- What is Social Security?

- History of Social security

- Social Security in India

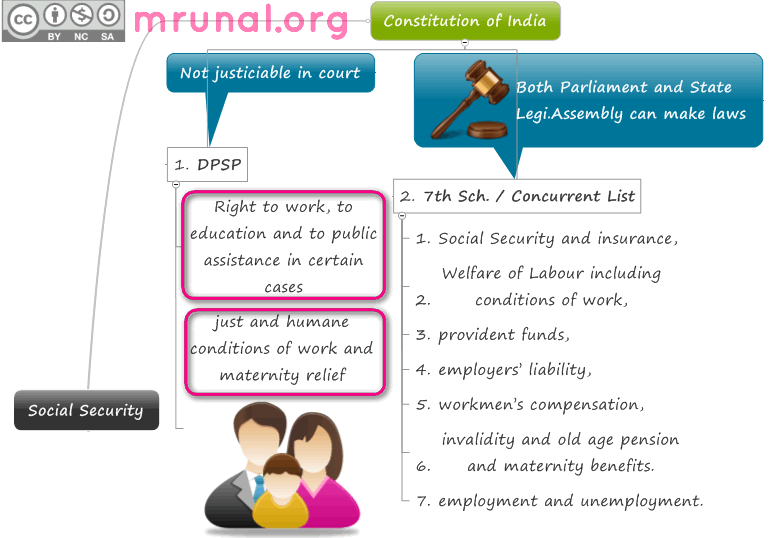

- Social Security: Constitutional Provisions

- Concurrent List

- Part IV Directive Principles of State Policy

- Difference between Organized and Unorganized Sectors

- SOCIAL SECURITY LAWS in India

- Social Security In India : Different From Developed Nations

- Provident Fund

- Mock Questions for APFC 2012 Exam

What is Social Security?

- any of the measures established by legislation to maintain individual or family income or to provide income when some or all sources of income are disrupted or terminated or when exceptionally heavy expenditures have to be incurred (e.g., in bringing up children or paying for health care)

- social security may provide cash benefits to persons faced with sickness and disability, unemployment, crop failure, loss of the marital partner, maternity, responsibility for the care of young children, or retirement from work

- Social security benefits may be provided in cash or kind for medical need, rehabilitation, domestic help during illness at home, legal aid, or funeral expenses

- It acts as a facilitator – it helps people to plan their own future through insurance and assistance.

History of Social security

- Germany was the first country to introduce Social security scheme (1883)

- each member of a particular trade (blacksmiths, painters, weavers etc) was required to contribute at regular intervals;

- Money from this fund was used for food,lodging, hospital and feneral expenses of aged and disabled members.

- In USA, Social Security Act came into existence in 1935. (years not important, this is only fodder material for Essay.)

Social Security in India

- India has always had a Joint Family system that took care of the social security needs.

- However with rise of migration, urbanization, nuclear families and demographic changes, Joint family system has declined. Hence we need a formal system of social security.

Social Security: Constitutional Provisions

Concurrent List

Social Security and labour welfare falls under Concurrent list, it means both union and state Government can make laws regarding these topics.

- (List III in the Seventh Schedule of the Constitution of India)

- Item No. 23

- Social Security and insurance,

- employment and unemployment.

- Item No. 24

- Welfare of Labour including conditions of work,

- provident funds,

- employers’ liability,

- workmen’s compensation,

- invalidity and old age pension and maternity benefits.

Part IV Directive Principles of State Policy

Article 41

- Right to work, to education and to public assistance in certain cases

- State shall, within the limits of its economic capacity and development, make effective provision for securing the right to work, to education and to public assistance in cases of unemployment, old age, sickness and disablement, and in other cases of undeserved want.

Article 42

- Provision for just and humane conditions of work and maternity relief

- State shall make provision for securing just and humane conditions of work and for maternity relief.

Difference between Organized and Unorganized Sectors

Organized sector

- includes primarily those establishments which are covered by the Factories Act, 1948, the Shops and Commercial Establishments Acts of State Governments, the Industrial Employment Standing Orders Act, 1946 etc.

- This sector already has social security benefits under above laws.

- Examples: employees of union and state Government, army, navy, airforce, Multinational companies, Infosys, TCS and so on.

Unorganized sector

| Rural Areas | Urban Areas |

|---|---|

|

|

- Unorganized sector doesn’t have labour law coverage. These are seasonal and temporary nature of occupations.

- Casual nature of work, labour mobility is high hence bargaining power is low.

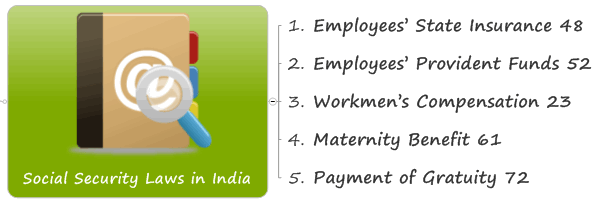

SOCIAL SECURITY LAWS in India

Employees’ State Insurance Act, 1948 (ESI Act)

- covers factories and establishments with 10 or more employees

- Provides medical care to employees and their families.

- Provides Cash benefits during sickness and maternity

- Monthly pension after death or permanent disability.

Employees’ Provident Funds Act, 1952

- applies to specific scheduled factories and establishments employing 20 or more employees and ensures terminal benefits to provident fund, superannuation pension, and family pension in case of death during service.

Workmen’s Compensation Act, 1923 (WC Act)

- Requires payment of compensation to the workman or his family in cases of employment related injuries resulting in death or disability.

Maternity Benefit Act, 1961 (M.B. Act)

- provides for 12 weeks wages during maternity as well as paid leave in certain other related contingencies.

Payment of Gratuity Act, 1972 (P.G. Act)

- provides 15 days wages for each year of service to employees who have worked for five years or more in establishments having a minimum of 10 workers.

Social Security In India : Different From Developed Nations

- We do not have an existing universal social security system

- 92% of the workforce is in the informal sector which is largely unrecorded

- today 1/8th of the world’s older people live in India. The overwhelming majority of these depend on transfers from their children.

- Addressing social security concerns with particular reference to retirement income for worker

- In India the coverage gap i.e. workers who do not have access to any formal scheme for old-age income provisioning constitute about 92% of the estimated workforce of 400 million people.

Provident Fund

- Here the employers to contribute to a provident scheme providing a lump-sum payment in the event of death or disability or on retirement.

3 disadvantages of Provident Fund

- Money is inadequate for risks occurring early in working life.

- Provident funds are generally invested in government securities, which have very low interest rate (~8%) compared to other investment options such as mutual fund or even Bank fixed deposits

- Inflation erodes the real value of savings.

But From the point of view of government, Provident Fund is attractive because it generates forced savings that can be used to finance national development plans.

Mock Questions for APFC 2012 Exam

Q1 Which of the following statements are correct?

- Social security falls under the purview of Union Government only.

- Social security is a fundamental right enshrined in the Constitution of India.

- Employees State insurance Act applies to any establishment with 5 or more workers.

- Workman’s Compensation Act requires payment of compensation to the worker or his family in cases of employment related death only.

| Name of Act | Year |

|---|---|

| Payment of Gratuity | 1961 |

| Maternity Benefit | 1972 |

| Workmen’s compensation | 1952 |

| Employee’s Provident Fund | 1923 |

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

Q1…all are false..

Sir may u pls. provide link for BHARAT 2011 also…thanks

The Bharat 2011 PDF only contains three pages. Frontcover, index page and backcover. That’s why not uploaded.

post more mock questions for apfc exam2012

Thank you sir…

Thank you sir…

4.workmen compensation act 1923.(both death or disability)

1.both union and state govt..

2.social security is a constitutional right(DPSP)

3.ESI(more than 10 employees) whereas EPF(more than 20 employees)

sir plz, post me any mock Question for ass.lebour com.exm

Thanks.

nice sirji asst com labour ke slybs ke bare me kuch aur jankari do

Years of Gratuity Act and Maternity Benefit Act must be altered, it is interchanged between them.

Kindly send me some comprehansive study material for ALC exam 2013.

asst labour commissioner ke liye pls refer some text book

what are the constitution provisions for insurance sector????

Sir pls provide social security programme link

Please inform me wheather Pradhan Manrty Jivan Joyti Bima Yojona(PMJJBY) & Pradhan Manrty Suraksha Bima Yojona(PMSBY) are under statutory social security scheme or not ?

how to prepare for APFC – epfo exam when only 17 days are left.

please tell us date of examination.. send me mail also

sir ,i want social security programme list

& information in india……….[1.security by insurance 2.security by help]

any govt.service holder is under social security scheme?as example-CPF member who joined in service after 2005

Sir, at present I am posted in EPFO. Please provide me guideline that how to crack in EO/AO Exam conducted by UPSC.

Sir , I am posted in EPFO. I have applied for the post of EO/AO Exam conducted by UPSC. Please provide me guideline that how to crack in this exam with healthy marks???

sir plz suggest me the better book for EPFO account officer exam 2016

sir plz suggest me the better book for EPFO account officer exam 2016

I am also apply for AO/EO EXAM, my contact no is 8928970031, if both r cooperate than may be crack, plz contacte

SIR I WANT SYLLABUS OF SOCIAL SECURITY FOR EPFO ACCOUNTANT EXAM SO PLZZ PROVIDE ME..??

M

SIR I WANT SYLLABUS OF SOCIAL SECURITY OF INDIA AND INSURENCE SECTOR NOTES

hello.., please write an article on upsc enforcement officer exam strategies and previous question papers

Hello sir, I need assistant labour commissioner model question papers…..

Please send previous question papers and tell me what type of questions are asked in UPSC enforcement officer exam

Sir plz send questions related with epfo previous year exam on topic of labour laws and industrial relations,and accounting principles also.

Ans.1. D

Ans.2.

1-B, 2-A, 3-D, 4-C