- Why identify banks “Too big Fail”?

- Who will identify D-SIB?

- D-SIB in India

- Benefits of D-SIB norms?

- Limitations of D-SIB norms?

- Mock questions

Why identify banks “Too big Fail”?

- 2009: Financial stability board (FSB) was setup. It is an international body affiliated with G20. Purpose: Monitor Global financial system. HQ: Basel, Switzerland.

- 2010: FSB observes following:

- Each country has certain “big” banks with huge client base, commanding billions of dollars, run cross-border and cross-sector (insurance | pension etc) investment through their NBFCs. (Non-banking financial companies)

- These NBFCs act as “shadow banks”, because while they carry bank like operations but not subject to bank like regulations.

- If the parent banks fail, Government is forced to ‘rescue’ them with ‘bailout package’ to ensure that national economy doesn’t collapse and ordinary citizen-clients don’t suffer. E.g. Subprime crisis, US & UK Government had to spend billions of tax-payer money to rescue their large banks.

- Consequently, these banks become confident they’re “too big to fail” so they will always be rescued by market-forces or the government, will continue to indulge in grey-areas and reckless practices.

- Hence, we need to identify such systematically important banks (SIB) at Domestic and global level.

- We must force them to have additional capital/backup against financial emergency, so that taxpayer money not wasted in rescuing them during crisis.

D-SIB in India

- 2014: RBI issued guidelines for Domestic Systemically Important Banks (D-SIBs).

- Each year in August, RBI will disclose the names of banks designated as D-SIBs, using two-step technical process that is not important for ordinary exams except may be for RBI Grade “B” office interviews.

- Further, these D-SIBs are sub-classified into bucket number 1 to bucket number 5 depending on their size (as % of GDP). Higher the bucket number, more capital they’ve to maintain.

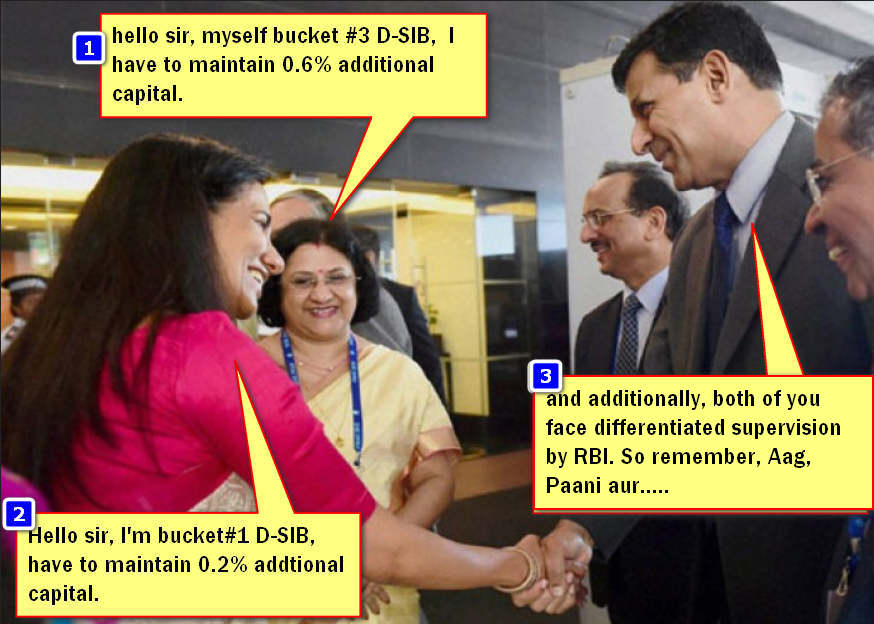

- 2015: SBI (Bucket 3) and ICICI (bucket 1) declared as D-SIBs. List will be updated each year in August.

| Bucket | Domestic Systematic important Bank (D-SIB) |

Additional Capital requirement |

|---|---|---|

| 5 | None for now | X + (1.0% of risk weighed assets RWAs) |

| 4 | None for now | X + (0.8% of risk weighed assets RWAs) |

| 3 | SBI (D-SIB) | X + (0.6% of risk weighed assets RWAs) |

| 2 | None for now | X + (0.4% of risk weighed assets RWAs) |

| 1 | ICICI (D-SIB) | X + (0.2% of risk weighed assets RWAs) so if they had to set aside Rs.1 earlier, now they’ll have to set aside Rs.1.02 |

| — | Ordinary bank | Suppose they’ve to maintain “X” crores in tier-1 common equity in BASEL norms |

- ICICI says they already maintain 12% above tier 1 so no problem for them to comply with this D-SIB game.

- But, SBI says they’ll have difficulty in arranging this much capital and hoping Government of India will help.

Benefits of D-SIB norms?

- 2013: Cobrapost sting operation caught ICICI indulged in money laundering and KYC-Violation, RBI had imposed Rs. 1 crore fine.

- Now that ICICI is classified as a D-SIB, Rajan Bhai will put stringent supervision over it, this will prevent ICICI/SBI from indulging in any grey areas, knowing well what happens when anyone tries to play with Aag (fire), Paani (Water) and rajanbhai.

- If such large banks behavior in prudent manner, it’ll prevent any national financial crisis in the first place.

- Even if financial crisis happens, SBI and ICICI will be able to run their operations, because of the additional capital.

- Government of India won’t have to use tax-payer’s money to rescue them.

Limitations of D-SIB norms?

- D-SIB mechanism alone not sufficient for preventing banking sector collapse, because apart from D-SIB, we must also control their “shadow bank” children.

- UK introduced a “ring fencing” law i.e. banks need to strictly separate operations from the NBFCs owned by them. In India, although we’ve RBI-guidelines for this but much needs to be done, e.g. Implement Justice BN Srikrishna’s report for financial sector legislative reforms (FSLRC), create new single statutory bodies to have overall supervision of sharemarket-insurancemarket-commoditymarket-pensionmarket and so on.

- 2014: News reports hinted that RBI was going to list 6 banks as D-SIB (viz. SBI, PNB, Citi, Standard Chartered, ICICI and HDFC). But the official list released in 2015 contains only two banks. The other four (PNB, Citi, Standard Chartered and HDFC) are also ‘too big to fail’ and should have been included in this list.

- In other nations, D-SIBs are required to maintain upto 3.5% additional capital. In India, highest Is just 1% (for D-SIB in Bucket#5) So, RBI’s norms are not as stringent as in other countries.

- Counter argument: Each central bank free to decide formulas and parameters. Given Indian economy’s size and otherwise strict regulation of banking sector, the current formula is sufficient.

Mock questions

Q1. A Domestic Systemically Important Bank (D-SIB)

- Has to maintain additional SLR and SLR

- Has to follow separate norms for priority sector lending.

- Has to invest additional money in compulsorily in G-Sec

- None of above

Q2. The concept of “Domestic Systemically Important Banks (D-SIB)” is the brain child of __.

- US federal reserve

- FSB

- Basel Committee on banking supervision

- Justice BN Srikrishna commission.

Q3. Consider following statements about Domestic Systemically Important Bank (D-SIB)

- A D-SIB is required to maintain two banking ombudsman per state.

- The Chairman/CMD of a D-SIB will be selected and appointed by a Committee made up of RBI governor and representatives from Union Government.

- Both A and B

- Neither A nor B

Q4. Many Factual MCQs possible from “bucket” table of above article. They’re important for Banking exams but not for UPSC.

Mains-Descriptive Question: As such this is technical topic, so direct question seems unlikely in UPSC Mains but it becomes a fodder point in the larger generic /vague question about controlling / reforming the banking sector / financial sector.

Interview: What is D-SIB, what is Shadow bank, How do they pose challenge to an Economy, what steps are done at national and international level to control them? What more should be done in your opinion?

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

Thank you so much sir fir new article..☺

…Aur Rajan bhai…thank you sir

The Bhishma Pitahma of online teaching is back.

sir I will write upsc in 2016,sir should I start preparing for economy lecture of 2015 or sir you are going to upload new lecures for economics & other.SIR PLEASE REPLY SIR

Sir, why have you stopped posting articles? Please don’t stop. Also, please include a donate button, so we aspirants can contribute in a little way to your work.

thnx sir

The extra capital that banks have to keep with themselves, will it be a part of SLR?

Hope you are back for the next 3 months!

Too many burning issues to cover

Welcome

Upsc pre exam analysis andains strategy plzzz

Typing errors…

Mains strategy… Plzzz

d

b

d

he is back ,back again !!!!!!!!!!!!!!!!!!!!!!!!!1

Sir please upload weekwise current affairs please make it continue that helps alot us but after may month you stop lot of disturbance in prepairing toward it

Please help us sir you help everyone why not us please sir make that continue

Sir,pls aap articles ko hindi me bhi provide karane ki kirpa karen aapki ati kirpa hogi

after a long gap it is very happy to feel to read your article.

Welcome Back Sir !!

With you around “The UPSC” struggle seems easy.

Agreed dost

हद कर दी सर GF भी इतना इंतज़ार नहीं करवाती खैर वापस आ गए welcome back & thanks you so much for article

Thank you Sir For continuing your awesome articles…………

Hi mrunal……..please update something something regularly because it helps in maintaining enthusiasm for mains examination

tan q sir

Thank you ? sir….

sir, when are you coming up with the lecture series for business and economy???

Thanks you sir, missed ur articles :)

hey can anybody guide me about IMS mathematic optional material? please…..

sir where is great mrunal analysis of gs csat paper 1

most welcome sir ….impatintly waiting 4 u .. ….thank u so much.

areyyyyy mrunal post analysis of 2015-prelims & strategy for prelims 2016 yarrrrrrr

Do not waste time to analsis in csat 2015 , sir focuse on mains exam and csat 2016 for futher preparation.

Thanks for the article :) :)