- UPSC Prelim-2021 Answerkey: Economy Compared to Previous Years

- Strategy for UPSC Prelims and Mains-2022’s Economy Portion

- Strategy for Prelims-2021: Economy, Schemes, Yearbook

- What if i don’t want to join Mrunal’s paid economy course

- Economy MCQs from UPSC prelims 2021

- AnswerKeys of various institutes

UPSC Prelim-2021 Answerkey: Economy Compared to Previous Years

| 2015 to 2020 Papers | 2021 Prelims: Continuity and change in the economy questions |

|---|---|

| Since 2015: 20+ MCQs from Economy and government schemes | 14 MCQ to make room for the the obsession of the UPSC examiner for environment, agriculture and sports.

However that is not to say that environment agriculture and sports questions very very easy and one should spend more time there in fact it is the economy that would help candidate score some marks because of relatively easy and medium difficulty compare to other subjects asked in 2021. |

| Spanwise: Theory (very few Q) < current (last 1 year) < contemporary (more than 1 year) topics | Reverse. More questions from theory than from contemporary / current issues. |

| Among the sub topics of economy: Banking Finance occupied the highest weightage | same |

| Nothing for microeconomics in the recent years, except 2018 | 1 MCQ from microeconomics |

| Hot topic of a given year is not usually asked in the same year | same- Aatma Nirbhar Bharat, TULIP, Yukti 2.0, Champions portal, MSME definition change , APMC ordinance, GATI SHAKTI, Ubharte Sitaare, 500 types of Initiatives taken by RBI…not asked. गजब बेज्जती है यार! शिक्षकों का गला सूख गया और विद्यार्थियों की आंखें सूज गई यह सब पढ़ते-पढाते! |

| BusinessGK not asked & the type of non-sensical Share market and Technical news peddled by the daily current affairs PDF wala was not asked | Same. |

| From 2019 to 2020 difficulty level gradually decreased | Same trend continues pretty much all the questions either easy to medium category |

| Lengthwise:

·2019: 15 MCQs were “One liner”, remaining contained 2 or more statements ·2020: Only 5 questions one liner remaining questions contained 2 or more statements…infact upto five and 6 statements! Which made the paper lengthy, Because you’ve to think from multiple angles. |

Same trend continues majority of the questions contain 3 to 5 sentences and you are to find correct statement. |

| Since 2017- Trend of asking at least one question related to digital economy such as UPI (2017), BHIM (2018), Digital payment system data (2019), blockchain (2020) | Nothing asked from digital payment related current affairs like Non-Fungible token, CBDC, E-Rupi etc. |

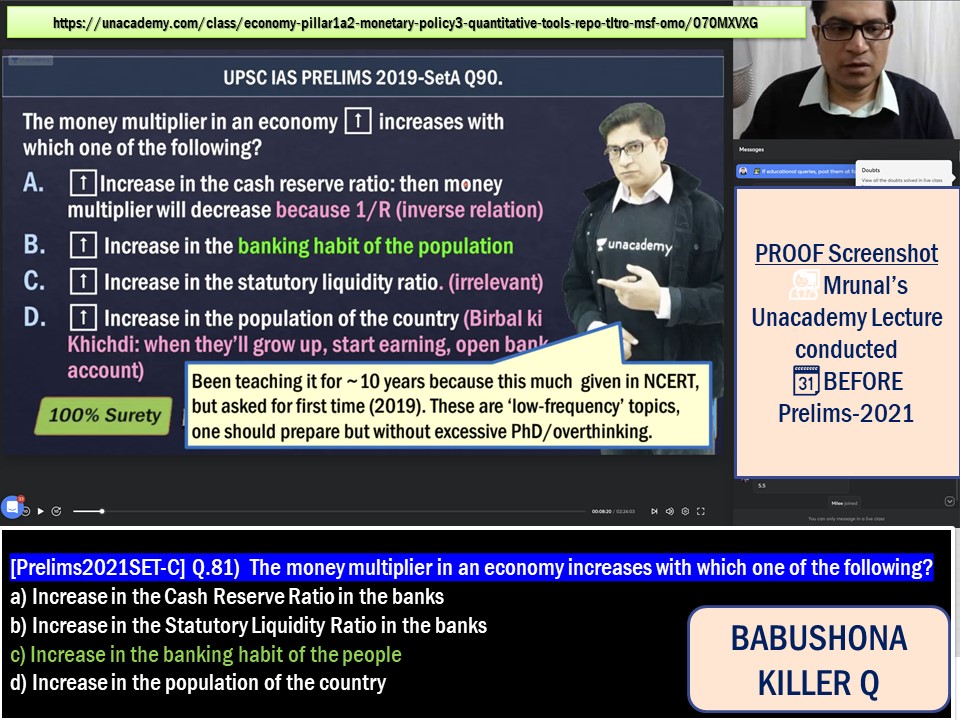

| 2019: Question about money multiplier effect on money supply

2020: Question about aggregate money supply (M3)- Which falls near the same category of topics |

2021: Repeated the same Money multiplier question which was asked in 2019 |

| -WTO related questions: 1 MCQ (2017), 1 MCQ (2018), 0 MCQ (2019), 1 MCQ (2020)

-2020: TWO questions on import export |

Did not ask World Trade Organisation but asked about the devaluation of currency and its impact on exports |

| 2019: Question about what to do in currency crisis

2020: Question about what to do in global financial crisis |

2021: Question about what to during recession (Countercyclical fiscal policy which was in news because of economic survey) |

| Since 2018- There was a trend of asking data interpretation from random government reports.

continued- with Data interpretation type questions from India’s trade with Sri Lanka and Bangladesh, employment scenario in India. |

Thankfully that drama is over |

| Trend of asking about Obscure Organizations / Yearbook Info: 2016- FSSAI labelling guidelines, 2017- QCI, 2018-Again FSSAI, 2019: PNGRB | nothing as such |

| since 2016: Trend of asking about economy and Human Development related Global indices and reports | nothing as such |

| Application of 🎲 GuessMaster-GiriTM:

-2017: 9 MCQs -2018: 3 MCQs -2020: 4 MCQ- Direct answers without studying anything. |

– Partially Applicable in single MCQ. |

Strategy for UPSC Prelims and Mains-2022’s Economy Portion

Over: all the striking differences are Compared to previous years papers

- Easy questions ⏬ while medium difficulty questions ⏫

- Multi-statement questions are ⏫, One liner MCQs ⏬

- The multi statement questions tested your logical elimination power.

- Beyond that in terms of preparation sources there is no change between 2020 vs 2021’s paper. These questions could be

- EITHER solved from NCERT, Economic Survey, Newspapers. (And since Mrunal’s economy course material is prepared by compiling those sources so it has also proved useful.)

- OR a few questions which were asked from random sources such Ownership of CDSL etc. But that does not mean we should drop everything and start preparing such random stuff in detail. Cutoff is never 200 / 200. And usually there is no permanent trend of asking only single type of random thing. So even if you prepare 500 different type of insurance products there is no guarantee next year there will be a question on insurance products!

Strategy for Prelims-2021: Economy, Schemes, Yearbook

- Which chapters of IYB are important is given in this separate article. At this stage no point of purchasing the 2020’s books. Better wait till 2021’s edition next year. Chapter list will most probably remain the same, so prepare accordingly. You don’t even have to buy the whole book there are plenty of free courses and free summary notes available online.

- Unlike Polity, History or Environment, there is no single book covering economy in sufficient exam oriented manner.

- The boundary of economy syllabus is fluid, students mistakenly start doing Ph.D / Chartered Accountant level preparation or chasing petty current affairs and figures.

- So, few years back I started putting economy series on my Youtube Channel youtube.com/c/TheMrunalPatel to cover the economy in an exam oriented manner. But, nowadays youtube is littered with too many UPSC channels so advertising revenue gets divided in such proportion that it’s not financially viable.

- So, I had launched Economy full course at Unacademy Plus Live platform, including 800+ pages worth of comprehensive revision handouts covering both Prelims and Mains. Uniqueness about those handouts is:

- You don’t have to separately consult other books, NCERTs.

- All the important schemes, policies, ministries and related yearbook organizations are covered.

- Latest Budget and Economic Survey is covered.

- Handouts are in English, but also contain Hindi terminologies to help the vernacular aspirants in the Mains-Exam as well. Saves a lot of time and trouble of going through dictionaries.

- Weekly quiz and doubt solution

- Free economy updates will be provided even after your course is over under “Win22” Series. So no need to purchase new course every year!

- 12 out of 14 Economy related MCQs in Prelims-2021 could be solved directly from my lecture series & its handouts. Screenshot proofs are attached with this answer key. I consider UPSC a sacred exam and don’t even like to brag about how many questions could be solved from my material, but with the entry of so many unscrupulous commercial elements in the online domain, such chest-thumping has became necessary, lest the novice youngsters get hypnotized by those chikni-chupdi-baatein krne walle MBA-types…. ई लर्निंग के नाम पे बहूत गंद मचा के रखी है उन लोगों ने, इसलिए मेरे जैसे शांतिप्रिय लोग जिनको मार्केटिंग का ढिंढोरा पीटना पसंद नहीं है वो भी मजबूर हो गए हैं छाती पीट पीट के बताने के लिए कि देखो मैंने पढ़ा था और मेरे लेक्चर भी से प्रश्न आया है।

- Now, my next economy course for prelims and mains 2021 is starting from October week#4, 2021. There will be weekly Live Classes, weekly quiz, updated material, Q&A doubt solution.

- Uniqueness about this Unacademy ‘Plus’ model is that just one subscription fees unlocks access to all full length courses by other faculties / educators– be it Essay writing or environment, history, science-tech, polity, geography, current affairs, various modules for Mains and even certain optional subjects. Link for Registration: Click Me, and Use PROMOCODE “mrunal.org” to avail further 10% discount.

What if i don’t want to join Mrunal’s paid economy course

For some reason you don’t want to join / can’t join the above paid course due to monetary issues, then how to approach economy for Prelims-2022? Thugs of Delhi will never tell you that properly, unless you join their Paid-course. So, here is the answer:

- First, study topic wise answer key for economy of previous years, available for free at mrunal.org/prelims It will give your basic idea on what type of questions are asked and as a result it’ll save you from pursuing Ph.D or Charter-Accountant giri which is not required to pass IAS-prelims. फ़ालतू में लोग इकोनॉमी के नाम पर मैं सबसे जटिल topic में से जटिल प्रश्न आएगा ऐसा झंडा ले के कुछ लोग PHD करने घुस जाते हैं आपने उस गलती से बचना है।

- For Economic Theory Portion read class 11 and 12 Tamilnadu State Board textbooks. They are much better And easier to understand compared to NCERT. ✋There is no need for buying a special book for it like Ramesh Singh, Sanjeev Verma, Singhania, Mishra Puri, Dutt Sundaram, Pratiyogita Darpan economy compilation etc.

- For economy current affairs, better to read Indian Express instead of theHindu.

- For Mains:

- Indian economy after independence read class 11 NCERT India’s Economic Development.

- Preface of last 2 years’ Yojana Kurukshetra Magazines. (Free PDFs available both in English and vernacular language)

- Introduction- Conclusion of Vol1 of Economic Surveys of last 5 years.

- If required, go through my Youtube playlist called ‘BES17’. It covers economy theory as well as budget and Economic survey 2017. So, focus only on theory and the contemporary topics like GST, NPA, BASEL etc.

- Then update economy current affairs from Mrunal’s Win20, Win21 and Win22 Series of FREE Lecture and Free Handouts.

- No need to go for Monthly CA-PDF compilation. Because they excessively focus on trivial data and figures. That’s why I have given the first step go through previous paper to get an idea what is important and what is not important. You should pursue the 6 pillar approach in current affairs, if you can’t classify a Economy-current topic in any of those 6 pillars then it’s not important for economy portion of exam.

- Pillar#1 Banking Finance: Every announcement made by RBI is not important. Only those announcement related to core of the monetary policy, financial inclusion, non-performing asset and digital payment are important. People had engaged in so much PHD over Project Shashkt’s Asset reconstruction companies financing mechanism but look how simple a question UPSC has asked from that topic. UPSC rarely asks microeconomics or in-depth question from SEBI-Sharemarket, so no need to prepare too much of it. Cutoff is never 200 out of 200 marks.

- Pillar#2: Budget speech should be prepared. Sometimes things are asked after a lag of 1 year. For every major scheme you should be aware which department is responsible for implementing it, what is the funding pattern, and what are the salient features / eligibility conditions. Even if this does not come in the IAS exam it helps in the non-IAS exams.

- Pillar#3: Basics of Balance of payment and currency exchange rate mechanism should be known. Unnecessarily people were doing so much haay-haay over RBI’s Currency swap but look how basic things UPSC has asked about currency exchange in Prelims-2019, 2020 and 2021. Similarly, for notable international organization – you should be aware of their membership, last summit, important treaties. For international reports, you should be aware of which organisation publishes them how frequently they are published what are the components of given index, who got first rank, what is India’s rank? In 2021 no question asked from international organisations and agreements related to economy but none the less you should prepare it because it will help you at least in the non-IAS exams. Every year UPSC civil service exam has hardly 700 to 800 vacancies so rest of candidates will have to eventually settle for non-IAS jobs.

- Pillar#4: Among the sectors of economy, agriculture and its schemes should be given more priority because of the merger with the Forest Service exam. Among the rest of the topics: IPR-Patents, NITI-FYP, MSME-Textile, GDP-Inflation-IIP: Basic theory and current affair should be known. PDF-wallas have to release monthly content, so they’ll keep giving ball by ball commentary about everything under the sun, but it’s not important for exam.

- Pillar#5: Infrastructure- Simply prepare the notable schemes, laws, organizations and portal/apps for mining, energy, water-sanitation, transport, communication and urban rural infrastructure. In the mains exam there is a topic on public private partnership (PPP), but UPSC is not asking IIM-A investment banker exam questions there. Prepare the basics only from any internet source.

- Pillar#6: Poverty, Education, HRD. Just prepare the notable schemes, laws, organizations & reports, including SDG. Sufficient material and compilations are available on the internet.

To conclude, Economy is not rocket science. Economy is a scoring component of General Studies. It’s much easier to master compared to certain other segments of GS. Now let’s solve Prelims-2021 paper:

Economy MCQs from UPSC prelims 2021

Pillar#1: Money Banking Finance Insurance

[CSP21-SET-C] Q.91) Consider the following statements:

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government. (रिजर्व बैंक के गवर्नर की नियुक्ति केंद्र सरकार करती है)

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest. ( कुछ संवैधानिक प्रावधानों के अंतर्गत केंद्र सरकार जनहित में रिजर्व बैंक को दिशा निर्देश दे सकती है)

- The Governor of the RBI draws his power from the RBI Act. ( रिजर्व बैंक के गवर्नर को आरबीआई कानून से शक्तियां मिलती है)

Which of the above statements are correct?

- a) 1 and 2 only

- b) 2 and 3 only

- c) 1 and 3 only

- d) 1, 2 and 3

Difficulty : Easy🤩

Type: Theory 📚

Explanation:

- Under section 7 of the RBI Act central government can issue directions to RBI in Public Interest. This was one of the reasons why Urjit Patel resigned from RBI. But that Central Government gives that direction using provisions “RBI Act” and not ✋“Constitution”.

- so, #2 is wrong. →A/B/D eliminated. So we are left with correct answer “C”.

📚 Source(s):

- Mrunal lecture Pillar#1B2-Burning issues in the banking sector.

- IndianExpress Article

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

[CSP21-SET-C] Q.81) The money multiplier in an economy increases with which one of the following? (इनमें से किस स्थिति में मुद्रा गुणक में बढ़ोतरी हो सकती है)

- a) Increase in the Cash Reserve Ratio in the banks [जब सीआरआर में बढ़ोतरी की जाए]

- b) Increase in the Statutory Liquidity Ratio in the banks [जब एसएलआर में बढ़ोतरी की जाए]

- c) Increase in the banking habit of the people [लोगों की बैंकिंग आदतों में बढ़ोतरी हो]

- d) Increase in the population of the country [देश की आबादी में बढ़ोतरी हो]

Difficulty : VERY Easy🤩 Because this is a repeat question from past UPSC paper 2019 (Set-A Q90).

Type: Theory 📚

Explanation:

- This is a repeat question. Same thing UPSC had asked in the 2019 (Set-A Q90)

- Money multiplier is inversely related with cash reserve ratio so A is wrong.

- Increase in the SLR will decrease the loanable funds with bank and so it will not help improving money multiplier.

- If population is increased but they do not open bank accounts then money multiplier will not improve So D is not right.

- By elimination we are left with answer “C”.

📚 Source(s):

- Mrunal lecture Pillar#1A2: Monetary policy → Money multiplier

- Economic Survey 2019-20’s observations about Money Multiplier.

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

[CSP21-SET-C] Q.96) India Government Bond Yields are influenced by which of the following? [भारत सरकार की बांड यील्ड निम्नलिखित में से किन से प्रभावित होती है]

- Actions of the United States Federal Reserve [ अमेरिकी फेडरल रिजर्व की क्रियाओं द्वारा]

- Actions of the Reserve Bank of India. [ रिजर्व बैंक की क्रियाओं द्वारा]

- Inflation and short-term interest rates [महंगाई और लघु अवधि के ब्याज दर]

Select the correct answer using the code given below

- a) 1 and 2 Only

- b) 2 Only🤔

- c) 3 Only

- d) 1, 2 and 3🤔

Difficulty : Medium to Tough🥵

Type:Theory 📚

Explanation:

- Bond yield is the amount of profit made by an investor in Bond investment.

- RBI tries to influence the Bond Yield by buying/selling G-Sec in the Secondary market for example they tried to do it in the “operation twist”. So, #2 is right. Answer could be A/B/D.

- If you want to cook “Birbal Khichdi i.e. Action X leads to Y leads to Z…” then actions of the US Feds also influence Bond Yields of Indian G-Sec Because the foreign investors will accordingly buy / sell / dump Indian government securities in the secondary market depending on the returns offered by the US feds on US Treasury Bonds & this will influence Indian Govt’s Bond yields. → 1 may be right.

- Similarly, Inflation and short term interest rate may also Influence the investor to buy/sell/dump Indian government securities in the secondary market to move money elsewhere → 3 may be right. Then Answer could be “D”: All 3 statements correct

- If UPSC examiner is asking about direct and immediate influence and not Birbal Khichdi then Answer “B”, ELSE answer could be “D”. Final judge UPSC official answer key to be published next year 2022 after Final result announced.

📚 Source(s):

- Mrunal lecture Pillar1A2: Monetary policies → Operation twist

- Various news articles in business standard newspaper.

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

[CSP21-SET-C] Q.85) In India, the central bank’s function as the ‘lender of last resort’ usually refers to which of the following? (केंद्रीय बैंक को अंतिम उपाय का ऋणदाता कहा जाता है इस शब्द का मतलब क्या है)

- Lending to trade and industry bodies when they fail to borrow from other sources. [व्यापार औद्योगिक संस्थाओं को जब कहीं और से कर्ज नहीं मिले तो केंद्रीय बैंक कर्ज देता है]

- Providing liquidity to the banks having a temporary crisis.[अस्थाई संकट के दौरान बैंकों को तरलता देता है]

- Lending to governments to finance budgetary deficits [बजट घाटा पूरा करने के लिए सरकार को कर्जा देता है]

Select the correct answer using the codes given below.

- a) 1 and 2

- b) 2 Only

- c) 2 and 3

- d) 3 Only

Difficulty : VERY Easy🤩 Basic Theory Asked.

Type: Theory 📚

Explanation:

- “Lender of last resort” is the word used in context of RBI giving loans to banks. So, #2 is right.

- For #3 (Giving loans to the government) = Appropriate word is “banker to the government”.

- Now some candidates may argue that #3 is also suitable for the word “Lender of Last resort” but we have to go by the rot-learning/explanation given by academic books on banking systems such as Prof Bharati Pathak and E.Narayan Nadar.

- In previous exam also UPSC asked a similar question about the “What is the meaning of RBI is “bankers Bank”?” And there too, UPSC examination had gone by the interpretation of academic books.

- #1 (Loans to industries) not directly done by RBI. At best RBI will open some special Windows to give loans to banks and NBFCs who will then indirectly give loans to industries e.g. LTRO, SLTRO etc. So, #1 is wrong.

- Therefore, correct option “B”.

📚 Source(s):

- Mrunal lecture Pillar1B1: Classification of banks → RBI origin and functions

- (Alternatively) Prof. Bharti Pathak’s book: Indian financial system → Ch.24 Financial regulation, Page 862.

- (Alternatively) E.Narayan Nadar’s Book: Money and banking Page 264

- (Alternatively) Tamilnadu Economy Textbook Class11-12

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

[CSP21-SET-C] Q.95) With reference to ‘Urban Cooperative Banks’ in India, consider the following statements: [शहरी सहकारी बैंकों के बारे में सही विधान ढूंढिए]

- They are supervised and regulated by local boards set up by the State Governments. [राज्य सरकार उनकी निगरानी और नियंत्रण करता है]

- They can issue equity shares and preference shares. [वे इक्विटी शेयर और वरीयता शेयर जारी कर सकते हैं।]

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966. [उन्हें 1966 में एक संशोधन के माध्यम से बैंकिंग विनियमन अधिनियम, 1949 के दायरे में लाया गया था।]

Which of the above statements given above is/are correct?

- a) 1 only

- b) 2 and 3 only

- c) 1 and 3 only

- d) 1, 2 and 3

Difficulty : Medium🧐 Third statement is testing your factual memory and 1st statement testing your command over current affairs.

Type: Current Affairs from last one year (1/1/2020 onwards)🗞

Explanation:

- Banking Regulation (Amendment) Ordinance/Act 2020: regulatory powers over UCBs rely solely to RBI & not State Governments. So, #1 wrong, Thus A/C/D are eliminated & we are left with correct Option “B”.

📚 Source(s):

- Mrunal Handout for Pillar1B1: Classification of banks → Cooperative banks

- (Alternatively) Newspaper articles on the Ordinance

🎲 GuessMaster-GiriTM: 😰ANTI-Guessmaster. Because as per rule number two: dates names and numbers are wrong then the third statement should be wrong but then you arrive at wrong answer. Examiner is basically TROLLING Guessmasters.

[CSP21-SET-C] Q.83) With reference to India, consider the following statements:

- Retail investors through demat account can invest in ‘Treasury Bills’ and ‘Government of India Debt Bonds’ in primary market. [आम निवेशक डीमैट खाते द्वारा प्राथमिक बाजार में सरकारी प्रतिभूतियों में निवेश कर सकता है]

- The ‘Negotiated Dealing System-Order Matching’ is a government securities trading platform of the Reserve Bank of India. [NDS-OM सरकारी प्रतिभूतियों में खरीद बिक्री करने के लिए रिजर्व बैंक द्वारा बनाया गया मंच है]

- The ‘Central Depository Services Ltd.’ is jointly promoted by the Reserve Bank of India and the Bombay Stock Exchange. [CDSL को रिजर्व बैंक और बॉम्बे स्टॉक एक्सचेंज द्वारा संयुक्त रूप से बनाया गया था]

Which of the statements given below is/are correct?

- a) 1 Only

- b) 1 and 2

- c) 3 Only

- d) 2 and 3

Difficulty : Medium🧐 to Tough🥵 Second and Third statement testing factual memory

Type: Contemporary 🗞

Explanation:

- RBI has an ownership with DICGC and some of the AIFIs. So, gut feeling says that statement#3 should be wrong. Upon going through the academic books, we find that CDSL is a depository set up by the Bombay Stock Exchange (BSE) with 54% shareholding and remaining 46% is owned by various banks namely State Bank of India, Bank of India, Bank of Baroda, HDFC Bank, Standard Chartered Bank, Union Bank of India, and Centurion Bank. So, Statement#3 is wrong. So, We are 50:50 between A or B.

- In both A and B options, The first statement is common, so we have to accept is as correct.

- In August, 2005, RBI introduced an anonymous screen-based order matching module on NDS, called NDS–OM. This is an order driven electronic system, where the participants can trade anonymously by placing their orders on the system or accepting the orders already placed by other participants. NDS–OM is operated by the Clearing Corporation of India Ltd. (CCIL) on behalf of the RBI. Direct access to the NDS–OM system is currently available only to select financial institutions like Commercial Banks, Primary Dealers, Insurance Companies, Mutual Funds, etc. Statement#2 is right.

- Therefore, Correct answer “B”.

📚 Source(s):

- Prof Bharti Pathak: Indian Financial System, 5/e (page. 744 and page 351).

- Mrunal’s Lecture 1C: Sharemarket → NDS-OM & RDAG Covered. But, CDSL ownership structure not covered. So, ✋I’m not claiming this MCQ for marketing propoganda.

🎲 GuessMaster-GiriTM: Partially Applicable. Rule#3: Parent Org / Dept is always wrong in statement then #3 should be wrong so we are 50:50 between A and B.

Pillar#2: Budget, Taxation, Black Money, Fiscal Policy

[CSP21-SET-C] Q.99) Which one of the following effects of creation of black money in India has been the main cause of worry to the Government of India? [काला धन भारत सरकार के लिए चिंता का विषय क्यों है]

- a) Diversion of resources to the purchase of real estate and investment in luxury housing [संसाधनों को आलीशान बंगले खरीदने के लिए मोड़ दिया जाता है]

- b) Investment in unproductive activities and purchase of precious stones, jewellery, gold, etc.[कीमती जवाहरात सोने और गैरउत्पादक प्रवृत्तियों में निवेश होता है]

- c) Large donations to political parties and growth of regionalism [राजनीतिक पक्षों को बड़ा चंदा दिया जाता है और प्रांतवाद की वृद्धि होती है]

- d) Loss of revenue to the State Exchequer due to tax evasion [सरकार को कर चोरी के चलते राजस्व आमदनी कम होती है]

Difficulty : Easy🤩

Type: Contemporary 🗞 / Theory

Explanation:

- Black Money/ Tax Evasion reduces the revenue collection / fiscal resources of the government for running the welfare schemes. This problem has been highlighted multiple times by the economic surveys. So, “D” is most appropriate out of the given option.

📚 Source(s):

- Mrunal’s Lecture Pillar#2B: Black Money

- OR Basic understanding of the budget taxation and black money from Whatever book or lecture you have attended.

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

[CSP21-SET-C] Q.97) Consider the following [निम्न में से किसे प्रत्यक्ष विदेशी निवेश कहा जा सकता है]

- Foreign Currency Convertible Bonds

- Foreign Institutional investment with certain conditions

- Global depository receipts (GDR)

- Non-resident external deposits

Which of the above can be included in Foriegn Direct Investments?

- a) 1, 2 and 3

- b) 3 Only

- c) 2 and 4

- d) 1 and 4

Difficulty : Tough🥵

Type: Theory 📚

Explanation:

| Instrument | Explanation | FDI or NOT? |

| #1] Foreign Currency Convertible Bonds | ·Previously in 2020, UPSC had asked a similar question on FDI. FDI is associated with equity investment and ✋FDI word is not associated with debt investment.

·Therefore by default, Bond cannot be FDI. But Convertible Bond/Debenture could be converted to Equity (Shares) so, #1 should be right. ·I also cross checked with RBI Circular of 2012 and it’s correct. → B and C eliminated. |

YES |

| 2] Foreign Institutional investment with certain conditions | ·Foriegn Institutional investment (FII) is Separate category, also known as “FPI. It is not FDI by default. But here it says ‘with certain conditions’…. So, #2 may be right.I also cross checked with RBI Circular of 2012: if FII invest in convertible debentures, then it’s counted as FDI subject to certainX% limit so, #2 is correct. | Yes |

| 3] Global depository receipts (GDR) | ·If Indian company issued GDR → foreigns indirectly invest in Indian shares so #3 could be FDI.

·Now just to cross check whether GDR is indeed FDI?- I checked with the RBI circular. Depository Receipts (DRs) such as ADR and GDR are treated as FDI- says RBI Circular of 2012. |

YES |

| Non resident external deposit (in Indian banks) | ·Indian bank may give such deposits as loans (debt) so #4 Cannot be termed as FDI so #4 shd be wrong.

·Some may argue what if such NRI using that bank account to invest in Indian shares then it could become FDI. But it’s birbal khichdi logic. |

NO |

- Thus By elimination we are left with ✅ right answer A) 1, 2 and 3.

📚 Source(s):

- Mrunal lecture Pillar1C1: Sharemarket → ADR GDR, OFCD- Optionally Fully Convertible Debentures, and Pillar#3A: FDI vs FPI.

- RBI Circular of 2012.

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

[CSP21-SET-C] Q.98) Consider the following statements:

The effect of devaluation of a currency is that it necessarily _ _ _ . [मुद्रा अवमूल्यन के बाद निम्न में से कौन सी चीज अनिवार्य रूप से होगी?]

- improves the competitiveness of the domestic exports in the foreign markets [स्थानिक निर्यात विदेशी बाजार में ज्यादा स्पर्धा कर पाएगा]

- increases the foreign value of domestic currency [स्थानिक मुद्रा के विदेशी मूल्य में बढ़ोतरी होगी]

- improves the trade balance [व्यापार संतुलन बेहतर होगा]

Which of the above statements is/are correct?

- a) 1 Only

- b) 1 and 2

- c) 3 Only

- d) 2 and 3

Difficulty : Easy🤩 repeated theme from earlier exams.

Type: Theory 📚

Explanation:

- Devaluation of the local currency example IF RBI notifying that henceforth “$1=₹90 instead of $1=₹70”.

- Such devaluation will improve the trade competitiveness of the domestic exports, because the foreign importers may be able to buy more quantity of Indian goods with the same quantity of dollars. Then if previously foreigners were importing tea from Ethiopia, Sri Lanka or Kenya, now foreigners may start doing it from India. #1 is right. We are 50:50 between A or B. Now answer depends on the validity of the statement#2.

- Devaluation: $1=₹70 → $1=₹90. Here the foreign value of domestic currency will be ₹1=$0.014 downgraded/reduced to ₹1= $ 0.011. So, #2 is wrong. → B&D eliminated.

- Therefore, Correct Answer is “A” Only 1.

📚 Source(s):

- Mrunal lecture Pillar3A: BoP → Currency exchange

- (Alternatively) Tamilnadu Economy Textbook Class11-12

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

Pillar#4C: GDP, Inflation, Unemployment

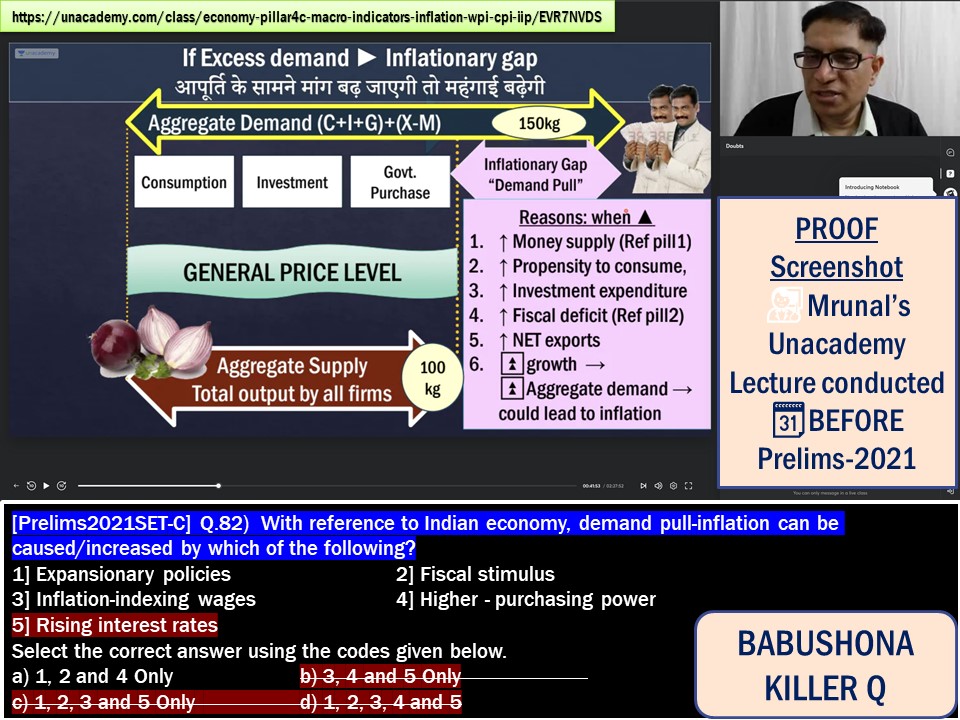

[CSP21-SET-C] Q.82) With reference to Indian economy, demand pull-inflation can be caused/increased by which of the following? [मांग-जनित महंगाई में बढ़ोतरी कब होगी?]

- Expansionary policies [विस्तार वादी नीतियां]

- Fiscal stimulus [राजस्व प्रोत्साहन]

- Inflation-indexing wages [महंगाई सूचकांक से जोड़े गए वेतन]

- Higher – purchasing power [खरीद शक्ति में बढ़ोतरी]

- Rising interest rates [ब्याज दरों में बढ़ोतरी]

Select the correct answer using the codes given below.

- a) 1, 2 and 4 Only

- b) 3, 4 and 5 Only

- c) 1, 2, 3 and 5 Only

- d) 1, 2, 3, 4 and 5

Difficulty : Easy🤩 by elimination

Type: Theory 📚

Explanation:

- Rising loan interest rate will decrease the demand of goods and services and so it will decrease the demand pull inflation. Question requires us to find the factors that will increase the demand. Thus #5 (interest rate) is wrong, B/C/D are eliminated & we are left with Correct Option “A”.

📚 Source(s):

- Mrunal lecture Pillar4C: Inflation and Pillar1A2: Monetary policy.

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

[CSP21-SET-C] Q.92) With reference to the casual workers employed in India, consider the following statements: [अयथावधि मजदूरों के बारे में सही वाक्य ढूंढिए]

- All casual workers are entitled for Employees Provident Fund coverage. [सभी अयथावधि मजदूर ईपीएफओ के लिए हकदार हैं]

- All casual workers are entitled for regular working hours and overtime payment. [सभी अयथावधि मजदूर सामान्य घंटों में किए गए कार्यवेतन और ओवरटाइम वेतन के लिए हकदार है]

- The government can by a notification specify that an establishment or industry shall pay wages only through its bank account. [सरकार यह निर्देश जारी कर सकती है कि चिन्हित उद्योगों ने केवल बैंक खाते द्वारा वेतन भुगतान करना होगा]

Which of the above statements are correct?

- a) 1 and 2 only

- b) 2 and 3 only

- c) 1 and 3 only

- d) 1, 2 and 3

Difficulty : Medium to Tough.

Type: Contemporary 🗞 Third statement is in context of an amendment made in 2017 [4 years before exam!]

Explanation:

- EPFO Act doesn’t does not differentiate between casual, contractual and regular employees. So, All types of workers are eligible/entitled for it. So, #1 is right

- #2 is right as per Code on Wages

- #3 right as per Payment of Wages Amendment 2017. In the aftermath of demonetisation in 2016, the government was trying to encourage bank transfer So this amendment was made in 2017.

- So, answer is option “D”: All 3 are correct.

📚 Source(s):

- Mrunal lecture #4B: Ease of Doing Biz: Code on Wages. But, ✋I’m not claiming marketing propaganda credit for it because all statements not solvable from my lecture.

- EPFO Circular.

- Payment of Wages Amendment 2017.

🎲 GuessMaster-GiriTM: 😰Anti-Guessmaster. Because the GM rule number#1 says extreme worded statements are wrong then both one and second statement will be wrong as they contain the extreme word “All casual workers” → but then it does not help you arrive at the answer because no option contains “ONLY 3”.

- ✋Counter Argument: EPFO applies only to establishments that have 20 or more workers. So, If we go by this “20 worker” technical rule then if there is a small shopkeeper having only one or two casual workers they’ll not be entitled to get EPFO coverage So, #1 is wrong → A/C/D are eliminated → we are left with correct answer B: 2 and 3. [Counter’s Counterargument: the MCQ is not framed in that tone, if UPSC examiner wanted to ask like that, he’d have written “All workers in all establishments are eligible.”]

[CSP21-SET-C] Q.93) Which among the following steps is most likely to be taken at the time of an economic recession? [आर्थिक मंदी के दौरान निम्न में से कौन सा कदम उठाए जाने की संभावना सबसे ज्यादा है]

- a) Cut in tax rates accompanied by increase in interest rate [ करों में कटौती और ब्याज दरों में बढ़ोतरी]

- b) Increase in expenditure on public projects [सरकारी प्रोजेक्ट के खर्च में बढ़ोतरी]

- c) Increase in tax rates accompanied by reduction of interest rate [करों में बढ़ोतरी और ब्याज दरों में कटौती]

- d) Reduction of expenditure on public projects [ सरकारी प्रोजेक्ट के खर्चों में कटौती]

Difficulty : Easy🤩

Type: Theory 📚

Explanation:

- This was even highlighted by the latest economic survey that during the times of recession and economic slowdown → government should spend more money using counter cyclic fiscal policy strategy. So, B is most appropriate.

- Increasing loan interest rate will decrease the demand of goods/services → so, not advisable

- Increasing tax rate will also decrease the demand of goods/services → so, not advisable.

📚 Source(s):

- Mrunal lecture #2D: Fiscal stimulus and countercyclical economic policy

- Economic Survey 2020-21

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

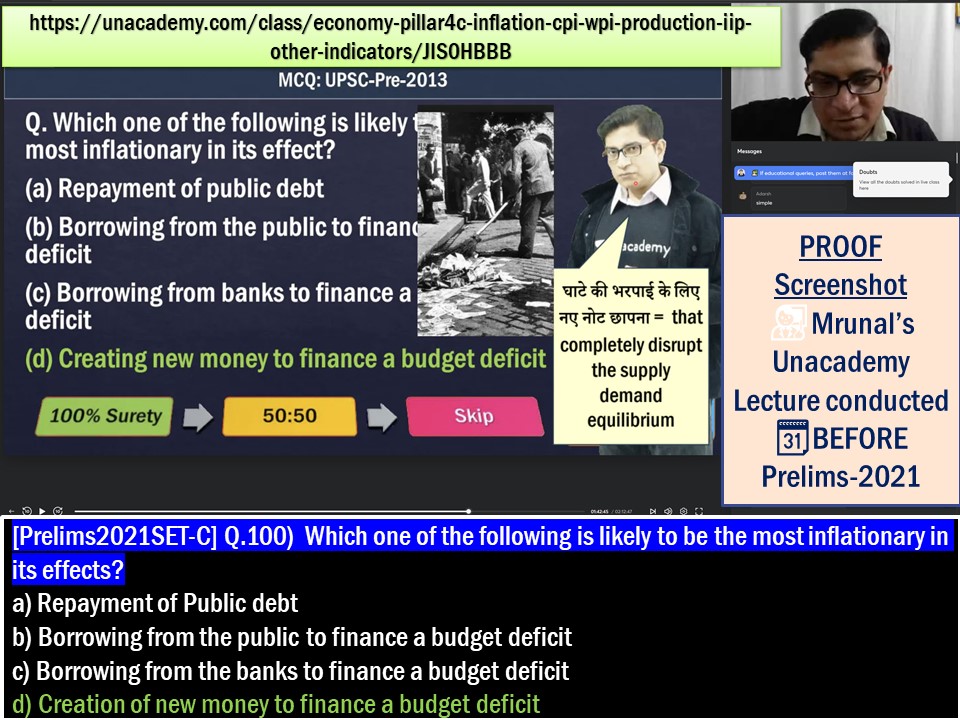

[CSP21-SET-C] Q.100) Which one of the following is likely to be the most inflationary in its effects? [इनमें से कौन सी चीज सबसे ज्यादा महंगाई पैदा करेगी]

- a) Repayment of Public debt [सरकारी ऋण का भुगतान]

- b) Borrowing from the public to finance a budget deficit [ बजट घाटे का वित्त पोषण करने के लिए जनता से कर्जा लिया जाए]

- c) Borrowing from the banks to finance a budget deficit [बजट घाटे का वित्त पोषण करने के लिए बैंकों से कर्जा लिया जाए]

- d) Creation of new money to finance a budget deficit [बजट घाटे का वित्त पोषण करने के लिए नया पैसा छापा जाए]

Difficulty : Easy🤩 This is a repeat question from 2013 prelims

Type: Theory 📚 Current/Contemporary 🗞

Explanation:

- Printing extra money will create a high level of inflation / hyperinflation, if there are not enough goods and services in the market for purchase. Therefore, Correct Answer is “D”.

📚 Source(s):

- Mrunal lecture #4C: Inflation and its handout.

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

Pillar4Z: Microeconomics

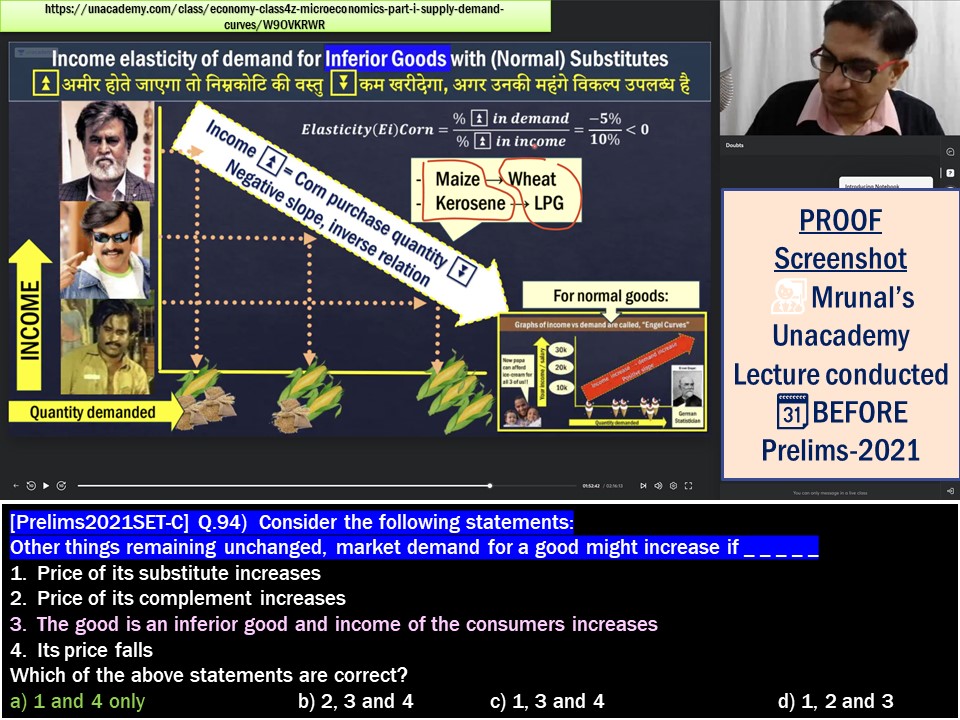

[CSP21-SET-C] Q.94) Consider the following statements:

Other things remaining unchanged, market demand for a good might increase if _ _ _ [यदि अन्य कारकों में बदलाव ना हो तो बाजार में किसी वस्तु की मांग में बढ़ोतरी होगी यदि _ _ _ ]

- Price of its substitute increases [वैकल्पिक वस्तु के दाम में बढ़ोतरी हो]

- Price of its complement increases [ पूरक वस्तु के दाम में बढ़ोतरी हो ]

- The good is an inferior good and income of the consumers increases [हिन कोटी की वस्तु हो और ग्राहक की आमदनी बढ़ जाए ]

- Its price falls [वस्तु का दाम गिर जाए]

Which of the above statements are correct?

- a) 1 and 4 only

- b) 2, 3 and 4

- c) 1, 3 and 4

- d) 1, 2 and 3

Difficulty : Easy🤩 by elimination, provided that candidate has studied Microeconomics.

Type: Theory 📚

Explanation:

- When a person becomes rich he will reduce the consumption of inferior goods such as kerosene and maize. So the demand for such goods will decline with the increase in income.

- Therefore statement#3 is wrong and by elimination we are left with correct answer “A”.

📚 Source(s):

- Mrunal’s Lecture #4Z: Microeconomics part#1: income elasticity of demand

- Microeconomics Textbooks: NCERT/Tamilnadu

🎲 GuessMaster-GiriTM: ✋NOT Applicable (N/A)

AnswerKeys of various institutes

- This year has too many vaguely worded / open-ended questions.

- As a result, the answer keys of private institutes differ. I make no claims that my answer keys 100% correct it. All depends on how the UPSC Examiner interprets the thing.

- So there is no need to fight over it in the comment section.

- Start preparing for Mains exam or some other exam depending on your career backup goals.

| Q-SETC | KEYWORD | Subject | Difficulty | Theory/Current/CTM | guessmaster | ARE ALL private AKEY SAME? | Key Mru | Key

Vision |

Key-

Insights |

KEY

SHANKAR |

| CSP21Q091 | RBI Governor | e1 | Ease 🤩 | Theory 📚 | No❌ | TRUE | C | C | C | C |

| CSP21Q081 | Money multiplier | e1a2 | Ease 🤩 | Theory 📚 | No❌ | TRUE | C | C | C | C |

| CSP21Q096 | Indian Bond Yield | e1a2 | Medium 🧐 | Theory 📚 | No❌ | FALSE | B/D | D | D | D |

| CSP21Q085 | Lender of last resort | e1b1 | Ease 🤩 | Theory 📚 | No❌ | TRUE | B | B | B | B |

| CSP21Q095 | UCBs | e1b1 | Medium 🧐 | Current 🗞 | ANTI😭 | TRUE | B | B | B | B |

| CSP21Q083 | Stock Market | e1c1 | Medium 🧐 | Contemporary 📅 | Partial#3 | TRUE | B | B | B | B |

| CSP21Q099 | Black Money | e2b | Ease 🤩 | Contemporary 📅 | No❌ | TRUE | D | D | D | D |

| CSP21Q097 | FDI | e3a | Tough 🥵 | Theory 📚 | No❌ | TRUE | A | A | A | A |

| CSP21Q098 | Devaluation | e3a | Ease 🤩 | Theory 📚 | No❌ | TRUE | A | A | A | A |

| CSP21Q082 | Demand-Pull inflation | e4 | Ease 🤩 | Theory 📚 | No❌ | TRUE | A | A | A | A |

| CSP21Q092 | Causal Workers | e4c | Ease 🤩 | Contemporary 📅 | ANTI😭 | TRUE | D | D | D | D |

| CSP21Q093 | Counter cyclic | e4c | Ease 🤩 | Theory 📚 | No❌ | TRUE | B | B | B | B |

| CSP21Q100 | Printing money | e4c | Ease 🤩 | Theory 📚 | No❌ | TRUE | D | D | D | D |

| CSP21Q094 | Market demand for goods | e4z | Ease 🤩 | Theory 📚 | No❌ | TRUE | A | A | A | A |

Stay Tuned for the Detailed Answerkeys with Explanations at Mrunal.org/prelims

![[Errors/discrepancy] 16 MCQs where UPSC Official Prelims-2020 Answerkey & Coaching classes differ, while 2 MCQs cancelled](https://mrunal.org/wp-content/uploads/2021/11/csp2020-akey-differ-table-500x383.png)

Please make the video on 2021 prelims questions in the economy section

Sir,

The purpose of employing casual workers is to have flexibility regarding the terms and conditions like working hours, days of work etc.. In 92 question ( about casual workers) the second statement says that all the casual workers have regular working hours. It is negating the theory of casual worker itself. BTW the code on wages is still not enforcable can we take them as a source

Plz clarify.

Thanking you

सर विनम्र निवेदन है इतने दिनो से wait क़र रहे है

बाक़ी answer key भी जल्दी डाले

सर आपके कारण 12/14 सही हो रहे है

धन्यवाद सर

Sir, how can all Casual Workers, be entitled to EPF? Because firms having less than 10 employees are not required to comply with EPFO provisions.

For Question Set C-92

Government has recently has brought an amendment to allow transfer of PF from establishment exempted to establishment not exempted. Here they have not written provident fund but Employees provident Fund converage.

https://economictimes.indiatimes.com/news/economy/policy/government-allows-bulk-transfer-of-provident-fund-from-exempted-establishments/articleshow/78576943.cms

Counter argument [CSP21-SET-C] Q.91)

1.Central government= executive+judiciary+legislature. With provision from constitution government direct RBI

a) with legislative capacity (make or amend law and direct(

b) judiciary have directed so many cases(with provison derived from consitution to deliver justice)

c)executive (if we consider central government as just executive, it can direct RBI with provison art 360=financial emergency to reduce salary of employee etc.

In fact, with provisons of Consitution, government can Direct any organization of India(provided that organization is not protected by Basic structure of the consitution,and RBI has no such protection)

Bottomline: We can argue whatever we can, but UPSC might have set question in the light you have solved. Thanks.

Bhai kya bole yr… Myself has applied that logic and now everyone is claiming it wrong… Upsc should not frame such open interpretation questions

Yes. It’s imp to understand where /what is the question hinting at(in what light/context has it been aksed) ?

Very detailed analysis sir …Thank You 🙏🙏

Sir, maine aapse padha hai, aur mere sare answers aapke sath match kr rhe hai buss ek EPFO wala maine not applicable for less than 20 soch k kiya tha. Thank you so much for your teaching, you are a blessing which UPSC Students got on this Earth.

Sir, in question no 97 if your explanation has to be true the word used should have been ‘eligible’ and not ‘entitled’, as when it is entitled it becomes matter of right and thus gets violated in institutions with less than 20 employees..

What if a casual worker employed in an establishment earn more than 15000/month ?

Then also he is not eligible for EPF benefits.

“All casual workers are entitled for Employees Provident Fund coverage” this is statment has been picked up from SC ruling on Pawan Hans limited case. In thas case company had not provided any pf coverage for casual workers and hence sc widened the meaning of workers under pf act 1952. But it should be noted that all casual workers, who are employed in such organisations which comes under preview of PF act, are entitled to of coverage. In other words only those casual workers who are employed in company ( which comes under pf act ) are entitled to pf coverage and not all.

And it has been directly placed into the question as it is. That’s it. So it’s the correct statement. No ifs and buts. Well that’s how it works here.

Sir, with due respect, I’d like to state that the answer to Q 97 (FDI) should be 3 only. Even on the link you shared of RBI, it states “ As far as debentures are concerned, only those which are fully and mandatorily convertible into equity, within a specified time would be reckoned as part of equity under the FDI Policy.” So even if bonds are convertible, unless they are “fully and mandatorily” convertible, they are not counted as equity, and hence shouldn’t be foreign “direct” investment.

As far as conditional FII is concerned, it is not always in equity. Foreign Institutional Investment can be in debentures, bonds or shares. So they are not necessarily FDI. Conditional FII usually includes restrictions like investing only for a certain time period. (The very fact that we have Voluntary Retention Route, was to enable certain FPIs to invest for a time period of their choice).

Tanya, I can help you make peace with your argument in that the question very leniently states as to ‘can be included’. So with that, your first line of argument can be settled for as the debentures ‘could be included’ as part of FDI if they are mandated so and so. So yes unless they are fully convertible only then, but they ‘can’ , right?

Again as for conditional FII, yes it’s not always in equity, but if it is, it ‘ can be included’ in FDI, no?

Just a litle tweak in the way u interpret the question can help u get ahead of these ambiguities that sometimes we ourselves create. Believe me, I’d been struggling the same way but now as I take a stock of PYQ’s I have been able to sort things out. Believe me prelims is not so difficult, just need to put in right perspective.

Two of the answers mentioned above are incorrect:

1. Firstly, only casual workers in establishments having more than twenty employees are entitled to EPF but all casual workers are certainly entitled to fixed working hours. As a qualified lawyer, I would appreciate if people actually read the new labour legislations from the bare act or from PRS (If time is short) or even the recent judgement of the Supreme Court a year back.

2. Secondly, the Banking Amendment Act 2020 certainly gives certain additional powers to the RBI but it does not strip the powers of the registrar of societies. Pls read this press release and also a speech by the Hon FM where this point was underscored a hundred times. https://pib.gov.in/PressReleasePage.aspx?PRID=1634684

Aspirants should go through the RBI website wherein it is clearly stated that UCBs are regulated and supervised by state registrar of co-operatives. Aspirants should read the state legislations and the 2020 Amendments.

These are basic legal questions.

I think UCB’s REGISTRATION is still under ‘registrar of cooperative societies’, while their REGULATION is under under RBI after the amendment.

I would request you to solve the question from the perspective of general studies and not as a qualified Lawyer.

If you will solve previous years papers with your perspective of lawyer then your answer wont match with the UPSC key which is is the ultimate authority.

Instead of defending your answer try to change your perspective in GS Paper.

No offence, just trying to help you.

Well, my friend thinking as a lawyer and a general studies student are not contradictory. In fact, questions which are legally incorrect is often marked incorrect by UPSC. Often, the mismatch between coaching classes and UPSC answer key is due to this reason as the questions in the paper are set by academics and former UPSC aspirants who have become teachers. Pls read the PIB press release wherein it is clearly stated that the amendments in no way interfere with the existing jurisdiction of RBI. This point was underscored even in press conferences by the concerned authorities Basic knowledge of law is critical to becoming a good administrator. You will see these divergences in answer keys when the Commission officially releases the answer key.

Basic knowledge of law also entails taking cognizance of supreme court rulings. The S.C. in Pawan Hans Limited and ors. Vs Karmachari sanghatna has very clearly ruled that all casual workers are ‘entitled’ to EPFO. Period !

Thanks a lot sir for your painstaking effort to help all aspirants.Very detailed answers.

Sir i learned economy with you on unacedamy plus.

Thanks sir for 12 right answers

You are just like an Angel for Economy

Question on: All Casual labour or workers:-

My take is, “What about a single worker, working in agriculture land of an individual landlord or is employed in a company with less than 20 workforce.

Very vague question by UPSC, which is not at all testing skill of our young people. It’s testing their patience. It’s not selecting them, but eliminating through somewhat like ‘lottery’

I have worked as IRS (Income Tax), belonging to1992 batch and have not applied any such law on any company with less than 20 employee. The Income Tax Act, 1961 also deals on such matter and we, the taxmen, need to have proper understanding on this aspect

Further, the decision of the Supreme Court is in different context, i. e. to give wider meaning to any construct, herein ‘Meaning of Employee’. A plain interpretation of statute, either of labour law or epf’ do not say that it’s applicable for ‘All’ employees, whether permanent or casual.

I agree with you. I think they are deliberately framing such vague questions with ambiguous answers to eliminate students. Every year there are 3-4 such questions and actually that decides you are in or out and wasting our whole precious year.

Another question where I think this answer key is wrong is the retail participation in gsec is not permitted through demat but through gilt account. A gilt account is not the same as a demat account.

I hope that’s correct. Same logic I also thought of

It might not be the same but then we surely know that 3rd statement is wrong. With that we are left with either option 1 or 2. That entails that statement 1 is correct nevertheless. And statement 2, we know for a fact that its correct. Thus the answer !