- Parts of Budget

- #1: Direct Taxes

- #2: Indirect taxes

- MCQ Data for Tax collection: Ascending descending

- Gross vs net Tax revenue

- Appendix

Parts of Budget

| revenue part (Current) | capital part |

|---|

within that, make two columns each, for incoming money (receipt) and outgoing money (Expenditure).

| REVENUE PART | CAPITAL PART | ||

| Receipt | Expenditure | Receipt | Expenditure |

Ya, but what’s the need of this labour? Why can’t we just have a simple income vs expense type of thing? We’ll come to that in third article.

For now, let’s focus on…

Budget => Revenue part

- Revenue column has two sub-columns: incoming money (Receipt) vs. Outgoing Money (Expenditure).

- The Incoming money (Revenue receipt) can come from two sources: from tax and non-tax sources.

| REVENUE PART | CAPITAL PART | |||

| Receipt | Expenditure | Receipt | Expenditure | |

| Tax | Non Tax | |||

|

||||

Thus, we’ve come to the main topics of today’s article= direct and indirect taxes and provisions of interim budget 2014 (related to these taxes).

#1: Direct Taxes

Have two subtypes

| On Income/ Expenditure | on properties/assets/Capital transaction |

|---|---|

|

|

- Taxes marked in (*) have been abolished long time ago. I’ve mentioned them here, only in case the nostalgic UPSC professor wants to ask classification type MCQs.

We should also know the direct taxes of state government.

| DIRECT TAXES OF UNION | DIRECT TAXES STATE |

|---|---|

Taxes on Income

Taxes on assets

|

Taxes on income

Taxes on properties

|

Now let’s check the provisions of:

Direct taxes under Interim Budget 2014

FM followed the Ethics(GS4) principles while making the interim budget, he did not make any changes in the direct taxes. That means, direct tax system remains the same like Budget 2013. Observe

Income Tax

| Taxable Income | Income Tax |

|---|---|

| 2 to 5 lakh | 10% |

| 5 to 10 | 20% |

| >10 | 30% |

Other direct taxes

| Corporate tax (desi company) | ~34% |

| Corporate tax (foreign company) | ~43% |

| MAT Minimum alternative tax | ~21% |

| Wealth tax (for wealth >30 lakh rupees) | 1% |

| STT Securities Transactions tax | 0.1%-0.001%* |

*Depending on nature of securities – future, option, equity etc.

However, FM has done a slight tweaking in the tax deduction for corporates.

| until now | In interim budget |

| if company spent money on “in-house” Research development = they can claim tax benefits. |

|

Did not implement

- GAAR

- Direct tax code (DTC)

- Goods and services tax (GST)

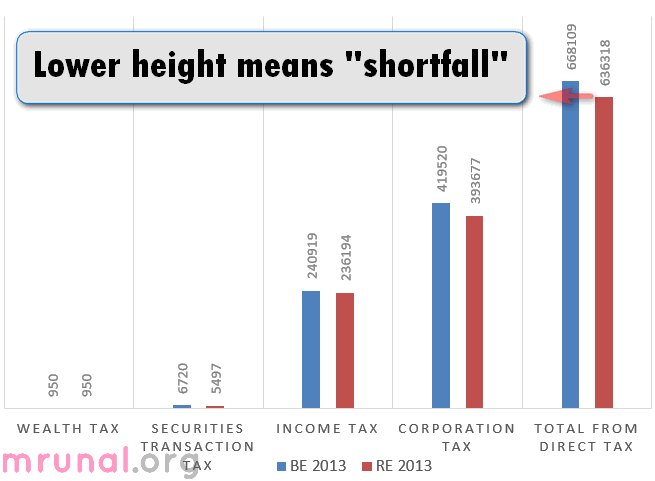

Shortfall in Direct tax collection = #EPICFAIL

Observe

- Feb 2013: FM proposes taxes for year 2013-14. Along with this, he’d give estimate of tax collection e.g. x crore from income tax, y crore from corporate tax and so on. Let’s label this column as Budget estimate (BE) 2013.

- 1st April 2013: new tax rates would have become effective, people start paying taxes accordingly….May, june, july, august, September, October, November, December,….January 2014… So now FM gets new data. So, he’d correct (revise) his previous “estimate”. We label this Revised Estimate (RE)2013.

- And finally for the year 2014-15 (Starting from 1/4/14 to 31/3/15, FM would again make budget estimates for next (interim budget) so let’s label it (BE)2014.

Thus total we’ve three estimates:

| Direct tax | BE 2013 | RE 2013 | BE 2014 |

| Wealth Tax | 950 | 950 | 950 |

| Securities Transaction Tax | 6720 | 5497 | 5992 |

| Income Tax | 240919 | 236194 | 300474 |

| Corporation Tax | 419520 | 393677 | 451005 |

| Total from Direct tax | 668109 | 636318 | 758421 |

Absolute numbers are not important but “interpretation” is. Let’s try a clichéd MCQ.

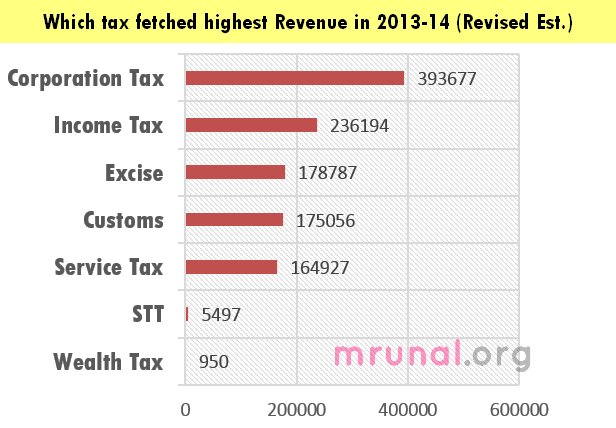

Which of the following direct tax, fetches maximum revenue to government of India

- Wealth Tax

- Securities Transaction Tax

- Income Tax

- Corporation Tax

For all three columns, you can see: Corp>>IT>>STT>>Wealth tax.

Anyways, let’s enter into a deeper analysis. Observe the total collection from direct Tax (in above table).

- In Feb 2013, Chindu estimated ~6.68 lakh crore rupees would come from direct taxes alone! (BE2013)

- But he revised the data yesterday, we see barely 6.36 lakh crore have come from direct taxes (RE2013).

- So, what’s the “shortfall” in direct tax collection here? 6.68-6.36= 32,000 cores

But Why shortfall in Direct tax collection?

- Because IT officials are lazy and incompetent, hence lot of people managed to evade tax? NOPE.

- Because Chindu (Harward Graduate) and his finance Secretary (IAS) are weak in maths and economics, hence they made wrong estimates in the first place? NOPE.

Then who is the main “villain” behind this shortfall? Ans. (1) inflation (2) policy paralysis.

Why high Inflation = Low collection of Direct taxes?

- Corporate tax= paid by Tata, Birla, Reliance, Samsung, LG, Motorola, Videocon etc. They’ll pay less tax IF their profit is DOWN. Now, High food/fuel inflation=> people spend less money on consumer durables– mobile, TV, fridge etc.=> sales down=>profit down=> corporate tax goes down.

- Less profit=> company cuts jobs, doesn’t give salary raise to existing staff= people pay less income tax.

- Less profit = less dividends to shareholders => mutual fund/sharemarket investment declines= security transaction tax also goes down.

- High inflation = real interest rates are negative (recall Urjit Patel) = people invest more in gold and less in mutual funds/sharemarket etc.=> security transaction tax collection is lower than expected.

Why Policy paralysis = Low collection of Direct taxes?

Run the same logic and you’ll see the connection. e.g.

- Policy paralysis=corporates cannot open new factories=> less profit=>less corporate tax.

- Since corporates cannot open new factories=> less new jobs=>less people fall in the income tax bracket (starting from Rs.2 lakh to 5 lakh).

ok enough of direct taxes. let’s move on. otherwise our remaining jawaani will be spent in analyzing the direct tax only.

| REVENUE PART | CAPITAL PART | |||

|---|---|---|---|---|

| Receipt | Expenditure | Receipt | Expenditure | |

| Tax | Non Tax | |||

|

||||

#2: Indirect taxes

What are the indirect taxes of Union and States?

| Indirect taxes (Union) | Indirect Taxes (States) |

|---|---|

|

|

*Note: CST-Central sales tax- it belongs to Union but ca$h entirely given to States. So in budget estimates, it’s collection is listed as “–” or “00”. But for MCQ purpose, know that it is the “Indirect tax of the Union.”

Indirect Taxes in Interim Budget 2014

We saw that FM has not changed direct taxes. BUT for indirect taxes, he has made slight reductions/tweaking for certain items, to boost the economy. Let’s check them one by one

#I1: Service Tax

The “Rate” of Service tax is not changed. It is same as last year (2013-14)

| Service tax | 12.00% |

| 2% educational cess. Meaning tax on tax = 2% of 12% | +0.24 |

| 1% Senior & Higher Education Cess= 1% of 12% | +0.12 |

| Effective service tax | =12.36% |

Then what is new in interim budget?

Following items have been exempted from service tax payment

- Rice: services related to loading, unloading, packing, storage and warehousing (Because)

- Tamilandu CM Jayalalitha has wrote letter to Mohan, demanding the same.

- putting service tax on rice related services=raises the cost of implementing Food security act.

- Cord Blood bank (they store umbilical cord for future stemcell therapy)

Make no mistake: they’re exempted, but not put in “negative list”.

| Service tax “negative list” | Exempted list |

|---|---|

| Govt. cannot levy Service tax on the names included in this list (total 17 items.) | Theoretically, these services are taxable under service tax, BUT for the time being, FM gave them exemption. |

| To modify this list, FM needs parliament approval (because he needs to amend the Finance Act.). | FM can modify this list by a simple notification. He doesn’t need parliament’s approval. |

Examples

|

Examples

|

#I2: Excise Duty: Automobiles

For past few months, Automobile sector was facing slowdown because

- High inflation =people postpone purchase of high value items

- High interest rates (because to combat inflation, RBI did not reduce monetary policy rate i.e. repo rate)

- High Fuel prices.

Therefore, to go a boost to automobile sector, FM has reduced the excise duty on

- Automobile: SUV, Small cars, motor cycles, scooters and commercial vehicle (rickshaw, bus etc)

- This will be applicable only upto 30 June 2014.

- Result: cheaper vehicles, (hopefully) more people will buy more, and automobile sector will see boost in sales.

#I3: Excise: Mobile handsets

To decrease the imports of mobile phones, FM has reduced the excise duty on mobile handsets as well. How does it help?

| Foreign mobile | Subjected to custom duty. (But FM did not reduce it) |

| Desi mobile | Subjected to excise duty (FM reduced it) |

Result? Price wise: Desi mobile cheaper than Foreign mobile. = more sales. Import of foreign mobiles declined=> less CAD. (just like the gold logic.)

By the way, why did not FM raise the custom duty of Foreign mobiles instead -afterall, that’d also make desi phones cheaper!

Reasons:

- US/China may drag us to WTO

- Higher custom duty doesn’t decrease consumption. It only increases smuggling. (lesson learned from gold!)

So it is better to reduce excise on desi phones, than raise custom on foreign phones.

#I4: Custom Duty: soap industry

- Rationalized the import duty on non-edible oils, fatty acids, fatty alcohols.

- This will reduce the cost of (imported) raw material used in soap industry and oleo-chemicals industry (e.g. glycerin)

- Results? Soaps will become cheap. (because that was the matter of life and death!)

#I5: Custom Duty: Bank note Mill

- Bank Note Paper Mill India ltd. (Bangalore)

- They make the special paper for producing currency notes

- FM allowed them to import capital good (machines) @a very low duty (5%)

#I6: Counter Veiling Duty (CVD): Road machines

First, What is CVD and how does it affect sales?

| Vehicle manufactured by | Subjected to |

| Desi player | Excise duty |

| Foreign company (and imported in India) | Custom duty |

- It may happen that, desi vehicle is expensive because high excise duty on its input (chassis, engine, wiring, glass etc.)

- Result: Foreign vehicle cheaper, juntaa more attracted to buying foreign vehicle than Desi.

- Consequence: domestic industry gets less sales. IIP declined, job loss, industrial sickness.

Possible- Solutions:

- Give subsidy to desi vehicle makers

- Reduce excise duty on desi vehicle (and its inputs)

- Increase custom duty on foreign vehicle.

- Put additional custom duty on foreign vehicle to such a level that, [taxes on foreign vehicle] become of same level like [taxes on desi vehicle].. This solution is called counter veiling duty (CVD).

Interim budget & CVD

Import of Road construction machinery will be subjected to CVD. (= it’ll help desi manufactures, because now foreign machines will no longer be very cheap compared to desi. So road contractors/companies are more likely to be buy desi items.)

Indirect Tax collection = #EPICFAIL shortfall

Just like Direct tax collection, here also, Chindu failed to meet targets

| Indirect Tax | BE 2013 | RE 2013 | BE 2014 |

|---|---|---|---|

| Excise Duties | 196804 | 178787 | 199831 |

| Customs | 187308 | 175056 | 201314 |

| Service Tax | 180141 | 164927 | 215478 |

| Total from Indirect Tax | 5.65 lakh cr. | 5.19 lakh cr. | 616623 |

Observe the columns of (original) budget estimate BE2013 VS Revised estimate RE2013. Every duty collection is less than original target.

What is the shortfall in the collection of indirect taxes?

5.65 MINUS 5.19 =~45000 Crore rupees.

Why shortfall in indirect tax collection?

#1: Excise duty down

In the recent months, IIP has been going down for Consumer durables

- Example of consumer durables: TVs, mobiles, cars, bikes, fans, ACs, refrigerators, ceramic tiles and carpets. (all these subjected to excise duty)

- High level of inflation =>people spend less on consumer durables. (because they’ve to spend more on food and fuel.)

#2: Custom duty down

- Duty on gold increased => smuggling => tax is evaded.

- Policy paralysis => Big projects file pending => businessman won’t need to import any raw material/ machines/construction-vehicles etc. (Even if he wants to!) therefore custom duty declined.

#3: Service tax

- Inflation responsible. High level of food-fuel inflation => people spend less on luxuries – hotels, spa, gym etc.

- In fact, government knew in advance that service tax collection would be lower than target, hence they had been running ads of “Voluntary Compliance Encouragement Scheme (VCES) for service tax.” From July 2013 onwards. But still, barely ~6000 crore recovered from people who had been evading service tax payment so far.

MCQ Data for Tax collection: Ascending descending

enough of shortfalls in tax collection, we need to worry more about MCQs than about economy. So let’s update tables

Table1: Direct vs indirect

| Tax | BE 2013 | RE 2013 | shortfall | BE 2014 |

|---|---|---|---|---|

| Direct | 6.68 | 6.36 | 32k | 7.58 |

| Indirect | 5.65 | 5.19 | 45k | 6.2 |

| Total (lakh cr.) | 12.35 | 11.58 | 77k | 13.78 |

ya but What’s the wisdom here for MCQs? =that DIRECT tax brings MORE revenue to government that INDIRECT tax.

So far, we’ve data for Direct taxes and indirect taxes. Now for MCQs, we need the overall ranking (of which tax brings highest/lowest revenue.) Since we’ve revised estimates (RE 2013), so we can now ignore the ORIGINAL estimates of BE 2013.

Table2: Ranking Among all taxes (2013-14)

| Type | Taxes | RE 2013 |

|---|---|---|

| direct | Wealth Tax | 950 |

| direct | Securities Transaction Tax | 5497 |

| indirect | Service Tax | 164927 |

| indirect | Customs | 175056 |

| indirect | Excise | 178787 |

| direct | Income Tax | 236194 |

| direct | Corporation Tax | 393677 |

Table3: Ranking Among all taxes (2014-15)

| Type | Taxes | BE 2014 |

|---|---|---|

| direct | Wealth Tax | 950 |

| direct | Securities Transaction Tax | 5992 |

| indirect | Excise | 199831 |

| indirect | Customs | 201314 |

| indirect | Service Tax | 215478 |

| direct | Income Tax | 300474 |

| direct | Corporation Tax | 451005 |

lets make one final table

Table3: Tax collection highest to Lowest

| Rank | 2013 (Revised Estimate) | 2014 (projected) |

| 1 | Corporation Tax | Corporation Tax |

| 2 | Income Tax | Income Tax |

| 3 | Excise | Service Tax |

| 4 | Customs | Customs |

| 5 | Service Tax | Excise |

| 6 | STT | STT |

| 7 | Wealth Tax | Wealth Tax |

Observe the rank of top two (Corpo, IT) and bottom two (STT, wealth) are same for each year.

only difference is in the rank 3-4-5 because Chindu hopes Service tax will bring highest collection among all indirect taxes in the year 2014-15. (will it? well, that remains to be seen!)

From exam point of view,

- At the moment, Tax Ranking of 2013 is more important. (Because it is near to reality – based on actual data gathered from April 2013 to almost upto Feb 2014. this ranking is unlikely to change.)

- While tax ranking of 2014 is just projected revenue from interim budget. It’ll change when new government makes new (full) budget (=tax rates changed= collection ranking will be changed).

- Then you’ll have to mugup the new updated ranking accordingly. (we’ll see when full budget comes after election).

Gross vs net Tax revenue

Before going into gross vs net, let’s take two quick bites:

#1: Tax sharing

80th amendment 2000: 29% of total taxes of the Union need to be shared with states

13th FC (Kelkar)= Union to share 32% with states.

14th FC (YV Reddy): yet to give recommendation.

#2: NCCF

National Calamity Contingency Fund (NCCF)

- Under Home ministry

- Part of Public account (hence parliament approval not necessary.)

Now coming to the main point:

Gross Tax revenue

It includes

- Total direct taxes of union (we already saw)

- Total indirect taxes of union (we already saw)

- +Union territories without legislature (Diu, Daman etc.)=> their direct & indirect taxes are also counted here.

Net Tax revenue

This equals, Gross tax revenue MINUS [revenue shared with states + money sent to National calamity contingency fund]

Let’s observe the data (numbers not important.)

| crores | RE 2013 | BE 2014 |

| A.(Gross) Tax Revenue [=direct + indirect + UT w/o legislature] | 1158906 | 1379199 |

| B.MINUS tax revenue shared with States/UT | 318230 | 387732 |

| C.MINUS money transferred to calamity fund (NCCF) | 4650 | 5050 |

| NET Tax revenue=A-(B+C) | 836026 | 986417 |

Ok, but why do we need to find Net tax revenue?

Because, from gross tax revenue, union has to give some money to States/UT and calamity fund=> remaining money is the “actual” money left in the hands of Union government (that they can spend as per their own wishes).

Let’s try a very cheap MCQ

Which of the following statements is/are correct

- In union budget, gross tax revenue is always lower than net tax revenue

- In the union budget, net tax revenue is calculated as the sum of [Gross tax revenue + taxes shared by States + money unspent in calamity fund]

- Both A and B

- Neither A nor B

Approach: When in doubt about gross vs. net, just count the number of alphabets in their spelling. Gross (5) and Net (3). So any formula that seems to go the other way = wrong. (e.g. observe statement B, if it were true, then NET would be higher than GROSS. Because everyhing is +…+) hence, B is definitely wrong. Same way, statement A is wrong because 5 > 3.

Side note:

Net GDP = Gross GDP MINUS depreciation.

Here also, Net (3 letters) is lower than Gross (5 letters).

So far,

| REVENUE PART | CAPITAL PART | |||

| Receipt | Expenditure | Receipt | Expenditure | |

| Tax | Non Tax | |||

|

||||

Remaining columns and topics, in next articles, one by one.

Appendix

some allied topics that’d have broken the flow of the article, hence putting @bottom appendix.

#1: Direct taxes can be levied on Expenditure also

Observe the case of Service tax vs FBT:

| SERVICE TAX | FBT |

|---|---|

| service sector= self-explanatory- doctor, spa, hotel etc. | Fringe benefit=when boss gives some facility to worker, Apart from his usual salary. |

| Salman himself joins a posh Gymnasium, Annual fees Rs.1 lakh (+12% service tax) | Salman buys membership to a posh gym, for his bodyguard “Shera”. = 1 Lakh + 12% service tax + 30% FBT on. |

| paid 1,12,000 to Gym Owner. Gym owner pays 12k to government as service tax. |

|

| Hence it’s called “indirect” tax, because Salman paid the tax but government did not took it from his hand. But from that Gym owner. | Called direct tax, because Salman directly had to pay FBT to government (and not to the Gym owner, not to bodyguard Shera.) |

| this is a tax on “expenditure” (on services) | this is also a tax on “expenditure” (on fringe benefits) |

| still levied as of 2014 | discontinued from 2009 |

let’s try a very cheap MCQ:

- A Direct tax can be levied only on the income OR property of a person

- Fringe Benefit tax is an example of Indirect tax.

- Both A & B

- Neither A nor B

#2: Canons of taxation: why some taxes get abolished?

Mind the spelling: “canon” (rules/principles) and not “cannon” (used for bombing).

Adam Smith gave four canons of good taxation system.

- Canon of Equality: taxes should be Proportionate to income.

- Canon of Certainty: about deadline and rates.

- Canon of Convenience: to the tax payer.

- Canon of Economy: tax collection cost should be minimum. (i.e. staff salary, Database Management)

+ Misc. principles: – transparency, simplicity, elasticity (to economic fluctuation) etc.

ya but where is it relevant? Recall that government abolished certain direct taxes (estate duty, gift tax etc.) in past. Why? Because, they were not following some of these canons. for example

Gift tax (abolished)

Most people managed to evade. Hence Gift tax used to fetch barely ~10 crores in revenue. Thus, fourth canon missed. (Collection cost very high- staff salary and database Management.)

Finally, in the late 90s, government dropped this tax. Although it doesn’t mean there is no tax on expensive gifts- they’re counted under Taxable income (of the person who receives the gift)

Estate duty (abolished)

- Estate duty was charged during the “inheritance” of estate. (although this was a Union tax- entirely cash was given to states.)

- Problem: most people evaded, Estate duty Barely fetched ~15 crores = Again 4th canon missed.

Hotel Receipt Tax (abolished)

- In the late 80s, we did not have service tax. But government imposed tax if you spent money on luxury hotels. (direct tax- because you had to pay this tax to government and not via hotel owner)

- problem: same as above. barely fetched a few crores.

Banking cash transaction tax (Abolished)

- introduced in 2005:

- 0.1% on cash withdrawals of more than Rs 50,000 (individuals) and Rs 1 lakh for others in a single day from non-savings bank account.

- Why? to track unaccounted money and trace its source and destination.

- Abolished in 2009, when Chindu felt he had fetched enough information.

- Although indirectly the canons were also responsible: #1, #3 and #4.

Fringe Benefit tax (Abolished)

| 2005 | Chindu started FBT |

| 2009 | Pranab abolished FBT |

- Compliance cost was very high (Because company would need to keep record and acount of every little fringe benefit they gave to employees)

- in other words, inconvenience to tax payer (company)=> it was even called “nuisance tax”. Therefore, 3rd canon missed.

- Besides, revenue collection was ~8k crore. and company would pay less salary to employees in pretext of giving those fringe benefits= employee’s pay less income tax. so indirectly, government was axing its own leg. (Recall our MCQ tables: income tax is the second largest source of revenue for union government!)

Mock Questions

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Budget, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

i couldnt understand the difference between full budget and interim budget ? ad you said interim budget is represented only in election/emergency years .

Contentwise, the difference between a full budget vs Interim budget= Interim budget doesn’t contain major changes in taxation/schemes/subsidies.

Mrunal sir,

i wnt to sit in CAPF 2014 exam, sir my age is 26 and i belong to J&K.. sir m i eligible for this exam and if so,then how to get age relaxation certificate..

PLZ HELp SIR…..

Simran,

You’re eligible if you’re a J&K migrant (not if you are simply a J&K resident). While filling up the form in April 1st week, remember to claim age relaxation (no need to provide migrant certificate until you qualify the written exam).

thanks sid, atleast someone replied….

one more thing @sid if u can clarify… i read CAPF 2013 notification and they said that candidate must have been ordinarily domiciled in J&K what does that mean…

Bhai Itna Gyan Rakhte kase ho????

You are “Dasanan” (Not Ra- One) because one head is not sufficient to hold

Vinay ji if u r new then start to study as much because these all things one should know to cross the final hurdle of this cross,,Surely apart from data u will able to know every bit of knowledge given above,,,No doubt Murnal ji puts a lots of effort to avail these all study material…..

no need of anythings just follow mrunal bhai

spelling grammar mistake………. new party comes into power. it should be new government not new party

sir cs 2013 mains ka result kab aayega

Very helpfull

sir your way of teaching is so nice. Easy to grasp and could memorize so easily. Doing a good job. Thanks a lot.

sir, another masterpiece, great starting of articles series of budget.

mrunal sir, you are my god in my achieving aims.

mrunal sir……. mere paas INDIA 2013 ki yearbook hai…… toh kya mujhe INDIA 2014 khareedne ki jarurat hai???previous yr or is saal ki yearbook ke coontents mein mein kitna diffrence hoga ???

nice article……….helps in clearing the basics more easily. one thing which i noticed is that mrunal sir is responding to doubts in this article very frequently, this is different as sir responds to only very few limited doubt……i have changed my name as someone else has the same name as of mine,so no particular intention of hiding my name. i am personally happy to see mrunal responding frequently. now, sir what about mains analysis, when you will be discussing that.

sir please post articles on basics of indian politics

respected sir,

the way u explain is really out of words.

thank u so much for providing such crystal clear understanding of the subject.

sir i have one doubt, if care taker government cannot pass the interim budget then if before the completion of full term gov lost its majority. Who will pass that time budget??

Thanks a lot Mrunal Sir.

Sirji,

The new look still doesn’t print the docs the same way it used to be earlier.

Earlier When I clicked print on my chrome..in order to save the articles…I used to get complete articles without much fuss…But now…it comes as a long trail of ads and the whole article is divided in 2 parts because of left hand side and right hand side menus on the page…

May be it needs some more testing … look into it.

Thanks

Shan

@Shantanu, I’ve fixed it now. please clear temp files in your Chrome (by pressing ctrl+shift+del keys together). then close browser. re-open. then click on the new print link at the bottom right corner of any article.

mrunal sir no one explains economy like you……..hatsoff to you

Thanks so much for this, sir. You really are an angel of some sort. May the gods bless you forever and ever.

Mrunal bhai : Difference between Anti Dumping and Counter Veiling ? both are same kya ?

yup both are same…….

I never knew economics can be this fun…respect Mrunal sir…

Mrunal Sir dont mind it as I am using your platform for this. But I am desperately looking for a room in ORN or its nearby location .Anyone from you people.Please help me out or guide me in the same.I will be highly thankful to you.

Sadhana Call to this num BK Prop 08826059105,09810569560.

very clear-cut concept, Bole to apan ko pyar hua he this Web side se………………!

Mrunal sir, why foreign car makers eg. Mercedez, Audi etc. are planning to reduce car price? Theoretically it should not be doing so because custom duties remain same.

Because of competition.

But none of Indian companies manufacture such a sophisticated and costly car.

I THINK U DIDNT LOOK AT THE FACTORIES’ DATA. ALL OF THE “BRANDS” YOU AVE MENTIONED HAVE FACTORIES IN INDIA.

THAT MEANS PRODUCTION IN INDIA, WHICH MEANS USING INDIAN RESOURCES TO MANUFACTURE.

BECAUSE OF THIS, THEY BYE-PASS CUSTOMS DUTY AND CVD.

SINCE THE EXCISE HAS BEEN LOWERED ON LUXURY CARS, THEY BENEFIT FROM THIS, AND THUS ARE PASSING ON THIS BENEFIT TO THE CUSTOMER.

mrunal best as always…..coaching walo ki chutti ..kar rahe hain…aap

god bless..following site since 2011…waiting for my turn of interview….

please unfold(decode) the paper gs.4 theory part…..

Hi mrunal sir!!

Sir please provide current news articles from Hindu and other sources as we are appearing in state civil service exam. Also provide some interview articles.

Thanks

Varinder singh

hi mrunal… i am really pained at the way your articles reflect biased approach against a a party . i know you are are helping us a lot but it would have been better if your article were unbiased…

hi mrunal… i am really pained at the way your articles reflect biased approach against a a party . i know you are are helping us a lot but it would have been better if your articles were unbiased. As far as i know you are respected a lot among aspirants but your political inclination( and its reflection in your articles) makes us smell something fishy…its my humble request that please dont give your articles political colour or favouritism to one party over another

Please take all this bullshit of political vendetta and ‘biased approach’ to some other place.. You dare not do anything other than contributing to this article or making valuable addition to the article.

There are enough forums for this idiotic debate of finding traces of political affiliation out of one’s writing but don’t pollute this forum OK..

You are at fault if you can’t filter knowledgeable aspects out of this article….

This politics has no place for serious aspirants and don’t initiate a ‘war-of-words’ for or against one or the other political parties; here at least…these comments are also read sincerely by people like me for information so please don’t put useless comments,even I hate to pollute this thread by my commentary but it is for all aspirants: please don’t indulge yourself to these ‘time-guzzling yet no-output’ thread-debates.

totally agree . hav read almost all arts . no pol bias here . wud like to request mrunal sir though to analyse some criticisms of d budget in the papers and some real crap about urjit suggestions .

Just one thing bro….

I am not a congress fan, neither a chindu, pappu, mannu, soni supporter….I read your articles with legitimate fun. But promise me that you will continue the same tone for Modu, Yashu, Sushu and Addu when BJP comes to power after the next general election. Your tone should not change when a Gujrati mota bhai becomes PM. Just an advise.

DISCLAIMER: I am a fan of yours and not of Congress or BJP. Nothing personal.

this is not biasness. this is criticism and we all know that ‘IT’ is worth of criticism. Mrunal is doing the right thing. yeah, it is right that he criticizes only one party normally, but there is also a reason. he is criticising the party at the power. what were you expecting? should he criticise the opposition party? how silly!

MAYBE MRUNAL WILL START CRITICISING ‘THE NEXT PARTY AT THE POWER’ WHEN THEY WILL WIN.

i dont think mrunal sir is doing something wrong….there is nothing fishy or political biasness….i think he just add some ” mirch masala” to the article so that we can learn important points with some sort of humour….

and i request him to continue writing as he always does

Ya,as Anubhab Das said we would like to believe that Mrunal sir citicizes all ruling parties eaqualy irrespective of their ideologies [whether rightist or leftist or else.]…..Anyhow thinks Mrunal sir can keep unbiased thoughts at all for the integrity and unity of our big nation and he can incline only towards the goal of attaining peace and justice for whole Indians beyond any religious/social divisions…ALL THE BEST FOR THIS UNIQUELY EXCELLENT COMPETITIVE EXAM MENTOR IN INDIA…

See…Mrunal sir is right ONLY IF he honestly criticize THE current ruling party at all irrespective of who is @ power [INC leads UPA/BJP leads NDA/CPIM leadsThird Front/else]…we would like to believe that our Mrunal sir HAS BEEN DOING the role of a fourth pillar of democracy- ie, the duty of a conscious media without any biased agenda towards rightists / leftists at all instead he always biased only towards peace and justice of entire Indians eaqualy…all the warm bests for this UNIQUELY EXCELLENT COMPETITIVE EXAM MENTOR in India…

Thanks Mrunal Sir, I am agree with Amit Ji and Hussain Ji. Friends plz do not politicize this forum..we are for serious discussions not to criticize others. Feeling bad when people try to validate his points… Mrunal Sir plz keep it up and block these people.

fokat me gyan chahiye…… wooooo bhi customised

Thankyou sir, your articles are really easy to understand and I dont feel that there is anything wrong in between if you have used off Article language they have done a work of tip to keep the points to remember easily.

Thanks Once again and I also want to see your site to cover the subjects other than Economy.

sir,

noble prizes …..their background……for the year 2013…every year a bit is asked in the prelims….kindly upload any material..

noble economics ……background of the work for which the noble was awarded…..

i will be thankful…

tax to be extracted like honey from flower :D Adam smith said something else !

Thank you Mrunal Sir for all knowledge…lots of respect sir