Prelim-2018’s Economy & Yearbook is tougher than 2017

- On 3rd June 2018, UPSC conducted Prelims exam for recruitment in IAS/IPS and other civil services.

- Paper-I consisted of 100 MCQs from general studies. For that, I’ve already published answerkey for Science, Polity , Environment, Geography, International Relation, History & Culture answerkey and their strategies for the next year.

- Prelims-2017: 12 Easy + 11 Medium + 6 Tough whereas Prelims-2018: 11 Easy + 4 Medium + 10 Tough. So, there is a distinct shift from medium towards tough level of difficulty.

- In 2017: Guessmaster-giriTM possible in 9 MCQs, whereas in 2018- only in 3 MCQs. In the remaining MCQs, Guessmaster-giriTM at best could only narrow down two options, then it became just like Polity – too tempting to walk away without ticking and therefore time consuming section.

- Microeconomics asked after a long gap, most candidates had skipped the subject altogether. So, that raised the stress level in the real-exam hall.

- Prelim-2018: Obscure data interpretation asked, and that too further raised the difficult level.

Data Interpretation ki दीवानगी (infatuation)

- Unique feature of Prelim-2018’s MCQs is that quite a few statements required “DATA INTERPRETATION (D.I.)” of random Government reports- whether we imported more edible oil than we produced, whether 60%+ Kerala agro households receive max. income from non-agro source, whether >90% of teachers training institutes are under State governments?

- Unlike the traditional publishers, the PDF-wallas don’t have to worry about papers as an input cost. Hence, it’s likely they will now begin to ENTHUSIASTICALLY copy-paste Data-Table from random Government reports, so that if UPSC examiner’s DI-infatuation continues in Prelim-2019, they can claim “so and so Economy-DI-MCQ could be solved from our PDF!!”

- In such scenario, as a student you’ve to be conscious of your own limitations while preparing from such material. Yes, in economics certain dates, numbers and figures are important, but the cost:benefit of spending too much time over DI / ascending-descending type GK will give poor returns.

Continuity and Change: 2017 vs 2018

- Unlike last year, good number of MCQs from theory portion.

- The Pillar#1 (Banking-Finance) continues to occupy 6-7 MCQs. However, internal composition is slowly moving from financial inclusion type MCQs towards NPA/BASEL type. However, Digital Payment system prem continues- last year asked about UPI, this year about BHIM. Over last five years, the complexity of Banking-Finance sector MCQs have surely increased: In 2013 very basic questions on SLR, NDTL, Venture Capital Fund. Each year, it’s getting more complex.

- WTO prem continues: 2016-subsidy boxes, 2017- TFA agreement and 2018- GI Act.

- Trade agreement prem also continues: 2016- TransPacific Partnership & RCEP, 2017- EU BTIA, 2018- ASEAN Free Trade Partners.

- Skill prem continues but at declined intensity. Last year asked about NCS, RPL and NSQF, this time only single MCQ: PMKVY.

- Obscure Organization Prelim also continues: 2016- FSSAI labelling guidelines, 2017- QCI, 2018-Again FSSAI. However, you should look at such MCQs as roadblocks meant to increase stress level & keep the paper tough, rather than as MCQs meant to be ‘solved.’ So, no need to waste time preparing an exhaustive note/compilation from the “About US” pages of such obscure organizations.

Discontinued after 2017:

- Sanskritized Scheme Prem discontinues: 2016- SWAYAM portal, 2017- Vindhyanjali Yojana. And afterwards Government had gone crazier than usual in launching dozens of schemes / projects with Sanskritized names. YET, no such stupid scheme asked. Yes, there were medium difficulty questions from headline schemes such NFSA and PMKVY, but they did not have forcefully contrived Sanskritized names.

- Economy / HRD type Index-Prem discontinues: 2016- Hunger index, 2017- Gender Gap index. Now 2018- asked about Rule of law index, but that’s more towards polity than economy.

- In Infrastructure: unlike last year, thankfully no obscure summit / fund like APMCHUD, Global infrastructure fund. This year straightforward question on Digital India mission.

Anyways, the more time we spend analyzing and comparing the papers, more continuity and change can be found. But ultimately we must build the roadmap for next year:

Prelims-2018: Strategy for Economy / Yearbook

Overall, Economy is not an easy section, but at the same time, it was not a sadistically tough & complex section UNLIKE HISTORY & Culture.

As you can see, ~50% of the Economy / Yearbook type MCQs could be solved from the routine prep source, and you’re not required to have 100 MCQs correct to clear prelims. So…

- Begin with the second video in Mrunal’s BES17 Lecture Series. Large chunk of theory & contemporary issues already covered in it from exam point of view- be it banking sector evolution, RBI & Monetary Policy, Inflation, HDI, GDP or GST. UPSC has bad habit of asking questions from events /issues that occurred 2-3 years back so it’s not completely irrelevant, yet. Yes, events / figures continue to update (E.g. new type of cess surcharges on income tax, new schemes, bi-monthly monetary policy updates). But either I’ve given them in form of articles at Mrunal.org/economy ,and if I’ve not updated xyz details, then you could do it yourself in the videos’ powerpoints available at Mrunal.org/powerpoint

- Among the loyal patrons there is unhappiness that I didnot release BES18 series. But BES17 is my magnum opus, like Kanti Shah’s Gundaa: ~10 Easy to Medium level MCQs could be solved from it even in Prelims-2018. And even if I had created new lecture series, I would not have covered those tough MCQs like FSSAI, Teachers’ qualification, NSSO data or equalization tax. Besides Budget and Economic survey 2018 had only a handful of exam-worthy developments, which I’ve already given in the gist-articles.

- Daily Indianexpress, and whichever PDF compilation you like. Don’t try to be Harry Potter’s Half-Blood prince that “I’ll create my own note by combining the compilations of 3 different PDFs” or that “I’ll create my own notes from theHindu”. Else you’ll get tired in finishing the course.

- It’s true that PDF compilations had limited utility in the last two prelims, but they help you keep tabs on current / contemporary developments. Besides, Mains is not an exam to to find best answer but less bad answer than others. Read the toppers interviews– nobody is trying to be Half-Blood Prince anymore, neither should you. Whatever material is available readymade- try to make do with that, as and where possible.

- When it’s published India Yearbook 2019 by Ministry of Information and Broadcasting. Selective study of selective chapters related to economy / HRD will prove beneficial.

- When it’s published Budget 2019 and Economic Survey 2018-19 from indiabudget.nic.in. For Mains, you should even read previous surveys- atleast the introduction and conclusion of each chapter.

- Government’s Yojana and Kurukshetra Magazines also have their utility, particularly at the mains stage. You can download them for free, or subscribe at a very nominal rate.

- Those wishing to appearing in Mains in Hindi / Gujarati / Marathi medium face the challenge of translating terminology. This can be accomplished by referring to Ramesh Singh’s Indian Economy book in Hindi, NCERT/NIOS in Hindi and the Economic Survey in Hindi.

- Read NCERT Class11 India’s Economic Development (useful for Mains also) and Class12 Macroeconomics (Selective, incl. Glossary).

Ignore / Low Priority

- If time permits you may go for selective study of NIOS’s Economy (Code-214) PDF | हिंदी में भी उपलब्ध | ગુજરાતીમાં પણ ઉપલબ્ધ. As such barring a few chapters, it overlaps with NCERT hence give low priority.

- If time and mood permits: Mrunal’s Microeconomics Lecture Part #1 and Part #2. Because it’s not asked regularly each year, so you’ve to study / skip as per your taste in economics. However, looking at the toughness of other sections in Prelims-2018, it’ll be a wise investment / insurance to prepare Microeconomics- even if it gains you just one MCQ in Prelims-2019.

- IGNORE NCERT Class12 Microeconomics. Because that and much more is already covered in my above two lectures. At max, you may read glossary of this textbook.

- It’s true that some of Prelim-2018 questions could be solved from NCERT Class 12 Business Studies, and a similar trend is also visible in the previous CDS/CAPF exams but the nature of those MCQs is such that, it could be solved even without having gone through a full-fledged textbook. In short, you may ignore / give low priority.

- Mishra Puri, Dutt Sundaram, Uma Kapila etc. they’re all good books but their utility is negligible in since the Mains-syllabus change of 2013. These older academic books are too much centered around 60s to 90s, whereas nowadays Mains-GS economy is mostly centered around the contemporary themes given in earlier Economic Surveys. do look at the Economy questions in the mains papers of GSM3 (2013-17) here, then you’ll get the idea.

Detailed Solutions for Economy-Yearbook MCQs in Prelims-2018

Banking & Finance

Q21. Which one of the following best describes the term “Merchant Discount Rate” sometimes seen in news ? (Pre18 Set-D)

- The incentive given by a bank to a merchant for accepting payments through debit cards pertaining to that bank.

- The amount paid back by banks to their customers when they use debit cards for financial transactions for purchasing goods or services.

- The charge to a merchant by a bank for accepting payments from his customers through the bank’s debit cards.

- The incentive given by the Government, to merchants for promoting digital payments by their customers through Point of Sale (PoS) machines and debit cards.

Difficulty: Easy, repeatedly in news after demonetization. It was covered both in my lecture and article.

Answer: Mrunal’s Youtube Lecture BES171/E-Payment #1: MDR, PoS, Interoperability

- Merchant Discount Rate (MDR) is the fee borne by the merchant for using credit and debit card payment system. So C is the correct definition.

- To encourage digital transactions, Ministry of Electronics and information technology (MEITY) had announced that from 1 January 2018 for the next two years, it’ll bear the MDR fees of merchants, for payments up-to Rs.2,000/- IF such payment is made via debit card, BHIM or Aadhar enabled payment system. But that itself is not the definition of MDR hence D is wrong.

Q81. With reference to the governance of public sector banking in India, consider the following statements (Pre18 Set-D)

- Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

- To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected.

Which of the statements given above is/are correct ?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Difficulty: Tough because data-interpretation asked in first statement, and by logical-guessing it’d seem correct that Government is in habit of throwing good money after bad money (as in the case of Air India). but such logical guessing is incorrect.

Answer:

- First statement is wrong because it is not steadily increasing, there have been falls in between. Graph Taken from IndianExpress-2017-July. Last year also similar data-interpretation was asked and UPSC examiner went with the literal expression of ‘steadily increasing’ hence we’ve to go by that only and disregard the ‘cumulative amounts’ under the Indradhanush (70k crore) and EASE package (2.11 lakh crore).

- Second statement is right. Mrunal’s Youtube Lecture Banking Classification #2: Nationalized PSBs, Merger of SBI Associate Banks & Mahila Bank (BMB). Same was also recommended / observed in Economic Survey that we’ve to ‘consolidate’ the public sector banks to improve their efficiency.

Q73. With reference to digital payments, consider the following statements: (Pre18 Set-D)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Difficulty: Tough because second statement asks technical details of BHIM. Yes it’s given in Indianexpress, but difficult to document and memorize all that on the night before exam.

Answer:

- BHIM App was launched in 2016, it allows money transfer to UPI-enabled bank accounts via Aadhar Enabled Payment system. [Ref: India Yearbook 2018 | हिंदी में भी उपलब्ध ch.8 on Communication] so, #1 is right.

- The BHIM apps has three levels of authentication. For one, the app binds with a device’s ID and mobile number, second a user needs to sync whichever bank account (UPI or non-UPI enabled) in order to the conduct transaction. Third, when a user sets up the app they are asked to create a pin which is needed to log into the app. Hence #2 is wrong. [Ref: IndianExpress-2017-Jan]

Guessmaster-giriTM helps narrowing down choices, if you go by their GM-Rule#2 that dates and figures are always wrong then #2 ough to be wrong, you’re left with A vs D.

Q61. Consider the following statements: (Pre18 Set-D)

- Capital Adequacy Ratio (CAR) is the amount that banks have to maintain in the form of their own funds to offset any loss that banks incur if the account-holders fail to repay dues.

- CAR is decided by each individual bank.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Difficulty: Easy for anyone who has studied Mrunal’s Youtube Lecture or Article on BASEL-III norms.

Answer: CAR formula is decided by by BASEL-III Committee on Banking supervision and implemented by the central bank of individual member-country. So, #2 is right, whereas #1 is correct.

Q41. Consider the following statements: (Pre18 Set-D)

- The Reserve Bank of India manages and services Government of India Securities but not any State Government Securities.

- Treasury bills are issued by the Government of India and there are no treasury bills issued by the State Governments.

- Treasury bills offer are issued at a discount from the par value.

Which of the statements given above is/are correct?

- 1 and 2 only

- 3 Only

- 2 and 3 only

- 1, 2 and 3

Difficulty: Tough, because of second statement not covered in routine prep. sources. So, I’m counting its source under “RandomGK”

Answer:

- RBI is Banker / Debt manager for both State and Union Government, so #1 is wrong.

- According to Dept of Economic Affairs,

- Short-term debt of the Central Government on residual maturity basis includes 14-day intermediate treasury bills, regular treasury bills, dated securities maturing in the ensuing one year and external debt with remaining maturity of less than one year.

- Short-term debt of State Governments comprises internal debt that includes market loans maturing within next one year, and repayment of loans to Centre. Therefore, #2 is right.

- T-bills are sold at discount and re-purchased at par value (face value). So, #3 is right. Watch Mrunal’s Youtube Lecture on Financial Securities to study this.

Anti-GuessmasterTM question because if we go by their GM-Rule#1 then both statement 1 and 2 are extreme-worded statements so they’ve to be wrong but then you arrive at the wrong answer B: 3 only.

Q31. Which one of the following statements correctly describes the meaning of legal tender money ? (Pre18 Set-D)

- The money which is tendered in courts of law to defray the fee of legal cases

- The money which a creditor is under compulsion to accept in settlement of his claims

- The bank money in the form of cheques, drafts, bills of exchange, etc.

- The metallic money in circulation in a country

Difficulty: Easy, given in NCERT Class12, covered in Mrunal’s YouTube Lecture and had been in news because latest budget said cryptocurrencies are not legal tenders in India.

Answer: Legal tender– is a fiat money which cannot be refused by any citizen of the country for settlement of any kind of transaction. So, B is the appropriate description.

Q30. Which one of the following links all the ATMs in India ? (Pre18 Set-D)

- Indian banks’ Association

- National Securities Depository Limited

- National Payments Corporation of India

- Reserve Bank of India

Difficulty: Easy, has been in news after demonetization and covered verbatim in my lecture series.

Answer: Mrunal’s Youtube Lecture on Banking Transactions Part #2

- NPCI’s NFS system runs it. So, C is the correct answer.

- Some Hairsplitters are engaged in hairsplittery that RBI looks after this. But according NPCi’s official page Till 2009, RBI’s Institute for Development and Research in Banking Technology (IDRBT) provided the linkages to ATM network in India but afterwards, it was taken over by NPCi’s National Financial Switch (NFS).

Budget, Taxation, Public Finance

Q24. Consider the following statements (Pre18 Set-D)

- The Fiscal Responsibility and Budget Management ( FRBM) Review Committee Report has recommended a debt to GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Governments.

- The Central Government has domestic liabilities of 21% of GDP as compared to that of 49% of GDP of the State Governments.

- As per the Constitution of India, it is mandatory for a State to take the Central Government’s consent for raising any loan if the former owes any outstanding liabilities to the latter.

Which of the statements given above is/are correct?

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Difficulty: Medium. Although statement#2 has data-interpretation but I’m not classifying it as tough because if you’ve studied the basics of the FRBM Panel, then you’d know that 1 and 2 can’t be both correct simultenously.

Answer:

- Mrunal’s Youtube lecture on FRBM Review Committee: First statement is right, and since Panel recommended Government to reduce the debt to GDP, so, definitely Central Government’s present domestic liability couldn’t be 21% otherwise it’d negate statement #1. So, #2 is wrong. Still, just to crosscheck: the Domestic liability figures given in Economic Survey 2017-18’s Statistical Appendix A61: they’ve been in the range of 54% to 47% of GDP each year during 2008 to 2017 for the Union Government so, #2 is wrong. This eliminates B and D.

- Statement#3 is right. Ref: M.Laxmikanth ch. 14 on Central State relations. Thus, by elimination we get correct answer C.

- Some people are engaged in Hairsplittery that “Budget-2018’s Fiscal strategy statement committed to reduce Central debt to 40% of GDP by FY2024-25 so #1 can’t be right”. But here statement is in context of NK Singh’s Committee report, and he had given 2023 as deadline, so we need not bother about postponed-deadline for this MCQ.

Q82. Consider the following items: (Pre18 Set-D)

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempted under GST (Goods and Services Tax)?

- 1 only

- 2 and 3 only

- 1, 2 and 4 only

- 1, 2, 3 and 4

Difficulty: Medium.

Answer:

- By default, fresh unbranded agriculture items are exempt from GST. So, if Fish is canned and processed = some GST % would be levied. By elimination we are left with either A or C.

- Debate wars were mainly centred around: “if Chicken eggs cooked in 5 star hotels’ it’ll be subjected of GST. So answer should be ‘A’, whereas others disagreed that it’s asking about eggs in simple manner without overstretching the origin of cooking so answer should be C.

Official UPSC Answer – C: cereal grains, cooked eggs and newspapers not subjected to GST.

Q86. Regarding Money Bill, which of the following statements is not correct? (Pre18 Set-D)

- A bill shall be deemed to be a Money Bill if it contains only provisions relating to imposition, abolition, remission, alteration or regulation of any tax.

- A Money Bill has provisions for the custody of the Consolidated Fund of India or the Contingency Fund of India.

- A Money Bill is concerned with the appropriation of moneys out of the Contingency Fund of India.

- A Money Bill deals with the regulation of borrowing of money or giving of any guarantee by the Government of India.

Difficulty: Money bill controversy was in news due to Budget-2017 wherein many unrelated items were packed into finance bill so that finance bill = money bill bolke Rajya Sabha scrutiny could be avoided. Given MCQ is tough because the routine understanding about Contingency fund is that it’s under president and doesn’t require parliamentary approval, hence “C” looks very tempting.

Answer: Since this MCQ has generated lot of fierce debate and Hairsplittery so Laxmikanth or any other ordinary source will not suffice. Let’s first list the provisions of Constitution of India: Part-V: Article 110

- 110/1/(a): the imposition, abolition, remission, alteration or regulation of any tax;

- 110/1/(b): the regulation of the borrowing of money or the giving of any guarantee by the Government of India, or the amendment of the law with respect to any financial obligations undertaken or to be undertaken by the Government of India;

- 110/1/(c): the custody of the consolidated Fund or the Contingency Fund of India, the payment of moneys into or the withdrawal of moneys from any such Fund;

- 110/1/(d): the appropriation of moneys out of the consolidated Fund of India;

- 110/1/(e): the declaring of any expenditure to be expenditure charged on the Consolidated Fund of India or the increasing of the amount of any such expenditure;

- 110/1/(f): the receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money or the audit of the accounts of the Union or of a State; or

- 110/1/(g): any matter incidental to any of the matters specified in sub clause (a) to (f)

Depending on how you interpret these provisions, your answer may vary.

Official UPSC Answer – C statement.

Anti-Guessmaster-giriTM if you go by their GM-Rule#1 extreme worded statements are always wrong, so #A ought to be wrong, as it contains the extreme word “only”. but official UPSC answerkey kept ‘C’ as correct.

Q23. With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct? (Pre18 Set-D)

- It is introduced as a part of the Income Tax Act.

- Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Difficulty: Tough because technical details asked, and this tax was not in high-profile news items in last one calendar year. Ofcourse, Sapna-Theorists are claiming that you were to get divination about this tax in context of BEPS (Base Erosion and Profit Shifting)- but even BEPS had been faded out of news in the recent times. ये लोग कुछ भी बकते रहेते है की यूपीएससी का हरेक प्रश्न अद्भुत व प्रशंसा के पात्र है, और आपको सपना आ जाना चाहिए था की वो प्रश्न पूछा जाने वाला था.

Answer:

- This levy would fall under a separate, self-contained code and would not be part of the Income Tax Act, 1961. So, #1 is wrong, says Ernst & Young’s consultancy paper

- The term income tax is defined in double tax avoidance agreements to be mean ‘Indian income tax’. As the levy is not in the nature of income tax, and this levy is currently imposed under domestic tax laws and hence no credit is available under tax avoidance treaties, says Deloitte consultancy paper

Intl. Trade & Balance of Payment (BoP)

Q71. India enacted The Geographical Indications of Goods (Registration and Protection) Act, 1999 in order to comply with the obligations to (Pre18 Set-D)

- ILO

- IMF

- UNCTAD

- WTO

Difficulty: Easy, for those who’ve prepared the International organization. Because even if you didnot know exact answer WTO, atleast you could eliminate the first three for being irrelevant.

Answer: Under WTO–> Trade related Intellectual property rights (TRIPS), the Member nations have to respect geographical indications. Government of India enacted Geographical Indications of Goods (Registration and Protection) Act in 1999. (Came into force in 2003). Ref: Mrunal’s Article on GI Tags.

Q89. Consider the following countries : (Pre18 Set-D)

- Australia

- Canada

- China

- India

- Japan

- USA

Which of the above are among the ‘free-trade partners’ of ASEAN ?

- 1, 2, 4 and 5

- 3, 4, 5 and 6

- 1, 3, 4 and 5

- 2, 3, 4 and 6

Difficulty: Easy, this topic has been regularly in focus by last three years’ economic surveys in context of RCEP, TPP and TATIP.

Answer: Mrunal’s Lecture BoP#3: at 24th minute

- RCEP about ASEAN plus its free trade partners which includes: China, India, Japan, Korea, Australia and Newzealand.

- Canada (#2) and USA (#6) is definitely not there, so A, B and D are removed. Thus by elimination, we are left with answer C.

Sectors of Economy: Agriculture

Q18. As per the NSSO 70th Round “Situation Assessment Survey of Agricultural Households”, consider the following statements (Pre18 Set-D)

- Rajasthan has the highest percentage share of agricultural households among its rural households.

- Out of the total agricultural households in the country, a little over 60 percent belong to OBCs.

- In Kerala, a little over 60 percent of agricultural households reported to have received maximum income from sources other than agricultural activities.

Which of the statements given above is/are correct?

- 2 and 3 only

- 2 only

- 1 and 3 only

- 1, 2 and 3

Difficulty: Prima-facie it looks like a tough MCQ because random data interpretation asked from a Government report published 5 years ago. But, if you pay careful attention, the examiner is teasing you. OBC reservation is 27%, their total population is around 40% so OBC having 60% agro-households at all India level, is rather farfetched hyperbole. So, #3 ought to be wrong and by elimination you get the right answer. Still I put this under tough difficulty level, because after exam it’s possible to think of all such wisdoms and logical eliminations but in real-exam stress it’s not always possible.

Answer: According to the Gist of said NSSO report on PIB-2017-Dec: Out of the total estimated agricultural households in the country, about 45% to OBC, 16% to SC and 13% to ST. So, #2 is wrong. By elimination we are left with option C.

Guessmaster-giriTM irrelevant because their GM-Rule#2 says dates / figures always wrong then all three statements ought to be wrong but there is no such option, so examiner was teasing them as well.

Q78. Consider the following: (Pre18 Set-D)

- Areca nut

- Barley

- Coffee

- Finger millet

- Groundnut

- Sesamum

- Turmeric

The Cabinet Committee on Economic Affair, has announced the Minimum Support Price for which of the above?

- 1, 2, 3 and 7 only

- 2, 4, 5 and 6 only

- 1, 3, 4, 5 and 6 only

- 1, 2, 3, 4, 5, 6 and 7

Difficulty: Easy for anyone who has prepared Agriculture related schemes.

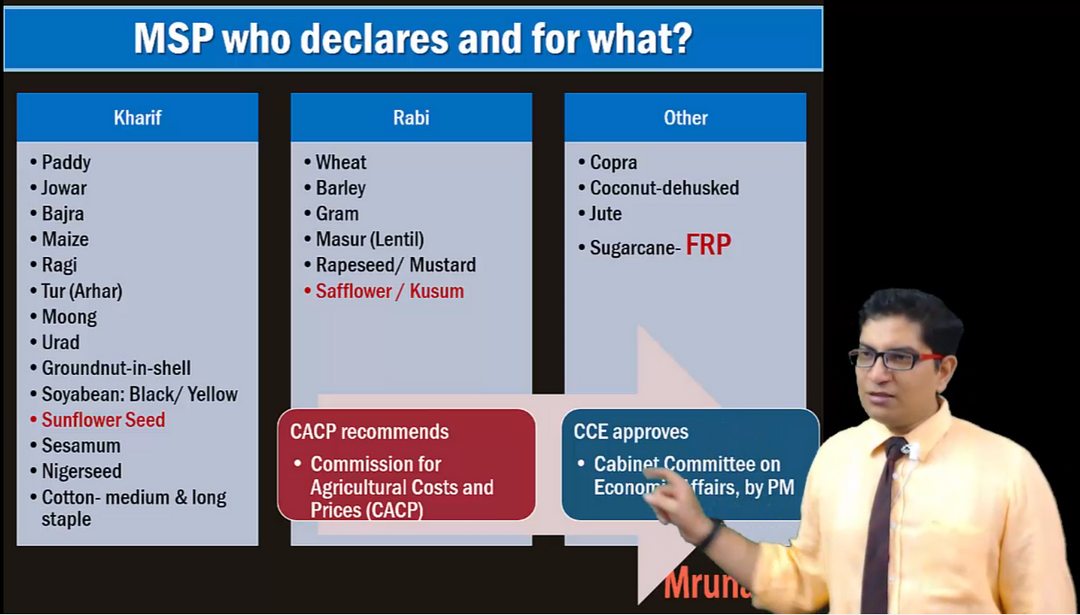

Answer: Mrunal’s Youtube Lecture BES164/P2: Agriculture OR India Yearbook 2018 | हिंदी में भी उपलब्ध ch. 4 on Agriculture.

- Government announces MSP on 23 crops. These include seven cereal crops (paddy, wheat, jowar, bajra, maize, ragi and barley), five pulse crops (gram, tur, moong, urad and lentil), seven oilseeds (groundnut, sunflower seed, soyabean, rapeseed, mustard, safflower, nigerseed and seasmum), copra (dried coconut), cotton, raw jute and sugarcane.

- So, Coffee is not in the list, #3 is wrong, by elimination we get correct answer B.

Guessmaster-giriTM is possible. GM-Rule#5 “Word association”: Area Nut (Supaari) is a demerit good / oral-cancer agent so CCEA wouldnot encourage its cultivation by offering MSP. Coffee is not widely cultivated all over India that CCEA would feel the vote-bank compulsion to declare its MSP! IF you eliminate using either association, you get the right answer. But to apply GM-Rule#5 at such depth, requires background knowledge, so, can’t say you could have solved it without studying anything.

Q25. Consider the following statements (Pre18 Set-D)

- The quantity of imported edible oils is more than the domestic production of edible oils in the last five years.

- The Government does not impose any customs duty on all the imported edible oils a special case.

Which of the statements given above is/are correct

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Difficulty: Tough, because first statement requires data interpretation of random Government report. Yes, by default Indian agriculture is in pathetic situation, so we ought to be importing more edible oil than what we are producing but those who’ve burned their hands with ‘Tax:GDP steadily-increasing / decreasing’ type Data interpretation questions in Prelims-2017, they’ll not just tick it without knowing the exact data.

Answer: First statement is right as per ICAR report. If we look at the budget documents of last three year, Government does impose custom duty on imported edible oils, so, #2 is a hyperbole wrong statement.

GM-Rule#1 extreme worded statements are always wrong, so #2 ought to be wrong but this only helps us narrowing down the choices between A vs D. But, subsequently, if you apply GM-Rule#2 that “Dates / figures” are always wrong then you arrive at wrong answer “D”.

Macro & Micro Economics

Q32. If a commodity is provided free to the public by the Government, then (Pre18 Set-D)

- the opportunity cost is zero.

- the opportunity cost is ignored.

- the opportunity cost is transferred from the consumers of the product to the tax-paying public.

- the opportunity cost is transferred from the consumers of the product to the Government.

Difficulty: Tough, because candidates ignore Microeconomics since it’s not regularly asked in civil services exam (CSE), unlike the combined defense services exam (CDS). And when you’ve not studied the actual theory, then blind guessing / bluffing about ‘opportunity cost’ will most likely cost negative -0.66 marks.

Answer: Mrunal’s Youtube Lecture on Microeconomics part1

- As per microeconomics, opportunity cost is zero for free goods such as Air and common goods such as fish / grazing land. For public goods such as street light and defense, opportunity cost is involved (Government could have spent that much money on street lights rather than on military) so, opportunity cost is not zero. Option A is wrong.

- Even though the consumer is getting it for free, the opportunity cost (of that commodity) is transferred to the Government. We can’t say that it’s transferred to the tax-payers because tax-payers don’t have direct control over how / where the Government will spend that money. Additional References: Random Google book1 and book2

- People were divided over C or D- some interpreting that opportunity cost is borne by the Decision Maker (Government), while others saying opportunity cost is borne by the person who eventually pays for it (Tax payer). It was difficult to ascertain from the standard books.

- Official UPSC Answer – C: opportunity cost transferred to tax payers.

Q35. Despite being a high saving economy, capital formation may not result in significant increase in output due to (Pre18 Set-D)

- weak administrative machinery

- illiteracy

- high population density

- high capital-output ratio

Difficulty: Easy, for those aware with GDP theory. Capital formation as a topic was in discussion because of the latest economic survey’s remarks in context of NPA / we’ve narrow window to become a developed country.

Answer: NCERT Textbook Class12 Biz. Studies Ch.13 on Entrepreneurship Development, Page 391

- Capital Output Ratio (ICOR) measures the percentage increase in capital formation required obtaining a percentage increase in GDP. Entrepreneurs, by investing their own savings and informally mobilising the savings of their friends and relatives contribute to the process of capital formation. These informal funding supplements the funds made available by the formal means of raising resources from banks, financial institutions and capital markets.

- So, “D” is the fitting option- if capital to output ratio is high then capital formation may not result in significant increase in the output.

Guessmaster-giriTM possible, if we go by their GM-Rule#5 “Word association”, then D is the fitting answer #WITHOUT-STUDYING-ANYTHING..

Infrastructure: physical, digital

Q91. Which of the following is/are the aim/aims of “Digital India” Plan of the Government of India? (Pre18 Set-D)

- Formation of India’s own Internet companies like China did.

- Establish a policy framework to encourage overseas multinational corporations that collect Big Data to build their large data centres within our national geographical boundaries.

- Connect many of our villages to the Internet and bring Wi-Fi to many of our school, public places and major tourist centres.

Select the correct answer using the code given below

- 1 and 2 only

- 3 only

- 2 and 3 only

- 1, 2 and 3

Difficulty: Easy for anyone who prepared major schemes and initiatives of the Modi Government.

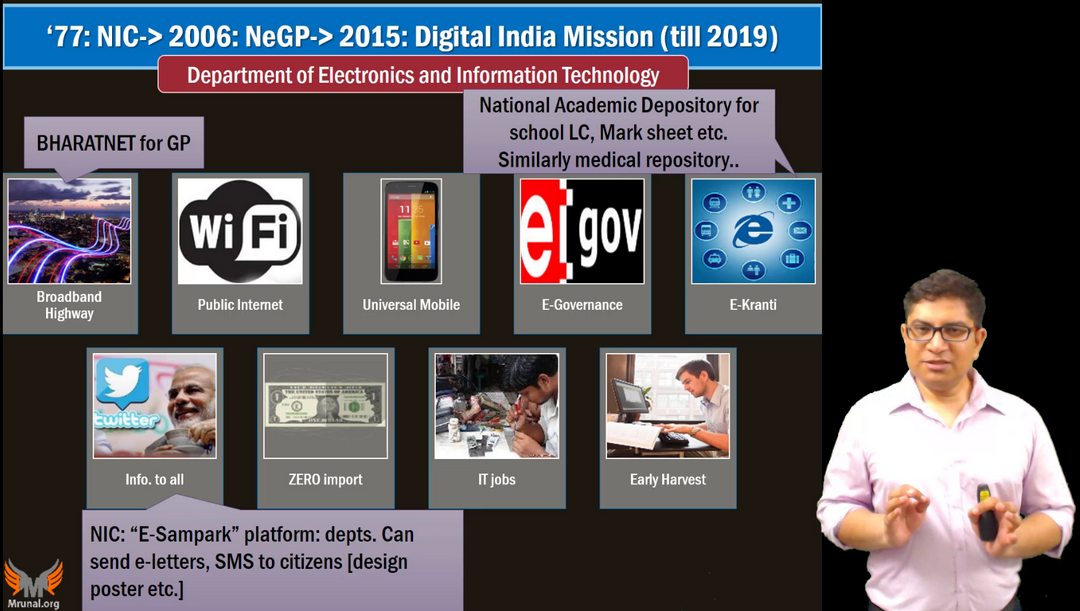

Answer: Mrunal’s Youtube Lecture on Infrastructure Part#1 OR India Yearbook 2018 | हिंदी में भी उपलब्ध Ch. 8 on Communication

- Digital India programme has three vision areas namely, digital infrastructure as a utility for every citizen, governance and services on demand and digital empowerment of citizens by bridging the digital divide in the country.

- Hence #1 and #2 are irrelevant / hyperbole / Birbal-Khichdi, and by elimination we are left with answer B: 3 only.

Human Development / Poverty

Q33. Increase in absolute and per capita real GNP do not connote a higher level of economic development, if (Pre18 Set-D)

- industrial output fails to keep pace with agricultural output.

- agricultural output fails to keep pace with industrial output.

- poverty and unemployment increase.

- imports grow faster than exports.

Difficulty: Easy, covered in NCERT / NIOS Economics textbooks.

Answer: NIOS Economics Textbook Page 32:

- Economic development includes not only economic growth but also various other economic changes that improve the quality of life or standard of living of people in a country.

- If with economic growth, a country experiences various economic changes such as reduction in poverty and unemployment, reduction in income and wealth inequality, increase in literacy rate, improvement in health and hygiene, etc, that improve the quality of life then that is economic development.

- So, C is the fitting choice.

Q70. With reference to the provisions made under the National Food Security Act, 2013 consider the following statements: (Pre18 Set-D)

- The families coming under the category of ‘below poverty line (BPL)’ only are eligible to receive subsidised grains.

- The eldest woman in a household, of age 18 years or above, shall be the head of the household for the purpose of issuance of a ration card.

- Pregnant women and lactating mothers are entitled to a take-home ration’ of 1600 calories per day during pregnancy and for six months thereafter.

Which of the statements given above is/are correct?

- 1 and 2

- 2 only

- 1 and 3

- 3 only

Difficulty: Medium because half of it available in routine prep. sources (BPL), but the other half (1600 cal) is not- so I’m counting its source as “RandomGK”.

Answer: Mrunal Youtube lecture on BES176/Human Dev #2: Poverty & Hunger or Alternative source: India Yearbook 2018 | हिंदी में भी उपलब्ध ch.15 on Food and civil supplies.

- In 2013, NFSA was enacted to provide food security to 67% of the population in the form of highly subsidized foodgrains at Rs. 2 and 3 per Kg for wheat and rice respectively. Beneficiaries are identified using SECC methodology so even non-BPL will also benefit. So, #1 is wrong.

- Pregnant women and lactating mothers are entitled to a nutritious “take home ration” of 600 Calories (NOT 1600) and a maternity benefit of at least Rs 6,000 for six months, says the official Act So #3 is wrong. By elimination, we are left with correct answer B: only 2.

- Let’s also take this opportunity to check guaranteed calories for other category of beneficiaries, LEST this is asked in next exam!

Guessmaster-giriTM possible. GM-Rule#1 extreme worded statements are always wrong, so #1 ought to be wrong because it says “ONLY BPL Eligible.” GM-Rule#2 dates and figures are always wrong so, #3 ought to be wrong. Thus we can arrive at correct answer B: only 2 #WITHOUT-STUDYING-ANYTHING..

Q66. Consider the following statements : (Pre18 Set-D)

- As per the Right to Education (RTE) Act, to be eligible for appointment as a teacher in a State, a person would be required to possess the minimum qualification laid down by the concerned State Council of Teacher Education.

- As per the RTE Act, for teaching primary classes, a candidate is required to pass a Teacher Eligibility Test conducted in accordance with the National Council of Teacher Education guidelines.

- In India, more than 90% of teacher’s education institutions are directly under the State Governments.

Which of the statements given above is/are correct?

- 1 and 2

- 2 only

- 1 and 3

- 3 only

Difficulty: Tough because half is available in India Yearbook, the remaining half requires technical details from the original act.

Answer:

- India Yearbook 2018 | हिंदी में भी उपलब्ध ch. 10 on Education: After RTE, it is mandatory that only those people may be appointed as teachers who are able to clear TET. So, #2 is right, this eliminates C and D.

- original Act uploaded on HRD Website: Under RTE Act section 23, National Council for Teacher Education (NCTE) decides the minimum qualification. So, #1 is wrong. Thus we are e left with Ans. B.

Guessmaster-giriTM helps narrowing down choices, if you go by their GM-Rule#2 that dates and figures are always wrong then #3 ough to be wrong, you’re left with A vs B.

Q48. With reference to Pradhan Mantri Kaushal Vikas Yojana, consider the following statements (Pre18 Set-D)

- It is the flagship scheme of the Ministry of Labour and Employment.

- It, among other things, will also impart training in soft skills, entrepreneurship, financial and digital literacy.

- It aims to align the competencies of the unregulated workforce of the country to the National Skill Qualification Framework.

Which of the statements given above is/are correct ?

- 1 and 3 only

- 2 only

- 2 and 3 only

- 1, 2 and 3

Difficulty: Medium, because half is given in IYB, rest requires ‘about us’ Page of Skill Ministry.

Answer: India Yearbook 2018 | हिंदी में भी उपलब्ध ch.21 on Labour and Skill Development:

- PMKVY is the flagship outcome-based skill training scheme of the Ministry of Skill Development and Entrepreneurship (MSDE). So, #1 is wrong

- Ministry of Skill Development is created with core focus on converging all skill development initiatives in the country under one National Skills Qualification Framework (NSQF). So, #3 ought to be right. Thus by elimination we get the answer C: 2 and 3 only.

Guessmaster-giriTM helps narrowing down choices. If you go by their GM-Rule#3 that parent organizations are always wrong then #1 ought to be wrong and your choices are narrowed down between B vs C.

Q34. Consider the following statements: Human capital formation as a concept is better explained in terms of a process, which enables (Pre18 Set-D)

- individuals of a country to accumulate more capital.

- increasing the knowledge, skill levels and capacities of the people of the country.

- accumulation of tangible wealth.

- accumulation of intangible wealth.

Which of the statements given above is/are correct?

- 1 and 2

- 2 only

- 2 and 4

- 1, 3 and 4

Difficulty: Easy for those who’ve prepared Human development basics from NCERT.

Answer: NCERT Class11 India’s Economic Dev. Ch. 5 on Human Capital formation

- Page 91: Human capital formation is the outcome of investments in education, health, on-the-job training, migration and information.

- Page 86: A substantial part of the human capital formation takes place in one’s life when she/he is unable to decide whether it would maximise her/his earnings. Children are given different types of school education and health care facilities by their parents and the society. The peers, educators and society influence the decisions regarding human capital investments even at the tertiary level, that is, at the college level. Moreover, the human capital formation at this stage is dependent upon the already formed human capital at the school level. Human capital formation is partly a social process and partly a conscious decision of the possessor of the human capital

- Yes, such educated / skilled person will then get a decent job or start business, from where he’ll acquire both tangible wealth (such as car & bungalow) and intangible/financial wealth (such as currency, certificates of deposit, stocks, bonds etc.). But, that “outcome” is irrelevant in explaining the “process of Human capital formation”, because even an illiterate farmer could also buy an Audi car, if his ancestral farm was located in a prime area & sold off to a businessman. Thus, only #2 is the fitting option.

- However, when we consider – Intangible wealth also includes patents and intellectual property rights- so if more patents are generated it shows population is more educated- pointing to human capital formation. Whereas some people countered it that intangible wealth could have been acquired by foreigners or only a handful of rich people. So answer could be B or C.

Official UPSC Answer – C: 2 and 4 are correct.

Misc: Yearbook Organizations

Q68. Consider the following statements (Pre18 Set-D)

- The Food Safety and Standards Act, 2006 replaced the Prevention of Food Adulteration Act, 1954.

- The Food Safety and Standards Authority of India (FSSAI) is under the charge of Director General of Health Services in the Union Ministry of Health and Family Welfare.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Difficulty: Tough, because “About us” type question from a low-profile government organization.

Answer: From FSSAI’s about us page:

- After the formation of the FSS Act, 2006 a number of Acts and Orders that no longer served any purpose were repealed viz. The Edible Oils Packaging (Regulation) Order 1998, Fruit Products Order (FPO), 1955, Meat Food Products Order (MFPO), Prevention of Food Adulteration Act,1954 etc. So, #1 is right.

- While FSSAI acts under the Administrative control of Health ministry, FSSAI has an independent chairperson enjoying rank of Secretary to Government of India. So, #2 is wrong.

Guessmaster-giriTM helps narrowing down choices. If you go by their GM-Rule#3 that parent organizations are always wrong then #2 ought to be wrong and your choices are narrowed down between A and D.

![[Download] Topicwise UPSC GSM2-2023 Paper- polity, Governance international relations in Hindi and English with topic wise analysis](https://mrunal.org/wp-content/uploads/2023/09/ana-gsm2-2023-mrunal79-500x383.png)

1. Mrunal sir dekho even OECD says that Human Capital is the most important intangible wealth..

https://www.oecd-ilibrary.org/docserver/5k4840h633f7-en.pdf?expires=1530289746&id=id&accname=guest&checksum=DF20EA7B4C1122AD2E6D5891E52DEDD1..

2. and how can you get Money Bill question wrong , no bill is required to withdraw money out of Contingency Fund, Bill is presented to withdraw money from Consolidated Fund to replenish the amount spent from Contingency Fund

With regard to your answer key on economy section 2 contradictions —

(1) Q.81 it mentions GST on newspapers containing advertising materials i.e it means those newspaper that contain ads and the GST is then 0% and the HSN code is 4902 . It clearly mentions ” Newspapers, journals and periodicals,

whether or not illustrated or containing advertising material ” has nil rate of GST.

What you have pointed out is 5% on the ad space in the newspaper but the question is not asking about the ad space but the collectively the newspaper. So any coaching wala if wants to put an ad in the Hindu , they have to pay GST but we students while paying rs. 10 do not pay GST.

(2) Q.86 Had it been the case that money bill deals with appropriation out of the contigency fund also, then Article 110 (1) (d) would have mentioned it also….it clearly and only mentions Consolidated fund of India……{ and not contigency fund }

Kindly respond to it if you find these concerns genuine.

I have been following all your post regarding answer key and since this being last, where do you see the cut off going this year sir.

http://pib.nic.in/newsite/PrintRelease.aspx?relid=170186

Please go through this I hope it will clear your doubt

in q 34 intangible wealth does not necessarily connote financial wealth but wealth in terms of number of patents issues, publications etc etc… well i have market it as C lets see now and happy to see someone finally correcting Q 86.

Thanks Sir,

Just because obc percentage is 40% of the overall population, guessing that agri household obc proportion would roughly be the same is a logical fallacy. The underlying assumption that’ agri population is representative’ may not be true (who knows if agri is more preferred among obcs?)

q 34 intangible wealth does not necessarily mean financial wealth, it can be patents issues or publications etc etc… thanks sir for correcting q 86

Mrunal sir looking at the kind of pre exam this time around the expected cut off according to you will be?

Looks like mrunal was in haste while giving the answer key..

Clearly Money will wala option c) says appropriation out of contingency fund..there is no “appropriation” out of this fund..

Similarly intangible wealth wala also..

Mrunal’s these 2 answer will definitely be wrong..

Looks like this site has started to see its fall..!

I hope mrunal will reinvest himself to support many others who awaits his old avtaar..!

Bill*

Reinvent*

Auto correct sucks

Money bill wrong hai Aur human capital formation bhi…. Kya ho gya Mrunal bhai

There is no concept of “appropriation ” in contingency fund, isn’t that the whole point of contingency fund?

People raising doubts over Mrunal Sirs answer for Human Capital should check NCERTs. Mrunal sir avoids intution. Last year on the same basis he said RTV to be constitutional. Rest is upto UPSC.

Bhai NCERT me intangible wealth diya hai human capital ka….

Human capital ka answer wrong hai according to me kyunki intangible wealth is necessary character of human capital…. How will society function without intangible wealth and how human capital formation will occur without it ?

What is intangible wealth? .. If you are thinking of skills, education, then it is already there as separate option.. Acc to WB, it refers to wealth created by functioning institutions, ie trust among people in a society, an efficient judicial system, clear property rights and effective government. Mainly Rule of Law (enforcement of contracts) has biggest share in intangible wealth..Hope that helps..

However i think the examples Sir gave are even more appropriate to define intangible wealth accumulation by ‘individuals’..ex shares, bonds, etc

Now whether UPSC meant accumulation of intangible wealth by ‘individuals’ or ‘by country’ only UPSC knows..either way its wrong

Bhai (or maybe behen :p), intangible wealth accumulation is due to skills, education etc. and these opportunities can’t be equated to be one and the same as intangible wealth… After skills acquisition, education awareness, the people in the society will have trust among them, certain level of understanding, effective governance i.e. intangible and tangible wealth are the effects…. People will also acquire tangible wealth but that doesn’t necessarily mean human capital formation, but intangible surely complements human capital formation…. Anyway, better not to argue as without upsc key, we are like “andho me kaana raja”.

acc to WB Human Capital is the most important intangible wealth

Thanks sir.

Sir this is one area i have done well in prelims all thanks to your articles. i’m fan of your work

Sir. Please publish your lecture series in English too. The non-Hindi speakers of India who form 55% of the population are not able to understand. Moreover, 90% of the upsc aspirants know english. Please consider that the south and north-east aspirants are also writing upsc.

Regarding Q.73, BHIM app can transfer money to either UPI enabled bank a/c or to any other bank accounts. So. option 1 is also false.

I agree that the answer to Q.86 is option ‘a’ … but the reason that I would give is not what Mrunal Sir gave.

My reason is-

Article 110(2) says “A Bill shall not be deemed to be a Money Bill by reason only that it provides for the imposition of fines or other pecuniary penalties, or for the demand or payment of fees for licences or fees for services rendered, or by reason that it provides for the imposition, abolition, remission, alteration or regulation of any tax by any local authority or body for local purposes”

by this it is clear that local taxes can not be the reason for declaring a bill money bill, that’s why option A is correct