

| Why? | to achieve 4% annual growth in the agriculture sectorto encourage States government to allocate more cash to agro and allied sectors |

| How much? | More than 60,000 crores allotted in 12th FYP. |

Sub-Schemes

|

In Eastern India: Assam, West Bengal, Orissa, Bihar, Jharkhand, eastern Uttar Pradesh and Chhattisgarh to improve in their rice cultivation |

|

Promote Pulses Villages in Rainfed Areas. |

|

Oil Palms=increase area under cultivation |

|

Initiative on Vegetable Clusters to increase in the productivity and market linkage of vegetables. |

|

bajra, jowar, ragi and other millets: create awareness regarding their health benefits. |

|

National Mission for Protein Supplements: to promote animal based protein production: milk, pigs, goats, fisheries. |

|

Accelerated Fodder Development Programme |

|

Rainfed Area Development Programme to improving productivity of crops in rainfed areas. |

|

Mission In Jammu & Kashmir. |

|

Intensified Irrigation project in Vidarbha, Maharashtra. |

|

PPP for Integrated Agriculture Development |

Rashtriya Krishi Vikas Yojna (RKVY) has greater acceptance among states as it provides flexibility to formulate state-specific strategies

| States | projects undertaken |

| Sikkim, Arunachal Pradesh and other North East States |

|

| Maharashtra |

|

| Tamil Nadu, West Bengal, Bihar, Jharkhand and tripura |

|

| Andhra Pradesh |

|

| Haryana and Punjab |

|

| Gujarat |

|

| Kerala |

|

RKVY challenges:

- More than 80% of farmers have small/marginal landholdings= poor economies of scale. RKVY hasn’t not effectively addressed the issue of land consolidation / land reforms.

- Less than 10% of the plan outlet spent on Marketing / Post Harvest Management.

- Often the projects proposed under RKVY are not in tune with priorities and developmental gaps identified in State Agricultural Plan (SAP).

Next Time: we’ll see with the supply chain management, upstream-downstream for food processing industries dealing with F&V (fruit and vegetables)

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

please note exception made to amazon to do e-commerce retail trade in india sidestepping regulations..

Mrunal Bhai , I appreciate your concern for details but I think this whole series has way too much info than anyone can hope to remember – I believe at least one article could just had problems of food processing and what are the possible policy interventions/solutions. Second set could have been government schemes. I seem to have lost the gist of problem with details like excise duties, negative list…may be this is just a problem at my end. Nevertheless, your hard work is much appreciated.

@Mrunal Sir and other veterans here,

We know how much marks people got in the last year mains exam. But can anybody tell how many questions do people generally attempt in GS mains paper. Are people really able to attempt 100%? For me, it seems even after preparing, I wont be able to attempt more than 60% in GS..

@mrunal

while filling my DAF form for mains, i made a mistake i have left blank 2-3 fields which were not mandatory and i have submitted it finally. But it is written that we have to write NIL in the field which is not applicable. please tell me will i be able to sit in the examination or not. please reply soon

Sir plz explain what is refinance facility by rbi ?

mrunal sir

happy new year in advance of 26 days to you

i am at chalisgoan maharashtra

i want to start flour milling under govt food processing subcidy & grants scemes

guide me for papers helpline to pass the fianances

thanking you

good job

There are many waste streams that structures need to “dispose of”.

These are contrasted to perceived needs and beliefs in invisble cultural constructs, such as the value of the

U. It’s a common form of hot water heating and general power creation.

i am just following ur notes, and i think it is sufficient for exam