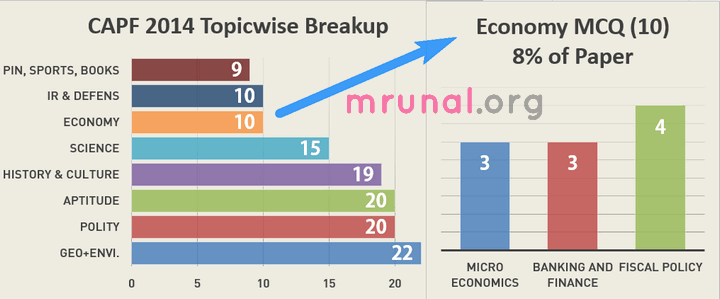

CAPF: Topicwise Breakup

To download scanned CAPF 2014 question paper Booklet “D” click me

| Topic | MCQs in CAPF-2013 | Weightage |

|---|---|---|

| Geography & Environment | 22 | 18% |

| Polity | 20 | 16% |

| Aptitude | 20 | 16% |

| History & Culture | 19 | 15% |

| Science | 15 | 12% |

| Economy | 10 | 8% |

| IR & defense related | 10 | 8% |

| PIN, Sports, Books | 9 | 7% |

| Total | 125 | 100% |

Economy in all recent exams of UPSC

| Economy | CAPF-2014 | CAPF-2013 | CSAT-2013 | CDS1-2014 |

|---|---|---|---|---|

| Economy | 10 | 21 | 18 | 9 |

| total MCQs | 125 | 125 | 100 | 120 |

| % | 8% | 17% | 18% | 8% |

Economy: Internal breakup in CAPF

| Internal breakup | MCQ | weightage |

|---|---|---|

| Micro economics | 3 | 30% |

| Fiscal Policy (budget, taxation, subsidies) | 4 | 40% |

| Banking and finance | 3 | 30% |

| total | 10 | 100% |

Compared to last year, Number of questions decreased and difficulty level increased. But still, there is continuity in the trend of MCQs- for example

| topic | CAPF-2013 | CAPF-2014 |

|---|---|---|

| Question that requires you to do “data interpretation of Annual financial statement” | ascending descending of taxes | which deficit increased between BE-2013 and RE-2013 |

| WTO related | latest nation to join | food subsidies in Bali summit |

Economy: Span of current affairs

| date | topic asked in CAPF-2013 |

|---|---|

| 11-Nov-13 | PSU bank ownership |

| 24-Nov-13 | SBI POS terminal |

| 6-Dec-13 | Bali summit WTO |

| 17-Feb-14 | Interim budget |

| 17-Apr-14 | SEBI norms |

| 13-Jul-14 | Exam conducted |

Moral of the story:

- at least last 6-8 months’ current should be prepared before CAPF exam

- overall 5 current + 2 contemporary (GAAR, Wheat) + 3 static micro = 10 MCQ

Economy Difficulty level of MCQs in CAPF-2014?

Debatable, depends on preparation level of a person. But in my opinion all questions were difficult, due to following reasons:

- Three MCQs on micro-economics because most candidates ignore it for CAPF.

- Bali conference food subsidies, old topic from last year. Many would have downplayed given that exam taken >6 months after it.

- Government stakes in bank ownership- again old topic from last year. Many would have forgotten that number 58 to 51. (because who has time for such trivial data memorization)

- GAAR: as such easy but due to term “Overseas investors” some candidates may become 50:50. Because IT commissioner can send notices even to Indians and NRIs under GAAR.

- Interim budget= who studies annual financial statement in such minute detail to see that ERD increased from 1.8% to 2%!

- Banking PoS terminal=> such banking GK not seen in earlier UPSC exams so candidates would have ignored while preparing.

- SEBI norms. Most candidates downplay the capital market / corporate sector part.

- MSP: it was easy to tell that second statement is wrong but still you were required to mug up an exact data that wheat MSP=1700, only then final answer could be ticked.

Lessons for CSAT-2014

- questions look tough yes, but they’re not “falling” from sky. The correct / incorrect statements are lifted verbatim from Hindu, Indian express etc. It again highlights the importance of making notes.

- Economic Survey is useful (observe MSP question).

- Microeconomics should be revised (only if you’ve read it already. Otherwise there is no time to start afresh, at this junction.)

- Never tick MCQ unless you’re absolutely sure. for example that interim budget question, many would have ticked fiscal deficit etc. by “gut feeling”.

- It is upto UPSC to replicate this model from CAPF to CSAT (i.e. economy section with less question and more difficulty) but nonetheless one should keepup the momentum because economy important for GS2 and GS3.

Conspiracy theory: TR Jain:

It seems all the micro economics questions were framed by T R Jain (or his fan) because all statements verbatim lifted from various books authored by T R Jain.

Anyways, without further ado, let’s begin solving.

Micro economics

total three questions

#1: Elasticity of Demand

37. When a fall in price of a commodity reduces total expenditure and a rise—in price-increases it, price, elasticity of demand will be :

- 1

- <1

- >1

- Infinity

Answer B <1.

Introductory Microeconomics and Macroeconomics By TR Jain, VK Ohri. Page 92

Less than unitary elastic demand (Ed<1), when:

- Total Expenditure increases when price increases

- Total Expenditure decreases when price falls

NCERT class12 microeconomics page32 tells same story but via a complicated mathematical equation.

#2: Commodity Demand

85.Which of the following factors affects individual’s demand for a commodity?

- Price of the commodity

- Income of the consumer

- Prices of related goods

Select the answer using the code given below:

- 1 and 2 only

- 2 and 3 only

- 1, 2 and 3

- 1 only

Business Economics by TR Jain, OP Khanna, Page 42

Determinants of individual demand for a commodity (DX)

- Price of the commodity

- Prices of other related goods

- consumers income

- tastes and preferences

- expectations

Therefore answer is C all 1,2 and 3 correct.

#3: Substitution rate

111.The rate at which the consumer is willing to substitute one good for another without changing the level of satisfaction is known as:

- Marginal rate of substitution

- Marginal rate of technical substitution

- Diminishing marginal utility

- Equi-marginal utility

Marginal rate of substitution (MRS) is the rate at which which the consumer is willing to substitute one good for another without changing the level of satisfaction therefore answer (A)

NCERT Class12 microeconomics chapter 2, page 14 also mentions this topic but without giving the verbatim definition.

Budget, Taxation, Subsidies

four questions from this segment

#1: MSP

104.Which of the statements given below is/are correct?

- For the marketing year 2014-2015, the minimum support price (MSP) for wheat in India has been fixed at Rs. 1,400/quintal. (right)

- MSP is the rate at which the government sells the grains through the fair price shops (wrong)

Select the correct answer using the code given below:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Statement 1 is right as per table 8.8 on Economic Survey 2013, Page 148.

1450: was “proposed” by Agri ministry (October 2013). But I’m unable to locate source where it says government accepted / announced 1450.

July, 2014 Financial express says

” government had announced a Rs 50 hike in the minimum support price (MSP) to Rs 1,400 per quintal for wheat procurement for 2014-15 marketing season.”

Statement 2 is wrong by common knowledge. But still if you want reference: Ramesh Singh Page 8.12 (6th edition), MSP is the Is the minimum price at which the government will purchase farmers crops – irrespective of whatever may be the market price for that crop.

Therefore, answer A only 1 correct.

#2: WTO Bali conference

119.As per the latest trade agreement in Bali Ministerial Conference of WTO, India and other developing and under developed countries can launch food security programs:

- Forever without any penalty under WTO rules

- Till an alternative mechanism is developed

- For four calendar years

- Only if subsidy component under such programmes is less than 10 per cent

Ref: TheGuardian, December 6, 2013

The negotiators in Bali finally came to a provisional agreement, where Countries agreed to a four-year peace clause, meaning that they won’t challenge India’s food security measures before December 2017.

Therefore, answer (C) For four calendar years.

Ref: Hindu’s businessline, Dec18, 2013

Sharma had said in his statement that the Bali outcome provided for an interim mechanism to be put in place and to negotiate for an agreement for a permanent solution for adoption by the 11th Ministerial Conference of the WTO, which will be held in 2017. (until then) members will be protected against challenge in the WTO.

Therefore answer (C) four calendar years.

#3: GAAR

110.Which of the statements given below is/are correct?

- In India, the provisions of General Anti-Avoidance (GAAR) will be implemented with the effect from 1 April 2015

- The provisions of GAAR were aimed at checking tax avoidance by overseas investors

Select the correct answer using the code given below:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

1 is right. “As per the existing proposal, GAAR is scheduled to roll out from April 1, 2015, for the assessment year 2016-17.” Ref: Indianexpress

Statement #2 is right Ref: Businessline. (some people may debate over the word “overseas” because IT commissioner is empowered to send notices even to Indians and NRIs. but since statement is verbatim is given in businessline hence correct.

Answer (C) Both 1 and 2 correct.

#4: Interim budget

125.Data presented in Interim Budget for 2014-2015 reveal that for the financial year 2013-2014, the revised estimates do not show a decline in :

- Revenue deficit

- Effective revenue deficit

- Fiscal deficit

- Primary deficit

I’ve discussed this question in my recent lecture on Economic survey: L1/P3 at 30:37 minutes

Answer is B Effective revenue deficit.

For “official” reference, you’ve to collect data from Annual financial statement from interim budget 2014

| DeficitBE-2013RE-2013BE-2014 | ||||

| Fiscal Deficit | 542499 | 524539 | 531177 | |

| GDP% | 4.8 | 4.6 | 4.1 | |

| Primary Deficit | 171814 | 144473 | 104166 | |

| GDP% | 1.5 | 1.3 | 0.8 | |

| Revenue Deficit | 379838 | 370288 | 378348 | |

| GDP% | 3.3 | 3.3 | 2.9 | |

| Eff. Revenue Deficit | 205205 | 232060 | 210244 | |

|---|---|---|---|---|

| GDP% | 1.8 | 2 | 1.6 | |

लेकिन यार इतना डिटेल में कोन प्रिपेर करता है? (who prepares in this much detail!?)

Banking and finance related

Three questions here too.

B1: PSU Bank ownership

107.The Economic Advisory Council to the Prime Minister (PMEAC) in India has recommended phased dilution of Government stake in Public Sector Banks from:

- 74% to 56%

- 58% to 51%

- 58% to 49%

- 51% to 49%

Rediff Date 11th November 2013

Prime Minister’s Economic Advisory Council has recommended phased dilution of government stake in public-sector banks, from 58 per cent to 51 per cent, and introduction of on-tap licensing of new banks.

Therefore answer (B)

B2: Banking POS

113.Recently a leading public sector bank of India allowed withdrawal of upto Rs.1000 from any shop/trader with a point-of-sale (PoS) terminal. Identify the bank from below:

- Bank of Maharashtra

- Punjab National Bank

- State Bank of India

- Bank of Baroda

Answer is State bank of India. Ref Hindu Businessline dated 24th November 2013.

B3: SEBI norms corporate governance

5. Which of the following statements about the detailed corporate governance norms for listed companies issued in April 2014 by SEBI is/are correct ?

- It provides for stricter disclosures and protection of investor rights, including equitable treatment for minority and foreign shareholders

- Under the new norms listed companies are required to provide the option of facility of e-voting to shareholders on all resolutions proposed to be passed at general meetings.

Select the correct answer using the code given below:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Answer C Both 1 and 2 Correct

Both statements lifted from Indianexpress 17th April 2014

Remaining parts coming soon. Corrections post in comments with reference.

Visit Mrunal.org/answerkeys for more answer keys with explanations.

![[Errors/discrepancy] 16 MCQs where UPSC Official Prelims-2020 Answerkey & Coaching classes differ, while 2 MCQs cancelled](https://mrunal.org/wp-content/uploads/2021/11/csp2020-akey-differ-table-500x383.png)

Sir i have joined the central government service recently. Am i eligible for age relaxation in capf ac exam

Dear mrunal sir,

i have attempted 92 question, 20 is wrong…

so is there any chances for next round…

Dear Manish,

can you provide us the key from which you evaluated your answers,

so that we can also check our answers !

if ur estimate is right. Then there is chance for u to appear for PET, but it also depends upon ur essay. If u qualify then all fine but if not then no way.

@wolfpack buddy i meant to say in terms of reservation of seats ….not in terms of level of cds vs cpf or any other exam

hallo sir according to me ac paper much tough.Gaar 2016,remaining questions ans will solv ,

hallo sir mere hisab s isbar papr kafi hard tha eco k 5 rt h baki qs k ans kab daloge

130 any chance????

Sir,

I belong to SC category.

i am expecting around 85-95 in paper 1 .and my paper 2 is satisfactory.

what is my chance for PET ???

http://wto.org/english/thewto_e/minist_e/mc9_e/desci38_e.htm

Sir,Please post preference list for SSC CHSL Exam and also exam analysis

Sir,Please post preference list for SSC CHSL Exam and also exam analysis

What can be the possible cut off for SC category?

I m getting around 108 from SC, any chances?

And also when do upsc guys publish result of this exam, or answer keys…. any tentative schedule

Hello sir. Has rbi grade b exam’s hallticket been uploaded…??? I havenot got any mail or message regarding it. Can anyone please tell..??

Dude,not yet…

Hopefully it will come sooner,asd notification also gave timeline of fourth week of july onwards.

Late here automaticlly would entail to shifting of exam dates.

BREAKING NEWS—

RBI grade B admit card out…….

http://rbi.org.in/scripts/bs_viewcontent.aspx?Id=2859

mrunal bhai thoda jaldi karno na next part upload karne mein!!

Sir, could u plz provide brief acct of few acts, in ur style..such as FRA, EPA, Wild life protection act, Eco Sensitive Zone guidelines, and ESA..

I could not find brief accts of these..getting full pdf texts..or full legal verbatim..

Static portion was just like last year’s paper, some questions worth Mrunal’s comment “YAAR ITNA DEEP ME KAUN PREPARE KARTA HAI” but it is the easy ones which give head ache in exam by creating confusion that turns into negative marks. Many debatable questions were there last year too. Easy or tough, is only one’s own perception.

Some of your answers in this and D booklate are contrary.

someone please give question paper link.

A dead silence everywhere about possible postponement of syllabus.Although it has slowed me to some extent.@Mrunal sir waiting for your articles.

sir can u plz provide solution for rest portion other than economics??

mrunal sir………………… extremely needed.. RBI GRADE B phase 1 previous years paper…. plzz render it ASAP. my exam is on 3rd aug.. and clashing with UPPCS.. …. (which exam to go for UPPCS or RBI GradeB) ?? …………..

Same with me Ashish I would suggest you go for UPPSC although it will take three years in completing but that kinda back a UPSC candidate must look for.Chances of clearing UPPSC Pre is much more than RBI grade B………..

I am going for UPPSC knowing full will that it will take at least three years but RBI mains must hinder my performance in UPSC mains(assuming i clear UPSC Pre and it happens on time)

vinay ru from UP ??…. well i am pondering to give RBI grade b…. bcz first..this year… my target is not upsc.. but yes i m preparaing for it.. and preparing economy for upsc too… so it will adv for me for rrbi exam… and SECOND…. i gave uppsc pre last year could not clear it and i think i cant clear it this year too until there is akhilesh govt…(2013 exam passed many candidates belonging to akhilesh-mulayam caste peoples—- this is bcoz u know vry well UP means CASTEISM in every aspect.. if u r from UP) and uppsc has TWO optional subject… :( i could give if have i done some MA from IGNOU..

Mrunal sir,,please provide solution to the remaining question,,

I have been clearing CPF Written since two times but unfortunately i couldnt clear PET test Both the times,,This time I have done better than previous ones.

Dear Mrunal Sir I have attempted 82 Q and I think 10-15 Q I have attempted is wrong ..then around 65 Q is correct ..so is any chance to qualify for PET ..and paper 2 I am expecting 80-90 marks

mrunal sir………………… extremely needed.. RBI GRADE B phase 1 previous years paper…. plzz render it ASAP. my exam is on 3rd aug.. and clashing with UPPCS.. …. (which exam to go for UPPCS or RBI GradeB) ?? ………….. sir same for me

I think you should go for RBi garde B exam,if you are prepared well about PCS exam with so many facts and figures and also good hold on CSat AND hindi part of the paper then you can go for up Pcs.In uppcs you have to go a long way and have to compete with much experienced babas,,they have been writing exam since four or more times.

plz someone send me the link cpf 2014 keys

regarding Wheat MSP doubt:

1450: was “proposed” by Agri ministry (October 2013). But I’m unable to locate source where it says government accepted / announced 1450.

July, 2014 Financial express says

” government had announced a Rs 50 hike in the minimum support price (MSP) to Rs 1,400 per quintal for wheat procurement for 2014-15 marketing season.”

NCERT micro text page 32.. Delta(E)=Delta(p).q.(1+e)

E is expenditure, p is price, q quantity, e elasticity.. now E goes up, as p goes up and vice versa.. so the coefficient q(1+e) has to be positive…

So, e>-1.. so one could say |e|1 will also give same result..

leave textbook aside, mathematics calls for staying away from such time-killing questions :)

@mrunal sir asap plz upload rest of keys

mrunal sir plz give ans of other questions

sir please could you upload full capf 2014

question paper as it is not available on internet