- Prologue

- [Act I] Government side: Fiscal Policy, Macroeconomics

- India’s bogus GDP growth rate

- Fiscal deficit 4.8% target = Mission impossible #6?

- CAD & gold

- FATF: Desi Diamonds = Money laundering

- Interim budget/Vote on Account?

- [Subsidy] LPG: nau se baara (9 to 12)

- Kejriwal vs electricity companies vs NTPC

- [Subsidy] Fertilizer Subsidy

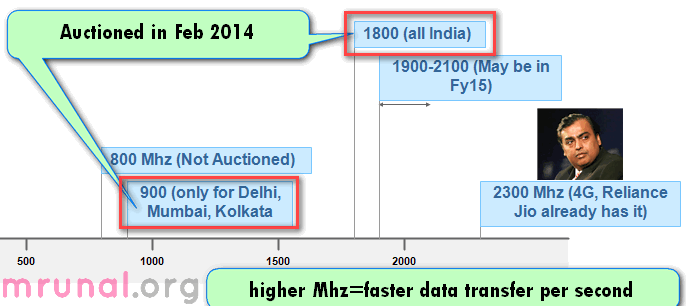

- [Auction] Spectrum 2014

- [Auction] NELP X (10) delayed

- [Act II] RBI, Banking, Monetary policy related

Prologue

Overview of Economy related Affairs during 1-7 Feb 2014. Total three parts:

- (you’re here) Part 1 of 3: fiscal policy, macroeconomics issue, subsidies, banking sector.

- Part 2 of 3: FDI, regulatory bodies and infrastructure.

- Part 3 of 3: bilateral, poverty-hunger-HRD, Agriculture-food processing and Persons in News (PIN).

[Act I] Government side: Fiscal Policy, Macroeconomics

Topics: GDP, Fiscal deficit, Interim Budget, Subsidy raj, Spectrum auction and NELP X.

India’s bogus GDP growth rate

| GDP growth rate : CSO calculation/estimates | year |

| 4.5% (earlier thought it’d be 5%) | 2012-13 |

| 4.9% | 2013-14 |

CSO: other observations/analysis for FY13.

- GDP will be 1.7 trillion US dollars. important: DONOT confuse GDP (absolute number in rupees or dollars) vs GDP growth Rate (percentage)

- Per capita income will be ~75,500 rupees.

- >4% growth in Agro and allied sector

- Negative growth in Manufacturing, mining sector.

- Household savings have decreased. (Because of inflation, people are able to save less money.)

- Corporate savings have also decreased (meaning their profitability has decreased)

- gross fixed capital formation (GFCF) has also decreased. (Meaning less money going towards investment in business.)

- Cost of energy has increased. Because desi coal mining projects stalled by environment ministry and SC orders. As a result, we had to import ~25% of our coal requirements from abroad. + adding insult to injury, heavy floods in Australia last year= their own coal output delinked= coal prices increased.

Solution

- @Government: Fast track clearance to infra-projects; decrease the excist duty; relax the strict environment rules over coal mining

- @RBI: Reduce the cost of borrowing (=decrease Repo rate); relax the rules for ECB (External commercial borrowing from foreign countries)

Fiscal deficit 4.8% target = Mission impossible #6?

What is fiscal deficit, why is it bad? We just saw in last article of Urjit Patel Committee. Click me

| Year | Fiscal deficit as % of GDP |

| FY2012 | 4.9% |

| FY2013 | Target 4.8% (this mean nearly 5.4 lakh crore rupees) |

- Why in news? Because we’ve already reached 95% of the limit in till December 2013.

- Who calculated? Controller General of Account. (and not CAG).

Is it good or is it bad?

- Imagine you’ve fixed a target “I’ll try to contain my household Expenditure to Rs.1 lakh for the FY13.” but you already spent Rs.95000 so far.

- Then, for Jan, Feb, March= you can spend only Rs.5000 [if you want to stay within the target.] This is difficult especially during election year- subsidy bonanzas.

Why fiscal deficit is problem?

- Even now, India’s fiscal deficit = highest among BRICS [Brazil, Rus, India, China and S.Africa]

- If we cannot keep the 4.8% target, then S&P, Moody etc. will definitely cut down our rating to junk level=less FDI, FII= high CAD =weak rupee= inflation, and more economic problems.

Can we keep with 4.8% target? Is it possible?

| Not possible (because of these outgoing money) | Possible (because of this incoming money) |

|

|

G-Sec auction cancelled

- When government wants to borrow money, they release government securities (g-sec), with help of RBI.

- Government was planning to borrow 15k crore rupees, through this. But Spectrum-2014 auction and selling the shares of Engineers India ltd. = Government has got sufficient money, for now. Hence decided to postpone the G-sec auction.

CAD & gold

| FY12 | >88 Billion USD = rupee starts weakening against dollar.

|

| FY13 | (expected) <50 Billion USD. Chindu says I’ll think about reducing gold duty after March 2014. |

- FY13: 200 tonnes of gold came in through the black market. Government has lost ~$1 billion (6,200 crore) worth taxes because of this smuggling.

- Government raised import duty on gold from 8% to 10%. (mind it: import duty, NOT excise duty).

- Reserve Bank of India made it mandatory for jewelers to export 20 per cent of their gold jewelry before placing orders for fresh gold imports. (also known as 80:20 rule)

Related topic

FATF: Desi Diamonds = Money laundering

- FATF= Financial Action Task Force (HQ : Paris)

- inter-governmental body to fight money laundering.

- Their latest report says Indian diamond trade is used for money laundering. How? The agents will overvalue the prices of low quality diamonds

| Incoming diamonds | Outgoing diamonds |

|

Indian trader will export low quality diamond @high prices=>foreigner sends more money=>black money comes back. => sent to “original” owner, via hawala operators. |

- Even terrorist financing is done via such overvaluation of bogus diamonds. After all UAE=>Paki=>Dawood & Co.

- By the way, if diamonds are super-high quality then trades don’t import it officially (else they’ve to pay high taxes). In case of high quality diamonds, they’re smuggled through Belgium.

Anyways, this is just an overview, you should prepare it in detail for GS Mains Paper 3 topic ” money-laundering and its prevention.”

Back to our original topic of fiscal policy cum firefighting cum subsidy-raj (=Chindunomics)

Interim budget/Vote on Account?

I’ve published separate article on interim budget – click me

Interim budget in past

| Year | FM | What did he do? | Budget speech |

| 2004 | Yashwant | Gave quite a few schemes and tax-benefits. (Despite the fact that it was a ‘vote’ on account.) | 12 page |

| 2009 | Pranab | Did not announce any new taxes or schemes. (perhaps because he was confident that UPA will be re-elected). | 18 page |

| 2014 | Chindu | Most likely he’ll announce some schemes/tax-benefits (with last hopes of winning some vote bank.). | ?? Bookies are taking bets on how long it’ll be! |

Experts believe, Interim budget 2014, will contain following

- Government will allot more money to certain schemes (NREGA, pension etc.)

- reduce excise duties on certain consumer goods, automobiles etc.

- May announce some disinvestment of shares from PSU (to get more money for allotting to schemes)

- Announce some tax benefits. Previously excise duty exemption given to the industry in states such as Himachal Pradesh and J&K. They’ll expire in May 2014. FM will renew them in Interim budget. = more job creation (or at least congress can make claim in election speeches).

Important:

- Changes in indirect tax rates don’t require Parliament’s assent (Government only needs to notify and place before Parliament).

- Changes in Direct tax = need parliament’s assent.

[Subsidy] LPG: nau se baara (9 to 12)

| LPG Cylinder | Price | Who decides? | 2012 | 2013 | 2014 |

| Subsidized | 400+ | Oil Ministry. | Every connection holder gets 6 subsidized LPG cylinders per year | 9 | 12 |

| Non-subsidized | 1200+ |

|

You’ll have to buy additional cylinders @this market priceprice. |

Subsidy payment

| initially | 2013 | After Rahulbaba (2014) |

| Government would pay the subsidy directly to Public sector Oil marketing companies. | Government would pay subsidy to beneficiary’s bank account via DBT (Direct benefit transfer) | Cancelled DBT plan. Meaning, subsidy will be paid to those PSU oil companies.** |

Direct Benefit transfer (LPG)

- Started in 2013, in selected districts

- Government would transfer 435 rupees in beneficiary’s account, then he’ll have to purchase cylinder @market rate.

- >2k crore transferred to 60+ million consumers this way.

Problems / Challenges in DBT for LPG

- To enlist in this scheme, you’ve to link three things (your Aadhar number-LPG connection number-Bank account number)

- Problem= not everyone has aadhar number, not everyone has bank account number (Census 2011: only 54% rural and 67% urban families have bank accounts]

- Supreme court said Aadhar card is not mandatory to claim benefits under government schemes.

**given above reasons, government has postponed the DBT plan in LPG.

But Oil minister Moily is not accepting the #EPICFAIL of DBT, he says “We are quiet proud and happy that this programme has gone on very well. Even if there is a marginal error, we need to correct it.”

Critiques: why 12 subsidized LPG cylinders= bad idea sir-ji?

- 89% families can survive with 9 cylinders per year. Only very big families need 12 cylinders. So if you give 12 cylinders= you’re covering almost 97% of the families.

- Subsidy money doesn’t fall from sky, you arrange money through direct/indirect taxes on the same families.

- So in a way, you first collect taxes from those 97% families and then give them subsidized LPG= idiotic. Let the juntaa themselves purchase it @market rate (after all they’re indirectly paying for the subsidy through taxes)

- This will increase black marketing activity [diverting household cylinders to restaurants, because most families can survive on 9 cylinders, they’ll sell away those three additional cylinders to restaurants, chai-walla.]

- You’ve cancelled DBT plan= more black marketing and leakage.

- Imprudent consumption [because government giving subsidy, so people don’t try to save / use LPG consciously.]

| FY13 | Rs. (Crores) |

| Oil subsidy | >1.5 lakh crores |

| Out of ^that, LPG subsidy | 40k [+5k because of 3 extra-cylinders] |

| DBT could have saved subsidy leakage worth | Rs.60k crore [but now Government cancelled DBT for LPG] |

Government also started DBT scheme f or Kerosene subsidy, But it’s in pilot stage in a few district.

[Allocation] CNG reduced by Rs.15 per kg: how and Why?

DONOT confuse this topic with 9 to 12 LPG cylinders.

Background:

- Government had ordered gas companies to allot only 80% of domestic gas for “retail” purpose (City gas entities- CNG stations, cooking gas pipeline companies).

- Remaining 20% exclusive for industrial purpose.

- As a result, many cities had to rely on imported CNG, LNG = prices expensive.

| Mumbai | Got all its gas supply from domestic field. |

| Delhi, Ahmedabad | Not all of their requirements met to desi gas.They had to rely on imported gas “regasified-liquid natural gas (RLNG)”This RLNG cost 4x times more then desi LNG. That’s why CNG, pipeline cooking gas was expensive all these years. |

For example, Delhi’s Indraprastha Gas supplies arranges 80% LNP+PNG from desi source and 20% from abroad.

After Kejirwal went to SC

- Delhi Government (Kejriwal) goes to SC against this above policy.

- UPA doesn’t want negative publicity in election year therefore, Oil ministry has made new rule: from domestic gas fields, 100% allocation to city gas entities.

Result?

| Cheaper by Rs./kg | |

| CNG | 15 |

| Piped cooking gas | 5 |

So, is it good/bad?

- Observe that desi-gas allocation to ‘retail’ sector has increased from 80%=>100%,

- where does the 20% gas come? Government arranged this by cutting the gas supply to petrochemicals, steel and refineries. (meaning those companies will have to buy gas @market prices=> their input cost increases=> in long term this will lead to inflation in many products, declined in IIP and GDP.)

Related topic:

Gas based power plant

- Gas based power plants in India, they don’t get sufficient gas supply from KG D6 basin.

- As a result, they’re running barely 27-30% of their full capacity.

- Reliance, Torrent, GMR Essar – all making losses. Cannot sell electricity @cheap prices.

- Power ministry wants state government to provide subsidy to them. (cost ~25k crores)

that leads to next topic

Kejriwal vs electricity companies vs NTPC

Daily three page newspaper column and five hours TV news coverage given on this as if akhkhaa India lives in Delhi only. Anyways, Gist of the matter is:

- NTPC= produces electricity, and sells it to distributor companies.

- Distributor companies (Discom) sell this electricity to “retail” customers (households and business firms).

- Anil Ambani’s (electricity) distributor companies (BSES, BYPL) = they supply electricity to 70% of Delhi.

| NTPC | (To Anil) Pay our money, else we stop supplying electricity to you. |

| Anil | But I don’t have enough money to pay your past bills! (To Delhi CM Kejriwal)

|

| Kerjiwal | I won’t do that. And if you try stopping electricity supply in Delhi, I’ll ask Delhi Electricity Regulatory Commission (DERC) to cancel your license under Electricity Act 2003 or even take over these distribution companies! (the present joint venture partnership=Anil:Delhi Government=51:49%) |

| Anil | But I desperately need money to make payments to NTPC!! |

| Kerjiwal | Then goto bank and take a loan. |

| Anil | Already tried. Banks are reluctant to give loans to any private electricity companies in Delhi (thanks to your Kejrinomics, those bankers think electricty-business will definitely shut down in a few months!) |

| Anil | (To Supreme Court) Maai baap, please help me out. |

| SC order | @Anil, pay Rs.50 crores NTPC asap. @NTPC, donot cut his supply until next hearing. |

Some more Kejrinomics:

- If inflation increases, rickshaw fares would then be hiked. If inflation declines, auto fares would be reduced by the government.

- Previously rickshaw walla had to install GPS+Meters (=Rs.17k). Kejrinomics: only install GPS first.

[Subsidy] Fertilizer Subsidy

Who gives Fertilizer subsidy? Department of Fertilizer. (and not agro ministry or rural development ministry.)

Under what mechanism? New Pricing Scheme (NPS) III

- Department has fixed the maximum retail price of urea at Rs.5,360/-

- But cost of production is higher than this. So, Department pays the price difference to companies to cover their losses= that is fertilizer subsidy.

- For FY13, fertilizer subsidy cost >65k crores.

- Now fertilizer ministry + Agro ministry agreed that subsidy should be increased, given the rise in cost of production=> this will increase subsidy burden by ye another 900 crore rupees per year.

- Important: we’re not 100% self-dependent on urea. >25% of demand met through imports.

Now let’s check two auctions: Spectrum and NELP-X. Both Need a mile long separate articles. Here I’m only covering the overview

[Auction] Spectrum 2014

| Frequency | What? |

| ~100Mhz | FM radio stations. |

| 800Mhz | Not auctioned this time. TRAI and Government yet to sort out its pricing formula. |

| 900 Mhz | Being auctioned in Feb 2014. only for three circle= Delhi, Mumbai and Kolkata.Airtel, Vodafone already own this spectrum but their license expiring soon, government is not renewing it. Companies went to TDSAT and SC, but did not get relief. Hence they’re again bidding for this 900Mhz spectrum. |

| 1800 Mhz |

|

| 1900-2100 Mhz |

|

| 2300 Mhz |

|

- In spectrum game, higher the number = more data can transferred per second.

- 2300Mhz=superfast= ideal for 4G internet.

- Mukesh bhai already owns this. But he tries to sell only 4G connection (without voice/phone call function)=> hard to get customers throughout India.

- Therefore, Mukesh Ambani interested in buying 1800 Mhz (=good for simple voice/calling services). Then he can first sell phone numbers for such cheap voice calling plans, and try to lure customers to upgrade to 4G connection – especially in metro cities.

| Players | what |

| TRAI | Recommends policy, and dispute resolution. |

| SMRA |

|

| Bidders | 8 companies: Bharti Airtel, Vodafone, Idea Cellular, Reliance Jio (Mukesh), Reliance Communications (Anil), Aircel, Tata Teleservices, Telewings (Uninor) |

| Kapil Sibbal |

|

Reserve price

- In auction, it means “we’ll not sell below this price.” (for example: you put “used iphone4” on ebay.in and declare its reserve price Rs.14k.)

- The reserve prices for 2014’s auction are as following

| 800 Mhz | Not auctioned because Government and TRAI are yet to fix its reserve price. |

| 900 Mhz Delhi | 360 Cr. Per Mhz |

| 900 Mhz Mumbai | 328 cr. Per Mhz |

| 900 Mhz Kolkata | 125 cr. Per Mhz |

| 1800 Mhz (all India) | 1765 cr. Per Mhz |

- Absolute numbers not important, but you can see 1800 Mhz spectrum is kept more expensive than 900 Mhz. why? Obviously because it can transfer more data per second.

- If all the spectrum was sold @this reserve prices (meaning no company bids higher price than above), then government would have earned 48000 crores.

- But companies bid higher amounts in auction (because every company wants pan-India presence). Result: government will earn more than 55000 crores from this auction.

- Good news for UPA, because they can launch a few more schemes named after “you know who”, using this ca$h, before EC’s model code of conduct comes in force.

- Bad news for we the customers, because companies will soon raise mobile/2g/3g prices to recover their investment.

Payment for the spectrum?

- Auction Winner Company will have to arrange cash by itself.

- They can also pay it in installments (with interest rate)

- They are allowed to borrow as much as USD 750 million (>4500 crore rupees) from abroad every year to make these “installment” payments.

| 2010 | CAG reveals 2G scam. 1.76 lakh crores. |

| 2012 | Supreme court cancels 122 spectrum licenses given to companies. |

| 2014, Feb | Spectrum auction for 900 Mhz and 1800 Mhz |

[Auction] NELP X (10) delayed

New Exploration Licensing Policy (NELP) X

- As per the Constitution of India, Union government owns all the hydrocarbon resources in India (both offshore and inland)

- Hence only union can ‘auction’ the exploration rights to private companies.

- This is done by New Exploration Licensing Policy (NELP). Total nine rounds since 1999.

- 2014: NELP X will be done under the Uniform Licensing Policy regime=> explorers can hunt for all kinds of resources: oil, gas, coal-bed methane or shale. Without have to get separate license for each work.

NELP-10 is delayed because:

- upcoming general elections. Planning commission advised the oil ministry to postpone.

- Ministries have different opinions about how to earn revenue from this?

| Committee | Recommendation on revenue sharing | Good/bad? |

| Kelkar | The contractor will first recover his investment by selling the oil/gas. Then he will start sharing part of the profit with government. | Difficulty. Because contractor will always try to show high cost, to delay sharing revenue with government. |

| Rangarajan | Production linked system. Contractor need to start sharing profit with government as per productions immediately. It doesn’t matter when his ‘investment’ is recovered’. | More transparent. And NELP-X will be done in this method. |

Related topic:

Mines-mineral development Bill 2011

- Will not be introduced in Lok Sabha this time (Budget 2014 session)

- Private companies are opposed to it because bill requires them to share profit with the local people/communities. (In case of coal companies- have to share ~26% of the profit)

- You can dig more details from prsindia.org

ATF: Aviation turbine fuel

How its pricing determined?

Every month three players meet

- Indian Oil Corp,

- Hindustan Petroleum Corp Ltd (HPCL)

- BPCL

They decide the ATF fuel prices based on avg. international prices (in the previous month.)

- In news: because recently they reduced the prices by ~2000 rupees per kiloliter.

- ATF fuel makesup >40% of operational cost.

- ATF cost will be different in every state. Why? Because of local sales tax and VAT.

- Vijay Mallya and others have been demanding reduction/abolition of taxes on this fuel, to reduce their operational costs.

Enough of government side, let’s move to

[Act II] RBI, Banking, Monetary policy related

#1: Fed Tapering

Lengthy Topic, requires a separate article.

Basic idea is following

- You’re aware of subprime crisis. American banks gave loans to people with no “aukaat” to repay money=>investment bankers took those loan files and issued “mortgage backed securities”. =>people default on loan=>those securities become paper-junk=> system collapses.

- To fix this problem, US feds (American RBI) decided two things

- buy those Mortgage backed securities (=to rescue the troubled banks)

- Follow “cheap” money policy, give loans to banks at very low interest rate (US Feds buy government bonds from those banks @cheap prices….recall how “repo rate” system works- with bonds as a collateral!)

- Result? Money supply increased=> cheaper loans for customers and businessmen=> economy starts bouncing back.

- That’s quantitative easing.=> more dollars=>more investment in India and elsewhere.

- But now, US Feds decided to reduce purchase of those securities and bonds=> this is known as fed tapering.

| US feds | Purchased securities worth ___ billion USD per month |

| Earlier | 75 |

| Now | 65 |

- You can see, US feds reduced the purchase by (75-65)=$10 billion USD.

- That’s called fed tapering.

- Result? Less money supply=>loans become expensive for American businessmen (=less import from India), less investment to India + rupee would weaken further (=petrol, diesel expensive for Indians).

- Financial Stability and Development Council (FSDC) = Chindu the chairman, + RBI, SEBI etc all financial sector regulators. This council met and deliberated on Fed tapering.

- They say “we don’t have to worry much. We’ve taken precautionary steps”. [will be discussed in a separate article later.]

- Although Rajan is bit unhappy, “USA should also worry about the (negative) impact on other countries before running such (Stupid) schemes.”

#2: Rajan Wisdom on Monetary policy

- Hawk= someone who believes inflation can be fought by raising interest rates (via monetary policy/repo rate.)

- In January 2014, I did increase the repo rate from 7.75 to 8%

- But I’m not a hawk, I’m an “owl”. Owl is vigilant when others are resting.

- I won’t have any wonder tool to fight inflation. I’ll be using the same old monetary policy tools (mainly repo rate) to fight inflation just like the previous RBI governors.

- Corporate houses are complain to me that loan interests are too high and I should decrease my repo rate.

- But, right now CPI is >9%. Banks pay maximum ~9% to depositors (in FD). Therefore, even if I reduce repo rate, they won’t decrease their loan interest rates. (Because their main source of cash comes from those deposits and not from my repo window)

- I’ve done everything in my hands to fight inflation. Now the ball is in government’s court: they must clear pending infra/business/FDI files quickly and reduce their fiscal deficit.

#3: Microfinance: RBI changes loan rate formula

- 2010: high interest rates charged by microfinance companies. Many poor in Andhra commit suicide because of Microfinance loan-recovery agents.

- 2011: RBI creates new category under NBFC: “NBFC-MFI”

- Then RBI order that MFI cannot have more than 12% profit margin on their loan products.

- 2014: Rajan comes up with new formula for MFI-loan rates

First get two figures

- Cost of fund (i.e. how much did it cost to the MFI, to arrange that loan money) + margin (12%)

- Average base rate of five largest commercial banks (like SBI,ICICI etCc) multiplied with 2.75%

Now find minimum between (a, b)

That’ll be the Maximum interest rate, an MFI can charge on her borrower.

System will be effective from FY14 (i.e. 1st April, 2014.)

Related topic:

Micro Finance Institutions (Development and Regulation) Bill, 2012.

Criticism:

- Against the federal principles

- Doesn’t help in financial inclusion

- Gives supervisory powers to RBI but RBI already overburned with so many things. Therefore, Microfinance matter should be completely handed over to SIDBI or NABARD.

Result: Parliament’s standing committee on finance is going to reject this bill.

Women SHG- interest subvention

- Scheme: National Rural Livelihoods Mission (NRLM)

- Women Self-help groups (SHG) under this scheme, will get interest subvention

Mechanism:

- All banks have to give them loan @7% (upto 3 lakhs)

- Government (Rural development Ministry) will give interest subvention of 3% (meaning government will pay that much interest to bank, on SHG’s behalf)

- Women SHG will have to pay only 7 minus 3 = 4% interest only.

#3: Housing Start Up Index (HSUI)

- Housing sector contributes ~10% GDP, critical indicator of macro-economic growth for banking (loans), labour, steel, cement, and paint business.

- Housing start up index = Joint initiative by RBI + national building organization.

- To measure housing growth in various cities of India. It found that

- Housing declined in big cities like Kolkata, Chennai and Bangalore

- But picked up growth in small cities like Dehradun, Bhopal and Hubli.

- It’ll help both public and private sector to design their economic activities accordingly.

- We are not the first country to develop HSUI.

- Six countries already using it: Canada, US, Japan, France, Australia and New Zealand

#4: Mobile Banking: new Committee

RBI’s Committee on Mobile Banking (Chairman =B. Sambamurthy)

Main Recommendations

- >85 crore mobile subscribers in India=mobile banking is an great tool for financial inclusion.

- All mobile phone operators should load a single mobile banking app in all mobile phones.

- Government should order mobile mfg. companies to pre-install mobile banking app. In their phones.

- customers should not be required to visit the bank branch to register his mobile for mobile-banking Usage.

#5: Banking Ombudsmen conference

Discussed following:

- In savings account, if customer doesn’t maintain minimum balance, then don’t charge penalty on him, simply convert his account to No frills account. [Basic Savings Bank Deposit accounts]

- In e-banking, if there is any scam, and customer was not negligent, then onus should fall on bank itself.

- For ATM: banks say we want to charge our own customers for ATM use (After 5 free transactions per month.) Then we can earn some additional commission =>use it for installing more securities guards.

- RBI Deputy Governor opposes this idea. Bank should not charge its own customers for ATM Usages.

- practice of levying a penalty for non-maintenance of a minimum balance in ordinary savings bank accounts was also discussed at the conference.

#6: Banking: Misc./Chillar topics

| Common Demat account |

|

| RIDF |

|

| RuPay Card |

|

| White label ATM |

|

| Plastic notes | Rs.10 plastic notes will be circulated on a trial basisin five cities — Kochi, Mysore, Jaipur, Shimla and Bhubaneswar.From second half of 2014. |

| Stress Test |

|

| Third party norm |

|

RBI related Numbers

As of January end 2014

| MSF | 9% |

| Repo | 8% (earlier it was 7.75), Rajan increased to 8% =dear money / hawk. |

| Reverse repo | 7% |

| SLR | 23% |

| CRR | 4% |

| PSL | 40% |

| Forex Reserve | 290+ billion dollars |

click me For the next part 2 of 3.

![[Laws] DESI liquor special edition Kerala, Mizoram & IPS Training, Tribal insurgency](https://mrunal.org/wp-content/uploads/2014/09/Cover_Polity_kerala-liquor-500x383.gif)

![[Economic Survey] Corrections in the previous articles + Parting words before Qatl ki Subha](https://mrunal.org/wp-content/uploads/2014/08/Cover-Economic-Survey-correction-500x383.jpg)

@ mrunal, sir this has reference to your saying that 1800 Mhz is costlier than 900 Mhz, u missed out a main point that 1800 Mhz rate is for all india that is for all telecom circle together, that is way cheaper than 900 Mhz band that has price for each circle.

murnal sir hemant is right.

u r superb mrunal ji… nice changes you have done it in blog…

Hi , Can anyone please help me on this ?

what is the diff b/w a firm , company , corporation ,Limited Liability Company..

thanks

Sir pls help:

1.Why do we need a seperate 1800 Mhz if 900 Mhz is totally awesome?

2.Why only 3 circles Delhi, Mumbai and Kolkata?

pata nhi???

Hi Mrunal

Plz revert to ur previous web page design… this one looks a bit dull… the old one looked grt and helped to understand and memorise stuff better… but if u hav changed the design bcaus of some graphic/memory related issues etc. then no problem… we will adjust to it… after all gyaan hi to batorna hai aapse…

I too agree with Subhash. This web page design and color looks dull than the previous one.

Good news for UPA, because they can launch a few more schemes named after “you know who”, using this ca$h. . .

“you know who” yeah, either IG or RG

How does gold trade regulate?

Hi mrunal sir, plz give me guidence for UPSC examin…….

awsm work

now i can use this website in my slow conection

phle to 5mint lgta tha ek page kholne m jo b ek mint m khul jata h

mrunal sir ap khud maintane krte h website????

First time in my life i feel economics is understandable and one can solve issue worth revolutionary!!!

Naya design mobile per shandar dikh rha h ….per right side me thoda sa portion cut rha h …

Thank you sir ..

Now this looks classy.

@mrunal Sir, Was SMRA used when the 2g Scam took place? Or is it introduced to combat leakage/corruption?

hello mrunal sir from where i can study gs( science portion, history, geography,economics, constitution) for cgl 2014.

a good description of above mentioned subjects is available @ http://www.mindfeeders.org/ for CGL and other competitive exams.

great… phli bar mujhe itna sara and itna achchha matter ek sath padhne ko mil gya… economics seems to be easy now..

Sir,pls provide the information regarding india’s relationship with other countries with clear discription.

Sir i loved reading it. I found it, the crux of the whole matter. Thanx for giving such a great insight.

sir,

I want to know the impact of key relevant provisions of the latest fiscal policy on the fertilizer industry.

[Economy] Inflation: Demand Pull Theory- Meaning, Causes

[Economy] Inflation: Cost Push – Meaning, Reasons, Solutions and CSAT Mock Questions

[Economy Q] Base year and Current year price? How to calculate WPI and CPI?

[Economy Q] How to calculate GDP (PPP) and GDP nomina

SIR THESE ARTICLE ARE NOT OPEN,,,IS THERE ANY OTHER LINK TO OPEN…..

Mrunal da What is hawala scam of 1991 and why name of momin qureshi is in news these days(hawala scandal in meat!!)

dear Mrunal…

i think NSDC target is 500 million (instead of 150 million) by 2022.

Awesome article.

dear sir,

With all due respect to you but i dont think relaxing the strict criteria in coal mining is the right approach because the problem is not about strict enviourmnetal norms but its about unclear and non-objective enviourmental norms which get manipulated for particular looby for particular befits.

2nd and most important problem with indian mining is about inefficiency and corruption. we dont have hi-tech technology for mining in companies like coal india on one hand and on other hand there is rampant corruption by local officials, local politicians and local mafias in coal sector. As far as other minign sector is concerned the problem is not altogether different where people like reddy brothers have accemulated millions by just selling our top quality ( magnetite ) ore from karnatka illegally in huge amounts.

that fees may be changed in suesqbuent years too. This will be put in the admission letter, binding students (and their parents) to pay higher fees if announced. The courts have earlier shot down fee increases for current students.2. The issue of increasing fees further (to 2.5 L and further as per inflation rates) as per the Kakodkar committee’s recommendations is still under debate, and the Council will get view points from different stakeholders and decide what to do in its next meeting. This deal includes a proposal to remove non-plan funding from the govt. This proposal says that EVERYONE will pay the higher fees. Category students, poor students (income wise), PG students, will be paid the fee amounts by the Govt. DIRECTLY (as Chandresh has suggested) who will then pay to the IITs. So, a lot of the funding will move from non-plan to plan heads of accounts. Only about 25% of the students in an IIT pay tuition fees (see Dheeraj’s calcs and to that add that about 50% are PGs).3. There will be a loan scheme where students will repay only after they graduate and get a job.4.Some of us are not very comfortable with the proposal of govt not funding any of the non plan expenditure (a la IIMs) as the ability of IITs to raise fees will not be as unconstrained as that for IIMs. Increasing fees along with a loan scheme is fine, but to leave us to fend for ourselves in times of stagflation?5.And what autonomy will we get? CAG will still audit the accounts, and can pay scales really float? Are they floating in the IIMs? The debate is on.Gautam Barua