- Prologue

- [Act 1] PSU Classification

- [Act 2] Disinvestment

- [Act 3] CPSE-ETF Exchange traded fund

- [Act 4] Various “Ratna” for PSU

Prologue

Economic Survey Ch.9 Industrial performance. Four subparts:

- Industries, Acts, Policies, excise and customs duty

- PSUs, Disinvestment, CPSE-ETF

- Companies Act 2013

- MSME sector

[Act 1] PSU Classification

What about Railways and Postal department?

Viewpoint #1:

- Railways and posts are departmental undertakings.

- And since all departmental undertakings are “public sector undertakings”, as per the classification given in Laxmikanth (Public Administration book) and NIOS courses.

- Therefore, railway, posts, also “PSU” or “PSE”.

Viewpoint #2:

Railways and Postal department are not “public sector enterprises” (PSE) or public sector undertaking (PSU) because of the following reasons:

- Department of public enterprises has no jurisdiction over them.

- Their manpower and finance are directly controlled by respective ministries.

- Their top Executives are Group-A Government officers recruited through UPSC civil service exam. [And not through Public sector enterprises selection board (PSEB) under personnel ministry.]

- If railway and post were PSUs then parliamentary Committee on PSU would have been examining them.

- But railways under parliamentary standing Committee on railways; Postal under parliamentary standing Committee Information Technology.

| Top profit maker | Top loss makers |

|---|---|

|

|

- Overall 277 Central public sector enterprises

- Out of them ~80 loss making.

| Problems with PSUs | REFORMS TAKEN |

|

Voluntary retirement scheme- VRS |

|

|

| Since Government is majority shareholder- constant political interference in board appointments, policy decisions, factory locations, product pricing etc. |

|

[Act 2] Disinvestment

Mind the money flow in annual financial statement

| (Non-Tax) Receipts | Expenditure |

|---|---|

|

|

| Receipt | Expenditure |

|---|---|

|

loans given to PSUs |

Current skeleton framework of “disinvestment” comes from UPA-I’s Common Minimum Program

- Department of Disinvestment will look after this matter.

- We’ll not disinvest from “strategic” Public sectors viz. arms, ammunition, defense equipment, railways and atomic energy.

- We’ll not privatize the profit making PSU. Government will control atleast 51% shareholding in them

- We’ll not disinvest Navratna PSU

- We’ll close / sell off the loss making PSUs, with adequate compensation to workers.

- We’ll setup Board for reconstruction of public sector enterprises (BRPSE) + National investment fund.

National investment fund (NIF-2005)

- Disinvestment = when Government sells its shares of Public sector undertaking.

- Obviously, Government would earn ‘money’ from this share-selling.

- This money doesn’t go into Consolidated Fund Of India

- It goes to National investment fund (under Public accounts of India), therefore, outside parliament control.

- Three fund managers look after NIF viz. UTI, LIC and SBI

| 75% | into sarkaari schemes- MNREGA, health education, JNNURM etc. |

| 25% | into reviving / expanding other PSUs |

Above 75:25 rule continued till 31st March 2013. After that, NIF Money is used for following purposes

- buying shares of CPSE to enture 51% sarkaari ownership

- recapitalizing sarkari banks and insurance companies

- Investing in EXIM bank, NABARD, Regional rural banks,

- Uranium corporation, Nabhikiya Vidyut Nigam

- Metro projects and Indian railways capital Expenditure.

And Government budget will decide where to spend money among these sectors. For Budget 2013, NIF money was spent on Bank recapitalization and Indian railways.

| Budget 2013 | Rs. 40,000 crore but #EPICFAIL |

| Budget 2014 | ~63,000 crores. |

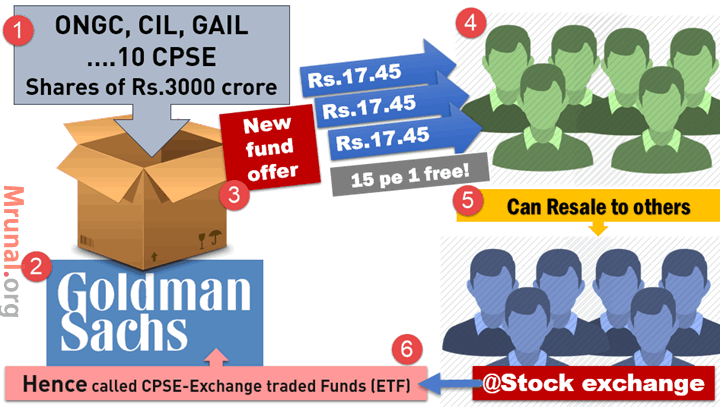

[Act 3] CPSE-ETF Exchange traded fund

CPSE-ETF = a novel method of doing “Disinvestment”

- Government takes out its shares of TEN Central public sector enterprises (CPSE) – ONGC, CIL, GAIL etc. worth total 3000 crore rupees.

- gives them to fund manager Goldman Sach.

- Goldman Sach packs these shares into a box. Then, he cuts off this box into smaller pieces, each piece sold for Rs. 17.45 as “new fund offer”.

- You can buy these pieces (minimum order has to be Rs.5000)

- if you’re first time investor, you can even get tax benefit under Rajiv Gandhi Equity Savings Scheme.(upto Rs.50k)

- Later, you earn dividend (From the profit of those CPSE companies).

- if you don’t want to wait for the dividend, simply sell your piece to another guy in the secondary market/stock exchange (BSE, NSE). (July rate Rs.26 for each unit).

- Hence these are called “Exchange traded funds” (ETF)

- and since the original shares were of Central public sector enterprises (CPSE)=> hence we call’em CPSE-ETF.

How is CPSE ETF different from Mutual funds?

| Mutual fund | CPSE-ETF |

|---|---|

| no such “free offer” | Initially Goldman sach made an offer- if you buy 15 ETF units, they give you 1 unit free. (but with caveats on investment limit etc.) |

| When you return your mutual fund “UNIT” to the fund manager, he’ll repay CASH. | when you return your ETF, Goldman SAch won’t give you CASH, he’ll give you shares (of those CPSE companies), then you can sell them in secondary market (at BSE/NSE etc) and recover the CASH |

| Fund manager takes higher Commission than ETF manager | lower commission (meaning more “return” for you). |

| 1963: UTI was the first mutual fund company in India |

|

SEBI Public listing norms

| Non PSU (listed) public ltd. company | 25% |

| PSUs | 25% within next 3 years. (Earlier 10%) |

- So in other words, Government shareholding in PSUs, will decline to atleast 75% in the days to come.

- Since Government will have to sell its shares= automatic disinvestment = ~60,000 crores will be earned = less fiscal deficit.

- May be Jaitley himself secretly told SEBI to order this? One can come up with many conspiracy theories.

- Related topic: PJ Nayak Committee for reducing Government shareholding in Sarkaari banks. But we’ll see that under chapter on financial intermediaries.

[Act 4] Various “Ratna” for PSU

Cost benefit of mugging up this topic= bad. But putting for the record.

Miniratna

- two categories: CAT1 and CAT2

- Common condition: must have made profit in last 3 years.

- then further classification, based on “how much” profit they made

- common benefit: capital Expenditure without Government approval

| Miniratna | CAT1 | CAT2 |

|---|---|---|

| condition |

|

|

| Expenditure freedom |

|

|

| examples | Airport Authority of India, Antrix (ISRO), BSNL | HMT, Mineral Exploration Corporation Limited etc. |

Navratna PSU (1997)

| CONDITIONS | BENEFITS |

|---|---|

|

|

Maharatna PSU (2010)

| CONDITIONS | BENEFITS |

|---|---|

in the last 3 years

|

can invest 5000 cr / 15% of networth in a single project- without Government approval.Full List (7)

|

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

SIR ,

Please ESB 16 series jaldi complete karo… Many others subjects currents are to be corelate with survey, but time limited.