Prologue

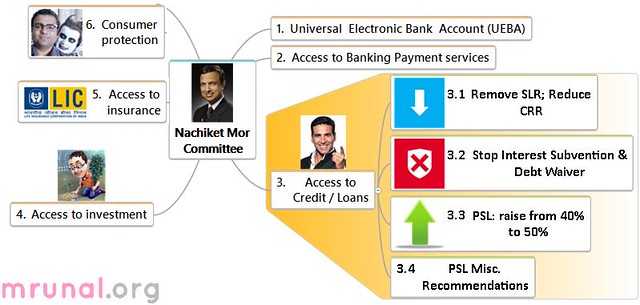

So far, we’ve seen RBI appointed Nachiket Mor Committee on financial products for small businessmen and poor people (low-income households). Nachiket cameup with six-point vision.

In this article, we’ll see vision #3: better access to loans (Credit). Nachiket has three major recommendations in this regard:

- Remove SLR, reduce CRR

- Remove interest subvention, Remove debt relief

- Priority sector lending: raise from 40% to 50%

- Other Misc. recommendations to increase access to credit (loans).

Accepting Deposits:

“Bank” is an organization who got license from RBI (under Banking regulation act)

A bank must have three features:

- Accepts deposit from public

- Gives these deposits for loan / investment

- Deposited Money can be withdrawn by cheque (and other means like Debit card, ATM card, netbanking etc.)

| Time Deposit | They ‘mature’ at a particular time e.g. Fixed deposit for 1 year @9% interest rate. If you demand this money before expiry of one year= they cut penalty. | Fixed deposit, recurring deposits, cash certificates |

|---|---|---|

| Demand Deposit | You can demand / takeout money without as per your wish. |

|

- For bank, both of them are “liabilities”. Because bank has to repay this money sooner or later.

- RBI counts SLR and CRR only on ^these net demand and time liabilities (NDTL.)

| Incoming (Time and Demand Liabilities) suppose its 100 crores | |

| CRR: Cash reserve ratio. (4%) | 4 cr.gone here. (Bank earns no profit/interest here) |

| SLR (23%): Bank has to keep aside some money in liquid assets such as gold, government security other RBI approved securities of public/private companies. | 23 cr. gone here. (some interest/profit earned) |

| Money left with bank | 100-(23+4)=73 cr. |

Now whatever car loan, home loan, and education loans the bank wants to give, they have only 73 rupees left. (even there, you’ve Priority sector lending requirements.)

| SLR | CRR | |

|---|---|---|

| What Nachi recommends? | Remove SLR requirement. (gradually) | CRR should be counted only on the “Demand deposit”.Ignore “Time deposits” for this calculations= CRR will be reduced automatically. |

| WHY? | Explained below | Money kept under CRR doesn’t earn additional money. it is a dead asset. So let money kept in CRR=better.For more points, click me to know why SBI hates CRR? |

Why Remove SLR?

- SLR=Statutory liquidity ratio =banks have to keep aside some assets into “liquid” form= cash / gold / government securities / RBI approved securities of public and private sector companies.

- these assets are called “liquid”, because you can easily sell them and recover money in ‘cash’ form. This cash comes handy during emergency for example: When many people simultaneously come to take out money from their savings/current account during festivals, after natural calamity, or when someone rumours that bank is going to collapse.

- When customers make such “bank runs”, bank can sell away the SLR securities and quickly arrange cash for customers.

- So, in a way SLR=one type of emergency backup.

- But SLR securities=very safe, low risk securities. And in market, “low-risk = low reward”. Banks hardly earn ~8% interest/dividend on such investment. So most bankers consider the SLR investment = lazy investment or even dead investment.

BASEL norm

BASEL norms=lengthy topic, needs separate discussion. For the moment, just know that

- BASEL is a town in Switzerland, where bankers across the world met, to decide how to make banking sector more safe and sound, and how to prevent repeat of sub-prime crisis.

- This leads to various terms: Capital adequacy requirements, tier I, tier II assets and so on.

- Third version of this system =BASEL III. Effective from 2013.

- Bankers agreed “we must keep some money apart, as emergency backup” (just like our SLR).

- They came up with a new concept called “Liquidity Coverage Ratio (LCR)”. The basics are similar to our SLR, that bank should invest part of their money into liquid assets like Treasury bonds / government securities and highly rated shares & bonds.

- RBI has been talking with BASEL board to include SLR securities into this LCR system.

- Indian banks have to comply with BASEL-III norms by 2018.

Nachiket’s argument is following

- SLR = lazy investment (Because it gets barely ~8% return)

- In future, we’ve to comply with BASEL-III norm. and they’ve LCR system that is very similar to our SLR

- If banks have to keep money aside for both LCR+SLR => less money available for lending=not good for economy. So, better abolish SLR and just follow the BASEL norms.

Overall, SLR removed + CRR reduced = more money available for banks, for lending to needy people = access to loans increased =financial inclusion.

Why Priority sector lending?

You’re aware of the common sense principle “no risk no reward”=>”high risk high reward”. So, What will happen in a free market economy (where RBI and Government donot interfere with the system)?

| Loan customer | Banker’s thought process | How much interest should bank charge on the loan? |

|---|---|---|

| Farmer | Maximum risk, because his income depends on the vagaries of monsoon. He is mostly to default on the loan. | High (50%) |

| Small businessman | Less Risky than farmer but still he may make losses during high inflation/recession and default on loan. | High (45%) |

| Student | He’ll not repay until he finishes graduation and gets a job. | High (40%) |

| Salaried middleclass family | Minimum risk. | Low (10%) |

| High net-worth individual (HNI), Big businessman | Minimum risk. | Low (5%) because minimum risk=minimum reward. |

Obviously, farmers, small business and students:

- Will be exploited with high interest rate OR

- Will never get any loan.

Therefore, RBI requires the banks to give part of their loans to the weaker sections of society. This is called Priority sector lending (PSL) requirement.

| Late 60s | RBI asks the banks to increase lending to agro + small Industries (but did not give any ‘targets’ |

|---|---|

| 70s | RBI required the banks to submit data on how much money do they lend to agro+small industries? (RBI had not imposed any “targets” on the banks yet) |

| 80s | Finance minister comes up with the idea of “40%” lending to priority sectors. |

Priority sector includes following categories:

- Agriculture and allied activities: (dairy, fishery, animal husbandry, poultry, bee-keeping and sericulture.)

| Direct lending | Indirect lending |

|---|---|

| Individual farmer, self-help groups (SHG), cooperative societies | Food processing industry, other Corporates and firms engaged in this sector. |

- Micro and Small industries (upto 2 crores)

- Education loans (10 lakh in India, 20 lakh for going abroad)

- Housing loans (upto max. 25 lakh in metropolitan cities)

- Renewable Energy: Loans for solar and renewable energy solutions.

Note: Export credit is not a separate category. Export credit to eligible activities under agriculture and MSE will be reckoned for priority sector lending under respective categories.

Weaker section

Within ‘priority’ sectors, bank has to give some of the loans to weaker section of society. Weaker section means:

| Farmer | Landholding upto |

|---|---|

| Small | more than 1 ht. but less than 2 ht. |

| Marginal | upto 1 hectare |

- Artisans, village and cottage industries

- Beneficiaries National Rural Livelihood Mission (NRLM); Swarna Jayanti Shahari Rozgar Yojana (SJSRY); and Manual scavangers rehab. scheme

- Scheduled Castes and Scheduled Tribes;

- Women, self-help groups

- Distressed people in the clutches of non-institution lenders (private Moneylenders, loan-sharks, financers etc.)

| Target | Desi Banks. (+foreign banks with 20 branches of more) | Foreign banks with less than 20 branches |

| Agro | 18% | No specific targets |

| Weaker sections | 10% | No specific targets |

| Remaining categories under PSL | Whatever left to reach the 40% target | No specific targets |

| Overall PSL target | 40% of net loans given** | 32% |

**To be technically correct that is Adjusted Net Bank Credit (ANBC) or credit equivalent amount of Off Balance Sheet Exposure (CEOBE), whichever is higher? But such minute technical details not important for exams.

What if PSL target not met?

| Year 2013 | % |

| Official loan target of PSL | 40% |

| Public sector banks gave | 36.3% |

| Private sector banks gave | 37.5% |

| Desi Banks. Foreign banks (with 20 or more branches) | Foreign bank with less than 20 branches. |

|---|---|

| They’ve to send remaining target money to RIDF | To SEDF |

| RIDF=Rural infra. Development fund | SEDF= small enterprises development fund |

| NABARD manages RIDF | SIDBI manages SEDF |

| NABARD pays interest rate to the bank for this money (RBI decides the rate) | Same by SIDBI |

| State governments get money from this RIDF fund to launch various infra. Projects. But this isn’t ‘free’ money. The state will have to repay money with interest rate. | Similar case. |

Additional safeguards under PSL

just for general awareness, not much important for exam:

- Bank itself has to arrange for applicant’s photograph. (in other words, Bank cannot reject application because poor man did not have photograph.)

- Branch manager is given discretionary powers while handling loan applications of weaker section. He can approve suc loan application without consulting his boss.

- If an SC/ST person has applied for loan under priority sectors, then Branch manager cannot reject. If he wants to reject, he must forward the file to boss.

- If loan application is less than Rs.25000, Branch manager must clear it within 15 days. (and for bigger amount than Rs.25k, then within four weeks)

- During natural calamities, floods, cyclones etc. bank has to restructure the loan repayment terms so the victim doesn’t suffer more.

- Bank cannot charge penal interest, if borrower delays repayment. (for loans upto Rs.25000)

- A farmer took loan but late in repayment, still bank cannot charge compound interest rate on his dues.

- At regional level, banks have to setup special machinery to handle complaints of PSL-borrowers.

- Bank has to maintain a separate register for all rejected PSL loan-applications, along with reasons. RBI has powers to inspect these records.

PSL target raised to 50%

| Mohan | Ok so far, I understood:

Now, tell me your next ambitious but unrealistic target! |

|---|---|

| Nachiket | well, I suggest PSL target should be raised from 40% to 50% |

| Mohan |

|

| Nachi | Hold on man. Don’t jump the gun so quickly. 50% doesn’t mean 50% of 100 rupees. It is a ‘weighted scoring’ system. Allow me explain: |

Existing situation

- There are no ‘regional’ targets under PSL. Suppose SBI’s plans to give total 100 crore as loans, then they’ve to give 40 crore as loans to priority sector areas. BUT, SBI is free to give this loans- anywhere in India.

- As a result, most of the PSL-loans are given in rich-n-developed states e.g. Gujarat, Andhra, TN, Punjab, Haryana etc. where a farmer is more likely to repay the loan, compared to a farmer in Assam or Arunachal Pradesh. Observe

- Therefore, I recommend a new system: if bank gives loan to “hardship” areas, then they’ll get more “marks”, and they must get minimum 50% marks to reach PSL target. That’s our new system. Observe:

| Financial inclusion at the moment | District | Direct agro. | Weaker section | Other sectors |

|---|---|---|---|---|

| highest | Pattanamthitta, Kerala | 1.25 | 1.1 | 1 |

| high | Namakkal, TN | 1.38** | 1.21** | 1.10** |

| medium | Rajkot, Guj | 1.43** | 1.25** | 1.14** |

| medium | Muzzaffarnagar, UP | 1.46** | 1.28** | 1.16** |

| lowest | Kurung Kumey, Arunanchal | 1.56** | 1.37** | 1.24** |

Suppose SBI’s net credit (ANBC)=100 Crore. So their (new) Adjusted PSL target =50%=50 crore rupees.

If SBI gives agri.loan of Rs.1 lakh to a farmer in Kurung Kumey district of Arunanchal, then under the (new) PSL target, we’ll say SBI has given 1 lakh x 1.5617=1,56,170 rupees loan under PSL target.

Now, Observe from SBI bank manager’s point of view:

| Earlier PSL-system (40%) | New (adjusted) PSL system (50%) |

|---|---|

| Whether SBI gives loan to farmer in Assam or in TN, its counted one and same. | hardship area will get more weightage. |

| 40%=40 crores target | 50%=50 crores target |

| To reach this target, SBI will have to give away exactly 40 crore rupees. | Not necessary to give exactly 50 crore rupees. Suppose SBI focuses only where they get multiplier of at least 1.3. then how much money does SBI need to give out?50 crore / 1.3 = approx. 38 crores. |

| Meaning, only 100-40=60 crore left for giving out as ‘normal’ loans (car loan, business loans etc. where SBI earns more profit margin) | Meaning, 100-38 crores=62 crores left. So additional two crores for giving out as “normal” loans=more profit than previous (40%) system. |

In other words, this is win-win situation for both parties:

- Banks earn more profit (Because they’ve to give out less money in PSL).

- Loan seekers in hardship areas, get more attention from banks.

| Mohan |

|

|---|---|

| Nachi | Right, I’m totally opposite of that. And to prove it, I give another recommendation: government stopping giving debt reliefs and interest subvention to farmers. |

| Mohan | But why?? |

| Nachi | For that, you’ve to understand the concept of Base rates. |

Base Rate

Banks accepts deposits from people and gives it as loan to others. But who or what decides how much interest rate should be charged on such loans?

| From 2003 | Benchmark prime lending rate (BPLR).

|

|---|---|

| From 2010 | RBI abolished above BPLR system. Introduced Base Rate

|

Benefit: System more transparent, all type of loans are linked with Base rate.

For example: SBI ‘s Base rate is 10% (as of Nov 2013)

| SBI’s | Calculation | result |

|---|---|---|

| Car loan | 0.75% above Base rate | 10.75% |

| Two wheeler loan | 8.25% above base rate | 18.25% |

| Education loan (upto 4 lakh) | 3.5% above base rate | 13.5% |

| Home loan for women (upto 75 lakh) | 0.10% above base rate | 10.10% |

If tomorrow, SBI changes the base rate, then all these loan interest rates will change accordingly. SBI cannot give loan to anyone, at a rate below the base rate. But Problem comes with the…

Agri. interest subvention scheme

- By government of India

- Applies to scheduled commercial banks (both public + private)

- Target beneficiary: farmers

- If farmer is given loan upto 3 lakhs @7% interest rate, THEN government will give 2% interest subvention.

- In other words, farmer has to pay only 7 MINUS 2 =5% interest rate to bank, and that remaining 2% will be given by government (From tax payer’s money)

| Mohan | Ok man but what’s the problem? |

|---|---|

| Nachi | This interest subvention scheme is inconsistent with RBI’s base rate system. Recall that a bank cannot give loan to anyone below the base rate. Most banks have base rate higher than 8% but government will give subvention only if farm loans given @7%. |

| Mohan | So what do you recommend? |

| Nachi |

|

| Mohan | Whatever dude. In the election year, it is unlikely that government will scrap down interest subvention scheme just because “Nachiket the great” recommends so! |

Debt relief= bad habits

2008= Government waived all the debts taken by farmers. (so they get happy and vote for UPA in 2009 election.)

| Lazy farmer | I don’t need to repay loans on time because government will again waive all the farm loans before next general election! |

|---|---|

| Honest farmer | if other lazy farmers are not repaying loan on time, why should I bother? |

- Thus, government’s debt waiver scheme has created negative implications for the banking system. Farmers now expect more such loan waivers schemes would follow before state/general election, so they don’t repay loan installments on time.

- This also hurt taxpayers because

- Government waived farmers loans=>government pays to the banks on behalf of farmer.

- But money doesn’t fall from sky. Such freebies =fiscal deficit increased and it leads to plethora of new problems. (To learn more on negative effects of high fiscal deficit click me)

Nachiket recommends that:

- From now on, government should stop giving debt waiver or interest subvention.

- Bank should bundle farm loans with weather based insurance scheme, that way, during crop failure, the farmer doesn’t default on loans. His insurance money will cover the loan payment.

- In case of large scale loan defaults after natural calamity, banks should work closely with insurance companies to recover money. (instead of relying on state or central government to pay bank losses from budget.)

- If at all, government wants to give relief to debt ridden farmers, then transfer money to their bank account via DBT (Direct benefit transfer- just like in LPG subsidies). Don’t directly waive everyone’s loan.

- Every loan defaulter should be reported to credit bureaus (e.g. CIBIL)- be it small farmer, self help group or big businessman. Then people will automatically become cautious to protect their credit history, and repay loans on time. Why? Because if a person has low score in CIBIL, next time bank will not give him loan easily.

PSL: Misc. Issues/recommendations

to increase access to credit/loans among small businessmen and low income households:

PSL Insufficient

- Banks alone cannot fulfill the credit/loan requirements. Entire MSME (micro-small-medium) enterprises need 4 lakh cores of credit.

- Banks don’t have that much money to lend to a specific sector. If banks divert all of the incoming money to business/agro loans then middle class will have hard time getting loans.

Nachi recommends:

- Legal/regulatory framework should be relaxed to help NBFC to raise more money from capital market, FII, External commercial borrowing etc. So NBFC can also lend more money to needy people.

- Setup “Wholesale” banks. (we’ll see it in detail, in a separate article)

Middle & Large farmer benefits most

- Small/marginal farmer= relies on self-labour. So, apart from seeds, fertilizer, pesticide and irrigation, he has to spend money on himself for health, food, life insurance and disability insurance premiums, clothing, shoes etc. => he’ll have to borrow again to manage expenses during the off-season.

- But such items are not counted as “Agricultural lending” under PSL. So banks have no interest in helping farmers for those side-expenses. And even if bank gives the loan, it’ll charge higher interest rate under “personal loan”.

- On the other hand, Middle / Large Farmer= Already has some machines (tractors, harvesters, diesel pumpset etc).

- So “labor”= Not his main factor of production and he has sufficient money to survive even in the off-season.

- Thus, medium and large farmers have benefit the most from PSL target. But small-marginal farmers have not benefitted much from PSL.

Nachiket recommends:

Loan given to small/marginal farmer and landless labourer= should be counted under PSL target, irrespective of whatever it is meant for buying direct agricture Inputs or indirect wage components.

Middleman model failed

- Banks cannot open branches in each and every village (and still they have to fullfill the PSL targets), so they tried the “real-sector intermediary” model.

- In this model: fertilizer dealers, Sugarmill owners, APMC agents etc. disburse loans to farmers on behalf of the bank.

What is Problem in this model?

- Overconsumption of fertilizers and pesticides. How? Because fertilizer dealer will invariably advice the farmer to buy more inputs using the loan money. And farmer would fear that dealer will create some hurdle in loan-processing if he doesn’t use complay.

- Dealer will increase the price of seeds, fertilizer and pesticides. And farmer has no alternative but to buy at higher price (Because dealer processes the loan papers.)

- Sugarmill owner will deliberately give less price to farmer’s sugarcane.

+None of these agents have any complaint/redressal facility where farmer can quickly seek justice. (unlike the regular bank and banking ombudsman model)

Nachi recommends: This Real-sector intermediary model should be used only as a ‘stop-gap’ arrangement. Bank should focus on increasing penetration in rural area by direct branch or business correspondence model.

March Rush

| Season | Kharif | Rabi |

| Months when farmer needs the loan desperately | June, July, September | December and January |

- But, statistics indicate that most of the loans are given in March month. Why? Because PSL-compliance is calculated at March end.

- This is similar to “March rush” in government departments. Parliament sanctions budget =>government gives crores of rupees departments=> but if department doesn’t spend it before 31st March, all the unspent money will go back.

- For the entire year, sarkari babus sleep, but during March, they rush to buy new office equipment, start clearing all tenders and project files. Same happens in Banks for PSL-target. Result?

- In the haste, banks don’t thoroughly verify the credit history of farmer=more chance of loan default.

- Farmer gets the money when he doesn’t need. (in the march month). He is more likely to spend it on unproductive things such as festivals, weddings, pilgrimage to Amarnath/Nashik etc.=> Only a small part of a loan money to agriculture inputs=>More chances of loan default.

Nachiket recommends: PSL counting should be done on quarterly basis (every three months) rather than yearly basis (12 months). That’ll prevent the ‘March rush’ among banks.

Customer Data Architecture

- When you apply for loan, Bank Officer will first check your credit worthiness.

- For city folks, this is no problem because they already have xerox passbook showing their balance history, income tax records, salary slips, land possession titles, vehicle registration and so on.

- But most villagers and city poors don’t have such records.

- In banking parlance they’re called “Thin file” clients. (Because their credit record, bank balance history is very thin).

- Banks don’t give loans easily to these “Thin file” clients. =100% financial inclusion not achieved.

- Solution? Make their file thicker.

But how? Ans. Via customer data Architecture.

But Again how?

- Even if the person doesn’t have a thick file record to show his credit worthiness, he may still have some ‘evidence’ that he regularly pays his dues e.g. lightbill, phone bill, gas-cable bills etc.

- In Italy, even water utility bill is counted in credit score. If you pay your water bill regularly, your loan application will be processed easily.

- In Brazil, phone companies share all data records that would predict creditworthiness of low-income borrowers. (e.g. how many times did the person recharge his phone, average monthly call/sms/internet usage and so on.)

- In India, even the poors without toilets, have mobile phones. Banks can crosscheck with mobile company about their credit worthiness.

Nachiket Committee recommends

- New guidelines so mobile companies can share data with banking and finance companies.- even with prospective employer, landlord, or creditor, whether bank or non-bank.

- But only with written authorization from user. (=the mobile phone customer)

- Special IT system to prevent misuse of information (e.g. only an officer above ** grade can login the system and check data, data cannot be copied in Usb and so on)

Weather stations

- Farmers need loan to buy seeds, pesticides, fertilizers and machinery

- But their loan repayment capacity depends on the vagaries of monsoon.

- Therefore, most banks sell agriculture loans along with weather based insurance cover. For example, the Weather Based Crop Insurance Scheme (WBCIS)

- Such insurance schemes give protection from crop loss during

- Adverse monsoon: Both excess rainfall and drought situation.

- Adverse weather: frost, heat, relative humidity, and un- seasonal rains during Rabi season.

- So what’s the problem? Lack of weather monitoring stations. So even if there is crop loss, it is difficult for farmer to prove the loss was because of bad weather. For complete coverage we need ~40,000 weather monitoring stations across India.

Nachiket Committee recommends:

- If bank gives loan to setup weather station, it should be counted under PSL target (priority sector lending). This will encourage entrepreneurs to setup weather stations.

- If farmer suffers crop loss due to bad weather, he should be given the compensation before next cropping season, without delay.

- Setup Automatic Weather Stations (AWSs) and Automatic Rain Gauge (ARGs).

Land Registries

- You can get loan more easily if you’ve an immovable collateral (e.g. apartment, factory, farmhouse in your name.) because even if you default on loans, the bank can take over that property and sell it to recover money under SARFAESI act.

- But most poors don’t have land records to prove their ownership over immovable collaterals.

- Therefore, banks don’t give them loans easily= 100% financial inclusion not achieved.

- In India, registration is compulsory for sale of land and property. But the authorities don’t verify the history or ownership of the property from the seller= nuisance of real estate mafias and property disputes pending in courts = difficult for the victim to get loans. Solution? reforms in the Tenancy reform acts.

Complimentary infrastructure

If bank gives equity investment in following, then it should also be counted under PSL target:

- warehouses,

- market yards,

- godowns,

- Silos

- NBFCs operating in district with low financial inclusion.

- Weather monitoring stations in rural areas.

In other words, Nachiket recommends that complementary infrastructure for rural Development should be brought under PSL targets.

Bond purchase in MFI

- If bank gives loans to an NBFC Microfinance institutions (MFI)= counted under PSL target

- But if bank buys the bonds of such NBFC-MFI= not counted under PSL.

- Nachiket says “count such bond purchases under PSL.”

Warehouse receipts

Basics Already explained click me

Nachiket recommends that Food Corporation of India (FCI) and State Governments should use warehouse receipts to raise money, rather than being reliant only on bank credit.

Mock Questions

- Which of the following, is/are not a part of priority sector lending?

- Food processing industry. renewable energy

- Small industries, housing loans

- both A and B

- Neither A nor B

- Which of the following is/are correct about classification of Small vs Marginal farmers?

- This classification is based on total hectares of land owned.

- This classification is based on total income from the land owned

- This classification is based on number of crops cultivated on the land owned

- None of above.

- Correct statement about Priority sector lending targets

- These are administered by Finance ministry

- If a bank fulfills its PSL targets, RBI gives it permission to open more branches in Metropolitan cities.

- Within the PSL targets, a bank is required to give 18% of the loans to weaker sections of society.

- None of above.

- NABARD administers a fund called Rural infra. Development fund. What is the major source of its funding?

- borrowing from RBI

- borrowing from World bank

- Penalties levied from foreign banks who fail to meet PSL targets.

- None of above

- Correct statements about small enterprises development fund?

- It is administrated by Ministry of Commerce.

- It gets funding from certain types of banks that fail to meet PSL targets

- Both A and B

- Neither A nor B

- What do you understand by Base Rate?

- As per RBI norms, Banks cannot pay interest rate higher than the base rate to time and demand deposits

- As per RBI norms, Banks cannot pay interest rate lower than the base rate to time and demand deposits

- As per RBI norms, Banks cannot charge interest rate lower than the base rate to any borrower.

- As per RBI norms, Banks cannot charge interest rate higher than the base rate to any borrower.

- Who decides Base rate of a bank?

- RBI through monetary policy

- Finance Ministry through gazette notifications

- Meeting among the representatives of RBI, Finance ministry and the respective banks.

- None of above.

- Which of the following will reduce the fiscal burden of the government?

- Removal of interest subvention scheme

- Removal of Priority sector lending targets

- Both A and B

- Neither A nor B

- Which of the following will be detrimental to the objective of financial inclusion?

- Removal of interest subvention scheme

- Removal of Priority sector lending targets

- Both A and B

- Neither A nor B

- (Paper II Decision Making) You’re posted as a District Magistrate in an area affected by left wing extremism. With your efforts, a few of the naxalites had surrendered, spent jailtime and resumed family life after release. One day, a former Naxal turned farmer approaches you, complaining how the branch manager of a public sector bank has rejected his loan application for agricultural inputs. What you’ll do?

- Call up the Branch manager, order him to pass the loan.

- Call up the SP, order him to write a police verification certificate for the said farmer, so he can avail the loan again.

- Ask the farmer to approach higher authorities within the said bank

- ask a journalist friend of yours to unearth the truth and get justice for this farmer.

Q11. RBI appointed Nachiket Committee has recommended

- RBI should Abolish Marginal Standing facility system.

- Government should stop giving debt waiver and interest subvention to farmers

- SLR system should be gradually removed.

Answer choices

- only 1 and 2

- only 1 and 3

- only 2 and 3

- None of above.

Q12. According to the current PSL-system:

- Banks are required to allot 23% of their deposits into SLR securities

- Banks are required to allot comply with BASEL-III norms by 2018

- Banks are required to allot 18% of their credit to North Eastern States

Answer choices

- only 1 and 2

- only 1 and 3

- only 2 and 3

- None of above.

Assertion Reasoning:

Assertion reasoning instructions: Each of the following questions contain a set of Assertion (A) and Reasoning (R) statements. Answer codes are as following:

- Both the statements are individually true and Statement R is the correct explanation of Statement A

- Both the statements are individually true but Statement R is not the correct explanation of Statement A

- Statement A is true but Statement R is false

- Statement A is false but Statement R is true

Question statements

- (A) In the recent years, most of the public sector banks have full filled or even over crossed their PSL targets (R) Public sector banks are given interest subvention benefit by government of India.

- (A) In the recent years, the farmers in Southern states have received large amount of agricultural loans under PSL targets (R) Southern States have highest % share in gross cropped area in India.

- (A) In recent years, Public sector banks have suffered large NPAs. (R) Delay in environmental clearance in power, iron and steel sector have reduced the industrial output.

Descriptive/Mains

- Despite the robust guidelines under PSL, the small and marginal farmers continue to suffer from lack of access to formal sources of credit. Examine the reasons and suggest remedies. (10m | 200 words)

- Lack of timely access to credit, has been one of the main factor behind the dismal performance of micro and small industries in the Eastern and North Eastern Sector. Examine the reasons, and suggest remedies. (10m | 200 words)

- Examine the “access to credit” as a factor for geographical distribution of secondary and tertiary industries in India. (10m | 200 words)

- Nachiket Committee’s new model of Adjusted Priority sector lending targets, will be a win-win situation for both the banks and the borrowers, do you agree? Justify your stand. (10m | 200 words)

Interview

- Are you in favor of the removal of SLR? Don’t you think it’ll make our banks more vulnerable?

- You’re aware of the PSL targets and all the issues about farmer debts, financial inclusion and NPA. What are your thoughts on following alternative:

- government orders the banks to submit 40% of their deposits to the consolidated fund of India

- A separate department is created “loans for weaker section”. They receive money directly from consolidated fund of India, and dole it out to the farmer via district collector’s office or post office.

- Whatever interest is earned, that is directly given back to bank account holders.

Don’t you think this is a better alternative than existing PSL? Why should we even trust the banks to give economic justice to farmers? Shouldn’t the government and the executive take up this job?

- (looking at your DAF form) In banking sector, if an officer serves in a hardship area, he is given additional points while the promotion list is prepared. Now, Nachiket Committee has a new system under which, if a bank lends money in the hardship districts, they get additional score under PSL target. Following the same logic, if Personnel ministry gives you an option to pick a “difficult state” cadre in North East or Red-corridor, we’ll give you faster promotion and pay grades. Will you change your cadre preference? Yes/ No and why?

Visit Mrunal.org/Economy For more on Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

Sir.pls provide the correct set of answers.Otherwise all the efforts will end in confusion.

Sir can you please rovide us an article on Basel Norms with full timeline and how Indian Banks are going to meet basel norms lll till 2018

sir where r the remaining articles

Better access to insurance???

Consumer protection???

plz

sir pls provide ans keys…..

Thanks mrunal ji for updating such a wonderful hot topic fun to read and basic knowledge gains maturity and in between Desi language increases more interest.

Mrunal sir please provide answers!!!! wating for your reply………

What happened to these recommendations?Accepted or rejected by RBI?

is saal ki sabse khatarneek committee hai ye wali. tang kar diya is mor ne.

mrunal sir please tell me about national income gdp gnp

hats off mrunal sir, but one thing i want from u that please give answers of all mcq in each article,so that confusion can finish.thanks

Sir ,on one slide you have mentioned that crr and slr is not applicable on RRB (on the slide where u have explained crr and why sbi hates it) and on the other you have said otherwise(the recently added rrb slide)……pls clear itsir.

Mrunal sir.. u make learning seem so fun… thanks.. keep going.