- Prologue

- [Act III] FDI related current affairs [2014FebWeek1]

- [FDI] Multi brand Retail: “Gaddari” by Delhi & Rajasthan

- [FDI] Lobbying by Walmart and Amazon

- [FDI] Railways: FM, HM oppose Chinese FDI

- [FDI] Drugs Pharmaceuticals

- [FDI] Vodafone: fully foreign owned

- [FDI] Andhra favorite despite Telengana protests

- IFC Rupee bonds

- [FDI] Defense

- [FDI] Environment clearances

- [FDI] flows in last eight months (from highest to lowest)

- [Act IV] Regulatory bodies (Truckload of)

- #1: DGH: need statutory status

- #2: PNGRB- koi hum ko bhi puchho yaar

- #3: Civil Aviation Authority= no country for non-IAS

- #4: Rail fare regulator: I’m Useless without statutory status

- #5: Desi Drug regulator: I want Firangi powers despite staff shortage

- #6: 14th Finance Commission: homework abhi baaki hai

- #7: 7th Central Pay commission

- #8: EPFO- I want to stay in news everyday

- #9: IRDA- I also want to stay in news every day

- [Act V] Infrastructure related

Prologue

Overview of Economy related Affairs during 1-7 Feb 2014. Total three parts

- Part 1 of 3: fiscal and monetary policy

- (you’re here) Part 2 of 3: FDI, regulatory bodies and infrastructure.

- Part 3 of 3: bilateral, poverty-hunger-HRD, Agriculture-food processing and Persons in News (PIN).

[Act III] FDI related current affairs [2014FebWeek1]

Important basics:

- FDI matters are handled by Department of Industrial Policy and Promotion (DIPP), under Commerce Ministry.

- They release the FDI policy notification. (and not under Finance ministry or home ministry or corporate affairs ministry or external affairs ministry)

- There are two types of FDIs : automatic approval vs non-automatic (i.e. where government permission necessary).

- Where government permission is necessary, two things can happen:

| Investment upto Rs.1200 crore | Investment above Rs.1200 crore |

|

|

|

|

Other bodies related FDI

| CCI |

|

| CCI (infra) | Cabinet Committee on infrastructure. No longer exists. It is merged with Cabinet Committee on Economic Affairs (CCEA) |

| PMG |

|

[FDI] Multi brand Retail: “Gaddari” by Delhi & Rajasthan

| 2012 | Government permits 51% FDI in Multibrand retail. |

| 2013 | Total 12 states/UT permit FDI in Multibrand retail.

Including Rajasthan and Delhi (Congi government in both states) |

| 2013, Dec |

|

| 2014 | New state governments of Delhi and Rajasthan, write letter to DIPP saying “we want to cancel the permission given to FDI-multibrand, by the previous Congi governments.” |

Union government is upset because

- Delhi Rajasthan’s move will create negative impression among foreign investors- “India has an unpredictable policy environment”.

- So far 12 state/UT has permitted. MINUS Delhi, Rajasthan = only 10 state/UT left where MNC can open multibrand shopping malls. = Market not “Big enough” to attract investors.

- Therefore, Union asks Attorney-General “can state governments revoke such permission after change in political regime?”

- Experts say “yes”. Besides even if Union gets some relief from Supreme court, still AAP/BJP state governments could refuse to give building permission etc. to those MNC to open shopping malls.

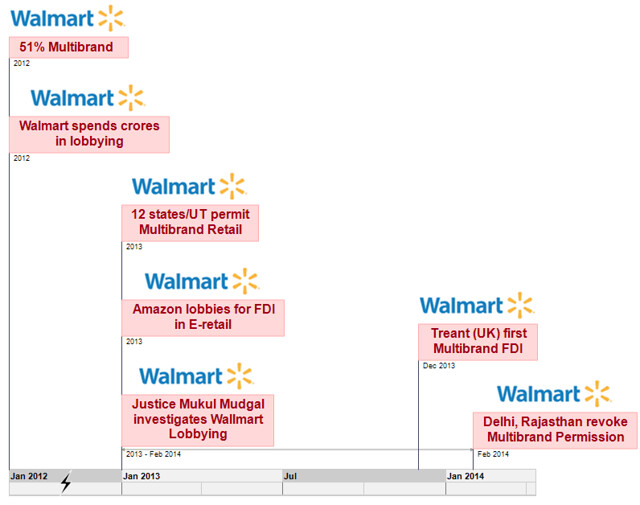

[FDI] Lobbying by Walmart and Amazon

- Lobbying= when private companies try to influence the politicians, to make favourable policy/act for them.

- American companies spend truckload of cash on lobbying- both within US and outside. But as per American laws, they’ve to submit report of their expenditure on lobbying (even if done in foreign countries.)

- So, from such disclosure reports, it was found that

| 2012 | Walmart spent crores to lobby for FDI-multibrand retail in India |

| 2013 | Government (Corporate affairs ministry) forms a commission to look into this allegation. (only one man army: retired Justice Mukul Mudgal) |

| 2013 | Amazon spent crores to lobby for FDI in E-commerce in India. (and simultenously government releases a “Whitepaper” on FDI in E-commerce. If you join the dots, then it’s obvious government is influence by Amazon lobbying. |

| 2014 | Justice Mukul Mudgal gives his report to Government (Corporate affairs ministry.) |

Limitations:

- Mukul Mudgal panel was not formed under “commission of Inquiry act” => he did not have the power to summon documents/witnesses.

- Walmart executives did not cooperate with him, refused to give detailed breakup of account/expenses in India.

- Walmart maintains that company did not spend money to lobby in India. Only some individual executives of walmart spend money from their own salary. So we as a “Company” have not broken any Indian law.

[FDI] Railways: FM, HM oppose Chinese FDI

DIPP: Department of Industrial Policy & Promotion wants to liberalizing FDI in Railways. here is their recommendation:

| permit FDI in | Don’t permit FDI in |

|

|

DIPP gave this note to Cabinet for consideration. But Home Minister and finance minister say Chinese FDI shouldn’t be allowed in railway sector because:

- China is India’s main rival on the economic and military fronts,

- We have unresolved border disputes with China.

- Recently Chinese company Huawei was accused of hacking into BSNL network.

- Therefore, Chinese investment in core sectors such as Railways= Dangerous from National security POV. (Point of view).

- Even if Non-Chinese players are allowed thru FDI window, all issues related to security, safety and quality control should vest with the Indian Railways.

[FDI] Drugs Pharmaceuticals

| Present status | What DIPP wants |

|

This system is right. |

|

Not good. FDI in existing Indian companies should be reduced to 49% (from 100%)** |

**why? Why does DIPP want to reduce FDI in existing desi-pharma companies?

- Because if desi pharma cos are 100% owned by Foreign MNC giants, it’ll impact the availability of affordable/cheap drugs in India.

- And in the worst case scenario: Pfizer /Novartis may simply buy out desi companies and make them produce only the patented expensive drugs only (and not the cheap generic drugs.)

Latest clearance: US company Mylan to acquire desi drug company Agila.

[FDI] Vodafone: fully foreign owned

- Vodafone India’s parent company is located in Mauritius, owns >60% shares in Vodafone India.

- The parent firm wanted to buy all shares from Indian shareholders, to have 100% ownership of shares.

| Dec 2013 | FIPB approves |

| Feb 2014 | Cabinet also approves |

Thus, Vodafone India=First telecom company in India that is 100% fully owned by Foreigners.

[FDI] Andhra favorite despite Telengana protests

- Andhra CM says that despite the political turmoil (about Telengana), Andra pradesh is still favorite destination for foreign investors. – MNCs like Johnson and Johnson, Proctor and Gamble are setting up plants worth crores of rupees.

Why?

- John D Rockefeller (American oil tycoon)- he was richer than Bill Gates, Steve Job and Mark Zuckerburg.

- His business mantra: “The way to make money is to buy when blood is running in the streets.” He used to buy firms, factories, land, shares and bonds – during riot/war/famine/depression like situation – because at that time businessmen in distress would sell their assets at throwaway prices.

- Perhaps same is happening behind the curtains in Andhra. That’s why favorite destination for MNCs.

IFC Rupee bonds

- IFC= International finance corporation, it’s a member of the World Bank Group.

- They’ve released IFC Rupee bonds.

- Foreign investors buy such bond (by paying dollars to IFC). Who are these clients? Asset companies, Private banks, insurance cos, even central banks of Asia, Europe and US.

- IFC convert these dollars into rupees and invests in India- particularly in the areas of low-growth states.

- They earn money (in Rupees), covert it into dollars.

- Then principle/interest paid to you in (dollars), and IFC keeps some part as commission.

- IFC also doing same with Brazilian real, Chinese renminbi, the Nigeria naira, Russia ruble etc. They convert dollars into local currency and invest.

So, is this FDI or FII? If we go by the Chindu definition (less than 10% investment in a company=FII and >10%=FDI, then rupee bonds is mostly FII).

[FDI] Defense

Needs a separate article. Just a few point here:

| DefExpo |

|

At present FDI limit in Defense= 29%. Latest clearance….

| Joint venture | ownership |

| Thales (UK firm) | 26% |

| BEL (Desi) | 74% |

| Product | Main focus= Radar production in India. |

Defense procurement procedure 2013

- Wants to boost Indian defense industry (Both public + private sector)

- In Defense purchases, it gives preferences to Buy (Indian), Buy and Make (Indian) category of products.

- India wants to procure 70% of its defense requirement from domestic players (both public + private) – but difficult given the low limit in FDI.

Some tie-ups between Foreign and Desi brands:

| Sensor |

|

| UAV |

|

| Vehicle |

|

Related topic

Rafael jets=purchase delayed (kyoki apni hesiyat nahi)

| 2012 |

|

| 2014 |

|

[FDI] Environment clearances

- Old story, Needs a separate elaborate article. Just an overview.

- December 2013: Moily becomes Environment minister. But he simultaneously holding charge a petroleum minister.= one is pollution controlling ministry, one is pollution creating ministry. = incompatible jobs. Should be done by two separate ministers.

- Moily giving fast clearances = to attract investors, improve IIP and show that he is also “pro-business” like Modi.

| POSCO | S.Korean company. Steel plant. $12bn USD. Odisha. | cleared |

| Vedanta | bauxite mining project in in the Niyamgiri hills of Odisha

Moily Says local gram sabhas are opposed to it, so I can’t approve. |

Not cleared |

| Tawang | Arunanchal Pradesh | Cleared |

| Ennore | Coal based powerplant, TN | cleared |

| Chennai | Petroleum pipeline | cleared |

| Teesta | Sikkim hydroelectricity project. (NHPC) | cleared |

| Coal Mines | Allowed some of them to increase output without requiring new permissions. | Cleared. |

| Hinduja | Coal power station @Vishakhapatnam, Andhra | Cleared |

[FDI] flows in last eight months (from highest to lowest)

| sector | From country |

|

|

** it doesn’t mean Mauritian people are very rich. These investors are mostly American/European tycoons who setup post-office companies in Mauritius to get tax benefits. [Recall Vodafone/Hutch controversy.]

[FDI] declined in India: says UNCTAD

UN Conference on Trade and Development (UNCTAD) report.

FDI destinations:

| Year | India’s position |

| 2012 | 15 |

| 2013 | 16 (meaning incoming FDI has declined.) |

[Act IV] Regulatory bodies (Truckload of)

#1: DGH: need statutory status

Directorate General of Hydrocarbons (DGH).

| Present status | What Finance ministry wants |

| DGH falls under Oil Ministry. | Should be given Statutory status. Because DGH implements New Exploraton Licensing Policy (NELP), matters related to Production Sharing Contracts for oil exploration fields etc. = it must have autonomous status. |

| funded by the Oil Industry Development Board (OIDB) | Should get ca$h from consolidated fund of India (from Budget). |

| Top officer from ONGC and Oil India, get posted here. | No, should have independent staff. |

| Not under direct CAG audit. | No. Once DGH starts getting funds from budget, then CAG will audit it. |

By the way, what’s the situation in other bodies? Where do they arrange cash?

| SEBI, IRDA, FMC | Charge fees on the licensees. |

| TRAI | Gets funding from government.

TRAI wants commission from the spectrum licensing, but government doesn’t agree to share the maal. |

| RBI | It’s the central bank. Central Banks earn money from “seigniorage”. We learned about it in Nachiket Committee article. Click me+ income through OMO, repo, MSF, license fees. |

#2: PNGRB- koi hum ko bhi puchho yaar

It is a statutory body setup under Petroleum and Natural Gas Regulatory Board (PNGRB) Act 2006.

You need to get its permission before setting up city gas distribution network (cooking gas lines, CNG station).

| 2013 |

|

| 2014 | Oil Ministry makes a U-turn. Tells GAIL to get permission from PNGRB. |

#3: Civil Aviation Authority= no country for non-IAS

- Statutory body.

- Problem: this boss (DG) is mostly a serving/retired IAS => CAA has become an inefficient bureaucratic organization. = lazy approach => USA downgraded India’s aviation safety rating.

- Now Ministry of Civil aviation proposing a bill, to ensure only professional person is appointed as DG. (and not some serving/retired IAS). And he must be given security of 3 years’ tenure.

- Problem: cabinet not clearing this bill.

#4: Rail fare regulator: I’m Useless without statutory status

- Cross subsidization = railway sells passenger tickets cheap (=~25k crore loss per year), but recovers that loss by keeping freight charges high. (=”ticket” prices for transporting non-human things cements,coal etc.)

- Result= not making optimum profits. Bogus food, bogus toilets, bogus security.

- Government finally notified to setup a new Rail Tarrif authority. (Feb 2014)

- It’ll suggest pricing in such way that railway generates healthy profit.

- Problem=Executive body. Recommendations not binding to rail ministry.

- If you want to make it statutory body, then need to amend Railway act ’89 = but that’s unlikely in the current budget session.

#5: Desi Drug regulator: I want Firangi powers despite staff shortage

- USA has FDA (Food and drug administration)

- Similarly India has CDSCO- Central Drugs Standard Control Organization

- CDSCO’s boss is called “Drugs Controller General of India”. (DGCI)

- CDSCO Falls under Ministry of Health (mind it: Drugs/Pharmaceutical falls under Chemical ministry)

Anyways, why in News?

- USFDA even monitors the desi-plants of desi pharma companies (e.g they banned Ranbaxy’s Toansa (Punjab) plant from manufacturing medical products for the US market.

- So CDSCO feeling envy, “we also want similar powers” – to inspect the foreign plants of foreign companies- who supply drugs to India.

- Problem: CDSCO doesn’t even have enough staff to supervise desi drug companies. They asked Union government to increase budget – so we can hire 5000 more people. But no positive response. After all funding to drug supervision =not as important as MNREGA.

#6: 14th Finance Commission: homework abhi baaki hai

- Constitutional body, setup in Jan 2013.

- Boss = Ex RBI governor Governor YV Reddy

- His recommendations will be effective from 1/5/2015, for a period of five years

- Apart from the usual terms of reference, 14th FC also has to make recommendations about:

- Pricing of public utilities such as electricity and water in an independent manner

- issues like disinvestment, GST and subsidies.

Why in News

- It was to submit report by 31/10/2014.

- But things are moving slow, Finance commission will take long time to meet all state government and process the data and demands. + issue related to compensation to Seemandhra from mega Polavaram project from Telangana and so on.

- Finance commission is seeking an extension of 3 months (i..e up to Jan 2015)

- This is not the first time in history though. 13th FC (under Kelkar) they also submitted their report in December 2009 (instead of original deadline in Oct 2009)

#7: 7th Central Pay commission

- Chief= Justice Ashok Kumar Mathur

- Member= Vivek Rae full time (IAS) + Rathin Roy part time (economist) + Meena Agarwal (Secretary, IRAS)

- Target audience= 50 lakh Central government employees, including the Railways and Defense. +30 lakh pensioners.

- Deadline= submit report in two years.

- Implemented from January 1, 2016. [6th PC’s recommendations from January 1, 2006.]

- Criticism:

- 6th PC cost us more than 20k crore rupees= fiscal deficit + and blamed to be one of the factors for inflation (Because money increased in babu-log’s hands without subsequent increase in their productivity.)

- Timing before the general election.

#8: EPFO- I want to stay in news everyday

- From aspirant’s point of view, EPFO= most bogus of all public entities. Because they create new current affairs on almost daily basis – or just keep coming in news for no reason.

- Anyways what did they do in Feb. 2014, first week?

- For anyone earning upto Rs.15000 = EPF contribution is must. = this will enroll 50 lakh more employees in the EPFO game.

- Minimum Rs.1000 pension to retired people.

- (did not implement) minimum age to get pension: raise from 58 to 60 years.

#9: IRDA- I also want to stay in news every day

- Just like EPFO, ye IRDA walla also keep doing something new every day to stay in the news. Anyways why in news?

- Broker model for Bancassurance (already covered in past article. click me)

- Allowed common service centres (CSCs) to sell life insurance products. CSC are setup under National e-governance plan.

- Norms/guidelines for Micro-insurance products (for rural/poor people). Allowed RRB, Coop. Banks, SHG, Banking BCA etc to sell such micro-insurance products.

- Asked companies to general insurance companies should increase their focus on agricultural insurance, disaster Management products.

[Act V] Infrastructure related

Important fact: that the 12th plan envisages $1 trillion for infra development

GS3 (Mains): Infrastructure: Energy, Ports, Roads, Airports, Railways etc.

Let’s check

| communication | spectrum auction |

| Energy | NELP, LPG, Electricity = given in part1 |

| airport | aviation safety sucks =given in part 3 |

| Railways | FDI given above, Monorail given below |

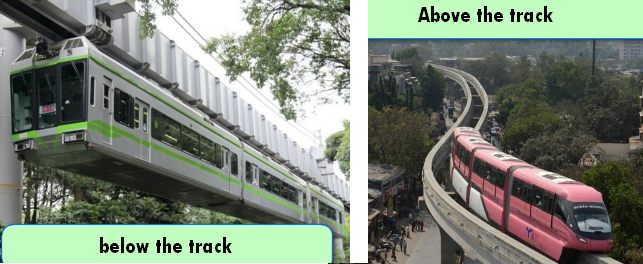

#1: Monorail @Mumbai

Monorail runs on a single rail. This rail may be located either above or beneath the railway cars. Observe the photo

- Mumbai Monorail was setup by Mumbai Metropolitan Region Development Authority (MMRDA) + L&T Engineering.

- None of our neighboring countries have Monorail (except China).

- First phase: ~9km from shootout @Wadala to Chembur.

- Minimum fare: Rs.5

When entire project is completed:

- it’ll have ~19km length.

- 7000 passengers per hour

- Cost: Rs. 3000 crores

| Ranking | Monorail in |

| 1 | Osaka, Japan |

| 2 | Mumbai, India (when entire project completed) |

| 3 | Tama, (Tokyo), Japan |

| 4 | Kuala Lumpur |

#2: Metro @Mumbai BOT Problem

- Being developed by Anil Ambani’s Reliance infra

- PPP Project under BOT model (build–operate–transfer).

- But dispute with Maharashtra government about pricing of metro rail tickets.

- CM asks union government to setup a dispute redressal mechanism at the national level to resolve disputes in such BOT projects.

Railway Misc.

| Kolar | New rail coach factory here. (will build passenger coaches)

Rail minister + Karnataka State government will share cost. |

| Delhi-Amritsar Bullet train | Bids invited |

| Chennai Metro | Under testing. manufactured in Brazil. |

#3: North East: hydro, manpower potential

Truckload of schemes and issues, only listing new points happened in Feb2014 week#1, related to economy:

Planning commission says

- North Eastern states can earn ~650 crores per year by hydroelectricity.

- 12th FYP wants to add 88000 MW electricity generation. And out of them North East can generate ~3000MW

- 5000 crore spent on developing airports @North East. Asks state governments to hasten the land acquisition

Modi says:

- Youngsters in the North Eastern states are generally tech-savvy with good command over English

- = Suitable for digital outsourcing/IT jobs. But at present they’ve to migrate to Bangalore and Hyderabad.

- Government should create such job opportunities within their own villages in North Eastern States.

Related issue: Arunanchal boy Nido Taniam murdered in Delhi in a racial hate-crime.

#4: [Summit] 101st Indian Science Congress

\Not an economy topic as such but Mohan said “we must spend atleast 2% GDP on science tech,” hence making a passing reference here (else separate discussion in S&T compilation later on)

- Where? Jammu

- Theme? ‘Innovations in Science and Technology for Inclusive Development’.

Major Points/Achievements listed by Mohan

- Neutrino-based Observatory @TN

- India joins CERN as associate member

- ISRO’s missions to Mars and moon

- Can issue Tsunami alert within 13 minutes

- Setup new dept for Health Education and Research

- A Rota Virus vaccine, a new drug for malaria, CSIR discovering new drug for TB

- We should not succumb to unscientific prejudices against genetically modified (GM) crops.

#5: Exhibition upgrades

- India Trade Promotion Organisation (ITPO)- government owned company. It has planned to spend crores of rupees to upgrade following venues

- Pragati Maidan, New Delhi.

- Vigyan Bhavan

- Kochi (for coffee, tea, spcies exhibition).

- Karnataka: wan to setup a venue for IT-related fares and exibitions.

Some notable expos in 2014:

| Expo-2014 | Venue |

| Auto | Pragati Maidan, New Delhi |

| Defense | Noida (UP); organized by Defense ministry. |

| Petro-Tech | Noida (UP) |

#6: Infrastructure Misc./chillar topics

Pharma

- You’re aware of the mega food parks click me. – In mega food parks, the companies have ‘common facilities’ for packaging, weighing etc. = operation cost reduced.

- Chemical ministry launching similar scheme for Pharma companies.

- In SEZ/industrial locations, Government will give them financial assistance to setup common infrastructure for setting up effluent plants, R&D labs, training centers etc.

Toll Tax

- Fall under State list (entry 59)

- As per National Highway Authority of India (NHAI) — minimum distance between toll booths should be 80 km.

- But in Maharashtra toll booths are setup even at distance of every 20-30 kms

- The toll collection money is supposed to be used for road-repair, but it’s not done.

- Traders allege bribery and irregularity by toll booth operators. Road contractors have ‘recovered’ their original investment, yet toll tax still collected.

- Shiv Sena and MNS have ordered their troops to attack and vandalize toll-booths.

Steel industry: we ar unhappy

- Goa used to be India’s top Iron-Ore exporter. But declined after SC ban on illegal mining. = less supply= input cost increased.

- government imposed a 5% tax on the export of iron ore pellets

- Jindal Steel says Karnataka-walla miners have formed a cartel = steel industries suffer.

- Inflation = automobile sales declined, therefore demand of steel decline.

click me For the next part 3 of 3.

![[Laws] DESI liquor special edition Kerala, Mizoram & IPS Training, Tribal insurgency](https://mrunal.org/wp-content/uploads/2014/09/Cover_Polity_kerala-liquor-500x383.gif)

![[Economic Survey] Corrections in the previous articles + Parting words before Qatl ki Subha](https://mrunal.org/wp-content/uploads/2014/08/Cover-Economic-Survey-correction-500x383.jpg)

Auto expo 2014 was held in 2 parts:

Automobiles – NOIDA (U.P)

Accessories – Pragati Maidan, Delhi

sir u r really ..really working hard for people like me who are staying in remote places.. thanks thanks a lot

Thank You very much…. mrunal…great work

How important would this Summary Would be ?

Since its time for the End Of FY13, we would be waiting for Economic Survey 2014. And Subsequently with the New Govt coming in would be making Drastic Changes (I do hope so.). the more changes they make more we have to study. Gosshhh!!!!

sir , aap jabardast tarike se samjate h ,

Hi Mrunal ,

The UK company name is TESCO which has invested in FDI in India. Trent is the hypermarket of tata. Please correct it in the article. I can tell it because i have worked for Tesco :P

so far by mrunal, we had many well scrutinized strategies for all GS papers except ethics, i hope mrunal will give some tactics on how to get prepared for this, worth 250 mark peper.

I became your fan after studying this article,You are awesome..

Colour Combination of website is not good../plz change

website is not working properly sir……. color combination khraab ho rha hai

Thankyou Mrunal sir, Keep updating weekly current affairs. For current affairs, I’m only depend on you(Mrunal). Because, i’m reading NCert’s books and preparing notes. although I reading “The hindu” as well.

Just a little correction:

Defence Expo was held @ Pragati Maidan & Auto Expo @ Greater Noida

*defense

your site give us confidence while we are preparing for civil service examination….thanks a lot sir…keep helping us….

FDI in defense is currently 26%

any increase from 26% will be subject to clearances from cabinet committee on security(CCS) Upto a limit of 49%.

Jhaanpanah tussi great ho

nice presentation .keep it up.

Error in #4: [Summit] 101st Indian Science Congress

A Rota Virus vaccine, a new drug for malaria WRONG

Rota virus vaccine is for diarrhea

imparting the high class awareness