- Prologue

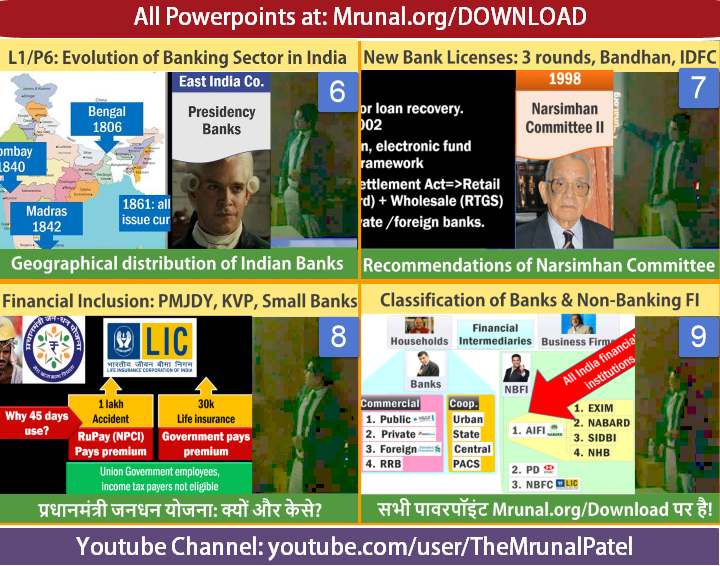

- L1/P6: Evolution of Banking sector in India

- L1/P7: Narsimhan Committee, 3-rounds of bank licenses

- L1/P8: Financial inclusion: PMJDY, KVP, Rupay, Small Banks-Payment Banks

- L1/P9: Classification of Banks and Non-Banking financial institutions (NBFI)

Prologue

- Third lecture was done on 30th January 2015, and uploaded on youtube. Total ~2:30 hours but I’ve split it into four parts.

- PowerPoint of the lecture, available at Mrunal.org/Download

- Medium of instruction- Hindi.

- English version not possible for the moment, because I’m required to teach at this batch, in Hindi/Gujarati only. Besides, same content is available in English-text articles and English PPTs on the site.

L1/P6: Evolution of Banking sector in India

- Indian and foreign banks in pre-independent India

- factors affecting location of banking industry

- Why was there no financial inclusion in British India, despite existence of Indian-banks?

- Why was RBI setup?

- Bank nationalization in Post independent India: Why, How, When?

- Problems created by Bank nationalization. How did it contribute to BoP crisis?

Youtube Link: http://youtu.be/XB9bJtb09lA

L1/P7: Narsimhan Committee, 3-rounds of bank licenses

- Recommendations of Narsimhan-I and Narsimhan-II Committees.

- Private bank licenses in 3 rounds.

- Bimal Jalan Committee’s “In-Principle” approval to (1) Bandhan Microfinance and (2) IDFC

- Bharatiya Mahila Bank (BMB) features, purpose and why is it a symbolic exercise without substance?

Youtube Link: http://youtu.be/7VCPyVXJQQk

L1/P8: Financial inclusion: PMJDY, KVP, Rupay, Small Banks-Payment Banks

- Define financial inclusion?

- Why do we need financial inclusion?

- Steps taken so far by various governments

- PM’s Jan-dhan Yojana- 6 pillars, salient features and criticism.

- Rupay card, what is payment gateway, how does it work? What’s the connection between Rupay card usage and 45 days?

- Kisan Vikas Patra- features, Shyamla Gopinath Committee and safeguards against Money laundering.

- Small Banks, Payment Banks: salient features-functions

Youtube Link: http://youtu.be/-MwlISnrVqw

L1/P9: Classification of Banks and Non-Banking financial institutions (NBFI)

- What’re financial intermediaries?

- What’re the difference between commercial and cooperative banks?

- Regional rural banks- origin, ownership, problems and amendment

- Cooperative banks: origin, classification, problems.

- AIFI (All India Financial institutions): EXIM, NABARD, SIDBI and NHB. origin, ownership, functions, past MCQs from UPSC

- Primary dealers: meaning, functions

- Non-Banking financial companies (NBFC): How are they different from Banking institutions, internal classification of NBFCs.

- Microfinance companies

- Leftover topics and the-end of Banking sector “static” portion

Youtube Link: http://youtu.be/xM3D0xaTesM

![[Summary] Budget & Economic Survey 2018 Gist for the UPSC IAS/IPS Interviews](https://mrunal.org/wp-content/uploads/2018/02/c-bes18-basanti-500x383.jpg)

![[BES171] Banking-Classification: Wholesale Banks, Cooperative Banks, DFI AIFI, MUDRA Bank, Islamic Bank, NBFCs & Indigenous Moneylenders](https://mrunal.org/wp-content/uploads/2017/05/c-bes171-evo-2-500x383.gif)

![[BES171] Banking-Classification: RBI Structure Functions, Nationalization, Scheduled Banks, Merger of SBI Associate Banks & BMB, Private Banks, SFB & Payment Banks](https://mrunal.org/wp-content/uploads/2017/02/c-bes171-cover-500x383.gif)

Sir, is the current affairs topic list enough or should we go through The Hindu again?… Coz it is difficult getting hindu copy… … They charge 6X more then that of the original price. And still irregular.

THANKS A LOT SIRJEEE

mrunal sir , I am not able to download ib admit card….and any of my friend who can see my comment pls post the link to ib admit card. I cud not find it in mha website

https://www.onlinesubmit.in/mha6/

https://www.onlinesubmit.in/mha6/Account/Login.aspx … good luck

IB ADMIT CARD- https://www.onlinesubmit.in/mha6/Account/Login.aspx

I don’t know.. I got it from my friend. & I do have some ncert books. (I am not sure) But … try this..

https://files.secureserver.net/0fHCh0CLd6Az63

can anyone explain me how changing of base rate has increased GDP growth rate recently ? with example

Sir these video links are not available on youtube.(L1/p6 to L1/p9)

go to site freejobalert.com,or sarkari result.com you can easily download

Hi can you guys can tell me pls I don’t know how to write general essays

thnx sir…

thank you so much sir..

God bless you sir !!!

dear mrunal sir,

I saw the video it was awesome as usual, but I have a doubt in the 1st video i.e regarding nationalisation of SBI in 1955. Sir as far as my knowledge is concerned SBI is not a nationalised bank it is a public sector bank which draws power from state bank of India Act,1955. correct me if I am wrong.

thanks & regards

6 private banks get license in 1993 & 2 in 2001 but at present there is 23 private banks. How ? Please explain

Lecture me jis DVD / PDF Print Out ki baat ki hai apne, wo kya hame mil sakta hai , ( Jo aapke Class se wanchit rah Gaey)

Hi murnal sir I need notes of sociology for upsc exam…

thanku sir…. God bless you ,

thanku so much sir…. God bless you,,,,,

Ppt are not getting open in my phone what to do

hi sir im not able to download eco lecture on laptop or mobile. smbdy plz guide.

sir you said that the first indian bank is allahabad,but allahabad bank is established by group of englishmen. plz clarify me

I have a doubt Sir…

You mentioned in your L1/P9 lecture that “Narsimhan Committee gave the idea for RRB”

When was this Narsimhan Comm. formed?

Thanks in advance….

Hello friends,pls help me.I can able to download economy lechure videos.when I play only audio is coming not video.pls give me solution.I am waiting for solution.

Through what you are trying to download..

..i mean through PC/laptop or through mobile..

..

If you are going on PC,

Download ‘Free you tube downloader’ from DVDvideosoft..

..

..

If on android mobile, download tubemate downloader from tubemate.net only..

Simply download it and you will get on it through their self-instructor..

I am downloding using laptop oly.wen I play that downloaded videos oly audio is coming no video.even I played it with vlc,mvk,km and media player also same problem.

If you are using ‘Youtube Music downloader’, there are two radio buttons, 1. MP3 2. Video, I think MP3 might be selected by default.

First go to you tube where all mrunal Sir videos are there.open new tab Just type cc converter in your browser.you will get clip converter.it will ask url in very first line .paste your you tube url over there, and select as MP4 and start downloading any kind of videos. .

Hope it would be helpful

replace ‘youtube’ in the url of video by ‘ssyoutube’ and you will be able to download video from youtube itself without requiring any additional software or visiting any additional website.

Use mediafire. May be. Not sure.

provide me d link of material of banking ..

in layman language :-)

sir

Awesome lecture, infact best one i have ever seen on youtube.

please announce the dates for next lectures.

thanks

sir,

i dont know hindi hence i could not see the youtube videos which you are uploading so, please try to upload in english medium it will be helpful to us than reading more than twice because watching the video will help to understand the key concept clearly..

Mrunal sir,

are your videos covering all topics under economics? As in, if I watch all the videos, I do not have to go through the articles posted by you in the economics section? Is my understanding correct?

Please respond.

Hello, I have some queries, would be grateful if anybody could help.

1. Are the PSL interest rates also de-regulated or are they decided by RBI ? Can interest of PSL be below base rate ?

2. Which areas the interest rates are still not deregulated ?

Hi Rishi,

De-regulation means something which is not under the control of Government. All rates are related/adjusted in accordance with the base rate. Base rate is decided by RBI.

Banks are not permitted to any lending below Base Rate (even if it PSL).

sir sound is not clear……is it a problem of downloading

can anyone give me the link of the note on these topics

Mrunal Sir,

Please let us know when will SBI PO and Clerical recruitment notification be published?

Paromita