- Prologue

- Royalties: Drain of wealth

- Royalties: TDS (Tax deduction at source)

- What Happened in Nokia Royalty case?

- UNCITRAL / Nokia BIPA

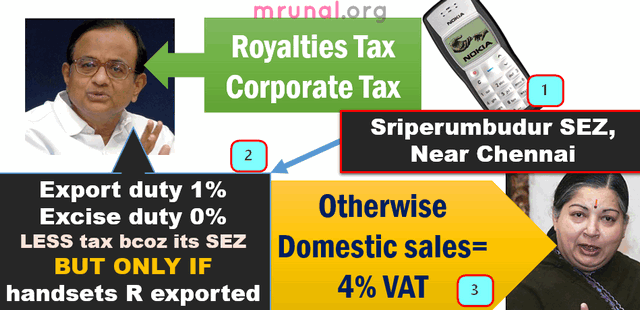

- JayaLalitha’s problem?

- Mock Questions

Prologue

Update I had to make some fixes in the site theme. IF the site is not displayed properly in your browser – clear cache (control+shift+del key together).

for more troubleshoot click me

- UPSC (Mains) General Studies Paper 2:

- Write a note on the structure and functions of UNCITRAL.

- Interview questions:

- What do you know about the tax controversy of Nokia’s Chennai plant?

- How is Nokia’s tax dispute different or similar to Vodafone-Hutch controversy?

- Will this affect takeover by Microsoft?

Royalties: Drain of wealth

- Whenever MNCs setup subsidiary companies in 3rd world countries, they keep design patents in first world Headquarter in USA, UK etc.

- Example, in case of Nokia, all design patents, software patents are held by main “boss” company in Finland.

- So, whenever Nokia’s subsidiary companies in India, Pakistan or Somalia manufacture any handset=> royalty is paid to its parent company in Finland.

- After subtracting such royalty payment, staff salary, lightbill, office rent, raw material cost etc.=> profit left.

- Higher the royalty=less profit for subsidiary (Indian) company= less corporate tax for Indian government and dividend to Indian shareholders (if any.)

To prevent this “Drain of wealth” through royalties, Indian Government uses two methods:

- Quantitative restriction on royalties

- tax on foreign parent that earns royalties

Let’s check them one by one:

#1: Quantitative restriction on royalties

| ProductSales occurring on | maximum royalty that can be paid to foreign parent | |

| if foreign company gave us “technology transfer” | if no technology transfer | |

| Indian soil | 5% | 1% |

| Exported abroad | 8% | 2% |

- In other words, if foreign company transfers technology to its Indian subsidiary- we allow them to take back more royalties as a gesture of goodwill.

- Maximum 8% means if one Nokia phone sells for Rs.1000, then Nokia(India) can sent upto 80 rupees to its Finland parent, as royalty payment.

#2: Tax on Royalties paid

When Indian subsidiary sends royalty ca$h to foreign parent, The foreign parent company has to pay (direct) tax on it. (because this is one type of “income” earned from India.)

| Royalty tax on foreign company | |

| if India has Double taxation avoidance agreement (DTAA) with that country |

|

| If India doesn’t have DTAA with that country | 25% |

Royalties: TDS (Tax deduction at source)

Tax on Royalty Payment (in theory)

Let’s assume Nokia India sold handsets worth xyz crore and has to pay Rs.25,000 crore to Finland parent as “royalty” for the software patents in those mobile phones.

Tax on Royalty Payment (in Real Life / TDS)

| IN THEORY | IN REAL LIFE (TDS) |

|---|---|

|

|

What Happened in Nokia Royalty case?

- Nokia Finland owns the patent for mobile software used in Nokia GSM handsets.

- Between 2006 to 2013, Nokia India sent 5 billion Dollars (=~25,000 crore rupees) to its Finland parent as royalty payment for that software.

- Obviously Income tax department deserves 10% TDS on this =Rs.2500 crores. (as per DTAA with Finland.)

- Numbers not important. Hindu says 2080, Hindu sometimes even says 21000 crore (i.e. approx. total amount sent). DeccanChronicle says Rs.25,000 crore dispute and 10% = 2500 as TDS liability. I pick 2500 because it’s easy to remember.

- Anyways who needs to pay this amount? Nokia India. (recall the TDS concept we just learned, sender has to withhold money.)

- But Nokia India didn’t cut TDS. Nokia India didn’t pay our Income Tax department Rs.2500 crores as tax on royalty payment. hence this controversy.

- Since Nokia did not pay taxes on time, IT department puts 100% penalty + interest rate= now more than 6500 crore needs to be paid.(as of Dec 2013)

Nokia’s excuses

- yes, India-Finland DTAA permits 10% TDS on Royalties

- BUT Mobile software are not listed in that “Royalty definition” under DTAA.

- For us, mobile software is a raw material, so how can you demand tax on money paid to purchase it from Finland?

- Since our factory is in SEZ, we don’t need to cut TDS on royalty payments to Finland.

- At max we’ll pay you Rs.3000 crores to resolve this tax dispute.

- We’ve also played role in India’s growth story. We gave employment to more than 30,000 Indians. In Chennai plant alone, 8000 people work, 20% of them women. (Again numbers not important, sometimes Hindu says 8000, sometimes it says 6500.)

- We’ve invested more than 650 million Euros in India. We are not a ‘scam’ company.

- But IF you continue treating MNC giants like Nokia and Vodafone as scam companies, then it’ll reduce incoming FDI to India.

Nokia’s current legal-strategy

- If Nokia’s Chennai plant is auctioned = it’ll barely fetch Rs.2000-3000 crores.

- But If Nokia honestly pays TDS (penalty+ interest) to IT Dept= more than 6500 crores.

- Therefore, Nokia is prepared for the worst possible scenario: let the case continue in court taarikh pe taarikh. If we are defeated, we’ll only lose the Chennai factory. Still our 6500 MINUS 3000 = 3500 crores will be saved.

- Therefore, Nokia has kept Chennai plant outside the Microsoft Deal.

- Meaning, Microsoft will takeover Nokia’s all factories, offices, staff BUT not Chennai plant.

- Nokia has even offered voluntary retirement scheme (VRS) to Chennai factory workers. They’ll also get entrepreneurship training under Nokia’s “Bridge” program.

- Chennai plant will continue production as “Subcontracter” / outsourced factory. They’ll supply handsets to Microsoft owned Nokia brand.

- So, even if Nokia is defeated in Indian court, Microsoft will have no legal liabilities, no obligation to give the tax money.

- And finally, some miracle (or suitcase-baazi) could happen and newly elected government may give relief to Nokia, and whole matter will be put in cold storage.

UNCITRAL

May 2014: Nokia sends letter to Mohan for resolving this royalty tax matter under Finland India Bilateral Investment Treaty (BIT). This BIT treaty provides that if dispute cannot be resolved in three months after notice THEN

| Option A | Party can approach local court => we already learned Nokia’s present strategy here. (aka Taarikh pe Taarikh, at max auction the factory). AND/OR |

| Option B | Party can approach for arbitration under UNCITRAL. |

UNCITRAL is also in news because of Vodafone’s never ending legal disputes. Therefore, UNCITRAL becomes important for UPSC general studies paper II last point of syllabus “Important International institutions, agencies and fora- their structure, mandate.”

Mock Question

Q. Write a note on the structure and functions of UNCITRAL (200 words)

United Nations Commission on International trade law is the core legal body of UN setup in late 60s. (1966)

Structure:

- 60 members elected from UNGA (General Assembly)

- Term: six years. Half of the members expire every three years.

- Election Quotas to ensure geographical representation from entire world.

- India is also a member. Its term will expire in 2016.

- Unlike IMF, here the Members don’t have to bear additional financial burden. UNCITRAL’s budget is entirely paid by UN General Assembly.

- Even Non-member states, international / regional bodies can participate

- Annual sessions @New York and Vienna alternatively.

- Decision by consensus rather than voting.

Functions

- Reduce legal obstacles, facilitate smooth flow of international trade and investment

- harmonize trade laws of all countries

- Drafts model trade laws on import-export, international payment, e-commerce, international arbitration, public procurement etc. Helps member countries to adopt them.

- Coordination with other international, regional and national bodies for trade laws.

- Drafts rules for arbitration for dispute resolution. Parties (companies or states) can use these rules as guiding principles to settle their disputes.

- Other than that, UNCITRAL itself doesn’t appoint arbitrators or private judges to sort any disputes

~210 words.

Side notes

| GEOGRAPHICAL REGION | QUOTA SEATS |

|---|---|

| Africa | 14 |

| Asia | 14 |

| East Europe | 8 |

| West Europe | 14 |

| Latin America + Caribbean | 10 |

| Total membership | 60 |

JayaLalitha’s problem?

Jayalalitha demands tax saying Nokia didnot furnish Export PROOFs!

- So far we learned what’s Chindu’s problem (= Nokia India did not cut TDS on Royalty payment to Finland) => UNCITRAL.

- But even Tamilnadu government has sent a separate notice to Nokia India.

- So, what’s Jayalaltha’s problem? Ans. VAT evasion.

- We learned that Nokia’s factory is located in Sri Perumbudur Special economic zones (SEZ).

- In SEZ, factories are given tax relief for a first few years.

- Accordingly, Nokia was given following tax reliefs / conessions:

| (Central) TAX | IF HANDSETS ARE EXPORTED |

|---|---|

| Excise duty | 0% |

| Export Duty | 1% |

- But these tax reliefs apply ONLY if Nokia India’s handsets are exported abroad.

- If they’re sold in domestic Indian market, then Tamilnadu government can demand Value Added tax (VAT).

| Jayalathia (TN government) | “Nokia India has not given us proof that all handsets were exported. We believe many were sold in domestic Indian market. Therefore we demand ~2400 crores as VAT” |

| Nokia’s excuse | document proofs = nearly 16 lakh pages. Obviously we can’t send them all. Better send your officials to inspect it in our office! |

April 2014, Madras High court order

- Nokia India will have to deposit 10% =240 crores.

- Tamilnadu commercial tax department have to inspect records and pass order.

GK

| Rajiv Suri | NOKIA CEO from Manipal university. |

| Satya Nadella | Microsoft CEO. By the way, his father was an IAS. |

| Helsinki | capital of Finland |

Mock Questions

Q1. Which of the following is an illustration of “Tax withholding Norms”?

- After receiving royalties from its Indian subsidiary, Nokia Finland sends tax proceeds to Indian government.

- While selling ABC Company to Vodafone London, Hutch Hongkong withholds xyz crores as Capital gains tax (CGT) and pays to Indian government.

- While buying ABC Company from Hutch Hongkong, Vodafone London withholds xyz crores as Capital gains tax (CGT) and pays to Indian government.

- None of above

Q2. Why are Nokia India and Income tax department involved in a court litigation just before takeover by Microsoft?

- Because while selling the company to Microsoft, Nokia did not pay capital gains tax (CGT) to IT Department of India.

- Because while buying the company from Nokia, Microsoft did not withhold capital gains tax (CGT) for IT department of India.

- Because Nokia Finland sold its shares of Nokia India ltd. to Microsoft via a post office company in Cayman Islands to evade capital gains tax (CGT) from IT department of India.

- None of Above.

Q3. Consider following statements about the Tax on Royalties paid to foreign entities.

- It is an example of Indirect Tax

- In real life, it is collected from the receiver and not from the sender.

- It is 100% exempted in case of royalties sent to countries that have DTAA agreement with India.

- It is 100% exempted in case of royalties sent to NRI authors that pay regular Income tax in India.

Answer choices

- only 1 and 3

- only 2 and 3

- Only 1, 3 and 4.

- None

Q4. Correct statements about United Nations Commission on International trade law.

- All the member states of IMF are ex-officio members of UNCITRAL.

- India’s membership to UNCITRAL expired in January 2014.

- Only sovereign states can approach UNCITRAL for arbitration.

- None of above.

Q5. When Nokia or Vodafone says “we want arbitration under UNCITRAL to settle our tax dispute with Indian government”, it means ___.

- We want our case to be heard at UNCITRAL’s international trade law court located in Vienna.

- We want UNCITRAL appointed Foreign Judge to resolve the dispute.

- We want UNCITRAL’s executive body to settle this case.

- None of above

Official answers

- C: the buyer has to withhold tax & pay to government. TDS=tax withholding norm.

- D: None of above. Nokia = royalty TDS matter

- D: None. All statements are wrong

- D: None of above

- D: None of above

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Taxation and Economy.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

yes Nokia can do legalbaazi nd tarikh pe tarikh but i think worst can b more than sir what u have assumed

Indian govt can ban selling of any Nokia products on Indian soil which will affect Microsoft Nokia deal and also affect the goodwill and brand value of Nokia.

the way u explain things makes it easy to understand and remember..

comendable job sir…

ur analysis is better. Sir

ias 2014 notification is delayed by upsc . I am confused about optional subjects whether prepare or not . I was planning to focus on it after 17th may. I wanted to know if POLITICAL SC & IR can be prepared from from N.D. Arora by TMH ? I have prepared laxmikanth well (almost 7 times) for indian polity . I wanted to know best book for IR other than IGNOU notes in HINDI medium . please anybody suggest. I have read IR by PUSHPESH PANT but not satisfied as it is not well organised and also it is difficult to make notes out of this book.

U read shashi tharoors pax indica for IR

One book of IR by Muchkund Dubey is quite good.

Naveen dear could please elaborate the details about the book? I mean the publication, full name of the book, current edition etc. I hope IR does not mean Industrial Relations.

http://www.flipkart.com/india-apos-s-foreign-policy-coping-changing-world/p/itmdd5uqafetn3n5?pid=9788131730577

does the elephant dance? written by david m malone is a very good book on international relations!

It is a good book for liesure,but I will not recommend it for competitive exams like UPSC

Great article, whole nokia india controversy in one place, very much helpful for aspirants

respected sir,

the answer to question no 1 must be b not c

Q1. read the old article on vodafone case and you’ll see why answer is C.

Mrunal Ji

There is a slight error in the mention of UNCITRAL( i.e. United Nation Commission on International Trade Law). It has been mentioned as UNICITRAL in the article.

hii guys im planning to write upsc ,,prelims ,,plz guide me ..and when is notification going to come

Mrunal sir I have studied many times about PIO, OCI ,there difference from Indian residents and NRIs schemes but often confused partly because of I could not absorb it because of shallow coverage in Laxmikant. Please throw some light or suggest some other sources.

Please help me out…

clearly explained. nice

excellent explanation, sir …we are easily understand this article

very nice article sir. clearly explained. thank you very much

@Mrunal-isn’t the Nokia Tax dispute and the explanation in the 1st para refers to TRANSFER PRICING IN ECONOMICS????

Mrunal bhai, can you please do an article on difference between IRNSS and GAGAN, newly discovered super heavy elements, graviational wave and ipcc report III. these are very science heavy topics not able to understand easily

nice one………..

nice article!!

sir, kindly substantiate US vs INDIA WTO TRIPS drug patent war and why india is synonymized as “PATENT KILLER” and related pharmacological issues such as Gavi alliance’s project in India, Generic drug etc.

good explanation

Sir, i could not understand the recent issues related to India-USA drug patent controversy and Apple-google. patent issues.

There is no information on UPSC website regarding the issue of notification for 2014CS exam. Anybody any idea as to why are they doing so and when should we expect the notification?

Excellent efforts sir…

Its really a boon for us…marvls way of sharing best knowledge…

Again m mch thankful to u sir.

Extremely good article for regular hindu readers ………..pls give articles from frontline…………now a days not at all getting time to read from them

Article is very informative like ever but what made me comment is the site theme. I really loved it. Big font, different colours even in selection is so very keeping the mood on. Plus its looking so cleaned up now, jaise diwali safai huyi ho. :D

Thank You Sir!

thnx 4 such valuable effrt 4us

Can someone pls explain what is a post office company..

Some companies register their headquarters in caymen islands, sitzerland etx countries to evade taxation in India. These companies having one room office in tax haven countires so that they can easily evade tax on their profits made in India. This companies called post office compnies.

Pls some1 coorect me if I am wrong.

I am so thankful to you Sir.. I am new to this.. Thanks a lot for your selfless efforts.. :)

thank you sir…

Thanks for such a easy-to-understand words and comprehension of an entire case study. Cheers.

for understanding BIPA, CECA & dispute resolution mechanism

http://www.indialegalhelp.com/files/faqtreatydisputesindia.pdf

sir i have a doubt regarding welfare schemes, economic survey and budget. should i keep preparing old welfare programmes or wait for new programmes of new govt? and about economic survey whats the cost benefit ratio of studying last years economic survey and budget or should i wait till july for the budget and new economic survey? please reply soon sir.