- GDP: an Introduction

- ??? GDP calculation controversy: background

- ? Gist of the Vol1 Chapter10: is Growth rate overstated?

- ?⚖️Standing Committee on Economic Statistics (SCES)

- ? Mock Questions UPSC Prelims MCQ

- ✍️ Mock Questions for UPSC Mains

- ? Mock Questions for UPSC Interview

- ?♂️Epilogue: Bhaktinomics ranking of Ch10: Indeed its overstated

Prologue

- 31st Jan 2020: CEA Subramanian K. published a new Economic Survey of India 2019-20 containing two volumes.

- In this series I am making the summary of the volume1’s individual chapters in the reverse order (11,10,09,08,….) for the benefit of UPSC Civil Services Exam Aspirants.

- In my 6 pillar approach to economy, this particular chapter would fit in: Pillar4C: Macroeconomic Indicators → GDP.

GDP: an Introduction

I hope you’re familiar with the GDP and growth rate. If not watch this video to understand the basics about GDP, its base year, current prices, constant prices, GDP deflator etc.

- Gross Domestic Product (सकल घरेलू उत्पाद) market value of all the goods and services produced within the domestic territory of a country. during a specified time period, usually one year.

- There are three methods to compute the GDP

- 1) Expenditure Method

- 2) Income Method

- 3) Production or Gross Value Added Method.

- Ministry of Statistics and Programme Implementation (MOSPI: सांख्यिकी और कार्यक्रम कार्यान्वयन मंत्रालय) → National Statistical Office (NSO: राष्ट्रीय सांख्यिकी कार्यालय ) is responsible for calculating and releasing the data of GDP.

- NSO was setup in 2019 by merging the erstwhile

- 1) Central Statistics Office (CSO: केंद्रीय सांख्यिकी कार्यालय) and

- 2) National Sample Survey Office (NSSO: राष्ट्रीय प्रतिदर्श सर्वेक्षण कार्यालय)

GDP of India and World

For this segment, we have to refer to volume 2 chapter 1 of the latest economic survey. Noteworthy figures are as following:

| Real Growth rate compared to previous year | 2017-18 | 2018-19 | 2019-20 | 2020-21 (Estimated) |

|---|---|---|---|---|

| India | 7.2% | 6.8% | 5.0% |

|

| World | 3.8% | 3.6% | 2.9% |

|

? Growth rate: why fall / decline?

- Global trade is negatively affected by

- Protectionism in China and the USA. संरक्षणवाद

- US-Iran geopolitical tensions. भू-राजनीतिक तनाव

- Consequently the investment and manufacturing production has fallen even in the G7 and OECD group of countries. India’s not the only country suffering from exports. यानी कि मोदी सरकार निकम्मी नहीं है पूरी दुनिया में ही मंदी का माहौल है ऐसा CEA Subramanian K. जताना चाहते हैं.

- Sharp decline in the automobile purchase. This problem will further worsen with Bharat-6 emission norms. Such vehicles are more expensive compared to the previous models.

- Virtuous Cycle of Growth (संवृद्धि का सु-चक्र):

- higher investment → higher economic growth → higher consumption → higher investment.

- In India, investment slowed down in the aftermath of Non performing assets – Twin balance sheet syndrome (TBS) & IL&FS-NBFC Crisis.

- Although now things are improving, it takes two to four years for the cycle to restart again.

- IMF research found that if there is a sudden increase in loans, → increased production, employment and demand. But this positive effect remains only for a short term. In the long term, it’ll cause a decrease in growth rate. Same has happened in India: during the mid-2000s (before the subprime crisis), the lending was very high → later growth slowed down.

- But according to critiques, the demonetization and GST too have harmed the growth rate but CEA Subramanian K. chose to remain silent on that part.

? Declining Growth rate: future risks / challenges

ES20 vol2ch1 identified following challenges:

- US-Iran geo-political → crude oil price rise → weaker rupee → higher inflation → reduced consumption → GDP declines.

- Even after the Insolvency Bankruptcy Code, the bad loan resolution process has been very slow. Banks are reluctant to give loans to the corporate sector → GDP can’t expand.

- The Government’s National Infrastructure Pipeline (NIP) aims to spend 102 lakh crore on infrastructure in the next five years. But then government will have to borrow more money → higher fiscal deficit → crowding out of the private investors → GDP cannot expand

- Unless real estate developers decrease the prices of homes, It is difficult to sell the unsold homes → Builders will not build new homes → less demand of Steel and cement → GDP cannot expand.

- 2019: India is among the top 5 economies of the world in terms of GDP at current US$ trillion i.e. USA (21 Trillion$), China ($14), Japan ($5), Germany ($3.9), India ($2.9 trillion)

- 2024-25: We plan to increase the size of our economy to 5 trillion. But to achieve this, we need 9% GDP Growth rate annually, which is rather difficult because presently we are struggling around 5%. Nonetheless, CEA Subramanian K. says we’ll achieve it. (खैर वह तो उसे मजबूरी में झूठा ही सही लिखना पड़ेगा वरना नौकरी से हाथ धोना पड़ सकता है)

? Declining Growth rate: glass is still half-full!

- Among the BRICS Nations, India’s growth rate is still relatively better and stable than Brazil, China, Russia.

- Even though the GDP growth rate is falling, Bombay Stock Exchange (BSE) SENXSEX is improving. Which means both domestic and foreign investors are still investing enthusiastically in the shares of companies → Which means they are confident that the Indian economy will improve in the upcoming days.

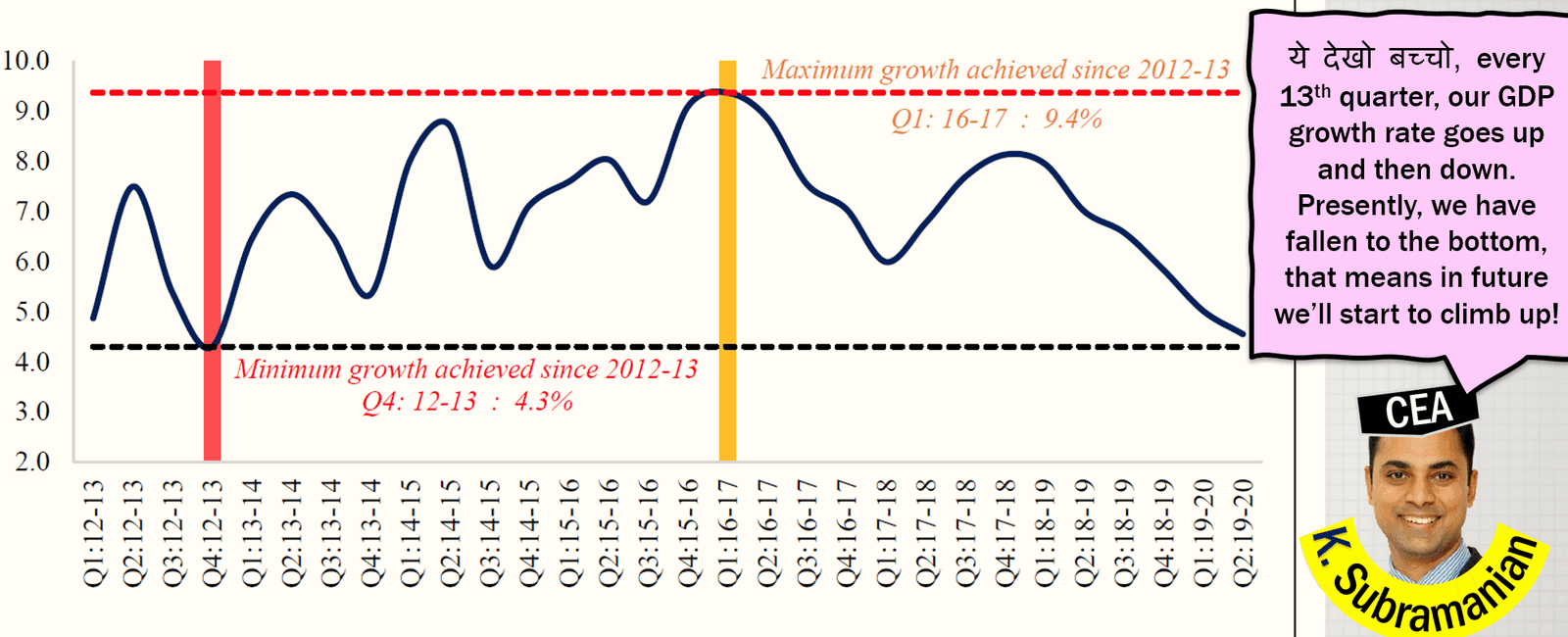

- By doing the quarterly growth analysis since 1996, CEA Subramanian K. found India’s business cycle is about 13 quarters.

- Meaning, after every 13 quarters, we will achieve the highest level and then it will start to fall.

- Presently we are at the “Fall phase”, But definitely improve after that as per the historic trend of our business cycles.

? GDP: how to improve & achieve $5 trillion dollar economy?

- For that we have to dwell into ES20’s initial chapters Which focused on wealth creation and entrepreneurship

- Presently we are at the second last chapter in the reverse order of economic survey. So, when we reach that initial chapters it will become clearer to you.

??? GDP calculation controversy: background

- 2015: India changed its GDP Base year from 2004 to 2011. It was done to comply with the System of National Accounts (SNA-2008) of the United Nations.

- Using the prices adjusted @2011’s base year prices, India’s

- average annual GDP growth rate was approximately 7% (2011 to 2016).

- average annual GDP growth rate was approximately 7.5% (for the last five years that is 2015-2019).

- 2019-March: Former RBI Governor Raghuram Rajan expressed doubt over India’s 7% growth rate. He felt it was overstated just like Sonam Kapoor’s acting skills.

- 2019-June: Former CEA Arvind Subramanian published a research paper.

- He compared the growth rate figures against India’s exports, imports, loans to industry, petroleum consumption, railway freight traffic, electricity consumption, etc.

- and he did not find strong evidence of 7% GDP growth rate. He estimated it’s only 4.5%

- That means, India’s growth rate has been overestimated by 7.0-4.5 = 2.5%. (भारत के जीडीपी वृद्धिदर को बढ़ा चढ़ाकर दर्शाया जाता है ) It hints either

- 1) The Government’s data collection methodology is wrong (डाटा को इकट्ठा करने का तरीका/कार्यप्रणाली गलत है) and/or

- 2) collected data is manipulated / doctored. डाटा के साथ छेड़खानी की जाती है.

- 2020-Jan: CEA Subramanian K. has dedicated a chapter in his economic survey, to prove how above criticism (By Raghuram Rajan and Arvind Subramanian) is invalid. (खैर वह तो उसे मजबूरी में झूठा ही सही लिखना पड़ेगा वरना नौकरी से हाथ धोना पड़ सकता है)

? Gist of the Vol1 Chapter10: is Growth rate overstated?

CEA Subramanian K. did a lot of ‘bol-bachchan’ using heavy academic words like Difference-in-difference (DID) Method, variable bias in regression models, etc.

- He basically tried to prove that all those national and international analysts are wrong. India’s GDP is not overstated or mis-calculated.

- “If Indianexpress gives 0/5 stars in the review of Akshay Kumar’s Houseful4 Movie, then IndianExpress’s reviewing methodology is wrong and Akshay Kumar’s movie is not wrong”, is basically CEA Subramanian K. is trying to suggest.

- But in terms of MCQ worthy content, there is hardly anything noteworthy.

Further, he has littered the chapter with lengthy ‘Modi-Bhakti-Paragraphs’ that in recent times, India has taken several initiatives to foster investment, such as:

- relaxing FDI norms, improving ease of doing business

- cutting corporate tax rates, reforming taxation.

- controlling inflation, etc.

- 10% increase in new firm creation increases district-level GDP growth by 1.8%. This is happening because of MUDRA scheme, Standup India etc. Therefore our GDP is improving. International analysts are not seeing this phenomenon.

- India’s nutrition and electricity access has increased so as a result Productivity of worker and productivity of a manufacturing firm will also increase and GDP will grow eventually.

Consequently, Both DESHI and international investors, see India as one of the fastest growing large economies in the world. And we’ll achieve the objective of becoming a USD 5 trillion economy by 31/3/2025.

?⚖️Standing Committee on Economic Statistics (SCES)

This is a side-topic mentioned in ES20 Vol1Ch10.

Why was this Committee needed?

- Earlier, former RBI Governor Dr. Raghuram Rajan and former Chief Economic Adviser Dr. Arvind Subramanian had raised doubts about India’s GDP figures and its data quality.

- Modi Government had also (allegedly) withheld / manipulated certain NSSO reports related to unemployment and consumer spending which contained negative observations about the economy. Consequently, some members of the National Commission on statistics had resigned in 2019.

- If this type of data manipulation & window-dressing is continued then eventually,

- 1) international organisations will lose confidence in India’s data collection methodologies.

- They will not believe fully, even if the Indian economy is growing really.

- Large sized economy has to contribute more money to IMF & in return gets more voting rights in IMF board (e.g. USA). But, if IMF loses confidence in our data collection methodologies, they may not increase our quota, even if we are becoming an economic superpower.

- 2) International credit rating agencies such as Standard & Poor’s (S&P), Moody’s, and Fitch Group will give poor ratings to Indian G-Sec and corporate bonds → Foreign investors will feel shy about investing in India or they will demand higher interest rates.

- 1) international organisations will lose confidence in India’s data collection methodologies.

Therefore, in 2019-Dec: Ministry of Statistics and Programme Implementation (MOSPI: सांख्यिकी और कार्यक्रम कार्यान्वयन मंत्रालय)’s decided to setup a new SCES Committee:

SCES committee : Structure and functions?

- Standing Committee on Economic Statistics (SCES: आर्थिक सांख्यिकी संबंधी स्थायी समिति)

- 27 members + 1 Chairman (Ex-Chief Statistician Pronab Sen) = 28 persons.

- This new SCES Committee subsumes previous 4 Standing Committees on 1) labour force statistics, 2) industrial statistics, 3) services sector and 4) unincorporated sector enterprises.

- SCES will review the existing framework/methodology/data collection for IIP, periodic labour force survey, economic census etc.

- Chairman Pronab Sen suggested that

- government should announce a specific calendar that on ‘x’ date of each month or quarter, ‘y’ Macroeconomic indicator data will be released.

- This way people will have more confidence In the data released by the Government.

- [Because in past, if CSO/NSO/NSSO data said unemployment is increasing and if election was coming near then government would not release the data until election was over and/or manipulate the figures]

? Mock Questions UPSC Prelims MCQ

Even if the chapter was not written, You had to prepare

- Questions related to GDP [theory], Various formulas involving GDP, trend of growth rate.

- Standing Committee on Economic Statistics [current affairs]: Who is the chairman of this Statistics Committee, to which ministry do they report to? What are its functions? Etc.

- Which organisation publishes which report?: IMF’s world economic outlook, World Bank’s Global Economic Prospects

✍️ Mock Questions for UPSC Mains

Q. Discuss briefly the challenges associated with computation of GDP in India. and what has been done to improve that?

Infact CEA Subramanian K. has not touched this area at all, in this chapter. But, let’s form an answer nonetheless:

- Introduction : Define GDP and give name of the organisation responsible for GDP computation of India.

- Body1: Challenges in GDP calculation:

- 1) Presence of unorganised sector of economy = not all the production data is captured.

- 2) To avoid any scrutiny by income tax and GST tax officials, the businessmen deliberately show low level of production during the surveys conducted by CSO/NSSO/NSO/MOSPI.

- 3) Large size of parallel economy which functions on black money and cash.

- <Even more points can be written but we are not preparing for economics as an optional subject>

- Body2: What has been done to improve the GDP calculation?

- 2015 onwards, CSO updated the base year, data collection methods and Mathematical formulas.

- 2019: MoSPI has merged CSO+NSSO into National Statistical Office (NSO: राष्ट्रीय सांख्यिकी कार्यालय). Which will further improve the operational efficiency and coordination of the organisation In data collection and computation.

- 2019: Standing Committee on Economic Statistics formed under Chairman Pronab Sen.

- Indirectly: with the computerised returns of GST, digital/less cash economy, seeding of PAN card and Aadhar card in all business and banking transactions = The formalisation of economy is increasing → we will be able to get more accurate data in the future.

- Conclusion: Our target is to grow Indian economy to 5 trillion$ by 31/3/2025. So its first and foremost requirement is the accurate computation of GDP. Therefore, above issues/reforms are necessary in this regard / Need to be addressed on priority basis.

Q2. Discuss briefly the challenges associated with achieving the five trillion dollar economy for India by 2025?

Ans.

- Introduction: You have to start doing the present data that we are the 5th largest economy in the world at present.

- Body: List the factors written in this article why our growth rate is declining.

- Conclusion: For reaping India demographic dividend it is necessary to create new jobs but that can only happen if we expand our economy today to a 5 trillion dollar level. Therefore, above challenges need to be addressed on a priority basis / war footing

? Mock Questions for UPSC Interview

- How is GDP calculated in India?

- Do you agree with the views presented by Arvind Subramanian and Raghuram Rajan that India’s GDP is overstated?

- To achieve the 5 trillion dollar target by 2025 Indian economy needs to grow annually at 9% but presently we are struggling given to grow at 5% so do you think the target is feasible at all? what specifically should be done? (Most candidate just start saying Bol Bachchan Modi Bhakti, “If We all join our hands togetherAnd work really hard then we can achieve the target!!” But they lack any specific technical economic terms to justify how that is possible.)

- As per your DAF form, if you’ve written a research paper, cleared UGC -NET or done PHD or have Economics as optional/graduation subject ….then What are the confounding factors in testing the research hypothesis? If you want to do cross country comparison of GDP, what confounding factors would you encounter?

?♂️Epilogue: Bhaktinomics ranking of Ch10: Indeed its utility is overstated for UPSC

Mrunal’s BhaktinomicsTM Index aims to measure CEA Subramanian K.’s MODI Bhakti in each chapter of Economic Survey 2019-20.

- Modi Bhakti: ?????

- UPSC Relevance: ??????????

- Total Pages: 28. Out of them 13 are wasted in just useless GRAPHS and mathematical modeling.

- You had to prepare GDP and SCES even if this chapter was not written in Economic Survey. The growth rate data table and why growth rate is falling – I have lifted that from another chapter of vol2ch1, Just to help you see the larger picture and to keep the article series interesting. So, this vol1ch10 by itself on its own merit is not adding anything worthwhile to the UPSC preparation or intellectual enlightenment.

- इस चैप्टर की नोट्स बनाना या इसकी प्रिंटआउट निकालना बुद्धि और कागज दोनों की बर्बादी मानी जाएगी. क्योंकि UPSC exam point of view से इसमें कोई खास माल है नहीं.

- Lastly, I am pleased to inform you that my next batch on Economy for UPSC Prelims 2020 starting from 15 February. If you are interested to join here is the registration link use the coupon code “Mrunal.org” to avail further discount!

Stay tuned for the remaining chapters

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

Now it’s crystal clear . Thanks sir ! You should be the Chief economic advisor .

I am highly indebted to you for this series…

You are just amazing!!!!!!!!!

Awesome

mrunal sir, de dijiye gist aishe hi..

Thanks gurudev

thanks you sir ..

Thank You Sir “an embodiment of excellence”! Very helpful.

SIR YOUR EXPLAINATION IS QUITE AWESOME, FUN AND VERY LUCID . SIR PLZZ UPLOAD ALL THE CHAPTERS OF ECONOMIC SURVEY AS SOON AS POSSIBLE.

after reading this article modibhakt and sonam kapoor fan are furious :)

Hello Mrunal Sir,

You are doing wonderful work. Thank you, Thank you so much from all of us(India). You contributing the best for society. Whenever Your name came suddenly one thought come in mind that U r also ‘One of KIND of this World’.

??✌️?? Thank you so much again.

It is the best way to cover economic survey in a short time. Waiting for more. Thank you mrunal sir

where are the rest chapters?

Chapter 10 and 11 hi h sir.. baki k chapter show nahi ho rahe

Mrunal..u are undoubtedly the best teacher I have ever seen.

You make us understand any cumbersome concept or subject in a very lucid manner..dnt hav words to express my gratitude..still thanx a lot!!!

Will it be available in pdf form