- Prologue

- [Act 1] PSU Classification

- [Act 2] Disinvestment

- [Act 3] CPSE-ETF Exchange traded fund

- [Act 4] Various “Ratna” for PSU

Prologue

Economic Survey Ch.9 Industrial performance. Four subparts:

- Industries, Acts, Policies, excise and customs duty

- PSUs, Disinvestment, CPSE-ETF

- Companies Act 2013

- MSME sector

[Act 1] PSU Classification

What about Railways and Postal department?

Viewpoint #1:

- Railways and posts are departmental undertakings.

- And since all departmental undertakings are “public sector undertakings”, as per the classification given in Laxmikanth (Public Administration book) and NIOS courses.

- Therefore, railway, posts, also “PSU” or “PSE”.

Viewpoint #2:

Railways and Postal department are not “public sector enterprises” (PSE) or public sector undertaking (PSU) because of the following reasons:

- Department of public enterprises has no jurisdiction over them.

- Their manpower and finance are directly controlled by respective ministries.

- Their top Executives are Group-A Government officers recruited through UPSC civil service exam. [And not through Public sector enterprises selection board (PSEB) under personnel ministry.]

- If railway and post were PSUs then parliamentary Committee on PSU would have been examining them.

- But railways under parliamentary standing Committee on railways; Postal under parliamentary standing Committee Information Technology.

| Top profit maker | Top loss makers |

|---|---|

|

|

- Overall 277 Central public sector enterprises

- Out of them ~80 loss making.

| Problems with PSUs | REFORMS TAKEN |

|

Voluntary retirement scheme- VRS |

|

|

| Since Government is majority shareholder- constant political interference in board appointments, policy decisions, factory locations, product pricing etc. |

|

[Act 2] Disinvestment

Mind the money flow in annual financial statement

| (Non-Tax) Receipts | Expenditure |

|---|---|

|

|

| Receipt | Expenditure |

|---|---|

|

loans given to PSUs |

Current skeleton framework of “disinvestment” comes from UPA-I’s Common Minimum Program

- Department of Disinvestment will look after this matter.

- We’ll not disinvest from “strategic” Public sectors viz. arms, ammunition, defense equipment, railways and atomic energy.

- We’ll not privatize the profit making PSU. Government will control atleast 51% shareholding in them

- We’ll not disinvest Navratna PSU

- We’ll close / sell off the loss making PSUs, with adequate compensation to workers.

- We’ll setup Board for reconstruction of public sector enterprises (BRPSE) + National investment fund.

National investment fund (NIF-2005)

- Disinvestment = when Government sells its shares of Public sector undertaking.

- Obviously, Government would earn ‘money’ from this share-selling.

- This money doesn’t go into Consolidated Fund Of India

- It goes to National investment fund (under Public accounts of India), therefore, outside parliament control.

- Three fund managers look after NIF viz. UTI, LIC and SBI

| 75% | into sarkaari schemes- MNREGA, health education, JNNURM etc. |

| 25% | into reviving / expanding other PSUs |

Above 75:25 rule continued till 31st March 2013. After that, NIF Money is used for following purposes

- buying shares of CPSE to enture 51% sarkaari ownership

- recapitalizing sarkari banks and insurance companies

- Investing in EXIM bank, NABARD, Regional rural banks,

- Uranium corporation, Nabhikiya Vidyut Nigam

- Metro projects and Indian railways capital Expenditure.

And Government budget will decide where to spend money among these sectors. For Budget 2013, NIF money was spent on Bank recapitalization and Indian railways.

| Budget 2013 | Rs. 40,000 crore but #EPICFAIL |

| Budget 2014 | ~63,000 crores. |

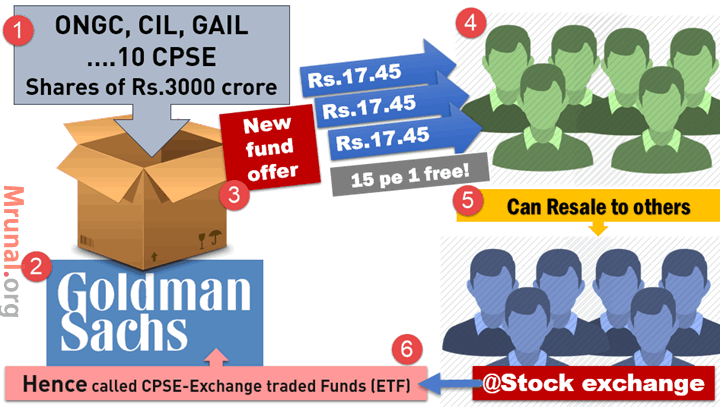

[Act 3] CPSE-ETF Exchange traded fund

CPSE-ETF = a novel method of doing “Disinvestment”

- Government takes out its shares of TEN Central public sector enterprises (CPSE) – ONGC, CIL, GAIL etc. worth total 3000 crore rupees.

- gives them to fund manager Goldman Sach.

- Goldman Sach packs these shares into a box. Then, he cuts off this box into smaller pieces, each piece sold for Rs. 17.45 as “new fund offer”.

- You can buy these pieces (minimum order has to be Rs.5000)

- if you’re first time investor, you can even get tax benefit under Rajiv Gandhi Equity Savings Scheme.(upto Rs.50k)

- Later, you earn dividend (From the profit of those CPSE companies).

- if you don’t want to wait for the dividend, simply sell your piece to another guy in the secondary market/stock exchange (BSE, NSE). (July rate Rs.26 for each unit).

- Hence these are called “Exchange traded funds” (ETF)

- and since the original shares were of Central public sector enterprises (CPSE)=> hence we call’em CPSE-ETF.

How is CPSE ETF different from Mutual funds?

| Mutual fund | CPSE-ETF |

|---|---|

| no such “free offer” | Initially Goldman sach made an offer- if you buy 15 ETF units, they give you 1 unit free. (but with caveats on investment limit etc.) |

| When you return your mutual fund “UNIT” to the fund manager, he’ll repay CASH. | when you return your ETF, Goldman SAch won’t give you CASH, he’ll give you shares (of those CPSE companies), then you can sell them in secondary market (at BSE/NSE etc) and recover the CASH |

| Fund manager takes higher Commission than ETF manager | lower commission (meaning more “return” for you). |

| 1963: UTI was the first mutual fund company in India |

|

SEBI Public listing norms

| Non PSU (listed) public ltd. company | 25% |

| PSUs | 25% within next 3 years. (Earlier 10%) |

- So in other words, Government shareholding in PSUs, will decline to atleast 75% in the days to come.

- Since Government will have to sell its shares= automatic disinvestment = ~60,000 crores will be earned = less fiscal deficit.

- May be Jaitley himself secretly told SEBI to order this? One can come up with many conspiracy theories.

- Related topic: PJ Nayak Committee for reducing Government shareholding in Sarkaari banks. But we’ll see that under chapter on financial intermediaries.

[Act 4] Various “Ratna” for PSU

Cost benefit of mugging up this topic= bad. But putting for the record.

Miniratna

- two categories: CAT1 and CAT2

- Common condition: must have made profit in last 3 years.

- then further classification, based on “how much” profit they made

- common benefit: capital Expenditure without Government approval

| Miniratna | CAT1 | CAT2 |

|---|---|---|

| condition |

|

|

| Expenditure freedom |

|

|

| examples | Airport Authority of India, Antrix (ISRO), BSNL | HMT, Mineral Exploration Corporation Limited etc. |

Navratna PSU (1997)

| CONDITIONS | BENEFITS |

|---|---|

|

|

Maharatna PSU (2010)

| CONDITIONS | BENEFITS |

|---|---|

in the last 3 years

|

can invest 5000 cr / 15% of networth in a single project- without Government approval.Full List (7)

|

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

awesome mrunal……….you’re doing such a commendable job…..thanks to you from myself and the ones from rural areas………thanks..

wow

Thanks

Mrunal Sir you’re raining articles!!

Sir earlier 75% of NIF was used for funding social sector schemes as you have rightly pointed. But this was amended in Jan 2013…now social schemes are not funded by NIF.

Link: http://www.divest.nic.in/Nat_inves_fund.asp

Thanks for being our messiah :)

thanks sir….nice work

Flood of articles.. With continuous raining.. No El nino effect. :-D

sugarcane is kharif or zayad crop? plz ans anyone

kharif mostly

@ Mrunal: under the head “National investment fund (NIF-2005)”

in spending on social scheme…..It is IAY not RAY… Is baar Maa Nahi..Is baar Beta h..!!!

http://www.divest.nic.in/Nat_inves_fund.asp

updated thanks Rajesh.

NIF Topic Update:

National Investment fund: the 75:25 rule continued till 31st March 2013.

After that, NIF Money is used for following purposes

buying shares of CPSE to enture 51% sarkaari ownership

recapitalizing sarkari banks and insurance companies

Investing in EXIM bank, NABARD, Regional rural banks,

Uranium corporation, Nabhikiya Vidyut Nigam

Metro projects and Indian railways capital Expenditure.

And Government budget will decide where to spend money among these sectors. For Budget 2013, NIF money was spent on Bank recapitalization and Indian railways.

good for basic knolewadge

if we get a question in the xam to classify PSU’s and railways or posts is among the given options then what should we do since mrunal has talked about 2 scenarios??

What’s up with English comprehension marks…..no notification yet by DoPT or upsc. They think that they can notify it later how does it matters. If someone knows the answer he should attempt all questions. But why shall I waste my 5-7 mins in these questions when I can attempt atleast a few more questions in that time as time management is also a part of CSAT paper 2.

Sir, english comprehensive ke marks to finel list me add nahi honge to fir

unhe attempt krna necessary to ni hai na and agar attempt karte bhi hai to usme nagative marking to hogi hi ni ??

Plz clarify.

I think in reference to National Investment fund, its not the actual proceeds that go into schemes and reviving PSUs.

But the interest income generated after investing the amount by fund managers is allotted to the schemes and other PSUs.

Not sure though. Imfact it would defeat the purpose of fund manager in the former case.

Kindly clarify.

mrunal sir please inform me about the best coaching center for economics in delhi,because i have planned to take economics as my optional subject for civil service main examination

NIF Topic Update:

National Investment fund: the 75:25 rule continued till 31st March 2013.

After that, NIF Money is used for following purposes

buying shares of CPSE to enture 51% sarkaari ownership

recapitalizing sarkari banks and insurance companies

Investing in EXIM bank, NABARD, Regional rural banks,

Uranium corporation, Nabhikiya Vidyut Nigam

Metro projects and Indian railways capital Expenditure.

And Government budget will decide where to spend money among these sectors. For Budget 2013, NIF money was spent on Bank recapitalization and Indian railways.

adding on;

all fund managers managing the funds(LIC,UTI,SBI) have been discharged off and only govt will declare in budget or by executive decision of how much amount is to be spent off and where.

so money will be spent on social sector schemes or not?

good work

good work. can anyone give ias toppers interview from wb

can anyone give ias toppers interview from wb

NIF:

The corpus as such is not used.

But the profits that are received by investing the amount in various mutual funds are used in the ways told by mrunal sir.

very helpful article.. Thanks Mrunal sir..

good job…mrunal….

sir please guide us about atempting the questions on english comprehension

https://mrunalmanage.wpcomstaging.com/2014/08/dopt-clarifies-csat-english-marks-wont-count.html … he has already guided … :D

criteria for maharatna has been revised in 2011…its 20/10/2.5 rather than 25/15/5

see the link

m.thehindu.com/business/Industry/norms-relaxed-for-maharatna-status-to-cpses/article1547322.ece/

the said report is from 2011.

But, as per PIB report Feb-2013 it is 25,000/- (and not 20,000).

http://pib.nic.in/newsite/erelease.aspx?relid=92030

sir if i m not wrong audit for LIC is done by private auditors n not CAG.. correct me if m wrong.. thanks for the article

3 category of Auditing of public corporation

1. CAG directly audit …..DVC, ONGC, AI, et

2. Private professional auditors who are appointed by Govt. in consultation of CAG….Central warehousing corp,

3. Totally audited by private auditors. CAG does not come into picture at all

ABOUT COMPANY, falls under second category…

correct me if I’m wrong

cheers!

example of 3rd category…LIC, RBI, SBI, FCI etc

like i said in the article, some large corporation given exemption from CAG audit.

@Mrunal: U r great..!! I sometimes wonder how many hours of effort you put into all this…u should get some award for this “subsistence” service…

Regards

@Mrunal.. small and humble addition.. goldman sach was giving 15 pe 1 free.. when one invested at least 200000 rs in etf..

sir as per ..s n lal..in case of maharatn condition are relaxed since mar17,2011…from 25000 to 20000 from 15000 and from 5000 to 2500…kindly make it clear…..tnx

Arun, since 2013, it is 25,000.

Ref 2013’s PIB release:pib.nic.in/newsite/erelease.aspx?relid=92030

sir thnk u vry much.

mrunal sir can u please tell in which sector NIF money is to be spent as per budget of 2014 if it is given

In an earlier article where you made a case for and against Disinvestment- you made an argument that Disinvestment proceeds are being used for bridging the FISCAL DEFICIT; and that reforms in FRBM are needed for the same.

Isn’t the very act of Disinvesment- that it shows up under the CAPITAL RECEIPTS portion of the AFS, a notion of filling up the deficit (or atleast made to look so?)

Are we to say that the accounting procedure itself will change in the future so that the Disinvestments won’t show up there?

Please clarify, thanks in advance! :)

when it is said “Disinvestment proceeds are being used for bridging the FISCAL DEFICIT”..it means that disinvestment money is only being treated as part of revenue received with no guideline for specific use of this revenue..this used to happen in 90’s..since disinvestment proceed are not likely to be regular and resource is finite using this to cover ur revenue shortfall is dangerous..might be rewarding in short term but dangerous in long term….i think this is what mrunal meant