- Prologue

- Monetary Policy reform: Where to focus?

- Why Target inflation?

- Hawkish trend: Why interest rates will rise?

- Mock Questions

Prologue

This article won’t make much sense, unless you’re thorough with the concepts of monetary policy: its functions, tools and limitation. So make sure you’ve read the previous article. click me.

- Place: RBI’s Main Adda @Mumbai

- Time: September 2013

- Boss: Rajan has recently taken charge as the new governor of RBI. Immediately he setups three Committees:

| Chairman | Occupation in RBI | Topic | Result |

| Bimal Jalan | Retire Governor | New Bank licenses | Work in progress. |

| Nachiket Mor | Board member | Financial products/ Financial inclusion | Published report in January 2014.Discussed in earlier articles. |

| Urjit Patel | Deputy Governor | Monetary policy framework: how to strengthen it? | Published report in Jan’14. This is the topic of our article. |

Urjit Patel Committee: Basics

- Formed by: RBI (and not finance ministry)

- Official name: Expert Committee to Revise and Strengthen the Monetary Policy Framework

- Chairman: Dr. Urjit Patel, Dy. Governor of RBI

- Eight Members: economics professors, finance experts etc. They’re not important for exams, because No high profile members. [may be because Nachiket took away all the high profile members like Shikha Sharma of Axis bank, so Urjit bhai was left with only chillar parties.]

Overall, Urjit Patel’s main recommendations can be summarized in just three lines:

- @Rajan, you fight inflation. [Nominal anchor, 4% CPI and everything]

- @Rajan, you fix accountability in your own gang. [form MPC Committee, decisions by voting etc.]

- @Chindu, you give cover-fire to Rajan, while he is fighting inflation. [fiscal consolidation.]

Let’s start with first recommendation.

| Urjit | My first recommendation is that RBI must target inflation only. Nothing else- don’t focus on increasing employment, don’t focus on increasing growth, don’t focus on stabilizing rupee-dollar exchange rate. Just focus on one thing and one thing only- Inflation. |

| Mohan | But why focus on inflation only? |

| Urjit | Observe. |

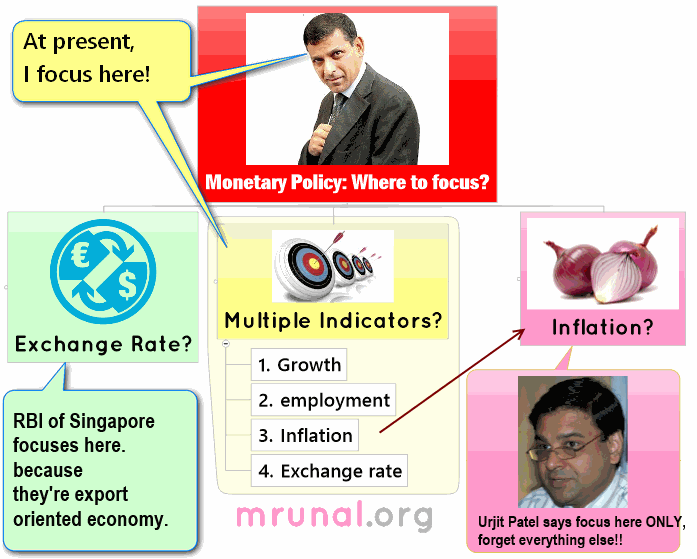

Monetary Policy: Where to focus?

There are three main ways to frame monetary policy

- Focus on Exchange Rate

- Focus Multiple indicator (GDP, IIP, Exchange rate, inflation)

- Focus on Inflation (started in 80s)

Let’s check the pros and cons of each strategy.

#1: Focus on Exchange rate

- If RBI adopts this strategy/method to frame monetary policy then- what will happen?

- Rajan will first decide an ideal “target” exchange rate say 1$=Rs.50.

- Then he’ll try to amend monetary policy to control rupee supply in the market.

To put this in technically incorrect example: Imagine dollars are “apples”.

- Prices of apple vs Rupee are decided by laws of supply and demand.

- At present 1 apple sells for Rs.60. But Rajan wants to bring it 1 Apple=50 rupees. What should he do?

- Rajan will tweak his monetary policy to reduce the supply of rupee in the market. Then, 1 apple will sell for Rs.50. (apple supply is same but rupee supply is decreased.)

- Alternatively, Rajan will open his own refrigerator (forex reserve), and put some apples (dollars) for sale. That’ll also bring down prices of 1 apple =50 rupees. (because apple supply increased)

Advantages/Benefits of targeting Exchange rate?

- Prices of imported goods are kept in check.

- Prices of imported crude oil is kept in check. (so indirectly inflation is kept in check).

- Since exchange rates are kept stable- both importers and exporters can decide their business expansion plans accurately. (compared to a situation where exchange rate is volatile-say today $1=40 Rs. And tomorrow $1=60Rs. Then it is not good for business decisions.)

- Clarity. Transparency in Decision Making. Aam Juntaa can understand what RBI is trying to accomplish and whether Rajan is succeeding or failing? (if they ever get free after watching cricket matches, Saas-Bahu serials and (un)reality shows.)

Disadvantages/limitations of targeting Exchange rate?

- This method works well to control (imported) fuel inflation. But cannot control (local) food inflation.

- Works well for a small countries. Because their population is small, they can even import food from India, China and just focus on export competitiveness in electronics and consumer goods. e.g. Singapore, Taiwan etc.

- But Doesn’t work for large countries like India, Mexico or Brazil. Our population is so large, we cannot sustain on imported food. We must be self-reliant in food production.

- Country becomes vulnerable to external shocks. Continuing the previous example of Apple vs Rupee

- What if American RBI tightens their own monetary policy to control local American inflation (= US Feds follow a dear money policy =dollar (apple) supply is reduced.)

- Then Rajan’s statistical projections will go wrong. He’ll have to make new adjustments in Rupee vs Dollar (Apple) quantity in Indian market.

- Government is bogus, and causes high food inflation. Result= Real interest rates become negative, Juntaa will start investing more in gold=>Gold import increased=>payments have to be made in Dollar. This also creates imbalance in supply-demand of rupee vs Dollars (Apples). Rajan will have hard time controlling this mess.

- Country becomes vulnerable to Speculative attacks. e.g. Forex traders in Europe or China decide to hoard Apples (dollars) in their refrigerator to create artificial shortage in market, so later then can sell their apples @higher rate. In such speculative attacks, Rajan will have hard time controlling supply-demand of Rupee vs dollars. He cannot prosecute them under FERA/FEMA laws, those traders live outside his jurisdiction.

- Outdated: During WW1 era, most central banks used to follow this Exchange rate targeting strategy. But today, almost all banks in developed countries, have shifted to inflation targeting strategy. Only few exceptions- like Singapore’s RBI – use this strategy.

Moving to next method/strategy

#2: Focus on Multiple indicators

At present, this is the strategy RBI uses for making monetary policy.

Under multiple indicator method, Rajan will first gather information about:

- Index of industrial production (IIP), Consumer confidence

- Professional forecasts (CRISIL, S&P, Moody, World Bank) about GDP, inflation, unemployment

- Inflation data: WPI minus food, fuel.

Then, he will design the monetary policy (mainly repo rate), with following objectives/focuses:

- Increase employment

- Increase GDP

- Stabilize inflation

- Stabilize exchange rate

Sounds fair enough? Not really!

Multiple indicator method: Negative points/ Limitations

- Multiple indictor method has no “nominal anchor”- no actual target. What exactly are you trying to accomplish? Bring down WPI by 5%, raise GDP to 9%…..no such targets. Just bol-bachhan. Therefore ineffective.

- Multiple indicator strategy worked well between 1998 and 2008. GDP was good and inflation was kept in check. But in recent times, this strategy is no longer working- inflation has skyrocketed and GDP is falling day by day.

- Since 2008, Consumer price index rose to double digits (i.e. 10% or more)

- But RBI doesn’t focus on CPI. They only focus on WPI (minus food and fuel). Result?

- WPI doesn’t track changes in the service sector related inflation (e.g. doctor, physiotherapist, IT, call center etc.)

- Service sector contributes more than 60% of GDP. So, when monetary policy is designed without considering service sector inflation=then it’ll be ineffective.

- WPI commodity list has been revised in recent times- they added ice cream, oven, cricket ball, guitar and so on. Result?

- RBI has to make new statistical calculation about each of such busines arenas- number of people employed in it, total bank loans given, their contribution to GDP etc.

- But when WPI commodity list is revised, RBI has to calculate new statistical projections= problem. Policy doesn’t give effective result in the meantime.

- Even if Rajan makes best policy, its Impact will be seen after a lag of 3-4 quarters (i.e. nine to twelve month). Why? We already learned the limitations of Monetary policy in a developing country, the past article. Click me

- Since this strategy doesn’t have a clear cut transparent targets, it becomes vulnerable to various pressure groups. For example

| Pressure group | informally forces Rajan to: |

| Chindu |

|

| Exporters/ IT companies |

|

| Importers |

|

| FICCI |

|

| Bankers |

|

Therefore, Urjit recommends Rajan to dump this multiple indicator method.

| Mohan | Ok boss. So far I’ve learned following:

Then what is your solution? |

| Urjit | Simple. Focus on inflation |

#3: focus on inflation

In this strategy- Rajan will decide a “Nominal Anchor” say CPI -to monitor inflation. Then he’ll fix an inflation-target say 2-6% and adjust his monetary policy so that inflation remains within that range.

Nominal anchor (CPI) method: Benefits/Advantages of

- Once Rajan sets a CPI target. Noone can ‘influence’ him or put informal pressure- be it Chindu, Exporters, Importers, FICCI, Mallya, Ambani or Bankers cannot influence Rajan’s policy. Because Rajan

- Easy to track progress. Because CPI data released after every twelve days.

- Central banks in all advanced economies and Emerging market economies have adopted this method. (Except India and China).

- It brings transparency. Even aam-juntaa can understand what RBI’s policy is and whether it’s yielding result or not? Because there is only target to monitor=CPI.

Previous Committees have also directly/indirectly recommended for this system. For example:

| year | Committee | Chairman |

| 2007 | Mumbai as International Finance Center | Percy Mistry |

| 2009 | Financial sector reform | Rajan the Boss himself |

| 2013 | Financial Sector Legislative Reforms Commission (FSLRC) | BN SriKrishna |

Nominal anchor (CPI) method: Drawbacks/Limitations/Anti-arguments

| Mohan | Hold on a second. You’re trying to paint a very rosy picture. But if Rajan’s monetary policy tries to control CPI, it’ll have many problems! |

| Urjit | Such as…?? |

| Mohan | In CPI index- more than 50% weightage is given to food and fuel components.

|

| Urjit |

|

| Mohan | Point taken. But in India, we have three CPIs: Urban, Rural and Combined…if we try to control all three of them, then….. |

| Urjit | No problem. We must focus only on CPI (Combined). Its data is released @every 12 days. Very easy to monitor, tracks price movement all over India. |

| Mohan | Ya but still, Its data is not accurate and…. |

| Urjit | yaar if you start to find fault in everything (like a TheH**** columnist), ….then only God can help you. Fidel Castro and Che Guevara cannot fix India’s inflation problem. This only gets fixed from inside the RBI! |

| Mohan | But even if Rajan focuses on this Nominal Anchor (CPI), still there will be a lag of 6-8 months before its impacts are seen. |

| Urjit | Brother, no matter which method we use – there will be lag of 6-8 months before its impact is seen on inflation @ground level.

|

| Mohan | Ok one last obstacle. Governments own policy to fight CPI. For example, whenever prices of sugar, onion or pulses get very high, the government arbitrarily puts export ban on those commodities, start importing them from xyz country, starts distributing them @subsidized rates in various cities. |

| Urjit | So? |

| Mohan | So Rajan may be designed his policy to fight CPI using abc statistical projections but at random, the government will do xyz policy on its own to fight inflation= Rajan’s statistical projections will become wrong and his monetary policy will become #EPIFAIL. |

| Urjit | For this I recommend better coordination and data sharing between Government of India and RBI, regarding inflation control. |

Why Target inflation?

| Mohan | I’m still not clear. Why should Rajan only focus on inflation (CPI). Other things are also important – like GDP, IIP, employment, investment, exchange rates. why focus on CPI only, and ignore everything else? |

| Urjit | let me explain: |

petrol and onion prices, hardship to middleclass= those are clichéd points. Let’s learn some new points.

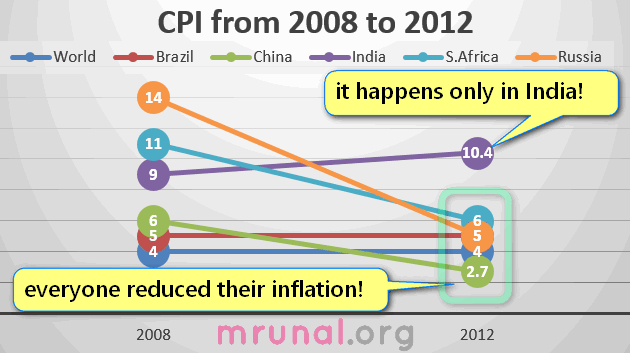

- In recent years, India’s inflation has been highest among all G20 countries.

- India’s inflation has been higher than its trade competitors.

| CPI | 2008 | 2012 |

| World | 4 | 4 |

| Brazil | 5 | 5 |

| China | 6 | <3 |

| India | 9 | >10 |

| S.Africa | 11 | 6 |

| Russia | 14 | 5 |

From above table, you can see that

- Between 2008 to 2012- China, South Africa and Russia have drastically reduced their inflation. Only India is the #EPICFAIL country where inflation has increased- instead of decreasing!

- Higher inflation = real interest rates decreased => makes people buy more gold=>CAD=>rupee weaken=>petrol expensive=>everything expensive=>every more inflation =vicious cycle.

| Mohan | Whoa, whoa, whoa man slow down. What is real interest rate? How does it affect economy? |

Nominal vs Real interest rate

| Urjit | Suppose I’ve 100 rupees. But instead of buying onions, I put this money in a savings account. |

Observe what happens with my purchasing power:

| Onion Rs./kg | Money | How much can you Buy? | |

| 1st Jan | 20 | 100 | 5 kg |

| 31st Dec | 100 | 104 | ~1 kg |

Meaning, although bank increased your money from Rs.100 to 104, but you can buy very less onions. Therefore, we must not focus on nominal interest rate i.e. 4% but on real interest rate.

| Bank deposit | Nominal Interest Rate | CPI (Inflation) | Real Rate of Interest=(Nominal-Inflation) |

| Savings account | 4.00% | 11% | -7% |

| Fixed deposit | 9.00% | 11% | -2% |

From above table, you can see Banks in India offer “negative” real interest. Therefore, people prefer to invest in gold, instead of putting money in bank accounts.

Result:

- Excessive gold import=>Current account deficit increased=>Rupee Weaken =>Petrol/diesel expensive=>even more inflation. This becomes a vicious cycle where you cannot find whether hen came first or the egg came first?

- When people invest money in gold, instead of putting it in bank=> businessmen get less loans=>less expansion =>less jobs=> less growth in GDP.

- Now if you compare India vs [China, Russia, South Africa]. You can see- their inflation is low=> real interest rate would be higher => people invest less in gold=> more money flows towards banks=>business loans=>higher GDP, higher IIP (index of industrial production).

| Urjit | In other words, when Rajan frames monetary policy, he should only fight against inflation – then low GDP, low IIP will be fixed automatically. |

| Mohan | fair enough. |

Nominal Anchor (CPI): the 4% Target

Ok far we’ve learned:

When Rajan frames monetary policy

- He must focus on fighting inflation only.

- To fight inflation, he must focus on “CPI”.

Now the problem? What should be his exact CPI target? 4%, 5%. 0%, -50%??

| Mohan | This is easy. Rajan should design monetary policy in such way, that CPI is -50%. If bottle of desi liquor was sold @100 Rs. in 2010, then in 2014 its price should reduce to Rs.50 only. Then Maujaa hi Maujaa. |

| Urjit | I hate to break your spirit, but such deflationary trend is not good for economy. |

- Every business has ‘fixed cost of production’ minimum light bill, phone bill, office rent, staff salary etc. So, if prices keep falling and falling, then businessman will suffer losses. He has no motivation to expand business. He wants to cut down his production costs, by firing some of the employees= less new jobs created= unemployment = social unrest.

- If prices of everything fall- then custom duty, VAT, excise duty, service tax- their collection will also decrease. Then government has less money to spend on education, healthcare, social sector, defense, law and order = poverty, disease, crime.

| Mohan | Then what should be the “minimum” target? What should be the lower limit of inflation? |

| Urjit | Minimum 2% inflation is necessary in any economy. |

| Mohan | Then what should be the “maximum” limit for inflation/CPI? |

| Urjit | I’ve analyzed data from various countries. When CPI gets higher than 6.2%, it negatively affects GDP and employment. Therefore Rajan should ensure CPI inflation doesn’t cross more than 6%. |

| Mohan | Ok, minimum 2% and maximum 6%. |

| Urjit | Right RBI should try to get CPI inflation @4% with band of +/-2%.

|

| Mohan | But why give this 2% band? Why not just say 4% is our target? |

| Urjit |

|

Besides, the RBIs of other countries also use similar ‘band’ method: observe

| Central Bank of | CPI target under their monetary policy |

| Mexico | 2-4% |

| South Africa | 3-6% |

| Israel | 1-3% |

| Chile | 2-4% |

So, it’s a tried and tested method. we should follow the same.

Nominal Anchor CPI 4%: WHEN to reach?

| Mohan | Ok so far I’ve learned:

|

| Urjit | That is correct. |

| Mohan | well, Your recommendation is ambitious, but unrealistic. I repeat again- There are many factors outside Rajan’s control like monsoon and black marketers. I don’t think Rajan can ever bring down inflation to 4% level. |

| Urjit | It is possible. Let me give you the case study of Chile. |

- During 90s, Chile was facing CPI inflation as high as 25%.

- But in the early 2000s, the RBI of Chile made the target “3% CPI (With +/-1% band)”=2-4% CPI

- Now observe the following graph- particularly the green band between 2002 to 2006. You can see Chile’s RBI has successfully managed to contain inflation within that 2-4% level.

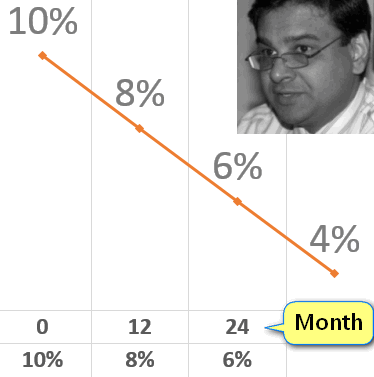

Urjit recommended following timeframe:

| 0 month (i.e. when Urjit was making report) | CPI is ~10% |

| Within 12 months | RBI should reduce CPI to 8% |

| Within 24 months | RBI should reduce CPI to 6% |

| Then | Just try to maintain inflation within the 2-6% range. (i.e. 4% with +/-2% band) |

In short: 0/12/24 (months)=>10/8/6 (CPI)

Nominal Anchor CPI 4%: How to reach?

| Mohan | Alright. If Chile can do it, we can also do it. But HOW? |

| Urjit |

|

| Mohan | What is policy rate? |

| Urjit | Repo rate under Liquidity adjustment facility (LAF)= that’s our policy rate. |

| Urjit |

|

Hawkish trend: Why interest rates will rise?

| Mohan | Ok so far I’ve learned:

|

| Urjit | That is correct. |

| Mohan | But then what’s the new story my friend? All these years, RBI has tried to fight inflation by using Repo rate as its “policy rate”. But it has failed to yield any positive result. What makes you think repo rate can fix our inflation problems? |

| Urjit | Swami Vivekanand has said “Aim higher.” On the same logic, I recommend Repo Rate should be kept higher than CPI. Then it’ll fix the problem. |

Observe.

| At present | |

| Repo | 8% |

| CPI | ~10% |

| Difference (Repo MINUS CPI) | -2 |

You can see Repo rate is lower than CPI. That’s why its ineffective. In the previous article on monetary policy, we learned that

| Monetary policy Tool | How to Fight inflation? | How to fight deflation? |

| Repo rate | Increase repo rate | Decrease repo rate. |

Therefore, to fight inflation repo rate MUST be increased. Urjit Patel recommends that Repo rate should be increased so much that its higher than CPI.

| At present | Urjit Patel’s recommendation | |

| Repo | 8% | Should be higher than CPI. Here CPI=10, so let’s keep Repo @11% |

| CPI | ~10% | ~10 |

| Difference(Repo MINUS CPI) | -2 | (11-10)=+1 |

In other words, Urjit Patel recommends that difference between Policy rate (Repo rate) and CPI should be “positive”, Only then Policy rate can fight inflation.

What will be the consequences of high repo rate?

- Banks borrow less from RBI (Because they’ve to pay more interest rate)

- Banks will increase their loan interest rates (because they’ve less new money and still want to keep profit margin same)

- Less business expansion (because less people take loans, due to higher interest rate)

- Less new jobs created

- Less income

- Less demand

- Sellers will reduce Prices of goods and services, to attract and retain customers.= inflation reduced.

| Mohan | Wait wait wait. Urjit Patel, you’re a “hawkish” person, a person who believes inflation can be fought by increasing the interest rates. |

| Urjit | So what? |

| Mohan |

|

| Urjit |

|

| Mohan | Whatever man. I’m going to write a column in TheH**** to criticize you that “If Urjit Patel Committee’s report is implemented, interest rates will rise and growth will be killed.” (Packs his laptop and Prepares to leave.) |

| Urjit | WAIT! Picture abhi baaki hai mere dost. Overall I made three important recommendations. In this article we only learned the first one: |

- @RBI fight inflation

- Target=4% CPI, +/-2% Band [=control inflation in 2-6% range.]

- Tool=Repo as policy rate, +/-1% spread in RR-Repo-MSF,

- Time limit: 0/12/24 (months)=10/8/6% (CPI)

- Strategy=keep repo higher than CPI.

- @Chindu, give cover fire to Rajan, while he is fighting inflation (=in next article click me)

- @Rajan fix accountability in your gang. (=in next article click me)

Mock Questions

- Incorrect statement

- Nominal interest rate doesn’t take inflation into account.

- Real interest rate doesn’t take Nominal interest rate into account.

- Both A and B

- Neither A nor B

- What do you understand by Real interest rate?

- Nominal interest rate plus inflation

- Nominal interest rate minus inflation

- Nominal interest rate multiplied with inflation

- None of above.

- In a futuristic society, if Real interest rate became a positive number, which of the following is most likely to be correct?

- Fiscal deficit increased at the expense of current account deficit.

- People have started putting their entire savings into gold.

- RBI and Government failed in combating inflation.

- RBI and government successfully managed to bring down inflation below the nominal interest offered in banks.

- Urjit Patel Committee has observed that

- CPI lower than 2% is good for economy but CPI higher than 6% is bad for economy

- CPI lower than 2% facilitates growth but CPI higher than 6% reduces employment.

- CPI lower than 2% and higher than 6%, are bad for GDP and employment.

- None of above.

- Urjit Patel Committee has recommended that

- RBI should continue with multiple indicator method to frame monetary policy, while targeting 4% inflation.

- RBI should ignore fuel, food and service sector inflation and focus on core inflation only.

- RBI should frame monetary policy while keeping CPI as the nominal anchor.

- None of above.

- Urjit Patel recommends RBI to:

- Bring down consumer price index inflation to 6% within next twelve months.

- Switch its focus from multiple indicators to exchange rate stabilization

- both A and B

- Neither A nor B.

- To Combat inflation, Urjit Patel Committee has recommended RBI to:

- Keep Repo rate lower than CPI.

- Keep Reverse repo rate higher than MSF.

- Keep the value of Reverse repo rate between Repo rate and MSF.

- None of Above.

Q8. If RBI frames monetary policy with primary objective of stabilizing the exchange rate, what will be the consequences?

- Country becomes vulnerable to shocks emanating from the country to which its currency is pegged.

- Country becomes immune to speculative attacks in forex trading market.

- Imported inflation will be kept in check.

Choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- All 1, 2 and 3.

Q9. What are the recommendations of Urjit Patel Committee?

- Inflation should be the nominal anchor for the monetary policy framework.

- RBI should adopt the new CPI (rural) as the measure of the nominal anchor for policy communication.

- WPI inflation should be set at 4 per cent with a band of +/- 2

Answer choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- Only 1

Q10. Match the following:

|

|

|

|

|

|

| — |

|

Answer choices

| Options | I | II | III |

| A | 1 | 2 | 3 |

| B | 4 | 1 | 2 |

| C | 3 | 1 | 2 |

| D | 3 | 2 | 1 |

Q11. Match following

|

|

|

|

|

|

|

|

| — |

|

Answer choices

| Options | I | II | III | IV |

| A | 5 | 1 | 2 | 3 |

| B | 3 | 1 | 3 | 5 |

| C | 4 | 1 | 2 | 5 |

| D | 4 | 1 | 2 | 3 |

Mains / interview type questions, once we finish remaining recommendations of the committee in next article.

MCQ hints:

- incorrect statement is B

- technical formula is bit different- but here opt B

- last one

- <2 and >6 both bad.

- second last

- neither

- none

- second statement is wrong.

- only first statement is right

- hawk-interest, bull -will rise; bears-will fall

- Nachi- products, Urjit- Nominal, BN-reforms, Nayak-Board.

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

wonderful article!….Thank You Very much..

I love this article – monpol in a very entertaining and remarkably clear written manner!

Keep up the good work!

Very useful. Good work. Keep it up.

Admin’s presentation is very cool… like the tapori way u referred people’s and other stuffs…. keep up the good work. ..

All the best

sir u are doing very great job for the students who can not afford coaching by providing your lecture and notes online.

sir please keep it up. i will be very thankful to you.

and sir please make the notes of the other subjects too.

sir your work has epitomised the academic egalitarianism

What is the answer of question 10???

Nice explanation

reading this article again in 2016 because of swamys letter to pm about raghuram rajan….the extraordinary measures(high repo rate) taken by rajan makes him really look “hawkish” … because growth is not up to the mark now…job creation is all time low..i aint a macro economy professional but for me picture looks bleak…better if rbi focus on wpi(INCLUDING food and fuel)

hats off sir… really such types of teaching make our morale high & boost our confidence… no need to go for delhi and elsewhere when there is mrunal sir… our dornyacharya

Wonderful and amazing explanation #love economy #love mrunal

This is brillliant.. Thanks sir.. analysis like this helps in taming Unpredictable PSC.

Solid explanation boss!! Thanku

Har Upsc candidate ko economy section k liye mrunal sir se guidance lena hi chahiye. Kyunki mrunal sir jis tarike se kisi bhi topic ko desi example se explain karte hain, shayad hi koi teacher explain kar paye. Thanks a lot mrunal sir….

down to earth and unambiguous explanations… keep it intact

ya mruanl sir presents his thoughts in extraordinary manner,simple example….very nice teacher and having profound knowledge

I love this…

give file

Clarity with which it is written is absolutely good. Highly useful in understanding the ancillary concepts too along with committees recommendations. Keep up the good work.