- Prologue

- L2/P10: Social Security, ESCI, EPFO, NPS and Atal Pension scheme

- L2/P11: Insurance- History and nationalization in India

- L2/P12: Insurance Evolution and Nationalization in India

- L2/P13: IRDAI: structure function and reforms under Insurance amendment 2015

- L2/P14: MicroInsurance, PM Jeevan Jyoti & Suraksha Bima Yojana

Prologue

- On 26th June 2015, my session on Insurance sector & 2015’s Amendment

- Total about 2:30 hours, split into 5 parts.

- PowerPoint of the lecture, available at mediafire.com/folder/2bb433i58hp2v/General_Studies_Mrunal

- in above link go to L2-Banking-Finance folder

- Medium of instruction- Hindi.

- English version not possible for the moment, because I’m required to teach at this batch, in Hindi/Gujarati only. Besides, same content is available in English-text articles or English PPTs on the site.

L2/P10: Social Security, ESCI, EPFO, NPS and Atal Pension scheme

- Social Security: meaning and importance

- history of Social Security legislation in Britain and India – the role of Sir William Beveridge and Prof. B.P.Adarkar.

- Employees State Insurance Corporation and its schemes.

- Employee Provident fund Organisation (EPFO) and its 3 schemes and tripartite centre board of trustees.

- Universal account number (UAN), labour identification number (LIN) and Shram Suvidha Portal.

- New pension scheme (NPS) of PFRDA: Timeline and salient features.

- Atal pension Yojana: salient features and benefits.

Youtube Link: https://youtu.be/clxrjaSAiqU

L2/P11: Insurance- History and nationalization in India

- What is insurance? How is it different from other financial intermediaries such as banks and mutual funds?

- What is the importance of insurance in an economy?

- Principles of insurance: Uberrima fides, Indemnity, Subrogation, Causa proxima and Insurable interest

- Life insurance types: endowment, whole life, term insurance, unit linked insurance policy (ULIP)

- Challenges faced by life insurance industry.

- Non-life insurance types: marine, rural, health insurance, fire insurance and 3rd party motor insurance.

- Challenges faced by general insurance industry

- Definition of insurance penetration and insurance density.

Youtube Link: https://youtu.be/I-H2eU4sOtw

L2/P12: Insurance Evolution and Nationalization in India

- Evolution of insurance business in world.

- Evolution of insurance business in India since ancient times.

- Insurance industry in British India and its challenges.

- Nationalisation of life insurance industry in 1956- LIC Corporation.

- Nationalisation of general insurance industry in 1972: GIC

- public sector insurers general insurers in India: National insurance, new India assurance, United India, Oriental insurance and Malhotra Committee reforms.

- Export credit and guarantee Corporation of India.

- Agriculture insurance Co Ltd and its products.

- Deposit linked insurance and credit guarantee Corporation (DICGC)

- insurance Amendment 2015: paid-up capital requirements, net owned funds, registration as public limited company, 49% shareholding by foreign investors (FDI and FII)- but it must remain Indian owned in Indian controlled.

- Will insurance Amendment 2015 increase the transparency and accountability in insurance industry? Arguments in favour and against.

- What is the insurance? IRDA’s norms on compulsory reinsurance? Provisions in Insurance Amendment 2015 to facilitate the entry of private sector re-insurers in India through 49% FDI and direct opening of branches.

Youtube Link: https://youtu.be/vKcoup8eZqU

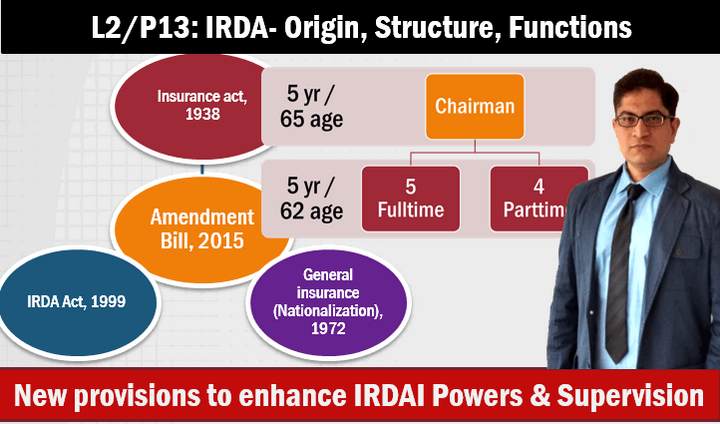

L2/P13: IRDAI: structure function and reforms under Insurance amendment 2015

- Malhotra Committee and origin of insurance regulatory and development authority (IRDA)- structure, membership, functions

- how does insurance Amendment 2015 increase the powers and authority of IRDAI? Appellate structure above IRDAI?

- Investment pattern norms on insurance industry

- rural and social obligations on insurance industry

- Will insurance Amendment 2015 help in further rural penetration of insurance products? Arguments in favour and against

- Will insurance Amendment 2015 help in stabilising the balance of payment, and increase the investment in infrastructure? Arguments in favour and against.

Youtube Link: https://youtu.be/HNJKAxWBDCI

L2/P14: MicroInsurance, PM Jeevan Jyoti & Suraksha Bima Yojana

- micro-insurance: meaning and salient features

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): salient features, eligibility, premium and compensation.

- Pradhan Mantri Suraksha Bima Yojana (PMSBY): salient features, eligibility, premium and compensation.

- How to memorise trivial factoids of above schemes, for stupid MCQs using Saif Ali Khan?

- Criticism against the three schemes launched by Modi: PMJJBY, PMSBY and Atal Pension Yojana.

- Insurance intermediaries: agents, corporate leaders, brokers, bancassurance, surveyors and loss assessors, third-party administrators (TPAs)- their eligibility conditions and new norms under insurance Amendment 2015 for protection of clients.

- Alternative distribution channels

- insurance council and changes made in insurance amendment 2015.

- tariff advisory committee

- grievance redressal mechanism in insurance sector: the report, consumer courts, insurance ombudsman vs. banking ombudsman.

- Mock question for Mains:Discuss the importance of Insurance amendments bill 2015 in bringing a framework for greater innovation, competition and transparency in Insurance sector of India

Youtube Link: https://youtu.be/vTShfzYlwLI

Visit youtube.com/user/TheMrunalPatel For more lectures on UPSC General Studies.

![[Summary] Budget & Economic Survey 2018 Gist for the UPSC IAS/IPS Interviews](https://mrunal.org/wp-content/uploads/2018/02/c-bes18-basanti-500x383.jpg)

![[BES171] Banking-Classification: Wholesale Banks, Cooperative Banks, DFI AIFI, MUDRA Bank, Islamic Bank, NBFCs & Indigenous Moneylenders](https://mrunal.org/wp-content/uploads/2017/05/c-bes171-evo-2-500x383.gif)

![[BES171] Banking-Classification: RBI Structure Functions, Nationalization, Scheduled Banks, Merger of SBI Associate Banks & BMB, Private Banks, SFB & Payment Banks](https://mrunal.org/wp-content/uploads/2017/02/c-bes171-cover-500x383.gif)

thank you so much sir..!!

Thanks a lot sir…..I was waiting eagerly for this post…finally u have posted it…great work by u and our team sir…

i cant explain in words,how much u have done for us…Thank you very much sir…

sir,when will you start the highly awaited economy articles for prelims 2015?

thanks sir you make easy my path and remove many confusions

धन्यवाद महोदय,

विषयो को पेश करने की शैली ही आपकी पहचान है। सरल, सुगम, और सरस.. आपके पोस्ट को नियमित रूप से पढ़ता हु। हिन्दी भाषा से हु पर भाषा कोई बाधा नही।

कृपया ethic पर भी कुछ विशेष केस अध्यन सरीका हिन्दी भाषा में पोस्ट करें ।

Hi mrunal this is linked up with Lecture no.2.. mean to say this is the further extension ??? am i rgt

Sir, there is no power point lecture showing in L2 – Banking and finance folder from P7 and onward. Therefore, i am not able to download P7 and onward folder of this section. Plz help me sir.

mrunal sir please current series ki topic list atleast june tak ki post kar dijiye. that will be a great relief to us

same is the my request sir

Sir, L2-P10 to P14 PPTs are not available in the specified folder.

thank you somuch sir, we did not get while preparing for GIC, but now they are conducting again, so we are happy

Sir , I have one query.

Are these latest lectures which are based on this year economic survey are usefull for aspirants preparing for 2017.

As you told in 1st lecture that 7 pillars you will be covering in static + current manner.

Thanks for this great support Sirji.

My message is give me the materail.. For general knwlge preparing for ias examination

thank u a lot guru ji

Sir where is the equivalent full text article in English? Cannot find… :(

hey patel you are doing a great deal of truly fine work.you should be awarded bharat ratna for your altruistic expedition for grooming and illuminating ideas of the would be servants of the motherland.

please increase the no. of posts/week.

Thanks a lot Mrunal sir..!!

Hi sir, I have applied for SSC CGL 2015 and also for SSC higher secondary level 2015 exams. I completed the registration successfully. When I wanted to view my application for CGL with my reg no,I am not able to open whereas with the newly registered higher secondary exam reg no, I am able to open the corresponding .

Will I be able to attend both the exams? Please help me in resolving this issue.

Sir, I have a query that does UPSC ask caste validity certificate from students belonging to SC category from maharastra state??? If any1 has any clue then plz reply. Bcoz here in maharashtra state they ask for caste validity and I have not yet made.

Sir, I am not finding the PPTs at the following location

MrunalOrgSharedFiles>>GeneralStudiesMrunal>>1_PowerPoints>>Economy_Youtube>>L2_Finance_Insurance

https://www.mediafire.com/folder/2bb433i58hp2v/General_Studies_Mrunal#ofcnqvfyv8i6c

Please help.

HELLO…

Sir,

Plz suggest a book for world history.

Can we refer Tamilnadu state board book for it?

And in your “jack sparrow” series … The remaining articles are over? Plz give the links…

Thanks.

What is your Message? Search before asking questions & confine discussions to exams related matter only.respected sir pls give some guide or suggest some books for upsssc lekhpal.

Mrunal sir plz suggest some books for upsssc lekhpal.

ye mrunal to sbke coaching institutes bnd kra k manega……ye koi sadharan manav nhi h

ye mrunal to sbke coaching institutes bnd kra k manega……ye koi sadharan manav nhi h

sir

if possible please upload indian art and culture in video, from indus to medieval period. because we face lot of problem to understand the topic.

Mrunal Sir…. please share the latest CurrentAffairs XL sheet. I am following your sheet to keep track of c.affairs, them it badly…

Please help .. :)

Regards

typo *badly need them*

Mrunal sir, I am working as a jto in bsnl since 6 year. Now u want to apply APFC -EPFO, is I am eligible for 6 year experience while applying APFC-EPFO form? Please guide.

THanku soooo much sir

how to get the text articles (not the powerpoints) of the above lectures???

Congrats mam….

Heartiest congratulations to Rajtanil Ma’am for making it to the list!#UPSC2014Results