- Prologue

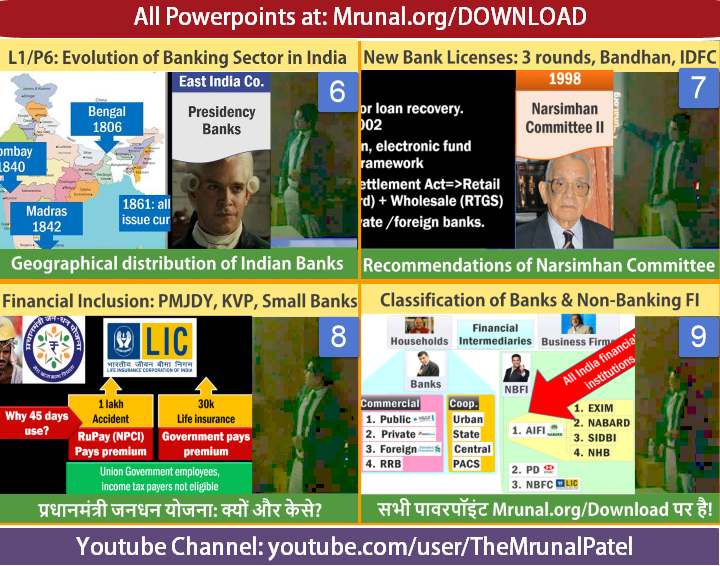

- L1/P6: Evolution of Banking sector in India

- L1/P7: Narsimhan Committee, 3-rounds of bank licenses

- L1/P8: Financial inclusion: PMJDY, KVP, Rupay, Small Banks-Payment Banks

- L1/P9: Classification of Banks and Non-Banking financial institutions (NBFI)

Prologue

- Third lecture was done on 30th January 2015, and uploaded on youtube. Total ~2:30 hours but I’ve split it into four parts.

- PowerPoint of the lecture, available at Mrunal.org/Download

- Medium of instruction- Hindi.

- English version not possible for the moment, because I’m required to teach at this batch, in Hindi/Gujarati only. Besides, same content is available in English-text articles and English PPTs on the site.

L1/P6: Evolution of Banking sector in India

- Indian and foreign banks in pre-independent India

- factors affecting location of banking industry

- Why was there no financial inclusion in British India, despite existence of Indian-banks?

- Why was RBI setup?

- Bank nationalization in Post independent India: Why, How, When?

- Problems created by Bank nationalization. How did it contribute to BoP crisis?

Youtube Link: http://youtu.be/XB9bJtb09lA

L1/P7: Narsimhan Committee, 3-rounds of bank licenses

- Recommendations of Narsimhan-I and Narsimhan-II Committees.

- Private bank licenses in 3 rounds.

- Bimal Jalan Committee’s “In-Principle” approval to (1) Bandhan Microfinance and (2) IDFC

- Bharatiya Mahila Bank (BMB) features, purpose and why is it a symbolic exercise without substance?

Youtube Link: http://youtu.be/7VCPyVXJQQk

L1/P8: Financial inclusion: PMJDY, KVP, Rupay, Small Banks-Payment Banks

- Define financial inclusion?

- Why do we need financial inclusion?

- Steps taken so far by various governments

- PM’s Jan-dhan Yojana- 6 pillars, salient features and criticism.

- Rupay card, what is payment gateway, how does it work? What’s the connection between Rupay card usage and 45 days?

- Kisan Vikas Patra- features, Shyamla Gopinath Committee and safeguards against Money laundering.

- Small Banks, Payment Banks: salient features-functions

Youtube Link: http://youtu.be/-MwlISnrVqw

L1/P9: Classification of Banks and Non-Banking financial institutions (NBFI)

- What’re financial intermediaries?

- What’re the difference between commercial and cooperative banks?

- Regional rural banks- origin, ownership, problems and amendment

- Cooperative banks: origin, classification, problems.

- AIFI (All India Financial institutions): EXIM, NABARD, SIDBI and NHB. origin, ownership, functions, past MCQs from UPSC

- Primary dealers: meaning, functions

- Non-Banking financial companies (NBFC): How are they different from Banking institutions, internal classification of NBFCs.

- Microfinance companies

- Leftover topics and the-end of Banking sector “static” portion

Youtube Link: http://youtu.be/xM3D0xaTesM

![[Summary] Budget & Economic Survey 2018 Gist for the UPSC IAS/IPS Interviews](https://mrunal.org/wp-content/uploads/2018/02/c-bes18-basanti-500x383.jpg)

![[BES171] Banking-Classification: Wholesale Banks, Cooperative Banks, DFI AIFI, MUDRA Bank, Islamic Bank, NBFCs & Indigenous Moneylenders](https://mrunal.org/wp-content/uploads/2017/05/c-bes171-evo-2-500x383.gif)

![[BES171] Banking-Classification: RBI Structure Functions, Nationalization, Scheduled Banks, Merger of SBI Associate Banks & BMB, Private Banks, SFB & Payment Banks](https://mrunal.org/wp-content/uploads/2017/02/c-bes171-cover-500x383.gif)

What is your Message? Search before asking questions & confine discussions to exams related matter only.

how to download written lectures. pls suggest steps, dowload options are not showing in the folders provided. pls help….

can you help me to find videos on English?

how to download written lectures.

i dont know englishi hence i could not see the youtube videos which you are uploading so, please try to upload in himdi medium it will be helpful to us than reading more than twice because watching the video will help to understand the key concept clearly

can anyone tall me plz that what is the name of author who write essay in THE HINDU on monday

Sir iam from north east …i could not understand Hindi…so can u please suggest me for english lecture video?

First purely Indian bank was Punjab national bank….but sir u r saying Allahabad bank…..please clarify it…

Can anyone plz provide me the pdf files downloading link for banking…….

Sir pls upload video in English please sir help nonhidi speaking peoples also sir plz

Sir,are your economy notes sufficient for economics for upsc .

Hi Mrunal sir, this is my first visit to mrunal.org and guess what, I adore the way you write the articles without having to use technical terms and jargon. A big round of applause to the sense of humor you have. Keep up the good word :) Cheers.

Sir ,download section me jo PowerPoint ka folder h uski files ko open krne k liye kaunse app ki. Jarurt h plz sif help me