- Prologue

- [Block-1] PPP finance for Infra

- [Block-2] Infra: Roads and Highways

- [Block-3] Infra: Aviation

- [Block-4] Infra: Railways and Shipping

- [Block-5] Infra: Urban-Smart cities

- [Block-6] Energy: Coal

- [Block-7] Energy: Natural gas

- [Block-8]Money Laundering, Black Money, Bitcoins

- [Block-9] Development vs Extremism

Prologue

In the last part revision note on economy

- Infrastructure: Energy, Ports, Roads, Airports, Railways etc.

- Money laundering, Bitcoin, BEPS

- Linkages between development and spread of extremism.

- All the revision notes are archived at Mrunal.org/UPSC#CSE-2014

[Block-1] PPP finance for Infra

Infra is important because:

- Population + Economic growth= heavy pressure on Transport + Energy + communications.

- So, if these 3 not improved = GDP bottleneck despite demographic dividend + poverty rise + costly essential services.

- No environmentally sustainable infrastructure= No inclusive growth

What’s Government role infra?

- “Planning” for all regions’ Development. Otherwise fueling extremism/secessionism.

- To control fiscal deficit, “contracting” out via PPP.

- After PPP projects done, “regulating” to prevent monopolies and market failures.

PPP problems in India

- Early 2000s: model success in highway, port, airports

- Boom=overleveraged firm bidding for projects beyond their aukaat. They hoped if epicfail, we’ll ask for more time to complete project / redraw contract to get concession/higher tolls.

- But subprime crisis + inflation+ Government refused to re-draw PPP contracts /policy paralysis / environment clearance delays=> projects unfinished=> NPA.

PPP solution in Budget 2014?

- 3P India inst. To make better contracts for PPP projects, with conditional flexibility examples:

- Traffic trigger: more traffic then allow operator to increase fees.

- Re-equilibrium discount: to drivers IF highway operator doesn’t improve service.

- + Survey asks Government to help NPA-firms to exit project. Let healthier firms takeover.

- Promote REITs, INVITS, Muni.bonds, IDF etc. for infra-finance.

[Block-2] Infra: Roads and Highways

R1: E-toll collection

- Highway toll rates not uniform all over india.

- Complaints of overcharging and under-reporting by private contractors

- Manual operation =>long queues at toll booth.

- 2010: Nilekani Committee suggests electronic toll collection using RFID – Radio Frequency identification.

- Separate company setup for this- “Indian highways Management company ltd.” E-toll made mandatory for all new highway projects. will save 86k crore annually.

How does E-Toll work?

How does Electronic Toll Collection work?

- Buy the prepaid fastag from ICICI/Axis bank. Affix it on car windshield.

- There will be separate lane for RFID tag-walla vehicles. Simply ride through it and toll money will be deducted from your pre-paid account.

- NH8: Mumbai to Delhi total 26 toll plazas, imagine the time saved.

R2: Highway finance PPP: BOT vs EPC

| PPP (BOT) mode | PPP (EPC) mode |

|---|---|

|

Engineering, Procurement Construction |

|

|

|

|

|

Just 3-4 months. |

Capital goods sector scheme

- Capital goods= heavy machinery used for mfg/construction.

- 2nd largest imported item after crude oil =high CAD So need to become self-reliant.

- Government launched Scheme for Enhancement of Competitiveness of the Capital Goods Sector

- Setup machine tool parks, engineering facility for textile machinery and separate fund for R&D via tech institutions.

- Compulsory QC for earth movers (bulldozers).

[Block-3] Infra: Aviation

A1: Draft aviation policy: 2014

- List AAI, Pawans Helicopters on stock exchange=> later disinvestment can be done.

- AirIndia privatization not yet.

- 6 metropolitan airports to be developed into international hubs

- Total ~130 airports today. Create more via PPP.

- Boost NE connectivity =>no frills airport.

- ATF cost 40% higher than other nations. Need to reduce taxes on it.

- Incentivize MRO – maintenance, repair, overhaul. (via land+taxes incentives)

- create more jobs in aviation sectors. Bcoz 100 jobs in aviation => creates 600+ jobs overall.

A2: Aviation: No frills airport

No Frills Airport= रस्ते का माल सस्ते में.

- Need Air connectivity to backward regions but Low profitability remains a challange.

- Therefore, No frills by AAI: no longues, no conveyor belts, single storey bulding

- Can be built in 2-3 years, with <100 crore investment.

- Approved @5 cities in Arun, Raj, Odi, Karna.

Others issues in Aviation:

- 49% FDI permitted; greenfield airport 150 from existing (100 kms)

- USA aviation safety rating: cat1 to cat2= longer time in checking.

- Predatory pricing by spice jet. DGCA notice

- State VAT on ATF: 30-35% need to reduce

[Block-4] Infra: Railways and Shipping

Examine the need for re-structuring railways:

- Only 31% total freight carried. Truck transport-more pollution and expensive.

- Poor operating ratio 94%. Only 6 paisa in surplus

- Compromise sanitation + safety

- Populist budgets in past. Need Rs.50k cr. Every yr for next 10 years to finish’em all.

- Too many rail stoppages.

USFD rail track security

- indigenously developed ultra-sonic flaw detector

- To detect breaks in the rail/weld of the tracks and allow preventative actions.

- It measures Ultra Sonic pulse intervals to pinpoint the place of crack.

- Can eve detect corrosion in the bottom of the tracks and the size of a crack,

- Tracks can be inspected much quicker without blocking any trains.

- Desi machine cost 2 lakhs; Imported machine- 2 crores;

Additionally: Bridges over unmanned crossing. RPF escort teams for passenger safety

Railways Green initiatives-

- windmill, solar panels at each rail station.

- Green curtain (chowkidari against urinators); Biotoilets with DRDO; 5% blending of biodiesel.

- Diamond quadrilateral to connect metros via highspeed rails.

- Finance and operations

- 100% FDI in rapid transit, highspeed, suburban and dedicated freight lines

- PPP, BOT financing

- 2% project cost to be given as commission if team finishes on time, says New Railminister Suresh Prabhu.

- Paperless ops in 5 years. Wifi in selected stations, next gen. reservation system.

- Tourism: eco circuit, pilgrim circuit etc.

- Rail univ. to provided dedicated skilled staff.

- Separate parcel biz from passanger biz.

- A’bad-Mumbai metro: speed >300kmph, JICA help, need 60k crore.

- Bibek Debroy panel for rail re-structuring, E.Sreedharan panel for transparency and accountability

Infra: Shipping

Problems:

- No ease of doing biz: 150 documents, 4 days clearance, 12 type of taxes.

- Large vessels cannot dock; poor warehousing; 12 ports’ tonnage=Shanghai alone.

Project Sagarmala

- Vajpayee Government (2003)

- NHAI like Sagarmala Development authority

- $$ via maritime cess, PPI, FDI (100% in port Development)

- Better ports, inland water, coastal shipping.

Project Sethu samudram: shipping canal between Palk bay and Mannar gulf to reduce time and fuel. Anti: will hurt biodiversity and religious sentiments.

[Block-5] Infra: Urban-Smart cities

- Example: Surat water quality; Boston-gun shot sensors; Dublin-parking lots app; London Mayor data mining twitter feeds.

- 50% Indian to live in cities by 2030. Indian Neo middle class wants better civic amnesties.

- Smart cities project= Urban ministry to build New satellite towns, upgrade existing. Proposed sites: Manesar, Dholera etc.

- Street light, water supply to swichoff on timers-Low carbon footprint.

- Parking, traffic congestion, public transport using ICT tools.

Financing the smart city projects?

- Government to pay 7k crore; municipal debt fund.

- 100% FDI norms relaxed. More concession to FDI investor, if 30% money spent on poor/low income housing.

REITs: Real Estate investment trusts

REITs will be used for financing Smart cities

- Real estate: home, office, township construction

- Investment: by Indian, NRI, foreigners

- Trust: like mutual fund.

- Pooled money=> near completion projects=>lease/rent=>profit sharing according to units held.

- invITS: infra investment trust. Mechanism similar to REITS but pooled money invested in ports, highways etc. money earned from service fees/tolls collected.

- Benefits of both: investment opportunities, less gold consumption, new finance to recover NPA, more infra.

New schemes for urban / rural infra.

| Sardar Urban housing Mission |

|

|---|---|

| Shyama prasad Muk. Rurban | to give villages city like infra+skill training + economic opportunities |

| Din Dayal Gram Jyoti | 24/7 electricity to villages. |

[Block-6] Energy: Coal

India got 4th largest reserve coal reserve, yet importing because:

- Delayed environment clearances

- Poor rail-linkages between coal mines and factories.

- Cyclone Phalin’s impact on Mahanadi coalfields, coal scam And so on…

DONE reforms in Coal sector

100% FDI in the power generation, transmission, distribution, trading

49% FDI in power exchanges

- Fuel supply agreements (FSA) between Coal India and its clients. If Coal India can’t supply 80% of the guaranteed quantity, it’ll have to pay fine/ give imported coal.

- Budget 2014 promised: coal supply to all plants setup by 2015, better rail connectivity, super critical technology and coal washries.

- Coal ordinance to fix complications arising from SC’s cancelation of coal blocks.

Coal SCAM

- 1973: coal nationalization act private coal mining not allowed.

- 90s: Coal mines (Nationalization) act amended to allow captive mining. Private companies can dig coal for their own steel, cement, power etc.

- Companies got coal blocks allotted through a screening Committee. It has representatives of coal-rail-power ministries, state Governments.

- Problem: No price discovery mechanism, procedural lapses, non-transparency . Some companies did not mine after allottment, They were hoping to sell the same block to another company at higher price a-la 2G scam allover again.

- 2012: CAG reports loss to exchequer.

- 2014: Supreme Court cancelled all 214 blocks.

Coal Ordinance 2014

- E-auction of coal blocks.

- Auction money goes to state Government, where mine is= JHK, W.Bengal, Odisha, Chhattisgarh etc.

- Convicted companies can’t bid. Other can companies can bid in e-auction. If license cancelled earlier- need to pay additional levy

- Only captive use, No trading

- State utilities to get mines quota. (Because they don’t have deep pockets to run for open bidding against private companies).

Coal: Pending reforms

- Investors afraid. Private cos backend infra in previous mines lost. Need clear long term policy.

- Indian government charges highest royalty in world, increases every 3rd year. Need to reduce.

- Coal India given soft-glove treatment in taxation, royalty and allocation. Private players want equal treatment.

- Allow only Large companies because they can afford underground mining=less environment damage.

- CIL & its 8 subsidiaries be modernized according to -TL Shankar Committee.

- Stop administered pricing for coal.

- Pass the Coal Nationalization bill 200 in Rajyasabha and amend MMDR act for environment, rehab. Issues.

- Adopt Green Law Panel recommendations when it comes.

[Block-7] Energy: Natural gas

Gas pricing

- Imported gas: market determined price

- Domestically produced gas: to be sold at Rangarajana formula.

Ranga price formula= Average (A,B), where

- A= average of US, UK, Japan

- B= price of imported gas to India.

Reliance controversy

- Using above formula, Reliance gas price would rise from ~$4 => $8/mmbtu. Government did not implement it because it’d need to pay higher subsidy to fertilizer cos (methan from natural gas=>Heber process=>Ammonia=>Urea and other nitro fertilizers.)

- New update: Government to tweak Ranga formula where A= average of US, UK, Japan, Canada and Russia.

- Now the avg. will go down because Russia is a gas producer, prices cheap.

- As per new formula, Reliance price rise to be from ~$4=>~$5.6

Pricing of natural resources

- Constitution: Union owns all hydrocarbon resources. Auctioning since 99.

- New exploration licensing policy (NELP-X) = 10th round, will provide uniform licensing for oil, gas, coal-bed methan, shale gas. No need to get separate license for each.

| Modified Revenue sharing contract | Existing Production sharing contracts |

|---|---|

| Government proposed this draft in 2014. | UPA adopted. |

| During bidding, the company has to indicate how much of oil/gas/its money they’ll share with Government, during various stages of production. | First contractor recovers his investment by selling oil/gas, after that he begins sharing Revenue with Government. |

| Immediately when production start, contractor has to deposit entire amount to an ESCROW account, from there Government takes its cut and remaining given to contractor. | |

| Problem: World price fluctuation, risk factor in exploration and yet contractor made to pay from day1. | Problem: Reliance allegedly manipulating account books to show higher investment (gold plating) / wilful underproduction to share less Revenue with Government from KG-6 basin. |

Vijay Kelkar panel recommendation

- Till 2017: Production sharing contract linked to investment by company. First let the company recover its investment then begin sharing revenue with Government.

- Decide Gas price by linking it with international liquid petroleum products.

- From 2017: move to market based gas pricing. Include oil and gas into GST framework.

[Block-8]Money Laundering, Black Money, Bitcoins

| Black money |

|

|---|---|

| Money laundering |

|

| Tax avoidance |

|

| Tax Evasion | Money not shown on record, required taxes not paid. Criminal matter |

| Tax inversion | company shifting tax-residence abroad to pay taxes at home. USA enacted new law to counter them. |

| Round tripping | Routing domestic investment through Mauritius to avoid taxes. Because of loopholes in DTAA. |

Swiz Black money

- 2006: A Liechtenstein bank employee gives list of names to Germany.

- 2009: Germany shares those names with India under DTAA.

- 2011: France gives list of customers in HSBC Geneva (Swiz.) to India.

- 2014: Indian Government refuses to divulge names till investigation is over. But has to hand the names to SC in a sealed cover. Later revealed many names duplicate and account balance NIL.

- SC appointed MB Shah SIT investigating the matter.

- 2014, Oct.: After Burning hands in SC, Government refuses to sign OECD’s MCAA (Multilateral competent Authority Agreement) for automatic info-sharing on tax matters.

- Reason given: India can’t commit that information will be kept secret till investigation is over.

Beyond that Swiz black money topic is mostly bol-bachan on how many DTAA signed, how much money stashed etc. so instead lets focus on some easy to memorize hardcore points on how to stop money laundering / black money.

Enforcement directorate (ED)

Under Revenue Department. HQ Delhi + regional offices.

| FEMA 1999 | PMLA 2002 |

|---|---|

| Civil Act. ED got Quasi-judicial powers to impose penalties. | Criminal Act. ED can only arrest, seize asset=>court will decide. |

|

Prevention of money laundering. |

SC SIT recommendation:

- ED can seize property under PMLA defined offenses of money laundering. But gundaa-log coming with innovative ways to launder money, which are not defined in Baba-adam’s PMLA.

- So, Need to expand PMLA Act.

- Amend Mines Act, IT acts, Customs act to allow ED’s jurisdiction over them too.

Tax administration reform commission (TARC)

May 2014: TARC headed by Parthsarathi Shome, gave report. (now What would General Dong sing for that man?)

- Abolish Revenue Secretary post. It is manned by Generalist IAS officer. Taxation requires subject specialization over finance, banking, commerce etc.

- Merge CBDT and CBEC=> Central board of direct and indirect taxes. Businessmen who evade indirect taxes, evade direct tax as well. Merger will help tracking them down more effectively.

- Replace PAN with CPAN (Common Permanent Account). Same number be used for DEMAT, EPFO, custom-Excise passbook, service tax ID, VAT TIN no. and so on. That way tax evasion difficult.

- Treat tax payers as customers. 10% of Department budget be spent on customer services. Separate ombudsman to “teach” lesson to rude IT officials.

- Introduce TDS passbook, Issue tax refunds on time.

- Customs department crucial role in tracking international money/gold/diamond transactions. Empower them with ICT technology, RFID for Real time tracking of shipping containers.

Additional: Adopt Direct Tax Code, Abolish Wealth tax. Because juntaa deliberately undervaluing their property on paper, to evade wealth tax=> real estate black money game begins from here.

G20 BEPS- Profit shifting: HOW?

मुनाफे को दुसरे जगह पहुचाके कम्पनी टेक्ष बचाने की कोशिश करती है

- MNCs have HQ in first world and subsidiaries in third world.

- Subsidiaries (third world) send profit$ to parent company (first world) in form of dividend, royalty and loan-interest payments.

- Over the years, MNCs came up with 3 methods to shift these profits in such way, they’ve to pay minimum taxes

- In third world (usually the source of profit) AND

- In first world (usually the destination of profit).

Three methods for profit shifting:

- 1.Transfer pricing e.g. Vodafone- selling shares of one subsidiary (India call centre) to another subsidiary in Mauritius at below market price. India gets less Capital gains tax, and later Mauritius company sells those shares to third party @market price to make windfall gain. Thus profit shifted from India to Mauritius. India (source country) got no taxes. UK, Netherlands (destination countries, HQs of Vodafone) got no taxes.

- 2.Special purpose entity. Usually a postbox company in a tax haven. E.g. Hutch owned Hutch-Essar via a postbox company CGP investment ltd. in Cayman island. This postbox company later sold to Vodafone, thus Hutch Essar India became Vodafone India; while India got no capital gains tax because matter outside IT act jurisdiction. Here too neither India, UK, Netherlands got anything.

- 3.Hybrid mismatch. Showing same money as debt in one country and equity at second country. Then juggling with shares vs bond to evade taxes.

Fiscal Imperialism: HOW?

- In the GS2 IR/Economy revision note, we saw FATCA Act. Indian financial companies need to collect data of American investors=> send data to CBDT=>to American IRS.

- Such methods are labelled as new form of “Fiscal imperialism”. Because we (Indians) required to do their work (of spying on American tax evaders in India) without getting anything in return. No commission, no help to nab Swiz account holders etc.

Why BEPS bad?

- Back to original topic: MNCs use three methods to shift profit from one country to another, to reduce tax liability.

- Tax avoided= Government got less money for public service- health, edu., defense. Suffers.

- Small desi players have to pay all taxes= can’t compete with MNCs in predatory pricing and deep discounts.

- OECD gave 15point plan to combat this Base Erosion and Profit Shifting (BEPS). Basic idea: that MNCs must pay taxes in the country where they make profit. And complex formulas to such calculate tax liability.

- 2013: G20 finance ministers and governors of their central banks- endorsed idea but disagreement on calculation formula.

- 2014: G20 summit @Brisbane

- We’ll finalize BEPS pact in 2015

- We’ll begin automatic exchange of Tax.info by 2016 or 17.

Content sufficient to handle 100-200 words question. Not much point in doing further PH.D because pact is yet to be signed.

GAAR and Shome

Same Shome headed Tax administration reform commission

- Tax evasion: hiding transaction, evading taxes, criminal matter.

- Tax avoidance: showing transactions but using loop holes to avoid taxes. e.g. indirect purchase of companies using post-box companies in tax havens (Vodafone-Hutch). Not criminal directly because loophole used. e.g. Vodafone won in SC.

GAAR: General Anti Avoidance Rules.

- IT commissioner take action against business deal made outside India, to avoid taxes.

- He can send notice to Indian Citizen, NRI, Foreigners, to recover such money:

- Even if they’re living outside India.

- Even for retrospective deals i.e. deals happened before GAAR was implemented

- Even if deals protected under any DTAA

- Burden of proof lies with the party and not IT commissioner i.e. Company has to explain their deal is genuine.

- GAAR not a completely new invention. China, Australia, Canada, New Zealand, Germany, France, S.America etc already have similar concepts.

Parthsarthi Shome Panel to review the GAAR rules.

- IT commissioner should send notices only in rare cases- where he can recover more than 3 crore rupees.

- GAAR should not be used for filling revenue shortfalls.

- For retrospective cases- only recover tax dues. Don’t demand additional penalty and interest rate

- Exempt the buying/selling of company shares from Capital gains tax.

- Don’t implement GAAR from 2014. Implement it from April 2016.

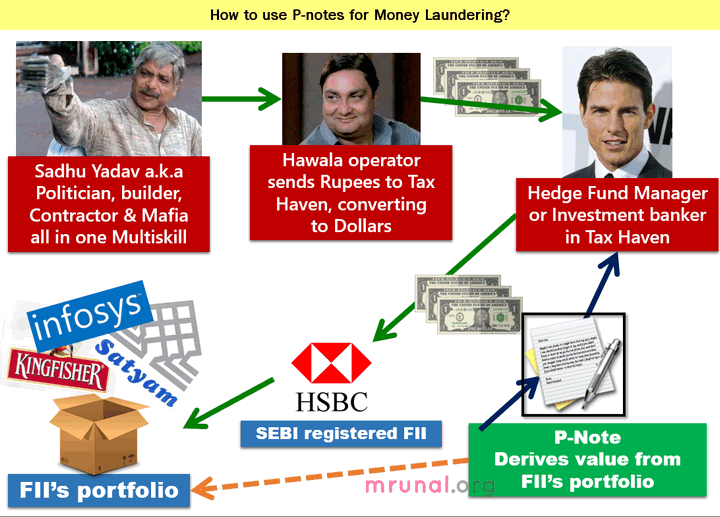

P-notes and CGT evasion

P-notes are used for money laundering and terror financing

- P-Note = offshore derivative instrument

- When a person wants to Invest in India but without registering with SEBI / getting PAN card.

- He indirectly invests money using Registered-FIIs via P-Notes. So he doesn’t own any shares, DEMAT account or has voting rights in the company.

- ~2 lakh crore rupees invested in India via P-notes.

Problems:

- Hard to trace original investor- evasion of CGT. Black money.

- Hot Money- comes quickly, leaves quickly creates heavy rise or fall in share market, so even genuine investors’ money is lost.

- Terrorist using P-notes to raise sharemarket then collapse it by quickly pulling out.

Reforms against P-Notes

- SEBI classified Foreign portfolio investors (FPI) in 3 categories. Only CAT-1 and selected groups in CAT-2 allowed to issue P-notes because they’re least risky & maintain proper KYC in India and parent country.

- Longterm: ban P-notes- says RBI’s Tarapore Committee, Ex-NSA MK Narayan and Finmin whitepaper.

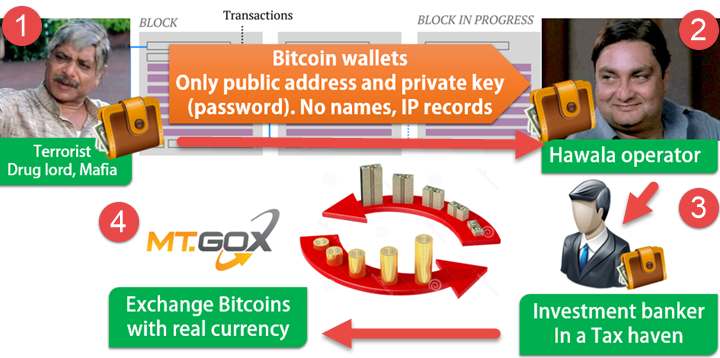

Bitcoins and Terror Finance

3 ways to Acquire Bitcoins

| Mining | Solve the crypto-algorithm created by Satoshi Nakomoto, using special computer software. Hence called crypto-currency. |

|---|---|

| Bartering | Sell something (desi liquor) to a bitcoin miner and get his coins. |

| Exchange |

|

Bitcoin in money laundering / terror finance?

Bitcoin wallet to wallet transactions don’t contain IP record or phone numbers or Bank account #

- In gmail, your ip address, phone number etc. stored.. But in Bitcoin digital wallet- no personal identity stored.

- Bitcoin can be converted into dollars, via online Bitcoin exchange sites like Mt.Gox

- 1+2=Bitcoin can be used for money laundering and terror-financing. Observe above image.

Silkroad = name of online shopping site selling cocaine using Bitcoin currency. Although arrested because website address=domain registration, DNS, IP records can be traced.

Rajanbhai’s stand on Bitcoin

Rajanbhai’s press statement in December 2013=sufficient to handle almost every question on bitcoin in 100-200 words.

What is Bitcoin?

- Bitcoin is a “Decentralised Digital Currency” because no central bank has issued it. Nobody monitering it.

- It’s a “Virtual Currency” generated by solving a crypto-algorithm. Bitcoin is not backed by a fiat (legal order) or gold, silver, oil, diamonds or any other commodity. it’s just an electronic code without any intrinsic value.

Bitcoin regulation?

- SEBI, FMC, NSE, BSE etc. noone permitted trading of Bitcoin. Same position in China.

- RBI has permitted no Forex dealers under FEMA to convert any currency with Bitcoin.

- Mt.Gox & other Bitcoin Exchange website = their legal status unclear.

Bitcoin Dangers?

- hacking, phishing, malware, password lost= can’t be recovered. Because no phone numbers/ personal details stored.

- If you buy something using bitcoin, Consumer courts cannot help.

- heavy volatility in Bitcoin to dollar exchange rate. Bad for investment.

- Media reports that Bitcoin being used for illegal drug, money laundering, terror-financing. You’ll unintentionally breach anti-money laundering / Anti-terror laws.

- RBI still studying legal-regulatory angles. Rajanbhai has same stand on laxmicoin, litecoins, bbqcoins, dogecoins etc.

[Block-9] Development vs Extremism

- Some fodder points as ‘fall back line’, when nothing else comes in mind.

- In such scenario, the answer’s thought-process should be Development scheme=>rural infra improved=>less recruits for Maoists and even their existing cadres would surrender to join mainstream to enjoy peaceful life.

Xaxa report

Picture worth 200 words. and for more visit Mrunal.org/Polity

Sansad Adarsh Gram Yojana

- under Rural Development ministry.

- MP adopts & develops one model village in their constituency by 2016 and two more by 2019

- Unlike MPLADs, No money to be given. Only social mobilization and people’s power e.g. celebrating girlchild, holding public officials accountable, cleanliness drive etc.

- The model village will influence other villages nearby to do similar=> overall rural Development.

- PM adopted Jayapur, Varanasi.

- Success depends on enthusiasm of MP, Villagers and district administration.

MNREGA Act 2005

- under Rural Development ministry

- Promises minimum 100 days of unskilled manual work, To each rural household, In a financial year.

Problems

- On the ground its not a “panchayat-centric and demand driven” program.

- Gram Sabha unaware of powers. Social audits not done.

- Shortage of Technical staff => Delay in work measurement => delay in payment.

- At many places, males find higher wages in nearby towns. Only a few women come at MNREGA sit =>worker shortage= Big MNREGA projects can’t be done.

- U w/o Q: universaliation without quality. Poor assets washed down on first rain.

- PIL: against Art.14, 16, 23: State giving lower than minimum wages.

- UPA itself reduced outlet from 40k to 33k.

Suggested reform

- Budget 2014: will use MNREGA for productive agro assets, tourism infra.

- Done: Wage: material ratio=> 60:40 to 51:49.

- Done: 50% of works in water conservation projects.

- Not done: only for backward areas.

Van Bandhu Kalyan

- Gujarat scheme, officially called: Chief minister’s 10 point program for Scheduled Tribes. Jaitley budget announced it for all India.

- Employment to Tribal families

- Education- ITI, Hostel in tribal tehsil

- Economy: market linkage to sell their handicraft.

- Health: Chiranjivi Yojana, medical camps for anemia etc.

- Housing for all tribal families

- Safe Drinking water, Irrigation, watershed programs.

- All weather roads (to habitats with population of 250 or more)

- 24/7 electricity, Urban Development, broadband connectivity in tribal tehsils.

All the revision notes are archived at Mrunal.org/UPSC#CSE-2014

Alternatively you can check in the top black menu=>Current=>revision note.

![[Revision] GS3: Environment, Conservation, Disaster-Management: Cyclone Hudhud, Kashmir Floods, Clean India & Ganga](https://mrunal.org/wp-content/uploads/2014/12/Cover-Revision-Environment-500x383.jpg)

![[Revision] GS3 Science-Tech: Biotechnology, Robotics, Nanotech, Computer/IT awareness, Space-tech, Agro, Defense](https://mrunal.org/wp-content/uploads/2014/12/Cover-Revision-Sci-Tech-500x383.jpg)

![[Revision] GS2/GS3: Public Health Special: Indigenization of Medical Technology, Medical-Gadgets applications](https://mrunal.org/wp-content/uploads/2014/12/Cover-Revision-GS3-Medical-500x383.jpg)

![[Mains-2014] Vehicle-pooling, Lodging, Centre Address doubts](https://mrunal.org/wp-content/uploads/2014/11/c-cab-pooling1-500x383.jpg)

Thanks a ton for artical….

Please provide some artical on psychology optional tooo..

@Mrunal, can you please provide some inputs regarding how to handle controversial topics like emergency, blue star, nehru socialism etc …. specially considering that there has been a tectonic shift in the central government

thanks

Again this is a superb article!!!!!!!!!!!!!!!!!!!!!!

Thnks a tón sir.

Plz upload stuf regdn SnT and Environment.

Regards.

Hey Kashmir, are you from Kashmir? If yes, is your centre Sgr?

Sir, plz. tell me how could i download hindu e-paper free pdf

Civil Services Mains(2014) admit cards available on upsc.gov.in…

sir, kindly help.. though registered for RSS feeds but not getting your mail alert for new posts for some time.

Thanks

SBI PO- 2014 ka final result aa gya h…..janhit me jaaari

congrats to those who made it. it’s like ias of all banks .good luck.

sir i m Msc in zoology please suggest me about taking philosophy (hindi medium) as an optional ?

MPPSC PRE 2013 RESULTS OUT

@Neha : I can not see the result on website. Are u sure results are out?

thanks neha

Mrunal sir, as MPPSC result is out please update “MPPSC Mains GS1 and GS2: Priority topics”

Sir,

Can you guess about the way these GS papers are corrected? For instance with the GS3 we have economy, security, science and technology and even much other topics which are of entirely different genres. So will it be corrected by a single person or will each part be corrected by domain specific experts(kind of)?

Thanks in advance.

more +ve outcomes of MNREGA. can be mentioned further in respective with social aspect i.e. SoC. & Env.

Hi Mrunal,

Is there no S&T articles for this mains? Also wish you give some revision on Ethics important terms… Anyways thanks for the wonderful job.

Dear All,

I have a doubt. How much relevent is study material of national Institute of Open Schooling for CSAT/Mains preparation?

Please reply

In the BEPS portion, what is a postbox company?

Sir tell me how 2 prepare gas paper for cs 2015

great work sir… no need to buy any other other mgziness ,u have prepared a solid stuff for compitition

Sir i have a question: If MPLADS is criticised for violating seperation of powers, then what is so different with Sansad Adarsh Gram Yojana ? Isn’t it on similar lines ? If we are asked whether this scheme will meet the expectation when MPLADS has failed, and whether this also violates seperation of powers and whether this ignores local government then how should we go about it ?

Sansad Adarsh Gram Yojana

Year Policies End Result

1991 Ambedkar Gram Sabha Vikas Yojana-Convergence of schemes in Dalit Majority villages Mayawati revised the scheme in 2008

2010 PM Adarsh Gram Yojana-44000 villages with 50% dalit population

2014 Minority concentrated Districts scheme-20 % minority population and focus on skill development

2012 Ram Manohar Lohia Samagra Gram Vikas Yojana Introduced by UP to replace Ambedkar gram Sabha Yojana

2014 Sansad Adarsh Gram Yojana

1. LS MPs can select any village with a population of 3000-5000 in plains and 1000-3000 in hilly areas in their constituencies besides their own villages(2)

2. RS MP can represent any MP from their own state

3. Two more villages by 2019 (5)

4. Total target is 2500 villages by 2019

5. Improving infra in villages associated with freedom struggle

1. For me an adarsh gram is one where disputes are those where the disputes are settled without approaching courts

2. Villages are selected irrespective of HDI indicators

2005 MPLADS

1. 5 crore funds available and any shortage in SAGY o be utilized from MPLADS scheme

2. Convergence of socio economic schemes for betterment of villages

2014 Model Villages and how is this to be achieved

1. MPs to mobilize additional funds thru CR

2. Drive immunization drives, improving mid day meal schemes, Aadhaar enrolment, setting up smart schools with IT enables classrooms, e-libraries, improving panchayat infra under MNREGA and BGRF

3. Better implementation of all central acts

4. Improve Hygienic behavior

5. Bathing, toilets, exercise,, village day, village song, focusing on ADR

6. Move from Swaraj to Suraaj

7. Inculcate a sense of pride, volunteerism and self-reliance