- Prologue

- Securitization

- What happened in Sub-prime crisis?

- Shadow Banking

- Wholesale Bank?

- Mock Questions

Prologue

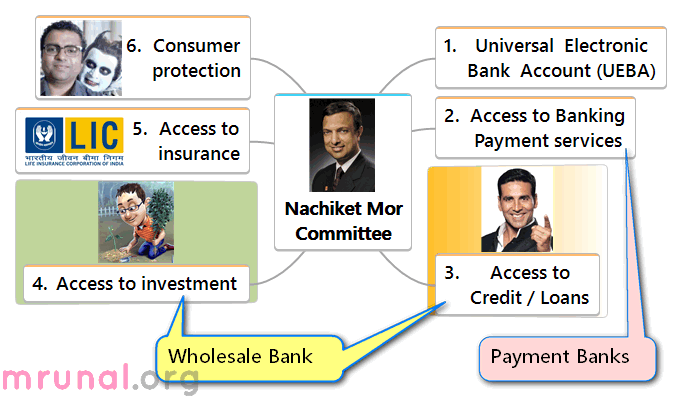

Under [Banking] Nachiket Committee article-series, so far we’ve seen following

- What is financial inclusion, steps taken by RBI and Government to achieve it.

- Nachi gave six point vision to achieve financial inclusion. Under that, Universal Bank account for everyone. Access to banking within 15 minutes of walking distance.

- Priority sector lending: meaning, benefits, constrains and Nachiket’s recommendation for 50% PSL target and 0% SLR.

If you’ve not read those articles, go to Mrunal.org/economy.

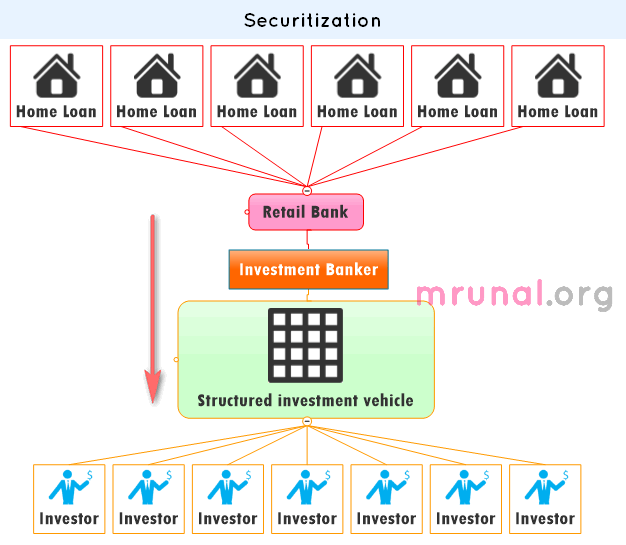

Securitization

As such very technical topic and not important for exam but basic understanding necessary before dwelling into Shadow Banking, Whole-sale banking. So, first let’s construct a technically-not-so-correct model:

- A retail Bank has given home loans worth total 100 lakhs to 50 families @10% interest rate. (if anyone defaults, bank snatch their house.)

- An investment banker, Hrithik Roshan, buys these loan-files from the normal bank.

- Hrithik makes a new company/entity, backed by those home loan files worth Rs.100 crores.

- Then he breaks down those 100 lakhs into (10 lakh bonds x worth Rs. 10 each) and promise to pay 8% interest rate.

- Aam Aadmi/retail investors/Mutual funds/insurance companies etc. buy these bonds.

Securities =some piece of paper that promises to some money to someone.

- Shares, bonds, IPOs, Debentures these are all examples of “securities.”

- So, What did the investment banker do in above example? He turned those “mortgages” (homes loan files) into “securities“. [and made some profit in between].

- This is called securitization.

So, is it good or is it bad?

- Good for banks because they can gather some new cash, look for new clients. (rather than waiting for EMI payments for 20-30 years.)

- Good for investors, because they can earn interest by buying those bonds.

- Bad? Yes, when the game is played without good faith- as it happened in Sub-prime crisis.

What happened in Sub-prime crisis?

- (normal) Banks gave loan to people who did not have the aukaat to repay the loans (hence they were called “Sub-prime” Borrowers.)

- But banks were smart, they “securitized” those loans, recovered money from investment bankers in wall street.

- Investment bankers in turn, sold securities (bonds) to aam aadmi/retail investors/pension funds/mutual funds/hedge funds etc.

- Then investment bankers used that money to buy even more loan-files from (normal) banks, and created even more mortgage backed securities.

- Everyone is happy. Bubble keeps blowing.

- But soon, one after another, those sub-prime borrowers default on EMIs.

- Wait, we shouldn’t worry right? Because we’ve their loan papers, we can attach their property and auction it to recover money.

- But unfortunately, as many people defaulted on loans, there is over-supply of houses on sale/auction => Real estate prices go down. if the house was originally worth 3 lakh dollars, now it’d sell not even for 30,000 dollars.

- Thus whole system collapsed.=>2007’s subprime crisis.

- World: Since investors all over the world had joined this game, they also suffered losses=>2008 global financial crisis. Ripples were felt even in India.

- Europe: Since European investors also lost money in Subprime crisis + Decline trade, tourism, export+ Their own governments had MNREGAish Maai-baap mindset with huge fiscal deficits and loss making PSUs=> PIGS crisis, sovereign default crisis, Greece crisis. (more on that, explained in old articles under Mrunal.org/Economy)

Shadow Banking

- Shadow Banks = organizations that function like banks but outside the banking regulation. American examples- hedge funds, securitization companies, Special Investment Vehicles (SIV), Money Market Funds (MMFs) etc.

- This term came after “subprime crisis” in USA, 2007.

- Shadow banks helped creating that asset bubble. But one day, home loan borrowers defaulted and the bubble collapsed =>crisis.

- Shadow banks have significant presence in Netherland, Hong Kong, USA, EU= they continue to remain vulnerable to such crisis even in future.

Shadow Banks: Why good?

They provide quick source of loan/credit/finance/liquidity.

Shadow Banks: Why bad?

- Shadow Banks lack transparency about their business model, modus operandi and profit margins.

- Some companies intentionally adopt shadow banking model to evade banking regulations for making higher profits. (e.g. CRR= bank earns no profit. SLR=bank earns barely ~8% interest. But if NBFC lends money they usually get 15-25% interest.)

- Since shadow banks don’t have “Backup plans” like CRR, SLR, deposit insurance etc. =>they’re more vulnerable to “runs”. (e.g. all depositors/FIIs pull out their money due to some rumor and company collapses.)

- Shadow banks don’t enjoy powers under SARFAESI Act.= difficult for them to recover money incase of loan defaults.

- Shadow banks send/receive money from many sources (mutual funds, insurance cos. etc.) so if Shadow bank collapses, it’ll have negative ripples in other areas of economy as well. (As it happened during Sub-prime crisis =>global financial crisis.)

- Even in China, recently one of the shadow bank defaulted, and ~3 billion yuan are lost. (Jan 2014)

Shadow Banking in India?

| NBFC | Function | example | Regulated under |

|---|---|---|---|

| Insurance companies | Take “premium” from you, invest It in shares/bonds. | LIC, Bajaj Allianz | IRDA |

| Housing Finance Companies | They arrange money from variety of sources, lend it to home-loan seekers | DHFL, Muthoot Housing finance etc. | National housing Bank (NHB) |

| Merchant Banking Companies | They lend money to company via buying its “shares” / underwriting. | Canara Bank, Andhra Bank (and many other banks- they take separate license to operate as a Merchant Bank) | SEBI |

| Stock Broker companies | They help buying-selling securities (of their clients) and earn commission in between. |

|

SEBI |

| Venture Capital Fund Companies | They finance start-up companies via equity. (=shares, partnership) | IFCI, IDG | SEBI |

| Nidhi Companies(mutual benefit funds) | They borrow money from members, lend it among the members. | South Madras Benefit Fund Limited and many similar names | Department of Company affairs |

| Chit Funds |

|

|

State government’s registrar. |

Some of these NBFCs do form one type of “Shadow banking” in India, because they’re outside the traditional regulatory rules for Banks, don’t have SLR-CRR “emergency backup”, still dwelling into deposits-loan-credit-finance type work.

Among all these, Chit fund is the biggest headache. Why?

- Constitution of India=>7th Sch.=> union list=> banking, post office savings, corporation, insurance, stock exchange, future market fall here.

- Hence union government make can make laws to setup All India regulators – RBI for bank, SEBI for securities and IRDA for Insurance.

- But as per SC verdict, Chit fund=contract = falls under concurrent list. = both union and state can make law. Hence chit funds government by their respective state laws. RBI only provides overall guidelines. SEBI doesn’t watch. that’s how Saradha chit fund managed to evade regulatory oversight and duped crores of rupees.

Should India be worried?

Ans. Not much. Reasons are following:

- India’s financial system is still Bank dominated. ~60% of financial sector’s assets are controlled by banks. So NBFC =not large enough to cause an shock/asset bubble.

- Largest NPAs are held by Public sector banks and not NBFCs. So if (god forbid) there is any “subprime” type crisis in future, it’ll be because of those banks and not NBFCs.

- American Shadow banks have MNC-like presence in various countries of Europe=> indirectly responsible for PIGS crisis, EU Sovereign default etc. but their presence is not much in India because of strict rules on FDI.

- 2008: Global financial crisis=> Indian NBFC saw a few negative setbacks but they’re sorted now.

- Indian NBFCs are strictly supervised by RBI/SEBI/IRDA/Government. Barring a few ponzi scams and Saradha Chit fund scam, there is no major threat seen in recent times.

Besides Indian NBFC= shadow bank = automatically “villains”. That assumption is not true. Some positive points about Desi-NBFCs:

- ~80% of the NBFCs have CRISIL rating of “AA” or above. (= NBFCs will not cause systemic instability in the economy.)

- NBFCs provide door to door service, their loan recovery rates are also better than banks.

- NBFCs have extended the reach of the financial services to the more difficult parts of the economy via micro-finance.

- Their agent-network / manpower is more efficient than public sector banks. (because they don’t have unions to go on strike every week.)

- Public sector banks like SBI, Dena etc. =giant elephants, cannot move quickly. Their own bureaucratic procedures slow them down. On the other hand, NBFCs are entrepreneur driven companies. Main boss keeps an eye on everything and doesn’t let any part of the company get slow or sick.

Gold Loan Companies as Shadow Banks?

- The gold-loan NBFCs were mostly catering South Indian borrowers. (Mannapuram, Muthoot etc.)

- But in recent times, they’ve seen high-growth and geographic penetration across the country. (thanks to Akshay Kumar.)

- These Gold loan NBFCs are regulated by RBI but they don’t fall under traditional “bank” rules about SLR, CRR norms.

- So, Do they pose a systematic challenge like American Shadow Banks?

let’s take an example:

- Jan 2014: 10 gm gold =30,000 rupees. I deposit it a gold loan company, they give me Rs. 30000 (=loan to value ratio of 100%; if they gave me only Rs.15k, the loan to value ratio=50%).

- I’ve to repay this loan, with 25% interest by Dec 2014.

- December 2014: price of gold still remains in the 29-30k region. Then i’ll not bother repaying the loan (because I’ve to give Rs.7500 interest). So, let them have the gold. I don’t care much.

- if large number of borrowers start doing ^this, system will collapse. Why? Because Gold Loan company doesn’t print currency notes at its office. They also have to arrange money from market (mostly from banks and debentures sold to aam-admi/retail investors).

- So, if gold loan company collapses, then negative ripples even in other sectors of economy.

RBI’s safeguards on Gold loan NBFC

RBI has taken following steps in recent times to ensure it doesn’t happen:

- Gold loan NBFC must maintain loan to value (LTV) ratio maximum 75%. (meaning, if i give them 1 lakh worth gold, they should loan me only Rs.75,000 rupees.) This ensures, I’ll try to repay the loan and take back my deposited gold.

- Gold loan NBFC with more than 1000 branches, must get RBI permission before opening any new branches.

- Strict rules for security and storage of such gold deposits.

- Must insist on PAN card copy (for gold loans above Rs.5 lakhs)

- RBI has ordered all NBFCs, not to lend money to any person for purchasing gold in any form (be jewelry or coins or even gold Exchange Traded Funds (ETF) and gold Mutual Funds.

- RBI has instructed Gold loan NBFC to maintain transparency in loan pricing and follow KYC norms.

- They were asked to adhere to a revised fair practices code and customer grievances.

Wholesale Bank?

- So far we know What is Shadow banking, how it can be a threat to economy.

- Right now Desi-NBFC sector is still small (compared to Banks), but with time, some of these NBFCs will grow extremely large.

- Then, it’ll not be our best interest to let them continue as “NBFC” (Because they’re not covered under CRR-SLR “emergency backup.”)

- Therefore, Nachiket Committee recommends a new type of bank called “Wholesale bank”. So, large NBFC could be allowed to transform into Wholesale banks and fall under full supervision by RBI.

| features | Sch.Commercial Bank (SBI, PNB, ICICI) | Wholesale bank | Payment Bank | NBFC |

|---|---|---|---|---|

| Has to get license under Banking regulation Act? | Yes | Yes | yes | Nope |

| Can accept deposits from aam aadmi? | Ofcourse yes. Hence also called “Retail” banks. | No. They can only accept deposits larger than Rs.5 crore. (hence called “Wholesale” banks). | Yes | Only for deposit taking NBFCs (NBFC-D) like Mahindra Finance. |

| Access to payment system (can give cheque book?) | Yes | Yes | Yes | No. |

| Can give loans? | Yes |

|

No | Yes |

| CRR? | Yes | yes | yes | Nope |

| SLR? | Yes | Yes | Nachi did not give specific targets. But they can invest in SLR-securities. | Only for NBFC-D |

| Entry capital requirement? | 500 Crores. | 50 crores. | 50 crores | 5 cr for Microfinane company. 2 cr for others. |

| PSL | Yes. | Yes but at a ‘wholesale’ level. And they help “retail” banks fulfill their PSL targets. | No. because they cannot lend money. | No. |

| SARFAESI powers.* | Yes | Yes | No. because they can’t lend money! | No. except housing finance companies |

*SARFAESI powers= If you default on loan, they’ll take away your mortgaged property. You cannot get stay order from civil court. You’ve to approach DRT (debt recovery tribunals) to get stay order, but they usually rule in favor of banks.

Wholesale Investment Bank vs Wholesale Consumer Bank?

Within “Wholesale bank”, Nachi recommends two sub-types

| Wholesale Investment Bank | Wholesale Consumer Bank |

|---|---|

| If given institution has 20 branches or less. | If given institution has more than 20 branches. |

| 25% rural branching mandate will not apply. | Applies. |

| No | They can act as Business Correspondent agents of other scheduled commercial banks. |

but Why Wholesale Banks?

- Suppose Banks/NBFCs give loan to PSL areas worth Rs.100 crores. And for xyz reason they want to get rid of that headache and arrange money quickly, rather than waiting for EMIs.

- So, They sell loan-files to wholesale bank.

- (recall wholesale bank can accept deposit of Rs.5 crore or more=they have really deep pockets to buy so many loan files).

- Now, Wholesale banker has purchased loan files worth Rs. 100 lakhs. He will create a structured investment vehicle worth Rs.100 lakhs. Then he’ll divide it into (10 lakh bonds worth Rs.10 each). Offering xyz% interest rate.

- Who will buy these bonds? Ans. Retail banks like SBI, ICICI, PNB; mutual funds, insurance companies, retail investors (aam Aadmi) etc.

- Thus PSL loans are ‘securitized’

- Wholesale bank can even such securitized loans from other entities/investment bankers in capital market and resell it further.

Benefits of Wholesale Banks?

- Wholesale banks will provide more liquidity in the system. (than in a situation where every bank keeps its loan-files to itself.)

- Wholesale banks also loan money to corporate clients, infra. Projects=> retail banks like SBI and ICICI’s cash is spared, that can be used as loans for small borrwers.

- Regional rural banks, Cooperative banks etc transfer their “local-risk” to Wholesale banks via “securitization.”

- This will make local banks structurally more stronger (because they’ll have less risk and less liabilities.)

- Big (retail) banks like SBI, ICICI etc. can fullfill their PSL targets by investing in Wholesale Bank’s (mortgage) backed securities. Rather than wasting their time and manpower on finding borrowers under PSL targets.

- This type of flexibility will help banks become more “Specialized” and focus on a “niche” groups e.g. RRB on farmers, SBI on small businessmen and middleclass, ICICI on corporate clients= new level of ‘economies of scale’= bank’s operating cost decreases, profit increases, clients get better services at lower prices.

- Thus wholesale banks indirectly help in financial deepening and inclusion.

Nachiket Mor Committee’s thought process for arriving @Wholesale Bank concept?

- PSL related problems: farmers don’t get loans on time, banks mostly focus on southern and western states.

- Large NBFC=shadow bank problem=>need to transform them into “Banks”.

- But if these Large NBFCs become regular banks, then they’ll also need to fulfill PSL targets= difficult for them. E.g. suppose a NBFCs deals with only infrastructure-financcing. Later it becomes bank. But its staff, organization structure doesn’t have the skills/experience/presence in rural areas to deal with Agri. Loans to fullfill PSL targets.

- So, better let them handle PSL via “securitization” process rather than via physical banking in rural areas.

- This securitization will also provide investment opportunity for retail investors. (Because Nachi offered tax-free status.)

- Therefore, we should allow such large NBFCs to transform into wholesale banks, instead of asking them to transform into retail banks.

Mock Questions

- Correct statements

- All NBFCs are regulated by SEBI

- All NBFCs are regulated by RBI

- Both A and B

- Neither A nor B

- Which among the following is/are covered under the Concurrent list in our Constitution?

- Banking, Bankruptcy, Contracts

- Contracts, Corporations, Trusts

- Trusts, Contracts, Bankruptcy

- None of above.

- What do you understand by the term Shadow Banking?

- A system wherein banks use technical loopholes to open more branches and expand operations beyond what is permitted by RBI.

- A system wherein scheduled commercial banks use technical loopholes to partially evade their true liabilities under CRR, SLR and PSL.

- A system wherein financial entities undertake activities akin to banks while remaining outside the traditional regulatory regime which are otherwise applicable to banks.

- None of above.

- Recently, Nachiket Committee has recommended “Securitization” of PSL loans. What do you understand by the term “Securitization”?

- It is a process under which banks get insurance cover for their loans under PSL targets, from General insurance companies.

- It is a process under which the mortgages issued by banks and other lenders are converting them into securities that can be sold to investors.

- It is a process by which a mortgaged loan asset can be converted to cash without losing value.

- None of above.

- Which of the following factor(s) make India less vulnerable to the risks from shadow banking?

- RBI has specifically prohibited shadow bank entities from opening branches in India.

- Under SARFAESI act, Government has specifically prohibited shadow bank entities from giving loans to people.

- Both A and B

- Neither A nor B

- Recently, Nachiket Committee has proposed a new model of banks, called “Wholesale banks”. Find correct statement about them

- Only Scheduled Commercial banks can setup such banks through subsidiary model.

- They’ll enjoy the rights and privileges under SARFAESI Act.

- They’ll have higher entry-capital requirements than commercial banks.

- None of Above

- (A) Chit fund companies are regulated by State laws. (R) The subject of Chit fund falls under State list in 7th Schedule of Constitution of India.

- Both the statements are individually true and Statement R is the correct explanation of Statement A

- Both the statements are individually true but Statement R is not the correct explanation of Statement A

- Statement A is true but Statement R is false

- Statement A is false but Statement R is true

Q8. All NBFCs are exempted from

- Maintenance of CRR

- Maintenance of SLR

- Priority sector lending targets.

Answer choices

- only 1 and 2

- only 2 and 3

- only 1 and 3

- all 1, 2 and 3.

Q9. Who among the following is/are not required to maintain a Cash Reserve Ratio (CRR)?

- Shadow Banking entity

- Merchant Banking entity

- Housing Finance Company

Answer Choice

- only 3

- only 1 and 3

- only 1 and 2

- All 1, 2 and 3

Q10. Who among the following is/are fall under SEBI’s direct regulatory watch?

- Nidhi Company

- Chit funds

- Housing Finance Company

- Merchant Banking company

Answer Choice

- only 1 and 2

- only 3 and 4

- only 1, 3 and 4

- all of them

Descriptive

- Define Shadow Banks. Assess the vulnerability of Indian financial sector from the threat of Shadow Banking. (10m| 200 words)

- Examine the need for a super-regulator over the other regulators in banking-finance-insurance sector with special reference to shadow banks. (10m| 200 words)

- List the salient features and functions of these wholesale banks envisioned by Nachiket Committee. (10m| 200 words)

- Discuss recent initiatives by RBI to preserve stability in Gold Loan sector. (5m | 100 words)

Interview

- Do you know the difference between:

- Merchant banking vs corporate banking?

- Wholesale banking vs retail banking?

- Investment bank vs commercial bank?

- Whenever someone raises even a hint of sub-prime like crisis in India or shadow banking in India, the RBI-apologists defend saying our fundamentals are strong, our regulatory regime is strong. If that is the case, why do Public sector banks have large NPAs?

- And don’t you think they pose danger of sub-prime crisis in India?

- Some economists suggest government of India should completely disinvest from public sector banks. Given the threat of Shadow banking and sub-prime crisis on side versus the inefficiency-unionism-strikes, BASEL norms and NPAs on the other side, where do you stand on this issue?

- Do you think “Contract” as a subject should be shifted to Union list, to prevent any more chit fund scams?Yes/No and Why?

Hints for MCQs

- see the very first table given in the article.

- M.Laxmikanth’s Appendix

- akin to banks but outside regulation

- mortgage=>securities

- neither

- only SARFAESI

- Chit fund in concurrent list.

- NBFC-D have to maintain SLR

- None of them are banks.

- All except Chit funds.

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

10) Who among the following is/are fall under SEBI’s direct regulatory watch?

1. Nidhi Company

2. Chit funds

3. Housing Finance Company

4. Merchant Banking company

Answer Choice

1. only 1 and 2

2. only 3 and 4

3. only 1, 3 and 4

4. all of them

sir for this Qs i.e. 10th , in the hints u have given ans as (all except chit funds i.e. Option 3) but in the article , you have written housing finance companies are regulated by national housing bank, nidhi companies by department of company afairs. So ans should be only merchant banking companies, and there is no option as “only 4” ? Please clarify

1D,2D,3D,4-,5D,6B,7C,8D,9B,10-….

SIR IN 10 ONLY MERCHANT BANKS ARE REGULATED BY SEBI …. AS IN THE ARTICLE…… THEN Y THE OPTION AS ALL EXPECT CHIT FUNDS…CAN YOU PLEASE CLARIFY…

mr.rahulvrk@rediffmail.com

what if banks simply start parking their money in wholesale securities…

isn’t it will effect the objective of lendind the priority sectors at reasonable interest rates

Wonderful analysis sir!!!

Today’s the Hindu business page article says– payment banks and small banks need Rs 100 cr paid up capital to start, as per draft guidelines released by RBI this July http://www.thehindu.com/opinion/columns/C_R_L__Narasimhan/differentiated-banks-has-their-time-come/article6252844.ece

sir,wholesale bank mein aapne bataya ki sceduled commercial bank apne PSL target “SECURITISATION KI GAYI FILES KE AADHAR PAR JARI BONDS KO KHARID KAR BHI PURE KAR SAKENGE”.

isme mujhe ye doubt hai ki isse to kai bank PSL poor peoples ko dene ke bajaay aadhe se adhik loan target to securitisation bond kharid kar pura kar lenge, usse unke “ek panth do kaajh ho jaayenge” par bechara aam aadmi mara jayega.

I don’t understand how investment banker gets profit on buying mortgage files and then he issue debt at interest…how profit is made plz clearity sir

PLEASE HELP

how whole sell bank makes profits ????

please give detailed answer with suitable example

thanks in advance

can email> bhartnathawat@gmail.com

Could someone plz clarify question 9.

i do not understand why the answer is b as several ppl have mentioned above.

I think the answer should be all of them.

plz help!

Hello sir,

For WLTF SLR is not required

However the table says it does require it

Please confirm