- Prologue

- BO1: RRB act

- BO2: Small banks and Payment Banks

- BO3: Kotak-ING Vyasa Merger

- BO4: NBFC regulation guidelines

- BO6: SBI Share splitting

- Mock Questions for Banks Exams

Prologue

- In this article, we’ll checkout a few current developments in Banking sector at “Organizational” level.

- In the next article, we’ll see developments at “operation / product” level e.g. Bharatiya Bill Payment system, SBI’s Shariya fund, E-mandate etc.

- Utility: Mainly for bank interviews and MCQs.

BO1: RRB act

Background theory

- 1976: Regional Rural banks Act, based on Narsimhan Committee’s recommendations for greater financial inclusion.

- RRBs aim to combine efficiency of a commercial bank with grassroot networking of a cooperative society.

- RRB is one type of Commercial bank. Therefore, it has to comply with RBI’s SLR, CRR and PSL requirements (Priority sector lending).

- Sponsor bank helps the RRB in HRM-training, account keeping services.

Anyways, RRB is an old theory topic, why has it resurfaced again?

| RRB Act 1976 | RRB Amendment Bill 2014 |

|---|---|

|

|

Shareholding

|

|

| State government’s shareholding was fixed to 15% | States can buy more shares, to increase their shareholding above 15% |

| — | RRB can appoint Board of directors from outside union-state and sponsor bank nominated people. |

| — | One person cannot become director in 2 RRBs. |

| Director’s tenure limit: 2 years | 3 years |

| — | Person cannot remain director for more than 6 years. (Meaning one individual can be an RRB director for only two terms 3 + 3.) |

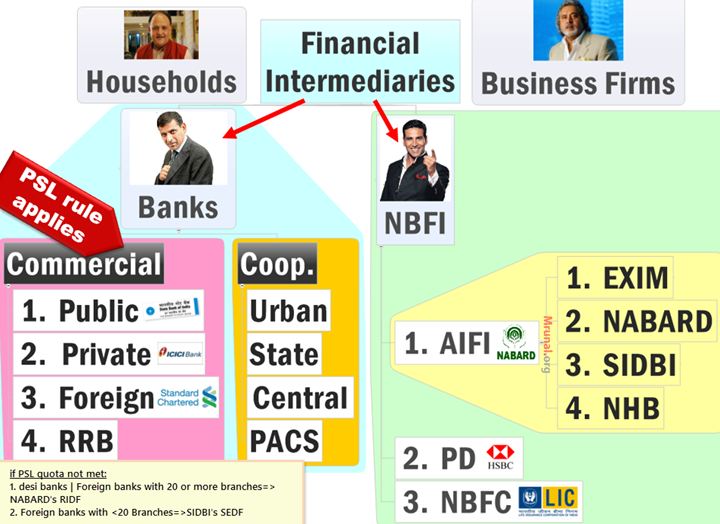

AIFI: All India financial institutions, PD: Primary Dealers

BO2: Small banks and Payment Banks

| 1998 | Narsimhan-II Committee recommends small banks in India. |

|---|---|

| 2009 | Raghuram Rajan Committee says the same. |

| 2013-14 | For greater financial inclusion, RBI’s Nachiket Mor Committee had recommend new types of banks such as payment banks and wholesale banks. |

| 2014, Feb-March | Bimal Jalan Committee approved Bandhan Microfinance and IDFC for opening private commercial banks. Bimal too recommended RBI to permit ‘differentiated’ banks in India. |

| 2014, Nov | Rajanbhai invites applications for Small banks and payment banks. |

Common Features of Small bank and Payment banks

- Deadline to apply for License: 16/01/2015. After that, an external screening Committee will decide the winners, probably in July 2015.

- Minimum capital requirement to apply for license: 100 crores. (For commercial bank license, it was Rs.500 crores)

- They’ll have to comply with the FDI norms like regular commercial banks i.e. 74% FDI only.

| Small banks | Payment banks |

|---|---|

| Can accept all types of deposits like a commercial bank (CASA, FDRD etc.) |

|

|

|

| Target customers: MSME businessmen, unorganized workers, small and marginal farmers. | Target customers: poor, migrants, unorganized workers wanting to send remittances home. |

| Focus: Deposit and loans | Focus: Payment/remittances only. Including cross-border remittances. |

Who can apply?

|

Who can apply?

|

Conditions:

|

Condition:

|

- Remaining differences are of technical nature like tier-1 capital etc. not worth the effort for MCQs.

- Public sector bank employee union has opposed this move, saying existing public sector banks are capable of delivering these services and last mile financial inclusion.

BO3: Kotak-ING Vyasa Merger

Kotak ING Vyasa Merger

RBI, CCI and other financial regulators have approved the ING-Vysya Bank to merge with Kotak Mahindra bank (2014, November).

| Kotak Mahindra | ING Vysya bank |

|---|---|

| Got Banking license in 2003 |

|

| 4th Largest private bank | 7th |

| Founder: Uday Kotak |

|

After Merger

|

After merger,

|

- Ranking of private Indian banks after this merger: (1) HDFC (2) ICICI (3) Axis (4) Kotak.

- Kotak group also got “in-principal” approval to takeover general insurance business from ING-Vysya.

BO4: NBFC regulation guidelines

Background

- Non-banking financial companies serve as an important tool for financial inclusion and turning savings into investment.

- But, in the 90s, Harshad Mehta and other scams put all Non-banking financial companies into bad light.

- As a result, RBI and Government always adopted precautionary and sometimes ‘step-motherly’ regulations on NBFCs. For example- they’re not allowed to get tax-benefits on NPA, mosto f them forbidden from external commercial borrowing (ECB), they are not given loan recovery powers under SARFAESI Act and so on.

- 2014, November: Finally, Rajanbhai decided to empower NBFCs, on par with Commercial Banks.

RBI’s new guidelines for NBFCs:

[no *that* important for MCQs, just memorize a few points for interview]

- Fair practice code (FPC) and Know your customer norms (KYC) will not apply to an NBFC IF

- Its asset size is less than Rs.500 crore AND

- It doesn’t accept deposits from public AND

- It doesn’t have any customer interface.

| 2014 |

|

|---|---|

| 2016 |

|

| 2017 |

|

| 2018 |

|

| Not done |

Allowing NBFCs to use SARFAESI Act powers to teach lessons to loan-defaulters. [Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act] |

BO6: SBI Share splitting

- Earlier: ICICI and PNB announced share splits- One share divided into five.

- SBI announced 1:10 share split in 2014, November. Meaning, you’ll get 10 shares of SBI, for every exiting 1 share owned by you.

| Before | 1 share with Face value of Rs.10 |

|---|---|

| After | 10 shares with face value of Rs.1 |

Benefits of share-splitting?

- Increases in share-quantity, thereby increases the participation of Retail investors- like cutting one banana and selling five of its pieces.

- Provides liquidity to investor. Example, if you had 1 share of infosys worth Rs.1 lakh, it’ll be difficult to find a buyer.

- But if you had 1000 shares of infosys worth 100 rupees, easier to find a few buyers interested for purchasing 20-30 shares individually.

- Thus share-splitting increases “demand” and new investors. Hence P/E Ratio also improves. [Share Price to earnings ratio.]

- Share splitting or stock splitting, doesn’t change following

- Company’s value. because Total face-value wise, 1 share x Rs.1 lakh = 1000 share x 100 rupees.

- Company’s market capitalization. For the same reason given above.

Mock Questions for Banks Exams

[columnize]

Q1. Consider following statements about RRBs

- RRBs are jointly owned by Government of India, the concerned State Government and Sponsor Banks

- In RRB, the sponsor bank is the majority shareholder.

- Both A and B

- Neither A nor B

Q2. The RRB Amendment Bill 2014

- Provides flexibility to shareholding pattern of Union, states and sponsor banks.

- Increases authorized capital of RRBs.

- Permits Individual to hold board directorship in multiple RRBs

Correct statements are

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- None of them

Q3. If an RRB has failed to fulfill its PSL quota for the given year, then it’ll be required to submit money to ____.

- NABARD’s RIDF

- SIDBI’s RIDF

- NABARD’s SEDF

- None of above.

Q4. Which of the following is/are example(s) of Differentiated banks in India?

- Small banks

- RRBs

- Payment Banks

Answer choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- All of them

Q5. Minimum capital required to apply for license of small bank / payment bank is ____.?

- 100 crores

- 200 crores

- 500 crores

- 1000 crores

Q6. Who among the following is/are eligible for applying small bank license?

- An individual with experience in cooperative or banking sector

- Corporate houses

- Non-Banking financial companies

Answer choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- All of them

Q7. Which of the following features are not available at a Payment Bank?

- Getting housing loans

- Getting a Credit card

- Opening a current account.

Answer choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- All of them

Q8. Who among the following, can open an account in Small bank?

- NRI

- High net worth individual

- Migrant laborer

Answer choices

- Only 1 and 2

- Only 2 and 3

- only 3

- All of them

Q9. A Payment bank will have to fulfill which of the following condition?

- 40% of the loans must be given under priority sector lending (PSL)

- 25% of the NDTL must be invested in G-sec.

- Maximum balance per client cannot exceed Rs.50,000

- None of above.

Q10. Which of the following mergers took place in 2014-15?

- Benares State bank with BoB

- Bank of Madura with ICICI

- ING Vysya with Kotak-Mahindra

Answer choices

- Only 1 and 2

- Only 2 and 3

- only 3

- All of them

Q11. Arrange the following banks in descending order of their total-assets?

- Kotak-Mahindra

- Axis

- ICICI

- HDFC

Answer choices

- 1234

- 4321

- 1243

- 2134

Q12. How does an investor benefit from Stock-splitting?

- It increases market capitalization of the said company.

- It decreases the liquidity of stocks held by him

- It increases the dividend earned by him

Answer choices

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- None of them.

Interview

- What do you know about RRB Amendment bill? How will it benefit Indian economy?

- What are your views on consolidation of Public sector banks in India?

[/columnize]

Visit Mrunal.org/Banking for more articles related to Banking, Finance and Insurance.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

Very Much useful to all those who are preparing for competitive exam.I’ll make us to revise soon. Good Morning

It will make*

Mrunal sir are u sure about 1.2 lakh branches of kotak mahindra..

In Kotak Mahindra and ING Vysya bank merger table,

In column 1, last row….the number of branches after merger has been shown 1.2 lakhs…thats wrong sir..pls rectify it..

total number of branches= 641(kotak mahindra)+527(ING Vysya)

=1168

Ref : http://en.wikipedia.org/wiki/Kotak_Mahindra_Bank

http://en.wikipedia.org/wiki/ING_Vysya_Bank

Largest is SBI with around 17000 branches upto FY 2014.

What are the answers ???

MCQ Answers:

1-a

2-a

3-a

4-c

5-a

6-c

7-a

8-c

9-a

10-c

11-b

12-c

respected admin,

i have iso certified

computer certificate.

is it valid in banks?

or i can be rejected by bank?

i m selected in rrb po as well as oa.

plz reply.

Dear Mrunal bhai,

I have great respect and reverence for your work. I wrote Mains this year and the content expected by us to learn is not purely academic in nature but analytical. This requires us to weave different strands of our knowledge and write an embroidered answer. It cannot come from mere rote or rhythmic learning. Reading of different newspaper, Internet, debates allows us to open up our minds and make us evolve as an individual. History teaches us to appreciate the complex nuances of our contemporary times. Geography is the base of any nation polity and economy.

In the above context, kindly pay your attention to the negatively toned language of your headlines like “katl ki subha”,”maut ka mahina” and “jawaani ki barbaadi by upsc”. These lines deviates one attention from the emboldening and enriching aspect of its preparation. You have exorbitant “referential power” which can be leveraged to motivate this vast swathe of upsc aspirants to bloom into an enlightened individuals. Therefore kindly frame your language (see Framing effect,psychology ) in positive words which can unveil the positive aspects of this game. I dont deny the negative aspects which you often implicitly or explicitly reflect in your content. But we shall have a “grey” and “balanced views” regarding everything.

With due respect, i beg to differ that people waste their years in its preparation. Ones who feel such have not evolved as an individual and not cross fertilised the academic content into their lifes.

My comment shall solely be seen in light of a “constructive criticism ” and a humble attempt to augment the resource base of this wonderful author (read Mrunal ). I apologise for any “misplaced ” argument.

sir ,

in today’s the hindu news it was given that PBs are not allowed for utility bill payments….but you have mention that they are allowed. …so plz clear this doubt. .

hello sir, kindly clarify my doubt

wpi iflation in november 2104 is 4% means, it is compared with november 2013 or november 2004 (baseyear)

Final Answers:

1. A

2. A

3. D/A .. little doubtful .. Mrunal pls comment.

4. C

5. A

6. C

7. C

8. C

9. A

10. C

11. B

12. D .. Little doubtful .. dont know why everyone is writing option C .. No market Capitalization will go up so Option A & C rules out .. also liquidity will go up .. so option B is also wrong .. Hence answer D

Only query is on question 3 .. not covered in the topic .. when I googled it .. google landed me to this page :D

Mrunal u hv mentioned above that largest pvt bank is HDFC…is it correct?I have read somewhere its ICICI:(

Regarding question 3 it was discussed that if any commercial bank is not able to fulfill 40% quota of priority sector then the remaing amount must be submit to RIDF-Rular infrastructure development fund and its managed by NABARD

1- A

2- a

3- d

4-c

5-a

6-c

7-a

8-c

9-d

10-c

11-b

12-b

Payment back don’t give loans. 9D

Does the sponsor bank have to be a PSB?

i m UPSC aspirant. do i need to read this article? as u have mentioned above about its utility

Where i will get answer of above questions…plz do reply

how does minimum leverage ratio of 3% amount to liabilities not exceeding 33 times of the net worth

I don’t get it.

“1976: Regional Rural banks Act, based on Narsimhan Committee’s recommendations for greater financial inclusion.”

I think it’s an error,Narsimhan I was established in 1991.How can RRB Act 1976 be based on Narsimhan Committee’s recommendations.

Please Reply.