- Foreign Investment rules: SEBI Vs RBI

- What are Hedge funds?

- Difference between Hedge Fund & Mutual fund

- What is Participatory Note (P-Notes)?

- Appendix: How Hedge funds make money?

- Mock Question

- Correct Answers for MCQs

FII rules: SEBI Vs RBI

| SEBI | RBI |

|---|---|

| FPI: Foreign portfolio investor | ReFI: Registered Foreign Portfolio Investor |

| effective from June 1, 2014 | effective from March 19, 2014 |

Includes

|

same as SEBI |

| NRI excluded | same as SEBI |

| Can trade in Indian shares, bonds, debentures, derivatives | same as SEBI |

SEBI: investment limit

|

investment limit

|

| have to register themselves as “FPI”, in any SEBI-approved Designated Depository Participants (DDP) | — |

| further classification into three categories (Given below) | nope |

SEBI new classification of Foreign investors

Foreign Portfolio Investors (FPI), New classification is based on two criteria:

- Risk profile: less risky – means better category

- KYC compliance: better Know Your customer compliance means better category

| CAT I |

|

|---|---|

| CAT II |

|

| CAT III |

|

Donot confuse between these FPI vs alternative investment funds

SEBI: Alternative investment fund (AIF) classification

| AIF Category | Examples | impact on Economy |

|---|---|---|

| 1 |

|

Positive. They help new entrepreneurs, startup companies and infra. Development |

| 2 | Those not in the category 1 or 2

|

Mixed. They use leverage only for day to day requirements. Hence less dangerous than Hedge Funds. (leverage explained in appendix). |

| 3 | Hedge funds | They pose systematic risk to Indian market, due to complex trading strategies. (explained in the Appendix) |

What are Hedge funds?

- You’re aware of the mutual funds (MF): you invest money in MF, they invest money in share market and give you profit, after cutting their commission.

- Hedge fund is a similar investment game, where High net worth individuals (HNI) pool their money into high risky games to earn high return on investment.

- But their trading-techniques are far more complex than mutual funds, hence Hedge funds can make money even with sharemarket going down.

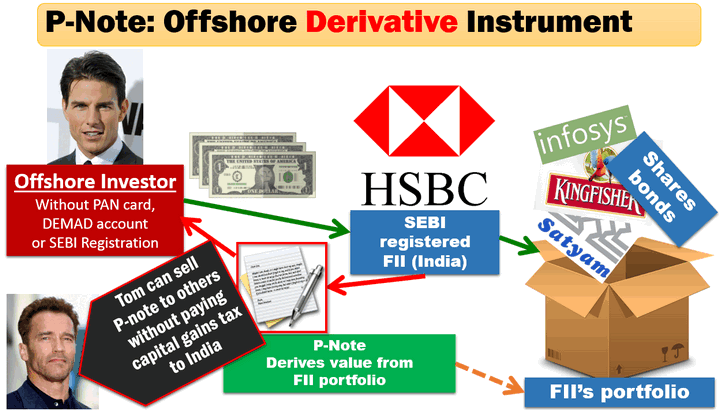

What is Participatory Note (P-Notes)?

- Tom Cruz wants to get maximum return on the investment in quickest possible time.

- For this, Tom will have to find risky securities (shares/bonds) in third world countries, then invest money from one country to another quickly, depending on how sharemarket moves.

- In India, no one can invest in sharemarket without getting PAN card + DEMAD account first. Other nations too have similar mechanism.

- But if Tom tries to get PAN card and DEMAT account in each third world country, then his profit will decline- given the cost of running branch office, staff salary, DEMAT fees etc. in each country.

- So, to take a shortcut, Tom will contact some ‘middleman’ who is already registered as an FII, has PAN card & DEMAT in India. e.g. HSBC.

- Tom gives money to HSBC, with instruction “buy A, B and C shares/bonds in X, Y and Z quantity.”

- HSBC buys Indian shares. They’ll be stored in DEMAT account of HSBC, and won’t be given to Tom.

- But HSBC then gives a receipt to Tom listing the shares/bonds purchased on his behalf and stored in HSBC’s DEMAT account.

- This receipt is called Participatory Note.

- Technically, it is called “offshore derivative instrument”. Observe the words

| OFFSHORE | Because foreigner owning something in India, without coming to India or opening office in India. |

| DERIVATIVE |

|

| INSTRUMENT | Self-explanatory- this is one type of financial instrument to invest abroad. |

- 1992: SEBI had permitted P-notes, to boost foreign investment in India, after BoP crisis of 1991.

- P-note owner doesn’t own the shares. (because they’re in the DEMAT account of that intermediary FII)

- P-Note owner doesn’t have voting rights in the shareholder meetings

Where is the profit in P-notes?

Tom has two options

- Wait and watch. If the price of those shares go up, call up HSBC to sell them. HSBC returns principal + profit to Tom, after cutting commission. Tom returns the P-note receipt to HSBC.

- Sell this P-note receipt to another foreigner say Jerry. Then Jerry again has same two options.

Why Ban Participatory Notes (P-notes)?

- As of March 2014, Foreigners invested ~Rs. 2 lakh crore in India via P-notes. (this is 13% of the total FII money coming in India)

- As such the FII has to disclose P-note owner data to SEBI on quarterly basis (every 3 months). But often, within 3 months the P-notes would have changed many hands (e.g Tom to Jerry to Micky to Goofy).

- Thus P-note investments are Anonymous. Hard to trace the owner. Can be used for money laundering and terror financing.

- Hot Money: can leave Indian market very soon based on just one phone call from Tom Cruz to HSBC. Hot money creates heavy rise or fall in share market, so even genuine investors’ money is lost.

- e.g. Tom continuously buys Infosys shares, they goup to Rs.3000 per share. So, you (indian) also buy, thinking “Infosys will go even higher to 3500, and I’ll make profit”.

- But suddenly tom sells everything, to invest in China for better return.

- Now infosys sells not even for 2000. Then you (Indian investor) lost 1000.

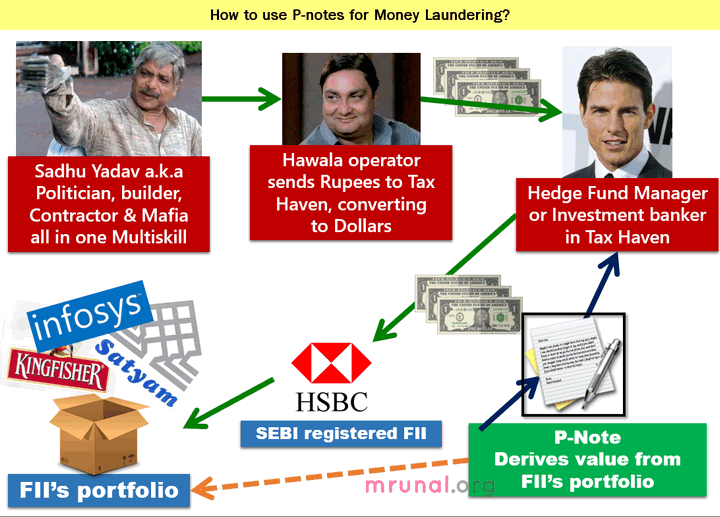

P-Notes, Money laundering & Terror Financing

- Finance Ministry Whitepaper: Indians first send their money to Cayman Islands, British Virgin Islands, Switzerland, or Luxembourg via Hawala operators. Then, their agents convert rupees to dollars, re-invest it in Indian market through P-notes. It is possible to hide the identity of the ultimate beneficiaries, because of these multiple layers. Thus, P-notes are used in money laundering.

- Ex-National security Advisor MK Narayan: Terrorists are using P-notes to invest in Indian stockmarket, and using the same profits to finance terror operations against India. They may use this mechanism to first boost Indian stockexchage, then collapse it by quickly pulling out money from the market. Doubt: how can a poor Pakistan afford creating volatility in Indian market? Ans. Via printing fake Indian currency, converting it to dollars in a tax haven, to buy P-notes via a post office company!

- RBI’s Tarapore Committee: Recommended Banning P-notes for national security and to stabilize stock exchanges

P-notes and CGT evasion

- Capital Gains tax is a direct tax levied on profit from sale of shares/bonds/gold etc.

- It is possible to evade capital gains tax via P-notes. Observe:

| With P-Notes | Without P-notes |

|---|---|

| Tom can buy Indian shares via FII via p-notes. |

|

|

|

- **In theory, the seller has to pay the Capital gain tax (Tom Cruz in our case). but in reality the buyer (Jerry) has to cut down the amount from payment to Tom, and give directly to government. Recall the Tax deduction at source (TDS) concept in Nokia controversy article click me.

| Parthsarathi Shome |

|

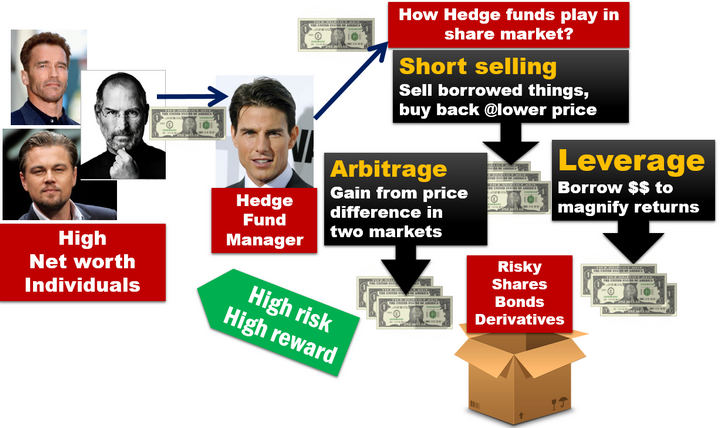

Appendix: How Hedge funds make money?

- Suppose, Mr.Tom Cruz runs a hedge fund for High net worth Individuals (HNI) Arnold Schwarzenegger and Leonardo di Caprio.

- To get maximum return in quickest possible time, Hedge Fund manager Tom Cruz will apply three techniques:

#1: Short selling

- Suppose Facebook shares are selling at $1200 dollars.

- Tom Cruz “borrows” 5000 facebook shares from a broker Bruce Willis, for two days; and immediately sells them in share market.

- Now, Facebook share price will fall to say $1000 (imagine sudden supply of new onions in the market)

- Tom buys 5000 facebook shares @$1000 from another investor, and returns them to broker Bruce Willis.

- What’s Tom’s profit here:

| Price per share | quantity | total | |

|---|---|---|---|

| Tom Sold | 1200 | 5000 | (+) 60,00,000 (because he received $$) |

| Tom bought back | 1000 | 5000 | (-) 50,00,000 (because he paid $$) |

| Tom’s profit | $10,00,000 |

- You can see this is a risky game. Sometimes share price may not fall down but increase (because of some other player doing large purchases). In that case Tom will lose money (because he’ll have to buy higher priced shares and return to Broker Bruce Willis.) ad Broker Bruce Willis will make profit. (Because he will receive shares whose market price has now increased.)

- For short-selling trick to yield result, you need massive quantity of shares. (If I sell 1 kilo onion from my kitchen, it won’t bring down prices in the Mandi. I need atleast a 1000 kilo, to change the supply-demand and prices.)

- Therefore, Hedge funds don’t accept aam-admi in their game. They only allow High Networth Individual to join the game, who can finance such large purchases and have deep pockets to suffer large losses.

#2: Leverage

Suppose Tom has only $500 and wants to bet in $1000 worth shares.

| his own pocket | $500 |

| borrows from a friend @10% interest | $500 ($50 in interest later repaid) |

| total with Tom | $1000 |

Tom uses this $1000, to purchase shares from Broker Bruce Willis. Now suppose same share’s price goes up** and Tom is able to sell them @$1200.

What’s Tom’s profit here?

| Earned | (+) $1200 by selling shares |

| invested | (-) $500 from his own pocket |

| borrowed | (-)$500 principal to friend |

| interest | (-) $50 interest to friend |

| Profit | $150 |

** Shares price can go up for variety of reasons.

- company expected to make good profit (and thereby declare bigger dividends)

- there are talks of merger / acquisition of that company

- If Tom himself starts buying large amount of shares (imagine scarcity of onions).

Again, this is a risky game, if Share prices doesn’t rise, Tom will make huge losses (Because he’ll have to return $550 to the friend at some point).

#3: Arbitrage

When same thing sells for different rates in two markets, Tom can take advantage of arbitrage, to make profit.

| New York stock exchange | California Stock Exchange |

| 1 facebook share sells @1000 (on today’s date) |

|

In this case, Tom will purchase 1000 shares of Facebook from NY and simultaneously make future contract with Californian investors “ok I’ll sell you the shares @ $1200 after three months”.

This Tom’s profit: $200 x 1000 Nos. = $2 lakh Dollars.

Although in real life, the arbitrage is so narrow Tom will have to apply ‘leverage’, to make significant profit. Example

- NewYork: $1000 / per Facebook share

- California: $1002 / per Facebook share.

Here only $2 profit per share

- If Tom wants to make $2,00,000 profit, he will have to buy 1 lakh No. of shares.

- But he may not have that much money in his own pocket, to purchase such large quantity.

- In that case, Tom will need to borrow additional money from friend to play this game (refer the Leverage concept again.)

With advent of online trading, the arbitrage has decreased to decimal points. say $1000.38 in NY and $1000.40 in Cali. So, here Tom has to buy even bigger quantity (Ten lakh shares) to see substantial profit. Tom Cruz may have excellent brain but he’d need High Networth Individuals like Arnold & Leonardo to provide him the necessary funding. Thus, Hedge funds emerged.

Going even complex:

- NewYork: $1002 / per Facebook share

- California: $1002 / per Facebook share

How can Tom make money here?

- He’ll first apply “Short selling” technique in New York so that Facebook price falls down at 1000. ($2 profit)

- Then he uses arbitrage between NY and Cali to make additional profit. ($2)

- So 2+2 = 4$ profit per share. Imagine if he bought 1 lakh shares like this.

Mock Question

Q1. Find correct statements about the new classification of foreign portfolio investors by SEBI

- the entities with higher risk profile and lower KYC compliance, are put under category Three

- alternative investment funds are put under category one

- University endowment funds are put under category Two

Answer choice

- only 1 and 2

- only 2 and 3

- only 1 and 3

- All of them

Q2. Find the incorrect statements about the classification of alternative investment funds by SEBI

- Entities with positive externality on Indian economy, are put under category three

- infrastructure funds are put under category two

- hedge funds are classified as alternative investment funds category III.

Answer choice

- only 2

- only 1 and 2

- only 2 and 3

- only 1 and 3

Q3. What are the consequences if SEBI/RBI doesn’t put any restrictions on foreign portfolio investors?

- Dollar to rupee exchange rate may become volatile

- Indian Sensex may become volatile

- India may run into another balance of payments crisis

Answer choice

- only 1 and 2

- only 2 and 3

- only 1 and 3

- All of them

Q4. Find incorrect statement

- An foreign portfolio investors can buy only a fixed quantity of government bonds in India, but he’s free to buy as many corporate bonds as he wishes.

- A foreign portfolio investor can demand position in the board of directors of a commodity trading exchange, if owns sufficient number of shares of the said exchange.

- Both A and B

- neither A nor B

Q5. Consider following statements

- An NRI need not register himself as a foreign portfolio investors, if he wishes to buy corporate bonds

- An NRI need needs to register himself as a foreign portfolio investors, if he wishes to buy government bonds

- An NRI is prohibited from buying Treasury bills.

Which of them are incorrect?

- Only 2

- only 1 and 2

- only 2 and 3

- only 1 and 3

Q6. Consider following statements about Hedge Funds

- A middle class Indian family cannot invest in Hedge Funds.

- In theory, Hedge fund can provide good return even during slowdown in sharemarket.

- Given their risky profile, SEBI doesn’t permit foreign hedge funds to operate in India.

Which of them are correct?

- Only 3

- only 1 and 2

- only 2 and 3

- only 1 and 3

Q7. P-Notes is a/an ____.

- Alternative investment instrument

- Alternative derivative instrument

- Offshore derivative instrument

- Offshore equity instrument

Q8. Who uses P-notes?

- Entities that want to raise capital from abroad but can’t, due to ADR/GDR/ECB related norms.

- Entities that want to raise capital from abroad but can’t because of ECB norms.

- Entities that want to invest in a securities market abroad, but want to maintain anonymity.

- Entities that want to invest in a sector where Foreign direct investment is prohibited.

Q9. As per SEBI norms

- Foreigners are completely prohibited from using p-notes to invest in India.

- Only NRIs can use P-notes to invest in India.

- IF a person wants to invest via P-notes, he needs to get a PAN card first.

Which of them are correct?

- only 1 and 2

- only 2 and 3

- only 1 and 3

- None of them

Q10. In stockmarket, what do you understand by the term “Leverage”?

- Seeking to increase returns by borrowing funds.

- process of selling securitis that the seller does not own.

- Profit from the price differentials between the two markets.

- Buying securities from the primary market to sell them at higher prices in secondary market.

Q11. In stockmarket, what do you understand by the term “Stag investor”?

- Seeking to increase returns by borrowing funds.

- process of selling shares of a security that the seller does not own.

- Profit from the price differentials between the two markets.

- Buying securities from the primary market to sell them at higher prices in secondary market.

Q12. In stockmarket, what do you understand by the term “Arbitrage”?

- A broker offering “option” on a share selling contract.

- Profit due to difference between two stock indexes e.g. SENSEX vs NIFTY.

- Profit from the price difference of securities between the two markets.

- Buying securities from the primary market to sell them at higher prices in secondary market.

Mains & Interview

- (GS3) What is Participatory note? Why does it pose challenge to the fight against money laundering and terror finance?

- (interview) SEBI should completely ban P-notes. What’s your opinion?

Correct Answers for MCQs

- Answer C only 1 and 3 correct. Alternative investment fund is a different thing

- Answer A. You were required to find the incorrect statement viz. statement #2

- D all of them.

- Answer C. You were required to find incorrect statement.

- Answer C only 2 and 3 are wrong.

- Answer B. 1 and 2 correct.

- P note: offshore derivative.

- Answer C maintain anonymity.

- D none of them correct.

- A. increase returns by borrowing funds

- D

- C price difference between two markets.

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

wonderful mrunal !!!….thanks !

thank you mrunal!!!!! wonderful!!

Thank you :)

FoR MRuNal sIr it’S thUmps uP rulE alwaZ….

Million of Thanks Mrunal Jee, Your article are really me helping for rural area aspirants

thank you sir….

Thank u ! Sir will b science and technology part b published before prelims ???

Nice one..

Frnds hve u any infrmtion abt remedical date of capf??

very well explained

thanku very much sir ….u’r articles clear all

the concepts of indian economy

excellent mrunal sir ………thnx !

Sir, I have one doubt. You mentioned that pakistanis print fake indian currency and weaken our economy. Does it mean anybody can affect any country’s economy by printing fake currency of that country?

They not just print, they send the fake notes to India. and definitely it will weaken our economy.

i meant anybody can weaken an economy by printing and sending fake currency to a country, or they can simply print notes in the country itself. So, all economies are very vulnerable.

lucky in theory yes , but in reality it is not so easy , there are many features which are unique to the currency notes , and also their paper and ink are also special . So it is not easy thing to do .

it took me two years to learn and use these hedging , arbitraging methods while trading in share market and future derivatives.

extra info

in futures contract u can leverage (intraday) upto 100x means if gold is today 30 lakh per kg then i can buy it for 30,000 only. (ultra high risk)

Hi Mrunal,

Could you write an article on GST and DTC ? I am requesting this as you have gift of explaining most difficult of things in simplest of words. Though I have understood that GST is just another Value added Tax, Albeit with a large base and with facility of reducing the earlier paid tax from the final payable tax and that It is to be paid by the consumer but I am still not very clear with all the concepts. So if you would take out some time to explain it , I would be extremely grateful to you .

yes sir , please write about GST and DTC .

Thanks ..Mrunal….plz continue your economy special…

thanks patel bhai..:)) u make economy alwazz easy…

marksheet of 2013 exam r out

SCORED 194 ONLY :(

\

mrunal bhai in india short selling it totaly ban

and in india ther is no hedge fund type

u will find hedge fund outside india

yes hedge fund make profit but through calculate risk in sector wise

by make trading position in future n option

they bet on option volatility our indian volatilty index === indian vix

u will see vix was high during election time ie national event

when market is down den vix will high and when market is up den vix is down

correct me if i m worng

in future derivatives and equity short selling is not banned,

i m not able to see my marks…I applied for IFS

mine CSE(P) 2012 score 202 cut-off was 209..failed by 7 marks

CSE(P) 2013 score 234 cut off is 241..again failed by 7 marks:(

i worked hard and boosted my score by 32 marks from 2012 to 2013..but upsc worked equally hard!

fine its really bad but dont lose. hopes neeraj b cool work out on your weak points and u r bound to get success in every phase of life

Thanks Mrunal,

Nice compilation

Great article!! Thanks a lot Mrunal..:)

Excellent article….after 5 years I could understand the concept like hedge funds p notes….thnx mrunal….u made economy very simple…

upsc uploaded the marksheet for pre, mains

got 217 (paper I – 67.34 + paper II- 150 ), first attempt. started preparation for prelims on March 29th 2013 (2 months before xam). OBC. hoping for the best this year.

Same here 221.34 (Paper I- 91.34+ paper II- 130) cutoff 222.

Nice job,,,All d best for 2014

Hi Harsha

I am also planning to give UPSC prilm did you take any coaching? i am also obc

God level!

Mrunal Sir,

Can we see our Mains Exam answer sheet through RTI?

Speechless. What an article!!!.

Thanks!

Need help plz..I am nt able to see my pre marks..roll no is 207683 nd dob 22.01.92 opted both ias ifs somebody plz help..

Sir plz clear my doubt in syllogism if two conclusions r complimentary and out of which one is proved then wht is our final answer? Either of two or one which proves true

super

Can somebody plz help

Please check ur roll no again

Mail me ur call letter at my mail id

Sahilkapoors23@yahoo.com

yaar mera bhi batana …

Roll no 677507 , 09/06/1987

I got the score , not worth of sharing here..