- Banking: PCA Framework, Countercyclical capital buffer (CCCB) and BASEL-III Capitalization Norms

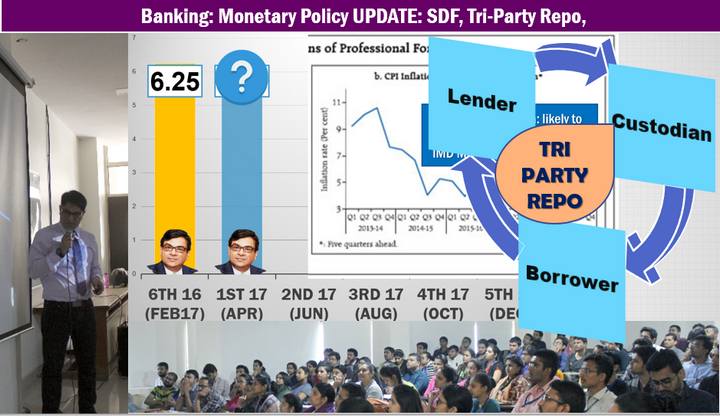

- Monetary Policy Update: standing deposit facility (SDF), Tri-party Repo Rate, Half Hour NEFT window

Prologue: from now on, all Powerpoint available at https://mrunal.org/powerpoint

Banking: PCA Framework, Countercyclical capital buffer (CCCB) and BASEL-III Capitalization Norms

- Banks must maintain an adequate capital base to protect themselves against “bank runs” and NPAs. Therefore, BASEL Committee on banking supervision has prescribed certain norms.

- First: they must maintain a minimum capital to risk weighed asset ratio (CRAR). RBI has prescribed limits and deadlines for its compliance.

- To comply with these norms, public sector banks of India will require 1.8 lakh crore additional capital, out of which, government of India is supply Rs. 70,000 crores under the Mission Indradhanush.

- Secondly, during the boom period, Banks are required to set aside certain capital buffer, which they’ve to use as loans during the bust period. This is known as countercyclical capital buffer- although RBI Governor Dr. Urjit Patel has said, we don’t need it for the moment.

- In 2002, the then RBI governor Bimal Jalan had drafted prompt corrective action (PCA) framework against weak banks, now Dr. Urjit Patel has further strengthen it. In what circumstances can RBI use this tool, we shall see in today’s lecture.

Youtube Link: https://youtu.be/nM72gdBPmAU

Monetary Policy Update: standing deposit facility (SDF), Tri-party Repo Rate, Half Hour NEFT window

- As such we covered the theory monetary policy and review of bi-monthly monetary policies during 2016-17.

- But, afterwards RBI released the first bimonthly policy of the financial year 2017 – 18 in April 2017. it contains so many new changes, so I have add it as a rejoinder to the topics I’ve already taught.

- Earlier we had learned that to absorb the excess liquidity created by the demonetization, forced RBI to impose incremental CRR, and issue Cash management bills under the market stabilisation scheme (MSS). But now those CMB are maturing, so to temporarily absorb that excess liquidity under reverse repo mechanism, RBI narrowed the policy corridor.

- What is standing deposit facility (SDF)

- Swapping of the collateral in repo window.

- Frequency of NEFT settlements increased from one hour to half hour.

- Prompt corrective action framework (PCA) against weak banks.

Youtube Link: https://youtu.be/j3mZGQ1ymOM

Next lecture: Non Performing Assets (NPA), Bad Bank.

![[Summary] Budget & Economic Survey 2018 Gist for the UPSC IAS/IPS Interviews](https://mrunal.org/wp-content/uploads/2018/02/c-bes18-basanti-500x383.jpg)

![[BES171] Banking-Classification: Wholesale Banks, Cooperative Banks, DFI AIFI, MUDRA Bank, Islamic Bank, NBFCs & Indigenous Moneylenders](https://mrunal.org/wp-content/uploads/2017/05/c-bes171-evo-2-500x383.gif)

![[BES171] Banking-Classification: RBI Structure Functions, Nationalization, Scheduled Banks, Merger of SBI Associate Banks & BMB, Private Banks, SFB & Payment Banks](https://mrunal.org/wp-content/uploads/2017/02/c-bes171-cover-500x383.gif)

ahhhh… finally glad to see you again ….

Thnak you sir , for coming with BES171 series .

pls complt lecture before prelims

Thank u Sir ji :)

Please upload the ppt on mediafire link as well Mrunal :)

Thanks a lot sir……….

Thank you for sharing this.This is very helpful for students.MahendraGuru

Thank you Sir….

Thanks a lot sir. Much awaited lecture… a sincere and humble request to you if other lectures could also be uploaded soon…

Monetary Policy Update video link is posted in the ‘Banking: PCA framework’ section and vice versa.

Pls tell me the name of books which we should reffer for prilims