- UPSC Prelim-2020 Answerkey: Economy section

- Pillar#1A1: Money – Evolution & Types

- Pillar#1A2: Money & Monetary Policy

- Pillar#1B1: Classification of Banks and NBFCs

- Pillar#1B2: NPA, Bad Loans

- Pillar#1C: Financial market & instruments

- Pillar#1D: Financial inclusion

- Pillar#1D2: Insurance and pension

- Pillar#2: Budget, Taxation, Public Finance

- Pillar#3A1: Balance of payment: Import-Export

- Pillar#3A2: BoP: FDI, Capital Account, BoP Crisis

- Pillar#3B: International agreements and organisations

- Pillar#4A: Sectors of economy → Agriculture

- Pillar#4C: Macroeconomic Indicators → Unemployment

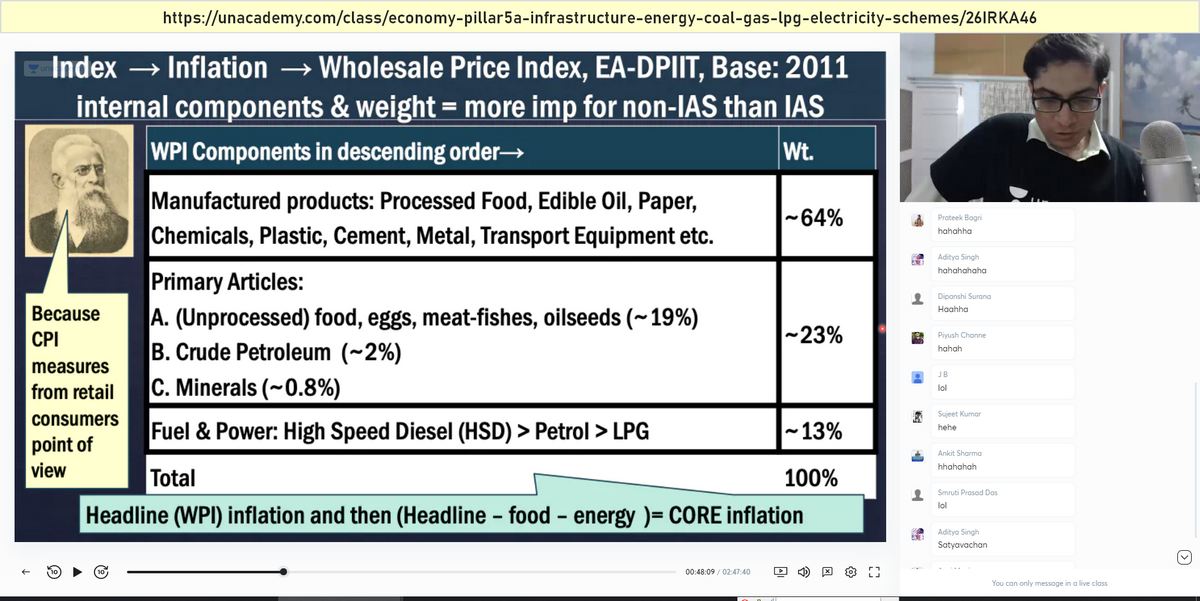

- Pillar#4C: Macroeconomic Indicators → Inflation

- Epilogue

UPSC Prelim-2020 Answerkey: Economy section

| 2015 to 2019 Papers | 2020 Prelims: Continuity and change in the economy questions |

|---|---|

| Since 2015: 20+ MCQs from Economy and government schemes | Trend continuous but, slight decrease in # of Economy MCQs, to make room for the the obsession of the UPSC examiner for agriculture |

| Spanwise: Theory (very few Q) < current (last 1 year) < contemporary (more than 1 year) topics | same |

| Among the sub topics of economy: Banking Finance > International trade agreements > other topics | same |

| Nothing for microeconomics in the recent years, except 2018 | Nothing for microeconomics |

| Hot topic of a given year is not usually asked in the same year | same- Aatma Nirbhar Bharat, TULIP, Yukti 2.0, Champions portal, MSME definition change , APMC ordinance, 500 types of Initiatives taken by RBI…not asked. गजब बेज्जती है यार! शिक्षकों का गला सूख गया और विद्यार्थियों की आंखें सूज गई यह सब पढ़ते-पढाते! |

| BusinessGK not asked & the type of non-sensical Share market and Technical news peddled by the current affairs PDF wala was not asked | same |

| 2019: Difficulty wise- 9 questions were tough e.g economic cost of food grains, service area approach, five year plan etc.

Remaining MCQs were easy to medium |

2020: Only 3 tough questions. Remaining are either easy or medium level. But the number of medium questions have greatly ⏫ compared to past papers. |

| Lengthwise: 2019: 15 MCQs were “One liner”, remaining contained 2 or more statements | 2020: Only 5 questions one liner remaining questions contained 2 or more statements…infact upto five and 6 statements! Which made the paper lengthy, Because you’ve to think from multiple angles. |

| Since 2017- Trend of asking at least one question related to digital economy such as UPI (2017), BHIM (2018), Digital payment system data (2019) | Trend continues with a question on blockchain technology |

| 2019: Question about money multiplier effect on money supply | Question about aggregate money supply (M3)- Which falls near the same category of topics |

| 2019: Question about of financial instrument participatory notes | about Financial instruments: Hundi, Certificate of Deposit |

| WTO related questions: 1 MCQ (2017), 1 MCQ (2018), 0 MCQ (2019), | Again resumed the love for WTO with an MCQ on TRIMS agreement. |

| 2019: Question about what to do in currency crisis | Question about what to do in global financial crisis |

| Since 2018- There is a trend of asking data interpretation from random government reports | continued- with Data interpretation type questions from India’s trade with Sri Lanka and Bangladesh, employment scenario in India. |

| 2 questions on import export | same |

| Trend of asking about Obscure Organizations / Yearbook Info: 2016- FSSAI labelling guidelines, 2017- QCI, 2018-Again FSSAI, 2019: PNGRB | nothing as such |

| since 2016: Trend of asking about economy and Human Development related Global indices and reports | nothing as such |

Application of ? GuessMaster-GiriTM:

|

? GuessMaster-GiriTM:

|

Strategy for UPSC Prelims and Mains-2021’s Economy Portion

Over: all the striking differences are Compared to previous years papers

- Easy questions ⏬ while medium difficulty questions ⏫

- Multi-statement questions are ⏫, One liner MCQs ⏬

- The multi statement questions tested your logical elimination power.

- Beyond that in terms of preparation sources there is no change. These questions could be

- EITHER solved from NCERT, Economic Survey, Newspapers. (And since Mrunal’s economy course material is prepared by compiling those sources so it has also proved useful.)

- OR a few questions which were asked from random sources such cybersecurity insurance and TRIMS agreement etc. But that does not mean we should drop everything and start preparing such random stuff in detail. Cutoff is never 200 / 200. And usually there is no permanent trend of asking only single type of random thing. So even if you prepare 500 different type of insurance products there is no guarantee next year there will be a question on insurance products!

Strategy for Prelims-2021: Economy, Schemes, Yearbook

- Unlike Polity, History or Environment, there is no single book covering economy in sufficient exam oriented manner.

- The boundary of economy syllabus is fluid, students mistakenly start doing Ph.D / Chartered Accountant level preparation or chasing petty current affairs and figures.

- So, few years back I started putting economy series on my Youtube Channel youtube.com/c/TheMrunalPatel to cover the economy in an exam oriented manner. But, nowadays youtube is littered with too many UPSC channels so advertising revenue gets divided in such proportion that it’s not financially viable.

- So, I had launched Economy full course at Unacademy Plus Live platform, including 600+ pages worth of comprehensive revision handouts. Uniqueness about those handouts is:

- You don’t have to separately consult other books, NCERTs.

- All the important schemes, policies, ministries and related yearbook organizations are covered.

- Latest Budget and Economic Survey is covered.

- Handouts are in English, but also contain Hindi terminologies to help the vernacular aspirants in the Mains-Exam as well. Saves a lot of time and trouble of going through dictionaries.

- Weekly quiz and doubt solution

- Free economy updates are provided even after your course is over, using Win20CSP series.

- 18 out of 23 Economy related MCQs in Prelims-2020 could be solved directly from my lecture series & its handouts. Screenshot proofs are attached with this answer key. I consider UPSC a sacred exam and don’t even like to brag about how many questions could be solved from my material, but with the entry of so many unscrupulous commercial elements in the online domain, such chest-thumping has became necessary, lest the novice youngsters get hypnotized by those elements and their MBA-walli sales pitches.

- Now, my next LIVE-batch for Prelim and Mains 2021 is starting from October week#4, 2020. There will be weekly Live Classes, weekly quiz, updated material, Q&A doubt solution.

- Uniqueness about this Unacademy ‘Plus’ model is that just one subscription fees unlocks access to all full length courses by other faculties / educators– be it Essay writing or environment, history, science-tech, polity, geography, current affairs, various modules for Mains and even certain optional subjects. Link for Registration: Click Me, and Use PROMOCODE “mrunal.org” to avail further 10% discount.

What if i don’t want to join Mrunal’s paid economy course

For some reason you don’t want to join / can’t join the above paid course due to monetary issues, then how to approach economy for Prelims-2021? Thugs of Delhi will never tell you that, unless you join their Paid-course (and that was the primary reason why I had started this site more than ten years ago!) so, here is the answer:

[accordion id=”my-accordion”] [accordion_item title=”Click me to expand & Know the Answer!” parent_id=”my-accordion”]

- First, study topic wise answer key for economy of previous years, available for free at mrunal.org/prelims It will give your basic idea on what type of questions are asked and as a result it’ll save you from pursuing Ph.D or Charter-Accountant giri which is not required to pass IAS-prelims.

- For Economic Theory Portion read class 11 and 12 Tamilnadu State Board textbooks. They are much better And easier to understand compared to NCERT. ✋There is no need for buying a special book for it like Ramesh Singh, Mishra Puri, Dutt Sundaram, Pratiyogita Darpan economy compilation etc.

- For economy current affairs, better to read Indian Express instead of theHindu.

- For Mains:

- Indian economy after independence read class 11 NCERT India’s Economic Development.

- Preface of last 2 years’ Yojana Kurukshetra Magazines. (Free PDFs available both in English and vernacular language)

- Introduction- Conclusion of Vol1 of Economic Surveys of last 5 years.

- If required, go through my Youtube playlist called ‘BES17’. It covers economy theory as well as budget and Economic survey 2017. So, focus only on theory and the contemporary topics like GST, NPA, BASEL etc.

- Which chapters of IYB are important is given in this separate article. At this stage no point of purchasing the 2019’s books. Better wait till 2020’s edition next year. Chapter list will most probably remain the same, so prepare accordingly. You don’t even have to buy the whole book there are plenty of free courses and free summary notes available online.

- Then update economy current affairs from whichever free PDF compilation / magazine you like. Although the problem with these PDF compilations is they excessively focus on trivial data and figures. That’s why I have given the first step go through previous paper to get an idea what is important and what is not important. You should pursue the 6 pillar approach in current affairs, if you can’t classify a Economy-current topic in any of those 6 pillars then it’s not important for economy portion of exam.

- Pillar#1 Banking Finance: Every announcement made by RBI is not important. Only those announcement related to core of the monetary policy, financial inclusion, non-performing asset and digital payment are important. People had engaged in so much PHD over Project Shashkt’s Asset reconstruction companies financing mechanism but look how simple a question UPSC has asked from that topic. UPSC rarely asks microeconomics or in-depth question from SEBI-Sharemarket, so no need to prepare too much of it. Cutoff is never 200 out of 200 marks.

- Pillar#2: Budget speech should be prepared. Sometimes things are asked after a lag of 1 year. For every major scheme you should be aware which department is responsible for implementing it, what is the funding pattern, and what are the salient features / eligibility conditions.

- Pillar#3: Basics of Balance of payment and currency exchange rate mechanism should be known. Unnecessarily people were doing so much haay-haay over RBI’s Currency swap but look how basic things UPSC has asked about currency exchange in Prelims-2019. Similarly, for notable international organization – you should be aware of their membership, last summit, important treaties. For international reports, you should be aware of which organisation publishes them how frequently they are published what are the components of given index, who got first rank, what is india’s rank?

- Pillar#4: Among the sectors of economy, agriculture and its schemes should be given more priority because of the merger with the Forest Service exam. Among the rest of the topics: IPR-Patents, NITI-FYP, MSME-Textile, GDP-Inflation-IIP: Basic theory and current affair should be known. PDF-wallas have to release monthly content, so they’ll keep giving ball by ball commentary about everything under the sun, but it’s not important for exam.

- Pillar#5: Infrastructure- Simply prepare the notable schemes, laws, organizations and portal/apps for mining, energy, water-sanitation, transport, communication and urban rural infrastructure. In the mains exam there is a topic on public private partnership (PPP), but UPSC is not asking IIM-A investment banker exam questions there. Prepare the basics only from any internet source.

- Pillar#6: Poverty, Education, HRD. Just prepare the notable schemes, laws, organizations & reports, including SDG. Sufficient material and compilations are available on the internet.

[/accordion_item][/accordion]

To conclude, Economy is not rocket science. Economy is a scoring component of General Studies. It’s much easier to master compared to certain other segments of GS. Now let’s solve Prelims-2020 paper:

Pillar#1A1: Money – Evolution & Types

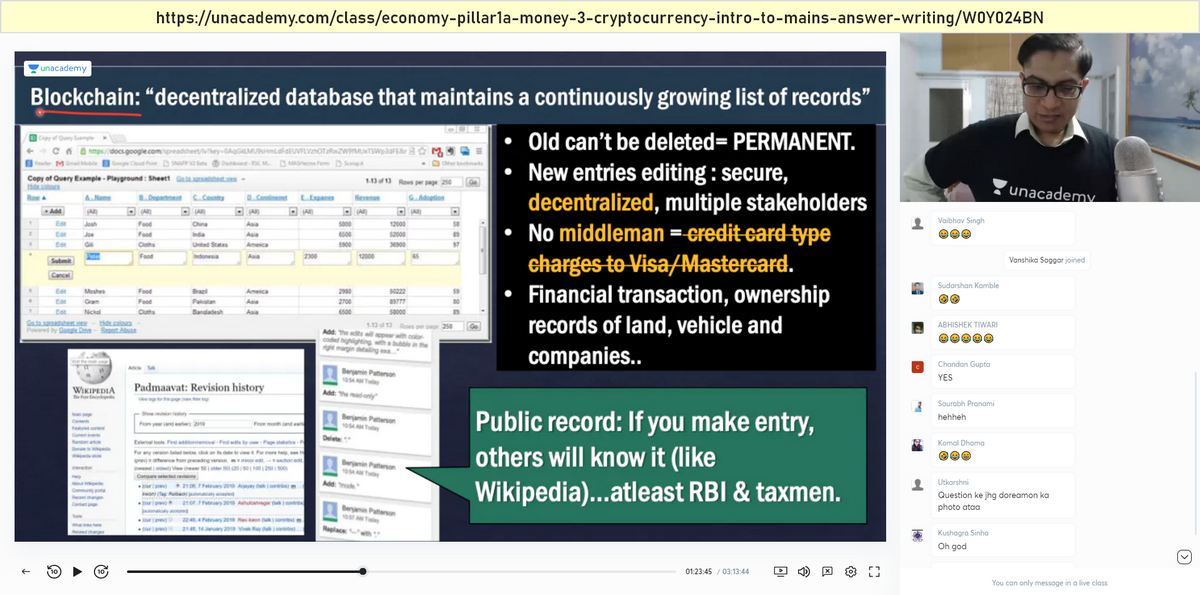

(Pre’20-SetB) Q.20. With reference to “Blockchain Technology” consider the following statements:

- It is a public ledger that everyone can inspect, but which no single user controls.

- The structure and design of blockchain is such that all the data in it are about cryptocurrency only

- Applications that depend on basic features of blockchain can be developed without anybody’s permission.

Which of the statements given above is/are correct?

[a) 1 only

[b) 1 and 2 only

[c) 2 only

[d) 1 and 3 only

Difficulty : Easy ?, High profile topic even in past questions have been asked in UPSC. This much basic knowledge expected from aspirants.

Type: Contemporary ?, Bitcoin was invented in 2009 and ever since it was in news.

Explanation:

- Mrunal’s Economy Lecture Pillar1A1: Money: Cryptocurrencies, dated 21st June, 2020. Slide #54. (Prelim was on 4th October 2020, so this was BEFORE the exam.)

- Blockchain technology is a decentralized Data Management Technology so #1 is right.

- Blockchain Technology can be used for storing any type of data from Land records to vehicle ownership two transactions of cryptocurrency, So, #2 “ONLY for cryptocurrency” is wrong. → B and C are eliminated. We are at ?50:50 between A or D.

- Bitcoin and other cryptocurrencies & their wallets have been created by computer experts, without taking permission from any government or Central Bank. so the third statement is correct. Therefore the answer is D.

? GuessMaster-GiriTM: ?Partially Possible. Extreme worded statements are always wrong → #2 wrong = ?50:50 between A or D

Pillar#1A2: Money & Monetary Policy

(Pre’20-SetB) Q.10. If you withdraw Rs. 1,00,000 in cash from your Demand Deposit Account at your bank, the immediate effect on aggregate money supply in the economy will be

[a) to reduce it by ₹ 1,00,000

[b) to increase it by ₹ 1,00,000

[c) to increase it by more than ₹ 1,00,000

[d) to leave it unchanged

Difficulty : Easy ?. Even last year there was a question about the Money Multiplier Effect. This much basic NCERT knowledge expected from every serious aspirant

Type: Theory ?

Explanation:

- Mrunal’s Economy Lecture Pillar1A2: Monetary Policy, dated 25th June, 2020, Slide #91. (Prelim was on 4th October 2020, so this was BEFORE the exam.)

- Aggregate money supply means M3.

- = Coin and currency with public +Demand Deposit with commercial banks +Time Deposits with commercial banks

- So if you withdraw 100000 rupees from your account then M3 will remain unchanged because ₹1 lakh will shift from the column of “demand deposits” to the “coin currency with public.”

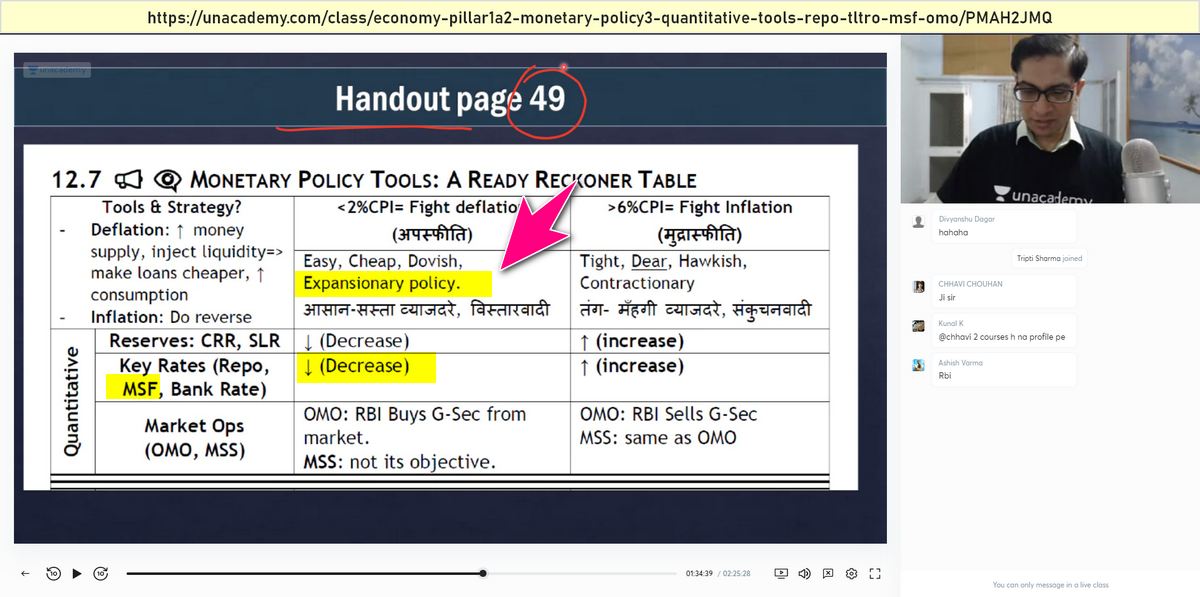

(Pre’20-SetB) Q.87. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do ?

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below :

[a) 1 and 2 only

[b) 2 only

[c) 1 and 3 only

[d) 1, 2 and 3

Difficulty : Easy ? Because basic understanding about the monetary policy is asked

Type: Theory ?

Explanation:

- Mrunal’s Economy Lecture Pillar1A2: Monetary Policy, dated Jun 28th, 2020. Slide #68 and its handout page no 49. (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- During the Expansionary Money / Cheap Money / Dovish Monetary Policy, RBI will try to increase the supply of money and/or reduce the loan interest rates.

- So reducing the SLR, bank rate and repo rate will help in that regard. So, RBI may do 1 and 3. So, here question is asking, “WHAT RBI WILL NOT DO?” So, Option A, C and D are eliminated. we are left with answer B: Only 2.

- Increasing the MSF will raise the loan interest rates, so, if RBI pursues Expansionary policy, it’ll not do it.

- Some candidates engage in hairsplittery (बाल की खाल निकालना), that under the external benchmark system, loans are linked with repo rate so #2 unlikely to have any impact. But such hairsplittery is not required for the scope of exam

Pillar#1B1: Classification of Banks and NBFCs

(Pre’20-SetB) Q.89. Consider the following statements :

- In terms of short-term credit delivery to the agriculture sector, District Central Cooperative Banks (DCCBs) deliver more credit in comparison to Scheduled Commercial Banks and Regional Rural Banks

- One of the most important functions of DCCBs is to provide funds to the Primary Agricultural Credit Societies.

Which of the statements given above is/are correct ?

[a) 1 only

[b) 2 only

[c) Both 1 and 2

[d) Neither It nor 2

Difficulty : Medium ? It requires understanding of the banking classification.

Type: Contemporary ?

Explanation:

- Mrunal’s Economy Lecture Pillar1B1: Classification of Banks and NBFCs, dated July 5th, 2020. Slide #63. (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Compared to DCCB, scheduled commercial banks command larger quantities of deposits, more number of Bank branches, have an obligation to give 18% of their loans to agriculture under the priority sector lending (PSL). Therefore statement#1 is unpalatable (हजम करना मुश्किल है) and wrong.

- Statement#2 is correct. DCCBs give funds downwards to PACS.

Pillar#1B2: NPA, Bad Loans and other burning issues in the banking sector

(Pre’20-SetB) Q.72. What is the importance of the term “Interest Coverage Ratio” of a firm in India?

- It helps in understanding the present risk of a firm that a bank is going to give a loan to.

- It helps in evaluating the emerging risk of a firm that a bank is going to give a loan to.

- The higher a borrowing firm’s level of Interest Coverage Ratio, the worse is its ability to service its debt.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Difficulty : Medium ?

Type: Contemporary ? It was mentioned in economic survey 2016-17, with regards to the problem of bad loans in Indian banking system.

Explanation:

- Mrunal’s Economy Lecture Pillar1B2: Bad loans and Other Burning Issues in Banking Sector, dated July 5th, 2020. Slide #45 and its handout page no 86. (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- By 2013, nearly one-third of corporate debt was owed by companies with an interest coverage ratio less than 1 (“IC1 companies”), meaning they are not generating enough revenue even to repay the loan interest.

- So that means higher ratio of IC is good and lower (<1) is bad.

- Further, NCERT class 12 Accountancy book also confirms, “A higher Interest coverage ratio ensures safety of interest on debts.”

- Third statement is wrong. We are at ?50:50 between A or B.

- Statement 1 is correct, By looking at the interest coverage ratio we can identify the present risk of a firm (That it is not generating good revenue). There is only “A” option where statement#1 is present.

Pillar#1C: Financial market & instruments

(Pre’20-SetB) Q.84. In the context of the Indian economy, non-financial debt includes which of the following ?

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below :

[a) 1 only

[b) 1 and 2 only

[c) 3 only

[d) 1, 2 and 3

Difficulty : Tough ?, because clear answer difficult to find in routine preparation sources.

Type: Theory ?

Explanation:

- As per this random google book, “Non-Financial debt” excludes the debt of Financial Institutions i.e. those institutions that borrow solely to re-lend and the money. [In other words if, NABARD, ILFS etc had borrowed money to re-lend it, then it’d be financial debt. And all other type of debt will be “non-Financial debt”]

- So, In above options, all three loans are taken by persons or entities who’ll not ‘re-lend’ it, but They will use the funds for their own purpose. Therefore, Answer should be “D”

- Some persons are interpreting the question in a different sense and saying that only “treasury bill” should be the answer because the money is borrowed by the government so Answer should be “C”. Well, the official UPSC answer key will be the ultimate judge.

(Pre’20-SetB) Q.45. Which of the following phrases defines the nature of the ‘Hundi’ generally referred to in the sources of the post-Harsha period?

[a) An advisory issued by the king to his subordinates

[b) A diary to be maintained for daily accounts

[c) A bill of exchange

[d) An order from the feudal lord to his subordinates

Difficulty : Easy ?

Type: Theory ?

Explanation:

- Mrunal’s Economy Lecture Pillar1C1: Debt Instruments, dated July 12th, 2020. Slide #56. (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.) Note: For the purpose of classification I have kept this question under Medieval history.

- Hundi/ Bill of exchange are short term financial instruments. So, C is the answer.

(Pre’20-SetB) Q.80. With reference to the Indian economy, consider the following statements :

- ‘Commercial Paper’ is a short-term unsecured promissory note.

- ‘Certificate of Deposit’ is a long-term instrument issued by the Reserve Bank of India to a corporation.

- ‘Call Money’ is a short-term finance used for interbank transactions.

- ‘Zero-Coupon Bonds’ are the interest bearing short-term bonds issued by the Scheduled Commercial Banks to corporations.

Which of the statements given above is/are correct

[a) 1 and 2 only

[b) 4 only

[c) 1 and 3 only

[d) 2, 3 and 4 only

Difficulty : Easy ?

Type: Theory ?

Explanation:

- Mrunal’s Economy Lecture Pillar1C1: Debt Instruments, dated July 12th, 2020. Slide #56 and #57. (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Certificate of deposit is a short term debt instrument. #2 is wrong since it says ‘long term instrument’. This eliminates A and D. So, we are ?50:50 between B or C.

- #3: Call money is a short term finance for interbank transactions that is correct. So, Answer is C.

Pillar#1D: Financial inclusion

(Pre’20-SetB) Q.76. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes ?

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- Post-harvest expenses

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below :

[a) 1, 2 and 5 only

[b) 1, 3 and 4 only

[c) 2, 3, 4 and 5 only

[d) 1, 2, 3, 4 and 5

Difficulty : Easy ? by word association that short term credit can’t help building village cold storage facility – which will require a long term loan.

Type: Contemporary ? Because it was launched in 1998. Although it had remained in news in the recent budgets, the government expanded the scheme towards the farmers who are engaged in the animal husbandry and fisheries.

Explanation:

- Mrunal’s Economy Lecture Pillar1D3: Financial Inclusion, dated July 23rd, 2020. Slide #36 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.) Kisan Credit Card primarily meant for buying farm inputs. So construction of ‘family house’ seems far-fetched. So, #5 is wrong. Further, setting up a village cold storage facility cannot be done through a short-term credit (as given in the question premise) it will require a very long term loan. So, #5 is wrong. By elimination we are left with answer “B”. Still for the sake of mental satisfaction, let’s cross check all the options:

- As per the Lok Sabha answer given by Govt on 5th Jan 2018 (Ref: PIB): Kisan Credit Card (KCC) scheme provides credit support for

- To meet the short term credit requirements for cultivation of crops;

- Post-harvest expenses; → #4 is right

- Produce marketing loan;

- Consumption requirements of farmer household; → #3 is right.

- Working capital for maintenance of farm assets and activities allied to agriculture; → #1 is right.

- Investment credit requirement for agriculture and allied activities.

- There are only two options where 1-3-4 are together Option B and D. But in the ministers reply to Lok Sabha there is no mention of #5: construction of family house and village cold storage facility, So, by elimination the answer should be B. Some candidates may drag the argument that investment credit requirement subsumes Village cold storage facility but still construction of family house is not fitting the pattern so #5 is not right. Besides for construction work, long term credit will be required.

Pillar#1D2: Insurance and pension

Interestingly no questions from the government schemes related to insurance and pension. Although in the last two years many initiatives were undertaken such as PM Shram Yogi Maan Dhan, Laghu Vyapari Maan Dhan, Kisan Maan Dhan etc. schemes

(Pre’20-SetB) Q.90. In India, under cyber insurance for individuals, which of the following benefits are generally covered, in addition to payment for the loss of funds and other benefits ?

- Cost of restoration of the computer system in case of malware disrupting access to one’s computer

- Cost of a new computer if some miscreant wilfully damages it, if proved so

- Cost of hiring a specialized consultant to minimize the loss in case of cyber extortion

- Cost of defence in the Court of Law if any third party files a suit

Select the correct answer using the code given below :

[a) 1, 2 and 4 only

[b) 1, 3 and 4 only

[c) 2 and 3 only

[d) 1, 2, 3 and 4

Difficulty : Medium ? to Tough ?. Verbatim answers are not easily available in the routine preparation sources. Second statement is also open to multiple interpretations.

Type: Contemporary ?

Explanation:

- If you make the word Association that cyber insurance means something that arises out of this internet related cyber security challenge then the second statement is difficult to digest, that if your personal enemy / neighbour’s kid / ex-husband/wife physical damages your computer → Insurance firm will pay the cover for that. So, #2 is wrong. By elimination the answer should be “B”.

- Let’s cross check: HDFC’s cyber insurance policy gives no verbatim promise of covering #2. It says “While we promise to protect you in the digital space, we’re afraid there’s not much we can do in the offline space under this plan.” So that means if someone is physically damaging your computer, HDFC making no clear promises to cover you. So, #2 wrong.

- Similarly, upon reading the policy document of Bajaj Allianz: page8: it says “Any damage or destruction to any tangible property is excluded. “

Mrunal-Comments: One has to read 14-15 pages of Insurance policy document and interpret it. So, this is 2019’s Wetland-MCQ walla tamashaa all over again. If my answer turns out to be wrong. I don’t see the benefit of researching this matter for 3 hours to find out indisputable source and answer. इस दुनिया में गम और भी है, यूपीएससी की आंसर-की बनाने के सिवा!

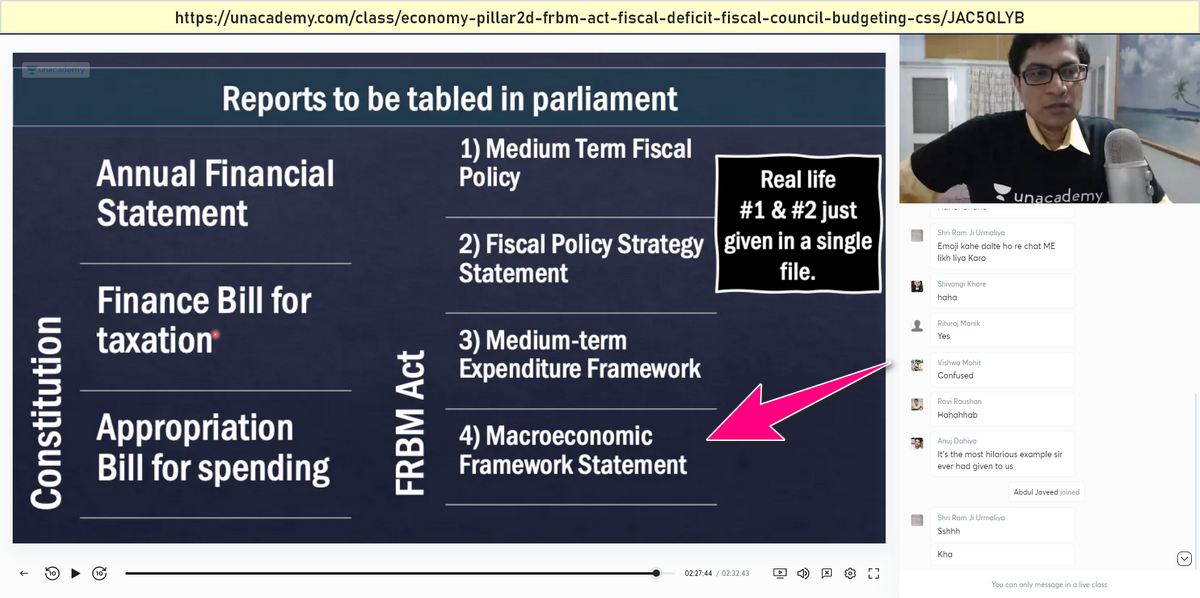

Pillar#2: Budget, Taxation, Public Finance

(Pre’20-SetB) Q.36. Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by

[a) Long standing parliamentary convention

[b) Article 112 and Article 110(1) of the Constitution of India

[c) Article 113 of the Constitution of India

[d) Provisions of the Fiscal Responsibility and Budget Management Act, 2003

Difficulty : Easy ? This much basic understanding of FRBM Act required from any serious UPSC aspirant.

Type: Contemporary ? FRBM Act was set up in 2003 so it is a contemporary issue.

Explanation:

- Mrunal’s Economy Lecture Pillar#2D: FRBM Act, dated August 7th, 2020. Slide #133 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- This document is presented as per the Provisions of the FRBM act.

Pillar#3A1: Balance of payment: Import-Export

(Pre’20-SetB) Q.82. With reference to the international trade of India at present, which of the following statements is/are correct?

- India’s merchandise exports are less than its merchandise imports.

- India’s imports of iron and steel, chemicals, fertilisers and machinery have decreased in recent years.

- India’s exports of services are more than its imports of services.

- India suffers from an overall trade/current account deficit.

Select the correct answer using the code given below :

[a) 1 and 2 only

[b) 2 and 4 only

[c) 3 only

[d) 1, 3 and 4 only

Difficulty : Easy ?. This much basic understanding about import export & balance of Payment of India is expected from every serious aspirant.

Type: Contemporary ?

Explanation:

- Mrunal’s Economy Lecture Pillar#3A: BoP (Part-I), dated August 8th, 2020. Slide #90 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Continuously, we are suffering from current account deficits so for statement#4 is correct. Option A and C are eliminated since they don’t contain #4. We are now ?50:50 between B or D.

- Further India’s Merchandise/ goods export is less than its goods imports. So, #1 is correct. Hence the answer should be D.

- For further datasets, you may refer to Economic Survey 2019-20 Volume 2: page 104.

(Pre’20-SetB) Q.83. The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of

[a) Crude oil

[b) Bullion

[c) Rare earth elements

[d) Uranium

Difficulty : Easy ? It was in frequent news because of the negative oil prices in USA

Type: Current ?

Explanation:

- Mrunal’s Economy Lecture Pillar#3A: BoP (Part-II) , dated August 9th, 2020. Slide #27 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- WTI is associated with crude oil trade in USA.

Pillar#3A2: BoP: FDI, Capital Account, BoP Crisis

(Pre’20-SetB) Q.81. With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristics ?

[a) It is the investment through capital instruments essentially in a listed company.

[b) It is largely non-debt creating capital flow.

[c) It is the investment which involves debt-servicing.

[d) It is the investment made by foreign institutional investors in the Government securities.

Difficulty : Easy ? to Medium ? While this much basic understanding about FDI is expected from every serious aspirant. But still some aspirant may feel confusion between A and B due to the word ‘Listed company’.

Type: Theory ?

Explanation:

- Mrunal’s Economy Lecture Pillar#3: BoP: FDI, dated August 9th, 2020. Slide #85 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- FDI is more than 10% equity investment by a foreign entity into an Indian company.

- That means debt / borrowing / loans are not the words we associate with FDI and therefore option C and D are wrong. we are now ?50:50 between A and B.

- Walmart has invested billions of dollars worth FDI into Flipkart which is still an unlisted company (Unlisted company means its shares are not listed in stock exchange such as BSE NSE.) Therefore, A, is also wrong. So, Answer should be B.

(Pre’20-SetB) Q.27. “Gold Tranche” (Reserve Tranche) refers to

[a) A loan system of the World bank

[b) One of the operations of a central bank

[c) A credit system granted by WTO to its members

[d) A credit system granted by IMF to its members

Difficulty : Easy ? Basic word Association about IMF and RBI forex reserve

Type: Contemporary ?

Explanation:

- Mrunal’s Economy Lecture Pillar#3: BoP: Capital Account, dated August 14th, 2020. Slide #95 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Word Association – “Tranche” is something related ot IMF. So, D is the answer.

(Pre’20-SetB) Q.09. If another global financial crisis happens in the near future, which of the following actions/policies are most likely to give some immunity to India ?

- Not depending on short-term foreign borrowings

- Opening up to more foreign banks

- Maintaining full capital account convertibility

Select the correct answer using the code given below :

[a) 1 only

[b) 1 and 2 only

[c) 3 only

[d) 1, 2 and 3

Difficulty : Medium ? because interpretation based question

Type: Contemporary ?

Explanation:

- Mrunal’s Economy Lecture Pillar#3: BoP: Capital account convertibility, dated August 14th, 2020. Slide #60 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Keeping full capital account convertibility will make India vulnerable to global crisis, just like the 1997’s crisis among the East Asian countries. So number 3 is wrong. C and D eliminated. We are left with ?50:50 between A or B.

- If Indian Government /RBI allows opening of more foreign banks in India, there could be a dangerous scenario where foreign problems may percolate into Indian economy. So, #2 is wrong. So we are left with Answer (A) only 1.

- Counterview: Entry of foreign banks will bring more capital to India and it can help us. So the answer should be B? We’ve to wait for the ultimate judge – UPSC official answer key to be published next year.

Pillar#3B: International agreements and organisations

(Pre’20-SetB) Q.86. With reference to Trade-Related Investment Measures (TRIMS), which of the following statements is/are correct ?

- Quantitative restrictions on imports by foreign investors are prohibited.

- They apply to investment measures related to trade in both goods and services.

- They are not concerned with the regulation of foreign investment.

Select the correct answer using the code given below :

[a) 1 and 2 only

[b) 2 only

[c) 1 and 3 only

[d) 1, 2 and 3

Difficulty : Tough ? Because this is not a very high profile agreement of WTO Unlike the agreement on agriculture or SPS. If you apply some word Association / guessing, You may arrive at a wrong answer.

Type: Contemporary ?

Explanation:

- As per the official page of WTO: https://www.wto.org/english/tratop_e/invest_e/invest_info_e.htm

- The Agreement is not concerned with the regulation of foreign investment. So, #3 is right. We are ?50:50 between C or D.

- The coverage of the Agreement is defined in Article 1, which states that the Agreement applies to investment measures related to trade in goods only. Meaning, the TRIMs Agreement does not apply to services. So, #2 is wrong. So, Answer should be C.

? GuessMaster-GiriTM: ??Anti-GuessMaster. If you apply in the rule#5: Word Association → Since TRIMS is an agreement of World Trade Organisation (WTO). And WTO ultimately aims to liberalise international trade. So if you make some word Association / GUESSING that it is covering goods and services then #2 should be right then you will be going towards wrong option

(Pre’20-SetB) Q.74. Consider the following statements:

- The value of Indo-Sri Lanka trade has consistently increased in the last decade.

- “Textile and textile articles” constitute an important item of the trade between India and Bangladesh.

- In the last five years, Nepal has been the largest trading partner of India in South Asia.

Which of the statements given above is/are correct?

[a) 1 and 2 only

[b) 2 only

[c) 3 only

[d) 1, 2 and 3

Difficulty : Medium ? to Tough ?. Requires candidates to have understanding of the relative size of economic development of different nations.

Type: Contemporary ? Because asking about the time span of last 5 to 10 years

Explanation:

- The phrase “consistently increased” in the last one decade is difficult to digest. So, #1 should be wrong. checking the statistical appendix of economic survey 2018-19 page 130, it’s evident that India’s export to SriLanka was >34000 crore (2015), >26000 crore (2016), >28000 crore (2017). Thus, it is not a steady increase but zigzag graph. Statement one is wrong, consequently, we are ?50:50 between option B or C.

- In South Asia, Bangladesh is bigger in GDP and population, compared to Nepal. So in terms of India’s import and export relationships it is unlikely that Nepal would be India’s largest trading partner in South Asia. So, #3 should be wrong.

- Thus, we are left with answer B.

- Just to cross check latest look at the Statistical Appendix from vol2 of Economic Survey 2019-20

| 2018-19 in ₹crores | import by India | export by India |

| Bangladesh | >7,000 cr | >64,000 cr |

| Nepal | >3500 cr | >33,000 cr |

? GuessMaster-GiriTM: ?Fully Possible. If you believe in the rule#1 that extreme worded statements are always wrong → Then first and third statement should be wrong because they contain extreme words “consistently” and “largest” respectively. So, elimination we arrive at the correct answer “B” without studying anything.

(Pre’20-SetB) Q.75. In which one of the following groups are all the four countries members of G20 ?

[a) Argentina, Mexico, South Africa and Turkey

[b) Australia, Canada, Malaysia and New Zealand

[c) Brazil, Saudi Arabia and Vietnam

[d) Indonesia, Japan, Singapore and South Korea

Difficulty : Tough ? because if you go by logical-elimination / guesswork that G20’s Osaka Summit (2019) was held in Japan so answer should be D= wrong answer.

Type: Contemporary ?

Explanation:

- Mrunal’s Economy Lecture Pillar#3B: International organisations and agreements Handout page 373 [For classification purpose I have put this question under “International relations”, However, it also overlaps with the international economy topic]

- G20 consists of Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, UK, USA, EU

- Therefore the answer should be A.

Pillar#4A: Sectors of economy → Agriculture

(Pre’20-SetB) Q.71. In India, which of the following can be considered as public investment in agriculture?

- Fixing Minimum Support Price for agriculture produce of all crops

- Computerization of Primary Agriculture Credit Societies

- Social Capital development

- Free electricity supply of farmers

- Waiver of agriculture loans by the banking system

- Setting up of cold storage facilities by the governments

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3, 4 and 5 only

(c) 2, 3 and 6 only

(d) 1, 2, 3, 4, 5 and 6

Difficulty : Medium ? to Tough Because interpretation based question. Depending on what line of interpretation you choose you may arrive at the correct or the wrong answer.

Type: Theory ?

Explanation:

- Mrunal’s Economy Lecture Pillar#2: Budget – Capital Account, dated August 6th, 2020. Slide #46 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Investment is a term associated with the capital part of the budget. So “subsidy” – a revenue part is not an example of ‘public investment’. Economic Survey 2019-20 page 84 also confirms this- “Given fiscal constraints, there is always a trade-off between allocating money through subsidies and increasing investments. As investments are the crucial input to increase in productivity, the increasing focus on subsidies is harming the growth of the agricultural sector in the long-run. This imbalance between subsidies and investments needs to be urgently corrected.”

- Free electricity to farmers involves the government paying subsidy to the electricity company. Therefore #4 is wrong. We are ?50:50 between A or C.

- Setting up of cold storage facilities can help in preservation of the perishable agricultural commodities so #6 is valid. So, answer should be “C”

(Pre’20-SetB) Q.73. Which of the following factors/policies were affecting the price of rice in India in the recent past?

- Minimum Support Price

- Government’s trading

- Government’s stockpiling

- Consumer subsidies

Select the correct answer using the code given below:

(a) 1,2 and 4 only

(b) 1,3 and 4 only

(c) 2 and 3 only

(d) 1,2, 3 and 4

Difficulty : Medium ? Interpretation based question. Requires you to be familiar with multiple schemes of the government.

Type: Contemporary ?

Explanation:

- Mrunal’s Economy Lecture Pillar#4A3: Agriculture (Part-III), dated August 23rd, 2020. Slide #26 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Prima facie all of these activities will affect the price of rice in India but just to cross check with authentic sources: refer to Economic Survey 2019-20 Volume 2

- page 156: “Prices of rice and wheat remained stable since 2014 due to adequate supply and also due to maintenance of adequate buffer stock of rice and wheat (by FCI)” So, #3 is correct. → Option A eliminated.

- Page 210: “Sale of wheat and rice is undertaken through Open Market Sale Scheme (OMSS) so as to check inflationary trend in prices of foodgrains”. So, #2 is also correct. → Option B eliminated. We are ?50:50 between C or D.

- The National Food Security Act provides subsidized rice at ₹3 per kg to the poor families. So, #4 is correct.

- There is only one option where 2, 3 and 4 are given together- Option D.

(Pre’20-SetB) Q.79. Consider the following statements

- In the case of all cereals, pulses and oil-seeds, the procurement at Minimum Support Price (MSP) is unlimited in any State/UT of India.

- In the case of cereals and pulses, the MSP is fixed in any State/UT at a level to which the market price will never rise.

Which of the statements given above is/are correct?

[a) 1 only

[b) 2 only

[c) Both 1 and 2

[d) Neither 1 nor 2

Difficulty : Medium ?

Type: Contemporary ?

Explanation:

- Mrunal’s Economy Lecture Pillar#4A2: Agriculture (Part-II), dated August 21th, 2020. Slide #89, #106, #110 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Successive Economic surveys have highlighted that Government’s open ended procurement is limited to wheat and rice.

- And even after PM-AASHA reforms, procurement is not done for all the cereals for which MSP is announced (e.g. Jowar, Bajra, Ragi etc). So, #1 is wrong.

- Market factors of Supply and demand may create a scenario where market price of cereal/pulses may rise higher than MSP. Market players are not legally bound to keep their prices lower or higher than MSP. So, #2 is wrong.

? GuessMaster-GiriTM: ?Fully Possible. If you believe in the rule#1 that extreme worded statements are always wrong → Then first and second statement should be wrong because they contain extreme words “ALL” and “NEVER” respectively. So, elimination we arrive at the correct answer “D” without studying anything.

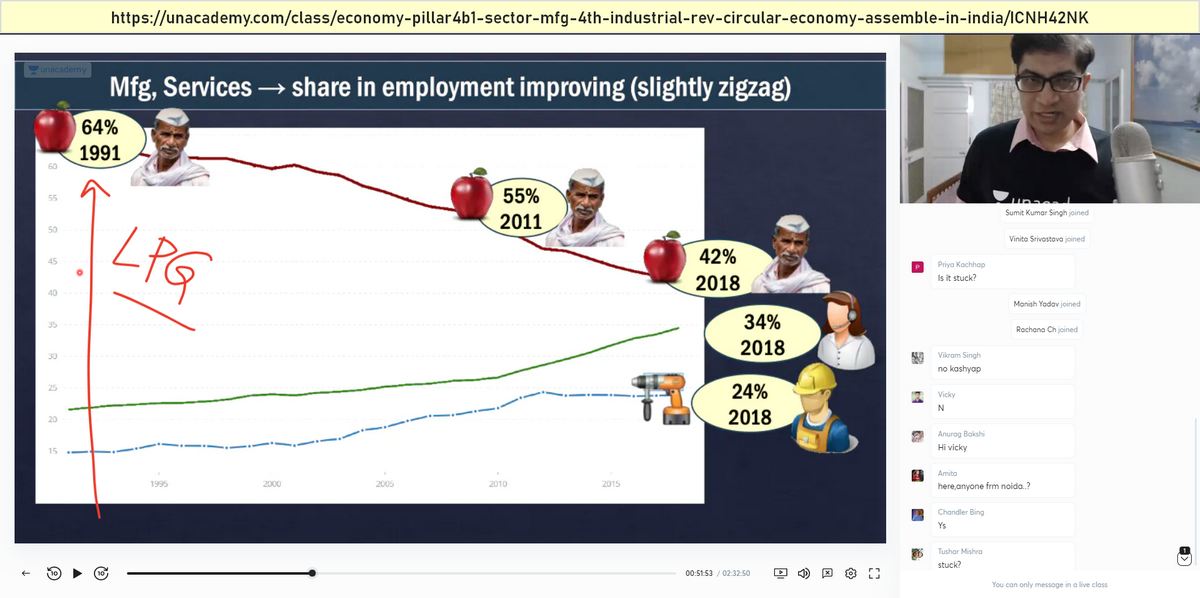

Pillar#4C: Macroeconomic Indicators → Unemployment

(Pre’20-SetB) Q.88. With reference to the Indian economy after the 1991 economic liberalization, consider the following statements :

- Worker productivity per worker (at 2004 — 05 prices) increased in urban areas while it decreased in rural areas.

- The percentage share of rural areas in the workforce steadily increased.

- In rural areas, the growth in the non-farm economy increased.

- The growth rate in rural employment decreased.

Which of the statements given above is/are correct ?

(a) 1 and 2 only

(b) 3 and 4 only

(c) 3 only

(d) 1, 2 and 4

Difficulty : Medium ? requires your logical understanding of the employment scenario in India.

Type: Contemporary ?

Explanation:

- Mrunal’s Economy Lecture Pillar#4B1: Sectors of Economy → Mfg Sector, dated August 27th, 2020. Slide #47 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- After the LPG reforms of 1991 it is inevitable that the rural/agriculture workforce would start shifting towards urban/non-agri sectors. So that means #2 is wrong and #3 should be correct, We are ?50:50 between B or C. For statement should be correct prima facie but let’s verify this with data:

- Economic Survey 2019-20 Volume 2 page 285: From table 5, we can see that the

| Number of workers in crores (Approx) | 2011 | 2017 |

| Rural | 33.64 | 31.59 |

| Urban | 13.65 | 15.53 |

| Total (Approx) | 47.29 | 47.12 |

- Since the total number of workers have remained more or less the same but # of rural workers declined, That means their Percentage share also declined, And it will also hint that growth rate in Rural Employment has decreased. so Statement#2 is wrong while #4 is correct. Only option B fits into this pattern.

Pillar#4C: Macroeconomic Indicators → Inflation

(Pre’20-SetB) Q.77. Consider the following statements

- The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

- The WPI does not capture changes in the prices of services, which CPI does.

- Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given- above is/are correct ?

[a) 1 and 2 only

[b) 2 only

[c) 3 only 4,

[d) 1, 2 and 3

Difficulty : Medium ? Requires you to be familiar with RBI monetary policy as well as basic theory of WPI.

Type: Contemporary ? Because RBI new monetary policy Framework came into effect from 2016

Explanation:

- Mrunal’s Economy Lecture Pillar#4C: Inflation, dated Sept 6th, 2020. Slide #28, #35, #37 (Prelim was on October 4th 2020, so my lecture was BEFORE the exam.)

- Under the new monetary policy Framework effective since 2016, RBI tries to control inflation at 2-6% of CPI (All India). So, #3 is wrong. Option C and D eliminated. We are ?50:50 between A or B. In both the options, statement#2 is common so we have to accept #2 as correct, Even without checking. Everything boils down to whether statement#1 is correct or not?

- Both WPI and CPI are based on Laspeyres formula wherein weightage is assigned to multiple commodities and their prices are tracked. The weight of an individual commodity depends on how frequently it is bought by the consumer. So obviously consumer price index would be giving more weightage to the food products compared to WPI which is aimed at the manufacturers. So, #1 should be correct.

- Just to crosscheck:

- Economic Survey 2019-20 Volume 2: Observe the table given on page 140 and 141

- Food articles and food products collectively command 24.4 % weight in the WPI.

- Whereas Food and beverages command 45.9% in CPI. #1 is correct.

- Thus the answer should be A.

(Pre’20-SetB) Q.33. With reference to the funds under Members of Parliament Local Area Development Scheme(MPLADS), which of the following statements are correct?

- MPLADS funds must be used to create durable assets like physical infrastructure for health, education etc.,

- A specified portion of each MP’s fund must benefit SC/ST populations

- MPLADS funds are sanctioned on yearly basis and the unused funds cannot be carried forward to the next year.

- The district authority must inspect at least 10% of all works under implementation every year

Select the correct answer using the code given below:

[a) 1 and 2 only

[b) 3 and 4 only

[c) 1, 2 and 3 only

[d) 1, 2 and 4 only

Difficulty : Medium ? Because everything boils down to the fourth statement which is not available in routing preparation sources.

Type: Contemporary ? While it was in the news in 2020, when the Government of India suspended it to save money during the coronavirus. But, the scheme was originally launched in the year 1993, And this question is asking about its features and not the latest current affairs development of 2020 so I put it under the contemporary topic and not as a current affairs topic.

Explanation:

- Mrunal’s Economy Lecture Pillar#5: Infrastructure → Rural, dated Sept 12th, 2020, slide number 26. While I had taught Basic features of the scheme under pillar#5 Rural Infrastructure lecture dated: But it can only help arriving at 50:50. Fourth statement was not covered. So,✋✋ I am not including this in the marketing claim that MPLADS question could be fully solved from my lecture.

- 15 percent of MPLADS funds are to be utilized for areas inhabited by SC population and 7.5 per cent for areas inhabited by ST population. So, #2 is correct. B eliminated.

- The funds released under the Scheme are non-lapsable, i.e., the entitlement of funds not released in a particular year is carried forward to the subsequent years, subject to eligibility. So, #3 is wrong. C eliminated. We are ?50:50 between A or D. In both the remaining options first and second statements are correct so everything boils down to the fourth statement.

- Fourth statement is not easily verifiable from routine preparations sources (including Ministry of I&B’s India 2020 Yearbook, where basic features of this scheme are mentioned).

- However upon reading the official guidelines page 34: District Authority would inspect at least 10% of the works under implementation every year. So, #4 is right answer therefore Answer is D.

Counter-view: Entire question is wrong!?

- As per Ministry of I&B’s India 2020 Yearbook- Chapter 6: Under MPLADS: MP can spend a maximum of ₹ 20 lakh per year for giving assistance to Differently Abled Citizens for purchase of tricycles (including motorized tri- cycles), battery operated motorized wheelchair and artificial limbs; and aids for visually and hearing impaired. So, #1 is wrong, Because it says it must be used for creating durable physical infrastructure, but Tricycles and hearing aids are not physical infrastructure. So, #1 is wrong. Option A, C and D are eliminated and we are left with answer “B”.

- But, #3 is wrong since The funds released under the Scheme are non-lapsable, i.e., the entitlement of funds not released in a particular year is carried forward to the subsequent years. Therefore, No option is fitting the pattern and hence the entire question should be remove the from the the question paper.

- As a candidate if you feel this is a valid grievance/error, then you are encouraged to to file complaint to UPSC using this form within 7 days of exam: https://upsconline.nic.in/miscellaneous/QPRep/

? GuessMaster-GiriTM: ??Anti-GuessMaster. If you believe in the rule#1 that extreme worded statements are always wrong → Then Forth statement should be wrong because it contains extreme word “must” → But then you will arrive at wrong answer.

Epilogue

- Stay tuned for remaining subjects’ Answerkeys!

- Any errors? let me know in the comment section!

- I do not have any arrogance to say all my answers are accurate. Infact, In Prelim-2019: 3 out of 100 MCQs in my answer key didn’t match with the official UPSC answer key…तो वैसे भी मेरी सब हेकड़ी निकल गई है, unlike some other entities in this business, जो कि यह बात मानने को ही तैयार नहीं कि उनकी आंसर की में गलतियां हैं, बल्कि प्रीलिम खत्म होने के बाद वह तो डबल जोर से चिकनी-चुपड़ी बातें कर रहे हैं.

Stay Tuned for the Detailed Answerkeys with Explanations at Mrunal.org/prelims

![[Errors/discrepancy] 16 MCQs where UPSC Official Prelims-2020 Answerkey & Coaching classes differ, while 2 MCQs cancelled](https://mrunal.org/wp-content/uploads/2021/11/csp2020-akey-differ-table-500x383.png)

There is no doubt about it. In India, no one can study an economy so simple and easy without you..There is no better option than you for Civil Services Examination??

Sir Input for Question on National Biofuel Policy:

Every Coaching Answer is rejecting Groundnut Seed and Horse Gram. BUT

1.https://www.researchgate.net/publication/287625877_Production_of_biodiesel_from_groundnut_Arachis_hypogea_L_oil.

National Policy on biofuel 2018 has given scope of including all such renewables by adding the word “etc” in every definition.

Groundnut seed has an efficiency of more than 40% for biodieseal production (follow link). Groundnut seed contain high quality edible oils, protein, and carbohydrate. Globally, 50% of groundnut produced is used for oil extraction, 37% for confectionary use and 12% for seed purpose. The fat in the oil is approximately 50% monounsaturated, and 30% polyunsaturated. In comparison, groundnut oil has been reported of having capacity to produce approximately 123 gallons of biodiesel per acre while soybeans yield only 50 gallons.

Excerpts from National Policy on Biofuel 2018:

ii. ‘biodiesel’: a methyl or ethyl ester of fatty acids produced from non-edible vegetable oils, acid oil, used cooking oil or animal fat and bio-oil;

One of the main ingredient in bio-oil is groundnut seed oil.

2. Same view is also applicable in the case of Horse Grams in case of ethanol production.

https://agris.fao.org/agris-search/search.do?recordID=US201301040197

Also “Horse gram seed contains carbohydrate (57.2% w/w), protein (22% w/w), dietary fiber (5.3% w/w), fat (0.50% w/w), calcium (287 mg), phosphorus (311 mg), iron (6.77 mg) and calories (321 kcal) as well as vitamins like thiamine (0.4 mg), riboflavin (0.2 mg) and niacin (1.5 mg) per 100 grams of dry matter.”

Excerpts from NPB 2018:

i. ‘bioethanol’: ethanol produced from biomass such as sugar containing materials, like sugar cane, sugar beet, sweet sorghum etc.; starch containing materials such as corn, cassava, rotten potatoes, algae etc.; and, cellulosic materials such as bagasse, wood waste, agricultural and forestry residues or other renewable resources like industrial waste;

So etc can include Horse gram too as carbohydrate content (i.e sugar and starch is high 57%)

Therefore going in broad sense answer for 64 should be D while every coaching are following the same logic popularly known as ”

Do ping me if anything wrong in this.

Also Thank you sir your teaching and blessings have helped me score 116 marks in my very first attempt.

And yes i am not going to indulge in this tu tu meme rather prepare for mains religiously from today onwards.

Even i marked option d for that question and now looking at your comment, it gives me a little bit of hope but most probably upsc won’t consider ground nut and horse gram as valid options

I also agree with you.

The policy provides for wide range of options.

Yes Avinash i also agree with you. The policy was not restricted to the mentioned items. Also, In the question they gave as “Biofuels” (which include Bio ethanol, Bio diesel, Bio-CNG, Drop in fuels, etc). According to the policy, Bio ethanol can be produced form starch containing materials and so Horse gram can also be used as a source. Bio diesel can be produced from Acid oil which is a major ingredient in Groundnut and other vegetable oils.

Thank you sir for uploading the answers. I have been waiting for your answers very eagerly.

I have a doubt regarding Q.82. With reference to the international trade of India “at present”, which of the following statements is/are correct?

In this question what does UPSC mean by ‘AT PRESENT’?

If we go by the latest data available on ‘https://pib.gov.in/PressReleasePage.aspx?PRID=1654586’ (April- August 2020-21 data) , the answer should be ‘Only 1 & 2’. But no choice like this is given in the options. I am just curious about it. I have marked the option D though.

Byju’s IAS valo se minimum 3 answer economy se alag alag hai. But i think you gave the reasons they gave the answers that’s the difference.

1) Sir, in question no. 88 Set B, the question asks about the period after 1991 reforms. Statement 4 asks about the growth rate in rural employment. So we have to compare growth rate before and after 1991 reforms. According to me, we can not take into account just the period of 2011 to 2017.

2) In MPLAD question, the counter view is a valid point.

3) There is also one another question which seems to be wrong to me. That is the question in which legal services authorities was asked. The income limits are not uniform in India to avail free legal aid. It varies from state to state. In fact, some states also provide free legal services to senior citizens. Anyone can check these facts on the FAQs of nalsa.gov.in Please review this question also.

Thank you mrunal sir for making economy such a interesting subject and providingme outstandingly conceptually clarity. Apart from TRIMS question, I’ve answered every other question rightly. With my score [ (102) EWS category] if I will clear the pre in 1st attempt it’s all your teachings that’s come handy !! Again sir thank you so much for such kind of simplified economy classes !!

Hope your other aspects will come handy in GS-III. Keep helping unprivileged students like me, this is a request from my end???

Hi dibyaranjan, great to hear about your score. Good luck for future. One question have you taken paid course of mrunal.? Or how did you prepare?

Sir please let us know what books should we read for this exam for all the subjects

Thank u sir

Nice explanation sir

How to approach other subjects Pre cum mains. Without any coaching. Please guide sir

Good evening sir …..

waiting since prelim has over

I know you do unlimited effort to give us reliable sources/data…..

I wish no any your given answer will mismatch with answer to be publish by UPSC next year………your dedication make us fearless ……..

Sir, in Q 82. I have a query because India has registered a current account surplus in the last quarter (first time in over a decade). Moreover, the question says at present, therefore statement 4 must be wrong.

Option 4 also say “overall” so i think it talks about in general not specific to a particular time

Sir when wi you post full answer key

Sir, please refer question on non-financial debt. According to Insolvency and Bankruptcy Code home loan is financial debt.

Exactly

According to IBC … Home loans have been categorised as financial debt.

I think answer will be treasury bill only. It also specified in indian context . But finally upsc will take a call on this and few others.

Respected Sir

Q. 82 is talking about “at present” . So, recently as we have observed that India experienced trade surplus. Plz enlighten…

sir, you are really great. we love and respect you as you share your knowledge with poor students like us. god bless you sir.

sir, i am in very strange dilemma. i got most of the medium and tough ques right but easy ones were where i made over thinking mistake i.e. this isnt so easy, there must be some different logic etc etc.

how can i make sure to not repeat this next time going?

Such detail analysis with ease and clarity . Thanks for your unmatchable efforts.

how much time it will take to finish religiously economy if i enroll in october course ?

PLEASE SUGGEST ANY AUTHENTIC CSAT ANSWER KEY , CSAT Dhokha de rha . english ke questions glat ho rhe hai

You can try going to Vajiram’s website, they have uploaded the key there.

https://drive.google.com/file/d/10AV6nuGYG_vbd-os_TAzCfiCCGpbcvUL/view

‘Click me to expand and know the answer ‘ open nahi ho raha Sir .Please look into this…

I attempted 89 questions (because a good part of the paper needed elimination and guesswork!) and am getting around 66-70 right. Should i start mains revision?

पिछले 3 बार से मैं कट ऑफ और 90 के बीच के फ़ासले को मिटा नहीं पा रहा हूँ . पेपर के बाद आंसर key देखकर कोई उम्मीद जगती हीं नहीं लेकिन ढीठ मन की हिम्मत भी टूटती नहीं . बहरहाल सोचता हूँ इसबार हिमालय हीं चला जाऊं , तपस्या किया करुँ और वरदान में कोई अदभुत हथियार माँग कर सीधे स्वर्ग पर हीं अटैक करुँ . निश्चित: दो में से एक चीज़ तो हो हीं जायेगी या तो मुझे “वरदान” मिल जायेगा या फिर कोई “मेनका” हीं मिल जायेगी , दोनों स्थिति में कुछ तो हाथ आयेगा हीं …

Bahoot paas ho mitra aap lakshya ke…Give na karna….is paper me 90 & 100 score karne wale ke beech bas luck ka differnece hai na ki knowledge or intelligence ka…..ho sakta hai luck agle saal aapka saath de aur aap100+ cross kar jao

Thank you so much ……there not .5% substitute of mrunalsir in market

if i crack this exam i swear to god i will buy your services or will try to pay you more than unacademy and publish it on youtube, we need more civil servant from weak backgrounds and less from daddy-IAS class.

Non-financial debt consists of credit instruments issued by governmental entities, households and businesses that are not included in the financial sector. So sir ans to that question should be only 3

– Guidelines on Members of Parliament Local Area Development Scheme (MPLADS) – Link (https://mplads.gov.in/MPLADS/UploadedFiles/MPLADSGuidelines2016English_638.pdf) has

Chapter number 2 – FEATURES, on Page no. 2, which has point 2.4 stating – “Expenditure on specified items of non durable nature are also permitted as per list in the Annexure-IIA”. This makes STATEMENT 1 wrong as it states – ‘MPLADS funds must be used to create durable assets like physical infrastructure for health, education etc.’ This makes option A,C,D wrong.

In Chapter 4 – FUND RELEASE AND MANAGEMENT, on page no. 18, which has point 4.4 stating – “Funds Non-lapsable: Funds released to the District Authority by the Government of India are non-lapsable. Funds left in the district can be carried forward for utilization in the subsequent years.” This makes STATEMENT 3 wrong as it states – ‘MPLADS funds are sanctioned on yearly basis and the unused funds cannot be carried forward to the next year.’ This makes option B wrong

As all options given are wrong in this question, this question should be cancelled.

Capitals asset by definition is one which creates debt unlike current account .

FDI is a component of Capital account , so by definition it has to create debt else it would have been current account component ??? can you explain this please ?

Sir by definition , capital asset is one which should either create debt or reduce an asset . Current account is one which neither reduces assets nor creates debt burden .

FDI is a Component of capital account , which means it has to be a debt creating investment model ??

Can you explain this please

sir does block chain technology development does not need govt or any authorities permision?? anybody can carry on illegal activity using blockchain and no govt agency will be able to decode it.

YES.BLOCKCHAIN IS A METHOD TO CREATE AND PROCESS INFORMATION.DO YOU NEED GOVERNMENT’S PERMISSION TO CREATE AN ANDROID APP?NO

ITS JUST IF YOU ARE DEALING IN BLOCKCHAIN THEN WITHOUT PERMISSION YOU SHOULD NOT INDULGE IN CRYPTOCURRENCY.

OTHERWISE YOU CAN CREATE ANY APPLICATION AND MANY STUDENTS DOING THAT

NO YOU CANNOT CREATE AN ILLEGAL APP AND GET AWAY WITH.FOR EXAMPLE EVEN PEOPLE CREATE FAKE WEBSITES ON HTML OR JAVA BUT ONCE THE CONCERNED AUTHORITY FINDS IT ,IT IS DEALT WITH AS PER THE LAW.

JUST UNDERSTAND BLOCKCHAIN AS AN OPEN SOURCE PLATEFORM (MEANS OPEN TO ANYONE) WHOSE BASIC PRINCIPLE LIES IN CREATING OUTPUTS BASED ON COMPLEX ALGORITHMS.

NOW, CAN YOUR GOVERNMENT CONTROL INTERNET??NO,BUT THEY CAN REGULATE IT BY PLACING RESTRICTIONS,SIMILAR WAY GOES IN BLOCKCHAIN.

HOWEVER IT IS CLAIMED THAT THE DATA CANT BE MANIPULATED BUT IN THE EVERY MINUTE CHANGING WORLD,NOTHING IS CERTAIN.

:)

Sir, in the interest coverage ratio, the answer should be 2 only as the wording of the question states that is bank is going to give loan to meaning that the loan is not given. So, the process is that when a new loan is sanctioned, the banks have to borrower has to maintain an interest coverage ratio . So, before the bank gives out the loan itself, the present risk cannot be measured as interest payments have not begun.

Basically, the interest payments cannot commence before the bank gives out the loan. Once, the loan is sanctioned on the basis of a particular interest coverage, the emerging risk can be assessed. So, basically, the bank cannot measure the present risk. The question clearly states that the loan has not been given.

IT IS THE REFLECTION YOU GET FROM COMPANY’S BALANCE SHEET SO IT IS ALREADY THERE BEFORE A BANK DECIDES TO LOAN OR AN INVESTOR DECIDES TO INVEST IN ANY COMPANY.

NOW READ THIS

https://www.investopedia.com/terms/i/interestcoverageratio.asp

The interest coverage ratio measures how many times a company can cover its current interest payment with its available earnings. In other words, it measures the margin of safety a company has for paying interest on its debt during a given period. The interest coverage ratio is used to determine how easily a company can pay its interest expenses on outstanding debt.

The ratio is calculated by dividing a company’s earnings before interest and taxes (EBIT) by the company’s interest expenses for the same period. The lower the ratio, the more the company is burdened by debt expense. When a company’s interest coverage ratio is only 1.5 or lower, its ability to meet interest expenses may be questionable.

The interest expenses cannot be calculated before a loan is given out. Having been a corporate lawyer and drafted any commercial agreements, I know that it is on the basis of the balance sheet that the commercials in the loan agreement are agreed upon. The question clearly states” that a bank is going to give loan to” meaning that the terms of the loan have not been decided. There is whole process of “due diligence” before a loan is given out. Option 1 would be right if you are presuming that the interest rate has already been decided before the loan is given out. There can be no doubt that 2 only will be a better answer as before a loan is given out, we can measure only the emerging risk before actual disbursement of the loan. Interest payment starts at a future date and not on the date of disbursement of the loan. There is a whole “Payment schedule” in any loan document. That is why it is only the emerging risk that can be measured. Available earnings will be calculated from the date of interest payment.