- Prologue

- #2: @RBI fix accountability in monetary policy making

- Monetary Policy Committee

- #3: @Government give Cover fire to RBI

- Urjit Patel: Misc recommendations

- Mock Questions

Prologue

RBI had formed a Committee under Dy. Governor Urjit Patel to strengthen monetary policy framework. Committee gave three major recommendations:

- @RBI Target inflation (4% CPI; 2% band). Already covered in previous article click me.

- @RBI fix accountability (discussed in this article)

- @Government: help RBI fight inflation (in this article)

#2: @RBI fix accountability in monetary policy making

What is the existing mechanism in RBI?

- Governor: Selection by finance minister, approval by Prime minister, appointment by Government of India.

- Term: three years for Rajan.

- Eligible for re-appointment? Yes RBI Act provides for appointment of a governor for a period of up to five years.

- He is directly accountable to government of India.

- Government can even issue him directives in public interest.

- Rajan is also accountable to Parliament’s standing Committee on Finance. They can summon him. On and average, RBI governor has to appear before this Committee 3-4 times a year.

How is monetary policy formed right now?

- At present, monetary policy is made by the governor alone.

- Rajan does consult with his Dy. Governors, board of directors etc. but only Rajan’s signature necessary for approval file= meaning Rajan and Rajan only is the decision maker.

Some initiatives in recent times:

- 2005: RBI governor started consulation meeting with noted economists, industrial bodies (FICCI etc) and Credit Rating Agencies (CRISIL etc.)

- RBI’s annual reports put on the official website

- Governor publishes quarterly reviews, and during the release, he answers media queries.

- But overall, Monetary policy is still “one man” game, without any formal mechanism for ensuring participation and accountability.

Recommendations in Past:

Previous Committees Tarapore, Reddy, FSLRC etc. have directly/indirectly recommended that

- Monetary policy should be decided by a Committee

- Decision based on majority voting

- Publish minutes of such meetings on the website/media.

| Mohan | alright man now come to the point. |

| Urjit | Well, Considering all of above facts and factors, I recommend that RBI should form a monetary policy Committee. |

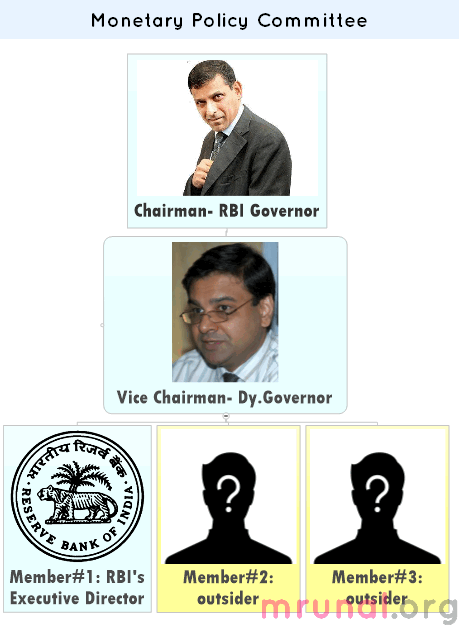

Monetary Policy Committee

Total five people in this Committee:

- Chairman: Rajan himself (governor)

- Vice Chairman: Any one Dy Governor (RBI has total four governors)

- Members:

- One Insider: RBI’s own Executive Director (in charge of Monetary policy).

- Two outsiders/External members:

- Noted Economists, finance experts etc, who’re not office bearers in RBI.

- term: three years

- not eligible for re-appointment.

Outsiders: Safeguards and provisions

| Urjit | The outsider members will have the right to assess all data/files/records in RBI office.But he cannot hold office of profit under the government. |

| Mohan | Meaning? |

| Urjit | To put this in crude words: he should not be on the payroll of the government. for example: IAS officers, bureaucrats, even certain bodies / corporations funded by the government. |

| Mohan | But why? |

| Urjit | Government may try to influence RBI’s decision making via such member- because his bread n butter depends on that job. |

- In all the advanced economies, monetary policy is made by a Committee of independent members- even in China, government directly doesn’t interfere with its officers/representatives.

- Exceptions where government side is represented in Monetary policy Committee =Colombia, Philippines.

Conflict of Interest

| Urjit | Secondly, such outside member must not involve in any activity that has conflict of interest with RBI. |

| Mohan | Meaning? |

| Urjit |

|

MPC Decision by Majority

| Urjit | Monetary Policy Committee (MPC) will decide the monetary policy by voting among themselves. |

| Mohan | But what if there is a tie? |

| Urjit |

|

| Mohan | Ya but what if one member is absent? Then four members left= 2 vs 2 tie possible! |

| Urjit | In that case Rajan (Chairman) will give the casting vote to break the tie. |

| Mohan | But what if Rajan himself is absent? And there is 2vs2 tie? |

| Urjit | Then Vice Chairman of the Committee (Dy.Governor) will give the casting vote to break the tie. |

| Mohan | But what if He is also absent? |

| Urjit | if both chairman and VC are absent, then common sense suggests we should postpone the meeting! |

| Mohan | Ok one last doubt: you told there are five people in MPC Committee: three insiders (Rajan, Dy Governor and one member) vs two outsiders (external members).

|

| Urjit | I’m not going to dignify that stupid question/case study with an answer. Let’s move to next topic: |

MPC: Accountability for #EPICFails

- In the previous article we saw the “Target”: RBI must control CPI within 2-6% range. (i.e. 4% CPI with +/-2% band)

- EPICFAIL = When MPC fails to keep CPI within this range for three successive quarters. (meaning 3 x 3 = 9 months continuously CPI remains outside the [2,6] range.)

In case of such #EPICFAILs, Urjit Patel recommends

- MPC Must issue a public statement

- Every MPC member must sign it

- This statement will contain

- Why did we fail? (Reasons)

- How will we fix it (Future action proposed)

- By when will we fix it? (Timeframe)

MPC: Summary

| STRUCTURE | Total five persons.

Members:

|

| DECISION MAKING |

|

| TRANSPARENCY |

|

^~130 words.

Moving to the third main recommendation:

#3: @Government give Cover fire to RBI

- RBI Makes monetary policy to control money supply in the system [and thereby fight inflationary and deflationary trends in economy.]

- But RBI’s monetary policy fails to yield result because of government’s policies and subsidies. Observe:

#: MNREGA:

- Money increased in Juntaa’s hand? Yes

- Productive infrastructure/assets increased =Hardly. (Most of those kuccha roads and ponds get washed away in first rain.)

- So in a way, more money in public’s hand, without corresponding rise in some physical goods/infrastructure/services. => leads to inflation.

- Additionally, MNREGA=>less poors migrating to rich states to work as farm laborers=> the farmers in those states have to arrange local laborers @higher wages=> food inflation.

- + lot of this money chowed down by Sarpanch, Patwari and Tehsildaar=> they give it local money lender, who in

- turn loans it to farmers @36% interest rate. Rajan has no control over this. His monetary policy fails to control this.

#: MSP

- In recent years, government kept increasing minimum support prices (MSP) of foodgrains (To benefit farmers/vote bank politics.)

- But APMC merchants are not ready to buy grains @such high price.

- So, Farmers bring the grain to FCI (to sell it @Minimum support price declared by the government.)

- FCI buys it, but FCI doesn’t have sufficient godowns= grains rotten @railway stations and eaten away by birds, rats, dogs and cows.

- Money increased in farmers’s hand? Yes

- Products/Goods/services increased in the economy? Nope. in fact foodgrain destroyed=> less commodities/products/breads/biscuits.

- Result= inflation.

- + even if this reaches to PDS shop, those shopkeeper themselves involved in hoarding and black marketeering. So, inflation continues.

- Ill-gotten money gets reinvested in gold, real estate etc (because black-marketer cannot deposit in banks- else Income tax walla will track him down through KYC form.)

- Again, Rajan doesn’t have control over this, so his monetary policy will remain ineffective.

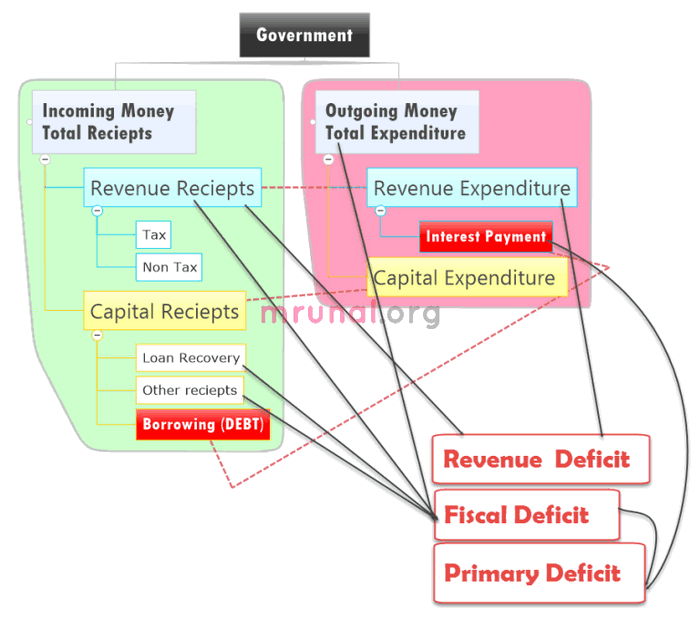

#: Fiscal Deficit

Without getting into all details:

- Any type of deficit = as such bad. Because it shows government is spending beyond its income.

- Revenue expenditure = not good. [e.g. salary to staff]

- Capital expenditure = good. [e.g. building new road/bridge]

- Receipts= incoming money

Let’s check the formulas to calculate various deficits:

| Deficit | formula |

| Budget deficit | Total expenditure – Total receipts |

| Fiscal deficit |

|

| Primary deficit | Fiscal deficit – interest payment (on previous loans) |

| Revenue Deficit | Revenue Expenditure – Revenue receipt |

| Effective Revenue deficit | Revenue deficit – grant for creation of capital assets |

So what do we get from above formulas?

- As such, any type of deficit is bad, because it shows you’re spending beyond your income.

- Sometimes it is good to overspend- e.g. A middleclass family takes loan to send their kid for higher education. [because money will recover when kid starts job/business.]

- Similarly, if government also overspends for productive purpose like building new bridges, dams, canals and powerplants (i.e. capital Expenditure), then it is good, even if they run into ‘deficit’.

- ^Atleast Keynesian economists believe so.

But in Modern Times, such “goodwill” expenditure also create more problems than they solve

- because you’re still ‘overspending’ beyond your income,

- even if bridges, dams, canals and powerplants are created – it’ll take 20-30-50-100 years before the money is recovered through tolltax/selling electricity and water.

- Besides governments tend to subsidize here also. So the “capital Expenditure” will not be recovered quickly.

- E.g. Kejriwal offering free water and cheap electricity. (After all it does come from some dam, some canal, some powerplant.)

Therefore, Free Market economists argue that Government should not borrow money even for capital Expenditure (building roads, canals, bridges and dams). Government should only spend according to its income. And thus fiscal deficit should be kept minimum.

There are two ways to cut down fiscal deficit:

- Government should increase its income (e.g. increase taxes, order PSU to give more dividend)

- Government should decrease its expenditure (e.g. stop bogus schemes, reduce subsidies, sell away loss making PSU, recruit less people and so on.)

But in real life scenarios, both solutions are difficult to implement, therefore instead of decreasing fiscal deficit, government will keep issuing more bonds/Government securities to arrange additional cash.=> fiscal deficit keeps increases. And High level of fiscal deficit leads to following problems:

- Banks and investors buy these government securities.

- As a result, less money left for businessman to get loans/investment => less business expansion, less jobs=>GDP reduced.

- In other words, fiscal deficit crowds out investment in private sector. Business loan interest rates continue to remain high.=> Rajan’s statistical projections about money supply, will become wrong. Thus monetary policy won’t be effective.

High Fiscal deficit: the vicious cycle:

- High Fiscal deficit=> S&P, Moody etc. reduce our “Rating” to junk level=> FDI, FII slows down. But crude-oil, gold imports remain high => less incoming “Dollars”=> rupee weakens => crude oil more expensive=> fuel inflation => inflation in everything transported by petrol/diesel.

- And IF government starts giving subsidies on petrol/diesel, then more fiscal deficit=>vicious cycle of weak rupee and high inflation continues.

- Rajan’s monetary policy give much positive result in this case.

#: Loan Waiver

- 2008: Government announced debt waiver scheme for farmer. Accordingly, government paid >60k crore rupees to the banks, on farmers’ behalf to settle their loans. This hurts in three ways

- Fiscal deficit increased=> more problem as we saw above.

- Rajan’s statistical projections for monetary policy go wrong.

- Farmers get bad habit of not repaying loans on time, hoping that government will again waive off their loans before general election.=> again NPA increases, banks are left with less money to lend => banks will charge high interest rate on business loans (to keep profit margin same)=> less business expansion = GDP, IIP declines.

Urjit Patel’s recommendations to Government

Given all these negative factors, Urjit Patel recommends government to do following:

- Eliminate administered prices (MSP on foodgrains, LPG cylinders),

- Eliminate administered wages (MNREGA)

- Eliminate administered interest rates (interest subvention given to farmers.)

- Implement Vijay Kelkar Committee’s recommendations on fiscal consolidation.

- Religiously follow the guidelines of Fiscal responsibility and budget Management Act (FRBM).

- At present fiscal deficit is ~5% of GDP. Reduce this to just 3% of GDP, by 2016-17.

| Chindu | Waah Urjit bhai waah. You’ve given some radical recommendations.Lejin Hum nahi sudharenge (we’ll not reform and continue to give truckload of subsidies and freebies before election.) Just observe: |

- We’ve increased number of subsidized LPG cylinders from 9 to 12 => subsidy burden increased by 5000 crore.

- Previously 6th Pay commission’s recommendation cost us Rs.20000 crores. Now We’ve formed 7th Pay commission under Justice Mathuor. You can be damn sure it’ll cost more than Rs.20000 crores.

- And before the Model code of conduct is announced, we may launch a few more schemes, freebies and highest MSP for farmer.

| Rajan | Then I better just run away to Nepal, Dubai or Bangkok than try to fix the inflation mess through monetary policy. |

Urjit Patel: Misc recommendations

- Create standing deposit facility (similar to MSF.)

- Reduce SLR rate as per basel III framework. (Nachiket Committee said remove SLR completely).

- Government’s cash and Debt management function should be under a separate Government body. (and not with RBI)

- Government should not give directives to public sector banks on interest rates.

- Exchange rates related. (QE, Tapering.)

- Fixed income financial products (e.g. various maturity plans, Non-convertible debentures, small savings scheme etc.): = for TDS and tax benefits, treat them similar to bank deposits. That’d motivate people to save into them rather than in gold.

Mock Questions

- Find correct statements

- Primary deficit cannot be higher than fiscal deficit

- Primary deficit is obtained by deducting interest rates from Revenue deficit

- Both A and B

- Neither A nor B

- Find Incorrect statements

- Fiscal deficit cannot be lower than budget deficit

- Fiscal deficit cannot be lower than Revenue deficit

- Both A and B

- Neither A nor B

- Effective revenue deficit means

- Revenue deficit + Interest payment

- Revenue deficit – Borrowing

- Revenue deficit + grant for creation of capital assets

- Revenue deficit – grant for creation of capital assets

- RBI governor is__

- Selected by a panel consisting of Finance minister, commerce minister and the leader of opposition in Lok Sabha

- Answerable to the parliament’s standing Committee on finance.

- Both A and B

- Neither A nor B

- (A) In the recent years, RBI’s monetary policy has failed to contain inflation. (R) High level of subsidies and fiscal deficit reduce the impact of monetary policy on ground level.

- Both the statements are individually true and Statement R is the correct explanation of Statement A

- Both the statements are individually true but Statement R is not the correct explanation of Statement A

- Statement A is true but Statement R is false.

- Statement A is false but Statement R is true.

Q6. Urjit Patel Committee has recommended setting up a monetary policy Committee. Which of the following statements are correct in that regard:

- Members will be chosen by a panel of RBI governor, Finance minister, commerce minister and the minister for corporate affairs.

- Their salaries will be charged upon the consolidated fund of India.

- They cannot be removed from office without a proved misbehavior and voting in both houses on such motion.

Answer choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- None.

Descriptive

- (GS2-regulatory bodies)

- What are the recommendations made by Urjit Patel Committee, to bring more accountability in the monetary policy formation in India? (5m | 100 words)

- Write a note on the salient recommendations by Urjit Patel Committee to strengthen the monetary policy framework in India (10m | 200 words)

- (GS3) Examine the role of Minimum support prices and farm subsidies as the Factors responsible for inflation in India. Do you agree with Urjit Patel Committee’s recommendations for removal of such administered prices and subsidies? Justify your stand. (10m | 200 words)

Interview

- Urjit Patel Committee has recommended RBI to keep repo rate higher than CPI. This type of hawkish policy to combat inflation, will hurt the growth momentum. Do you Agree? Yes/No/Why?

- Urjit Patel Committee says bring down fiscal deficit to 3% of GDP by 2016. Do you think this is even plausible? Yes/no/why? If you’re made by the finance minister of India, how will you address the problem of fiscal deficit?

- In the recent years, RBI’s monetary policy has failed to put much impact on inflation. If you’re made the governor of RBI, how will you address this problem?

- Suppose you’re the Finance minister of India, and have to pickup the next governor of RBI. There are two candidates- both man of high integrity and impeccable career record- one is an IAS, who has long served in finance, commerce and corporate affairs ministries. And the second candidate is an IIM graduate with long experience of teaching economics at prestigious institutions abroad, and working with IMF but he holds a US Green card. Which one will you select and why?

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

These picture illustrations and dialogues are enough for any one to remember the topics.. Well written sir…

But what are the arguments/comments one can give for the last interview question (abt IAS officer Vs IIM alumni/ IMF Officer).. The only clue i could get is the fact that the person has a green card which means permanent residence in the US or work permit (as put by Mr. Rajan himself when he was aksed this question), that person cannot be a governor. Most importantly there is no point being diplomatic during an interview, so can any one give more suggestions as to whom and why you would choose ??

Mr Rajan’s answe- http://www.thehindu.com/business/i-am-an-indian-citizen-raghuram-rajan/article5286188.ece

bhut bhut shukriya Mrunal Sir , Bhut hi achche se concept clear hua ,,

Keep it bhai

1-a

2-b

3-d

4-b

5-a

6-d

Can you explain the answer of second question? # Fiscal deficit cannot be lower than Revenue deficit ?

Thank you

Why are you always against subsidies and welfare policies? These are one the reasons genuine people are preparing for civil services. Even if the schemes are not 100% effective, there are huge number of people (sometimes more than population of United States) get benefited by them.

Fine, if you really think that Govt. should spend only on creating capital goods than also point out Tax expenditure and tax preferences. They, in total, amount to more than 50 percent of total tax revenue of central government. Your critic should be balanced and with complete information rather than half-baked truth because many aspirants follow yours website during their initial years of preparation and it affects their foundation.

I guess you should start posting articles for our management institutes (IIMs etc.) which are inclined towards business aspects.

Who will appoint 2 outsider members in MPC?

sir plz give detalis of standing deposit facility

A

D

D

B

A

D

MPC has 6 members, not 5!!!