- Analysis

- Economy (Static/Theory)

- Economy-Current

- IR/International Affairs

- PIN (Person in news)

- The End and FAQ

Analysis

Economy

- Last year only 6 Qs from economy, this year 21 question=>~250% increase in the importance of economy!

- last year asked about QFI related current affairs, this year about FII related

- like last year- a 2statement true/false type question about employment

- WTO was trap question. Answer is not Russia but Tajikistan.

- Seems Most of the Economy current affairs related questions came from June 2013 month.

- static: current is nearly 50:50 weightage.

- Majority of static questions can be solved through the combination of Ramesh Singh, NCERT and Mrunal.org

- Almost all current questions can be solved through Hindu/Indianexpress.

- Seems government job examiners have taken an oath to ask about ‘which tax get maximum revenue’- almost same question asked in ACIO 2013.

- Schemes

- Last year one question from govt. scheme, this year two questions from scheme.

- Finally clichéd question from Swavalamban is asked. But still UPSC continues to disrespect *you know who* by not asking about a scheme named after him- especially SABLA.

IR/International Affairs

- 6 question last time, 4 question this time.

- Asking a multi-statement questions from international summits=one of the patented MCQ style of UPSC. and it continues with BRIC related MCQ.

- other than that, usual stuff, nothing much to say.

Misc GK/PIN (Persons in News)

- Seems finally UPSC following the CSAT way here. drastically cut down the importance of PIN/MiscGK: last year 9 questions, this year barely 2 questions.

- 27th Indira Gandhi national integration prize= was announced in September 2012 and CAPF 2013 was held in October 2013= tells us the timeframe for PIN is nearly 1 year.

And finally for the bogus marketing propaganda: In this Economy/IR/PIN section atleast 10 questions can be directly solved from various articles of Mrunal.org

Economy Internal Breakup

| static | poverty, unemployment, inflation | 4 |

| budget | 2 | |

| banking/finance | 1 | |

| LPG | 2 | |

| Misc/Generic | 2 | |

| Current | International news | 2 |

| budget/taxation | 4 | |

| banking finance | 2 | |

| Scheme | 2 | |

| total Econmy | 21 |

Overall

| Polity | 14 | Covered. Click me |

| Geography+EnB+Agro | 14+8 | Covered. Click me |

| Economy+IR+PIN | 21+4+2 | Given in this article |

| Science | 20 | Given in this article. |

| History | 22 | click me |

| Aptitude | 20 | Click ME |

| total | 125 |

Corrections, Additions post them in comments.

Economy (Static/Theory)

Unemployment and Inflation

Q1. Which one among the following sectors in India has the highest share of employment?

- Agriculture and allied activities

- Manufacturing

- Construction

- Tertiary sector

Agriculture, including allied activities= ~14 per cent of the GDP (2011), but their share in total employment ~58 (2001 Census). Meaning, Agriculture’s role in the country’s economy is quite crucial.

Hence answer A

Ref. Summary of Economic Survey Ch8, https://mrunal.org/2013/04/economic-survey-ch8-agriculture-and-food-management.html

Q2. The rate of inflation in India is measured generally in respect of movement of

- consumer price index

- wholesale price index

- cost of living index for agricultural labor

- money supply

| Ramesh Singh, Page 7.13 | WPI inflation is used at macrolevel policy making, CPI inflation is used for microlevel analysis. The inflation at WPI is the inflation of Economy.=> answer B |

| RBI document | Official inflation rate is measured based on annual point-to-point basis change in the Wholesale Price Index (WPI). Answer (B) |

Q3. Which one among the following items has maximum weight in wholesale price index in India?

- Primary article

- Fuel and power

- Manufactured product

- Food item

Approx. weightage in WPI is

- Primary Articles (food,fruits etc):~22%

- Fuel, Power, Light & Lubricants :~14%

- Manufactured Products (biscuit,toothpaste):earlier 63.75% and in the revised series they increased it to 64.97%) hence answer (C)

Ref.

- https://mrunal.org/2011/08/economy-q-base-year-and-current-year.html

- Ramesh page 7.15

Q4. The Government of India refers to the absolute poverty line in terms of

- household savings

- household consumption

- household investment

- household income

Summary of Economic Survey Ch13

- Planning Commission estimates poverty using data from the large sample surveys on household consumer expenditure.

- These surveys are carried out by the National Sample Survey Office (NSSO) every five years.

- Planning Commission defines poverty line on the basis of monthly per capita consumption expenditure (MPCE).

Therefore, answer B

Budget (theory)

Q1. The following are some of the items of expenditure of the Central Government in India:

- Interest payments

- Major subsidies

- Pensions

- Loans and advances

Which of the above is/are included in non-plan revenue expenditure?

- 1 only

- 2 and 3 only

- 1, 2 and 3

- 2, 3 and 4

NCERT MacroEconomics, Class12, Page 63

Budget documents classify total revenue expenditure into plan and non-plan expenditure. The main items of non-plan expenditure are interest payments, defense services, subsidies, salaries and pensions.

That means answer must contain 1, 2 and 3. =>Option C

Q2. If we deduct grants for creation of capital assets from revenue deficit, we arrive at the concept of

- primary deficit

- net fiscal deficit

- budgetary deficit

- effective revenue deficit

The amendment to FRMB Act in 2012 defined Effective revenue deficit as the difference between “the revenue deficit and the grants for creation of capital assets”.

Hence answer (D)

Banking Finance

Q1. Consider the following statements:

- Repo rate is the interest rate at which RBI lends to commercial banks for short period.

- Reverse repo rate is the interest rate which RBI pays to commercial banks on short-term deposits.

- Gap between repo rate and reverse repo rate has been declining in India in the recent past.

Which of the above are not correct?

- 1

- 2 only

- 3 only

- 2 and 3

Approach 1

In the MSF article

We saw that, reverse repo is 100 basis points lower than repo rate. in other words, Repo rate = reverse repo + 1%

So gap in recent past, is not ‘declining’. Gap is fixed at 1%=> statement 3 is not correct. Hence answer (C)

Approach 2

Statement 1 and 2 are correct as per Ramesh Singh, so statement 3 has to be incorrect. And the question is asking you to find incorrect statement=> answer (C)

LPG

Q1. Privatization includes

- sale of public enterprises to private sector

- disinvestment of public enterprise equity

- participation of private sector in management in public sector enterprises

- All of the above

Ramesh Singh page 6.8

- Privatization in its purest form means de-nationalization i.e. transfer of state ownership of assets to private sector in tune of 100%

- The sense in which privatization has been used, is the process of disinvestment all over the world. This process includes selling of shares of the state owned enterprises to private sector=> statement B is correct.

- If an asset sold by government to the tune of 51%, the ownership is really transferred to private sector, seen then it’s termed as privatization=>C is also correct.

Therefore D All of Above.

Q2. Which of the following statements is correct with respect to the convertibility of Indian rupee?

- It is convertible on capital account

- It is convertible on current account

- It is convertible both on current and capital account

- None of the above

Ramesh Singh Page 15.7

- Current account is today fully convertible.

- India is still a country of partial convertibility in 40:60 in capital account, but inside this overall policy, enough reforms have been made and to certain level of foreign exchange requirements, it is an economy allowing full capital account convertibility.

Thus answer C: it is convertible both on current and capital account.

Generic

Q1. Consider following statement

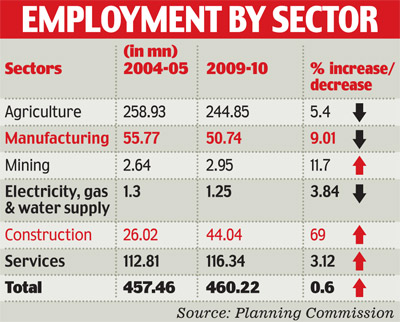

- Employment growth in India in the second half of the first decade of 21st century was relatively modest.

- There was lower labour force participation rate across all ages during the period.

Which of the statements given above is/are correct?

- 1

- 2

- both

- None

First statement:

First decade of 21st century=2001-2010. Second half of that first decade=2005-10

According to planning commission, India has lost 5 million jobs in a five-year period ending 2010. Overall increase in employment growth = just 0.6%. Hence first statement correct. Modest growth in employment.

Second statement

Labor force participation rate (LFPR)

| Category | LFPR 2004-05 | LFPR 2009-10 |

| Rural | 44.6 | 41.4 |

| Urban | 38.2 | 36.2 |

| All India | 43.0 | 40.0 |

We can see that it has declined in the given time frame. So Statement number 2 is correct.

Hence answer (C) both correct.

Ref.

- employment growth: http://indiatoday.intoday.in/story/india-lost-5-million-jobs-during-2005-2010-india-today/1/252585.html

- labour participation: http://data.gov.in/dataset/labourforce-participation-rate-lfpr-and-work-force-participation-rate-wfpr-and-unemployment-

Q2. With reference to India, which of the following statements relating to urbanization is/ are correct?

- It is a manifestation of economic, social and political progress.

- Rapid growth of urban population puts pressure on public utilities.

- Urban sprout is encroaching the precious agricultural land.

Select the correct answer using the code given below.

- 1 and 2 only

- 2 only

- 1 and 3 only

- 1, 2 and 3

Statement 2 is definitely correct. (IGNOU MA modules on Local administration) This eliminates answer C

For remaining statements 1 and 3, they appear legit from common understanding. So answer should be (D).

Although Haven’t located exact sources to confirm/deny 1 and 3 so one can even debate A or B.

Economy-Current

Economy- International news

Q1. The Human Development Report 2013 (UNDP) does not focus on

- Sustaining development momentum

- Peace and security

- Confronting environmental pressure

- Managing demographic change

The 2013 Report identifies four specific areas of focus for sustaining development momentum:

- enhance equity (+women)

- enable greater voice and participation of citizens (+youth)

- confront environmental pressures

- manage demographic change

Therefore, A, C and D are given. Meaning HRD 2013 doesn’t focus on (B) Peace and security.

Q2. Which one among the following is the latest nation to join the World Trade Organization (as on March 2013)?

- North Korea

- China

- Russia

- Tajikistan

Trap question.

| officially Member from | |

| N.Korea | — |

| China | Jan 1995http://www.wto.org/english/thewto_e/countries_e/macao_china_e.htm |

| Russia | 22 August 2012http://www.wto.org/english/thewto_e/countries_e/russia_e.htm |

| Tajikistan | March 2013http://www.wto.org/english/thewto_e/countries_e/tajikistan_e.htm |

Therefore, answer (D) Tajikistan

Budget/ Taxation related

Q1. The following are some important sources of tax revenue for the Union Government in India

- Corporation tax

- Customs

- Union excise duties

- Service tax

Arrange the aforesaid sources of revenue in ascending order as per the Budget Estimates for 2013-14.

- 1-2-3-4

- 1-2-4-3

- 2-1-3-4

- 4-3-2-1

Similar question asked in ACIO 2013

we’ve to look at the Revenue Account – Receipts, released with Budget 2013.

| question code | tax | Crore rupees in Budget 2013-2014 |

| 4 | service tax | 180141.00 |

| 3 | Excise duties | 196804.95 |

| 2 | income tax | 240919.00 |

| 1 | corporate tax | 419520.00 |

Therefore, in ascending order, it’ll be 4321. Answer (D)

Alternatively- corporate tax is highest so answer must contain “1” at the end. There is only one such option (D)

Ref: http://www.indiabudget.nic.in/afs.asp

Q2. Statement I: For the three years after 2007-08 Annual Budget in India, there was practically no increase in tax/GDP ratio.

Statement II: At the same time, government expenditure jumped noticeably.

- Both the statements are individually true and Statement II is the correct explanation of Statement I

- Both the statements are individually true but Statement II is not the correct explanation of Statement I

- Statement I is true but Statement II is false

- Statement I is false but Statement II is true

From Economic Survey Chapter 1, Page 13

| year | Tax to GDP ratio |

| 2007-08 | 11.9 |

| 2009-10 | 10 |

| 2011-12 | 9.9 |

So there is practically no increase in tax:GDP ratio =>statement 1 correct. This eliminates D

From budgets uploaded on http://indiabudget.nic.in

| Total Expenditure | crore rupees |

| 2008-09 | 900953.41 |

| 2009-10 | 1020837.68 |

| 2010-11 | 1216575.73 |

| 2012-13 | 1430825.24 |

as you can see, government’s expenditure has increased considerably over these years. Means statement (II) also correct. But does it means II explains I? Nope

Because this ratio looks after tax vs GDP. Theoretically if government increases expenditure on education, HRD etc. then more poors should become Middle class and fall under Income tax bracket=>tax collection should increase.

according to Moody’s report, the three reasons for India’s low tax:GDP

- Low average incomes and a high poverty rate result in a very small portion of the labor force being eligible to pay personal income taxes

- large proportion of economic activity that is generated by small and medium enterprises (SMEs). Although these enterprises have enjoyed strong profitability growth over the past decade, the government has not captured their earnings in tax revenues due to a variety of exemptions and compliance issues

- certain tax exemptions on agriculture related activity and until the mid-nineties, on most services as well. The tax net has been progressively expanded to include a greater number of services each year, and service tax revenue has grown the fastest of all revenue sources. Yet, service taxes constitute merely 5 percent of total general government revenues, although they comprise about 60 percent of GDP

In short, II doesn’t explain I. Hence answer is (B)

Q3. In the current pricing policy, the price of diesel in India consists of

- Fuel component + Customs duty + Excise duty + Sales VAT + Dealer’s commission

- Fuel component+Excise duty + Sales VAT + Dealer’s commission

- Fuel component + Customs duty + Sales VAT + Dealer’s commission

- Fuel component + Customs duty + Excise duty + Dealer’s commission

from the Chart given in this Hindu article,

we can see, It is made up of

- fuel component

- custom duty

- excise duty

- states VAT

- dealer commission

let’s check the options

|

right, contains all components |

|

wrong doesn’t contain custom |

|

wrong, doesn’t contain Excise |

|

wrong, doesn’t contain VAT |

hence answer (A)

Q4. The Central Board of Direct Taxes (CBDT) in June 2013 has specified a value for the cost inflation index of 2013-14. In this regard. which of the statements given below is/are correct?

- There has been a rise in the cost inflation index over the year 2012-13.

- The cost inflation index helps in reducing the inflationary gains, thereby reducing the long-term capital gains tax payout for a taxpayer.

Select the correct answer using the code given below.

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

- Last year, the index was ‘852’, and this year it is ‘939’. This would mean that there has been a 10.2 per cent rise in the cost inflation index for 2013-14.=>1 is correct

- A cost inflation index helps reduce the inflationary gains, thereby reducing the long-term capital gains tax payout for a taxpayer. =>2 is correct.

Hence answer C both correct.

Banking/Finance related

Q1. The Government of India on 12th June, 2013 enhanced the limit of foreign investments in government securities by 5 billion US dollar, In this regard, which of the following statements is not correct?

- It was done in order to increase inflow of overseas capital

- It will strengthen the value of rupee

- The foreign institutional investors registered to SEBI are only eligible for investment in the enhanced limit of 5 billion US dollar

- The investment can be made in all categories of investments across the board

from theHindu and Indianexpress news reports on next day (13 June 2013)

|

statement A and B correct |

| Sebi, in a circular issued today, said that the enhanced limit of $5 billion shall be available for investments only to those FIIs that are registered with the market regulator… | Statement C is correct. |

| However, the enhanced limit of $5 billion will be available for investments only to foreign central banks, sovereign wealth funds, multilateral agencies, endowment funds, insurance funds and pension funds. | D is wrong. |

Question wants us to find wrong statement hence answer (D)

Ref.

- www.thehindubusinessline.com/markets/govt-hikes-foreign-investment-limit-in-gsecs-by-5-b/article4809507.ece

- http://www.indianexpress.com/news/foreign-investment-limit-in-govt-debt-hiked-by–5-billion/1128493/0

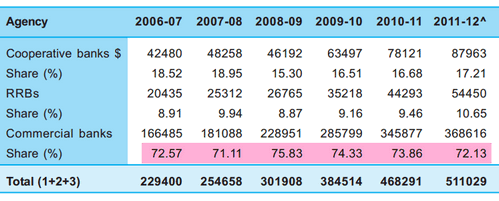

Q2. Which among the following agencies disbursed maximum credit to the agricultural sector in India between 2005-07 and 2011-12?

- Cooperative banks

- Regional rural banks

- Commercial banks

- Moneylenders

From Economic Survey Chapter 5, table 5.1, for Agency-wise Credit Disbursed to the Agriculture Sector between 2006-07 and 2012-13

We can see that commercial banks’ share has remained above 70% consistently. Hence answer (C). (can be debatable as well because doesn’t give data on Moneylenaders.)

Scheme

Q1. In order to provide pensions to workers of the unorganized sector, which one among the following schemes has been launched by the Government?

- Swabhiman

- Swavalamban

- Swadhar

- Aadhaar

copy pasting my own words from NPS article:

when it comes to MCQs, DONOT make silly mistakes the schemes starting with “S”

| Swavalamban | Government gives subsidy on NPS account of unorganized sector. |

| Swabhiman | Increase banking penetration in remote rural areas. |

| Sabla | (Rajiv Gandhi) Scheme for Empowerment of Adolescent GirlsGives them food, skill-training and health education. |

| Swadhar | This provides food, shelter, support, counseling to women in difficult circumstances e.g.

|

| Swajaldhara | Improving drinking water availability in the rural areas |

| STEP | Support to Training and Employment Programme. |

Answer is (B) Swavalamban.

Q2. Which of the following statements about the scheme ‘Roshni’ launched by the Ministry of Rural Development in June 2013 is/are correct?

- The scheme is supposed to provide training and employment to youth in the age group of 10 to 35 years.

- 50% of the beneficiaries of the scheme will be women.

- It is a cent percent Central Government funded scheme.

Select the correct answer using the code given below.

- 1

- 2

- 1 and 2

- 1,2 and 3

|

wrong. age limit is 18-35 |

|

right |

|

wrong it is 75:25 |

Hence answer B only 2

Ref: http://pib.nic.in/newsite/erelease.aspx?relid=96474

IR/International Affairs

Q1. Consider following statement

- The Fifth Summit of BRICS (2013) was held in Durban.

- Dr. Manmohan Singh became the only head of States or head of Government to attend all BRICS Summits held so far.

- The theme of Fifth Summit of BRICS was “BRICS and Africa: Partnership for Development, integration and Industrialization’.

Answer

- 1,2 and 3

- only 1 and 2

- 2 & 3

- only 3

In the PIN 2013 article

At Durban, S.Africa (5th Summit)=>statement 1 correct

Theme: BRICS and Africa: Partnership for development, Integration and industrialization=>statement 3 correct.

Therefore, answer must contain 1 and 3. There is only one such option: (A) 1, 2 and 3

Q2. In February 2013, the International Court of Arbitration at The Hague ruled in favour of India’s position on the diversion of Kishanganga water setting aside the objections raised by

- Pakistan

- China

- Nepal

- Bangladesh

It was Pakistan

Q3. United Nations General Assembly declared the year 2013 as

- International Year of Water Cooperation

- International Year of Space Cooperation

- International Year of Air Cooperation

- International Year of Science and Technology Cooperation

World Tourism Day (WTD) is celebrated on September 27. This year the theme for WTD is “Tourism and Water: Protecting our Common Future”. This is in line with the UN General Assembly’s declaration of 2013 as the ‘United Nations International Year of Water Cooperation’.

Hence Answer (A) water cooperation

Q4. Which of the following statements related to globalization is/are correct?

- It has resulted in the change of scale in economic activities.

- End of Cold War facilitated globalization,

- Flow of money in transnational corporations is discouraged.

Find correct statements

- 1 and 2 only

- 1 only

- 2 and 3only

- 1,2 and 3

Globalization and the National Security State By Norrin M. by Page 6

Economic definition of Globalization denote an expansion of the scale of economic activity beyond the nation-state.=>Statement 1 correct.

Globalization and Feminist Activism By M. E. Hawkesworth Page 5

In economic sphere some suggest that this phase of globalization began with demise of Bretton Woods agreement…others suggest that the collapse of Soviet Union and Cold war facilitated..=>statement 2 is correct. So far B and C eliminated.

Globalization and Identity: by Majid Tehranian, B. Jeannie Lum, Page 71

Powerful economies and transnational corporations are the major beneficiaries of global flows of capital=> Statement 3 is wrong. This eliminates C and D.

Thus, we’re left with answer (A) 1 and 2 only.

PIN (Person in news)

Q1. The 27th Indira Gandhi Award for National Integration was conferred on

- Ela Bhatt

- Gulzar

- Mohan Dharia

- A .R. Rahman

From the PIN2013 article, we can see It was Gulzar answer (B)

Q2. Who among the following won the Men’s Singles All-England Badminton Championship held in Birmingham, England in 2013?

- Lee Chong Wei

- Chen Long

- Chen Jin

- Lin Dan

It was Chen Long answer (B) http://www.globaltimes.cn/content/767204.shtml

The End and FAQ

This article concludes the [CAPF 2013 Answerkey] series.If there are any corrections/additions, post them in the comment below.

FAQ1. What will be the cutoff for CAPF 2013?

I don’t speculate cutoffs for any exam.

- When lakhs of candidates appear in CAPF, we need a really large sample data to estimate cutoffs. But on internet sites/forum: only a few hundred candidates post their score. Within them only three type of people are vocal (1) those who performed exceptionally well (2) those who performed terribly (3) those who just inflate their scores for the sake of trollery and nuisance.

- People make silly mistakes unconsciously. In the head they think A answer but in reality they tick B unknowingly. I didn’t appear in this exam, yet I also made silly mistake in the house privilege question because question said “courts can inquire” but in my head I kept reading “courts cannot inquire”.

- Because of ^above reason: after result comes there always dozens of candidate claiming “I ticked more than xyz yet I’m not selected”

- Some MCQ answers are debatable. UPSC’s official key is the final arbitrator but they haven’t released it yet (and most proably won’t release it until entire ‘recruitment process’ is over i.e. after April-May 2014.

- If God doesn’t want a candidate to get selected, he can always fail him in physical / interview.

You studied hard, now leave rest in the hands of God. Don’t raise your blood pressure over cutoffs.

FAQ2: if you don’t want to speculate cutoffs then why the hell you release answerkeys for CAPF/ACIO/CSAT?

- To prove that most questions came from standard reference books, hence coaching is unnecessary for success in competitive exams.

- To help candidate figure out what went right and what went wrong with his preparation. Show him the pitfall of negative marking and ticking answers based on guess-work/gambling. So if he fails in this exam (or wants to appear in some other similar exam), he can rectify his mistakes and update his study habit accordingly.

- To check the pattern, so I can update studyplans accordingly for the next year’s exam

FAQ3: What should I do next?

- Many people clear the written but fail in the physical test of CAPF. So, start daily exercise routine. Tips given in toppers’ interviews. available on https://mrunal.org/category/capf

- Even if you clear physical, the interviews are by and large similar to IAS/IPS level: they ask profile based questions, current affairs, opinion based questions and so on. Therefore you need to continue reading newspapers, journals, magazines and maintain diary of current affairs.

- Don’t put all eggs in one basket- apply for other banking/PSC/SSC etc exams based on your taste for career. Continue your preparation for GS and Aptitude.

FAQ4: What will you do next?

1. finish the [Land reform] article series. 2. Decide the winners for Oct 2013 writing competition.

![[Errors/discrepancy] 16 MCQs where UPSC Official Prelims-2020 Answerkey & Coaching classes differ, while 2 MCQs cancelled](https://mrunal.org/wp-content/uploads/2021/11/csp2020-akey-differ-table-500x383.png)

155+ according to mrunal’s answers (and im not gloating )….for me taking this xam was honing my writing skills b4 cs mains ,marked all 125 mcq witht caring for penalty and i think it worked .

hello sir

i have a request … sir plz provide the link for download or view ias mains G.S. question papers of previous years in hindi… if it is section wise then good like history portion, geography portion means in the form of trend analysis… sir plz sir help me im preparing modern history now a days but dont have questions so not getting that what kind of questions can be asked and not having confidence that im approaching right… so sir plz sir provide questions

hello sir

i got 120 marks in this paper what are my chances

Thank You So Much Mrunal Sir.

sir in answer key and also paper of acpf aptitude question number 3 they say that 40 students passed in mathematics they never sayed that class contains 40 students

SIR PLZ CLEAR MY DOUGHT. I I MAY BE WRONG

gettng around 85 in paper1 n after deductng heavily around 65 ATLEAST in paper 2.. reservd category.. can i expect a pet cl.. guys pls help..

friends i am getting around 100 marks in paper 1 and 70 in second paper…..what are my chances , belongs to obc category……some one plz tell??

how do you know that you will get 70 in 2nd paper, its subjective exam?

yatin you are right.

Hi Mrunal,

We appreciate your guidance and effort. Explanations and comparative analysis helped a lot (Section wise). Is it possible for you to take some time to give a detailed analysis/comparison (Holistically) w.r.t previous year paper.

I personally feel that thread would be also relevant in gauging individual performances for many of us.

Thanking in anticipation.

i got 115 in 1st pep st any chance

I scored 74 in paper first, & sure i wont be able to clear CAPF-13 exam.

i want to know Sir, how to make a good approach to all section to grape good knowledge

i am in Coast guard and feel much problem to manage my preparation, compare to last year i scored

good marks but failed much disappointed what to study what not.

pls sir guide me how to prepare for sure success next year.

thanking you,

how may i be benefited max form mrunal site, how much time should i give in a day.

upsc hass declared to start online exams

do check out upsc website for more information

I am getting 110 and 70 in Paper 1 and 2 , belongs to OBC category

what are my chances of qualify and also for the CISF what should I score min in Interview.

sir i am gettin 100-108 marks as per ur key answer(thnks alot for providing it )

any chances i may clear???

pls help me out sir i am new to this exam

MRUNAL SIR WAT WILL BE THE EXPECTED CUT OFF FOR PAP-1 THIS YEAR??

THNKS FOR KEYS :)

HI… Mrunal sir..goood show…. thanks alot ///,,, i m happy to meet ppl like u // in this selfish world…

.. sir .. i m prparin for state psc exams .. i have read lots of books,, and in exam i find every que. familier but then also i cant reach the exact answer .. can u suggest me the reading technichs or any strategy for exams .. to get the perfect answer… ///

I AGAIN SALUT U FOR UR GREAT CONTRIBUTION ..FOR THE GREAT INDIA

-S PATIL. PUNE

iam getting near about 150 bt in 2nd paper writing poor essays thanks mrunal bhai

Hi friends…I have a query…I missed to write arguments FOR in Q.2 of paper II(I written only AGAINST…as i didnot read question properly)..Will there be adverse impact on marks..

Sir can we expect of economy related current affairs in near future

Sir, these questions were very useful to me. From where can I get more questions of this type? please suggest something.

I got spectacles of power -1.25 D

Am I qualified per medical standards ?

Please reply

I got spectacles of power -1.25 D

Am I qualified per medical standards ?

Please reply sir

sir , when will they publish results for capf?

Guys any idea about capf result!

nice job sir, very fundamental questions with good explanations

https://mrunalmanage.wpcomstaging.com/2014/07/answerkey-upsc-capf-2014-economy-all-sets.html

currency not convertible on capital a/c …acc to rbi and answer key