- Demographic Dividend?

- Why jobs are not created?

- Problem#1: MSME

- Labour laws

- Case#1: downsizing

- Case #2: Shifting business

- Rigid Labour laws: Implications?

- Pro-Worker or Pro-employer?

- Apprentices

- Apprentice: Indian scenario

- Education

- School Governance

- Education: recommendations

- CONSEQUENCES AND CONCLUSION

- Mock questions

Demographic Dividend?

In next 35 years, around 70 percent of India’s population will be between the working age of 15 and 59.

| By 2050 | Employable people (crores) |

| India | 100 |

| Europe | 45 |

| USA | 27 |

- It means, India will have more number of people in the productive age groups= more incomes=more demand of products= more growth=high GDP.

- Seems plausible in theory. But hard to do in practice.

- A larger workforce translates into more GDP only if there are productive jobs for it.

- If people are given work of digging up wells and ponds (MNREGA), they’re employed but that doesn’t lead to significant rise in GDP (compared to if same number of people were given some skill training and job in manufacturing or service sector).

- So If you really want to tap the demographic dividend, then labour force must go through following “transitions”:

- From agriculture to non-agriculture (manufacturing / service sector).

- from rural to urban

- from the unorganized sector to the organized.

- from subsistence self-employment to wage employment.

Why jobs are not created?

Problem#1: MSME

MSME= micro, small, and medium enterprises. MSME is defined as per investment in plant and machinery.

| Sector-> | Goods | Services |

| Micro | Upto 25 lakh | 10 lakh |

| Small | 25 lakh to 5 crore. | 10lakh-2cr |

| Medimum | 5-10 crore. | 2cr-5cr |

- MSME sector employ 80+ million people in 30+ million units across the country.

- But in the MSME group, most of the firms are “small”, there are hardly any “medium” enterprises. Why?

- Because The regulatory environment plays an important role in the lifecycle–birth, growth, and death of MSMEs

- Small scale firms more receive tax benefits from various Government schemes. For example

- If your firm has less than annual 10 lakh Revenue= you don’t need to pay service tax.

- Similarly, less than 1.5 crore annual turnover= you don’t have to pay Central excise duty.

- While medium scale firms have to pay more taxes, have to obey more regulations on pollution, social security of employees etc.

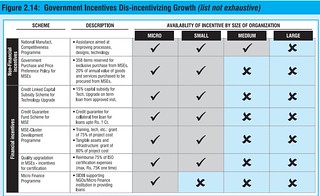

- For more, check this Table:

- That means, if your firm grows from ‘small’ to ‘medium’ size = Government benefits reduced but Government regulation increased.

- So most of the small scale firms don’t buy expensive machinery for production.

- In the short run: owner makes decent profit because there is less investment (in machines) + contract laborers are cheap.

- In the long run: their productivity remains very low (compared to Chinese or American firms of same size.)

- Low productivity gives them little incentive to grow, completing the vicious circle.

Problem: Bureaucratic procedures

- According to the World Bank’s Doing Business 2013 data, India ranks 132 out of 185 countries in ease of doing business.

- Entrepreneurs have to obtain a number of clearances when applying for building/occupancy permits and utility connections (gas, electricity, water, pollution control).

- They’ve to separately visits to various Government offices and applications are not approved without bribes.

Problem: Infra bottlenecks

- Lack of quality infrastructure (roads, railways, telecom-internet-electricity connectivity etc.)

- Big firms are less impacted by such bottlenecks, because they have the cash to create alternatives. For example, if electricity is gone, a big company can install huge diesel generator/ its own thermal plant.

- So, absence of quality infrastructure increases transaction costs disproportionately for small and medium sized firm.

- Ok so solution = Government should create quality infrastructure. But there is a problem there too:= land acquisition.

- However it doesn’t mean, Government is not doing anything to improve infrastructure. One of the prominent project is Delhi-Mumbai Industrial Corridor (DMIC).

- DMIC project worth 90 billion dollars, covering about 17 percent population and 14 percent land in India

- It extends over Delhi, Uttar Pradesh, Haryana, Rajasthan, Madhya Pradesh, Gujarat, Maharashtra, Daman and Diu, and Dadra and Nagar Haveli

- The project goals are to double employment potential in 7 years, triple industrial output in 9 years, quadruple exports from the region in 8-9 years

- skill-building strategy in DMIC is based on a hub-and-spoke model. There will be one Skill Development Centre in every state with subsidiary institutions linked to it. Curricula will be based on the types of industries located in the region and identified regional strengths.

- Other infrastructure plans include logistic hubs, feeder roads, power generation facilities, up-gradation of existing ports and airports, developing greenfield ports, environment protection mechanisms, and social infrastructure.

Problem: Getting finance

- Suppose you finished cooking/catering course and you wish to start a restaurant/cafeteria. For that, you need initial investment of let’s say 30 lakh rupees.

- But you don’t have a single penny in your pocket. So you decide, “I’ll not borrow even a single rupee from anyone. first I’ll work in some other person’s hotel/restaurant. Save money and once I’ve 30 lakh, I’ll open my own restaurant.”

- Problem?= well, depending on your salary (+family expenses), It’ll 5-6-15 years to save that much money and by then inflation would have increased (property rents, electricity, milk, vegetables, tea, coffee etc.) so at that time, 30 lakh won’t be sufficient to start a restaurant, you’ll need 50 or 70 lakhs!

- Thus, most of the time you can’t start business by ^above approach. You’ve arrange finance from someone else. And we already know there are two ways arrange cash/finance to start a business: first is debt and second is equity. Click me

- For small scale firms, arranging finance by either way (debt or equity) = headache. Because

Problems in Debt (borrow) method

- Many small firms have defaulted on loans in the past. Therefore bank officers are often reluctant to approve their loan applications.

- To prevent ^risk of loan-default, bank might ask for collateral (e.g. property/valuables that bank can attach if you don’t pay EMIs) but most small scale entrepreneurs don’t have such collateral.

Loan application procedures are “bureaucratic” in nature: they’d ask you lot of documentary proofs (like income tax returns, account books, property papers and so on). But most small scale firms run business informally without maintain lot of paper records.

Problem in Equity (partnership, IPO, shares)

- Launching IPO = requires lot of paper work, team of CAs, finance experts, lawyers etc. = small scale firms don’t have it.

- In India, Angel investors, venture funds are at a nascent stage and small compared to America. (Their meaning / functions already explained in Debt-Equity article.)

- The Indian angle investors and Venture funds prefer to invest in technology and e-commerce related business. So small scale firms (mostly concentrated in manufacturing sector) don’t get finance from them either.

Solutions?

- A vibrant corporate bond market could help.

- Even though the MSMEs will typically not be able to issue bonds

- But large firms and infrastructure projects will be able to access (typically cheaper) bond financing for their long-term projects.

- So banks will get that much less loan takers from “upper end of the pyramid”= banks will have more spare cash lying around. Then they’ll be tempted to loan that money to small and medium sized firm to earn some profit (interest).

Labour laws

- India’s labour regulations have been criticized on many grounds including sheer size and scope.

- There are 45 different national- and state-level labour legislation in India.

- Labor laws in India = very rigid.

- As the size of a factory grows, it increasingly becomes subject to more and more outdated laws.

- This has hindered the growth of large-scale manufacturing industry.

- Let’s understand this with an example:

Suppose you’re running a firm with 500 employees, exporting diamond jewelry to USA. But due to recession in USA, the demand of your diamond jewelry has decreased.

Case#1: downsizing

- Demand of your company’s products is decreased, and there is no way you can increase demand because Americans don’t have money, so no matter how much you spend on advertisement, they won’t buy more diamond jewelry.

- On the other hand, Indian consumers prefer gold jewelry instead of diamond.

- So you cannot increase the demand, then you have to reduce your input costs, else you’ll start making losses.

- One way to reduce input cost is “downsizing”=lay off a few workers, so you’ve to spent less money on wages.

- But according to Industrial Disputes Act (IDA), if a firm with more than 100 workers, wants lay off workers, it must get permission of state governments (via Labour Commissioner).

- While the Industrial dispute act does not prohibit laying off workers but State Governments are often unwilling to grant permission because opposition parties will make an issue out of it saying “This Government is anti-worker, anti-poor.”

Case #2: Shifting business

- Since you cannot lay off workers easily (case#1), you decide to shift the business and use those workers.

- Instead of diamond jewelry, you decide to make gold jewelry, stop the export oriented business, and concentrate on domestic Indian consumers.

- But according to the same Industrial disputes Act, if the employer (boss) wants to change the terms and conditions /salary/ job description of workers or if he wants to move workers from one plant to another, then he must get (written) consent of workers.

- This again increases rigidity. The trade union type leaders will blackmail the employer, “Give xyz amount of money else we will not sign the consent papers.”

Rigid Labour laws: Implications?

Because of the rigid labor laws, It is very difficult for the sick industry to either shut down, downsize or shift business arena. So Indian businessmen try to bypass such laws by

- buying some expensive machinery to do to the production. =Industries turn capital intensive rather than labour intensive= less jobs created.

- hiring contractual labour without doing paper work (so industrial disputes act doesn’t apply in the first place!) and if there is any raid, they’ll simply bribe the officials.

- + outsourcing non-core activities to even smaller firm and those smaller firms also hire contractual labour without doing paper work. Ultimately these things lead to

- Roughly 85 per cent of the workforce is engaged in the informal sector. = They don’t receive social security benefits, pension, insurance, provident fund disability /maternity benefits, paid leave etc.

- informal workers are also more vulnerable to violations of basic human rights such as reasonable working conditions and safety at work.

- With little job security and limited access to safety nets, most of the informally employed remain extremely vulnerable to shocks such as illnesses and loss of income.

- Workers in informal sector are usually poor and hence they have neither the time, money or knowledge to approach courts to seek justice.

- Thus informality and poverty are directly linked with each other.

Pro-Worker or Pro-employer?

- From above examples, it is clear the Government needs to make labour laws flexible. But when Government tries to reform labour laws, opposition parties and trade unions create lot of hue and cry.

- Besides, there is always some state Government election after every few months so the ruling party in union Government doesn’t want to lose any vote bank. That’s why labour reforms are always put on backburner.

- Anyways, if and when Government decides to reform labour laws, what should be its “form”? should it be pro-worker or should it be pro-employer?

- In most countries, there is a “middle path” in labour laws= not too “pro-worker” and not too “pro-employer” either. Such laws provide for

- Employer can terminate a worker in case of business distress or for poor worker performance.

- At the same workers are provided a redressal mechanisms if they’re fired without cause

- Compensation for severance and unemployment benefits.

Apprentices

- Apprentice = Someone who works for an expert in order to learn a trade.

- For example hawala operator, cricket bookie, running your own liquor and gambling dens etc.

- Such trades cannot be learned by reading theory from books. You’ve to work under a master for many months and years to learn the actual skills. That is called Apprenticeship.

- The syllabus taught in Indian schools, colleges and polytechnics =outdated.

- The present Indian education system doesn’t produce “Work-ready” labour force. That gap is filled by the system of Apprenticeship.

- Apprenticeships are an effective way of ensuring that entry-level workers have the skills required to join the formal workforce by ‘learning on the job’ and even ‘earning while learning’.

- Several countries have benefited greatly from focused programmes Apprenticeship. For example Japan, US, UK, and Germany.

- Germany, in particular, has a well-known dual education system that combines classroom/online courses at a vocational school with workplace experience at a company.

- More than 75 per cent of Germans below the age of 22 have attended an apprenticeship programme.

Apprentice: Indian scenario

Years ago, Government had enacted Apprenticeship Act. But it is outdated and rigid from both employer’s and worker’s point of view.

Problem#1: Apprentice ratio

- The statutory limit on (regular) worker : apprentice ratio is very strict.

- Implication: suppose the rules say for a drug company, worker : apprentice ratio cannot be more than 20:1.

- You recently finished final year exam and now you need an apprenticeship certificate otherwise university won’t give you degree for B.Pharm.

- But the factory nearest to your home already got another apprentice and factory owner cannot take you because his quota is over according to that ratio.

- Ratios are strict because Government feared that businessmen will show their regular workers as “apprentice” on paper, in order to pay them very low salary.

- Even for small violations of Apprentice rules, the penalty provisions for companies, are very severe. So no matter how much you beg or request, the factory owner won’t take you as apprentice once his quota is over.

- Thus the whole purpose of apprenticeship system is defeated because of that outdated law.

Problem#2: coverage

- Apprentices are only allowed in specified trades: for example Pharmacist, Engineers etc.

- But majority of graduates are not currently covered under formal Apprenticeships.

Some recommendations

- Simpler regulation: A single window mechanism is needed to clear company applications for pan-India apprenticeship programmes.

- Wider reach: Add more graduation fields in Apprentice Act.

- company-led apprenticeship programmes, that place employers at the heart of education, can play a powerful role in imparting job-relevant skills and also repairing, preparing, and upgrading the labour force.

- For example, the duration of apprenticeship training can be allowed to vary across trades and companies.

- Short-duration programmes (less than 12 months) can be freed from much of the oversight provided they pay minimum wages.

- Relaxing the rigid requirements on the ratio of apprentices to workers could also accelerate capacity creation

- Dual system of training: Partnerships between companies and educational institutions should be encouraged

- Active exchanges: There should be active exchanges and portals, matching prospective apprentices to employers.

Education

Government measures its success in education sector mainly by two numbers:

- School enrollment.

- Money spent in mid-day meal scheme

If we just look at those two numbers, then everything looks hunky-dory. But does it mean all Indian children are getting quality education? But does it mean all Indian children are getting quality education?

According to ASER Survey-2012 (by NGO Pratham)

- Among all children enrolled in Std. 8, only 47% could read English sentences. And Of those who could read English words or sentences, barely 60% could convey its meaning in their own language.

- In class 5, more than 50% students cannot read a class 2 level textbook.

- In class 5, almost 50% students cannot solve two-digit substraction (e.g. 49-23)

- In class 5, almost 75% students cannot do division. In rural India as a whole, 75% of kids cannot do simple division. (e.g. 25/5)

Interestingly, Mohan has declared the year 2012 as the ‘National Year Of Mathematics’ to mark the birth anniversary of Indian mathematical genius Srinivasa Ramanujan.

- Anyways, point is Indian children are bad at maths, English and comprehension (especially in Government school).

- But “There are no bad students, only bad teachers”. (says Jackie Chan in Karate Kid)

- There is no positive relationship between teachers possessing formal teacher training credentials (B.Ed, M.Ed) vs. their teaching caliber.

- Besides, State Governments treat teachers as contract laborers, paying extremely low salaries to those “teaching assistants / vidhya sahayak”.

- Hence there is no incentive for teachers to pour their hearts and minds into child-education.

- On the other hand, since money is low, it doesn’t attract brilliant minds into teaching profession in Government schools.

Pedagogy

- The default Indian pedagogy (method of teaching) = complete the syllabus of textbook.

- But it does not reflect the learning levels of children in the classroom, who are considerably further behind where the textbook expects them to be.

School Governance

- In Government run schools, there is high rate of teacher absence .

- The fiscal cost of teacher absence was estimated at around Rs 7,500 crore per year.

- There is evidence that even modest improvements in governance can yield significant returns.

Education: recommendations

- If Government improves the monitoring and supervision of its schools, then teacher absence will reduce significantly.

- Government should make learning outcomes an explicit goal of primary education policy (rather than “finishing textbook syllabus).

- Government should invest in regular and independent high-quality measurement of learning outcomes.

- Government should motivate teachers by rewarding good performance.

- Government should Launch a national campaign of supplemental instruction targeted to the current level of learning of children (as opposed to teaching to the textbook) delivered by locally hired teacher assistants, with a goal of reaching minimum absolute standards of learning for all children: There is urgent need for a mission-like focus on delivering universal functional literacy and numeracy that allow children to ‘read to learn’.

- Government should pay urgent attention to issues of teacher attendance, teacher performance measurement, better monitoring and supervision.

CONSEQUENCES AND CONCLUSION

- Recent economic history is replete with examples of economies that were supposed to have great potential but ultimately did not achieve rapid economic growth and improvements in standards of living. India could become the next example of it.

- In India reforms are typically implemented only after there is really big crisis (for example 26/11, or Delhi rape). And that too after long debate and after some sort of political consensus is reached on them.

- Let’s check the possible scenarios:

Approach #1: Business as usual

If Government continues on the current path then effects on Indian society and economy will be as following

- Some improvement in infrastructure but only slow improvement in education, and no change in institutional structure such as business regulation and labour laws.

- Some movement from agriculture to low skill services such as construction and household work, but very few quality jobs.

- GDP growth settles into a comfortable 6-7 per cent, the new “normal”. Achieving 9-10% will be impossible.

Approach #2: Pro-active, Reformist

If Government seriously implements the necessary reforms then effects on Indian society and economy will be as following

- The manufacturing sector becomes a training ground for workers, absorbing more students with a middle or high school education.

- India moves into niches vacated by China such as semi-skilled manufacturing, even while enhancing its advantage in skilled manufacturing and services

- India experiences faster and more equitable growth.

- Social frictions are minimized as both agriculture and manufacturing create better livelihoods.

Approach #3: Populist, Anti-risk

In order to win election, if Government spends all money on populist schemes. It doesn’t implement reforms for the fear of opposition (like FDI, labour laws, land acquisition etc.) then effects on Indian society and economy will be as following

- There will be no improvement in infrastructure, education, or institutions

- Very few jobs are created outside of agriculture.

- ^because of that, more people stay in agriculture= Pressure on land will increase + Per capita income will decrease.

- Small agricultural plots do not provide enough income, nor can they be leased out.

- When things go really worse (a point is reached where monsoon is bad, farmplots are become extremely small, heavy inflation)…villagers will start large-scale migration to overburdened cities. (=problems of slums=unhygienic living conditions=outbreak of some contagious disease, increase in crime etc.)

- Then Government will come up with some scheme to prevent this large scale migration e.g. “Rajiv Gandhi Village mein raho yojana” under this scheme, whoever goes back to live in village, will be given monthly Rs.500 and 5 kilos of wheat. Thus strain on government finances increases. (=fiscal deficit=even more problems.)

- The Income inequality between good service jobs in cities and marginal agricultural jobs in rural areas increases tremendously= rich and poor divide grows even further=social unrest, breeding ground for Naxal elements.

Mock questions

Q1. Which of the following are correct about ASER Survey-2012?

- It is related to status of University education in India.

- It is an official survey conducted by Ministry of Human resources and Development.

- Only 1

- Only 2

- Both

- None

Q2. Government’s classification for Micro, Small or medium enterprise (MSME) is based on:

- Number of workers employed in a firm.

- Annual profit earned by a firm.

- Annual taxes paid to Government.

- Investment in plant and machinery.

Mains

| GS1 | Discuss the contribution of workers and trade unions in freedom struggle. |

| GS2 |

|

| GS3 | Examine the need for labour reforms in India. |

| Essay | Tapping the demographic dividend |

Interview

- ASER survey has highlighted the pathetic status of Indian primary school education. As a district collector, what will you do to improve the situation?

- Suppose you’re the PM of a country whose demographic dividend phase has passed (number of people in working age are very low compared to aged). So what new policies, laws will you launch to keep your economy booming?

- What do you understand by the term Industrial unrest. Can you cite any recent examples of Industrial unrest?

- Last year a Maruti General manager died following a labour unrest at the factory. Some company decided to leave operations due to labour unrest in Kolkata Port Trust. should trade unions be banned to prevent recurrence of such episodes?

![[Laws] DESI liquor special edition Kerala, Mizoram & IPS Training, Tribal insurgency](https://mrunal.org/wp-content/uploads/2014/09/Cover_Polity_kerala-liquor-500x383.gif)

![[Economic Survey] Corrections in the previous articles + Parting words before Qatl ki Subha](https://mrunal.org/wp-content/uploads/2014/08/Cover-Economic-Survey-correction-500x383.jpg)

Best part

“Rajiv Gandhi Village mein raho yojana” :D

wikipedia and also DMIC website says, the corridor covers only Mah., Guj., Raj., Hary., and UP. It has not mentioned anything about Madhya Pradesh. And even UTs like Diu and Dadra.

can you please confirm?

The way india is progressing is really worrying.populist govt,populist schemes,irresponsible opposition,draconian police system,corrupt bureaucracy,soft diplomacy,afspa,punctual cases of rapes ,murders,rigid labour laws,poor educatiin system,political hypocrisy,poor hea,lth standards,farmer suicides…nd still we prepare for upsc wit a hope we can change sumthng.reading the conclusion of tis article nf forecasting our india prospects is deeply paining nd agonizing.wish sumthng happens …in need of electoral reforms.hmm

you are the best sir,

sir, u have written the working age 15-59 years but in the survey this year its 15-64 years. which is the right one?

sir, kindly suggest some practical steps which can be taken by the govt to encourage big industrial houses to raise money by issuing corporate bonds and not through loans by banks as this can reduce pressure over msme’s …

Really nice 1.

Why have you not given notes on the demographic analysis done in the surevey this time.

This analysis is something new in the survey this year.

Your have completely avoided it.

Very sad.

Sir,

I can’t see the image below PROBLEM: BUREAUCRATIC PROCEDURES

seems your hostel/office firewall has blocked imageshake website that’s why image not appearing.

anyways, try this link:

http://www.flickr.com/photos/97816112@N02/9104490607

Thank you very much Sir.

sir hello.i asked u two questions some months ago but till now no answer .seems as if u r not interested in helping me .but still thanks for helping all.

sir you are an excellent guy with the greater understanding of entire subject..and your articles gives us an impetus to study more.

a greater gratitude for inspiring to do some service

and bring changes in our way of living..

we are with you sir.