- Prologue

- Pillar1: Banks & NBFCs

- Pillar2: Budget / Public Finance

- Pillar3: Balance of Payment & International Trade

- Pillar4: Sectors of Economy

- Pillar5: Infrastructure & Environment

- Pillar6: HDI

- Conclusion: Modi government & Indian Economy

Prologue

- Since many aspirants will be facing interviews of UPSC / GPSC and other state PCS exams in February-March, therefore I’ve quickly assembled a summary of budget and economic survey for their reference, before I begin my lecture series in a systematic manner.

- Haste makes waste, so I don’t claim this article being ‘best’ among my products. It covers following areas:

- Economic Survey volume1 (entirely-but I’ve written only interview-related important points here).

- Economic Survey volume2 (only first chapter. Because rest of the chapters are mostly data-tables for last years’ economic events. That much information overload = bad cost:benefit for interview prep.)

- Budget-2018: Major announcements covered.

- FREE Download Links for Budget & Economic Survey documents: English | Hindi

In this summary, I’ve not written full forms or given background theory-connectives, because the target audience is Interview candidates. They should be well aware of that…. if not, then watch my BES17 Lecture series again.

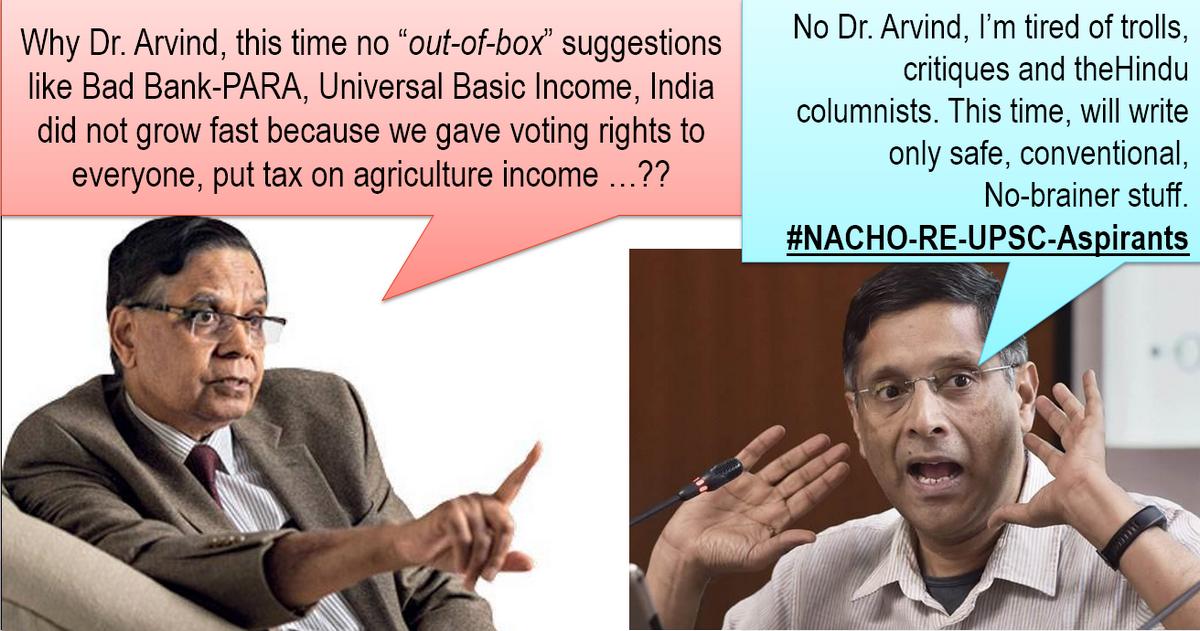

इस बार कुछ खास नया माल नही है. CEA Arvind Subramanian is neither repeating many old things, nor proposing new things.

Pillar1: Banks & NBFCs

- RBI to have Uncollateralized Deposit Facility to absorb excess liquidity. (banks can park surplus funds overnight just like European Central Bank.)

- 80k crores on PSB recapitalization. Strong RRB can raise $ from market, RBI to handover NHB to Government.

- RBI, SEBI to encourage corporate bond market. ~25% of Corporate borrowing from there. Unique IDs to enterprises for tracking loans, schemes and Ease of Doing Biz.

- Post office, NSC, PPF acts to be more people friendly. SEBI, Securities Act to have more teeth.

- Blockchain tech. to promote digital economy, but Bitcoin & Cryptocurrencies declared “not-legal tenders”. Government to take action against their use in illegal activities.

- Three Public sector Insurance Cos: National Insurance Company Ltd., United India Assurance Company Ltd and Oriental India Insurance Co. Ltd will be merged into a single insurance entity, and later its shares will be listed.

- Hybrid instruments for VCF and Startup. (Hybrid= debt and equity)

- Financial inclusion: Already 60 cr. Jan-Dhan accounts. More efforts to link them with PM Jivan Jyoti, Surakasha Bima, Fasal Bima. + new Health insurance scheme of Rs.5 lakh per BPL/rural family per year.

- New policy / reforms for: MSME-NPA, MUDRA refinancing via NBFCs, Angel Funds / VCF.

Above things were from Budget, below is from Economic survey:

- ES18v1c3: After 2000, India’s savings and investment rates falling :-(

- For Mobilizing saving (into financial instruments): we’ve done: demonetization, drive against black money.

- For mobilizing Investment: we’ve done FDI, Ease of Doing Biz, Bank recapitalization, I&B Code. But we must focus more on attracting investment, for 8-10% GDP growth rate.

- ES18v1c1: crony socialism to stigmatized capitalism:

- Twin Balance sheet Syndrome (TBS), Infosys-TATA board battles. Greater demand for state intervention.

- TBS: Banks reluctant to lend. Many PSBs making losses in past 3 years. Recapitalization increases fiscal deficit. I&B work in progress, FRDI bill proposed.

- Presently Stock price boom but when it’s corrected there could be capital outflow. Domestic investors will get angry because 1) gold is unattractive 2) Post-demonetization FD rates down. If then to appease middle-class if government hikes the Small Savings Schemes interests before election then Fiscal deficit targets will be missed :-(

Pillar2: Budget / Public Finance

Figures: Ascending Descending

- Direct Taxes: Corporation > Income Tax > STT

- Indirect Taxes: CGST > Union Excise > Customs > GST compensation Cess > IGST.

- Subsidies: Food > Fertilizer (Urea) > LPG > Kerosene. (Major subsidies~1.4% of GDP)

- Salaries: President (5L) > Vice President (4L) > Governors (3.5L); MP salaries revised with inflation every 5 year.

- Deficits Targets for 2018-19: RD: 2.2%, FD: 3.3%; PD: 0.3% of the GDP. Debt to GDP: 40%

- Disinvestment Targets: 80k Crore (Last Year 72,500 cr). New ETFs, incl. Debt-ETFs planned. Air India to be privatized.

Tax related announcements

- Tax buoyancy has improved. 90k cr more collected compared to the scenario two years ago.

- No. of Tax-filers increased, though “compliance” behavior is not appreciative. Non salaried professionals hardly paying IT in ~7k to 35k range.

- Income tax Slabs: Not changed (5-10-20-30%). (New) 40k Std. deduction. But transport & Medical exemptions removed.

- Elderly: No IT or TDS on interest income upto Rs.50k (earlier 10k), Upto 50k deduction for health insurance premium, upto Rs.1 lakh for critical illness. Pradhan Mantri Vaya Vandana Yojana (LIC): 8% return for upto Rs.15 lakh till March 2020.

- 25% corporation tax for Companies with turnover upto Rs.250 cr (earlier only 50 cr.) Companies given deduction for hiring new people. [previous rules tweaked]

- Cess on Income Tax & Corporation Tax Cess: 2% Primary Education + 1% Secondary & Higher education + (new) 1% Health cess to finance the new health insurance scheme for BPL/Rural.

- Securities: 15% short term CGT + (new) 10% Long term CGT, if profit more than 1 lakh. Equity Mutual Funds: 10% distribution tax.

- Gift City (IFSC): certain securities removed from Capital Gains Tax (CGT), There will be Alternate Minimum Tax (AMT) instead of MAT. New regulator for Gift city.

- Black Money: Trusts can’t pay more than 10k in cash. Stricter rules for TDS compliance. Every entity doing transactions of Rs.2.5lakh or more must get PAN, incl. its office bearers.

- Farmers FPO: 100% deduction for next 5 years. This will help in Op. Greens and Pradhan Mantri Kisan SAMPADA Yojana (Scheme for Agro-Marine Processing).

- To reduce Tax terrorism: E-assessment for direct taxes. Customs Act’62 amendments for implement WTO’s Trade Facilitation Agreement (TFA). Customs to have authority for advance ruling.

ES18: v1c1 and v2c2

- Fight against Black money successful, we got 65,000-Rs. 90,000 crores more in IT collection. [Negative: Dem+GST = 18 lakh new tax filers. But most in the 2.5 lakh slab.]

- GST: Yet to be stabilized. But, data also helps in finding more about informal vs formal sector of economy and employment level.

- Attacking Corruption & Weak Governance has its fallouts. E.g. Demonetization= informal sector jobloss. I&B Code: companies might shutdown & jobloss. “Auction cancelled, Tax-terrorism”: Foreign investors reluctant. We should rely more on using incentives and carrots than on sticks

- CEA repeating things from last 2 years i.e. poor services -> citizens “exit” or become “free rider” -> Government’s accountability decline. Compared to Brazil and Germany, our State governments and Rural local bodies not collecting adequate taxes on their own. So, they rely more on FC devolution. Aid curse and resource curse, due to lack of accountability.

Pillar3: Balance of Payment & International Trade

- Budget: Gold monetization scheme and Outward FDI to be reformed. GIFT city IFSC to have separate regulator.

- ES18v1c1 identified International Risks to Indian Economy:

- War in Korean peninsula

- Political unrest in Middle East (Iran domestic, GCC boycotting Qatar), Chinese slowdown, OPEC-Russia oil cuts.

- Advanced Economies recovering and coming out of zero interest rate regimes- consequently flight of capital could happen.

Pillar4: Sectors of Economy

4A: Agriculture

- Farm loan target: 11 lakhs (Last year 10 lakhs). Lessee cultivators will be covered.

- 2x farm income by 2022 ke liye 1.5 x MSP. FCI’s working capital to be raised via debt & equity for this.

- GrAM gramin haats. Because small-marginal farmers can’t bring their produce to APMC / E-NAM. These GrAM haats will be connect via PM Gram Sadak Yojana.

- Organic farming ke liye Women SHG.

- Op. Greens for Tomato Onion Potato (TOP). National Bamboo Mission. (Bamboo already removed from the legal definition of ‘trees’ to reduce inspector-raj.)

- Fishermen and Animal Husbandry-walla to get Kisan Credit card and new funds.

- Farmers to sell surplus electricity from solar panels in their farms to DISCOMMs.

- RURAL Infra ke liye: SBM ,Ujjawala, Saubhagya electricity, PM Awas Yojana, PM Krishi Sinchai yojana, NRLM … all these schemes’ funds and targets increased.

- Total rural infra Expenditure: 14 lakh crores.

- ES18v1c6: For both for economic and social development, people need to be moved out of farms and villages. (Sir Arthur Lewis and Dr. Ambedkar).

- Extreme weather events affect agro. climate impact is twice on unirrigated farms than irrigated.

- With higher temperature and shorter rainfall: income fall- 15-18% (irrigated), 20-25% (unirrigated).

- Just like GST, we need cooperative federalism against Agricultural distress.

Or, as BASANTI would put it: “रहेने वाले सहेर के हो, लेकिन समजदार हो! #Pro-Rural-Budget-2018”

4B & C: Mfg & Service Sector

- EPF rules tweaked to create new jobs, provide relief to women workers.

- PM Kaushal Kendra in every district. Package for textile sector.

- World Bank’s Ease of Doing Business Report (EODB), 2018: Rank #100 (^30) But enforcing contracts, we are behind Pakistan, Congo and Sudan. Therefore, ES18v1c9 talks about how to reform judicial system to reduce case pendency. Just like Cooperative Federalism: similarly there should be cooperative separation of powers i.e. Judiciary vs (Executive|Legi) should not interfere or encroach upon each other’s domain. [Self-Study the chapter for more points, even for GSM2]

4D: GDP [ES18v1c1 and v2c1]

Positive observations

- 2017-18: 6.75% growth rate. Per capita income: 1,11,782 Rupees (Current price) | 86,660/- @constant price (2011). IIP improved.

- 2018-19: Growth rate projected at 7 to 7.5% [+0.5% if exports pickup.]

- Moderate level of inflation, CAD, FD.

- IMF: Post-GFC recovery is occurring in major economies. Indian economy is now 2.5 trillion dollar economy – seventh largest in the world.

- World Bank Ease of Doing Biz 2018: 130->100th rank.

- Moody Rating: BAA3->BAA2.

- Global Innovation Index-2017: 66->60.

- Forex reserve at $409 cr.

Negative observations

- 2016 vs 2017: While most sectors recorded positive growth, but Agro ~5% -> 2.1%

- Pre-GFC boom catalysts were 1) private investment 2) exports, but both are not upto picking up at present.

- “economic convergence,” whereby poorer countries have grow faster than richer countries and closed the gap in standards of living. Since 80s, India began catching up. But this has not resulted into labour shifting from agro to mfg, unlike Japan and S.Korea. Now, 4 challenges:

- Anti-globalization

- structural transformation and pre-mature deindustrialization

- HR-challenges (ASER, Skill Development)

- Climate changes hurting agro.

- Post-demonetization: less cash economy, growth is recovered but not to full potential.

- Global hunger report: India very poor performer.

- RESIDEX: house-prices inflation in majority of the cities, even Post-Demonetization.

4F: Inflation

- OPEC-Russia Oil cut deal: 12% hike in oil prices expected in 2018. If hike is passed on, there will be inflation. RBI’s 2-4% CPI target already breached on Dec’17 (5.2%).

- Fiscal Deficit to aggravate when there are excise-cuts to absorb oil price hike before election.

- CAD also increasing due to oil prices.

Pillar5: Infrastructure & Environment

- NHAI to turn its road assets into SPV for monetization. Encourage Fast-tag and “Pay as you use tolls.”

- New: Sela Pass tunnel for Arunanchal Pradesh. Rest is just mention of Existing initiatives like PRAGATI portal for monitoring infra progress, BHARATMALA, Smart City, AMRUT, HRIDAY.

- Railway: Focus safety, unmanned crossing, CCTV, wifi; broad gauge conversion, Mumbai & Bengaluru local train network to be strengthened. A’bad Bullet traine ke liye Vadodary academy. Rail University at Vadodara.

- Aviation: (existing) UDAN for cheap regional flights. Now, NABH Nirman: five times more airports will be built to handle billion trips a year.

- Digital Infrastructure: 5G test Bed @IIT,Chennai. NITI program for AI, DoT mission for Cyber physical systems; Digital India: 2x funds, broadband and wifi for rural Indians under BHARATNET.

Environment

- GOBAR-DHAN: Galvanizing Organic Bio-Agro Resources Dhan for management and conversion of cattle dung and solid waste in farms to compost, fertilizer, bio-gas and bio-CNG.

- Burning Crop residue = Delhi pollution. So, funds & Subsidy for neighboring states’ farmers.

- Namami Gange, Villages made ODF free. (although nothing major-new)

Pillar6: HDI

HDI: Education

- DIKSHA portal to upgrade teachers’ skill. Because we’ve enrolled kids under RTE but their learning outcomes have not improved (ASER).

- More Ekalavya Residential schools for ST kids.

- “RISE” scheme to promote research in Higher education institutes

- PM Research Fellow Scheme for B.Tech so they do PHD and teach on weekly basis.

- ES18v1C8: talks about Importance of Science Tech in national development. India’s achievement so far. But we are underspending on R&D. Brain-drain, Patent delays, Basic research neglected. Problems remedies given in the chapter, self study it for GSM3 & Essay.

HDI: Health

- ‘‘Ayushman Bharat”: For improving primary, secondary and tertiary care system. Both prevention and health promotion.

- National Health Protection Scheme: Rs.5 lakh cover per poor family per year for secondary and tertiary care hospitalization. (This will be world’s largest scheme).

HDI: Gender empowerment

- ES18v1c7: Per capita income or development levels wise NE < Punjab & Haryana, yet NE better on Gender indices. So, development is not an ‘antidote’ to gender inequality.

- If women employments increases, it’ll help family and economy. But, Women don’t have control over their body- contraception, their labour participation rate very poor. We need to create more jobs in textile, footware and those industries should shift to smaller towns.

- Sex selective abortion and neglect of girl child= results in 63 million missing women

- Son meta preference i.e couples will not stop breeding till a son is born = 21 Million “unwanted girls”- They’re neglected in food & education.

- Notable steps by the Modi-government: Sukanya Samriddhi FD, BBBP but Survey not measured its success.

HDI: “Ease of Living”

- PM Ujjwala Yojana gives LPG connection to BPL. Target increased.

- Saubhagya Yojna for electricity connections to poor.

- Passport @doorstep, interviews removed from group C/D. Jan Aushadhi centres for cheap generic medicines, stent price curtailed….ye sab Ease of Living hai.

- 150th birth anniversary of Gandhi in 2019 so Rs.150 cr under PM chaired committee for event management in latest budget.

- ES18v1c1: We need to change mindset also: toilet users have to be increased, not just number of toilets. If we give free Gas and electricity connections but users don’t have money to pay bills later on? Hence, “income support / DBT” also necessary.

Conclusion: Modi government & Indian Economy

ES18v2c1 gives overview of the notable steps initiated by Modi Government so far (apart from GST, Demonetization):

- Agro: Soil health card, Pradhan Mantri Krishi Sinchayee Yojana(PMKSY), Fasal Bima

- Mfg: Make in India programme, Start-up India and Intellectual Rights Policy. Anti-dumping on Chinese gods; PM Mudra yojana for MSME.

- Labour: 38 Acts-> 4 codes.

- Infra: BHARATMALA, SAGARMALA, BHARATNET, UDAN. Rail budget merged.

- Electricity: Ujjawal DISCOM Assurance Yojana (UDAY), DD Gram Jyoti, Saubhagya(Pradhan Mantri Sahaj Bijli Har Ghar Yojana), was launched in September 2017 to ensure electrification of all remaining willing households in the country in rural and urban areas. Pradhan Mantri Ujjwala Yojana: LPG connection to BPL. Then Ujjawala plus+ Yojana for poor not under SECC.

- Girls: BBBP, Sukanya Samriddhi Yojana. Health: SBM.

- Intl cooperation: SDG adopted, Voluntary national review given in 2017, Intl. Solar Alliance, Paris agreement ratified.

Budget2018 speech: Modi now focusing on:

- Strengthening agriculture and rural economy

- Healthcare for poor.

- Tax reliefs for senior citizens.

- Infrastructure creation and cooperative federalism.

For Government jobs interviews, these much information should be at your lips. For Prelims and Mains point of view, we’ll be studying these things in a detailed manner, later on.

yes I’ll be doing the BES-18 “GREEN” series this time. I’ve chosen green color because both in the budget and economic survey, noting much new to teach: so, it’s going to save a lot of slides, printouts & mental-effort for the aspirants. So, it’s “Eco-friendly” green BES18.. [Although I’m open to suggestions on other colors as well, Do share thoughts in the comments below!] And stay Tuned to Youtube.com/c/TheMrunalPatel….

![[Free] UPSC Offline Mock Interview with Mrunal for those who cleared Mains-2019, Venue- New Delhi, Dates: Feb 3,4,5](https://mrunal.org/wp-content/uploads/2020/01/mock-interviews-C1-500x383.jpg)

Sir, agar aapki bes test series mein time lag raha hain to sirf itna bata de ki padna kya hain economic survey mein specially for prelims…Thank you :)

Only 90 days left..well as u have already maked it clear that..this time also there is nothing new In ES..but budget is Sir..gonna kill us..plz do make video..eagerly waiting..

Dear mrunal sir i have seen your BES17 atleast 2 times (selective videos), i love the way of your examples from SRK to ajay devgan and to jeta lal :)

sir 2018-19 budget ke video bnaye please hamare ve bahut hi upyogi hoge aapke dvara bnaye gye videos hamare liye coaching ka kam krte hai ….. thank you sir.

sir do tell the date from when u r going to start the new lecture series of economics…

Like almost everyone above mentioned – Eagerly awaiting your BES18 lecture series, Sir.

sir, when will b&es 18 series will start.

sir pls video series share kar dijiye ?

desperately waiting for your series.

Sir plz..jaldi shuru kar dijeye

sir economy survey 2018 ki videos kb aega you tube p plz.. upload.

Sir kindly upload the BES 18 series. Everyone is eagerly waiting for it.

Sir Plz uploaded BES18

sir please start Bes18 as early as possible.

Come back Mrunal, come back and save the WORLD! :)

Sir many students are waiting for your BES18 course. Plz enlighten us as to when you are planning to start it.

thank you sir.. this is my first year.. earlier I hv completed your old videos..and currently 38/55 of your lecture note. where I am living I cannot afford most of the resources and my condition do not permit me to go Delhi.. your lecture and also geography lectures help me a lot. waiting for this year lecture. Thank you Sir…

pls come with bse18

bes18 plzzzz………..

Sir, When will you launch the full version for candidates of prelims and mains 2018?

awaiting earliest response

guru ji ajaieye…bht der ho rhi h.

Sir please start BES18 as soon as possible because we are near of 3rd June and please cover it in details…???

In the economics part, I am totally depend upon you sir and 3rd June , it is my first attempt…?

Sir come up with BES 18

Sir , eagerly awaiting for bes18 video series !!

Sir plz upload bes 18 series budget and economic suvey 2018 .i have been eagerly waitng this series. I watched all your economics videos and recommend my friends .some of my friends clear upsc exam and they always gives you credit for his success. Your teaching way and fact presentation is very intresting. Plz upload series as soon as .

sir please jaldi se BES 2018 series start kijiye….

Sir please make “”PAID”” video series asap. Dont upload for it for free on youtube. Decide the fee structure, all are willing to pay it, they just want timely guidance from you .

Hi, God of simplified economics,

Please start BES 2018 Video Series as soon as possible. NABARD unveiled its vacancies for GR-A, we need you, sir.

sir please bring BES 2018 as soon as possible, lakhs of aspirants are dependent on you….

Very happy to know that Mrunal Sir will be delivering lectures on Budget 2018 and Economic Survey 2017-18.

If it can be released asap, it will be highly beneficial.

But considering Mrunal Sir will keep the content of the highest quality and also the videos can be seen at the students’ discretion (thus eliminating exhaustion of attending classes), it willl be quite manageable if Mrunal Sir take his own time.

Waiting eagerly for BES 18 “GREEN”.

Thanks in anticipation, Mrunal Sir.