- Analysis

- Economy (Static/Theory)

- Economy-Current

- IR/International Affairs

- PIN (Person in news)

- The End and FAQ

Analysis

Economy

- Last year only 6 Qs from economy, this year 21 question=>~250% increase in the importance of economy!

- last year asked about QFI related current affairs, this year about FII related

- like last year- a 2statement true/false type question about employment

- WTO was trap question. Answer is not Russia but Tajikistan.

- Seems Most of the Economy current affairs related questions came from June 2013 month.

- static: current is nearly 50:50 weightage.

- Majority of static questions can be solved through the combination of Ramesh Singh, NCERT and Mrunal.org

- Almost all current questions can be solved through Hindu/Indianexpress.

- Seems government job examiners have taken an oath to ask about ‘which tax get maximum revenue’- almost same question asked in ACIO 2013.

- Schemes

- Last year one question from govt. scheme, this year two questions from scheme.

- Finally clichéd question from Swavalamban is asked. But still UPSC continues to disrespect *you know who* by not asking about a scheme named after him- especially SABLA.

IR/International Affairs

- 6 question last time, 4 question this time.

- Asking a multi-statement questions from international summits=one of the patented MCQ style of UPSC. and it continues with BRIC related MCQ.

- other than that, usual stuff, nothing much to say.

Misc GK/PIN (Persons in News)

- Seems finally UPSC following the CSAT way here. drastically cut down the importance of PIN/MiscGK: last year 9 questions, this year barely 2 questions.

- 27th Indira Gandhi national integration prize= was announced in September 2012 and CAPF 2013 was held in October 2013= tells us the timeframe for PIN is nearly 1 year.

And finally for the bogus marketing propaganda: In this Economy/IR/PIN section atleast 10 questions can be directly solved from various articles of Mrunal.org

Economy Internal Breakup

| static | poverty, unemployment, inflation | 4 |

| budget | 2 | |

| banking/finance | 1 | |

| LPG | 2 | |

| Misc/Generic | 2 | |

| Current | International news | 2 |

| budget/taxation | 4 | |

| banking finance | 2 | |

| Scheme | 2 | |

| total Econmy | 21 |

Overall

| Polity | 14 | Covered. Click me |

| Geography+EnB+Agro | 14+8 | Covered. Click me |

| Economy+IR+PIN | 21+4+2 | Given in this article |

| Science | 20 | Given in this article. |

| History | 22 | click me |

| Aptitude | 20 | Click ME |

| total | 125 |

Corrections, Additions post them in comments.

Economy (Static/Theory)

Unemployment and Inflation

Q1. Which one among the following sectors in India has the highest share of employment?

- Agriculture and allied activities

- Manufacturing

- Construction

- Tertiary sector

Agriculture, including allied activities= ~14 per cent of the GDP (2011), but their share in total employment ~58 (2001 Census). Meaning, Agriculture’s role in the country’s economy is quite crucial.

Hence answer A

Ref. Summary of Economic Survey Ch8, https://mrunal.org/2013/04/economic-survey-ch8-agriculture-and-food-management.html

Q2. The rate of inflation in India is measured generally in respect of movement of

- consumer price index

- wholesale price index

- cost of living index for agricultural labor

- money supply

| Ramesh Singh, Page 7.13 | WPI inflation is used at macrolevel policy making, CPI inflation is used for microlevel analysis. The inflation at WPI is the inflation of Economy.=> answer B |

| RBI document | Official inflation rate is measured based on annual point-to-point basis change in the Wholesale Price Index (WPI). Answer (B) |

Q3. Which one among the following items has maximum weight in wholesale price index in India?

- Primary article

- Fuel and power

- Manufactured product

- Food item

Approx. weightage in WPI is

- Primary Articles (food,fruits etc):~22%

- Fuel, Power, Light & Lubricants :~14%

- Manufactured Products (biscuit,toothpaste):earlier 63.75% and in the revised series they increased it to 64.97%) hence answer (C)

Ref.

- https://mrunal.org/2011/08/economy-q-base-year-and-current-year.html

- Ramesh page 7.15

Q4. The Government of India refers to the absolute poverty line in terms of

- household savings

- household consumption

- household investment

- household income

Summary of Economic Survey Ch13

- Planning Commission estimates poverty using data from the large sample surveys on household consumer expenditure.

- These surveys are carried out by the National Sample Survey Office (NSSO) every five years.

- Planning Commission defines poverty line on the basis of monthly per capita consumption expenditure (MPCE).

Therefore, answer B

Budget (theory)

Q1. The following are some of the items of expenditure of the Central Government in India:

- Interest payments

- Major subsidies

- Pensions

- Loans and advances

Which of the above is/are included in non-plan revenue expenditure?

- 1 only

- 2 and 3 only

- 1, 2 and 3

- 2, 3 and 4

NCERT MacroEconomics, Class12, Page 63

Budget documents classify total revenue expenditure into plan and non-plan expenditure. The main items of non-plan expenditure are interest payments, defense services, subsidies, salaries and pensions.

That means answer must contain 1, 2 and 3. =>Option C

Q2. If we deduct grants for creation of capital assets from revenue deficit, we arrive at the concept of

- primary deficit

- net fiscal deficit

- budgetary deficit

- effective revenue deficit

The amendment to FRMB Act in 2012 defined Effective revenue deficit as the difference between “the revenue deficit and the grants for creation of capital assets”.

Hence answer (D)

Banking Finance

Q1. Consider the following statements:

- Repo rate is the interest rate at which RBI lends to commercial banks for short period.

- Reverse repo rate is the interest rate which RBI pays to commercial banks on short-term deposits.

- Gap between repo rate and reverse repo rate has been declining in India in the recent past.

Which of the above are not correct?

- 1

- 2 only

- 3 only

- 2 and 3

Approach 1

In the MSF article

We saw that, reverse repo is 100 basis points lower than repo rate. in other words, Repo rate = reverse repo + 1%

So gap in recent past, is not ‘declining’. Gap is fixed at 1%=> statement 3 is not correct. Hence answer (C)

Approach 2

Statement 1 and 2 are correct as per Ramesh Singh, so statement 3 has to be incorrect. And the question is asking you to find incorrect statement=> answer (C)

LPG

Q1. Privatization includes

- sale of public enterprises to private sector

- disinvestment of public enterprise equity

- participation of private sector in management in public sector enterprises

- All of the above

Ramesh Singh page 6.8

- Privatization in its purest form means de-nationalization i.e. transfer of state ownership of assets to private sector in tune of 100%

- The sense in which privatization has been used, is the process of disinvestment all over the world. This process includes selling of shares of the state owned enterprises to private sector=> statement B is correct.

- If an asset sold by government to the tune of 51%, the ownership is really transferred to private sector, seen then it’s termed as privatization=>C is also correct.

Therefore D All of Above.

Q2. Which of the following statements is correct with respect to the convertibility of Indian rupee?

- It is convertible on capital account

- It is convertible on current account

- It is convertible both on current and capital account

- None of the above

Ramesh Singh Page 15.7

- Current account is today fully convertible.

- India is still a country of partial convertibility in 40:60 in capital account, but inside this overall policy, enough reforms have been made and to certain level of foreign exchange requirements, it is an economy allowing full capital account convertibility.

Thus answer C: it is convertible both on current and capital account.

Generic

Q1. Consider following statement

- Employment growth in India in the second half of the first decade of 21st century was relatively modest.

- There was lower labour force participation rate across all ages during the period.

Which of the statements given above is/are correct?

- 1

- 2

- both

- None

First statement:

First decade of 21st century=2001-2010. Second half of that first decade=2005-10

According to planning commission, India has lost 5 million jobs in a five-year period ending 2010. Overall increase in employment growth = just 0.6%. Hence first statement correct. Modest growth in employment.

Second statement

Labor force participation rate (LFPR)

| Category | LFPR 2004-05 | LFPR 2009-10 |

| Rural | 44.6 | 41.4 |

| Urban | 38.2 | 36.2 |

| All India | 43.0 | 40.0 |

We can see that it has declined in the given time frame. So Statement number 2 is correct.

Hence answer (C) both correct.

Ref.

- employment growth: http://indiatoday.intoday.in/story/india-lost-5-million-jobs-during-2005-2010-india-today/1/252585.html

- labour participation: http://data.gov.in/dataset/labourforce-participation-rate-lfpr-and-work-force-participation-rate-wfpr-and-unemployment-

Q2. With reference to India, which of the following statements relating to urbanization is/ are correct?

- It is a manifestation of economic, social and political progress.

- Rapid growth of urban population puts pressure on public utilities.

- Urban sprout is encroaching the precious agricultural land.

Select the correct answer using the code given below.

- 1 and 2 only

- 2 only

- 1 and 3 only

- 1, 2 and 3

Statement 2 is definitely correct. (IGNOU MA modules on Local administration) This eliminates answer C

For remaining statements 1 and 3, they appear legit from common understanding. So answer should be (D).

Although Haven’t located exact sources to confirm/deny 1 and 3 so one can even debate A or B.

Economy-Current

Economy- International news

Q1. The Human Development Report 2013 (UNDP) does not focus on

- Sustaining development momentum

- Peace and security

- Confronting environmental pressure

- Managing demographic change

The 2013 Report identifies four specific areas of focus for sustaining development momentum:

- enhance equity (+women)

- enable greater voice and participation of citizens (+youth)

- confront environmental pressures

- manage demographic change

Therefore, A, C and D are given. Meaning HRD 2013 doesn’t focus on (B) Peace and security.

Q2. Which one among the following is the latest nation to join the World Trade Organization (as on March 2013)?

- North Korea

- China

- Russia

- Tajikistan

Trap question.

| officially Member from | |

| N.Korea | — |

| China | Jan 1995http://www.wto.org/english/thewto_e/countries_e/macao_china_e.htm |

| Russia | 22 August 2012http://www.wto.org/english/thewto_e/countries_e/russia_e.htm |

| Tajikistan | March 2013http://www.wto.org/english/thewto_e/countries_e/tajikistan_e.htm |

Therefore, answer (D) Tajikistan

Budget/ Taxation related

Q1. The following are some important sources of tax revenue for the Union Government in India

- Corporation tax

- Customs

- Union excise duties

- Service tax

Arrange the aforesaid sources of revenue in ascending order as per the Budget Estimates for 2013-14.

- 1-2-3-4

- 1-2-4-3

- 2-1-3-4

- 4-3-2-1

Similar question asked in ACIO 2013

we’ve to look at the Revenue Account – Receipts, released with Budget 2013.

| question code | tax | Crore rupees in Budget 2013-2014 |

| 4 | service tax | 180141.00 |

| 3 | Excise duties | 196804.95 |

| 2 | income tax | 240919.00 |

| 1 | corporate tax | 419520.00 |

Therefore, in ascending order, it’ll be 4321. Answer (D)

Alternatively- corporate tax is highest so answer must contain “1” at the end. There is only one such option (D)

Ref: http://www.indiabudget.nic.in/afs.asp

Q2. Statement I: For the three years after 2007-08 Annual Budget in India, there was practically no increase in tax/GDP ratio.

Statement II: At the same time, government expenditure jumped noticeably.

- Both the statements are individually true and Statement II is the correct explanation of Statement I

- Both the statements are individually true but Statement II is not the correct explanation of Statement I

- Statement I is true but Statement II is false

- Statement I is false but Statement II is true

From Economic Survey Chapter 1, Page 13

| year | Tax to GDP ratio |

| 2007-08 | 11.9 |

| 2009-10 | 10 |

| 2011-12 | 9.9 |

So there is practically no increase in tax:GDP ratio =>statement 1 correct. This eliminates D

From budgets uploaded on http://indiabudget.nic.in

| Total Expenditure | crore rupees |

| 2008-09 | 900953.41 |

| 2009-10 | 1020837.68 |

| 2010-11 | 1216575.73 |

| 2012-13 | 1430825.24 |

as you can see, government’s expenditure has increased considerably over these years. Means statement (II) also correct. But does it means II explains I? Nope

Because this ratio looks after tax vs GDP. Theoretically if government increases expenditure on education, HRD etc. then more poors should become Middle class and fall under Income tax bracket=>tax collection should increase.

according to Moody’s report, the three reasons for India’s low tax:GDP

- Low average incomes and a high poverty rate result in a very small portion of the labor force being eligible to pay personal income taxes

- large proportion of economic activity that is generated by small and medium enterprises (SMEs). Although these enterprises have enjoyed strong profitability growth over the past decade, the government has not captured their earnings in tax revenues due to a variety of exemptions and compliance issues

- certain tax exemptions on agriculture related activity and until the mid-nineties, on most services as well. The tax net has been progressively expanded to include a greater number of services each year, and service tax revenue has grown the fastest of all revenue sources. Yet, service taxes constitute merely 5 percent of total general government revenues, although they comprise about 60 percent of GDP

In short, II doesn’t explain I. Hence answer is (B)

Q3. In the current pricing policy, the price of diesel in India consists of

- Fuel component + Customs duty + Excise duty + Sales VAT + Dealer’s commission

- Fuel component+Excise duty + Sales VAT + Dealer’s commission

- Fuel component + Customs duty + Sales VAT + Dealer’s commission

- Fuel component + Customs duty + Excise duty + Dealer’s commission

from the Chart given in this Hindu article,

we can see, It is made up of

- fuel component

- custom duty

- excise duty

- states VAT

- dealer commission

let’s check the options

|

right, contains all components |

|

wrong doesn’t contain custom |

|

wrong, doesn’t contain Excise |

|

wrong, doesn’t contain VAT |

hence answer (A)

Q4. The Central Board of Direct Taxes (CBDT) in June 2013 has specified a value for the cost inflation index of 2013-14. In this regard. which of the statements given below is/are correct?

- There has been a rise in the cost inflation index over the year 2012-13.

- The cost inflation index helps in reducing the inflationary gains, thereby reducing the long-term capital gains tax payout for a taxpayer.

Select the correct answer using the code given below.

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

- Last year, the index was ‘852’, and this year it is ‘939’. This would mean that there has been a 10.2 per cent rise in the cost inflation index for 2013-14.=>1 is correct

- A cost inflation index helps reduce the inflationary gains, thereby reducing the long-term capital gains tax payout for a taxpayer. =>2 is correct.

Hence answer C both correct.

Banking/Finance related

Q1. The Government of India on 12th June, 2013 enhanced the limit of foreign investments in government securities by 5 billion US dollar, In this regard, which of the following statements is not correct?

- It was done in order to increase inflow of overseas capital

- It will strengthen the value of rupee

- The foreign institutional investors registered to SEBI are only eligible for investment in the enhanced limit of 5 billion US dollar

- The investment can be made in all categories of investments across the board

from theHindu and Indianexpress news reports on next day (13 June 2013)

|

statement A and B correct |

| Sebi, in a circular issued today, said that the enhanced limit of $5 billion shall be available for investments only to those FIIs that are registered with the market regulator… | Statement C is correct. |

| However, the enhanced limit of $5 billion will be available for investments only to foreign central banks, sovereign wealth funds, multilateral agencies, endowment funds, insurance funds and pension funds. | D is wrong. |

Question wants us to find wrong statement hence answer (D)

Ref.

- www.thehindubusinessline.com/markets/govt-hikes-foreign-investment-limit-in-gsecs-by-5-b/article4809507.ece

- http://www.indianexpress.com/news/foreign-investment-limit-in-govt-debt-hiked-by–5-billion/1128493/0

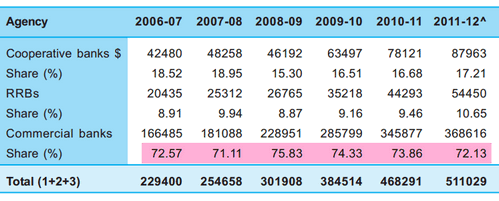

Q2. Which among the following agencies disbursed maximum credit to the agricultural sector in India between 2005-07 and 2011-12?

- Cooperative banks

- Regional rural banks

- Commercial banks

- Moneylenders

From Economic Survey Chapter 5, table 5.1, for Agency-wise Credit Disbursed to the Agriculture Sector between 2006-07 and 2012-13

We can see that commercial banks’ share has remained above 70% consistently. Hence answer (C). (can be debatable as well because doesn’t give data on Moneylenaders.)

Scheme

Q1. In order to provide pensions to workers of the unorganized sector, which one among the following schemes has been launched by the Government?

- Swabhiman

- Swavalamban

- Swadhar

- Aadhaar

copy pasting my own words from NPS article:

when it comes to MCQs, DONOT make silly mistakes the schemes starting with “S”

| Swavalamban | Government gives subsidy on NPS account of unorganized sector. |

| Swabhiman | Increase banking penetration in remote rural areas. |

| Sabla | (Rajiv Gandhi) Scheme for Empowerment of Adolescent GirlsGives them food, skill-training and health education. |

| Swadhar | This provides food, shelter, support, counseling to women in difficult circumstances e.g.

|

| Swajaldhara | Improving drinking water availability in the rural areas |

| STEP | Support to Training and Employment Programme. |

Answer is (B) Swavalamban.

Q2. Which of the following statements about the scheme ‘Roshni’ launched by the Ministry of Rural Development in June 2013 is/are correct?

- The scheme is supposed to provide training and employment to youth in the age group of 10 to 35 years.

- 50% of the beneficiaries of the scheme will be women.

- It is a cent percent Central Government funded scheme.

Select the correct answer using the code given below.

- 1

- 2

- 1 and 2

- 1,2 and 3

|

wrong. age limit is 18-35 |

|

right |

|

wrong it is 75:25 |

Hence answer B only 2

Ref: http://pib.nic.in/newsite/erelease.aspx?relid=96474

IR/International Affairs

Q1. Consider following statement

- The Fifth Summit of BRICS (2013) was held in Durban.

- Dr. Manmohan Singh became the only head of States or head of Government to attend all BRICS Summits held so far.

- The theme of Fifth Summit of BRICS was “BRICS and Africa: Partnership for Development, integration and Industrialization’.

Answer

- 1,2 and 3

- only 1 and 2

- 2 & 3

- only 3

In the PIN 2013 article

At Durban, S.Africa (5th Summit)=>statement 1 correct

Theme: BRICS and Africa: Partnership for development, Integration and industrialization=>statement 3 correct.

Therefore, answer must contain 1 and 3. There is only one such option: (A) 1, 2 and 3

Q2. In February 2013, the International Court of Arbitration at The Hague ruled in favour of India’s position on the diversion of Kishanganga water setting aside the objections raised by

- Pakistan

- China

- Nepal

- Bangladesh

It was Pakistan

Q3. United Nations General Assembly declared the year 2013 as

- International Year of Water Cooperation

- International Year of Space Cooperation

- International Year of Air Cooperation

- International Year of Science and Technology Cooperation

World Tourism Day (WTD) is celebrated on September 27. This year the theme for WTD is “Tourism and Water: Protecting our Common Future”. This is in line with the UN General Assembly’s declaration of 2013 as the ‘United Nations International Year of Water Cooperation’.

Hence Answer (A) water cooperation

Q4. Which of the following statements related to globalization is/are correct?

- It has resulted in the change of scale in economic activities.

- End of Cold War facilitated globalization,

- Flow of money in transnational corporations is discouraged.

Find correct statements

- 1 and 2 only

- 1 only

- 2 and 3only

- 1,2 and 3

Globalization and the National Security State By Norrin M. by Page 6

Economic definition of Globalization denote an expansion of the scale of economic activity beyond the nation-state.=>Statement 1 correct.

Globalization and Feminist Activism By M. E. Hawkesworth Page 5

In economic sphere some suggest that this phase of globalization began with demise of Bretton Woods agreement…others suggest that the collapse of Soviet Union and Cold war facilitated..=>statement 2 is correct. So far B and C eliminated.

Globalization and Identity: by Majid Tehranian, B. Jeannie Lum, Page 71

Powerful economies and transnational corporations are the major beneficiaries of global flows of capital=> Statement 3 is wrong. This eliminates C and D.

Thus, we’re left with answer (A) 1 and 2 only.

PIN (Person in news)

Q1. The 27th Indira Gandhi Award for National Integration was conferred on

- Ela Bhatt

- Gulzar

- Mohan Dharia

- A .R. Rahman

From the PIN2013 article, we can see It was Gulzar answer (B)

Q2. Who among the following won the Men’s Singles All-England Badminton Championship held in Birmingham, England in 2013?

- Lee Chong Wei

- Chen Long

- Chen Jin

- Lin Dan

It was Chen Long answer (B) http://www.globaltimes.cn/content/767204.shtml

The End and FAQ

This article concludes the [CAPF 2013 Answerkey] series.If there are any corrections/additions, post them in the comment below.

FAQ1. What will be the cutoff for CAPF 2013?

I don’t speculate cutoffs for any exam.

- When lakhs of candidates appear in CAPF, we need a really large sample data to estimate cutoffs. But on internet sites/forum: only a few hundred candidates post their score. Within them only three type of people are vocal (1) those who performed exceptionally well (2) those who performed terribly (3) those who just inflate their scores for the sake of trollery and nuisance.

- People make silly mistakes unconsciously. In the head they think A answer but in reality they tick B unknowingly. I didn’t appear in this exam, yet I also made silly mistake in the house privilege question because question said “courts can inquire” but in my head I kept reading “courts cannot inquire”.

- Because of ^above reason: after result comes there always dozens of candidate claiming “I ticked more than xyz yet I’m not selected”

- Some MCQ answers are debatable. UPSC’s official key is the final arbitrator but they haven’t released it yet (and most proably won’t release it until entire ‘recruitment process’ is over i.e. after April-May 2014.

- If God doesn’t want a candidate to get selected, he can always fail him in physical / interview.

You studied hard, now leave rest in the hands of God. Don’t raise your blood pressure over cutoffs.

FAQ2: if you don’t want to speculate cutoffs then why the hell you release answerkeys for CAPF/ACIO/CSAT?

- To prove that most questions came from standard reference books, hence coaching is unnecessary for success in competitive exams.

- To help candidate figure out what went right and what went wrong with his preparation. Show him the pitfall of negative marking and ticking answers based on guess-work/gambling. So if he fails in this exam (or wants to appear in some other similar exam), he can rectify his mistakes and update his study habit accordingly.

- To check the pattern, so I can update studyplans accordingly for the next year’s exam

FAQ3: What should I do next?

- Many people clear the written but fail in the physical test of CAPF. So, start daily exercise routine. Tips given in toppers’ interviews. available on https://mrunal.org/category/capf

- Even if you clear physical, the interviews are by and large similar to IAS/IPS level: they ask profile based questions, current affairs, opinion based questions and so on. Therefore you need to continue reading newspapers, journals, magazines and maintain diary of current affairs.

- Don’t put all eggs in one basket- apply for other banking/PSC/SSC etc exams based on your taste for career. Continue your preparation for GS and Aptitude.

FAQ4: What will you do next?

1. finish the [Land reform] article series. 2. Decide the winners for Oct 2013 writing competition.

![[Errors/discrepancy] 16 MCQs where UPSC Official Prelims-2020 Answerkey & Coaching classes differ, while 2 MCQs cancelled](https://mrunal.org/wp-content/uploads/2021/11/csp2020-akey-differ-table-500x383.png)

in ascending order of taxes i have some objection.1st is,in the paper there were no choice for income tax.choices were corporation tax,customs,central excise,and service tax.you included income tax in place of central excise.2ndly central excise have more portion than customs.hence no given option is correct.answer should be 4231 rather 4321.there is something wrong in option sequence.what is your view?

Mrunal bhai hat’s off …….l, u r doing exceptionally well 4 candidates who actually deserved success but lack of resources, n guidance create hurdle.

According to your answer key mrunal sir i am getting 128.66 marks, i made some stupid mistakes, if i hadn’t made it, i would ve scored a satisfied marks.

Sir about convertibility of Indian rupee the answer could be none of the above,because the right choice is “fully convertible on current account and partially convertible on capital account”? I took this logic and marked the answer as D.

Thanks a lot mrunal ji

bhai as per ur keys iam scoring 106 aftr deductions nd i know dis is a poor score…….even if i qualify writtens i vud get stuck in d merit coz of low written score….nywayz thanx fr ur support….god bless u

Ur words of wisdom are must for any candidate.Frends I must say that this year (for me) paper was a bit difficult compared to previous year.Becoz when at home solved previous year question I got 154 marks but this year its not even crossing 130.UPSC peoples are really awesome..

mrunal sir, i am big fan of yours, and u do a great job indeed, but in the recent i have felt that u have neglected exams like nicl ao and ssc cgl, no paper analysis and not much other stuff, nicl ao was totally neglected, may be these exams were leaked but still many students have put up their hopes to these, so plz discuss their papers

koi idea cut off kitni jaegi..for both the papers ?

I thk we shouldn’t bother for cut offs. Just keep an eye on next exams,cutt off will be low compared to last year due to question difficulty level and candidates absence due to various exams

thanks for the optimistic view..will keep that in mind :) but can you pls give me an idea wat was last years combined cutoff? thnks

sweet answers

The answer for the rupee convertible is on current account only. We do not have capital account convertibility and after the recent RBI steps to prevent further depreciation the INR has become even less convertible on the Capital Account. So it is only convertible on the current account. I would advise you to change that answer. Thank you for the effort though.

The capital account is partially convertible too and we define Indian economy is having partial capital account convertibility. For example under automatic route, foreign companies can take controlling stake in certain sector like single brand retail etc.

Though in certain sector we have limits or caps like in Insurance, Defense etc. on maximum limit on foreign capital investment. Thus, our currency is partially convertible and it is the most important factor that stop Rupee depreciating from the ebb it reached recently and is the one of the few safeguard (another being partially floating or managed currency) against a crisis like Tequila Crisis, Asian Economic Crisis etc happening in India.

In Q2 of budget/taxation, you have arrived at option d using income tax instead of customs. Customs revenue is at about 187000 crore rupees hence correct order would be 4-2-3-1

It’s Q1 actually (under the Budget/Taxation section of this post).

1. Corporation tax (419 k crore rupees)

2. Customs (187 k crore rupees)

3. Union excise duties (196 k crore rupees)

4. Service tax (180 k crore rupees)

Hence the sequence in ascending order would be: 4-2-3-1 which is not available in options.

Kindly check this and update the answer.

dear i think it is wrong(bogus) question.should be drop in official answer key by upsc

I hope so.

According to Mrunal’s sir answer key I am scoring 135-140…

What are my chances(Gen)as I think i will clear paper2 for sure..

full chance…start running and jumping :)

Sir ruppee is only partially convertible on capital account..

Also,disinvestment doesnot necessarily mean privatisation.only moree dan 51% will mean pvtisation.

even if a company has less dan 51% stakes in public sector,it will have members on board.bt less dan 51 percent is not pvtisation.

Govt has never agreed dat it is privatising by disinvestment.woteva critics say.

In upsc xam v have to pick d idea of govt of india.

Plz reconsider

privatisation is induction of private ownership or ownership pattern in public enterprises,either partially or fully.but disinvestment is merely stake sale.there is no ownership or management change in disinvestment.

http://www.thehindubusinessline.in/mentor/2003/02/24/stories/2003022400401100.htm

I knw dis dat dusinvestmentn doesnot necessarily mean priatisation

For equatorial line the answer will be south america. B coz the length. In Africa is 1800 km where ad for south America is more than 2400 nm. 1 nm = 1852 meter. Nm means nautical mille measure of SRA distance used by mariners. Today I event to chart house and measure the approximate distance. Regards. This time cut off will be 75-80.

Bro. i think answer is Africa.equitorial belt extends to 10 degree north-south lattitude from equator,in this lattitude Africa has more area than South Africa.

u r right bro. I have calculated the equatorial line length only. as per area Africa will be correct. regards. can u tell me expected reasult date. what’s ur score in paper 1.

Nm means sea mile.

You are awesome Mrunal .You make studying for upsc exams like attending school tests !thank you very much for immense support

Last year i was getting 115 this year only 100 marks… in paper one. Is it enough to get a call…..

last time aayi thi call?

Sir, I want to ask you about date of result for capf 2013. can u please guide?

Great WOrk!! Time saving and say FO to coachings…

score above 100 in paper 1 and will get a call for physical…forsure

For the Question 2 above the reference can be taken from the Ramesh Singh’s book of Economy!!

It is not bogus mkting propaganda Lol :D, infact I would come here for a lot of doubts without which a lot of stuff cannot be understood, there is a multiplicity effect.

Mrunal sir can u file a Rti act regarding why Indian coast guard officers exam is not conducted by upsc through CDs or calf. There are a lot of irregularities in conduct of exam by self.

pls answer the question given below for 20 marks my email id is killallyourdesires@gmail.com

Q. critically examine the institutional and operational aspects of health care system in india

thnks in advance

Sir, i m regular follower of your site. The way of giving information of u is amazing !

Sir cg psc pre12 has come and mains will be held on march14

, the cg mains syllabus is so long…, sir plz u make strategy/studyplan for this ! It will b great for all cg aspirants… I m waiting sir !