- Prologue

- #5: Difficult to store Value

- #6: Savings don’t turn into investment

- What is Circular flow of income?

- #7: Account-keeping = mission impossible

- #8: Lack product specialization

- #9: Future contracts and deferred payments

- Time value of money

- Bitcoins and Smart Contracts

- Mock Questions

Prologue

In the previous article (Part I), we evaluated Barter-Money-Bitcoin systems on four parameters:

| features | barter | Fiat money (Rs./$) | Bitcoin |

| #1: trade can happen without double coincidence of wants? | No | Yes | Yes, if both parties agree. |

| #2: Promotes division of Labour? | Hardly | yes | Yes, but limited @the moment. |

| #3: Divisible? | Not always | Yes but upto 10-2 | Yes and more divisible than fiat money. 10-8 |

| #4: Fungible? | Not always | Yes | Yes, for now. |

Let’s continue further, what are the limitation of bartering system? Why did people shift to money system and how does Bitcoin fare on those parameters?

#5: Difficult to store Value

| UNDER MONEY SYSTEM | UNDER BARTER SYSTEM |

|

|

|

|

|

|

So far, money system is better than barter system, for storing the ‘value’ of your labour.

But the Main problem: Inflation erodes the value stored in money. For example:

- within 2013, the onion prices have rose from Rs.20/kg to almost Rs.100/kg= 400% price rise

- In a fixed deposit, you’ll barely get ~9% return in a year.

- So even if you prudently store the value of your labour (salary) in money, your purchasing power declined.

Similarly, if government overprints currency notes for the sake of financing a war, bailouts of troubled PSUs or running populist welfare schemes =that also creates inflation, and erodes the purchasing power of money. Recall Rajiv Gandhi Suitcase Yojana.

What about Bitcoins?

Bitcoins are created by a mathematical algorithm, total amount of Bitcoins is finite (~21 million Bitcoins). Nobody can overprint Bitcoins beyond that.

It is possible to store value of your labour in Bitcoins e.g. IT Professional makes new software for American businessman and gets paid in Bitcoins. But…

- Bitcoin itself cannot buy many goods and services at the moment, because Bitcon is not a fiat currency unlike Rupee, dollar or Euro.

- At some point, you’ll have to exchange Bitcoins for a fiat currency- when you want to buy milk, vegetables or pay electricity bill.

And there comes the problem: the exchange rate between Bitcoin vs. fiat currency

| year 2013 | 1 Bitcoin = ____ $ |

| Last week of October | ~190 |

| first week of December | ~1200 |

| third week of December | ~580 |

- As you can see, Bitcoin exchange rate is way too volatile / fluctuating. Fortunes are made and lost in a matter of weeks.

- A Botson Economics professor even predicts that by June 2014, one Bitcoin will be worth less than 10$, based on its current downfall!

- Agreed that inflation (or overprinting) erodes the purchasing power of fiat currency such as dollars or rupees.

- But you’ll never expect so much ‘erosion’ of value – in such a short period-like in first week of December you could buy two iphones in $1200, but in second week of December, inflation is so increased you cannot even buy one iphone!

- In a separate article, we’ll see more about the connection between money supply vs inflation/deflation and how Bitcoin fits in that picture. but for the moment let’s just update the table

| features | barter | Fiat money (Rs./$) | Bitcoin |

|

No | Yes | Yes, if both parties agree. |

|

Hardly | yes | Yes, but limited @the moment. |

|

Not always | Yes but limitations | Yes and less limitations than fiat money |

|

Not always | Yes | Yes, for now. |

|

Not always | Yes | Yes, but volatile at the moment. |

Continuing with the original discussion: what were the limitations of barter system, that made people switch to money system?

#6: Savings don’t turn into investment

- Under Barter system, there is no common storage for value (i.e. currency)=> difficult to operate banks, insurance companies and mutual funds.

- As a result, people can save very less and often they just hide their gold, silver and jewelry under a tree or under their bed pillow.

- This type of savings doesn’t help the entrepreneurs get loans to start new business, hire more people, produce more goods and service = not helpful for the economic growth.

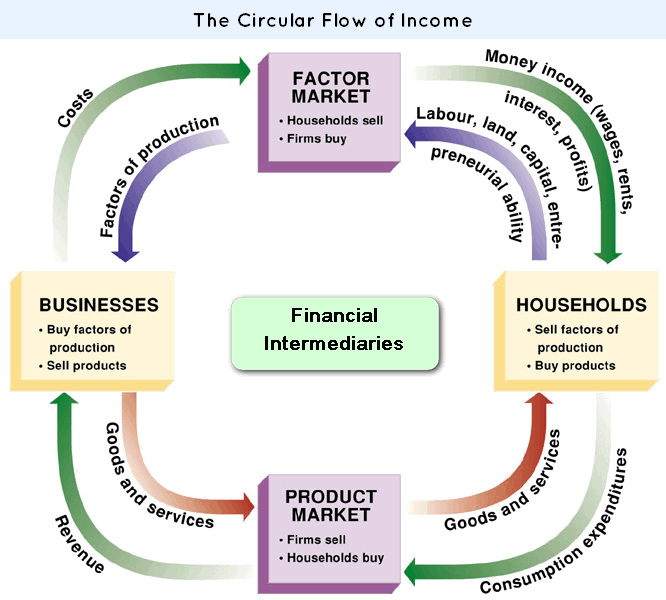

Money system solves this problem through “Circular flow of Income”

What is Circular flow of income?

Money system creates two entities

| HOUSEHOLDS | FIRMS |

| They buy goods and services from the firms. | They produce goods & services and sell it to households. |

they supply the factors services to the firms

|

they pay for those factor services in terms of:

|

- Firm’s profit = whatever money is left after paying the rent + wages + interest (+ tax + bribes).

- And firm can use that profit for buying additional factors (land, labour, capital) to produce even more goods and services = even more income for the households (through rent, wages and interest)….this cycle of income continues.

- Financial intermediaries such as bank, insurance companies and mutual funds, help running this cycle by acting as a ‘middleman’ between the households and firms.

- On one hand they accept money from households and on the other, they help firms get the necessary investment via debt (loans, bonds) or equity (IPOs, shares). For more on Debt vs Equity, click me.

Thus the money system and circular flow of income leads to more jobs, more business, and more economic growth. This is not possible under barter system.

What about Bitcoins?

In theory, Bitcoins savings can also turn into investment and thus the whole ‘circular flow of (Bitcoin) income =possible. But it is full of problem at the moment:-

- In recent times, many people have entered in the Bitcoin game out of speculative purpose that “in December 2013, one Bitcoin=1200$ so may be in 2014 one Bitcoin=worth 2000-3000$ and I’ll become a crorepati in no time, if I somehow get hold of a few Bitcoins! “

- So they go to online Bitcoin exchange website, and give their fiat money savings (Rs. or $) to buy Bitcoins and just wait-n-watch hoping that Bitcoin to Dollar exchange rate will rise in future. In a way, this is same like hiding gold under your pillow and hoping that its price will rise in future.

- According to the critiques of Bitcoin, ^this is not turning savings into investment but mostly speculative gambling.

- For the circular flow of income, you need the savings of a household becoming investments in business firms. And for that you need financial intermediaries like banks, mutual funds and insurance companies.

- but recently People’s Bank of China (=Chinese RBI) has issued following notice:

“Bitcoin is a specific virtual merchandise, which does not have the same legal status as currency, and cannot and should not be used as currency in circulation in the market.”

- Meaning Chinese financial intermediaries and businessmen are officially prohibited from accepting Bitcoins and thus ‘circular flow’ of Bitcoins is stopped in real life.

- Ofcourse some entrepreneurs have started companies with crowd funded Bitcoins, but one or two Cinderella stories doesn’t mean “Circular flow of income”.

- Besides, even if an entrepreneur manages to get ‘loan’ of Bitcoins to start a business, he’ll have to convert some Bitcoins into fiat money (Rs/$) to pay for office-rent, electricity bill, wages to laborers etc.

- But since Bitcoin vs dollar exchange rate is so volatile, it is hard to determine a reasonable interest rate that a businessman should pay back to the household or the financial intermediary (who lent the Bitcoins.)

Recently Winklevoss Brothers (facebook fame; they claimed Mark Zukerberg stole their idea), anyways these Winklevoss Brothers have launched a Bitcoin investment Trust. To put their mechanism crudely:

- Junta gives dollars to Winklevosse brothers, gets shares in return.

- Brothers convert those dollars in Bitcoins, and invest in Bitcoin related startup companies.

- Those startup Companies make profit, return Bitcoins loans to Winklevosse brothers.

- Brothers convert those Bitcoins in real dollars, and all the junta gets dividend according to the number of shares owned by them. And if a person cannot wait for that long, he can also sell those shares to others at the stock exchange.

- A NewYork based company SecondMarket Inc. also launched similar Bitcoin investment fund but aam-juntaa (retail investors) are not allowed. Only institutional investors (such as pension funds) can invest in their fund.

Overall, these things are yet to pick up the momentum similar to a rupee or dollar based sharemarket and mutual investment funds.

However in a futuristic society, there may be financial intermediaries owned and operated by Artificial intelligence (AI) outside the control of government and if Bitcoin is accepted as global currency, then perhaps Bitcoin savings could really turn into a decent investment.

Anyways, let’s update our table:

| features | barter | Fiat money (Rs./$) | Bitcoin |

|

No | Yes | Yes, if both parties agree. |

|

Hardly | yes | Yes, but limited @the moment. |

|

Not always | Yes but limitations | Yes and less limitations than fiat money |

|

Not always | Yes | Yes, for now. |

|

Not always | Yes | Yes, but volatile @the moment. |

|

Difficult | easily possible | Possible but difficult@the moment. |

Continuing with our original topic: what are the limitations of barter system, why did people switch to money system and how does Bitcoin fare on those parameters?

#7: Account-keeping = mission impossible

- In a barter economy, If there are 1,000 different goods and services in the market, then the value of each would have to be stated in terms of 999 others. = no meaningful accounting system is possible.

- A farmer may be able to keep track of his income, expense, profit and land revenue liability (Lagaan) because he uses very few inputs and produce only one or two crops per year.

- But imagine the plight of the Samsung company. They use so many inputs- screws of various size and shapes, precious metals, circuit boards, plastic, glass, paint and produce three dozen type of galaxy smartphones+ the cost of their marketing, transport, service-centers..….it is impossible to keep track of income, expenditure, profit and tax.

- And account keeping is not just for tax calculation. It is essential to measure your assets, liability and revenue stream to make future business strategies accordingly.

- Another problem: If there are “n” tradable commodities products in a barter system, the total number of MRPs will be [n(n-1)/2] (Think of the total handshake question under permutation- combination.)

- =difficult to run a ‘kirana’ store in a Barter village because you’ve to remember so many MRPs!

Money system solves these problems. You can express value of each and every item- no matter how big or small -in terms of rupees/dollars/euros= thus, account keeping is easy as pie.

What about Bitcoins?

Account keeping easier in Bitcoin system than in Money system because,

| Money system account keeping | Bitcoin Account Keeping (BTC) |

|

|

|

|

#8: Lack product specialization

In the barter system, buying/selling/trade can happen only when two parties want each other’s stuff. So, to increase the chances of this ‘double coincidence of wants’, people only produce goods/services that are likely to be “wanted” by a larger population.

| UNDER MONEY SYSTEM | UNDER BARTER SYSTEM |

Procter & Gamble (P&G)- a FMCG (Fast moving consumer goods) type MNC.

|

|

variety of toothpastes

|

|

|

|

What about Bitcoins?

Bitcoin will promote product specialization to a whole new level of ‘smart’ products.

- Imagine a futuristic laptop -if it stops working because of warranty covered defects, then its ‘blackbox’ will send automatic distress signal to Mother Company. And equivalent amount of Bitcoins can be automatically refunded to your digital wallet. =No headache of talking with service station employees.

- Variety self-service products. Imagine a 3D printer-robot. You can email it product design image, with a pre-payment of xyz Bitcoins. It’ll automatically print the customized product for you and ship it @your home.

- Variety of pay and use products. Imagine a futuristic shopping mall, you walk in & pickup xbox360 or playstation but instead of paying 30-40 thousand rupees upfront, you bring it home, play as much as you like and return back. Only the Bitcoins equivalent of playing hours will be cut from your digital wallet. Same for cars, bikes etc. with microchips, that’ll only function if you pay Bitcoins.

Possibilities are limitless but let’s update our table.

| features | barter | Fiat money (Rs./$) | Bitcoin |

|

No | Yes | Yes, if both parties agree. |

|

Hardly | yes | Yes, but limited @the moment. |

|

Not always | Yes but upto 10-2 | Yes and more divisible than fiat money. 1 Satoshi=10-8 BTC |

|

Not always | Yes | Yes, for now. |

|

Not always | Yes | Yes, but volatile at the moment. |

|

Difficult | easily possible | Possible but difficult@the moment. |

|

difficult | easy | easier than fiat money. |

|

hardly | yes | even better than Fiat money |

Continuing with our original topic: what are the limitations of barter system, why did people switch to money system and how does Bitcoin fare on those parameters?

#9: Future contracts and deferred payments

Deferred payment = you get the goods/ services right now, but pay for them in future. Example- Monthly bill of newspaper, electricity, telephones.

This is difficult under Barter system.

| Sonu Nigam | (Orders a cup of tea) |

| Chai-walla | How’ll you pay? |

| Sonu Nigam | I’ll sing any song of your choice for two minutes. |

| Chai-walla | Sounds like a fair exchange. But I’m not in a mood of music at the moment. So, How about this: I give you tea right now but you perform that two minutes song, after two years, during my daughter’s wedding! |

| Sonu Nigam | Sorry, I can’t accept that contract because:

|

SECOND CASE

| JK Rowling | Orders a cup of tea, offers two pages from her Harry potter book. |

| Chai-walla | well my son likes Harry potter series but two pages are useless, I want the entire book. |

| JK Rowling | ok, How about you serve me one cup of tea every morning for next 300 days, and then I’ll give you the entire Harry Potter book! |

| Chai-walla | Sorry madam, I cannot accept, because

|

Similar problems when:

- Farmer offers to give his bullock as payment, after 2 years but value of bullock declines as it grows older and weaker.

- Quality of wine improves with time. Value of art increases after the artist’s death and so on.

Thus, it is very difficult to make deferred payments under barter system because:

- Contracts can happen only when both parties agree on which specific commodity to use for repayment. (double coincidence of wants)

- Both parties face the risk that the commodity to be repaid would increase or decrease seriously in value over the duration of the contract.

- Either party will dispute the method of calculating the exact increase/decrease in the value of a commodity over time.

All this makes credit / lending / borrowing / deferred payments =almost impossible in bartering economy except a few basic contracts like farmer borrows from money lender and agrees to give a part in the wheat produced.

But the advanced contracts on wages, salaries, interests, rents, and other prices extending over a period of time= again mission impossible in a barter system.

Money system makes it possible because:

- Household savings =>investment. And household earns ‘interest’ on it (say ~4% in savings account, ~9% in fixed deposit and ~11% in mutual funds per annum.)

- These interest-rates or “rate of return”, help us determine the ‘time value of money’ and hence makes it easy to create future contracts and deferred payments.

Time value of money

Often you’ve seen the receptionist @coaching center say following:

- Entire year’s fees is 10,000 rupees, you can pay it in five installments of two thousand each.

- But if you want to pay entire sum right now, we’ll give you discount of Rs.500/-

So, why is she offering this ‘loss making’ proposition. Why is she ready to accept 9500 right now rather than waiting for 10000 at the end of one year? The answer is: time value of money.

- If they accept payment in ‘installment’, there is always ‘risk’ that you stop coming to class after 5-6 months and don’t pay the remaining fee installments.

- You pay them 9500 right now, they put it in a fix deposit for 1 year @9% interest rate=> get Rs.10384.29*. So even by accepting less than 10,000 right now, they’ll earn more than 10,000 in future.

*under fixed deposits, Indian banks usually give compound interest rate at each quarter i.e. 9% is paid @every 3 months.

Same concept works in following cases:

- In Gujarati dining halls, if you buy coupons for entire month, they’ll either give you discount or a 5-10 additional coupons for free.

- Magazines offer higher discounts if you subscribe for more years.

- In DishTV/Tata sky, if you pay 6-months or entire year’s subscription at once, they’ll give you discount / a few more channels for free.

Thus money system facilitates future contracts, deferred payments, debt obligations.

What about Bitcoins?

At present, it is difficult to estimate the time value of Bitcoin because

- BTC to Dollar exchange rate is volatile and unpredictable. in First week of December 2013: 1BTC=~1200 USD but in Third week of December 1BTC=~580 USD.

- Real life Banks don’t accept Bitcoins in savings account or Fixed deposits. China has imposed a specific ban.

- Of course there are some random website claiming to give interest on Bitcoins, lending out peer-to-peer loans to small business etc. But they’re not time tested (for a period of 10-20 years). No guarantee, he’ll shut down the server and run away to Nepal/Dubai after exchanging the Bitcoins to dollars when exchange rate dramatically fluctuates.

But in a futuristic society, when more real-life trustworthy financial intermediaries accept Bitcoins as a currency, then it’ll be possible to predict the time value of Bitcoins.

Bitcoins and Smart Contracts

As such, the Bitcoin system enables more ‘smarter’ contracts because of computer programing.

You can have conditional-scripting capabilities. e.g. “IF Event “A” happens, Pay “B” number of Bitcoins to Mr.”C”’s digital wallet on “D” date at HH:MM:ss time..”.

Thus, it possible to create smart contracts and deferred payments based on Bitcoin transactions. Future applications are numerous for example:

| under conventional money (currency) system | under Bitcoin system |

|

|

|

|

Counter argument: what if a person hacks/tempers the set-top box so even if he watches for 100 hours, the chip will say on 10 hours watched? (Counter-counter argument: what if someone puts a gun on his head and orders him to take out all money from ATM? Just because there is a possibility of misuse doesn’t mean technology shouldn’t be used.)

| under conventional money (currency) system | under Bitcoin system |

| You sit in a rickshaw/taxi. Driver deliberately takes a longer route to destination. And / or he tempers the meterbox in such way that you’ve to pay more fare than what you actually travelled. |

|

| Petrol pump owner gives you adulterated petrol mixed with kerosense OR he tempers with instrument so even if meter says “1 liter” while in reality only 950ml is transferred. | Vehicle fuel tank has Bitcoin enabled petrol-analyzer. It’ll measure both the quantity and quality of petrol and make payment accordingly from your digital wallet. If less petrol is transferred then less payment. |

Anyways let’s update our table:

| features | barter | Fiat money (Rs,$) | Bitcoin (BTC) |

|

No | Yes | Yes, if both parties agree. |

|

Hardly | yes | Yes, but limited @the moment. |

|

Not always | Yes but limitations e.g. Rs14.05897 | Yes and more divisible than fiat money (1Satoshi= 10-8 BTC) |

|

Not always | Yes | Yes, for now. |

|

Not always | Yes | Yes, but volatile at the moment. |

|

Difficult | easily possible | Possible but difficult@the moment. |

|

Difficult | easy | Easier than Fiat money. |

|

hardly | yes | More possibilities than Fiat money. |

|

Difficult | easy | More possibilities than Fiat money. |

In the next articles, we’ll see the functions of money, then evolution of money: from commodity money, metallic money, fiduciary money, gold backed paper currency, fiat currency, bank money; and then we’ll see how Bitcoins system works.

Mock Questions

Assertion reasoning instructions: Each of the following questions contain a set of Assertion (A) and Reasoning (R) statements. Answer codes are as following:

- Both the statements are individually true and Statement R is the correct explanation of Statement A

- Both the statements are individually true but Statement R is not the correct explanation of Statement A

- Statement A is true but Statement R is false

- Statement A is false but Statement R is true

Question Statements:

- (A) Money system is conducive for deferred payments. (R) In a barter system, cost of living generally increases with time.

- (A) Money system facilitates the circular flow of income more than the Barter system. (R) Presence of financial intermediaries impedes the circular flow of money from households to business firms.

- (A) In Money system, it is possible to store the value of labour for a long period of time. (R) It is easier to maintain accounts and ledgers in a Money system than in Barter system.

Direct MCQs

- inflation will not erode the value of your savings, IF

- If You invest it in Bitcoins

- If You invest it in inflation indexed bonds.

- If You invest it in a fixed deposit.

- None of above.

- Barter system could have continued to function successfully, IF

- If majority of the people remained illiterate.

- If Computers were used for maintaining accounts and display boards for barter trades, to facilitate the meeting between parties with double coincidence of wants.

- If the needs of society were limited to only bare essential food, clothing and shelter.

- If empires were governed on communist principles.

- What do you understand by term “Circular flow of income”?

- For every flow of factor service from businessfirms to households, there is counter flow of rent, wages, interest and profit from households to businessfirms.

- For every flow of factor service from households to businessfirms, there is counter flow of rent, wages, interest and profit from businessfirms to households.

- Households provide rent, wages, interest and profit to financial intermediaries, who in turn give it to business firms.

- It is the theoretical mechanism that prevents the concentration of wealth in the hands of few.

Q7. IF _______, then it’d would facilitate the circular flow of income through Bitcoins.

- if Bitcoin became a fiat currency

- If more financial intermediaries accepted Bitcoins.

- If the mathematical algorithm was changed to release more Bitcoins in the system.

Answer choice:

- only 1 and 2

- only 2 and 3

- only 1 and 3

- All 1, 2 and 3

Q8. Which of the following, make(s) Bitcoins a superior system than Indian Rupee system

- Theoretically, it is possible to maintain accounts more efficiently and accurately in a Bitcoin system than in rupee system.

- Bitcoin to US Dollar exchange rate is more stable than Indian Rupee to Dollar exchange rate.

- At present, it is easier to calculate time value of money in the Bitcoin system than in Rupee system.

Answer choice:

- Only 1 and 2

- Only 2 and 3

- Only 1

- None of above

Q9. What do you understand by the term “Time Value of Money”?

- That inflation erodes the value of money.

- That money today is more valuable than the same amount of money in future.

- That any amount of money is worth more, the sooner it is received.

Answer choices

- Only 1 and 2

- Only 2

- Only 2 and 3

- All of them

Aptitude questions for timepass:

Assume that interest rate is 7% compounded annually, which of the following is a better deal?

- (A) Accept 100 rupees right now OR (B) Accept 200 after 10 years.

- (A) Accept Rs.50,000 per year for next 20 years OR (B) Accept Rs.40,000 right now.

For more on Economy, Visit Mrunal.org/Economy

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

u r really awsm sir…thnx a lot..:)

you have given the example of Artificially intelligent Tata sky (with some sort of chip) in case of bitcoin. But same concept can be used for Currency without using bitcoin. For using advanced AI machines or devices, we don’t have to use bitcoin. For ex: If i watch only few channels, then i should have to pay money (currency and not bitcoin) for watching those channels. then what is the use of bitcoin here.

Hi guys,

You say there are only limited amount of ie 21milion bitcoins all over the network and we can get bitcoins by mining.What if all the bitcoins are mined???

i m bitcoined..itni jyada info…

MAY I KNW THE EXPLANATION ABOUT 3RD ANSWER PLZ…STORING THE VALUE IS EASY BCOZ OF THE SAVING SCHEMES IN BANKS/SOME OTHER INVESTMENTS..BUT I THINK THAT MAINTAINING LEDGERS AND ACCOUNTS IS NOT THE REASON FOR THIS SAVINGS???PLZ EXPLAIN

Mrunal sir pls provide some information about SIDBI grade A officer paper pattern and study plan .. thanx in advance

Thanks !! Good Job !!

http://qjshdfjhgzer.com

why this such volatility in use of bitcoins??