- Mock Question for UPSC Mains GSM3

- Answer#1: Fiscal Stimulus: To give or Not?

- Introduction:

- Direct Taxes alone can’t fill treasury even after Demonetization

- Indirect Taxes: Non-cooperative fiscal federalism

- Non-Tax Revenue potential is limited

- Money is better spent in social sector than as fiscal stimulus

- Fiscal Stimulus creates more problem than it solves

- Conclusion (Finding Type: F.S. give or not?)

- Answer#2: GST hurts small traders/MSME so give Fiscal Stimulus?

Mock Question for UPSC Mains GSM3

Answer following Questions in 200 words each, in Blank A4 Sized pages with 1″ margins on each side.

- What is “Fiscal Stimulus”? India’s quarterly GDP (gross domestic product) growth has declined for the sixth consecutive quarter in June 2017. Critically examine the feasibility of a fiscal stimulus package to invert this trend.(Fiscal Stimulus: राजकोषीय प्रोत्साहन)

- Small traders & MSME have been complaining that GST has negatively affected their business. Should government of India provide a fiscal stimulus package to help them? Yes / No? Justify your stand. (GST: वस्तु एवं सेवा कर)

Syllabus Relevance: UPSC General Studies Mains Paper3 (GSM3): Indian Economy (issues related to planning, mobilization of resources, growth, development, employment); Government Budgeting.

Media begun speculation in Sept 2017 that Jaitley would give fiscal stimulus in Oct-2017 (esp. on DDU’s anniversary) but he says he never said / planned it!

Answer#1: Fiscal Stimulus: To give or Not?

Introduction:

There are three ways to begin any answer (1) definition, (2) origin, (3) data. Given the peculiar nature of these questions- it’s better to begin with a combination of ‘definition + origin’ of Fiscal stimulus.

Fiscal stimulus is a temporary increase in public spending or a temporary reduction in the taxation to boost economic growth. Earlier, it was given during 2008-09 to stimulate Indian economy in the aftermath of subprime crisis. The fall in the growth figures in the aftermath of demonetization and GST (or the fall in quarterly GDP growth rate for six consecutives times), has generated the demand for yet another fiscal stimulus for Indian economy in 2017-18.

Fiscal stimulus is like steroid- it gives short term boost. Once withdrawn, the impact may go away. Hence the word “Temporary” is important.

In practical terms, a “Fiscal stimulus package” means Government initiates following actions:

| Forgoing taxes: | Increase Expenditure: |

|---|---|

|

|

- Experts opine that size of such stimulus has to be minimum Rs.40,000 crores to spark ignition / recovery in the Indian economy to thaw it from the chilling effects of Protectionism, Demonetization and GST.

- But in the present circumstances, difficult for the government to forgo this much tax, or spend this much additional money because:

One should spread his legs after measuring the length of the blanket. Else Fiscal Deficit will overshoot.

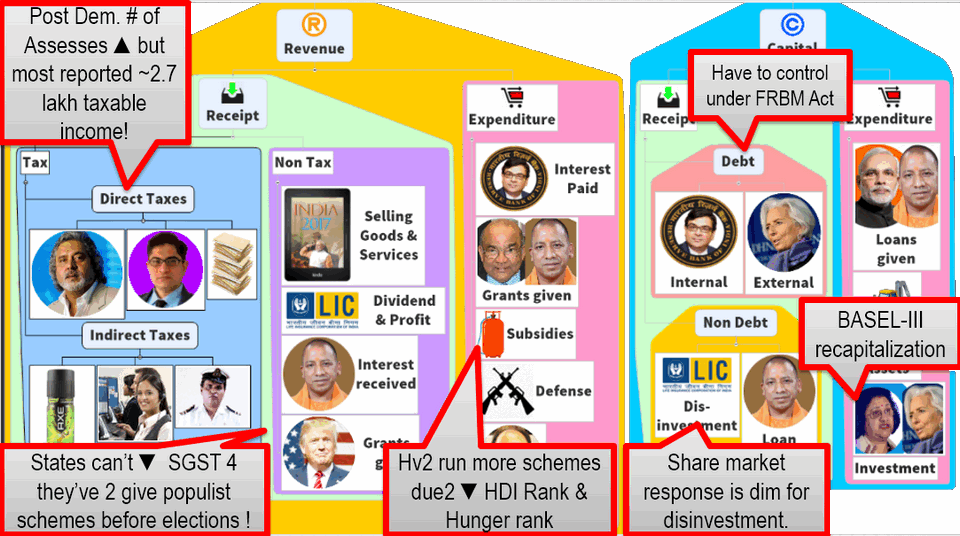

Direct Taxes alone can’t fill treasury even after Demonetization

- Economic survey vol1 had predicted that demonetization will increase the number of tax payers and direct tax collection.

- But, as new data arrived, Economic survey vol2. noted that while no. of tax assesses have increased after demonetization, but majority of them have declared taxable income ~2.7 lakh rupees, so Government is unlikely to get large amount of direct taxes from them.

- IT department has unearthed suspected transactions during demonetization, and issued notices to such companies and individuals, but recovery of such amount could take a lot of time, because of appeals and litigations.

माने के अतिरिक्त ४०,००० करोड़ प्रत्यक्ष करो से हांसिल हो जाए ये संभव नही.

Indirect Taxes: Non-cooperative fiscal federalism

- While states get to keep the entire SGST revenue, Union has to share part of the CGST amount with the states as per the recommendations of finance commission.

- Therefore, union can’t be expected to launch a GST related fiscal stimulus ‘unilaterally’, it will require both union and the states to cut the indirect tax rates, but states may be reluctant for this because:

- Some of the states have announced / planning to announce farmer debt waiver packages.

- Some of the states have implemented / planning to implement liquor prohibition. It reduces their own state excise from liquor.

- With the looming state assembly elections in mind, the state governments are on war footing to declare new schemes, begin new construction projects, initiate large scale recruitments, regularize the jobs of contractual teachers, lecturers, constables, Asha workers, patwaris, forest guards and other cutting edge functionaries OR raise their ‘fixed’ salaries, and so forth.

1+2+3 puts additional stress on states’ own fiscal deficit targets under the FRBM Act. So, they’ll be reluctant to cut VAT on fuel and electricity / OR SGST on any goods / services to boost consumption.

Non-Tax Revenue potential is limited

Government did not earn enough from the spectrum auction and disinvestment against the budgeted targets in 2016-17. The new financial year is unlikely to be any better because:

- Jio 4g effect: The price war among the telecom companies have reduced their profitability. Some of these companies are having interest coverage ratio turning less than 1, meaning they’re not even earning enough to pay the interest on past loans! So, even if Government launched another round of spectrum auction to makedo for the 40k crs, the auction will receive a dim response. (besides, even if telecom companies wanted to bid high amount on borrowed money, banks themselves reluctant to lend due to TBS problem!)

- Recently launched IPOs of SBI life insurance etc. received lukewarm response from the market. IF government launches any direct disinvestment right now, it’s unlikely they’ll fetch premium prices. Even if they launched ETF, It may not get fully subscribed.

Hence proceeds from the disinvestment are unlikely to fill treasury with such amount that we can launch fiscal stimulus package. Because already we’ve two large expenditures ahead

- The implementation of 7th Pay commission puts additional burden on the treasury.

- Given the NPA problem in PSBs, Government may have to provide larger capital to comply with the BASEL-III norms [FRBM Review Panel also said the same].

Money is better spent in social sector than as fiscal stimulus

- In HDI-2016 report, India’s rank has deteriorated (from 130 to 131).

- Under the UN sustainable development goal #1, we’ve promised to be a hunger free country but in Global Hunger Index-2017, India slipped to 100th Rank. We are ranked worst than even North Korea. We’ll have to spend more on food and nutrition schemes.

- Public Health Policy 2017 aims to increase public health spending to 2.5% of GDP.

- Government aims for 100% ODF India @2019 and 100% housing and 100% poverty free India @2022. The pace of improvement is lagging against projected targets, hence government will have to spend more here as well. (especially as general election 2019 date comes near!)

In the light of above facts, if Government has additional 40,000 crores to be spent, they’re better spend on such social sectors – particularly health and hunger, than a fiscal stimulus for MSME/small traders.

Fiscal Stimulus creates more problem than it solves

Economic survey 2016-17, Vol1. analyzed the impact of past fiscal stimulus and concluded that for India- A fiscal stimulus, led “growth” is a problem rather “Solution”, because:

- Our Tax:GDP is low. Fiscal stimulus makes Government to spend money beyond its “means”. This translates into high fiscal deficit.

- Leakages of the stimulus package leads to Inflation, and thereby reducing the efficacy of monetary policy in combating inflation.

- Expansion of public Expenditure / high inflation, leads to depreciation of Indian Rupee against foreign currency, thereby further raising the import bill of crude oil.

Therefore, Budget 2017-18 targeted fiscal deficit at 3.2% of the GDP. FRBM review panel has recommended even more parsimony and bring this Fiscal Deficit down to 3%.

Question is about “can we give fiscal stimulus?” and not about ‘examining why growth fell for 6 quarters?’ so we should not spend more words on dissecting GDP fall- let’s summarize it in the conclusion itself.

Conclusion (Finding Type: F.S. give or not?)

- 2014 and 2015 were drought years which had severely affected our agriculture growth rate.

- The NPA, Twin balance sheet problem and the subsequent reluctance of banks to lend, have affected the expansion of our MSME sector.

- The rising protectionism in the developed nations affected our service exports.

- Both IMF and the Economic survey 2016-17 have pointed out that foundations of Indian economy are strong, GST and Demonetization have created short term challenges particularly for the unorganized sector, but they present many benefits in the long term.

- Therefore, while we should continue to work for economic reforms, but a short term & populist solution such as fiscal stimulus, should be avoided.

We can do more PHD “thesification”, but these many points sufficient even to handle a 1200 words essay. However, if it’s a 1200 words essay you should diversify the points and talk about the need for economic reforms in individual sector of economy, instead of focusing solely on Fiscal consolidation (parsimony: बचत) as I’ve done here. Anyways, let’s move to the next question:

Answer#2: GST hurts small traders/MSME so give Fiscal Stimulus?

Introduction:

There are three ways to begin any answer (1) definition, (2) origin, (3) data. Given the peculiar nature of these questions- it’s better to begin with a combination of ‘definition + origin’ of GST.

Goods and services tax (GST) is a destination based indirect tax on consumption. It has been implemented in India under the 122nd Constitutional amendment act with effect from 1st July 2017. Since its inception, the small traders & businessman have been complaining and demanding relief. Following is the assessment of GST problems and whether they necessitate a fiscal stimulus package or not?……

Since you’re mentioning GST for the first time, you should write it in full form: Goods and services tax into bracket GST bracket closed.

Body#1- GST & Higher compliance Cost?

| Issues in GST | Assessment |

|---|---|

|

|

|

|

|

|

Body#2- GST & Reduced Consumption?

- There is no GST on unbranded or fresh food items. Sugar, tea, coffee and edible oil etc. will carry a concessional GST rate of 5%. So in theory, GST is unlikely to have reduce consumption / sale of these goods.

- Toothpaste, soap and hair oil and other fast moving consumer goods (FMCG) which are meant for mass consumption- earlier that attracted 22-25% total tax under Excise-VAT system but now only 18% GST. So in theory, it ought to boost consumption and benefit small traders. Even if MNCs are producing these items, local MSME also ought to benefit via Ancillarisation.

- MSME account for 40% of our exports. Under GST regime, exports are zero rated so it ought to boost exports. But, Protectionism in the developed nations, as well as the competition from other Asian economies for our lackluster export figures. So, fiscal stimulus is unlikely to improve things. We’ve to address those underlying fundamental issues related to skill, technology, logistics and ease of doing biz.

- Government has already rationalized the GST rates to help Textile and garment traders. (Oct 2017)

- Earlier total service tax + Cess was 15% but GST on services is 18%. This could have indirect negative effect on the sales of even goods, as household reduce consumption of non-essential items to make do adjust monthly budget. [e.g. household buys cheaper shampoo brand because son’s competitive exam coaching fee has increased on account of 18% GST]

But, the overall impact on the small traders / MSME sales is difficult to quantify from the reports of just one or two quarters, because Indian households’ consumptions are determined by many factors including festivals, seasons and inflation in food and fuel.

- For July 2017, Government collected total Rs.95,000 crores in GST but suppliers have reclaimed 60,000 crores from it as input credit. GST itself has not yet filled Government treasury in sufficient capacity. (meaning, if you are thinking the GST amount collected from top corporates like infosys, Reliance and tata could be used to announce some relief to small traders- then it’s not possible for now.)

- Any fiscal stimulus package at present might endanger our fiscal deficit targets under the FRBM Act.

- Economic survey has pointed out that fiscal stimulus led growth leads to higher fiscal deficit, inflation and depreciation of domestic currency. Thus fiscal stimulus creates more problems than it solves.

- Depending on the time and space you can also justify that government doesn’t have enough money for a fiscal stimulus package, because of its prior commitments under FRBM act and social sector obligation- for more fodder, refer to Answer#1’s body.

- If you can’t think of more points and the answer space is still left, then you can fall back to “benefits of GST to small traders/MSME” for padding the answer sheet.

- Question was “should we give fiscal stimulus / tax break to small traders or not? Hence it’s a ‘critically examine’ type of question. Conclusion should be “finding type”.

Conclusion: Finding- GST merits reform not F.S.

- It’s difficult to justify a fiscal stimulus or determine the quantum of loss for small traders/MSME with limited data of just one quarters (July to September 2017).

- GST is a new ecosystem, therefore in the initial few months, both the suppliers and the tax authorities will have to adapt and iron out the technical and administrative issues, instead of looking at fiscal stimulus as a quick fix to these problems.

Useless to do CA-giri on how section __ of CBEC notification dated __ is harming small traders. but these many ‘generic’ points are sufficient.

Btw, I wish a Happy Diwali and a Prosperous New Year to all the serious and hardworking players. (Because non-serious & lazy candidates’ new year can’t be prosperous even if I wished.)

![[Lecture] Mrunal’s UPSC GSM3-2020 Model Ans: Science Technology, Internal Security & Border Management Questions from last Mains Exam Solved!](https://mrunal.org/wp-content/uploads/2021/11/AD-GSM3-2020-IntlSecu-fb-500x383.jpg)

![[Lecture] Mrunal’s UPSC GSM3-2020 Model Ans: Agro, Food Proc, Environment, Disaster Management](https://mrunal.org/wp-content/uploads/2021/11/ad-gsm3-20-agro-TB-500x383.jpg)

Happy Diwali dear Mrunal Sir.

Thanks for the material.

In all this ho-halla around Fiscal Stimulus, most of the points i had covered but left the most important one, WHAT IS FISCAL STIMULUS ? Thanks again for pointing that out.

Happy Diwali

Happy Diwali sir !

well done Mrunal sir HAPPU DIWALI TO YOU AS WELL

wish you happy new year ! please give some ideas for essay test topic test 29 november

thnk you ..reply sir

This line inspired me the most ?Because non-serious & lazy candidates’ new year can’t be prosperous even if I wished…he he really witty..

Happy Diwali sir

cds-17/2 also mention in notification of day left

Thanks sir

Very important topic for Mains 2017 “Merits,demerits and features of Interlinking of Rivers” .Link : https://www.iassolution.com/interlinking-of-rivers/

Happy mains

thanks for it sirrrrrrrrr…….

and

happy Diwali & gujrati new year

Thanks for this topic.

Happy New Year Sir! Sir pls the answer writing section be published everyday

Paper 4 related answer writing segment also be described

Superb sir..