- Prologue

- Banking sector in British India

- Birth of RBI

- Banking sector Post Independence

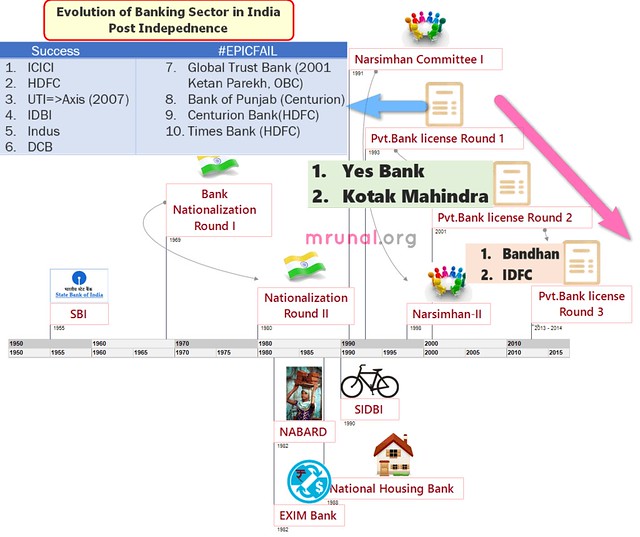

- Narsimhan Committee I (1991)

- Bank licences: 1st Round (1993)

- Narsimhan Committee II (1998)

- New Bank licences 2nd round (2001)

- New Bank licences 3rd Round (2013-14)

- Bharatiya Mahila Bank (2013)

Prologue

important: SSC has uploaded halltickets for reexamintion of CGL-2013 to be held on 27th April. Respective players check your regional SSC sites accordingly. now coming to the subject…

Bandhan and IDFC got new licences, you already know that. it’s just two line current affairs. but for SBI /UPSC interviews, we need to some background information for questions like:

- After Sahara Scam and NSEL crisis, why should we risk giving bank licences to private companies? In fact why not simply nationalize the existing private sector banks so they cannot do any scams!?

- We already have large banks such as SBI, ICICI, BoB- all of them having pan-India presence, capable of fulfilling the goal of financial inclusion, then why is there a need to get new private sector banks?

To answer such “Devil’s advocate” type interview questions, we need to go back in history:

Banking sector in British India

There were two types of banks

| British Banks | “Swadeshi” Banks |

|

|

| Their target audience = British army, civil servants and judges | Target audience= big merchants, particularly raw-material exporters in Bombay and Madras Presidency. |

Overall, neither British Banks nor Swadeshi banks helped in the financial inclusion of poor people, they still had to rely on local money lenders and Zamindars.

Birth of RBI

- By early 30s, there were >1200 banks in India!

- But all of them under Companies law- there was no banking regulation, no RBI, no SLR, CRR, repo rate, reverse repo rate etc.

So the Civil service & BankPO aspirants of that era, were relatively “Stress free” compared to present generation. - Problem starts with Great American depression (’29) => sharemarket and companies of US and Europe collapse= raw material import declines = desi merchants cannot repay loan EMIs = Indians banks starts collapsing one by one.

- therefore, British Indian government setups Reserve bank of India to supervise over these banks (’34)

Banking sector Post Independence

- from mid-50 onwards, there is gradual expansion of banking sector in India

- SBI, ICICI, PNB, BoB all start opening more and more branches.

- but still target audience= merchants, urban (upper) middle class and industrial houses

- Branches increased? YES

- Rural penetration? NO

- Did they help aid in Five year plans like giving cheap loans to farmers and micro-enterprises? NO

- All these banks were in the hands of industralists. (who owned majority shareholding => can vote majority of board of directors=> bank’s policy decision will only be made to suit those industrialists e.g. opening branches near factory-townships, giving loans @cheap rate for setting up new factories and so on….)

Nationalization

- Government gets impatient with ^all this.

- starts nationalizing banks (By taking over the ownership from those industrialists)

| Year | How many? | who? |

| ’55 | 1 | Imperial bank (SBI) |

| ’69 | 14 | banks with >50 cr. deposits. |

| ’80 | 6 | banks with >200 cr. deposits (Andra, Vijaya, Oriental bank of commerce etc.) |

Nationalization: more problems

- In theory, nationalization =government becomes majority shareholding in those banks => government can pick board of director of her choice = bank takes decisions to suit government’s Five year plan requirements= everyone’s happy, right? nope

- In reality, nationalization =created more problem than it solved. for example

- Now all the board members = politicians, their relatives, retired IAS/IPS etc. Result? Professionalism =nope, sycophancy=yes.

- Banks were forced to give loans @throwaway prices to farmers/ small enterprises, sometimes even cost of giving loan (staff salary, light bill, office rent etc.) would be higher than the profit involved.

- Local politician interfered in operations. Run “loan mela” in our Constituency, open all branches in RaiBareily and Amethi only, pass applications of our chamcha-log. They would get lakhs of rupees @4% interest rate (to buy cattle) and then circulate the same money to farmers @36% interest rate and so on…

- When banks tried to recover loan money from such political elements, t hey’d get stay order from courts, then “taarikh pe taarikh”.

- This politicization even came into Bank employee unions- they’d always demand higher wages and lower working hours, irrespective of how much profit bank made.

- adding insult to injury, RBI kept the CRR and SLR very high (15 & 40% respectively)

- =very less money left for banks to lend.

- Business man cannot get easy loans = no business expansion =export declines =in a way all this contributed to the Balance of Payment crisis (BoP) in 1991.

moral of the story = nationalization is not a solution – even if Sahara, NSEL, Ramalinga Raju, Ketan Parekh, Harshad Mehta or Mr.XYZ is doing scam- that doesn’t mean you should nationalize everything.

Narsimhan Committee I (1991)

By government of India in 1991. It recommended following:

| recommendation | result? |

| Government / RBI mustnot regulate the banks’ loan interest rates. Banks should be allowed to decide their home loan, bike loan etc rates by themselves. | RBI adopts BENCHMARK PRIME LENDING RATE (BPLR) => nowadays Base rate system. |

| setup Debt recovery tribunals. so loan defaulters cannot get stay orders from courts, no more “Taarikh pe taarikh” | DRT setup in 1993 => later SARFAESI Act in 2002 to give them more powers. |

| Liberate Branch expansion policy. Let the banks open branches outside Raibarely and Amethi also. | done. banks can open branches anywhere. only condition 25% of the new branches each year must be setup in rural areas. For more read Nachiket Committee article. |

| Reduce CRR and SLR so banks are left with more money to lend. | Done, gradually reduced. from (15,40)=>(4,23) |

|

done |

| government should reduce its shareholding from public sector banks. | done, SBI shares sold, nowadays government owns ~60%. (this facilitates entry of professionals in the board of directors) |

| Allow entry of private sector banks and foreign banks. | done, leads to first round of bank licences, explained below: |

Bank licences: 1st Round (1993)

- RBI invites application 1993

- New private banks start Operation: 1994-95 onwards

- Total ten private banks given licences: 6 still running + 4 closed down.

6 running

- ICICI

- HDFC

- UTI=>became Axis bank (2007)

- IDBI

- Indus

- DCB

All of above running successfully, so that gives us “positive arguments”- that not all private entities are seamstress. in fact, ICICI, HDFC, Axis = top banks of India, even have presences abroad, employ lakhs of people. Hence no harm in giving bank licences to private players.

4 closed down

| Bank | merged with | why? |

| Global Trust Bank | Oriental bank of Commerce | recall Ketan Parekh- he took money from Madhupura cooperative Bank, A’bad and used it to run scam in Sharemarket. Same Ketan had also taken some money from Global Trust bank also=> news stories =>junta panics and runs to take out all money=> business collapsed. |

| Bank of Punjab | Centurion bank | loss making. hardly any depositors and loan takers, couldn’t stand in competition against SBI, ICICI, BoB etc. |

| Centurion bank | HDFC | same as above |

| Times Bank | HDFC | same as above |

These four #EPICFAIL banks give us the “negative arguments” that private companies must not be given bank licences. Because they can also close down like ^these, creating panic among the clients, blood pressure, heart attacks and suicides.

Anyways, moving on

Narsimhan Committee II (1998)

- Introduce Voluntary retirement scheme (VRS) in public sector banks.

- Legal reforms for loan recovery. =>SARFAESI 2002

- Computerization, electronic fund transfer, legal framework

- Payment and Settlement Act=>Retail (ECS, NEFT, Card) + Wholesale (RTGS)

- Continue allowing entry of private banks and foreign banks.

New Bank licences 2nd round (2001)

- 2001: applications invited

- 2003-04: winners launch banks.

From the earlier #EPICFAIL of those four banks, RBI also learned lesson.

This time RBI gave licence only two strongest contenders:

- Kotak Mahindra

- Yes Bank

New Bank licences 3rd Round (2013-14)

- 2010: Finance minister says we need to give more licences.

- 2013, February: RBI invites applications with following conditions:

Conditions/guidelines for new bank licence application:

- must include class 10-12-college marksheet, school leaving certificate and three passport sized photos

- 10 years’ successful work-ex (=”Fit and proper” criteria)

- minimum capital Rs.5 billion

- Will have to get shares listed on stock exchange within three years, bring down voting rights to 15% within 12 years. why?

- say Anil Ambani gets licence, in the beginning he’d have ~100% ownership and decision making. But in the long run such “one man game show” = not good in banking sector. So he’ll have to get the shares listed within three years.

- once shares are listed, junta starts buying those shares= they elect the board of directors (BoD) and then BoD makes policy decisions of the bank, appoints CEO and top executives and so on.

- By 15 years, Anil should sell majority of his shares to junta- so that he holds barely ~40% or less of the bank shares = he cannot have lot of “say” in bank’s decision making = bank doesn’t run according to his whims and fancies =rational decision making.

Anyways moving on to the rules

- foreign shareholding must not be more than 49% (for the first five years)

- 50% of the directors should be independent (=not chosen by majority shareholder e.g. Anil)

- Such bank must not invest in shares/bonds of its parent group (e.g. Anil’s telecom/electricity business)

- must have viable business plan

- must open atleast 25% branches in the unbanked rural areas. (as per latest census there are ~10000 such places)

- Have to comply with PSL (priority sector lending) norms.

Many other technical rules but for descriptive/interview answer- above 9-points sufficient.

- Total 26 applied, including Anil Ambani, Birla, Bajaj, Tata, Muthoot, Indian post.

- later two left (TATA, Videocon)

- + one came (KC Land and finance ltd.)

- Thus 25 left.

Bimal Jalan Committee

- Now Rajan had to decide winners among those 25 applicants.

- Sep 2013: Rajan sets up RBI High level advisory Committee to process those applications.

| Bimal Jalan (Chairman) | Former RBI governor |

| Usha Thorat | Ex-RBI Deputy Governor |

| C B Bhave | Ex-Sebi chairman |

| Nachiket Mor | RBI board member |

Important: Bharatiya Mahila Bank also launched in Sep’13 (but its public sector bank, has nothing to do with this “third” round of Bank licences or Bimal Jalan Committee)

Anyways, moving on

| November 2013 | Bimal first meeting |

| February 2014 | Bimal submits report |

| March 2014 | Rajan fears Election commission’s model code of conduct, seeks their approval. |

| 31st March | EC gives approval |

| 2st April | Two winners announced. (Bandhan Microfinance and IDFC) |

Bandhan Microfinance and IDFC

| Bandhan Microfinance | IDFC (Infrastructure Development and Financial Corporation) |

| West Bengal | Mumbai |

| Micro-finance company | infrastructure finance company |

| Chandra Shekhar Ghosh | Rajiv Lall |

| net worth 1100 Cr., 45% branches in rural areas | net worth 21000 cr., but rural presence low. |

These two are given only “in-principle” approval. Meaning

In principle approval

- Within 18 months

- must get net worth Rs.1000 crore

- Must open 25% branches in unbanked rural areas.

- once they fulfill above conditions, RBI will give them licence under Banking Regulation Act, 1949 [Sec.22(1)]

- Once they get licence under BRA, then we can open current account, savings account etc.

RBI has also prohibited the promoters (Ghosh and Lall) to hold CEO position in their respective banks. This is meant to prevent conflict of interest. Because in past, Global Trust bank’s CEO Ramesh Gelli was accused of involved in Ketan Parekh scam.

Curiously though Yes Bank’s promoter Rana Kapoor enjoys both MD and CEO position in his bank!

India post

- For Indian postal department, Bimal Jalan said “RBI should consult separately with government and give licence if necessary.”

- Kumar Mangalam Birla’s name involved in Coal block scam, Anil Ambani in 2G case, hence licence not given.

What is Differential licences?

- Total 25 applied, but only two won so what about the remaining 23 contenders? Will they get any consolation prize? Yes.

- Rajan said they can later apply for Differential bank licences.

- Differential bank licences = for opening payment banks, wholesale banks etc (who’re not “full” banks like SBI, PNB etc.)

- for more on these differential banks read following articles on Nachiket Committee:

New Private banks: Pro and Against arguments

| Anti arguments | Pro arguments |

| There is no need for additional private banks, existing banks sufficient. |

As per Census 2011

|

| well in that case, government should launch some Rajiv Gandhi scheme to open bank accounts for everyone, there is no need to get new private banks! Besides, these two (Bandhan and IDFC) are too small to be any relevant in “financial inclusion”. |

|

| As per your own table, Bandhan already has 45% of her branches in rural area as microfinance company, then why do they need bank licence? They’re already doing financial inclusion! |

|

| In the first round, ten banks were given licence, four of them closed down…..private sector cannot compete with existing giants. They try to take ‘shortcuts’, hence all the scams. | The same licensing round gave us giants like ICICI, Axis bank and HDFC. It is wrong to think every private player is out there only to bully, loot and steal. |

| The same ICICI Bank, HDFC Bank and Axis Bank were caught violating KYC norms and doing money laundering case in the Cobra post sting operation. | RBI has taken quick and firm action against those three banks. And the inquiry revealed it wasn’t the mass scale organized money laundering operation but irregularity on part of certain branch managers to overcome the “targets”. |

| These two small players cannot even afford to launch all India ATM network, forget about opening “branch” offices. | They don’t need to open ATMs anyways, because of the “White label” ATM scheme. |

| RBI should gave given licences to more applicants, like they did in the 90s (ten licences). | In the early 90s, all nationalized banks were heading towards #EPICFAIL, so to correct the course, RBI had to get in more players to breed competition. Same is not the case today- two new banks are good enough. If Rajan gave licence to 15-20 applicants at once => too much competition => predatory pricing like in aviation industry => smaller players will be wiped out. |

| Public sector banks are already bleeding because of the heavy marketing and teaser rates offered by Private banks. Two more such banks will increase the misery of the public sector banks. | In the end, Business is all about the survival of the fittest. Public sector banks and their “trade unions” should learn to perform or perish. Customer deserves better services. Just to make life easier for sarkaari banks, we must not prevent the entry of private sector. |

| Rajan’s “American” ideas of free market, wholesale banks, differential licenses etc. will ruin Indian banking sector and Economy. What works in USA need not automatically work in India as well. This will lead to subprime crisis like disaster. | Just two new banks cannot create Subprime crisis. RBI is much more vigilant and strict than their American counter part US feds. It is wrong to assume that Rajan comes from America so he is automatically an evil capitalist, and all the “hushiyaari” (smartness) is with Newspaper columnists in The***** only. |

More pro-con arguments can be added, post them in comments below!

Bharatiya Mahila Bank (2013)

This has nothing to do with Bimal Jalan Committee or third round of private bank licences. But to confuse you in MCQs, the examiner will deliberately include some facts related to Mahila bank. Therefore, you must know the basics:

- Budget 2013: Chindu announced to open this bank with 1000 crore Rs. (=100% State Owned / public sector bank.)

- Keep in mind, Chindu also setup “Nirbhaya fund” for women security initiatives. But that’s separate 1000 crore fund and this is separate 1000 crore bank. (tricky MCQ)

- Concept is not new: Pakistan and Tanzania already setup such banks in past.

- MBN Rao Panel prepared blue print (he was chief of Canara bank)

- Sept. 2013: licence given

- November 2013: bank launched on Indira Gandhi’s b’day.

- HQ= Delhi but since assembly election was going on, hence to follow the model code of conduct, they launched the bank from Mumbai

How is it a Mahila Bank?

- Boss Usha Anantha-Subramanian =woman

- Board of Directors=all women.

- but staff = male + female

- mid-level staff from BoB, PNB on deputation= male + female.

- Customers (Depositors) = male + female. (no distinction among them, both get same interest rate on their savings account / FD etc.)

- BUT Loan giving => predominantly to women.

- Women entrepreneurs can get loans up to Rs 1 crore without collateral (meaning they don’t have to mortgage their house/factory/jewellary)

- kitchen loans, education loans, small home-based catering businesses

- Projects for Skill development, financial literacy among women.

- hence the name “Mahila Bank”- because it’ll predominantly cater the credit needs of women entrepreneurs and Self help groups.

Business plan of Mahila Bank?

- By March 2014: 25 branches in capitals/major cities of India

- 25% branches in unbanked rural areas.

- By 2020: 700+ branches; 60k cr business

Software

- as such most desi banks use “finacle” core-banking software designed by Infosys

- But this Mahila bank got Core Banking Software by FIS (American Co.)

(^ya this type of GK essential for IT-graduates for the bank interview stage.)

Why Mahila Bank is mere publicity stunt?

(Interview Q.) Bharatiya Mahila Bank is a mere symbolic exercise for feel good publicity. Do you agree? Yes/No and Why?

I already mentioned the Positive points 1 cr. loan without collateral, skill development for women etc.

But in Group discussion/ interview, you need to be aware of the negative points as well, in case the other party decides to play “Devil’s advocate”.

Mahila Bank is mere tokenism, without substance because:

- SBI, PNB, BoB better suited, they have pan-India presence including in rural areas. Govt. already majority shareholder. Could have launched the 1 crore without collateral scheme without Mahila Bank.

- 25% rural branching: duplication of effort.

- In the first phase focus on state capitals and UT = real need of women financial inclusion is in rural areas and not those big cities.

- Mid-level executives all “imported” from BoB, PNB etc. such deputed staff usually don’t have or motivation to put their blood and sweat in making this new bank successful. Their loyalty remains with their own parent bank only.

- They’re offering 4.5%/5% interest rate on savings account but pan India presence necessary, otherwise customers won’t feel attracted. Besides private banks like Kotak already offering 6%

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

sir kindly upload ppt of economy L2/p7 to L2/p14 ..its not there

IN-PRINCIPLE APPROVAL

Sir according to rule a bank has to first expand to 1000 cr business and 25% in rural areas within 18 months then they would be given license under BRC.

But how they can expand if not given CASA permit? or by NBFC?

Good work sir, dhany ho gya….