- Subsidies

- PDMA: Public Debt Management Agency in Interim budget

- FRBM: States succeed where Union fails

- Structural deficit & Cyclic deficit

Subsidies

Back in the mid-90s, P.Chidambaram himself classified Subsidies in three types

#Type 1: Public Goods

- Services given to everyone- be it rich or poor: Police, Defense, Judiciary etc.

- Any money spent on these public goods = not be counted under “subsidies” because these are essential services.

- Example, if government announced free electricity to all police station, or free uniforms/shoes to all army personnel, we donot call it “Subsidy”.

#Type 2: Merit goods

- Polio Vaccination, Primary Education, forest plantation, roads, bridges, R&D on Agro-Space-public Health, renewable energy etc.

- These have positive “externality” E.g. polio vaccine + free edu. =kid is saved, and 20 years later, companies get healthier-more skilled labor force.

- Similarly, forest plantation = environment saved, wildlife saved. And simultaneously, more oxygen => healthier population =>more productive labour force=>higher GDP.

- In short, society at large, benefits. Therefore, subsidies given to Merit goods =not evil. They’re justified. Government should give subsidies to merit goods as and when possible.

#Type 3: Non-Merit Goods

| Method | example |

|---|---|

| Direct Cash |

|

| Subsides In “Kind” | Instead of giving “cash”, government gives some “item” (Goods) to beneficiary. example

|

| Procurement |

|

| Price Regulation |

|

| Interest Relief |

|

| Tax Relief |

|

These are called “non-merit” goods because society pays and individual benefits.

Where do these fall in the budget? Revenue Expenditure or capital Expenditure? Obviously subsidies= Revenue Expenditure.

(Free market) economists hate them because

Non-merit subsides = “negative” externality.

- Diesel subsidy (meant for farmers): jeep & SUV-owners also get cheap diesel => pollution (+ accidents from drunk driving)

- excessive use of diesel pumpsets= ground water depletion

- Fertilizer subsidy => farmers use excessive amount of urea => soil fertility decline, water-pollution after monsoon.

Non-Merit subsidies =often diverted & misused

| MNREGA | Bogus job cards, Sarpanch chows down the money. |

|---|---|

| Subsidies LPG | beneficiaries give them to restaurants and 5 star hotels @black market |

| Subsidized kerosene | PDS owner sell it to rickshaw-walla rather than poors =>misuse + pollution. |

| Food subsidies | Black marketeering by PDS shop owner. |

| Fertilizer subsidy, free electricity | Most of the benefit goes to big farmers. The small marginal farmer doesn’t get them. |

Non-Merit subsides =cascading effect

- Government pays subsidy to oil/fertilizer/electricity companies to give cheap diesel, urea and electricity to Farmer.

- Government pays FCI to procure wheat from farmer @MSP (usually above the market prices)

- Government also gives wheat/rice to the poor @cheap/free price.

Result? lot of overlapping, lot of leakage. But still, majority of the subisides go in the non-merit goods food>> fertilizer >> fuel

PDMA: Public Debt Management Agency in Interim budget

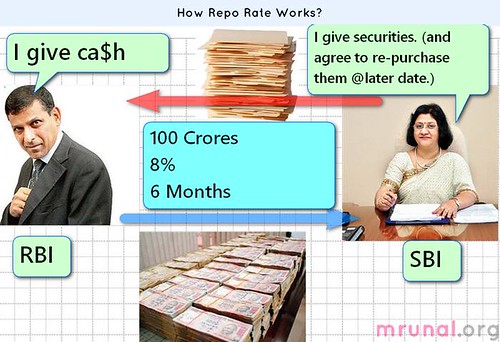

@present, RBI is the debt manager of the Government. = Conflict of interest. How?

| GOVERNMENT | RBI |

|---|---|

| borrows money from market via issuing Government-securities (G-sec). This is one type of bond e.g. “pay me 1000, I’ll pay 8% interest for next ten years, then I’ll repay entire principal.” | RBI uses the same G-sec to control money supply. |

Government release Government securities (G-Sec) to borrow money from market. RBI uses the same G-sec to control money supply.

Example

- Repo rate: recall that G-sec are used as “collateral”, so money can be recovered incase the client doesn’t pay.

- OMO (Open market operation): Here RBI buys/sells G-sec in open market, to control money supply. (RBI buying G-sec from juntaa = money supply increased in juntaa’s hand, and vice versa).

- SLR: RBI requires the banks to invest part of their money in G-sec.

Therefore, monetary policy maker and debt manager should be two separate persons. Else there is conflict of interest, clouding of judgment. Although experts are divided

Argument: RBI should continue as Debt manager

because

- Only RBI has the necessary expertise, staff and tools to make macro-assessments about the debt management (and its impact on money supply, banking and finance sector, foreign exchange rates etc). While An independent agency will not have the same level of expertise. Their mindset will be “narrow”.

- only RBI can harmonise the Debt management of union and State governments- and their impact on the economy. While the separate debt management office will only focus on union government but not on the state governments. => this lack of coordination will have negative impact on money supply

- Even a separate debt management office cannot stop conflict of interest. Because government is the majority shareholder in public sector banks. (e.g. Government can order its puppet Board of Directors in SBI, PNB etc to buy government securities beyond the SLR requirement and thus government gets money.)

- So far, RBI has effectively carried out that Debt management operation without problem. So why waste time in “Trial n Error” with a separate debt Management office?

Argument: RBI should not continue as debt manager

because:

- Because there is conflict of interest (as explained in the beginning).

- 13th Finance Commission (Vijay Kelkar) has recommended there should be separate National debt Management agency.

- In most of the advanced economies, monitoring policy and debt management are carried out by two different agencies.

- Since late 80s- Sweden, New Zealand have separate offices for Public debt Management (outside their RBI but inside their finance ministry).

- Germany and Denmark are even one step ahead- they have separate financial companies to look after the public debt management. (outside their RBI and finance ministry)

If those economies can run smoothly, then Indian economy can also run smoothly by having a separate debt management office.

Timeline: PDMA

- 2007: FM makes announcement in the budget, “we’ll setup a statutory body for public debt management.” (meaning they’ll pass a law to create this body)

- 2011: Public Debt Management Agency Bill

- 2012: bill not passed

- 2013: bill not passed

- 2014, Feb: Interim Budget. Chindu says, no worries, we’ll set up a NON-Statutory Public Debt Management Agency (PDMA), they’ll look after debt Management from 2014-15 (i.e. 1/4/2014 to 31/3/2015).

Note: at the moment, PDMA = non statutory, just like UIDAI. (Because there is no law/act behind them).

FRBM: States succeed where Union fails

- 2003: Fiscal Responsibility and Budget Management (FRBM) Act was enacted.

- FRBM gave following TARGETs to the Finance minister:

| deficit | target |

|---|---|

| Revenue deficit | eliminate (0%) by 31/3/2008 |

| fiscal deficit | reduce it to 3% of GDP by 31/3/2009 |

- 2010: New concept of “Effective revenue deficit” introduced in the budget.

- 2012: Chindu realizes, “It is beyond my aukaat to eliminate revenue deficit.” So, he amends the FRBM target. “I’ll not eliminate revenue deficit, I’ll eliminate “Effective” revenue deficit.”

| deficit | targets amended |

| EFFECTIVE Revenue deficit | eliminate (0%) by 31/3/2015 |

|---|---|

| fiscal deficit | reduce it to 3% of GDP by 31/3/2017 |

FRBM: Success by State governments

while union government is yet to reach its targets,

| target | already achieved by |

| Revenue deficit = 0% | Gujarat |

| Fiscal deficit = less than 3% of the state’s GDP | Gujarat, MP, Odisha, Bihar and WB |

Structural deficit & Cyclic deficit

Not given in the budget, but for stupid MCQs, we’ve to prepare. Because once in a while, Montek mentions it.

| year | Year1 |

| total income | 100 |

| total Expenditure | 110 |

| deficit | 10 |

In year2, there is recession like scenario. Government’s tax-income decreases, And government’s expenditure will increase (Because of various social security / unemployment allowance/ MNREGA type schemes) to help the people during slowdown.

| year | Year1 | year2 (downturn in economy) |

| total income | 100 | 80 |

| total Expenditure | 110 | 120 |

| deficit | 10 | 40 (this is Cyclical deficit) |

In year3, economy recovers and there is FULL employment (Every person has got job). Economist believe that IF a country has FULL employment, then government’s tax Revenue will automatically improve and there will be no deficit (in fact there will be surplus).

But in real life, even if there will full employment, still there will be deficit

| year | Year1 | year2 (downturn in economy) | year3 (economy recovers, full employment) |

| total income | 100 | 80 | 100 |

| total Expenditure | 110 | 120 | 105 |

| deficit | 10 | 40 (this is Cyclical deficit) | 5 (this is structural deficit) |

why? because government still running some populist scheme/subsidies to farmers, fertilizer companies, LPG to middle class and so on. This type of deficit, which exists EVEN during full employment = is called structural deficit. Structural deficit results when government is giving unnecessary subsidies and freebies- despite full employment.

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Budget, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

Fab contents sir.. thank you so much