- Prologue

- [Act 1] Industrial license & reserved sectors

- [Act 2] Policies and Acts

- [Act 4] Excise and Customs

- [Act 5] Stupid statistics and rankings

- Epilogue

Prologue

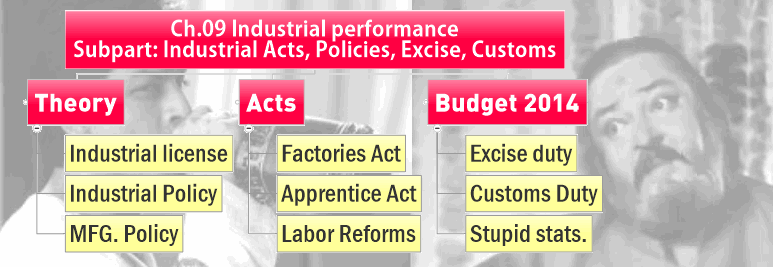

Economic Survey Ch.9 Industrial performance. Four subparts:

- Industries, Acts, Policies, excise and customs duty

- PSUs, Disinvestment, CPSE-ETF

- Companies Act 2013

- MSME sector

[Act 1] Industrial license & reserved sectors

Desi Liquor, Tobacco Products, Defense Aerospace Electronics, Industrial explosive, Hazardous chemicals

| Industrial License Required For | Areas Reserved For Public Sector |

|---|---|

|

Similarly, there are items reserved for MSME sector- bread, agarbatti etc. if large company wants to enter, they’ve to get license click me to know more. |

| Nitrocellulose |

|

| Hydrocyanic acid |

|

| Phosgene |

|

| Methyl Isocyanate (MIC) |

|

[Act 2] Policies and Acts

Industrial policy, National Manufacturing Policy 2011, Factories Act, Apprentice Act.

P1: Industrial policy 1991

| 1948 | Shyama Prasad Mukerjee declared India’s first industrial policy. |

| 1956 | policy revised- main focus on Public sector undertakings. |

| 1991 | LPG reforms, Narsimharao’s new industrial policy. |

Q. What’re the salient features of new Industrial policy 1991? (200 words)

- Liberated industrial licensing. Presently, only five sectors require license.

- For the industries that donot require license- they only need to submit an “industrial entrepreneur’s memorandum” to Department of Industrial Policy and Promotion (DIPP), under commerce ministry.

- Reduced the no. of areas reserved for public sector. (at present only 3)

- FDI relaxed for many sectors.

- NRIs allowed to invest upto 100% in majority of the industries.

- Software technology parks, Electronic hardware technology parks etc.

- HRD focus: gainful employment and optimal use of Human resources.

- Provided disinvestment of PSU

- Govt. signed MoU with PSUs – giving them operational flexibility. Later Maharatna, Navratna, Miniratna categories to give them further freedom depending on profit making. (more details “PSU” subpart of this chapters’ summary).

- To facilitate merger and acquisitions – Government relaxed the MRTP act (Monopolies and Restrictive trade practices Act 1969) => later Government replaced this act with Competition Act 2002 and established a statutory body “CCI” (Competition commission of India).

~160 words.

P2: National Manufacturing Policy 2011

Q. Write a note on the salient features of the national manufacturing policy 2011. (100 words)

- Enhance share of manufacturing industries in GDP to 25%. (At present ~15%)

- Create 100 million jobs over a decade.

- Will setup manufacturing promotion board- to coordinate between union and states.

- will simplify labor and environment laws => related topic factories bill and apprentice bill. (Given in separate section in this same article).

- will create enabling infrastructure via PPP => related topic REITs, INViTs under ch13, urban infra.

- will create of national investment and manufacturing zones (NIMZ)

- 16 NIMZ announced, 8 along Delhi-Mumbai Industrial Corridor (DMIC)=> related topic industrial corridors under Ch11.

- Tax reliefs on venture capital funds to increase fund-flow to startup companies.

- Funds to polytechnics for skill development

- Focus industries

- employment intensive, produce capital goods, have strategic significance,

- sector where India enjoys a competitive advantage (e.g. IT, textiles)

- small and medium enterprises => related topic Government schemes for MSME.

- Public-sector enterprises => related topic “Various Ratna”. (in this same article)

A1: Factories Act 1948 / Bill 2014

- GS2 syllabus: Government intervention in various sectors.

- GS3 Syllabus: Changes in Industrial policy, their impact on industrial growth.

(GS3) Q. Write a note on the salient feature of the Factories Bill 2014 (200 words)

| 2010 | Dr. Narendra Jadhav Committee to examine factory act |

| 2014 | Factories amendment bill as per Jadhav recommendations |

First the definition of a “factory”

| criteria | Factories Act 1948 | New Bill 2014 |

|---|---|---|

| mfg unit where power used | 10 workers | 20 |

| power not used | 20 workers | 40 |

- Redefines factory as a manufacturing units where minimum 20 workers employed in a given year (for units using power), OR 40 workers for non-power units.

- Women workers permitted to do nightshift – with safety provisions and home transport facilities.

- Nightshift not permitted for pregnant / lactating mothers.

- Women workers can work on moving / heavy machinery. But pregnant women and disabled workers can’t.

- Paid leaves reduced to 90 days (earlier 240!)

- Each worker can do 100 hours overtime in every quarter (3 months).

- Re-defined “hazardous substances” – it’ll include any item that can cause physical or health hazards to any person, animal, plant or the environment.

- Factory can decide its own workweek. (doesn’t have to be Monday to Sunday)

- Factory must provide cool drinking water in hot weather, irrespective of number of workers employed.

- Installed Power capacity will be measured in kilowatts. (Earlier horsepower)

- Factory owner will have to maintain spittoons, washing facilities, drying lines, sitting facilities etc. But if he doesn’t => compoundable offense i.e. he can do compromise with workers (victims), no need to waste court time in lengthy trial.

- Factory owner has to open restrooms, lunchrooms if 75/more workers

- Factory owner has to run canteen if 200/more workers

- Factory expansion permitted via self-certification. Reduces the nuisance of inspections and bribes.

- Even Union Government can make rules for factories. (Earlier only State Governments could do).

Overall, the new bill

- Puts women workers on equal footing with men

- Improves safety and facilities for workers.

- Saves factory owners from getting arrested in minor issues. (Therefore, trade unions don’t like this bill. NOT ONE BIT.)

~300 words. But you may not recall all points in exam, so it’ll automatically “FIT” the 200 words limits.

A2: Apprentice Act 1961 / Bill 2014

- GS2 syllabus: issues relating to Development and Management of human resources.

- GS3 Syllabus: Issues relating to employment.

Q. Write a note on the salient feature of the Apprentice Bill 2014 (200 words)

- by Labor ministry

- To amend the original (And outdated) act of 1961

| non-hazardous industry | 14 |

| hazardous industry | 18 |

- Government will decide the number of apprentices in each industry

- Government will provide the syllabus and equipment for “PRACTICAL” training, for specific trades.

- However, companies free to launch new courses other than designated trades.

- Companies can accept non-engineering graduates and diplomas for apprenticeship.

- Companies free to fix work / leave period for these apprentices.

- Multiple companies can come together to give common training. Can even outsource the basic training (for teens that have received no institutional training e.g. grownup child laborers.)

- After training, the apprentice will have to give a certificate-exam by National Council for Vocational Training (NCVT).

- In case of violation – Reasonable fines and inspection. To reduce harassment and “inspection raj”.

- Web portal to file self-compliance reports.

Overall, new bill gives more flexibility to companies, and makes apprenticeship more attractive to youth, and will make them more employable in future, thus helping India to reap its demographic dividend.

~160 words.

Moving on…

F1: Fodder: Why India needs labor reforms?

- India has 44 labour acts union Government and 150+ labor acts from state governments.

- These laws have overlapping provisions= “inspection-raj”, Owner can’t comply with one act without breaking/side-stepping another law = bribery and inefficiency.

| Industrial DisputesAct1947 |

|

| Apprentice Act |

|

- So in a way, companies misuse apprentice act, to evade the archaic “industrial dispute act” (100 worker firing).

- Ultimately both sides suffer.

- Worker doesn’t give his 100% because, he is not “permanent”.

- Owner doesn’t invest in his training /skill upgrade because he is not “permanent” = low skill, low output, demographic dividend can’t be reaped.

| FactoriesAct 1948 |

|

| Contract Labour Act, 1970 |

|

Labour reforms in Rajasthan (2014)

| Provision | elsewhere | Rajasthan |

|---|---|---|

| Owner has to get Government permission before firing employees | if 100 workers | 300 |

| Trade union can be setup IF | 15% workers join | 30% |

| contract labour act applies IF workers more than | 20 | 50 |

| factories act applies to power units IF | 10 | 20 |

| factories act applies to non-power units IF | 20 | 40 |

Q. If Union Government tables all these bills/acts in parliament then how can Rajasthan reform labor laws?

Ans. because Labour laws come into CONCURRENT list under 7th Schedule.

[Act 4] Excise and Customs

| EXCISE DUTY | CUSTOMS DUTY |

|---|---|

| on goods manufactured in India |

|

| as per Central Excise Act, 1944 | as per customs Act 1962 |

| It’s an indirect tax under CBEC | same |

|

Custom Duty in Budget 2014

- we’ll setup 24/7 clearance facility on selected airports and seaports

- Indian Customs Single Window Project for traders. So they’ve to submit all documents at one site/office, and they’ll be forwarded to respective organizations, files will be cleared within given timeframe.

- Result: Our ranking will improve in World Bank’s “ease of doing business”. At present top 3= Singapore, Hong Kong, NZ. India’s rank slipped from 131 to 134 (2014).

#1: Electronics sector

| import of | custom duty |

| Cathode ray tubes (for TVs mfg by MSME, for poor junta) | 0 |

| LCD, LED panels (<19″) | 0 |

| Other specific inputs in mfg. of these TV | 0 |

Implications: cheaper TVs for poors and middleclass, boost in demand, boost in electronics sector and employment.

#2: Energy related

Already discussed in ch.11 energy but for the recap

| RENEWABLE | NON-Renewable |

implications: Boost to clean energy sector |

|

#3: Mineral, Metal, Precious Stones

| Bauxite Export: increased to 20% | less exploitation of this mineral resource from India |

| Ship breaking: reduced (Steel) | more orders from abroad |

|

Earlier each had separate tax rates.Now simplified = less litigation between traders and CBEC. |

| Baggage allowance |

|

Excise Duty in Budget 2014

| Decreased | increased |

|---|---|

|

Tobacco products.

Implications: less demand, less cancer. Atleast in theory. |

|

carbonated drinks

|

|

Smart Cards |

| Absolute Earning | Custom Duty | Excise Duty |

| we earned this much in 2013 | 1.75 lakh crore | 1.79 lakh crore |

| we hope (estimate) to earn this much in 2014 | 2.02 lakh crore | 2.07 lakh crore |

| 2013(Actual) | Corporation > IT > Excise > Custom > Service > Wealth |

| 2014(Estimate) | Corporation > IT > Service > Excise > Custom > Wealth |

[Act 5] Stupid statistics and rankings

| share in GDP | services > Industry > Agro |

| share in employment | Agro > services > Industry |

|

|

| Steel | China, Japan, USA, India (4th) |

| Sponge iron | India First rank. |

| MFG share in GDP | World Export | |

|---|---|---|

| China | 34.1 | 14.6 |

| India | 14.9 | 2 |

| POSITIVE | NEGATIVE |

|---|---|

|

|

Negative growth because:

- inflation = input cost increased

- Low demands in Indian and world economy due to inflation and slowdown.

- Investment declined since last three years

- mega projects stalled, new projects not coming up

- land accusation, rehabilitation, environment clearance problem

- infra bottlenecks, rail road power connectivity, coal supply

Epilogue

- Last years’ survey contained lot of topics like Industrial gears, foundry clusters, jute mission, TUFS etc. But this year’s budget and survey silent on them, hence not dwelling. But if you want to check, click me for last year’s survey.

- Industrial corridors already covered under Chapter.11 on infra

- IIP along with ch4 on inflation

- export, import etc. under ch7 international trade

- Location factors for various industries: under Mrunal.org/GEOGRAPHY

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

Thank u mrunal..

Thanks Mrunal…………..God will Surely Reward U for Such Selfless work.

ThankYou sir!, was waiting for this

Mrunal gone crazy! You are embarrassing my efforts for the exam. If you are working this hard, i dont know how much should we aspirants must be putting in…

Highly knowledge-laden content….

This write up extrremely useful for exam,really !

Hats off,mentor Mrunal!

mrunal ji , ma itna kse yaad karugii.haaye rabba

lol …. :D

Mansi ji apne pe raham kr k yad kijiye

sir …thanks alot…..no ways no express…what u have done for us….jo ghar par app ke madhyam se padte hain…aur app hume sache guru saman humare mind set ke hisab se padate ho..

may kanha g bless u….

sir ..ek request u thi a k industrial index kya kai aur asee hi jo economics ke index hain…unka link de do…humne app ko abhi thoda tym pehle hi join kiya hai to…es liye patani jada

sir …thanks alot…..no ways no express…what u have done for us….jo ghar par app ke madhyam se padte hain…aur app hume sache guru saman humare mind set ke hisab se padate ho..

may kanha g bless u….

sir ..ek request u thi a k industrial index kya kai aur asee hi jo economics ke index hain…unka link de do…

Finally D.P.agrawal is going to retire.Rajni rajdan mam will be the new chief.I’m sure mrunal sir will be feeling very relaxed now.

only time will tell.

please try to provide one article regarding geography in which all the dams, species, places and map related bits before prelims exam which are in news

sorry, occupied in this survey work. not possible to compile such list before prelims.

@Sarath.. can you elaborate on this. Maybe all of us can work on this since Mrunal is occupied

sir …thanks alot…..no ways no express…what u have done for us….jo ghar par app ke madhyam se padte hain…aur app hume sache guru saman humare mind set ke hisab se padate ho..

may kanha g bless u

such a great work…………..god bless u

Good work always beneficial for students and professionals…………..!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

@mrunal i think in ” Act 5 :Stupid statistics and rankings” you have used incorrect sign it should be “>” instead of “<". Service has maximum share in GDP.

mrunal sir absolutly speechless……thank you sir

Typing error correction:

Share in GDP: services > Industry > Agro

Share in employment: Agro > services > Industry.

Dear Mrunal ji,

is it advisable to use Whitener in the OMR sheet in case somebody marks a wrong answer in OMR.

Will it create a problem in scanning or checking??

looking at the number of OMRs UPSC processes to check everyday and the technicalities.

please answer……

I suggest u dont use fluid on ur omr. last year ssc did clarify in cgl exam that candidates can use fluid if they need and the devices will still read the omr but upsc never put any such clarification as far as i know. so just be more careful in marking ur answers and roll no etc in omr. best of luck.

thanks brother

whitener should not be used in OMR sheet.

Mrunal sir, You will be nominated for Padam awards by our govt. Sir, You did yeoman service for all the students for country. Great person Mrunal sir.

Please elaborate if possible, It would be great help, because sometime all the important points are included in the 3rd category and sometime one, in category 1 and 2 sometime the clear cut statement is taken from the passage and sometime synthetically framed statement even in the option of clear cut statement is given

1. Objective of the passage,

2. Important message/idea conveyed by the passage/author,

3. Passage aims/intended to emphasise upon

Cheers and Thanks in advance for gyandata

ENIGMA THANKS FOR UR ADVICE.HUHHHHH

Today, Prime minister has said about to dismiss Planing commission……he has plan to establish a new institution instead of PC……..please share your views.

Mrunal sir , from which month we should revise current affairs and kindly guide us regarding s&t part also…thanx a lot sir

hey manisha are you from kolkata?

M nt from Kolkata risha

hi sir,

plz check the ranking BE 2014 Corporation > IT > Service > Excise > Custom > Wealth.. its

Corporation > IT > Service >custom > Excise > Wealth ( as per your previous lectures)…

Plz clarify..

satish

2014: Corp > IT > Service > Excise >Custom >wealth

excise always ahead of wealth.

Corp always ahead of IT

wealth always at bottom.

Happy Independence day:)

Mrunalji,

Thanks for your article. I guess, Medicine and Pharmaceutical industry also require a licence.

In factories act 1948/2014

Point no.5. It is the days to work to eligible for getting paid leaves not the paid leaves….

Pls correct it Mrunal ji

Dear Mrunal Sir,

As per our Sir’s notes regarding Industrial Licence : it says, it has decreased from 18 to 06. Now only 06 industries need to take ‘licence’ and remaining have to take ‘Permission Letter’.

The 06 industries are : 1. Alcohols 2. Cigar 3. Hazardous Industries (as per define in Govt. Co. Acts.), 4. Defense 5. Explosive &

6. Pharmacy

The Pharmacy is not given in above list. Kindly do the needful.

Looking forward & Thanking you……..SRK

srk: industrial licenses list is taken from India yearbook 2014, ch.19 third para. page 467.

only five categories. Pharmacy is not mentioned anywhere.

thanks sir

i wish if you could publish an separate economic survey. its best then real one..

Also mrunal please tell is it sufficient to read this much survey which you provided or we need to dig something else for pre as well as for mains..

i hope you will get back..

why there is no excise duty on liquor?

Great job Mrunal :D ..you will certainly have hundreds of ever thankful IAS and IPS guys