- Prologue

- L4/P1: Fiscal policy: Direct Taxes & Budget 2015

- L4/P2: Indirect Taxes, Subsidies & Capital Part of Budget 2015

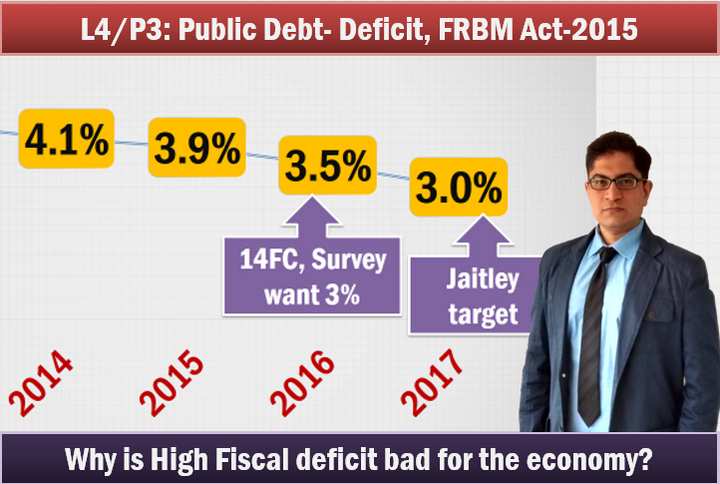

- L4/P3: Public Debt, Fiscal Deficit & FRBM Act Targets

Prologue

- The economic survey related articles will be published after I’m done reading and researching myself.

- In the meantime, here’s the recoding of my lecture series on budget and economic survey at SPIPA, Ahmedabad.

- First session 2:30 hours, I’ve split it into three parts.

- PowerPoint of the lecture, available at Mrunal.org/Download

- Medium of instruction- Hindi.

- English version not possible for the moment, because I’m required to teach at this batch, in Hindi/Gujarati only. Besides, same content is available in English-text articles and English PPTs on the site.

L4/P1: Fiscal policy: Direct Taxes & Budget 2015

- Budget versus economic survey: who prepares what?

- Economic survey 2014 – 15: how to approach its two volumes in a systematic manner for UPSC civil service provision?

- What is the theme of economic survey 2014?

- 3 documents in budget (annual financial statement, finance bill, appropriation Bill

- 3 Types of “Funds” in Budget: Consolidated fund, public account and contingency fund

- What is the difference between Vote on account and interim budget?

- Direct taxes of union and State governments.

- Direct taxes: on income or expenditure vs on those on assets and capital transactions

- List of abolished direct taxes, apart from wealth tax.

- Direct taxes: Merits and Demerits

- Direct taxes under budget 2015, and list of deductions

- Difference between cess and surcharge? How they are computed?

- Wealth tax: why was it abolished? 4 Canons of taxation is by Adam Smith

- Corporate tax, MAT and other direct taxes in budget-2015

Youtube Link: http://youtu.be/jRM1oC9FJXg

L4/P2: Indirect Taxes, Subsidies & Capital Part of Budget 2015

- indirect taxes of union and State governments

- indirect taxes: merits and demerits

- Service Tax theory: negative list vs exempted list.

- How and Why does Jaitley want pruning of negative list?

- Cess provisions on custom duty, excise duty and service tax in budget 2015

- Reforms in indirect taxes to promote ease of doing business.

- Collection Ranking: direct and indirect taxes in revised estimates 2014-15 and budget estimates 2015-16 ascending and descending order.

- What is the difference between gross tax revenue and net tax revenue?

- Non-tax receipts of revenue budget and collection orders.

- Revenue expenditure: ascending, descending orders

- Subsidies: Major subsidies, Targets for budget-2015, ascending descending orders.

- Capital receipts and expenditure: major heads and ranking

- Plan versus non-plan expenditure.

- the larger picture: Classification of budget- old method vs new method.

Youtube Link: http://youtu.be/JSTsf50ytYs

L4/P3: Public Debt, Fiscal Deficit & FRBM Act Targets

- formulas and figures for: revenue deficit, effective revenue deficit, fiscal deficit and primary deficit

- High level of fiscal deficit is bad for economy- why and how?

- Fiscal responsibility and budget Management act (FRBM): Jaitley target vs. Economic survey target vs. 14 finance commission target.

- Why does 14 finance commission want government to replace effective revenue deficit with revenue deficit in FRBM target list?

- remaining parts- in next lecture video…(continued)

Youtube Link: http://youtu.be/l8nh2cCrZ6k

![[Summary] Budget & Economic Survey 2018 Gist for the UPSC IAS/IPS Interviews](https://mrunal.org/wp-content/uploads/2018/02/c-bes18-basanti-500x383.jpg)

![[BES171] Banking-Classification: Wholesale Banks, Cooperative Banks, DFI AIFI, MUDRA Bank, Islamic Bank, NBFCs & Indigenous Moneylenders](https://mrunal.org/wp-content/uploads/2017/05/c-bes171-evo-2-500x383.gif)

![[BES171] Banking-Classification: RBI Structure Functions, Nationalization, Scheduled Banks, Merger of SBI Associate Banks & BMB, Private Banks, SFB & Payment Banks](https://mrunal.org/wp-content/uploads/2017/02/c-bes171-cover-500x383.gif)

Gr8 work sir….thnx alot

holi gift….thanx :)

Daily i visited your site after every 1hr to see whether you posted any video or not. I did not read budget/Economic survey with a mindset that somewhere you are working hard at present. My situation was similar to ‘Rakhi’ of Karan Arjun waiting for her sons. Same trust i had that budget and economic survey will come. Thanks a lot. I really appreciate your work.

Thanks a lots gurudev…

Happy holi

Thank You Very Much Sir

Thanx fr my holi gift…..nd happy holi to u bhaiya

thanks sir and wish u a vry happy holi…..

Mrunal Sir, you said – “same content is available in English-text articles and English PPTs on the site” but there is nothing on your site in text form about budget 2015

yes plz provide in english also

Sir, Happy Holi. Thanks for providing Budget as a gift on this day.

thank u sir

Happy Holi Sir ! . The videos are priceless and thanking you is an understatement ! .I wish you remain in the best of health :)

nice one sir

Happy Holi!

Sir , as u said i cant find same content in English sir ..plz do the needful for non hindi students sir.

thank u sir

thanks a loooootttt sir…

Thanks Mrunal :)

Very nice sir

Very nice sir pls keep doing

Brother,

Besides your busy schedule, Kindly convert the slides to articles.

Cgl 2014 tier 1 result out

hi friends i have cleared tier 1.when is tier 2 exams and reference books if any for tier 2

happy holi

sir L4 ke bad L6 he ,L5 kis topic se related he and vo muje nahi mil rha he …economy lectures???

thank u sir,happy holi.

I took print of key of budjet ,budjet speech,economic survey + mrunal video is it sufficient material of budjet study ?

Sir,

Please share text article of budget-2015,Pls

Mrunal sir..please upload economic survey lecture and railway budget lecture….its imp for upcoming rbi grade. B exam…

very useful ppt

low internet connectivity…cant follow article :(

no text article ?? :o

Thank you very much sir for providing budget 2015-16.

Happy Holi :P