- Prologue

- GSM3/Agri: Pulses inflation: Arvind Subramanian report, PPP procurement, higher MSP, DBT?

- GSM3/Agri: GM Mustard, DMH-11 Hybrid should we adopt in India?

- GSM3/Budgeting: Why Plan-Non plan merger? Is Revenue-Capital sufficient?

- GSM3/Budgeting: Why Budget advanced to 1st February? Merits, Rationale, Summary

- GSM3/Budgeting: Why change Financial Year of India instead of 1st April-31st March?

Prologue

- Continuing the mains revision and answer writing for selected topics. We were done with GSM2 in the last round, now moving to paper-3.

- Following two syllabus topics, we shall focus:

- Farm subsidies and MSP and issues therein (direct and indirect). Two questions in were asked from this syllabus topic in 2013, one question in 2014, no question has been asked in 2015 from this topic.

- Government Budgeting. Three questions were asked from this topic in in 2013, one question in 2015, no question in 2014.

GSM3/Agri: Pulses inflation: Arvind Subramanian report, PPP procurement, higher MSP, DBT?

Q. Why are we unable to control skyrocketing prices of pulses in domestic market? Suggest remedies.

हम घरेलू बाज़ार में दालो के आसमान छुते दामो को क्यों काबू में नहीं कर पा रहे? उपाय बतायें.

As such, we had covered pulses and other 'how to grow more from less' during budget and economic survey lecture series before prelims-2016. but UNGA declared 2016 as international year of pulses and CEA's report came on how to boost pulses cultivation via MSP and other measures. So we've to prepare.

As Marie Antoinette suggested hungry bread seekers to eat cake, certain liberal-intellectual-Jholachhap columnist in English newspapers are indirectly hinting that if vegetarians were to starts eating fish, meat and eggs then the demand and inflation in pulses could be controlled. How far is this logic valid? What does Arvind Subramanian have to say on this matter? Find out in the video!

Youtube Link: http://youtu.be/-cLk2ZkoyZM

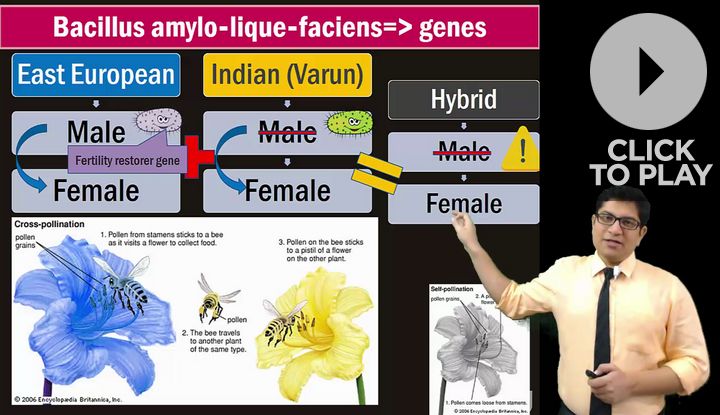

GSM3/Agri: GM Mustard, DMH-11 Hybrid should we adopt in India?

Q. Explain GM mustard? Should we adopt its DMH-11 variety developed by DU scientists?

जीएम-सरसों का मतलब समझायिए. क्या दिल्ली यूनिवर्सिटी के वैज्ञानिकों द्वारा विकसित की गई इसकी DMH-११ को हमें अपना लेना चाहिए?

GEAC subcommittee has given thumbs up to commercial cultivation of the hybrid variety of GM-mustard. But, why do TheHindu columnists refute it? Is GM-Mustard safe for human and animal consumption? Will it endanger our biodiversity and environment? Does it have higher yield and pest-resistance than traditional mustard? Can Rajesh Khanna, Shahrukh Khan and Anushka Sharma safely dance in the GM-sarsaun ka khet without dying of cancer during the climax?

Youtube Link: http://youtu.be/l0kyVeDFylk

GSM3/Budgeting: Why Plan-Non plan merger? Is Revenue-Capital sufficient?

Q. Examine the rationale behind merger of plan and non-plan expenditure in general budget. Do you think Revenue vs Capital classification is sufficient for budgeting purpose?

सामान्य बजट में प्लान और नॉन-प्लान खर्च को एकीकृत करने के निर्णय के पीछे के तर्क की समालोचनात्मक समीक्षा कीजिए. क्या आपको लगता है की राजस्व बनाम पूंजी वर्गीकरण बजट निर्माण के लिए पर्याप्त है?

Why do some economists look down upon the plan-non plan classification of Expenditure as a 'relic' of past. Why do state governments hate plan-nonplan classfication? Can we maintain same level of accountability, monitoring and transparency in the western style "Revenue-capital" classification?

Relevance- UPSC Mains GS Paper-3 Syllabus topic: : Government Budgeting. Three questions in 2013, one question in 2015, no question in 2014.

Youtube Link: http://youtu.be/4A8Wis0awp0

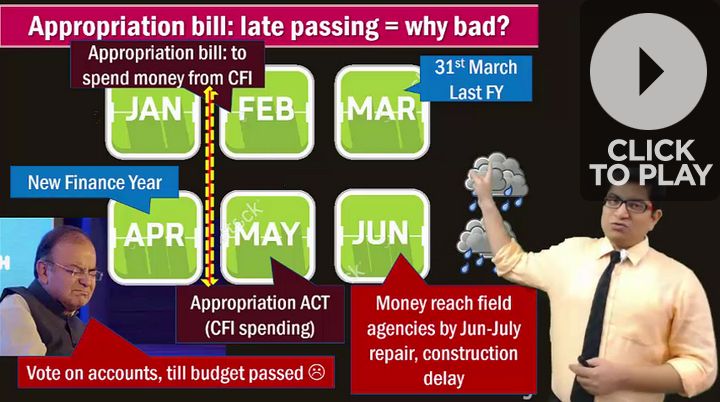

GSM3/Budgeting: Why Budget advanced to 1st February? Merits, Rationale, Summary

Q. Why has Union govt advanced the date of presentation of AFS to 1st Feb? Discuss.

केंद्र सरकार ने वार्षिक वित्त-विवरण को प्रस्तुत करने की तारीख को आगे बढाकर १ फरवरी पर क्यों तय की है? चर्चा कीजिए.

If finance bill and appropriation bill are passed before starting of the new financial year, what impact will it have on investors and public administrators?

Youtube Link: http://youtu.be/H3vj735b1Ls

GSM3/Budgeting: Why change Financial Year of India instead of 1st April-31st March?

Q. Examine the merits of changing the financial year of India from the present 1st April-31st March.

भारत के प्रवर्तमान वितीय वर्ष अप्रेल-मार्च को बदल देने के सुजाव का योग्यता परिक्षण कीजिए.

Why do British start their financial year from 1st April in their home country? What were the views of LK Jha Committee and 1st ARC? why did Modi form Shankar Acharya Committee? If we change annual financial year starting date to 1st November or 15th January, will it make our fiscal policy more proactive?

Youtube Link: http://youtu.be/y1eGzFSPa1M

Next (and last round) tomorrow will wind up with GST and UBI.

![[Summary] Budget & Economic Survey 2018 Gist for the UPSC IAS/IPS Interviews](https://mrunal.org/wp-content/uploads/2018/02/c-bes18-basanti-500x383.jpg)

![[BES171] Banking-Classification: Wholesale Banks, Cooperative Banks, DFI AIFI, MUDRA Bank, Islamic Bank, NBFCs & Indigenous Moneylenders](https://mrunal.org/wp-content/uploads/2017/05/c-bes171-evo-2-500x383.gif)

![[BES171] Banking-Classification: RBI Structure Functions, Nationalization, Scheduled Banks, Merger of SBI Associate Banks & BMB, Private Banks, SFB & Payment Banks](https://mrunal.org/wp-content/uploads/2017/02/c-bes171-cover-500x383.gif)

Thankyu sir.

Please update WW-2 ppt

I have NABARD asst mains on dec 8.please guide me for agriculture,rural development,rural banking,latest development in recent times in farming.

What should i read as this section will be if 50 marks.

Thanx.

I have NABARD asst mains on dec 8.please guide me for agriculture,rural development,rural banking,latest development in recent times in farming.

What should i read as this section will be if 50 marks.

Thanx..

whice hindi magazine and newspaper best in upsc

how to go about this bpsc exams ??

sir please if you can help