- Prologue

- E1: [WTO SPS Agreement] EU Ban on Indian Mangoes

- E2: [Banking] HDFC Bank vs FIPB: Foreign investment Problem

- E3: [Banking] Cheque Bouncing: SC guideline for faster case trial

- E4: [Banking] RBI- Public Key Infrastructure in Online Banking

Prologue

- Lord Curzon was to upload notification on 17th May but hasn’t done so, therefore Delhi’s rumor market became active with variety of conspiracy theories.

- But irrespective of what changes UPSC makes in the notification / syllabus – you’ll have to prepare history, geography, science, economy, polity and IR anyways. So stop the timepass and focus on the core areas of general studies. Just ~three months left before prelims.

- Same way, Staff selection (SSC) aspirants – you should be practicing maths, reasoning, English and GA instead of wasting time speculating the exam dates and whether Modi will reduce the vacancies or not.

Mary Kom doesn’t stop practicing just but there are three vacancies- Gold, Silver and Bronze; Nor she waits until the match date and venue are announced.

Anyways coming to the topic at hand: Current affairs April Week4 (23rd to 30th)

- Polity, History, Culture, Environment: Coming soon

- Economy: you’re here.

- International Relations (IR)/ Diplomacy: Done.

General studies paper 2:

What is SPS agreement? Is EU justified in banning Indian Alphonso under SPS agreement? (200 words)

Interview:

- Can we say EU Ban on Indian mangoes is an example of non-tariff barrier in WTO? What is the permanent solution to Mango fruitfly problem?

- What’s the present limit for foreign investment in Indian banks?

- Why is FIPB delaying the permission to HDFC for additional foreign investment?

- Why does Cheque bouncing case fall under “Negotiable instrument act”?

- Can you name any other “Negotiable instruments” apart from Cheques?

- Are you aware of the new guidelines of Supreme Court, for quick disposal for cheque bouncing cases?

- What is digital signature? What is public key infrastructure (PKI)? Why does RBI panel recommend they should be compulsory for all banks?

E1: [WTO SPS Agreement] EU Ban on Indian Mangoes

All over the world, Governments impose barriers to protect domestic industries and prevent entry of foreign players. These trade barriers are of two types:

| Tariff Barrier | If US President Obama imposes 56% custom duty on Indian Cars. |

| Non-Tariff Barrier | If Obama tries to restrict entry of Indian cars without imposing heavy taxes on Indian cars, for example

|

- World Trade organization (WTO) aims to reduce such tariff and non-tariff barriers to international trade.

- Countries sign WTO agreements, if any country violates, WTO can impose penalty.

- As such WTO has ~five dozen agreements but main three are

| 1.Goods | GATT: General Agreement on Tariffs and trade |

| 2.Services | GATS: General Agreement on Trade in Services |

| 3.Intellectual property | TRIPS: Trade-Related Aspects of Intellectual Property Rights |

By the way, what if China starts manufacturing cheap cars with poor breaks, bad steering and carcinogenic paint. Can Obama ban such dangerous foreign products? Does WTO permit that?

Yes, WTO made two special agreements for “safety”:

| Non-food products | Technical Barriers to Trade Agreement (TBT) |

| Food Products | Sanitary and Phytosanitary Measures Agreement (SPS) |

Since our topic is EU’s Mango ban, let’s focus on SPS agreement.

Under SPS provisions, WTO’s Member states can impose trade barrier on foreign goods, to protect their own human, plant, animal lives from harmful food additives, pests and microbes.

Mango Ban: Timeline / Sequence of Events

- March 2014: EU Plant healthcare Committee found fruit flies in ~200 Indian shipments.

- April 2014: EU Trade Commissioner temporarily banned Alphonso mangoes, eggplants, taro plant, bitter gourd and snake gourd.

- This “temporary” ban extends from 1st May 2014 upto 31st December 2015.

- UK traders and opposition parties have opposed this ban. Because England= large south Asian diaspora customers that enjoys Indian mangoes. Business more than 10 million euros.

- Although Pakistani mango farmers are delighted. They hope to cash this opportunity by exporting their inferior Mango varieties to EU. (In past, even Paki mangoes were banned because their ban has been lifted.)

India’s stand on EU Mango Ban

India has threatened to drag EU to WTO. Because

- From 1st April 2014, Indian Government made it compulsory that only APEDA certified food processing / packing houses can export fruits/vegetables from India.

- Only after thorough inspection, testing and labelling by trained personnel at such houses, the mango (or any other fruit/veggies) can be exported.

- So there is no danger of fruit flies any more. (from 1st April onwards)

- We had also informed EU’s SPS Committee about our new strict export rule, in advance.

- But still EU officials acted in haste. Yes they’ve found 200 shipments with fruitflies. But those boxes were exported way back in 2013. We’ve “reformed” and strengthened our quality measures since then.

- So, there was no “imminent danger” anymore. It wasn’t going to cause some deadly virus outbreak.

- Yes SPS agreement says countries can impose ban on product that can harm humans, plants or animals. BUT at the same time SPS also gives leniency to developing countries (like India)- gives them more time frame for adopting quality measures when there is no “imminent” danger.

Thus, EU has blatantly violated WTO’s SPS agreement and India is justified in complainng to WTO.

Anti-Arguments

Some experts / apologists say India shouldn’t drag EU to WTO because

- It’ll have negative consequences in the ongoing talks for India-EU Free trade agreement that is pending since 2007.

- India-EU relations will turn sour.

- India’s Mango export to EU is barely 5% of India’s total mango export to world. Hardly any money or business is lost.

- This is good news for Indian customers because more mangoes in local market = cheaper price.

But these jholachhap columnists don’t understand – it’s not about money but brand-image and negative Publicity. It’ll reduce demand of Indian food products among health conscious customers in USA, Canada even Middle East. Then our agriculture & fish export business will be severely hurt, affecting the livelihood of crores of Indian farmers and fishermen.

Preventive measures against Fruit Fly

Agricultural & Processed Food Products Export Development Authority (APEDA) is a statutory body under Commerce Ministry. It has prescribed following measures for mango exports:

- Sex traps: On the mango trees, hang plastic bowls with chemicals like Methyle Euginol/Cuelure. Male Fruitflies mistake it for pheromones of female fly. Hence they come and get trapped. Benefit: Mangoes don’t get contaminated with pesticides/chemicals. Otherwise EU-walla will again reject on pesticide/cancer angle.

- Hot bath: dipping mangoes in 52 Degree hot water with Sodium Hypo Chloride (= bleach, acts as sanitizer) for 2-3 minutes. This kills any larvae of fruitfly within mango pulp.

- Sort these mangoes into three grades. Each mango should be placed in polystyrene netted sleeves to prevent bruising and subsequent microbial growth.

From 1st April 2014 onwards, fruits and vegetables can be exported from India ONLY if they’re packed in an APEDA certified packing house.

More about shortcoming / obstacles ot Indian food processing / exports, HACCP compliance etc are covered in Mrunal.org/Economy under [Food processing] Section.

Sample question for Mains

Q. What is SPS agreement? Is EU justified in banning Indian Alphonso under SPS agreement? (200 words)

Meaning

Sanitary and Phytosanitary Measures (SPS) is an agreement under WTO to permit member states…

- to protect their plant, animal and human lives

- from harmful food additives, microbes and pests,

- By putting reasonable trade restrictions on foreign goods.

Safeguards under SPS

- Member states have to harmonize their national food safety standards with WHO-FAO’s codex standards.

- Member can choose higher quality standards than CODEX, only on scientific grounds.

- Aggrieved countries can also approach WTO’s dispute settlement mechanism.

- Developing countries can request SPS Committee to grant additional time for for compliance.

EU Ban:

In April 2014, EU Trade commissioner imposed a temporary ban on Indian Alphonso and 4 vegetables upto December 2015, citing fruit fly contamination in previous shipments.

Ban is unjustified because:

- The said fruitfly contaminated shipments were sent in 2013.

- As per new rule by Government of India, from 1st April 2014, only APEDA certified food packing houses can export fruits & vegetables from India.

- We had notified EU’s SPS Committee about this reform, in advance.

- There was no “imminent” danger of spread of deadly disease or pest attack anymore.

- India, as a developing country deserves longer time frame to comply with international food standards.

Yet, EU’s trade commissioner has acted in haste and arbitrary manner to impose this ban. It goes against the letter and spirit of SPS agreement.

~230 words

E2: [Banking] HDFC Bank vs FIPB: Foreign investment Problem

| 1977 | Hasmukhbhai Parekh opens Housing Development Finance Corporation Limited (HDFC ltd.) as a non-banking financial company (NBFC) to provide home loans. At present ~75% of HDFC ltd.’s shares are owned by foreign institutional investors (FII). |

| 1993 | HDFC get license to open Bank (for more on new bank licenses, click me) |

| 1994 | HDFC Bank starts operation. |

Foreign investment in banking sector

| Upto 49% |

|

| Upto 74% |

|

What is HDFC’s problem?

- HDFC ltd. (Parekh-walli non-banking financial company) = they own ~22% shares of HDFC Bank.

- But 75% shares of this HDFC ltd (NBFC) itself owned by FIIs.

- RBI says “since majority of HDFC ltd. Shared owned by foreigners => HDFC ltd (Parekh-walli NBFC) itself is a foreign company.”

- So, when HDFC ltd (NBFC) owns 22% in HDFC Bank = that also counts as Foreign investment.

RBI’s interpretation

| Foreign holding | I. HDFC ltd (NBFC) | 22% |

| II. Other FIIs | 52% | |

| Total Foreign investment (I + II) | 74% | |

| Desi holding | Indian investors | 26% |

| HDFC Bank’s total shares | 100% | |

Rajan: Since Foreign holding in HDFC Bank is already 74%, we cannot allow any foreigner/NRI/PIO to purchase any more shares of HDFC bank. Otherwise it’ll cross the 74% limit.

HDFC’s own interpretation

| Foreign holding | FIIs | 52% |

| Desi holding | HDFC ltd. (NBFC) | 22% |

| Desi investors | 26% | |

| HDFC Bank’s total shares | 100% | |

HDFC Bank says:

- In 2009, government made new rule about “downstream investment” i.e. if one desi company owned by foreigners, and it invests in another desi company = that counts as foreign investment.

- It is true that HDFC ltd (NBFC) is owned by foreign investors (75%)

- It is true that HDFC ltd (NBFC) owns 22% shares in HDFC Bank.

| HDFC |

|

| Rajan |

|

| HDFC |

|

| FIPB | I’ve asked law ministry’s opinion. But given the model code of conduct (and usual policy paralysis) they’ve not given their opinion yet. Hence file pending. |

E3: [Banking] Cheque Bouncing: SC guideline for faster case trial

- Negotiable instrument are the alternative equivalent of fiat money. (Rupee, Dollar Yen, Yuan etc.)

- Indian laws recognize three type of Negotiable instruments:

- Cheques

- Promissory Notes (*Mind the term, it’s not “participatory” notes)

- Bill of exchange

- Government enacted Negotiable instrument Act, to safeguard the parties in this game e.g Buyer-seller, payee-drawer and banks.

- But legal loopholes in this act = taarikh pe taarikh = 40 lakh cheque bouncing cases stuck in the courts right now.

To fix this problem, Supreme Court issued new guidelines (April 2014):

- Once magistrate receives complaint, he shall issue summons to accused person on the same day.

- Summon should be issued via both post + email.

- Once the accused person appears in court, Magistrate should give him option “pay the amount + reasonable interest” and case will be disposed immediately on the same day.

- If he doesn’t comply, then start proceedings with day to day trial.

- Finish cross-examination of witnesses within three months.

- Victims and witnesses don’t need to appear in court every time. They can send reply via affidavit.

E4: [Banking] RBI- Public Key Infrastructure in Online Banking

- Jan 2014: Rajan forms an expert group under Anil Kumar Sharma for Public Key infrastructure in Banking Payment system.

- April 2014: gave report hence in news.

Timeline: Payment system in India

| 1986 |

|

| 1994 | Electronic Clearing Service (ECS) introduced. This provides automatic credit and debit for certain services. example

|

| 2004 | Real Time Gross Settlement (RTGS) System for online money transfer above Rs.2 lakhs. |

| 2005 | National Electronic Funds Transfer (NEFT) System. by the way NEFT vs RTGS already explained click me |

| 2008 | National Electronic Clearing Service (NECS) to look after ECS system. |

| 2008, Oct. | Mobile banking system |

| 2009 | Pre-paid Payment Systems permitted (like Airtel money). Already explained click me |

| 2010 |

|

| 2013 | White label ATMs. Already explained click me |

What is Digital signature / E-Signature?

- can be used to authenticate the identity of message sender

- cannot be imitated by someone else;

- They’re legally recognized under IT Act 2000

- IT Act also provides “Non-repudiation” of digitally signed message. Meaning sender cannot deny at a later time that he has not signed it.

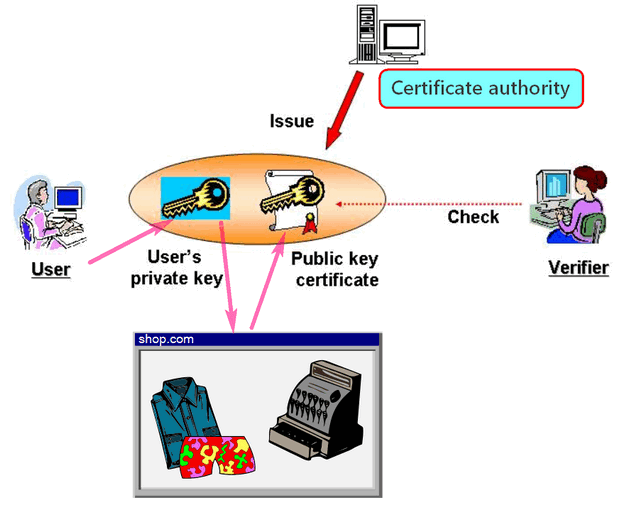

What is Public Key Infrastructure (PKI)?

It is a combination of

- Technology = hardware + software

- Stakeholders = certificate authority, verifying authority, buyer, seller, bank, client etc.

- Legal components = agreements between above stakeholders

- Processes, practices, policies

PKI binds the identity of the private key with the corresponding public key.

PKI makes it difficult for hackers to commit frauds.

| Uses PKI | Doesn’t use PKI |

|---|---|

|

|

| Value wise most transaction done here | Less |

| Less | Volume wise, max. transaction done here |

RBI panel has suggested that all online transaction must have “two-factor” authentication with Public Key infrastructure.

| For corporate clients/RTGS etc. | For aam junta |

|---|---|

OR

|

OR

|

| Panel recommended, implement this in three stages: short term, medium And long term. | Banks already have this feature in netbanking account. Panel recommended that it should

|

|

— |

@those aspiring to become Bank specialist Officer (IT) – they should read the entire report thoroughly. It’s available on www.rbi.org.in/scripts/PublicationReportDetails.aspx?UrlPage=&ID=759

It contains details of various cyber-attacks, preventive measures in SBI and ICICI netbanking and all other technical aspects of online money transactions.

Visit Mrunal.org/CURRENT for entire Archive weekly current affairs compilations published so far.

![[Current] Economy SepW1: Wilful Defaulters, MNREGA reformed, Global Competitiveness Index, BSNL-MTNL Merger, Gold Account scheme](https://mrunal.org/wp-content/uploads/2014/09/Cover-Wilful-defaulter-500x383.jpg)

Mrunal ka ‘haath’,

Junta ke “saath’………

sir, i have been preparing for UPSC since 2012 and your valuable guidance through me and my friends have learnt lot of things but i would like to

convey that if your provides it in diagramatically in a little space in order to give it a visual effect it will far better than existing one.

sir pls upload may last and june. month current affairs plzzzzz