What is Financial Inclusion?

| BANKING | Savings & payment (through ATM, cheques, e-transfer etc.) |

|---|---|

| CREDIT | loans @affordable interest rates. |

| INVESTMENT | mutual funds, pension plans, child investment plans etc. |

| INSURANCE | life insurance and non-life (general) insurance. |

We need financial Inclusion because

- It Turns savings into investment. Circular flow of income=helps the economy. (Compared to if everyone just hid their money under pillow.)

- Insurance/investment/savings =Protects family against unfortunate circumstances. Child future secured.

- Income inequality falls more rapidly in areas that have more developed financial intermediaries (banks, insurance companies).

- In the 80s, countries that focused on providing easy financial services to small businessmen =became large economies today be it Japan, South Korea or USA.

- Financial inclusion = cheaper loans=faster growth of agri and small business. (Because Banks charge less interest rate than private moneylenders and financers.)

- IF all of the government subsidy/benefit payments are done via netbanking/e-transfer then Rs.1 lakh crore rupee will be saved per year in terms of manpower-time-paperwork-leakages. [As per Mckinsey research.]

- If there are no formal channels to save money (like Bank), then low income households are more likely to fall victim to Ponzi schemes like Saradha chit fund in Bengal.

- IF everyone has bank account=> lowers the transaction costs, paperwork and time. (Compared to counting currency notes, maintaining records, manually recovering money vs cheque drop box and so on.)

- Economic well-being of the poor people also ensures social harmony, they’ll not fall into brainwashing by Maoists/Secessionist/Extremist elements.

- + Women empowerment.

[If you can add more points, post them in the comments below]

Financial Inclusion: Steps taken so far

- In a free market economy, banks, NBFC, mutual funds and insurance companies would only focus on urban areas and High networth individuals (HNI). Because if they try to serve poor people, the cost of operation =higher than the profit.

- Therefore, RBI and Government had to intervene and force these financial intermediaries to serve the poor people all over India. Here is a list of steps taken so far

Giving More Access to banking /Payment

- Post office: savings account, e-money order, even international money transfer (remittances)via Western Union.

- Government has nationalized Banks and insurance companies, made them serve low income groups and rural areas.

- Government helped setting up Regional rural banks, Cooperative banks, Primary Agriculture societies.

- Lead bank schemes: RBI assigns a district to a particular bank. That Bank will be responsible for promoting banking services and financial literacy, in that district.

- Government launched Swabhiman project to extend banking services to rural areas.

- RBI permitted Business Correspondents (BC) system. Banks extend their services to villagers with help of these agents.

- Bhartiya mahila bank setup and owned by GOI,exclusively for women is a initiative towards financial inclusion

- RBI permitted White label ATMs, and ordered the companies to open 2/3rd of these ATMs in semi urban and rural areas. click me for more.

- RBI has ordered the banks to open at least 25 per cent of their new branches in unbanked rural centres.

- RBI’s No Frills accounts for poor people. Later renamed to Basic Savings Bank Deposit Account (BSBDA).

- Government’s Direct Benefit Transfer (DBT) initiative. Money directly sent to beneficiary’s bank account. If he doesn’t have bank account already then it’ll be opened.

- RBI relaxed Know Your Customer (KYC) norms for small value accounts. RBI allows customer accounts to be opened without any documentary proof of identity or current address if the amounts involved are less than Rs.50,000. (but once that limit is crossed, he’ll have to give proofs).

- RBI permitted Aadhar card can be used as proof, for opening bank account.

Giving Access to Credit (Loans)

- Priority sector lending targets. Banks have to compulsory give some of the loans to farmers, students, small businessmen etc.

- NABARD=>Microfinance, Various schemes for Self-help groups.

- Interest Subvention scheme for farmers.

- Debt relief to farmers in 2008.

- General Purpose Credit Card (GCC)and Kisan Credit Card (KCC) to help people get loans easily.

Giving More Access to Investment

- National Savings certificates

- Public Provident Funds

- New Pension Scheme

- Rajiv Gandhi Equity Savings Scheme

- inflation indexed bonds

Giving Access to Insurance

- Post office: has tied up with LIC, offering variety of insurance schemes, particularly targeting rural junta e.g. Gram Surakha, Suvidha, Sumangal etc.

- Weather based crop insurance loans for farmers

- Aam Admi Bima Yojana

- Rashtriya Swasthya Bima Yojana (RSBY)

- Rajiv Gandhi Shilpi Swasthya yojana (one type of Health insurance)

Plus, RBI and SEBI running financial literacy campaigns.

But, despite all the previous efforts, result has been unsatisfactory. As per Census 2011

- Only 67% of Urban households getting banking services.

- Only 54% Rural households getting banking services.

Another study indicates that:

- In Banglore alone: while 70% micro-enterprises have bank accounts, barely 1% of them given loans.

- There is also regional variation: some districts in Nagaland – 0% people have bank account while in some urban districts of Southern and Western states, more than 70% adults have bank accounts.

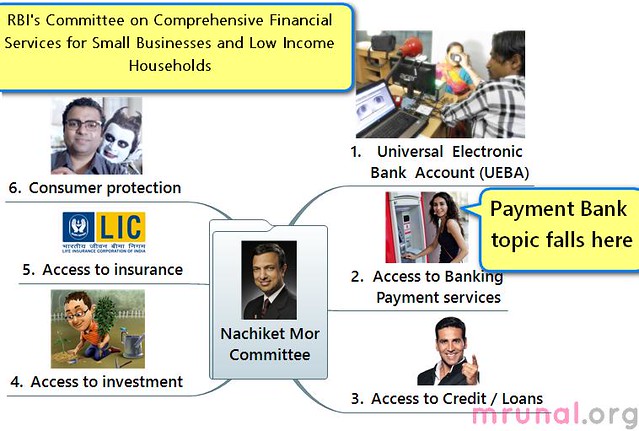

Therefore, Nachiket Mor Committee recommended 6 pillar strategy for 100% financial inclusion.

Let’s check these visions one by one. In the present article, we’ll see vision 1 and 2. other visions later on.

Vision #1: UEBA Bank account for Adult

- Bank account is an essential gateway to all financial services, even those outside RBI regulation. For example IRDA has ordered the life insurance companies to give money only through cheque/electronic transfer to bank account of beneficiary.

- So if you don’t have a bank account, you’ll be shut out of the entire financial system.

- Government also wants everyone to have bank accounts so money/subsidies can be directly transferred into beneficiary’s account under DBT.

- Nachiket recommend that By 1/1/2016, every Indian resident (above 18) will be given a Universal Electronic Bank Account (UEBA). HOW?

- When Aadhar Card is issued to any adult (above 18), he’ll be given a choice to open a bank account automatically.

- It’ll be called Universal Electronic Bank Account (UEBA).

- In the bank of his choices. (So far, State Bank of India, Bank of Baroda and Axis Bank have indicated their willingness to participate. )

- Account opening=Totally free of cost. (But subsequently bank is permitted to charge fees- for ATM, credit card etc.)

- This UEBA account would remain active as a perpetual account as long as the Aadhaar number remains active.

Shikha Sharma

(This panel member has officially criticized Nachiket’s 1/1/2016 plan)

- You’re talking about “Electronic” Bank account but In many rural and naxal areas, we don’t have the physical structure (office/staff) OR even virtual structure (by mobile/broadband) to run banking services.

- Besides, if deadline is 1st Jan 2016, means everything has to be finished by the end 31/12/2015= Mission impossible.

- A more plausible target is 100% bank accounts by 1st January 2018.

Additional criticism to Nachiket’s Universal Bank account plan:

- Nachi’s plan is noble but no different than the Paternalistic formulation which say the State knows everything- about what should be consumed by each customer= licence-quota-inspector raj.

- Nachi says bank account for every “resident” (not citizen). So even outsiders like Bangladeshi and Nepali immigrants get the benefit, and money comes out of tax payer’s pocket. (How? because even if SBI agrees to open UEBA accounts for free, it’ll need to spend money on paper-work and staff. and over the years, SBI is not making optimum profits and suffering from large NPAs. So, Government will have provide some special scheme, Rajiv Gandhi Sabko bank account dedo Yojana, under which, Government pays 10-20 rupees to such public sector banks for every new UEBA account opened.)

Vision#2: Access Points for Banking/Payment Services

- ok, for the sake of argument, let’s assume everyone gets a universal bank account by 1/1/2016. BUT if a person has no branch office / ATM nearby, then it is useless.

- So, by 1/1/2016, we’ll also create so many “access points” that everyone can reach them within 15 minutes of walking distance.

- Example of access points: bank branch office, Bank’s business correspondence agent, mobile recharge/repair shop, small retailer, Panchayat office, post office.

Facilities given @access points:

- Deposit and withdraw money

- Transfer money from one bank account to another

This service will not be 100% free. You’ll have to pay “reasonable” charges.

- Government is planning to cover all the 2.5 lakh gram panchayats through the National Optical fiber network (NOFN) by 2014. This network + Panchayat office can be used for e-banking.

- Mobile Penetration is higher than you believe: There are more than 85 Crore mobile phone subscribers in India. Out of them 35 crores in Villages. And that number is increasing at 10% every year=> Mobile banking opportunity.

- Additionally, I also recommend RBI to give license for “Payment Banks”.

Rural Branching Mandate

| Center | city | census definition:population is ____ | SCB (Scheduled commercial bank): |

| Metropolitan | — | 10 lakh and above | Need RBI permission needed to open new branch [Except Northeast and Sikkim] |

|---|---|---|---|

| Urban | Tier 1 | 1 lakh and above | |

| Semi-Urban | Tier 2 | 50,000 to 99,999 | |

| Tier 3 | 20,000 to 49,999 | doesn’t need RBI permission to open new branch. | |

| Tier 4 | 10,000 to 19,999 | ||

| Rural* | Tier 5 | 5,000 to 9,999 | |

| Tier 6 | less than 5,000. |

*Additionally, Bank will have to open atleast 25% of its branches in unbanked rural areas.

White label Business Correspondence Agents

- Nachiket recommends White label Business correspondence agents. Meaning same agent be allowed to tie up with multiple banks.

- Why? Same logic like White label ATM: if all banks open ATMs in every village=operation cost increased. But is a white lable company gives service common to all of them, then operational cost reduced.

In short, NOFN + Mobile Banking + Payment Banks + Rural Branching Mandate=the Vision#2 achieved.

Apart from these, Nachiket also suggested reforms in NBFC, RRB etc. to achieve vision #2 but they also overlap with vision 3,4,5 and 6. So, we’ll discuss them later on in separate articles.

The end of the article, unless you want to read some additional topics associated with vision 1 and 2

Appendix: side topics

Basic Savings Bank Deposit Account (BSBDA)

- 2005: RBI cameup with “No frills account” for poor people.

- Allows you to open bank account with no minimum balance requirement.

- 2012: RBI renamed it to Basic savings Bank deposit account (BSBDA).

Facilities/ features:

- Anyone can apply for BSBDA (rich, poor, middle class doesn’t matter)

- Available at All scheduled commercial banks in India (including foreign banks with branches in India)

- Can deposit and withdraw cash

- Cheque and electronic payment facilities.

- Free ATMs-cum-Debit Card

- If you account remains inactive, still bank cannot charge any penalty on you.

- KYC norms apply

- Account opening is free

- Each year, First chequebook free.

- Netbanking facility is free

- Interest paid : 4% just like regular savings account.

Limits

- Maximum of four withdrawals in a month, including through ATMs.

- He cannot open any other account in the same bank.

Are Bank Branches useless for financial inclusion?

- A traditional bank branch (of SBI or ICICI) has high cost of operation – office rent, staff salary, securiy guard, lightbill, telephone bill etc. Even an ultra-small branch will cost ~20-22 lakh per year.

- In rural area, most people will get No frills account / Basic savings and deposits account= bank can hardly make any profit to make.

- Some Regional rural banks and cooperative banks are yet to be integrated with Core Banking platforms (CBS) = difficult for NEFT and RTGS money transfers.

- Traditional bank branches have fixed working hours and bank holidays. If a poor labourer wants to access his account, he’ll have to waste 2-3 hours in walking and talking=>late at work =>contractor will cut his wages.

- Most villagers need loans less than Rs.5 lakh. In this type of small loans, bank’s paperwork, headache, loan default risk is high compared to the profit/reward.

But It doesn’t mean Bank branches are useless. Nachiket recommends following

- Branch should focus on high value customers, transactions, cheque clearing and cash management only.

- Outsource other things to Business correspondence agents. e.g. account opening, organising financial literacy camps, sourcing loans resulting in sanction and disbursal, maintaining records, and post-sanction monitoring and recovery of loan accounts.

- Allow White lable Business correspondence agents. (i.e .same agent/PCO operator/kiranawalla can do work for multiple banks) in other words, permit Interoperability of BCs.

- Allow Non-deposit taking NBFCs to run Business correspondence agents’ network for Banks.

- Real Sector Adjacencies to increase banking penetration: For example

- Diconsa, an operator of 22,000 grocery stores in rural Mexico, began a program to deliver cash payments from government benefit programs to people in its stores.

- Axis Bank partnered with Airtel and Idea to leverage their wide outreach in rural areas.

- Banks should partner with Community Service Centres (CSC) and Panchayat Offices in the villages.

- Right now Aadhar cards enrolling is done via “camps.” Once this phase is over, bank branches could be used for handling new aadhar cards in applications in upcoming years.

Banks should get commission for DBT

- If a person wants to transfer money via NEFT (netbanking) from one bank account to another- he’ll have to pay fees between 2.5 to 25 rupees to the bank.

- Similarly if government wants to give direct (cash) benefit transfer to poor beneficiaries accounts, then government should also pay fees the banks.

- Nachiket recommends that for every DBT Transfer, the government should pay the bank 3.14% commission (upto to maximum Rs. 15.71 per transaction).

- Problem? Most government departments don’t like it. Not one bit.

RBI’s Seigniorage and E-Money

Just food for thought, not very important for exams.

- In the medieval times, there was no RBI (central Bank.) The king himself issued the coins. He’d give gold/silver/copper/bronze metal to mint-officers. They’ll melt it and make coins.

- In this case, Profit of the king (Seigniorage)= face value of a coin MINUS the Input cost. (salary to staff, blacksmith, charcoal burned to melt the metal etc.)

- Today we live in the era of Fiat-currencies- Rupee, Euro, Dollars, Yen and Yuan.

- So, how does the Seigniorage work now?

- Suppose cost of printing one “fifty rupee” note= twenty rupees (in terms of the money spent on buying paper, ink, electricity and staff salary).

- Thus RBI’s Seigniorage (or profit) = face value of currency notes MINUS the cost of printing currency notes. In our example, 50-20= 30 rupees.

- But that’s not “the end”. There are two cases when RBI needs to print money

- To replace the torn out currency notes.

- To pump additional money into the system.

In the second case, RBI cannot arbitrarily print money as per its time and mood (because it’ll lead to inflation). First government will have to give equivalent amount of bonds/government securities (G-Sec) to RBI. Say worth 100 crores. Then RBI will print 100 crore worth notes and circulate it in the market. And on those G-sec, government will have to pay interest to RBI.

so, What will be RBI’s Profit in this case?

- Direct profit: face value of notes minus production cost of those currency notes.

- + Interest earned from G-sec. [RBI earns more than Rs.85,000 crores from this only!]

Anyways, what’s the point?

- When junta switches to Electronic money transfer (NEFT, RTGS, mobile banking etc.) then less wear-n-tear of currency notes= demand of physical currency notes decreased=RBI’s profit (Seigniorage) decreased.

- In a futuristic society, junta will stop using physical cash altogether, All transactions will be done through mobile and electronic devices. How will RBI make profit? obviously the ‘direct profit’ is stopped (because RBI doesn’t have to ‘print’ currency notes anymore).

- RBI will still earn interest from G-sec. (because even in an electronic money system, RBI Governor will have to type the “100 crore“ in his super-duper banking software to pump 100 crore rupees in the electronic system. and he cannot do so, unless government gives him some legal backing through those securities/bonds.)

But overall, e-money= threat to RBI’s Seigniorage(Profit). Nachiket gives two solutions (just like Yudhisthir when asked about Ashwashthama’s death):

- We should admit it will not a big problem, and RBI can survive on less Seigniorage, even if Junta switches to e-money.

- We should admit that it will a big problem, and find an alternative solution. (e.g. Rajiv Gandhi RBI Bachaavo Yojana, under which government will agree to pay *** crores to RBI every year to compensate for the loss of Seigniorage because of electronic money.)

Mock Questions

- Correct Statement

- Since Independence, if India had followed a free market capitalistic model of economy, Financial inclusion would have been extremely high.

- Since Independence, If India had taken concrete steps for financial inclusion, the regional disparities would have been less.

- Both A and B

- Neither A nor B

- Recently RBI formed a Committee under Nachiket Mor. Which of the following is one of the vision statements issued by the Committee?

- Bank account for every citizen by 2016

- Bank account for every resident by 2018

- Bank account for every BPL by 2018

- Bank account for every resident by 2016

- Nachiket Committee has recommended Universal Electronic Bank Account (UEBA). How will it be achieved?

- Nationalized Banks will be required to hold camps and Melas to enroll people in UEBA

- RBI will issue a circular mandating all scheduled commerical banks to enroll all the unbanked BPL families in their branch-territories under UEBA

- Every resident will be issued a UEBA account automatically at the time of receiving their Aadhaar number

- None of Above.

- What do you understand by RBI’s “Rural Branching Mandate”?

- that all scheduled commercial banks have to open atleast 25% of their branches in tier-1 and tier-2 areas

- that all scheduled commercial banks need RBI’s permission before opening 25% of their branches in tier-1 areas

- that all scheduled commercial banks to open atleast 25% of their branches in tier 3 to 6 areas.

- None of above

- Correct statements about Basic Savings Bank Deposit Account

- This is special type of bank account only Micro finance institutes can open.

- only BPLs and self-help groups can apply for it.

- They get higher interest rate than (regular) savings account.

- It was earlier called “No frills account”.

- If we completely moved to an electronic money system in place of physical currency, then which of the following will be reduced?

- Government’s subsidy burden

- RBI’s Seigniorage

- both A and B

- Neither A nor B

- A place is given Tier 6 rank in Census 2001. it means the given place is a ____ area.

- Semi Urban

- Rural

- Urban

- Semi-rural

- (Aptitude) Suppose rural branches ratio of SBI : PNB=1:3, PNB: ICICI=2:5 and ICICI:BoB=2:3, then what is the ratio of SBI :PNB: ICICI:BoB?

- 4: 12: 3: 5

- 12: 4: 50: 10

- 4: 12: 30: 50

- None of above

- (Aptitude) SBI, PNB and BOB have rural branches in the ratio of 2:3:4. If each of them adds 40 new branches, then ratio becomes 4:5:6. Find the total number of rural branches in the beginning.

- 220

- 200

- 180

- None of above

Q10. Match the following

|

|

|

|

|

|

|

|

Answer choices

| choice | I | II | III | IV |

| A | 1 | 2 | 3 | 4 |

| B | 4 | 1 | 3 | 2 |

| C | 3 | 2 | 4 | 2 |

| D | 2 | 1 | 4 | 3 |

Q11. Which of the following factor(s) aid in financial inclusion?

- That under National optical fiber network, government plans to connect all Gram Panchayats with internet connection.

- That Mobile penetration is increasing day by day in rural areas

- That as per Census 2011, India’s working age population (15-64 years) is more than 60%

Answer choices

- only 1 and 2

- only 1 and 3

- only 2 and 3

- All of above

Q12. Financial inclusion doesn’t automatically help in:

- turning savings into investment

- reducing current account deficit

- Decreasing inflation

Answer choices

- only 1 and 2

- only 1 and 3

- only 2 and 3

- None of above.

Descriptive/Mains

- Examine the lack of financial inclusion as a factor responsible for inequality of income in India. (10m | 200 words)

- Nachiket Committee’s plan of providing Universal Electronic Bank Account to everyone by 2016, is ambitious but unrealistic. Do you agree? Justify your stand. (10m | 200 words)

- Nachiket Committee’s recommendations, if implemented in letter and spirit, can achieve 100% financial inclusion. Elaborate. (10m | 200 words)

- Critically evaluate the utility of Aadhar card in facilitating financial inclusion. (10m | 200 words)

- (Ethics Paper 4: Case study) DevAnand is member of a Committee on financial sector reforms appointed by the Finance Ministry. Chairman Alok Nath comes up with recommendations that are good in theory but highly impractical if implemented in real life. Dev had some reservations but this wasn’t a matter of life and death, so Dev did not object while recommendations were being finalized. After the report was released in public domain, TIMESNOW editor Arnab Goswami invited DevAnand on his show, and started asking uncomfortable questions pertaining to the practicability of those recommendations.

The following are some suggested options. Evaluate the merits and demerits of each of the options:

- DevAnand should tell the truth that he did not agree with some of the recommendations but did not oppose officially during the meetings because it wasn’t a matter of life and death.

- DevAnand should tell Arnab that he was merely a member, and Alok Nath is the chairman of the Committee, he is more capable of answering such interview questions.

- DevAnand should fervently defend those recommendations of the Committee.

- DevAnand should informally request Arnab Goswami not to ask hard questions because such Committee reports are never implemented anyways.

Also indicate (without necessarily restricting to the above options) what you would like to advise to DevAnand, giving proper reasons. (25 marks | 300 words)

some chillar questions:

- What is National optical fiber network? How does it facilitate financial inclusion? (5m | 100 words)

- Write a note on the steps taken by RBI for prompting financial inclusion. (5m | 100 words)

- Write a note on the steps taken by Government of India for prompting financial inclusion.(5m | 100 words)

- Write a note on the steps taken by RBI and Government of India for prompting financial inclusion.(10m | 200 words)

Interview

- 100% financial inclusion vs 100% literacy. Which one will you pick first, as the prime minister of India? and why?

- Do you think higher literacy levels and financial inclusion are directly related with each other? Yes/No and Why?

- If yes, then why North Eastern States have performed relatively low on the parameters of financial inclusion, despite having relatively higher education levels?

- As a policy maker, what will you do, to fix this anomaly, apart from giving money in subsidies and schemes with special component for NE states?

- Recently Nachiket Committee recommended bank accounts for everyone in India. Others recommend government to give food to everyone, give education to everyone, even mobiles for everyone! Critiques say this type of paternalist planning or Maai-baap-mindset is outdated. The state should not be doing everything. Do you agree? Yes/No and why?

Visit Mrunal.org/Economy For more on Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

Regards to #interview question number 1:

I hold that the question itself is absurd/irrational. can there be any effective 100% financial inclusion in country like India without a good literacy rate for that matter say- 100%??

It is undeniable facts that the problems of financial inclusion in our country is mainly (not the only) due to low literacy rate especially from the rural areas. 100% literacy, amongst other several factors, is a pre-requisite for achieving 100% financial inclusion.

Any correction/ alternate view is welcome.

100% final inclusion is next to impossible when literacy rate is 74% and poverty rate is 29%. the recommendations of this committee is not taking reality into consideration.. what is the use of having bank account when you don’t have money to buy food… in case government transfers money directly into their account, imagine the situation of Indian economy.

11. More people will come under tax net

You are so hilarious . At the same time very academic. Whole Financial inclusion thing very lucidly taught . Thanks in these tight circumstance (time before Mains)

increased literacy will surely make the financial inclusion effort more holistic.however,we can not wait till we achieve 100% literacy(somewhat hypothetical) to fullfill the urgent financial needs of poors and excluded sections.What is more required is to create awareness among the targeted section about these initiatives.

More TRANCPERENCY in the system

BLACK MONEY can me be kept in check.

@durgesh singh the profit earned on account of replacing old currency notes will decrease with reduction in use of paper money…this will result in loss of seigniority of RBI…in referred eg. already cost incurred including administrative cost is accounted in 20 rs…so 30 rs profit will be foregone

sir, your article on nachiket mor committe is very helpful, but this is only first article related to vision first and second , i need a complete article related to this topic please send it on my e-male id……

Mrunal sir plzzz help me in solving q.no 8 and 9. its taking too much time doing all the mathematical work to get answer.

Hey Guys, It’s 2016 now! Does UEBA exist?

I read the recommendations in 2014 and suddenly just happened to read them again… I tried to find on google about UEBA but all the news that shows up is of 2014. Even a lot of other recommendations had target 1/1/16.

Point to add in financial Inclusion : People will be more self sufficient and their dependency on moneylenders will decrease Therefore a sense of confidence and well being will be generated amongst them + they will be well aware of Govt policies made for them and thereby feel more connected with the government which will promote Active prticipation in Democracy in long run.

how financial inclusion will help in women empowerment?