- Prologue

- Bancassurance

- Benefits of Broker model?

- Anti-Arguments: Broker Model

- Nachiket on Insurance

- Mock Questions

Prologue

As such Bancassurance=important for IBPS but not so much for UPSC, but topic has recently came in limelight because:

- (Chindu+IRDA) vs Banks on broker model for selling insurance policies.

- Nachiket Committee’s recommendations: “insurance/investment service to all poors by 1/1/2016”

Bancassurance

- Bancassurance= Banks as Insurance Agents=Bank and an insurance company form a partnership so that the insurance company can sell its products to the bank‘s customers.

- Concept originated in France.

- Overall, Insurance companies’ 30% of the business comes from Bancassurance. (i.e. bank customers).

- There are three business models in Bancassurance.

Benefits

- Insurance company can reach more customers using Bank’s marketing channel, without having to invest in more offices and manpower. Bank Customer is more likely to buy insurance policy because of past faith. (than if insurance company asked a shopping mall/cinema owner to sell insurance policies to their customers.)

- Even Regional rural banks and cooperative banks are allowed to sell insurance policies like this= most economic for insurance companies, because they don’t have enough money/manpower to reach every rural area.

- Bank earns additional income.

- Bank staff already proficient in processing such forms/applications.

- Banks already have e-banking, mobile banking, ATM etc. facilities=> easy to collect money from customers.

- Customer gets both banking and insurance services at one place= time and effort saved in visiting multiple offices.

- + financial inclusion (when bank’s business correspondence agent or bank staff itself is providing insurance services to rural/poor customers.)

There are three business models of Bancassurance.

#1: Referral Model

- Here, Bank will give office space to the insurance company in its branches.

- The insurance staff will sit in the bank branch and sell its products to bank customers.

- Bank staff doesn’t participate in selling.

- Bank faces no risk. Insurance company pays fixed-fees for using the office space.

- Pro: Customer directly talks with insurance staff=less chance of bank staff misguiding/mis-selling policies to them.

- Con: In other two models, bank can make more commission.

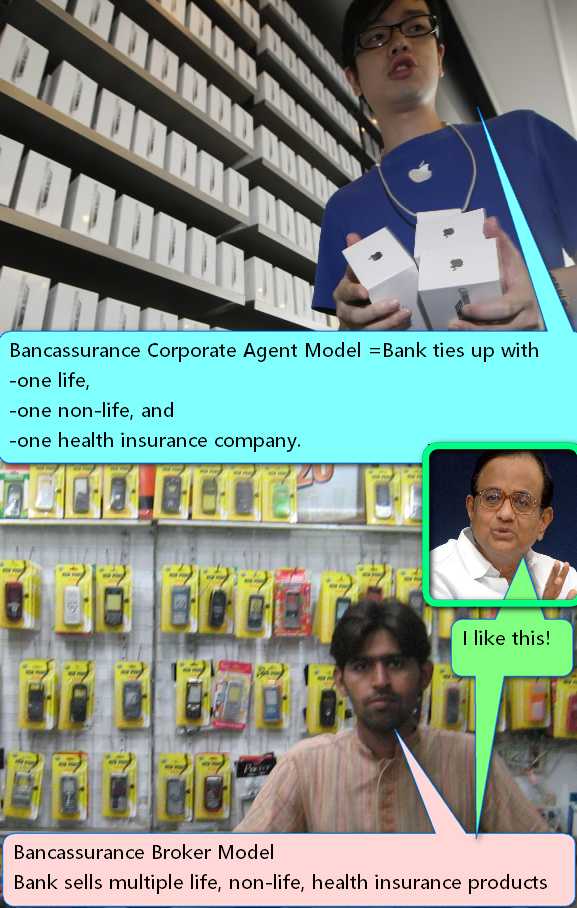

#2: Corporate Agent model

Here, Bank ties up with one life, one non-life and one health insurance company. For example:

| Insurance company | Its corporate Agent (Bank) | Bank type |

|---|---|---|

| SBI life insurance | State Bank of India | Public sector |

| Tata AIG General Insurance | HSBC | Private sector |

| Bajaj Allianz General Insurance | Saraswat Cooperative Bank | Regional rural bank |

| United India Insurance. | Tirunelveli District Central cooperative bank | Cooperative |

- Majority of banks follow this model.

- Bank sells policies of only one insurance company= customer is deprived of ‘choice’, even if other insurance companies are offering better alternatives. (imagine walking into an Apple showroom- the salesman can only sell you apple phones, even if other Samsung/LG/Micromax phone is more suitable to your requirement and budget.)

- Bank is not liable to customer.

#3: Broker Model

- Bank sells policy of multiple insurance companies under one roof. (multiple life insurance companies, multiple general insurance companies, multiple health insurance companies.)

- Bank earns commission according to sales-agreement with individual company. Imagine running a shopping mall displays variety of biscuit brands.

| Timeline | What happened |

|---|---|

| 2000 | Government and RBI permitted banks to sell insurance policies. (either through corporate model or through referral model.) |

| 2013 budget | Chindu allowed Banks to act as insurance brokers. (so that insurance penetration can increase in rural areas= financial inclusion) |

| November 2013 | RBI permits Banks to use Broker model and starts drafting guidelines. |

| December 2013 | Chindu writes letter to public sector banks- “in budget 2013, I had hinted that you should switch to Broker model. But you havenot yet implemented it yet. Anyways, adopt the insurance broker model by 15 Jan 2014!” |

| Jan 2014 | Bank chiefs don’t take Chindu’s advice seriously. None of them adopts the Broker model. They continue selling insurance under “Corporate Agent” Model. |

| Jan 2014 | Chindu feels disrespected and maybe he even informally complained to IRDA chief.IRDA Chief TS Vijayan makes press statement that “IRDA will make it make it compulsory for banks to adopt Broker Model. (once RBI drafts final guidelines.)” |

Benefits of Broker model?

- Bank will offer more choices to Customer= less chance of mis-selling.

- insurance penetration will increase in rural areas, thanks to bank branches and their business correspondence agents.

- In past, some insurance companies couldn’t tie up with big banks under corporate agent model. These insurance companies get less sales, even if their products are better (Because big banks are selling other xyz single product.) The broker model will benefit these insurance companies- to display their products on banks’ “showroom”.

Anti-Arguments: Broker Model

Banks and Financial experts have criticized the move of government + IRDA because:

#Bad impression to Foreign investors

- Bank have already have signed MoUs/Agreements with specific foreign insurance companies promising “we’ll sell only your products.” (e.g. Bank of India with Japan’s Dai-ichi life insurance.)

- Now, If IRDA/Chindu forces them to adopt Broker model, then foreign insurance companies will feel cheated. They may even drag the banks to courts.

- Chindu’s “devil-may-care” attitude= Potential foreign investors fear Indian economic policies are ‘unpredictable’ = less investment in future = current account deficit increases = rupee weakens = petrol expensive = more inflation.

#Staff skills

- Bank Staff lacks the skills in broking multiple insurance products. (again- Apple showroom salesman only needs to mugup the feature list of Apple phones and tell customer that Apply is best! But a smalltown’s mobileshop salesman has to mugup feature lists for 3-4 dozen phones, and guide the customer in choosing the right phone!)

- Therefore, Banks will have to hire separate staff to deal with insurance-brokering only. = operating cost increases. And NPAs are already high because of pending infrastructure projects and environmental clearances. = systemic risk.

#Diseconomies of scale

- Broker model= bank has to keep staff trained for selling multiple products. They’ve to keep literature, application forms of multiple companies. Keep separate finance/accounting records/softwares. Keep in touch with multiple executives in different companies = diseconomies of scale (Compared to doing this with just one company.)

#BC already doing it

Banks are permitted to appoint Business Correspondents (BCs). This BC may even sell mutual fund products, pension products, and micro-insurance products of third parties. Examples:

- Syndicate Bank’s officially tied with Birla Sun life insurance. But its Business correspondents in rural areas sell TATA AIG insurance policies as well.

- So Chindu’s aim/intention that people in rural areas should get multiple product choice = this is already being done by Business correspondent agents. There is no need to ‘force’ Banks to adopt to broker model.

# Consumers more aware:

- With internet penetration, even customer himself go online and buy insurance product. So, there is no need to force bank to sell insurance policies of multiple companies.

- Sites like “policybazaar dot com” even give daily ads “don’t buy insurance without comparing”= consumer awareness is increasing. They can decide for themselves, even if bank staff tries to sell them a “not-so-good” insurance product.

Nachiket on Insurance

All small businessmen and poor families will be given insurance/investment products for

- insurance for humans: life insurance, health insurance, disability insurance

- insurance of livestock (Cows, buffaloes, poultries)

- insurance of crops/farming/agriculture

- Insurance against property damage.

- Protection against commodity price movement. (e.g. Negotiable warehouse receipts.

Deadline: 1/1/2016.

Cross KYC

- At present RBI, IDRA, SEBI, PFRDA(NPS) have permitted Aadhar card as a “proof of identity and address”.

- But still Banks, Insurance company, mutual funds, NBFC- all carry their own separate KYC checks. = duplicity of effort. Villages face inconvenience because they’ve to get photos and xeroxes of documents every time for every new account.

- Nachiket suggests RBI to give explicit instructions about Cross-KYC to Banks, Insurance Companies, Asset-Management Companies, Mutual funds, NBFC , Banks, and Non-Banking Financial Companies.

- All of them must be permitted to rely on KYC done by each other, instead of duplicating the effort every time you open a new account.

Reforms in NBFC bancassurance models

Like the banks, NBFCs also sell life and general insurance to their customer base. but there are limitation:

| NBFC’s Bancassurance | IRDA’s current guidelines | Nachiket recommends |

|---|---|---|

| Referral model | not permitted | allow =>financial inclusion. |

| Corporate agent model | permitted | already permitted so nothing new to do here! |

| Broker model | not permitted. | permit, with some conditions. |

Allow NBFCs to take deposits

At present there are two type of NBFC: (i) Deposit taking and (ii)Non-deposit taking.

- Even if NBFC sells insurance products still NBFC cannot accept premium money from customer.

- The customer will have to directly deposit the premium to the insurance company (LIC etc.)

- It’s not a big deal for city folks. But in remote villages, people don’t have access to netbanking, cheque dropbox etc.=problem.

- Nachiket recommends removal this classification of Deposit taking vs. non-deposit taking NBFC.

- Simply allow all NBFC to accept deposits/premiums on behalf of banks/insurance companies.

- It’ll facilitate financial inclusion.

- Insurance companies will be able to reach even the farthest parts of India, with help of NBFC agents.

NBFCs as mutual funds agents

at present NBFCs can sell/distribute mutual fund policies after RBI’s permission. But RBI will grant permission ONLY if

- the given NFC has minimum 100 crores of funds

- making profit for last three years

- minimum NPA

Given these stringent conditions, most of the small-time NBFCs are disqualified from selling mutual fund policies to their customer-base.

Solution: RBI should relax the eligibility critiera, so more NBFCs can apply. That way, people from remote areas can also invest in Mutual funds, through their local NBFC agents.

Banks as Mutual fund agents

With RBI’s permission, the Banks can also sell mutual fund policy and give investment advice to its customers.

| Bank as___ | Where does the commission come from? |

| Mutual fund agent | Bank will convince its customer to invest in xyz mutual fund policy. Customer fills up the application form, bank forwards it to the mutual fund company, and mutual fund company gives commission to Bank. = this is typical salesman / agent type model. |

| Investment advisor |

|

But as you can see, there is conflict of interest. IF the bank is simultaneously acting a mutual fund agent + investment advisor=problem. Because bank staff will only advice you to invest money in the mutual funds where bank earns commission= misguidance, mis-selling, fake promises.

Nachiket has given many recommendations for consumer protection in such cases. But we’ll see that in a separate article. But let’s get a brief overview here:

Guidelines for “Agents”

- RBI should publish a guideline for appointment of agents including National Banks, Regional Banks, and NBFCs. (no matter whether they sell insurance or mutual funds policies.)

- All Agents must be required submit some security deposit. Minimum Rs.5 lakh. Amount can be increased depending on the number of customers and volume of transactions

- Biometric authentication of customers to prevent frauds.

- Agent must have trained staff to explain the risks and benefits of various financial products to customers.

- Agent must not design the salary/bonus package in such way that staff is motivated to do mis-selling/fake-promises to reach the sales target.

- Agent must set up an internal grievance redressal mechanism, must publish give contact number/helpline for customers complaints.

- All customer grievances should be solved within a defined time frame.

- Other recommendations related to consumer protection – discussed in a separate article.

Mock Questions

[columnize]

Q1. Who among the following can to sell insurance policies in India?

- Scheduled commercial banks

- Regional Rural Banks

- District cooperative banks

- NBFC

Choice

- Only 1 and 4

- Only 2 and 3

- Only 1, 2 and 4

- All of them.

Q2. Recently, Finance Ministry issued a circular asking the public sector banks to adopt Broker model for selling insurance products. This move will:

- increase insurance penetration in rural areas

- Reduce mis-selling of insurance products.

- Improve profit levels of Public sector banks.

Answer choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- All of them.

Q3. Recently, Finance Ministry and IRDA have asked the Banks to adopt Broker model of Bancassurance. But the banks have not yet adopted this model because

- Broker model doesn’t allow them to sell life insurance, non-life insurance and health insurance simultaneously.

- RBI does not permit Broker model-that sector is completely reserved for NBFC entities.

- Bank unions have demanded additional overtime-payments to work under this system.

Answer choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- None of them.

Q4. Which of the following is / are correct about Bancassurance?

- If a bank provides bancassurance services to a farmer, poor or marginalized group, it qualifes under Priority sector lending targets.

- If a customer doesn’t make timely payments for Bancassurance services, bank is entitled to impose penalties under SARFAESI Act.

- Both A and B

- Neither A nor B

[/columnize]

Descriptive

- “The compulsory broker model for bancassurance, will improve Insurance Penetration in Rural India.“ Comment. (5m | 100 words)

- Despite the nationalization of insurance companies decades ago, the insurance penetration in rural areas has been far from satisfactory. Examine causes and suggest remedies. (10m | 200 words)

- Write a note on the initiatives taken by Government of India to improve insurance penetration in rural India. (10m | 200 words)

Interview

- On the issue of Broker model of Bancassurance, bank chiefs have said unofficially that IRDA and Finance ministry shouldn’t try to force their economic views upon others, this is akin to the erstwhile license-quota-inspector raj. Do you agree? Yes/No and Why?

- Nachiket Mor has suggested removal of various restrictions on NBFCs, to allow them to sell insurance-mutual funds in rural India more easily. Of course his thought process is focused on financial inclusion. But don’t you think this sudden exposure of free market forces in Rural India may lead to financial exploitation of villagers rather than “inclusion”? yes/no and how?

- Suppose, NBFCs are allowed to freely sell insurance/mutual fund policies of private companies in Rural India- but what if one day stock market crashes and the villagers’ investment is lost! Don’t you think Government should setup a separate organization or department to sell policies in rural area? yes/no and why?

MCQ Hints

- all

- FinMin’s official letter to PSB mentions statement 1 and 2. Third statement is wrong (or debatable on how you drag the logic of “increase in profit vs increase in operational costs”.)

- None.

- Bancassurance is outside the purview of PSL and SARFAESI.

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

Awesome article :)

gud one

I always think that patel sir y u r not a ias officer?.. i my view u r more than deserving than anyone else in this country..

Well anyways like every single time again u did a great job..

Thanks a tonn

could someone please give the correct answers for the MCQ’s…

sorry didn’t see the hints.. got it..

Thnx mrunal bhai…

too good …waiting for last one .

I have a doubt. Is it necessary to have KYC to control inflation through repo rate and MSF vis a vis NBFC and others in India by the RBI mechanism that deals with currency and other macro economic factors of severe importance in the smooth functioning of a good democratic and sustainable country ?

Brother KYC is Know Your Customer.. it is to do with controlling NPAs of banks.. it has little to no affect on inflation/repo rate/MSF

Is KYC to do with NPA or Money Laundering?!!! I read on RBI’s website where it was mentioned that KYC is to stop money laundering. Also the reason to implement KYC was asked in IBPS clerk. To stop customers from money laundering was there in option.

Mrunal thank you very much for all the articles…it has helped me a lot. Will it be possible to publish some material on Quantitative easing ? I read about it in other sites but didn’t understand very clearly.

To Mrunal

For the economy section I have one doubt regarding 12th five year plan. Its been suggested to read 12th plan. So I want to ask do we need to read entire plan document? Even you have suggested it will provide us with a lot of fodder points. Will it suffice if I just go through summary of the 12th plan or approach paper of the plan. What do you think would be the best option??

Thanks & Regards

plz answer my query

Mayank,

I have read 12th plan approach paper and found it to be quite useful and informative. One can find good fodder points on [Energy, water, health, education, Infrastructure] important issues. There is no doubt that complete 12th plan would enhance knowledge more than approach paper but other factors such as length of the document, time constraint and retaining ability may be considered. But there is no doubt that at least approach paper must be read before mains.

Thanks Sumit.

As you have read approach paper of 12th plan and you must have skimmed through 12th Five Year Plan document. So I want to know that is approach paper summarized form of entire plan document. If the crux of the plan document has been covered by approach paper then I think it is better for us to read approach paper more than once rather than going for entire plan document.

What is your view regarding economic survey?

Mayank,

I have not skimmed through all of the 12th five year plan document but have seen few chapters such as health, education and infrastructure. They are more detailed, contain more information than approach paper and can not say with conviction that approach paper is the summary as i have not read complete 12th plan document.On Economic survey, read all chapters, when ever it comes to the market.

Thanks a lot Sumit.

for prelims: Ramesh Singh has given the targets.

for mains: just the gist of recommendations given @bottom of each chapter in 12th FYP.

Thanks Mrunal Bhai.

What to do about Economic Survey?

Hi Mrunal,

This question is off the current topic. In the exams (essay, paper-3) questions are being asked on PPP model. Are you planning to write an article on this. If not, can you give some references?

Hi mrunal sir,can you please tell me job profile of social security officer.If anyone knows also,please tell me.thanks!!!

for this pref is given to law and management stu plus one year exper

Hi all , i know this may sound stupid to many of you but … need to ask so here it is ..

i have just started preparing for upsc and facing a basic or starting doubt on approach that is expected to be followed for analyzing the Hindu articles on international relations . Suppose if an article comes on INDIA-JAPAN relation than what all possible factors and areas should i look upon ? Shall i go like – what is their for india … why japan wants to have a stronger relationship with India … ?? ……is it the correct way ??? Can someone briefly explain me with an example .

Let me explain best to my abilities. First of all, you can divide any foreign relationship into a)Strategic b)Economic c)Defence d)Cultural etc. categories and notes may be made by noting down fodder points(Today’s editorial is an example). Secondly, you may also try to analyze the equation why India needs Japan or why Japan needs India. Reasons may be economic, china factor or any thing. Then One can also understand this relationship by considering contentious issues of Nuclear energy, Climate change and what is the stand of these two countries. As exam pattern has changed and any thing can be asked and we have just 6-7 mins to respond so i think short, crisp notes can be made on diverse, multiple angles with clear understanding.

it was very imp stuff

who is chindu?

p.chidambram miss.

Thankz mrunal bhai….!!!!!

excellent article..well explained Mrunal sir

1)D

2)C

3)D

4)D……………………PLS CORRECT ME IF I AM WRONG

hi mrunal thanks for rendering assistance for our preparation.You didn’t update this article ?? Other recommendations related to consumer protection – discussed in a separate article.

“8.Other recommendations related to consumer protection – discussed in a separate article.”

Mrunal Sir,

Where is the concluding article on Nachiket Committee?

I am still waiting……

WONDERFUL

Mrunal sir pls come with geog module,,,most of the aspirants are finding it tough to prepare geog in themanner as asked in changed pattern of p.t.

Hi, Good article – easy to ready. However, there is an error – NBFCs do not have to be deposit-taking companies to accept premium from clients. As corporate agents, they are allowed to collect the premium and pass it on to the insurer within reasonable time – this is not considered a deposit.

sir,

have you published regarding consumer protection???pls do hlp

Hello Mrunal,

I am preparing for IBPS exam. My question is “What is the diff. between corporal agent model and referral model “.

Regards

CAN YOU PUBLISH THE LIST OF BANKS AS CORPORATE AGENT WITH WHICH INSURANCE COMPANIES?

How cn I prepare fr lic aao n bank po exam

Sir ur lectures are amazing pls start also geography

Very well written